As a small business owner, you can inevitably be overwhelmed by the financial challenges of running your business. You've got a lot on your plate. There's a feeling of uncertainty and pressure, from juggling marketing and sales to product development and customer service. On the worst days, you don’t know how to proceed.

It's not your fault if you're juggling a million things. But if you don't get your finances in order, you could be in for a world of hurt down the road. Luckily, many bookkeeping agencies help you with your accounting and finances. They also enable you to take some pressure off of yourself as a business owner. In this blog post, we’ll learn more about online bookkeeping services and how they can help you with your financial business challenges.

Business challenges may be due to several factors. The first is external influences, such as market circumstances or interest rate swings, trends, technology shifts, and more. Other small business challenges may be related to internal issues, such as a lack of skilled employees, inefficient processes, management issues, and poor investment opportunities.

Regardless of the source of the difficulty, business leaders need to understand and address these issues head-on to keep their businesses running smoothly and successfully. One effective approach for addressing business challenges is utilizing modern technology tools such as budgeting and accounting software that can help to streamline business operations and minimize risk factors within the business environment.

But if it's out of your expertise, seeking professional advice from experts in the field is the best thing you can do. By consulting with financial firms that offer accounting and bookkeeping, business owners can get valuable insights into current trends and best practices to help them navigate any challenges.

There's no one-size-fits-all answer when it comes to finding the right bookkeeping firm. The equation will be different for every business, based on your standards in an agency. For example, maybe you need a full-service firm that can handle everything from payroll to tax preparation. Or maybe you're just looking for someone to reconcile your accounts and prepare your financial statements.

It's essential to choose a firm that can meet your specific requirements. Here are a few things to consider as you search for the right bookkeeping firm:

You'll be well on your way to hiring the proper bookkeeping service if you keep these items in mind.

Start-up businesses are looking for more affordable alternatives, considering the rising costs of bookkeeping services. For example, a bookkeeping agency like Pilot bookkeeping automates many accounting processes, saves time, and eliminates errors that can compromise the accuracy of business reports.

However, one small drawback is that it can be costly for small businesses on a tight budget. Pilot bookkeeping calculates your average monthly costs depending on your monthly spending. Therefore, as your company grows, the bookkeeping charge rises in lockstep with the growth in expenses.

Another Pilot bookkeeping review states that it is only compatible with a limited number of accounting software programs. So if you're not using one of the supported programs like Quickbooks, you're out of luck.

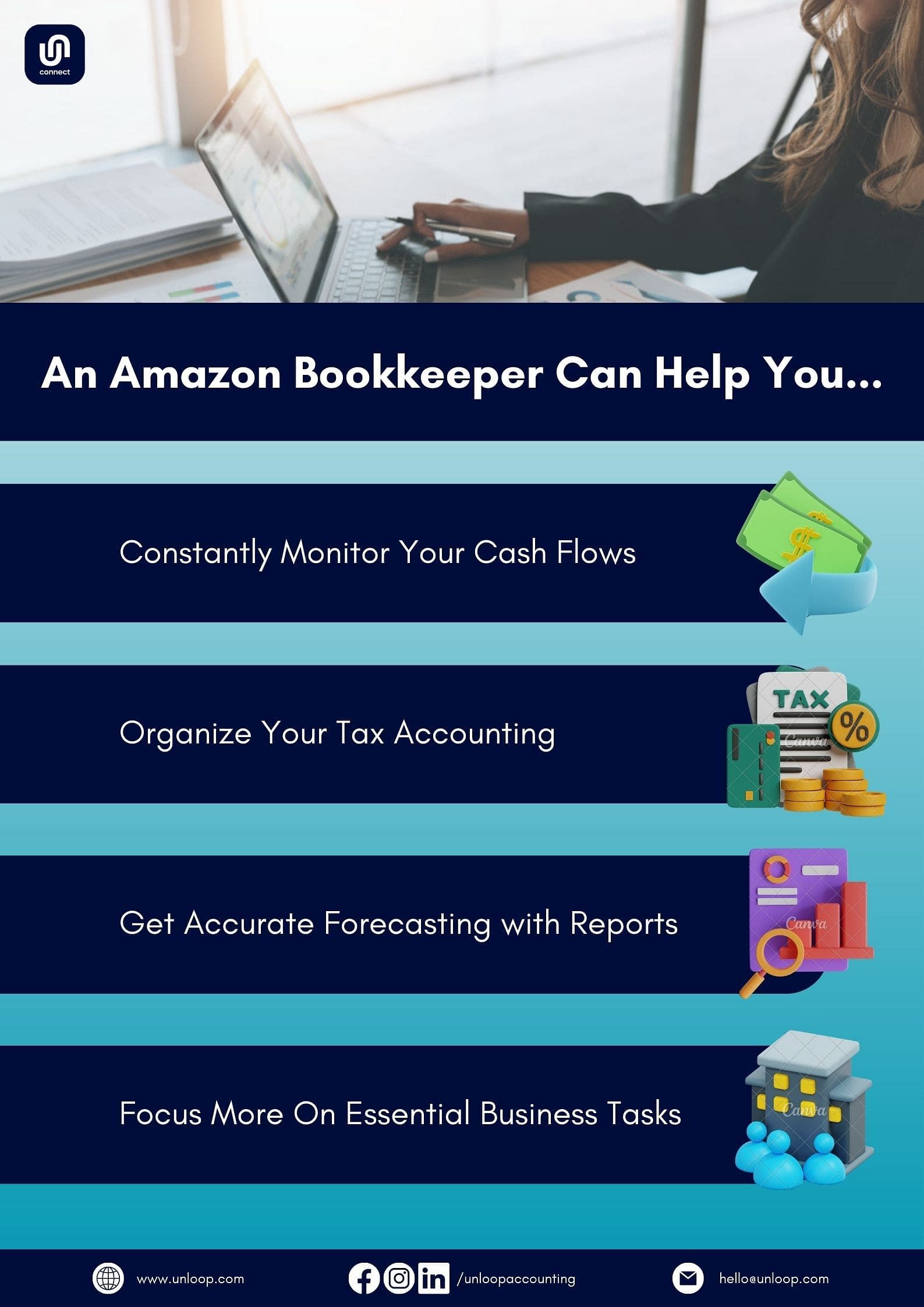

Luckily, Unloop has the accounting demands that every small business is looking for. Similar to Pilot, Unloop provides small businesses with access to skilled accountants who can help them navigate the ins and outs of financial management without investing hours of their time or limiting their flexibility.

Furthermore, this alternative to Pilot bookkeeping offers competitive rates and round-the-clock support, making it a convenient and cost-effective solution for small business owners seeking financial insight into their companies.

Here's why it's worth checking out:

So if you're looking for a comprehensive bookkeeping solution with lots of extra features, give Unloop a try.

So, if you're feeling overwhelmed by your business finances, don't worry, you're not alone. But fortunately, there are solutions out there. We believe that Unloop is one of the best. We offer comprehensive bookkeeping and consulting services to businesses of all sizes and industries to help you get your finances in order.

We hope this article has provided you with enough information to make an informed conclusion about your bookkeeping needs. Book a call today!

As a small business owner, you can inevitably be overwhelmed by the financial challenges of running your business. You've got a lot on your plate. There's a feeling of uncertainty and pressure, from juggling marketing and sales to product development and customer service. On the worst days, you don’t know how to proceed.

It's not your fault if you're juggling a million things. But if you don't get your finances in order, you could be in for a world of hurt down the road. Luckily, many bookkeeping agencies help you with your accounting and finances. They also enable you to take some pressure off of yourself as a business owner. In this blog post, we’ll learn more about online bookkeeping services and how they can help you with your financial business challenges.

Business challenges may be due to several factors. The first is external influences, such as market circumstances or interest rate swings, trends, technology shifts, and more. Other small business challenges may be related to internal issues, such as a lack of skilled employees, inefficient processes, management issues, and poor investment opportunities.

Regardless of the source of the difficulty, business leaders need to understand and address these issues head-on to keep their businesses running smoothly and successfully. One effective approach for addressing business challenges is utilizing modern technology tools such as budgeting and accounting software that can help to streamline business operations and minimize risk factors within the business environment.

But if it's out of your expertise, seeking professional advice from experts in the field is the best thing you can do. By consulting with financial firms that offer accounting and bookkeeping, business owners can get valuable insights into current trends and best practices to help them navigate any challenges.

There's no one-size-fits-all answer when it comes to finding the right bookkeeping firm. The equation will be different for every business, based on your standards in an agency. For example, maybe you need a full-service firm that can handle everything from payroll to tax preparation. Or maybe you're just looking for someone to reconcile your accounts and prepare your financial statements.

It's essential to choose a firm that can meet your specific requirements. Here are a few things to consider as you search for the right bookkeeping firm:

You'll be well on your way to hiring the proper bookkeeping service if you keep these items in mind.

Start-up businesses are looking for more affordable alternatives, considering the rising costs of bookkeeping services. For example, a bookkeeping agency like Pilot bookkeeping automates many accounting processes, saves time, and eliminates errors that can compromise the accuracy of business reports.

However, one small drawback is that it can be costly for small businesses on a tight budget. Pilot bookkeeping calculates your average monthly costs depending on your monthly spending. Therefore, as your company grows, the bookkeeping charge rises in lockstep with the growth in expenses.

Another Pilot bookkeeping review states that it is only compatible with a limited number of accounting software programs. So if you're not using one of the supported programs like Quickbooks, you're out of luck.

Luckily, Unloop has the accounting demands that every small business is looking for. Similar to Pilot, Unloop provides small businesses with access to skilled accountants who can help them navigate the ins and outs of financial management without investing hours of their time or limiting their flexibility.

Furthermore, this alternative to Pilot bookkeeping offers competitive rates and round-the-clock support, making it a convenient and cost-effective solution for small business owners seeking financial insight into their companies.

Here's why it's worth checking out:

So if you're looking for a comprehensive bookkeeping solution with lots of extra features, give Unloop a try.

So, if you're feeling overwhelmed by your business finances, don't worry, you're not alone. But fortunately, there are solutions out there. We believe that Unloop is one of the best. We offer comprehensive bookkeeping and consulting services to businesses of all sizes and industries to help you get your finances in order.

We hope this article has provided you with enough information to make an informed conclusion about your bookkeeping needs. Book a call today!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

When running an ecommerce business, it's crucial to know how to reconcile Shopify in QuickBooks to manage it effectively. It means making sure your books are in order. But reconciliation has its own set of challenges that comes with bookkeeping mistakes. For a business owner, it's important to identify and fix them to ensure every puzzle piece fits.

If you have a Shopify store and use QuickBooks Online (QBO) to do your accounting, this article is for you. Let Unloop show you the seven of the biggest Shopify bookkeeping mistakes sellers make when reconciling Shopify transactions to their QuickBooks Online.

Not collecting Shopify net sales that account for deductions, taxes, or other details that provide data about your transactions may result in inaccurate financial records and incomplete insights to analyze.

A Shopify account isn't simply about sales; it should include gross sales before deducting returns, refunds, sales taxes, and deductions. These figures must be analyzed to see what is happening with your online store.

Returns and refunds eat your profits; they can even put you in the red if you're not careful. The same goes for sales tax.

You could overpay or underpay sales tax if you aren't paying attention, and neither is good for your bottom line. Deductions are more complex, but they're any expenses that can be directly attributed to generating revenue.

All these must be in your financial report to get accurate profitability insight. Otherwise, you might think you're doing better than you are or worse, and no one wants that.

You may think that if you connect the Shopify app with your QuickBooks Online, everything will be automatic, and you can set aside accounting tasks altogether. That's far from reality. Among many things, you must reconcile Shopify payments with expenses incurred in the online store and outside of it. It's how you get to the true bottom-line profit.

Always remember that when you integrate Shopify with cloud accounting software, you’re not letting technology do every task. There is a manual reconciliation process involved. The purpose is to make your life easier, so you can spend more time on other important aspects of your online business.

Several apps can migrate a lot of data from Shopify to QuickBooks. Selecting one of these third-party applications allows you to sync over every transaction, sometimes even the unnecessary ones.

New Shopify businesses can adapt to this feature well. Low expenses and sales transactions make it easy to sort through what to keep and discard. But a high-volume Shopify seller should be more diligent with selecting integration apps for efficient accounting and financial reporting.

Alternatively, they can hand over their accounting processes to experts. A team of accounting and bookkeeping professionals has mastered how to manage accounting for Shopify. They know which apps to integrate and can manage volumes of transactions efficiently. It's an excellent resource saver.

Some integrated applications connect Shopify and QuickBooks and automatically reconcile transactions to accounts—these are QuickBooks labels where amounts are recorded for future financial reporting and analysis.

Certain integrations only sync Shopify transactions into a few accounts. This means some of the incoming transactions need to be mapped manually. Shopify merchants must pick this up and map the account and transaction themselves. Incorrectly doing so will affect reporting, bank account reconciliation, and business management.

Most accounting software has inventory-related features. As for most sellers, QuickBooks is their go-to because it’s a superior software for managing accounting processes and seamless inventory management. But depending on your specific needs, this may or may not be the ideal tool for your business.

If you're deep into using QuickBooks as an accounting software, gaps can be bridged by using applications, versions, or add-ons that boost its inventory management capabilities. Accounting experts would know how to make it work for your business.

| 💡 For inventory syncing, the ideal approach is to use cloud inventory software such as Xero or Vend with a multi-channel inventory feature. These software are ideal for a growing business. Otherwise, QuickBooks can work if you're prepared to be more hands-on with your inventory. |

The next blunder is not reconciling transactions in the bank with Shopify data. You may have a Shopify-QuickBooks Online integration, which can accurately record Shopify sales and expenses. But are those net figures identical to your bank account statements? Most likely, they aren’t.

It is frustrating when the accounting numbers don't match the expected business bank account balance. It may be because there's a failure to reconcile bank accounts regularly. While you can connect your bank account to your QBO and sync your Shopify store transactions, some things still need review (e.g., portioning off sales tax from gross income).

Finally, a grave mistake is assuming you can set up and maintain your accounting without the assistance of a qualified ecommerce accountant. Even if you are using excellent cloud accounting software, it won’t yield good results without the hands of an expert.

If you're not well-versed in bookkeeping and accounting, it's better to have an expert by your side to help manage the various Shopify account transactions. Otherwise, you will still be susceptible to issues such as failing tax compliance and messy financial liabilities.

Once you've identified one or several of the mistakes mentioned above, you'll have to fix them as soon as possible to prevent them from creating bigger problems moving forward. Note the following solutions indicated in the table below.

| Double-Check Your Financial RecordsEnsure accurate financial records and comprehensive insights by recording Shopify net sales, gross sales, deductions, taxes, and other transaction details. |

| Verify Shopify and Quickbooks SyncTo reduce errors, always review your Quickbooks sync settings to identify which accounting software features operate with or without automation. |

| Examine Integration Apps Before Using ThemLook at the features of the 3rd party app you’ll use for Shopify-Quickbooks integration. This will help you get an idea of what data it can bring over to your books. |

| Learn Bookkeeping BasicsGrasp basic bookkeeping and accounting principles to align synced Shopify transactions with accurate accounts. |

| Choose a Specialized Inventory SoftwareImprove stock management using specialized inventory software like Fishbowl (if you’re a QuickBooks or Xero user.) |

| Review Business Bank Account StatementsEstablish a reconciling routine by setting a time period, such as a month or a week, to examine line items on your bank statement. Determine how they arrived at the current balance. |

Bookkeeping for Shopify sellers is daunting. You must keep track of all your income and expenses and comply with all the relevant tax laws. You also have to deal with managing inventory, fulfilling shipping orders, and the crucial process of reconciling Shopify with QuickBooks. Altogether, these challenges pose overwhelming responsibilities for Shopify sellers.

Even if you have the table of solutions above, doing all of them on your own is no easy feat. Fortunately, there is a solution to this problem: you can hire a bookkeeper or an accounting firm to handle or help you with most of the work. It will free up your time to focus on scaling your online business and rest easy knowing that your finances are in capable hands.

If you're making or wanting to avoid any of these mistakes, don't worry—you're not alone. We always see this with our clients using QuickBooks Online for their Shopify accounting. So we put together this list to help you identify where you might be going wrong and how to get back on track.

If you think identifying these mistakes and troubleshooting them keeps you away from growing your business, let our team help. Our seasoned ecommerce accountants can assist you in getting your books in order and ensure that your Shopify online store runs as smoothly as possible. Give us a call at 877-421-7270 today.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

When running an ecommerce business, it's crucial to know how to reconcile Shopify in QuickBooks to manage it effectively. It means making sure your books are in order. But reconciliation has its own set of challenges that comes with bookkeeping mistakes. For a business owner, it's important to identify and fix them to ensure every puzzle piece fits.

If you have a Shopify store and use QuickBooks Online (QBO) to do your accounting, this article is for you. Let Unloop show you the seven of the biggest Shopify bookkeeping mistakes sellers make when reconciling Shopify transactions to their QuickBooks Online.

Not collecting Shopify net sales that account for deductions, taxes, or other details that provide data about your transactions may result in inaccurate financial records and incomplete insights to analyze.

A Shopify account isn't simply about sales; it should include gross sales before deducting returns, refunds, sales taxes, and deductions. These figures must be analyzed to see what is happening with your online store.

Returns and refunds eat your profits; they can even put you in the red if you're not careful. The same goes for sales tax.

You could overpay or underpay sales tax if you aren't paying attention, and neither is good for your bottom line. Deductions are more complex, but they're any expenses that can be directly attributed to generating revenue.

All these must be in your financial report to get accurate profitability insight. Otherwise, you might think you're doing better than you are or worse, and no one wants that.

You may think that if you connect the Shopify app with your QuickBooks Online, everything will be automatic, and you can set aside accounting tasks altogether. That's far from reality. Among many things, you must reconcile Shopify payments with expenses incurred in the online store and outside of it. It's how you get to the true bottom-line profit.

Always remember that when you integrate Shopify with cloud accounting software, you’re not letting technology do every task. There is a manual reconciliation process involved. The purpose is to make your life easier, so you can spend more time on other important aspects of your online business.

Several apps can migrate a lot of data from Shopify to QuickBooks. Selecting one of these third-party applications allows you to sync over every transaction, sometimes even the unnecessary ones.

New Shopify businesses can adapt to this feature well. Low expenses and sales transactions make it easy to sort through what to keep and discard. But a high-volume Shopify seller should be more diligent with selecting integration apps for efficient accounting and financial reporting.

Alternatively, they can hand over their accounting processes to experts. A team of accounting and bookkeeping professionals has mastered how to manage accounting for Shopify. They know which apps to integrate and can manage volumes of transactions efficiently. It's an excellent resource saver.

Some integrated applications connect Shopify and QuickBooks and automatically reconcile transactions to accounts—these are QuickBooks labels where amounts are recorded for future financial reporting and analysis.

Certain integrations only sync Shopify transactions into a few accounts. This means some of the incoming transactions need to be mapped manually. Shopify merchants must pick this up and map the account and transaction themselves. Incorrectly doing so will affect reporting, bank account reconciliation, and business management.

Most accounting software has inventory-related features. As for most sellers, QuickBooks is their go-to because it’s a superior software for managing accounting processes and seamless inventory management. But depending on your specific needs, this may or may not be the ideal tool for your business.

If you're deep into using QuickBooks as an accounting software, gaps can be bridged by using applications, versions, or add-ons that boost its inventory management capabilities. Accounting experts would know how to make it work for your business.

| 💡 For inventory syncing, the ideal approach is to use cloud inventory software such as Xero or Vend with a multi-channel inventory feature. These software are ideal for a growing business. Otherwise, QuickBooks can work if you're prepared to be more hands-on with your inventory. |

The next blunder is not reconciling transactions in the bank with Shopify data. You may have a Shopify-QuickBooks Online integration, which can accurately record Shopify sales and expenses. But are those net figures identical to your bank account statements? Most likely, they aren’t.

It is frustrating when the accounting numbers don't match the expected business bank account balance. It may be because there's a failure to reconcile bank accounts regularly. While you can connect your bank account to your QBO and sync your Shopify store transactions, some things still need review (e.g., portioning off sales tax from gross income).

Finally, a grave mistake is assuming you can set up and maintain your accounting without the assistance of a qualified ecommerce accountant. Even if you are using excellent cloud accounting software, it won’t yield good results without the hands of an expert.

If you're not well-versed in bookkeeping and accounting, it's better to have an expert by your side to help manage the various Shopify account transactions. Otherwise, you will still be susceptible to issues such as failing tax compliance and messy financial liabilities.

Once you've identified one or several of the mistakes mentioned above, you'll have to fix them as soon as possible to prevent them from creating bigger problems moving forward. Note the following solutions indicated in the table below.

| Double-Check Your Financial RecordsEnsure accurate financial records and comprehensive insights by recording Shopify net sales, gross sales, deductions, taxes, and other transaction details. |

| Verify Shopify and Quickbooks SyncTo reduce errors, always review your Quickbooks sync settings to identify which accounting software features operate with or without automation. |

| Examine Integration Apps Before Using ThemLook at the features of the 3rd party app you’ll use for Shopify-Quickbooks integration. This will help you get an idea of what data it can bring over to your books. |

| Learn Bookkeeping BasicsGrasp basic bookkeeping and accounting principles to align synced Shopify transactions with accurate accounts. |

| Choose a Specialized Inventory SoftwareImprove stock management using specialized inventory software like Fishbowl (if you’re a QuickBooks or Xero user.) |

| Review Business Bank Account StatementsEstablish a reconciling routine by setting a time period, such as a month or a week, to examine line items on your bank statement. Determine how they arrived at the current balance. |

Bookkeeping for Shopify sellers is daunting. You must keep track of all your income and expenses and comply with all the relevant tax laws. You also have to deal with managing inventory, fulfilling shipping orders, and the crucial process of reconciling Shopify with QuickBooks. Altogether, these challenges pose overwhelming responsibilities for Shopify sellers.

Even if you have the table of solutions above, doing all of them on your own is no easy feat. Fortunately, there is a solution to this problem: you can hire a bookkeeper or an accounting firm to handle or help you with most of the work. It will free up your time to focus on scaling your online business and rest easy knowing that your finances are in capable hands.

If you're making or wanting to avoid any of these mistakes, don't worry—you're not alone. We always see this with our clients using QuickBooks Online for their Shopify accounting. So we put together this list to help you identify where you might be going wrong and how to get back on track.

If you think identifying these mistakes and troubleshooting them keeps you away from growing your business, let our team help. Our seasoned ecommerce accountants can assist you in getting your books in order and ensure that your Shopify online store runs as smoothly as possible. Give us a call at 877-421-7270 today.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Understanding sales tax is essential for any business owner and Amazon seller. After all, you are responsible for collecting sales tax if you're a third-party merchant. Unfamiliar Amazon merchants may ask questions like “How many states does Amazon charge sales tax,” and “What type of sales tax do they collect?”

To quell some of your first-time seller worries, let’s run through these questions and take some time to learn about Amazon sales tax. It could save your business from unexpected fees or penalties down the road!

Sales tax compliance is the root of many concerns for online sellers, particularly on Amazon. While it may not be the most exciting topic, addressing these concerns is essential for any e-commerce business.

In this section, we'll break down some of the most common Amazon sales tax concerns in a straightforward, no-nonsense manner.

Amazon collects sales taxes on "Fulfilled by Amazon" products sold to customers in states that have adopted Marketplace Facilitator, Marketplace Fairness, or similar laws and where the seller has a nexus (presence or location, such as a warehouse).

📝Note that Amazon only takes into account where the inventory is currently located.

As a result of these restrictions, the marketplace on which the merchant relies to make a sale takes on the role of a collector.

However, a third-party Amazon seller must still set up their own tax accounting system to keep up with the regulations and filing dates. In short, if Amazon fulfills your products, you don't need to worry about sales taxes, but that comes with its cons, such as increased returns due to Amazon's return policy.

For years, consumers have enjoyed shopping online without paying sales taxes on their purchases. It seems like an unfair advantage: laws have long required brick-and-mortar stores to collect sales taxes in every state where customers shop in person.

However, they didn't pay sales taxes because no physical presence was required for ecommerce merchants or marketplace sellers, like Amazon FBA sellers who shipped through third parties.

This setup has evolved due to the implementation of "Amazon Laws" by various states. These laws mandate that online retailers located outside their borders, even those who sell indirectly, must now collect online sales taxes from customers residing within those jurisdictions.

Amazon collects and processes state sales tax from 46 American states and areas, including D.C., which contrasts with a sales tax nexus. Below is a list of states where customers must pay sales tax on their Amazon online purchases.

The sales tax nexus is where a business operates, not the location of the buyer or where the product is going. For example, if a seller maintains physical locations in several states, such as offices or in-store retail shops, the seller must know each state's tax regulations.

Amazon also offers its own Sales Tax Calculator to help sellers determine the appropriate sales tax rate to charge their customers.

If you're wondering, "How much sales tax does Amazon charge?", the total tax for your purchase will be based on several variables, including but not limited to the following:

The total state and local tax rate in effect at the location of delivery or fulfillment will be the rate charged to your order. For example, if your product is being transported to a state with a sales tax, you may still be charged sales tax even if you are in a tax-free zone.

If you're an FBA vendor, the procedure is still taxing, but Amazon can help you do the job efficiently.

Amazon customers are required by law to pay state sales tax in jurisdictions where Amazon operates retail warehouses, including any warehouses, offices, or other facilities in a state owned or leased by the ecommerce giant or its affiliates.

In addition, Amazon is required to collect tax if they charge shipping and handling (S&H) and other fulfillment-related services performed at their fulfillment centers.

The laws vary from state to state but generally require you to collect sales tax if you're doing business there and make charges for S&H or fulfillment services.

When dealing with Amazon sales tax, you must be aware of the different sales tax types that may apply to your business, such as state and local taxes or county taxes. You must also understand how each product code is taxed in these places.

Each jurisdiction has its own sales tax laws. Therefore, you must research the specific sales tax laws for the state or states you are doing business in.

Also, some localities within a state may have their own sales tax laws. For instance, Seattle has a local sales tax of 3.75% combined with Washington's state sales tax of 6.50% for a total of 10.25%.

Some jurisdictions also charge their taxes in addition to state and local taxes. These fees, ranging from 0.5% to 2%, are generally added on top of state and local sales taxes. Furthermore, certain counties may have different rules regarding sales tax collection.

Another factor to consider is how different products are taxed. For example, you may sell goods, digital content, or services, such as streaming movies or consulting services, which can all be charged differently.

For sales tax on goods sold on Amazon, you must know the rates that apply to different products in your state or locality.

In addition, some items may be exempt from sales tax collection altogether. These include food and certain types of clothing. However, these exemptions may vary.

Do your research to ensure that you correctly charge sales tax on all of your products with the right product tax code. You can find this information on Seller Central.

As mentioned, Amazon FBA sellers don’t have to do much regarding sales tax collection from customers in states with Marketplace Facilitator laws. Amazon handles all the sales tax calculations and remittances for them.

However, with Amazon FBM, it'll be entirely up to the seller to ensure that the proper amount of sales tax is collected from buyers.

One of your main goals should be to maximize your profits while minimizing potential issues with the tax collection authorities.

Several key steps can help you achieve these goals, such as carefully reviewing the tax laws for your state or locality and familiarizing yourself with the different types of taxes that may apply to your products or services.

Additionally, keeping accurate records of your sales and purchases is important to ensure that you are correctly calculating and remitting any taxes that may be due.

There are plenty of pros to understanding sales tax. For one, you can avoid penalties and interest charges if you mistakenly fail to remit or collect sales tax. Additionally, you can accurately calculate your taxes owed, which will help you stay organized and efficient come tax time.

As you can see, there are varieties of Amazon sales tax that may apply to your business. You need to know how these taxes impact your bottom line to stay tax compliant and avoid hefty charges.

If you need help sorting through this complex information or want advice on managing your sales tax obligations, Unloop is here for you. We offer excellent bookkeeping services for small businesses.

So unloop, take a breather, and give us a call at 877-421-7270 if you want to learn how to grow your business with comprehensive accounting.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Understanding sales tax is essential for any business owner and Amazon seller. After all, you are responsible for collecting sales tax if you're a third-party merchant. Unfamiliar Amazon merchants may ask questions like “How many states does Amazon charge sales tax,” and “What type of sales tax do they collect?”

To quell some of your first-time seller worries, let’s run through these questions and take some time to learn about Amazon sales tax. It could save your business from unexpected fees or penalties down the road!

Sales tax compliance is the root of many concerns for online sellers, particularly on Amazon. While it may not be the most exciting topic, addressing these concerns is essential for any e-commerce business.

In this section, we'll break down some of the most common Amazon sales tax concerns in a straightforward, no-nonsense manner.

Amazon collects sales taxes on "Fulfilled by Amazon" products sold to customers in states that have adopted Marketplace Facilitator, Marketplace Fairness, or similar laws and where the seller has a nexus (presence or location, such as a warehouse).

📝Note that Amazon only takes into account where the inventory is currently located.

As a result of these restrictions, the marketplace on which the merchant relies to make a sale takes on the role of a collector.

However, a third-party Amazon seller must still set up their own tax accounting system to keep up with the regulations and filing dates. In short, if Amazon fulfills your products, you don't need to worry about sales taxes, but that comes with its cons, such as increased returns due to Amazon's return policy.

For years, consumers have enjoyed shopping online without paying sales taxes on their purchases. It seems like an unfair advantage: laws have long required brick-and-mortar stores to collect sales taxes in every state where customers shop in person.

However, they didn't pay sales taxes because no physical presence was required for ecommerce merchants or marketplace sellers, like Amazon FBA sellers who shipped through third parties.

This setup has evolved due to the implementation of "Amazon Laws" by various states. These laws mandate that online retailers located outside their borders, even those who sell indirectly, must now collect online sales taxes from customers residing within those jurisdictions.

Amazon collects and processes state sales tax from 46 American states and areas, including D.C., which contrasts with a sales tax nexus. Below is a list of states where customers must pay sales tax on their Amazon online purchases.

The sales tax nexus is where a business operates, not the location of the buyer or where the product is going. For example, if a seller maintains physical locations in several states, such as offices or in-store retail shops, the seller must know each state's tax regulations.

Amazon also offers its own Sales Tax Calculator to help sellers determine the appropriate sales tax rate to charge their customers.

If you're wondering, "How much sales tax does Amazon charge?", the total tax for your purchase will be based on several variables, including but not limited to the following:

The total state and local tax rate in effect at the location of delivery or fulfillment will be the rate charged to your order. For example, if your product is being transported to a state with a sales tax, you may still be charged sales tax even if you are in a tax-free zone.

If you're an FBA vendor, the procedure is still taxing, but Amazon can help you do the job efficiently.

Amazon customers are required by law to pay state sales tax in jurisdictions where Amazon operates retail warehouses, including any warehouses, offices, or other facilities in a state owned or leased by the ecommerce giant or its affiliates.

In addition, Amazon is required to collect tax if they charge shipping and handling (S&H) and other fulfillment-related services performed at their fulfillment centers.

The laws vary from state to state but generally require you to collect sales tax if you're doing business there and make charges for S&H or fulfillment services.

When dealing with Amazon sales tax, you must be aware of the different sales tax types that may apply to your business, such as state and local taxes or county taxes. You must also understand how each product code is taxed in these places.

Each jurisdiction has its own sales tax laws. Therefore, you must research the specific sales tax laws for the state or states you are doing business in.

Also, some localities within a state may have their own sales tax laws. For instance, Seattle has a local sales tax of 3.75% combined with Washington's state sales tax of 6.50% for a total of 10.25%.

Some jurisdictions also charge their taxes in addition to state and local taxes. These fees, ranging from 0.5% to 2%, are generally added on top of state and local sales taxes. Furthermore, certain counties may have different rules regarding sales tax collection.

Another factor to consider is how different products are taxed. For example, you may sell goods, digital content, or services, such as streaming movies or consulting services, which can all be charged differently.

For sales tax on goods sold on Amazon, you must know the rates that apply to different products in your state or locality.

In addition, some items may be exempt from sales tax collection altogether. These include food and certain types of clothing. However, these exemptions may vary.

Do your research to ensure that you correctly charge sales tax on all of your products with the right product tax code. You can find this information on Seller Central.

As mentioned, Amazon FBA sellers don’t have to do much regarding sales tax collection from customers in states with Marketplace Facilitator laws. Amazon handles all the sales tax calculations and remittances for them.

However, with Amazon FBM, it'll be entirely up to the seller to ensure that the proper amount of sales tax is collected from buyers.

One of your main goals should be to maximize your profits while minimizing potential issues with the tax collection authorities.

Several key steps can help you achieve these goals, such as carefully reviewing the tax laws for your state or locality and familiarizing yourself with the different types of taxes that may apply to your products or services.

Additionally, keeping accurate records of your sales and purchases is important to ensure that you are correctly calculating and remitting any taxes that may be due.

There are plenty of pros to understanding sales tax. For one, you can avoid penalties and interest charges if you mistakenly fail to remit or collect sales tax. Additionally, you can accurately calculate your taxes owed, which will help you stay organized and efficient come tax time.

As you can see, there are varieties of Amazon sales tax that may apply to your business. You need to know how these taxes impact your bottom line to stay tax compliant and avoid hefty charges.

If you need help sorting through this complex information or want advice on managing your sales tax obligations, Unloop is here for you. We offer excellent bookkeeping services for small businesses.

So unloop, take a breather, and give us a call at 877-421-7270 if you want to learn how to grow your business with comprehensive accounting.

The choice of bookkeeping service package you make today will directly impact your profit margin and your time for the short or long term. You also have to account for the costs your business incurs more than your revenue for it to be profitable.

Accounting services are essential for a growing business, but they have a cost. As a business owner, you pay to keep your business numbers intact. So it's only logical to make a cost-effective choice before deciding to commit.

If you're looking for bookkeeping price packages in Canada or the US, let Unloop help you with the following guide.

Bookkeeping and accounting firms adapt different pricing models for their services. This is to allow an option that will match the client's needs with the solutions they provide. There are at least three pricing packages.

This type of bookkeeping pricing package offers you a fixed amount to pay for an agreed service. They may do the work earlier or later than expected, but as long as the service is completed, you must pay the rate.

Compared to a flat rate, an hourly rate charges you a fixed amount on an hourly basis. This type of accounting pricing package makes efficiency important because the longer the service takes to complete, the higher the amount you pay. The good news is that an hourly rate is a good option if you only need minor services.

Some accounting businesses bundle services together and offer them on a fixed monthly bookkeeping and accounting rate called a subscription. They also offer different levels or what they call "tiers" that cater to different levels of accounting business needs.

Many accounting service companies offer a host of services for their clients. Their arrangement may vary depending on your case, or it may be a fixed package containing several services. But no matter what accounting service firm you deal with, you will encounter the following services.

This service is a staple in any bookkeeping service company. If there's only one service they have to provide, it is bookkeeping, which is the core process of any financial accounting.

From bookkeeping, they can extend the service to financial statement preparation and reporting. In most cases, financial statements come bundled as part of bookkeeping service packages as it is connected to the process. But some accounting service firms offer monthly financial reports as a business advantage.

In some enterprises with a business-to-business (B2B) model, there can be frequent volume purchases, and these transactions often involve credits. Accountants understand that with the volume comes the complexity of managing accounts payable, which can wreak havoc on a business's cash flow. So they offer assistance and management as part of their service offering.

As the number of employees increases, paying them becomes more challenging. That's because apart from the volume, you may also have different types of employees, such as regular full-time, part-time, or contract employees. All these employee types have different treatments. So accountants offer payroll services to ensure salary is paid accurately for everyone and the disbursement is recorded properly in the business's accounting system.

Accountants understand the value of knowing future revenue potential for management. So to relieve business owners of the guesswork, accountants offer forecasting services to project short-term and long-term income and how a purchase decision can affect future revenues.

Tax is the most complex subject for any business owner. Yet taxes are obligations that every business must fulfill. To ensure that business owners are paying the correct tax amount and avoid legal repercussions, accountants can offer tax preparation assistance to help businesses know the right tax amount to pay.

Before selecting from bookkeeping pricing packages offered by an accounting service company, consider the following criteria. These will help you determine the right arrangement that will maximize your profit.

How big the business is plays an important factor when choosing a bookkeeping service. There are several ways to measure your business size: the number of employees, the size of equity invested, and the volume of transactions.

Each of these will affect how complex the accounting service is needed. For example, if you're a startup business with less than five employees, you may only need a part-time bookkeeping service, but if you have hundreds of regular workers, you'll need a skilled accounting team handling the payroll, books, and bank accounts.

Most small businesses use a program or software to handle their accounting and bookkeeping work. So it's important to tell your prospective bookkeeper what you are using (or not using) so they can do their best to adjust to your needs.

As an example, Unloop is a bookkeeping agency that specializes in QuickBooks. If you're using the same software, the transition will be smooth, but if you're using a different accounting software such as Xero or Sage50, they will have to work with what you have or transition you to QuickBooks.

An accountant familiar with your industry will know how your numbers work. This means they are far more capable of working efficiently and giving you accounting information that they know will help.

Unloop is a service agency that specializes in ecommerce. We know how to work with numbers and can provide you with the reports you need for decision-making. Not only that, but we can also offer advice on what steps you can take to maximize profitability.

Inquire about what services the bookkeeping company has to offer. The more services they can offer, the better. That's because you can always expand the service you need for them, which makes for a more efficient operation of your accounting systems.

You'll want to get a full-service accounting agency that offers services like the ones mentioned above. This way, you won't have to search for another company to do a different aspect of your accounting.

A bookkeeping service company must have a track record of both past and ongoing clients. So check if they have some under their belt. This verifies their legitimacy and competence.

It's much better if you can get feedback about their service. Check their website for client testimonials or ask for case studies you can read. If their clients are satisfied, then it's likely that you will be, too.

Now that you know the different pricing packages and services available, you are in a better position to decide what the best package applies to your business. But to hone in on the most cost-effective decision, you must find out what your business needs and talk to an accounting service provider.Talk to Unloop. We have three different price packages to offer you to make sure it's customized according to your business needs. Book a call with us or check out our ecommerce services now.

The choice of bookkeeping service package you make today will directly impact your profit margin and your time for the short or long term. You also have to account for the costs your business incurs more than your revenue for it to be profitable.

Accounting services are essential for a growing business, but they have a cost. As a business owner, you pay to keep your business numbers intact. So it's only logical to make a cost-effective choice before deciding to commit.

If you're looking for bookkeeping price packages in Canada or the US, let Unloop help you with the following guide.

Bookkeeping and accounting firms adapt different pricing models for their services. This is to allow an option that will match the client's needs with the solutions they provide. There are at least three pricing packages.

This type of bookkeeping pricing package offers you a fixed amount to pay for an agreed service. They may do the work earlier or later than expected, but as long as the service is completed, you must pay the rate.

Compared to a flat rate, an hourly rate charges you a fixed amount on an hourly basis. This type of accounting pricing package makes efficiency important because the longer the service takes to complete, the higher the amount you pay. The good news is that an hourly rate is a good option if you only need minor services.

Some accounting businesses bundle services together and offer them on a fixed monthly bookkeeping and accounting rate called a subscription. They also offer different levels or what they call "tiers" that cater to different levels of accounting business needs.

Many accounting service companies offer a host of services for their clients. Their arrangement may vary depending on your case, or it may be a fixed package containing several services. But no matter what accounting service firm you deal with, you will encounter the following services.

This service is a staple in any bookkeeping service company. If there's only one service they have to provide, it is bookkeeping, which is the core process of any financial accounting.

From bookkeeping, they can extend the service to financial statement preparation and reporting. In most cases, financial statements come bundled as part of bookkeeping service packages as it is connected to the process. But some accounting service firms offer monthly financial reports as a business advantage.

In some enterprises with a business-to-business (B2B) model, there can be frequent volume purchases, and these transactions often involve credits. Accountants understand that with the volume comes the complexity of managing accounts payable, which can wreak havoc on a business's cash flow. So they offer assistance and management as part of their service offering.

As the number of employees increases, paying them becomes more challenging. That's because apart from the volume, you may also have different types of employees, such as regular full-time, part-time, or contract employees. All these employee types have different treatments. So accountants offer payroll services to ensure salary is paid accurately for everyone and the disbursement is recorded properly in the business's accounting system.

Accountants understand the value of knowing future revenue potential for management. So to relieve business owners of the guesswork, accountants offer forecasting services to project short-term and long-term income and how a purchase decision can affect future revenues.

Tax is the most complex subject for any business owner. Yet taxes are obligations that every business must fulfill. To ensure that business owners are paying the correct tax amount and avoid legal repercussions, accountants can offer tax preparation assistance to help businesses know the right tax amount to pay.

Before selecting from bookkeeping pricing packages offered by an accounting service company, consider the following criteria. These will help you determine the right arrangement that will maximize your profit.

How big the business is plays an important factor when choosing a bookkeeping service. There are several ways to measure your business size: the number of employees, the size of equity invested, and the volume of transactions.

Each of these will affect how complex the accounting service is needed. For example, if you're a startup business with less than five employees, you may only need a part-time bookkeeping service, but if you have hundreds of regular workers, you'll need a skilled accounting team handling the payroll, books, and bank accounts.

Most small businesses use a program or software to handle their accounting and bookkeeping work. So it's important to tell your prospective bookkeeper what you are using (or not using) so they can do their best to adjust to your needs.

As an example, Unloop is a bookkeeping agency that specializes in QuickBooks. If you're using the same software, the transition will be smooth, but if you're using a different accounting software such as Xero or Sage50, they will have to work with what you have or transition you to QuickBooks.

An accountant familiar with your industry will know how your numbers work. This means they are far more capable of working efficiently and giving you accounting information that they know will help.

Unloop is a service agency that specializes in ecommerce. We know how to work with numbers and can provide you with the reports you need for decision-making. Not only that, but we can also offer advice on what steps you can take to maximize profitability.

Inquire about what services the bookkeeping company has to offer. The more services they can offer, the better. That's because you can always expand the service you need for them, which makes for a more efficient operation of your accounting systems.

You'll want to get a full-service accounting agency that offers services like the ones mentioned above. This way, you won't have to search for another company to do a different aspect of your accounting.

A bookkeeping service company must have a track record of both past and ongoing clients. So check if they have some under their belt. This verifies their legitimacy and competence.

It's much better if you can get feedback about their service. Check their website for client testimonials or ask for case studies you can read. If their clients are satisfied, then it's likely that you will be, too.

Now that you know the different pricing packages and services available, you are in a better position to decide what the best package applies to your business. But to hone in on the most cost-effective decision, you must find out what your business needs and talk to an accounting service provider.Talk to Unloop. We have three different price packages to offer you to make sure it's customized according to your business needs. Book a call with us or check out our ecommerce services now.

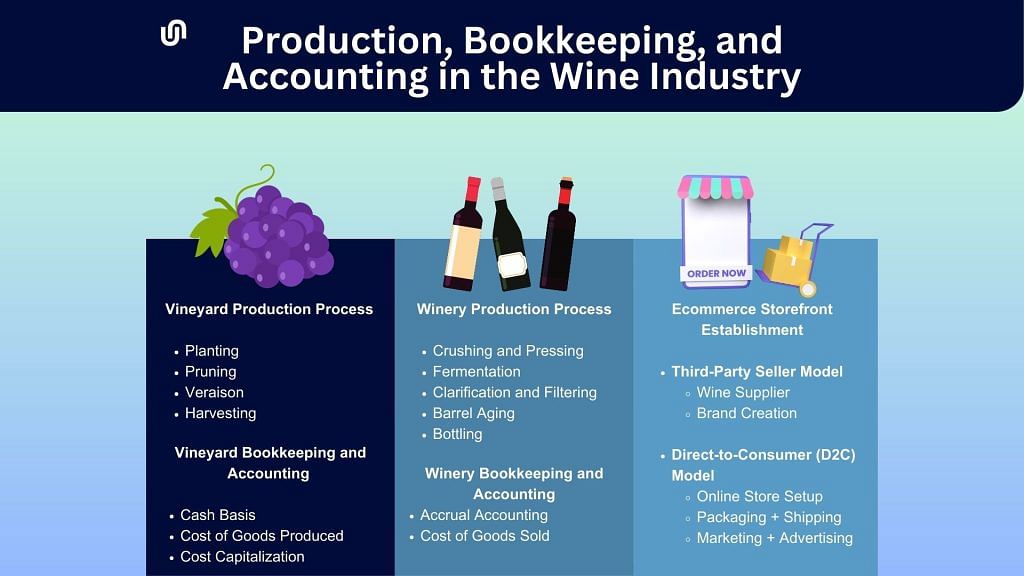

The wine business is one of the most vertically integrated businesses there is. A vineyard can work down the supply chain by building a winery and going further with an ecommerce storefront. But winery bookkeeping and accounting become more complex with this integration.

Sounds daunting? Let Unloop show you how bookkeeping and accounting for wineries work as simply as possible.

At the top of the wine industry supply chain is the vineyard. This business takes care of grapefruit planting up to harvesting, which wineries will use as a raw material for making wine. The following is the vineyard's production process.

A vineyard is heavy on agricultural activities. The production is long-winding, and it will take years before the vineyard realizes a profit. Given the situation, accountants follow these accounting practices.

Most farm businesses operate using the cash basis accounting method, where income or costs are immediately recognized as soon as the cash is received or spent.

With this accounting type, farms have a clearer view of their cash flow. It also makes tax filing easier because they won’t have to pay taxes in accumulated amounts, unlike in accrual accounting.

Since vineyards are farms, vineyard accountants and bookkeepers use the same accounting method, making it easier to record production costs accurately.

According to accounting principles, accountants use COGP to allocate vineyard costs associated with growing grapes, such as direct labor, overhead, and other supplies and activities involved in the process.

They do so to avoid any miscalculations and confusion between the cost pool of the winery and the vineyard.

Grapes take years to grow. As a result, the vineyard only gets revenue after several years. Farming costs add up during that time without any income to offset them. To resolve this problem, accountants may capitalize on the vineyard's expenses so the business realizes a profit according to the total sales in the given period.

Harvesting the grapes is the departure point of the vineyard and the start of the winery production processes. In the winery, the grapes are turned into wine and are stored as collections for sale in the future.

In most cases, vineyards also have a wine production facility (i.e., winery), so the two terms are often mixed up. But wineries work differently. The video below details the winemaking process.

As briefly shown above, wine production has a different behavior compared to the vineyard. It has similar functions to a general manufacturing process, with some nuances. As a result, accountants adjust their practices according to the winery's needs.

Professionals use the accrual basis accounting method for winery accounting. It's a rational choice because obtaining the raw material for winemaking may not need to be paid immediately due to integration.

On the other hand, getting cash from a sale of a barrel or bottles may also take time. To avoid any miscalculations, accountants record transactions once incurred.

Wineries use the common COGS system primarily because they have a tangible good to sell for a profit.

At present, many wine sellers take their products online. Ecommerce marketplaces, like Amazon, offer a vast network of wine consumers, making it attractive for sellers of all kinds. Online wine sellers can choose between these two models.

A third-party seller can offer a wide variety of wines from different wineries. They are strictly retail. They must also follow the steps a direct-to-consumer takes to have an ecommerce presence (see next section).

However, two additional core steps are necessary to enter the ecommerce market.

Wineries can now sell their wine bottles directly to consumers using the power of ecommerce. Smaller wineries often use a D2C approach, which offers a high-profit margin and a seamless transition, leveraging their existing supply and brand.

All that’s left for wineries like yours to do are the following:

The challenge of running a winery business is that it has two different accounting systems—one for the vineyard and another for the winery itself. Plus, you can take your business online, like creating a separate retail business with another accounting system. Establishing multiple accounting systems is no easy feat, so outsourcing the job to the experts can be significantly beneficial.

Here's what wineries can expect when they outsource their financial management.

Accounting professionals will record all the ecommerce business financial data using double-entry accounting software, such as QuickBooks. This service will include generating financial statements and other financial reporting documents as needed.

The ecommerce retail side of the wine business will have separate COGS recordkeeping. Accountants and bookkeepers report this financial data to you or include them in the income statement for your analysis.

In the ecommerce market, adherence to accounting compliance is essential, which often entails tax management, such as sales tax and income tax. By outsourcing your ecommerce accounting, you'll gain access to seasoned bookkeeping experts who can collaborate with your accountant, ensuring precise tax filing obligations based on comprehensive records and data.

Whether you own a vineyard or are a third-party wine seller, outsourcing your bookkeeping and accounting will lift a huge burden off your back.

Ecommerce has a lot of potential to scale. If the demand for wine spikes, it will be more challenging to do bookkeeping and accounting on your own, so leave it to the experts at Unloop and focus on growing your winery into a successful business. Book a call with us if you want to know more about what we are capable of, or check out our bookkeeping services now for more information.

The wine business is one of the most vertically integrated businesses there is. A vineyard can work down the supply chain by building a winery and going further with an ecommerce storefront. But winery bookkeeping and accounting become more complex with this integration.

Sounds daunting? Let Unloop show you how bookkeeping and accounting for wineries work as simply as possible.

At the top of the wine industry supply chain is the vineyard. This business takes care of grapefruit planting up to harvesting, which wineries will use as a raw material for making wine. The following is the vineyard's production process.

A vineyard is heavy on agricultural activities. The production is long-winding, and it will take years before the vineyard realizes a profit. Given the situation, accountants follow these accounting practices.

Most farm businesses operate using the cash basis accounting method, where income or costs are immediately recognized as soon as the cash is received or spent.

With this accounting type, farms have a clearer view of their cash flow. It also makes tax filing easier because they won’t have to pay taxes in accumulated amounts, unlike in accrual accounting.

Since vineyards are farms, vineyard accountants and bookkeepers use the same accounting method, making it easier to record production costs accurately.

According to accounting principles, accountants use COGP to allocate vineyard costs associated with growing grapes, such as direct labor, overhead, and other supplies and activities involved in the process.

They do so to avoid any miscalculations and confusion between the cost pool of the winery and the vineyard.

Grapes take years to grow. As a result, the vineyard only gets revenue after several years. Farming costs add up during that time without any income to offset them. To resolve this problem, accountants may capitalize on the vineyard's expenses so the business realizes a profit according to the total sales in the given period.

Harvesting the grapes is the departure point of the vineyard and the start of the winery production processes. In the winery, the grapes are turned into wine and are stored as collections for sale in the future.

In most cases, vineyards also have a wine production facility (i.e., winery), so the two terms are often mixed up. But wineries work differently. The video below details the winemaking process.

As briefly shown above, wine production has a different behavior compared to the vineyard. It has similar functions to a general manufacturing process, with some nuances. As a result, accountants adjust their practices according to the winery's needs.

Professionals use the accrual basis accounting method for winery accounting. It's a rational choice because obtaining the raw material for winemaking may not need to be paid immediately due to integration.

On the other hand, getting cash from a sale of a barrel or bottles may also take time. To avoid any miscalculations, accountants record transactions once incurred.

Wineries use the common COGS system primarily because they have a tangible good to sell for a profit.

At present, many wine sellers take their products online. Ecommerce marketplaces, like Amazon, offer a vast network of wine consumers, making it attractive for sellers of all kinds. Online wine sellers can choose between these two models.

A third-party seller can offer a wide variety of wines from different wineries. They are strictly retail. They must also follow the steps a direct-to-consumer takes to have an ecommerce presence (see next section).

However, two additional core steps are necessary to enter the ecommerce market.

Wineries can now sell their wine bottles directly to consumers using the power of ecommerce. Smaller wineries often use a D2C approach, which offers a high-profit margin and a seamless transition, leveraging their existing supply and brand.

All that’s left for wineries like yours to do are the following:

The challenge of running a winery business is that it has two different accounting systems—one for the vineyard and another for the winery itself. Plus, you can take your business online, like creating a separate retail business with another accounting system. Establishing multiple accounting systems is no easy feat, so outsourcing the job to the experts can be significantly beneficial.

Here's what wineries can expect when they outsource their financial management.

Accounting professionals will record all the ecommerce business financial data using double-entry accounting software, such as QuickBooks. This service will include generating financial statements and other financial reporting documents as needed.

The ecommerce retail side of the wine business will have separate COGS recordkeeping. Accountants and bookkeepers report this financial data to you or include them in the income statement for your analysis.

In the ecommerce market, adherence to accounting compliance is essential, which often entails tax management, such as sales tax and income tax. By outsourcing your ecommerce accounting, you'll gain access to seasoned bookkeeping experts who can collaborate with your accountant, ensuring precise tax filing obligations based on comprehensive records and data.

Whether you own a vineyard or are a third-party wine seller, outsourcing your bookkeeping and accounting will lift a huge burden off your back.

Ecommerce has a lot of potential to scale. If the demand for wine spikes, it will be more challenging to do bookkeeping and accounting on your own, so leave it to the experts at Unloop and focus on growing your winery into a successful business. Book a call with us if you want to know more about what we are capable of, or check out our bookkeeping services now for more information.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

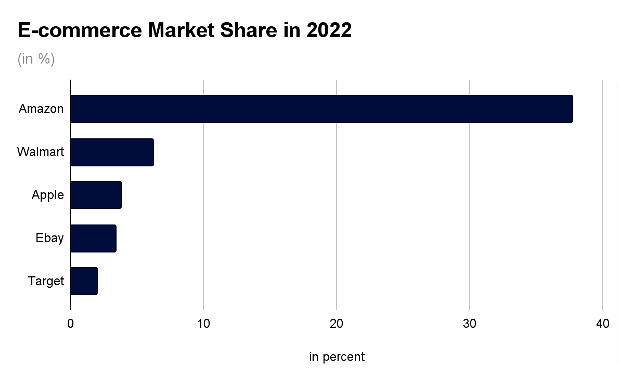

Almost every business owner across all e-commerce platforms can agree that accounting and bookkeeping for e-commerce are some of the most tedious parts of running a company. While they are undeniably challenging, both are essential to keep a business afloat.

This post will focus on e-commerce bookkeeping, the common challenges e-commerce business owners face, and some tips to overcome them.

Bookkeeping primarily involves documenting all financial transactions around your business. Keeping track of these may seem easy initially, but once they pile up, they pose challenges.

Bookkeeping obstacles may seem inevitable, but you can always be one step ahead. Read this blog about common e-commerce bookkeeping challenges and note the tips we'll share with you.

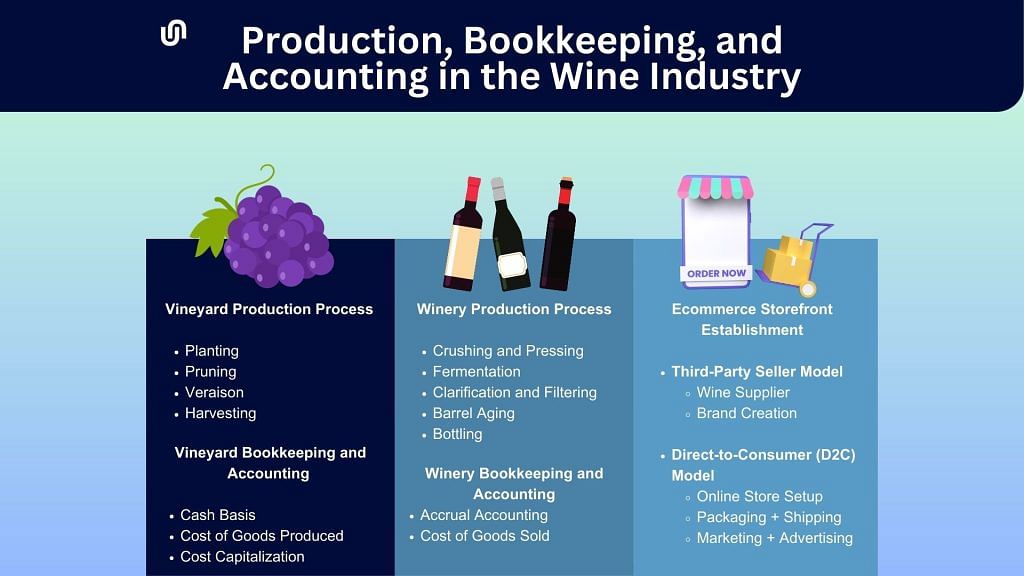

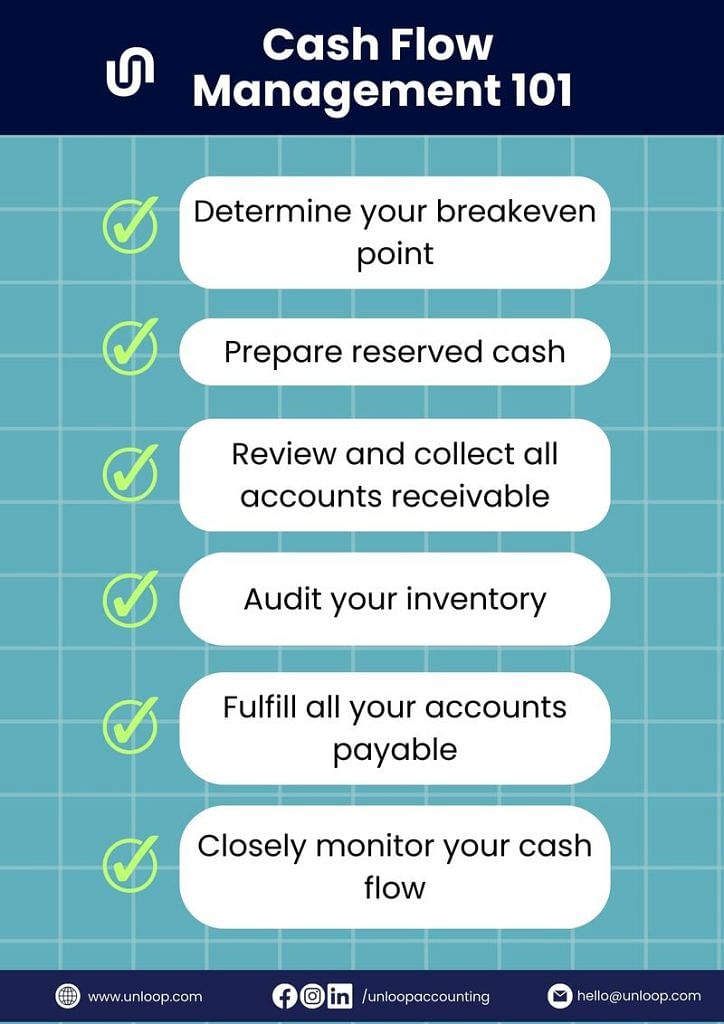

Proper bookkeeping is crucial in monitoring your cash flow. To create a working budget for your business operations and assess your financial health, you must know how the money goes in and out of your business.

Unfortunately, most small e-commerce businesses have problems with their cash flow.

At the end of each accounting period, businesses tend to have unbalanced cash flow because of various factors, including failure to keep tabs on their accounts receivable and payable.

Solution

Here are simple tasks you can do to ensure your cash flow remains consistent:

#2: Issues with Your Inventory Management System

Even seasoned small business owners find inventory management confusing. The more products you sell and the more sales channels you open, the harder it is to keep up with your stock management.

When tracking inventory, you monitor item count, determine their value, and trace locations (if you’re multiple warehouses or outsourcing). Every sale you make means a change in your inventory. Changes also happen when you process returns and refunds.

Solution: Your inventory is the backbone of your business's cash flow management. Manually tracking inventory is a difficult endeavor, but not impossible.

It is best to have ecommerce accounting software with inventory tracking features to avoid any issues. The software will automate the whole inventory management process so you can fully control the stock's movements.

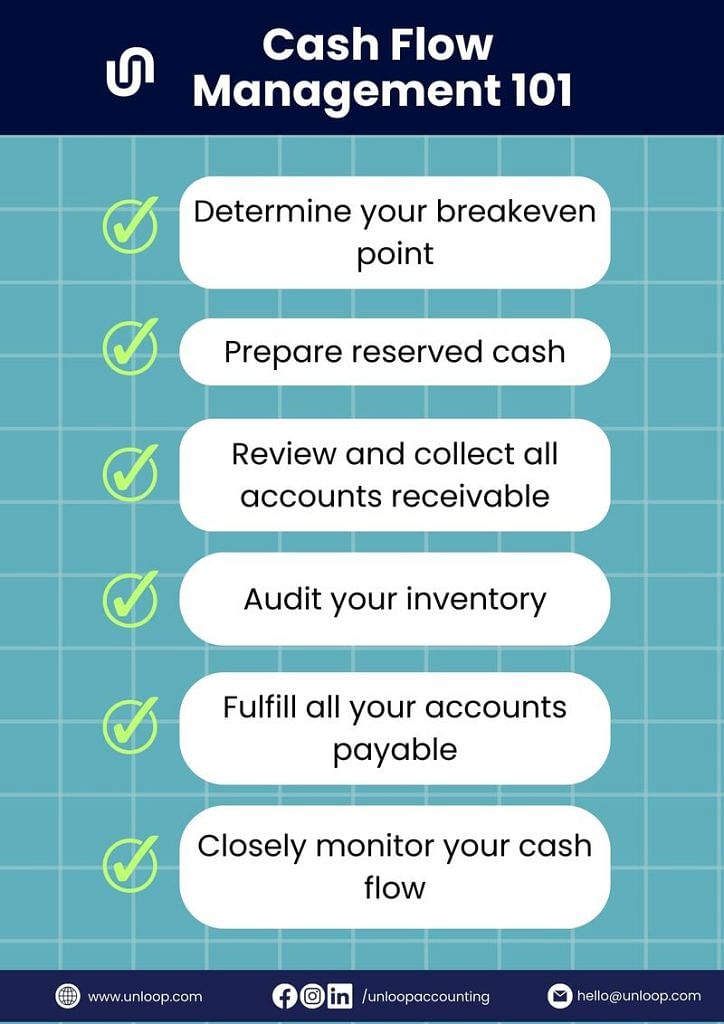

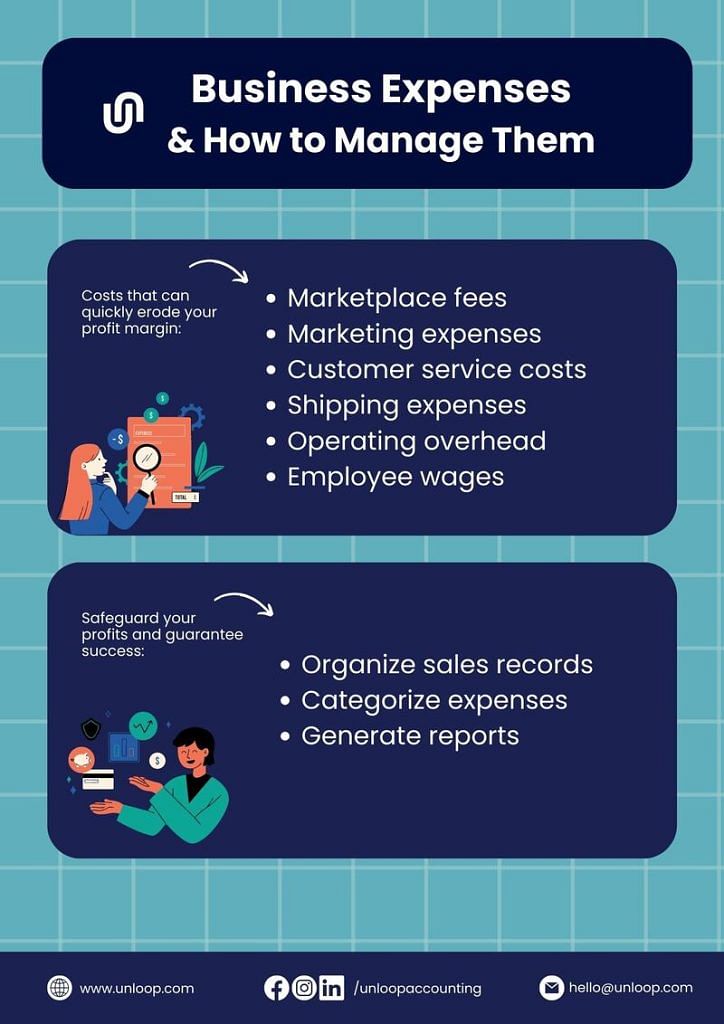

Running a business is not all about income. While gaining sales is the better part of running it, you must also manage and understand your expenses. If you don't monitor your costs, you can spend over your budget, which could reflect a negative income.

Here are some types of business expenses you should consider and how to manage them:

The biggest challenge for e-commerce business owners is handling sales tax. Tax, in general, is the most complicated part of accounting.

The issues start with identifying your tax nexus. Depending on where you belong, sales tax rates may differ. In bookkeeping, sales tax has its own ledger. This will help the owner track if they are collecting the right amount. But it can disrupt your cash flow if you don't know the correct rates.

Solution: You can overcome difficulties in sales tax by doing the following:

Paying monthly fees to maintain an online selling presence is common, but managing them isn't always easy. Miscellaneous fees, including listing, advertising, shipping fulfillment, and other merchant fees, can be difficult to track because they are applied differently.

When you have bulk orders, these fees may go unnoticed and unlisted. Failing to list them as expenses can reflect discrepancies on your balance sheets at the end of the accounting period. And if you sell on multiple platforms, it adds another layer of complexity to the system.

Solution: Fortunately, online calculators exist for accounting fees in popular marketplaces like Amazon and Shopify. Still, the best solution to avoid mistakes is automation through accounting software. Don't play a guessing game with your fees. When errors pile up, it will cost you more money in the future.

Traditional bookkeeping method isn’t wrong, but it's a thing of the past.

Even if you own a small business, never underestimate its demand for record-keeping. You may find manual entry easy at first, but it will be harder to keep up as your business grows.

Solution: Again, investing in cloud accounting software is the best solution for this problem. You don't have to worry about investing big money in an accounting system. Instead, take advantage of software you can use for free.

Even free versions can do the basics of e-commerce bookkeeping. You don't have to spend much (if at all) at the beginning to automate your record-keeping process.

Fraud is probably the biggest concern that will get your bookkeeping into shambles. Imagine your records being manipulated. Data manipulation can affect your business's financial health if things get out of hand.

Small e-commerce businesses are more prone to fraud compared to larger companies. They don't have as much security for their financial statements and other documents as big companies do.

Here are some common fraud cases you should look into:

Solution: You can prevent fraud by being consistent and transparent with your records. Furthermore, assigning a dedicated and trustworthy e-commerce bookkeeper for your bookkeeping process can keep your financial records secure.

If you're an ecommerce business owner, you must have many things on your plate. Managing a business has many aspects; bookkeeping can be time-consuming and confusing for some. Instead of worrying about it, let Unloop handle it for you.

Our bookkeeping services cover the following tasks:

E-commerce bookkeeping may seem like a walk in the park, but it is better to let professionals assist you when your business starts to grow. This way, the process is guaranteed to run smoothly and without problems.

Aside from bookkeeping, Unloop also offers different accounting services for small business owners. Book a call with our experts and work with us today!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Almost every business owner across all e-commerce platforms can agree that accounting and bookkeeping for e-commerce are some of the most tedious parts of running a company. While they are undeniably challenging, both are essential to keep a business afloat.

This post will focus on e-commerce bookkeeping, the common challenges e-commerce business owners face, and some tips to overcome them.

Bookkeeping primarily involves documenting all financial transactions around your business. Keeping track of these may seem easy initially, but once they pile up, they pose challenges.

Bookkeeping obstacles may seem inevitable, but you can always be one step ahead. Read this blog about common e-commerce bookkeeping challenges and note the tips we'll share with you.

Proper bookkeeping is crucial in monitoring your cash flow. To create a working budget for your business operations and assess your financial health, you must know how the money goes in and out of your business.

Unfortunately, most small e-commerce businesses have problems with their cash flow.

At the end of each accounting period, businesses tend to have unbalanced cash flow because of various factors, including failure to keep tabs on their accounts receivable and payable.

Solution

Here are simple tasks you can do to ensure your cash flow remains consistent:

#2: Issues with Your Inventory Management System

Even seasoned small business owners find inventory management confusing. The more products you sell and the more sales channels you open, the harder it is to keep up with your stock management.

When tracking inventory, you monitor item count, determine their value, and trace locations (if you’re multiple warehouses or outsourcing). Every sale you make means a change in your inventory. Changes also happen when you process returns and refunds.

Solution: Your inventory is the backbone of your business's cash flow management. Manually tracking inventory is a difficult endeavor, but not impossible.

It is best to have ecommerce accounting software with inventory tracking features to avoid any issues. The software will automate the whole inventory management process so you can fully control the stock's movements.

Running a business is not all about income. While gaining sales is the better part of running it, you must also manage and understand your expenses. If you don't monitor your costs, you can spend over your budget, which could reflect a negative income.

Here are some types of business expenses you should consider and how to manage them:

The biggest challenge for e-commerce business owners is handling sales tax. Tax, in general, is the most complicated part of accounting.

The issues start with identifying your tax nexus. Depending on where you belong, sales tax rates may differ. In bookkeeping, sales tax has its own ledger. This will help the owner track if they are collecting the right amount. But it can disrupt your cash flow if you don't know the correct rates.

Solution: You can overcome difficulties in sales tax by doing the following:

Paying monthly fees to maintain an online selling presence is common, but managing them isn't always easy. Miscellaneous fees, including listing, advertising, shipping fulfillment, and other merchant fees, can be difficult to track because they are applied differently.

When you have bulk orders, these fees may go unnoticed and unlisted. Failing to list them as expenses can reflect discrepancies on your balance sheets at the end of the accounting period. And if you sell on multiple platforms, it adds another layer of complexity to the system.

Solution: Fortunately, online calculators exist for accounting fees in popular marketplaces like Amazon and Shopify. Still, the best solution to avoid mistakes is automation through accounting software. Don't play a guessing game with your fees. When errors pile up, it will cost you more money in the future.

Traditional bookkeeping method isn’t wrong, but it's a thing of the past.

Even if you own a small business, never underestimate its demand for record-keeping. You may find manual entry easy at first, but it will be harder to keep up as your business grows.

Solution: Again, investing in cloud accounting software is the best solution for this problem. You don't have to worry about investing big money in an accounting system. Instead, take advantage of software you can use for free.

Even free versions can do the basics of e-commerce bookkeeping. You don't have to spend much (if at all) at the beginning to automate your record-keeping process.

Fraud is probably the biggest concern that will get your bookkeeping into shambles. Imagine your records being manipulated. Data manipulation can affect your business's financial health if things get out of hand.

Small e-commerce businesses are more prone to fraud compared to larger companies. They don't have as much security for their financial statements and other documents as big companies do.

Here are some common fraud cases you should look into:

Solution: You can prevent fraud by being consistent and transparent with your records. Furthermore, assigning a dedicated and trustworthy e-commerce bookkeeper for your bookkeeping process can keep your financial records secure.

If you're an ecommerce business owner, you must have many things on your plate. Managing a business has many aspects; bookkeeping can be time-consuming and confusing for some. Instead of worrying about it, let Unloop handle it for you.

Our bookkeeping services cover the following tasks: