Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Almost every business owner across all e-commerce platforms can agree that accounting and bookkeeping for e-commerce are some of the most tedious parts of running a company. While they are undeniably challenging, both are essential to keep a business afloat.

This post will focus on e-commerce bookkeeping, the common challenges e-commerce business owners face, and some tips to overcome them.

Bookkeeping primarily involves documenting all financial transactions around your business. Keeping track of these may seem easy initially, but once they pile up, they pose challenges.

Bookkeeping obstacles may seem inevitable, but you can always be one step ahead. Read this blog about common e-commerce bookkeeping challenges and note the tips we'll share with you.

Proper bookkeeping is crucial in monitoring your cash flow. To create a working budget for your business operations and assess your financial health, you must know how the money goes in and out of your business.

Unfortunately, most small e-commerce businesses have problems with their cash flow.

At the end of each accounting period, businesses tend to have unbalanced cash flow because of various factors, including failure to keep tabs on their accounts receivable and payable.

Solution

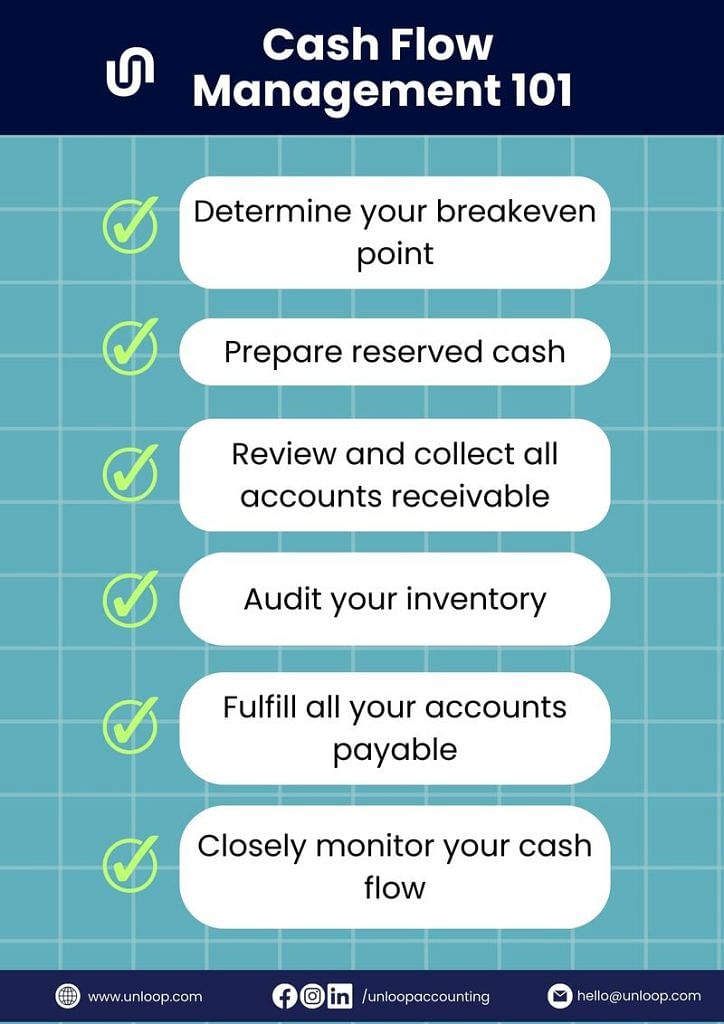

Here are simple tasks you can do to ensure your cash flow remains consistent:

#2: Issues with Your Inventory Management System

Even seasoned small business owners find inventory management confusing. The more products you sell and the more sales channels you open, the harder it is to keep up with your stock management.

When tracking inventory, you monitor item count, determine their value, and trace locations (if you’re multiple warehouses or outsourcing). Every sale you make means a change in your inventory. Changes also happen when you process returns and refunds.

Solution: Your inventory is the backbone of your business's cash flow management. Manually tracking inventory is a difficult endeavor, but not impossible.

It is best to have ecommerce accounting software with inventory tracking features to avoid any issues. The software will automate the whole inventory management process so you can fully control the stock's movements.

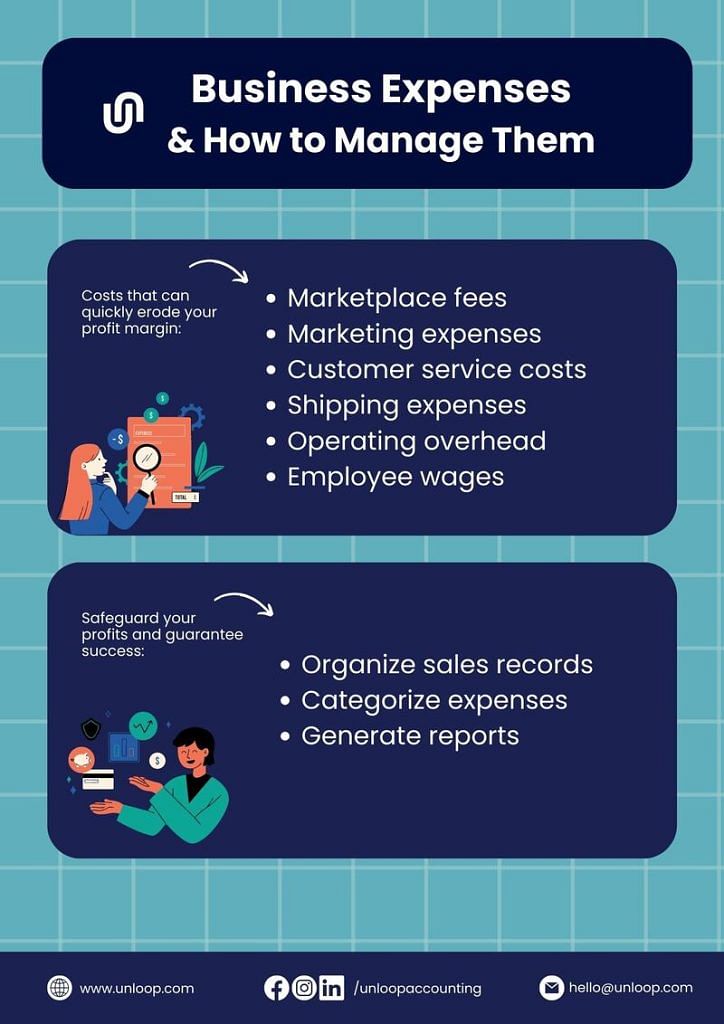

Running a business is not all about income. While gaining sales is the better part of running it, you must also manage and understand your expenses. If you don't monitor your costs, you can spend over your budget, which could reflect a negative income.

Here are some types of business expenses you should consider and how to manage them:

The biggest challenge for e-commerce business owners is handling sales tax. Tax, in general, is the most complicated part of accounting.

The issues start with identifying your tax nexus. Depending on where you belong, sales tax rates may differ. In bookkeeping, sales tax has its own ledger. This will help the owner track if they are collecting the right amount. But it can disrupt your cash flow if you don't know the correct rates.

Solution: You can overcome difficulties in sales tax by doing the following:

Paying monthly fees to maintain an online selling presence is common, but managing them isn't always easy. Miscellaneous fees, including listing, advertising, shipping fulfillment, and other merchant fees, can be difficult to track because they are applied differently.

When you have bulk orders, these fees may go unnoticed and unlisted. Failing to list them as expenses can reflect discrepancies on your balance sheets at the end of the accounting period. And if you sell on multiple platforms, it adds another layer of complexity to the system.

Solution: Fortunately, online calculators exist for accounting fees in popular marketplaces like Amazon and Shopify. Still, the best solution to avoid mistakes is automation through accounting software. Don't play a guessing game with your fees. When errors pile up, it will cost you more money in the future.

Traditional bookkeeping method isn’t wrong, but it's a thing of the past.

Even if you own a small business, never underestimate its demand for record-keeping. You may find manual entry easy at first, but it will be harder to keep up as your business grows.

Solution: Again, investing in cloud accounting software is the best solution for this problem. You don't have to worry about investing big money in an accounting system. Instead, take advantage of software you can use for free.

Even free versions can do the basics of e-commerce bookkeeping. You don't have to spend much (if at all) at the beginning to automate your record-keeping process.

Fraud is probably the biggest concern that will get your bookkeeping into shambles. Imagine your records being manipulated. Data manipulation can affect your business's financial health if things get out of hand.

Small e-commerce businesses are more prone to fraud compared to larger companies. They don't have as much security for their financial statements and other documents as big companies do.

Here are some common fraud cases you should look into:

Solution: You can prevent fraud by being consistent and transparent with your records. Furthermore, assigning a dedicated and trustworthy e-commerce bookkeeper for your bookkeeping process can keep your financial records secure.

If you're an ecommerce business owner, you must have many things on your plate. Managing a business has many aspects; bookkeeping can be time-consuming and confusing for some. Instead of worrying about it, let Unloop handle it for you.

Our bookkeeping services cover the following tasks:

E-commerce bookkeeping may seem like a walk in the park, but it is better to let professionals assist you when your business starts to grow. This way, the process is guaranteed to run smoothly and without problems.

Aside from bookkeeping, Unloop also offers different accounting services for small business owners. Book a call with our experts and work with us today!

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.