Starting an Amazon business requires essential bookkeeping and accounting to support your growth in the highly competitive marketplace. The vast scale of Amazon attracts numerous sellers and buyers, offering significant growth potential. Proper Amazon seller accounting is vital for identifying and capitalizing on these opportunities.

With the potential volume of transactions possible for every Amazon seller, it's important to understand the role accounting and bookkeeping play to ensure a smooth-sailing business. These can be the difference between stagnation and achieving your desired income level.

So let Unloop tackle these important business facets.

If you're an absolute beginner or have little idea about bookkeeping, you must get educated. Invest time in knowing the basics of bookkeeping and how it works.

If you have some idea already, reviewing the basics will benefit you when setting up a proper accounting system for your FBA business. Consider the following:

Educating yourself with fundamental lessons on bookkeeping is crucial. From there, skim other bookkeeping principles. For example, you can look into the significance of assets, liabilities, and capital and how these three relate to each other.

You must understand the accounting cycle to get the gist of how bookkeeping services work. Bookkeepers follow the steps of the cycle to ensure proper recording and allocating of income and expenses.

You'll also learn double entry accounting and do trial balances. You can choose whether to dive deeper into the bookkeeping practice once you fully grasp how the accounting cycle works.

Once you've learned how the accounting cycle works, you can now practice or outsource it. But first, you must decide what accounting method you'll use. There are two:

This accounting method records the transaction on a cash-received basis. The actual money must be in your bank account to qualify as an official record.

Microentrepreneurs and other startup enterprises most commonly use cash accounting for its simple, straightforward, and accurate process. It works well for simple business transactions.

The accrual method involves a time element. It records transactions based on when the transaction happened, regardless of whether there's money paid or not.

Accrual accounting is more complex, but it provides more information for those who manage businesses involving multiple transactions. Some large-scale companies have more leeway regarding credit, so a big-ticket item sale may inevitably be paid later.

It's also possible for you to acquire products and pay for them later or in advance before the product arrives. Accrual accounting is useful when reflecting these transactions in your accounting records.

Amazon Seller Accounting refers to the financial management and record-keeping practices that sellers on the Amazon platform use to track and manage their business transactions. It involves:

Automated Amazon Accounting will give you a quick view of your business transactions and finances. These numbers will then guide you on future steps and whether your current strategies effectively make your business profitable and sustainable.

Accounting is the backbone of Amazon businesses—of any business, in fact. Monitoring your numbers keeps your online store afloat. But there are other benefits to accounting that every Amazon business owner should leverage.

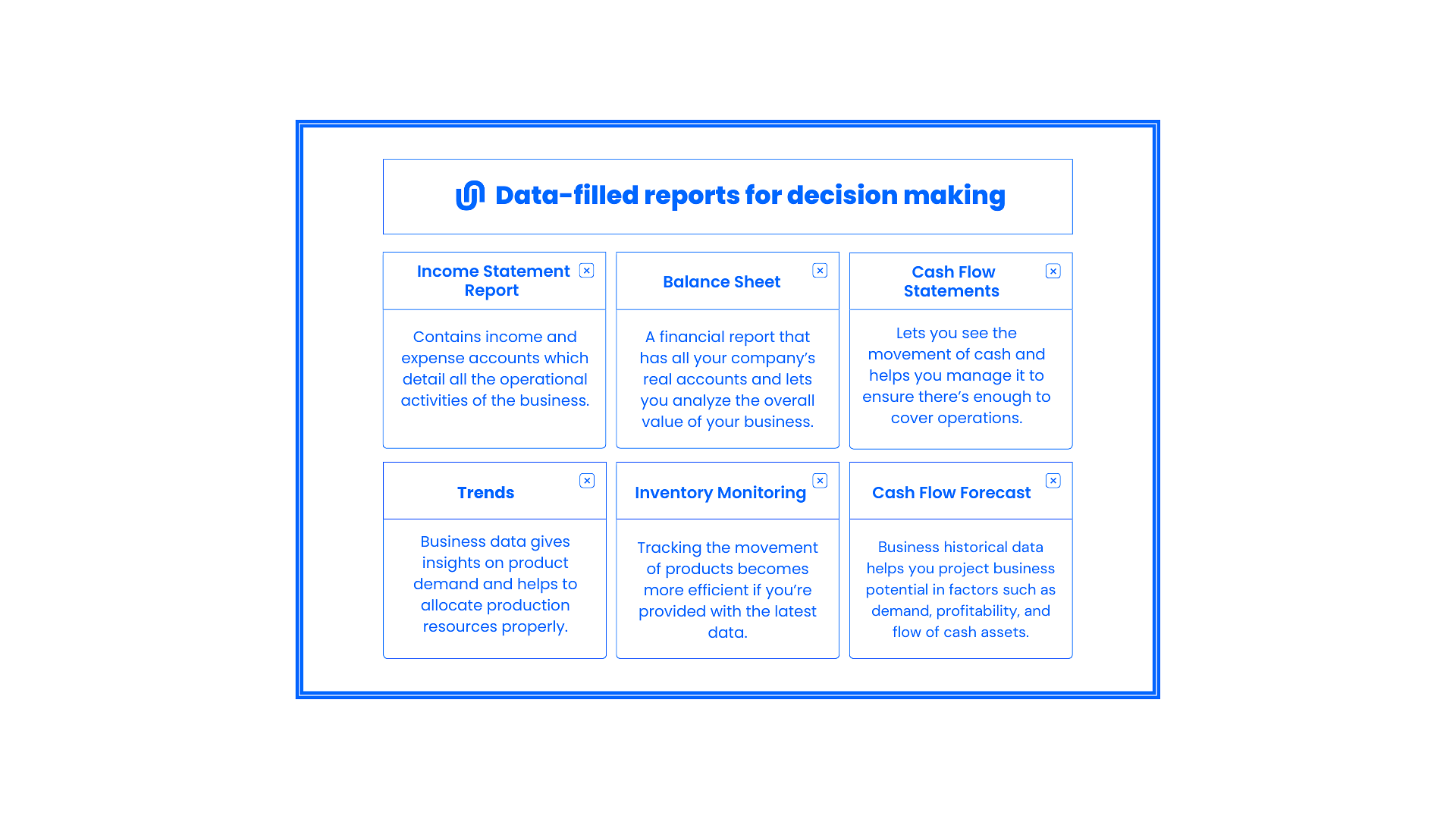

Once you begin your business accounting, you can get plenty of reports to help you create strategies and make decisions.

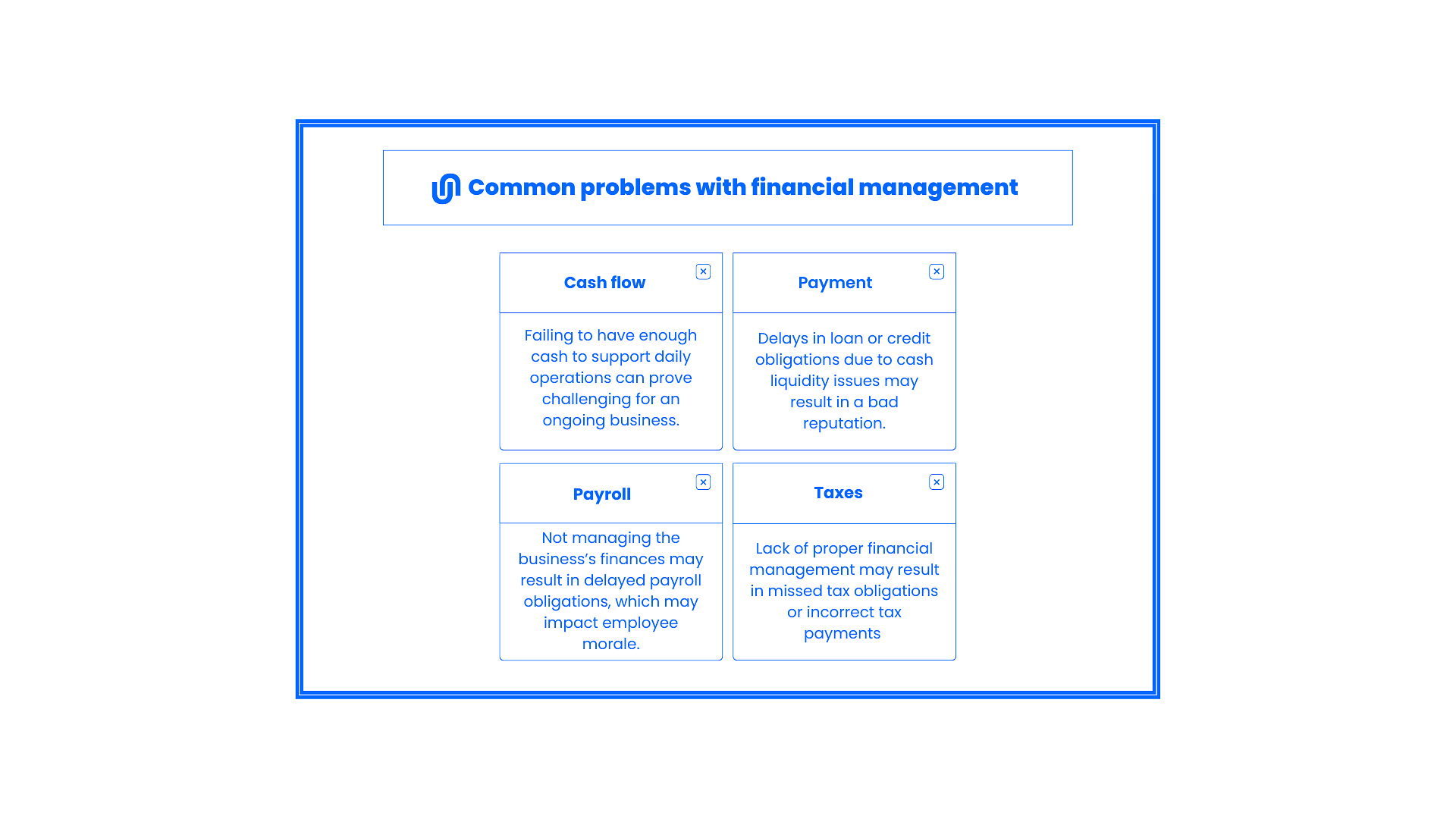

Your business will only grow and move forward if you manage your money well. Part of proper financial management is quickly knowing the factors that hurt your business so you can inhibit these problems from happening. The key to this is proactive planning.

Common problems with financial management:

You can be at peace once you get in-house accountants or a third-party agency offering Amazon seller accounting services. You know your business finances are monitored. There will be individuals who can give you valuable insights about your business's current status and manage your growth.

With that, you'll have plenty of time for the different areas in managing your Amazon store and other online stores. You can also focus on developing your products to ensure quality and increase sales. All these steps are done with coherence to the financial status of your business.

Some strategies that company executives and accountants use are the Profit First Framework and Traditional Accounting.

If you are increasing your profit, you should set a good amount aside as your earnings first before spending the rest on expenses.

Your business financial strategy is like a map. Like any other plans you have for your business, it will serve as a guide to take you to a successful end.

When is an early time? It would be best if you start accounting the moment you start your business. Minding this only during tax season is a typical mistake sellers make. Monitoring your assets and liabilities should be done immediately.

The tasks you'll need to accomplish as an entrepreneur never ends, but fulfill first what ensures your business's survival and success. And that is accounting.

Attending webinars and taking courses about accounting will help, especially when you get reports from accountants. Still, it would be best to delegate this task to specialists offering accounting and bookkeeping services. All these details are best accomplished and planned with your store and product launch planning.

Whether it's an online or physical store, you should register your business for necessary permits as soon as you start the business—this is for taxes and other legal factors. Some sellers get too busy with other tasks to launch their stores that they forget to register for taxation, while some intentionally do not write. Doing this just increases the hassle. Your business will risk getting fined for not paying on time or at all.

Defining how much tax you must pay also ensures you know exactly how much money will come from your account. This practice will make your Profit First Framework easier to enact.

Amazon sellers, in particular, will encounter issues involving sales tax. All merchants in the marketplace have to remit this to authorities, which means tracking sales tax becomes a crucial part of their business activity. Even if Amazon is the one collecting sales tax, they only give you all the collections in a lump sum, and you still have to determine the portion of the sales tax you should remit to the government.

If you are a trained accountant with experience in handling Amazon Seller Central and other relevant tools, then you can control your own accounting. However, if you do not have a background in this area, it is better to delegate it to experts.

Your period-specific reviews should always have accounting reports. As a business owner you can personalize the reports you want to have and when. Here are some samples:

| Report | Details You Can include |

| Cash Flow Management Report | Quick ratio, current ratio, cash balance, days sales outstanding, days payable outstanding |

| Profit and Loss Report | Gross profit margin, operating expense (OPEX) ratio, operating profit margin, net profit margin, earnings before interest and tax, income statement, net profit |

| Financial Performance Report | Balance sheet, assets return, working capital ratio, equity return, debt-equity ratio |

| Financial Key Performance Indicators Report | Current working capital, current liabilities, cash conversion cycle, vendor payment error rate, working capital |

| Financial Statement | Revenue, gross profit, earning before Interest and tax (EBIT), operating expenses, net income, economic value added (EVA), berry ratio, employee satisfaction, customer satisfaction |

All these reports will be more pleasing to the eyes and easy to understand if you establish a template and maximize the usage of graphs. In addition, information contained in the reports are not fixed, which means they can change depending on your company’s priorities.

If you have an automated system, all these reports can be checked anytime—even daily— to acquire the data. If Excel works for you, automation would make your systems a breeze. Still, the most advanced and convenient way to do accounting, especially on Amazon, is through software.

Here are the benefits of using software:

Many software allow a free trial, but most work on paid plans. Your investment is worth it with the automatic insights.

Efficient Amazon accounting means choosing the right accounting software for your business. Here are some of our top recommendations:

QuickBooks

Intuit's QuickBooks Online is one of the most popular and user-friendly, cloud-based accounting software out there. With the right third-party app, QuickBooks easily syncs to your Amazon seller central account, feeding the software with business transactions which you or your accountant can easily manage. Most Amazon sellers use this accounting software to handle their business finances.

Fetcher

If you’re only looking into accounting for Amazon FBA, you'll get more with Fetcher. This software can deliver you the following:

The order coverage Fetcher offers depends on the plan you will avail of.

Xero

Another popular choice among accountants and small business owners is the software Xero. You can use the functions of this free accounting software for a time and enjoy essential reports that management needs. Xero can also give you better features if you’re willing to pay.

Taxomate

As the name of this software suggests, Taxomate is a tool that can assist you with all your tax reports. It’s best if you use it hand-in-hand with the software QuickBooks or Xero. Whether you use FBA or FBM or sell in other marketplaces, your tax report will automatically generate.

GoDaddy

GoDaddy is the tool to use if you are an accounting beginner or would like to give it a try in handling your business accounting while looking for specialists to partner with. You can monitor the following on the platform:

The software also lets you create invoices if you’re participating in different marketplaces other than Amazon.

A2X

Another software you'll often hear in the Amazon accounting world is A2X, which should be combined with several other platforms to maximize its accounting capabilities. Note some of the important ones it can link to below:

Everything you need to know about your FBA expenses can be tracked and turned into easy-to-understand reports through A2X.

Now that you know all these nitty-gritty details about Amazon accounting, it is time to take action.

If you’re still relying on excel sheets, it’s time to level up your processes and reporting by moving to automated reports from software.

You have invested so much effort, time, and money to grow your business, so secure the ascension of your sales and growth of your store by ensuring your financial stability. We'd love to discuss how we can help you with Amazon accounting. Contact Unloop now.

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.