After years of earning the trust of business owners and retailers, Peachtree Accounting has rebranded and is now known as Sage Accounting. Sage Accounting software also offers Sage 50, Sage 100, and more products for accounting needs.

Interested to know what’s new with Peachtree, or should we say Sage Accounting? Can we still use Peachtree Accounting software? What can businesses get from this rebranding, especially small business owners? Let’s dive deeper into this article and learn the new strengths of Sage Accounting.

Before we explore the improvements in Sage Accounting, let’s first learn the history behind this accounting software.

| 💡Before it became the Sage Accounting that we know, it was first known as Peachtree Accounting. It was released way back in the 1980s by the Sage Group. |

Everything was simple back then. Do you still remember what Windows looked like? The setup of Peachtree required Windows 95, Windows 98, or Windows NT 4. Then, you insert the Peachtree Accounting compact disc and install it. Peachtree was, in fact, a classic software.

After more than twenty years of providing powerful accounting and financial reporting capabilities, Sage released their 2011 version. Two years later, the cloud-based online accounting software Sage 50cloud was officially launched in the US market.

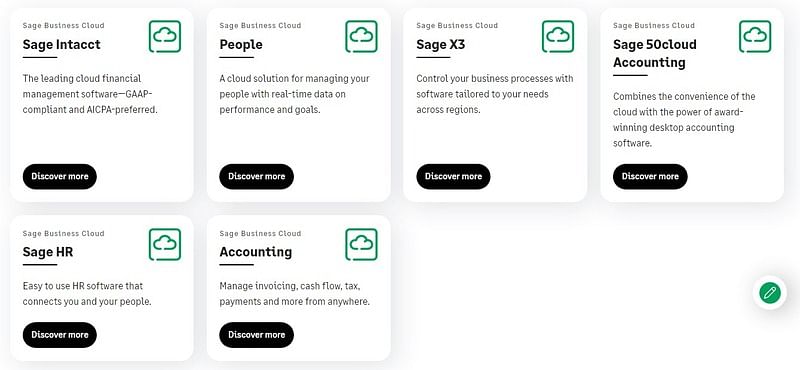

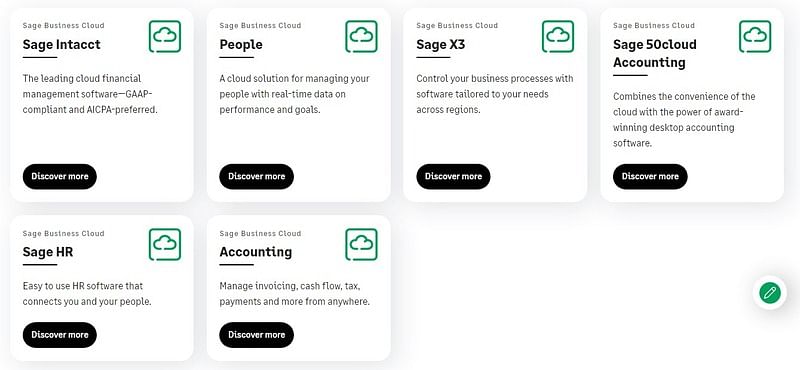

Now, Sage Accounting offers an excellent roster of accounting products and services for all sizes of businesses, including Sage Intacct and Sage X3.

Peachtree was well-received by many—a trusted solution, the perfect accounting software for small businesses. So, we’re pretty sure many of the product’s long-time users doubt the upgrade is any good. Why fix something that’s already perfect, right?

But, as advertised, Sage Accounting still features the same functionality and interface as Peachtree. So, believe us when we say it still looks like the ever-so-technical dashboard of Peachtree with a few tweaks in the system.

There are upsides to getting the latest software. Let’s see if the Sage business cloud accounting improvements are worth your money.

We live in the era of technology and e-commerce. As a result, no device, no mere program, does one simple function. Let’s take a look at some of the basic accounting functions and new features of Sage accounting:

| Basic accounting services: |

| New features: |

Seamless. Convenient. Collaborative.

These are the words we would use to describe today’s new and improved Sage online accounting software. Let’s take a deeper look into the strengths of this cloud-based accounting software:

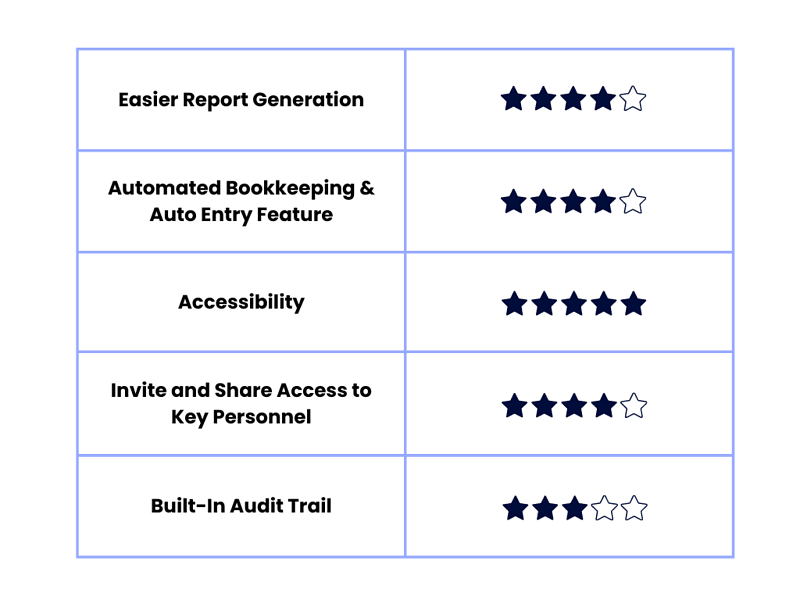

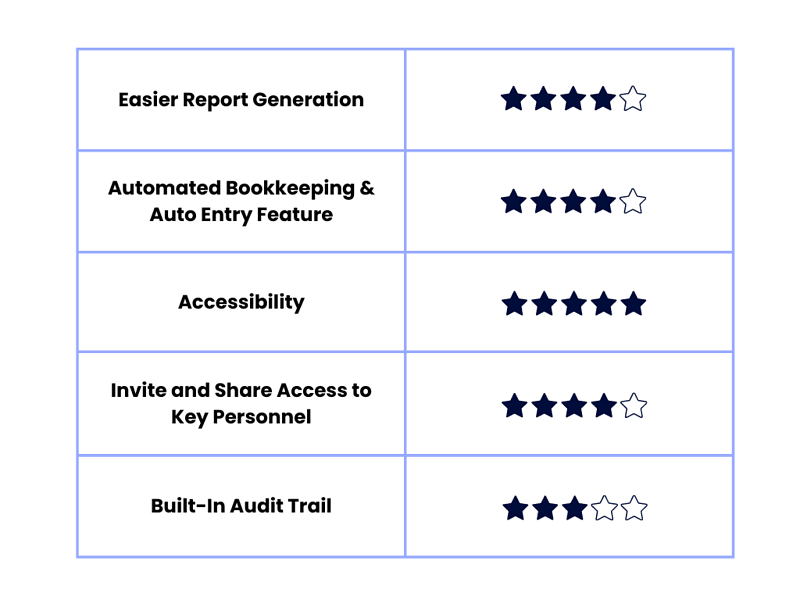

Sage may not always have a user-friendly interface. However, filing payroll and income tax reports could never have been easier and simpler with Sage Accounting. Everything you need is right before you, just a click away.

Sage Accounting’s simplicity is a huge advantage, especially when not all business owners are tech-savvy. Since they’re comfortable with using this tool, it is only a matter of time before they can enjoy the other benefits of Sage Accounting completely.

The accounting software has an automated bookkeeping system that allows you to focus on other parts of your business. You don’t have to worry about losing the receipts you have on hand through the Sage Accounting plan. With your smartphone, you can take a picture of the receipt and upload it directly to the accounting software.

The Auto Entry feature automatically extracts information from the receipt and categorizes them. These categorized entries are posted accurately on Sage, eliminating the need for manual data input.

With Microsoft Office 365 Integration, Sage Accounting provides you with secure online access and financial tools on any device at any time of day. Of course, you need to have internet access, but who doesn’t have internet access in this day and age?

Financial reports from the previous year are easily traceable, and every transaction is backed up and saved. You have fewer worries about redoing your work.

Employees, customers, and suppliers are all part of your company. Therefore, it makes sense that your financial statements include paychecks, purchase orders, and deposits.

Sage Accounting allows you to invite your accountant and colleagues and manage their access settings. Such a feature gives way to a more collaborative work environment as it happens in real-time, which is more secure overall.

The built-in audit trail lets you track every user’s activity, providing peace of mind that your employees are doing their job and your books are updated on time.

Now that you know the improvements and advantages of Sage Accounting, it would also be beneficial for your business to consider the potential drawbacks of this software before using it.

Not satisfied with Sage Accounting’s makeover? No problem. We want to give you financial decisions optimal for your organization’s unique needs. So, if Sage Accounting is not the one for you, here are the top 3 accounting programs you might want to try:

Compared to Sage Accounting’s Sage 50cloud program, Wave has limited features centered around invoicing and printing receipts. Wave is suitable for business owners who use traditional accounting tools and want to try out accounting software. The tool’s accounting, invoicing, and receipt scanning features are free.

This could be the perfect alternative if your business is doing great in your industry and expansion is around the corner. FreshBooks offers great invoice-to-payment functionality integrated with e-commerce platforms such as Shopify and Stripe.

Do you want flexible and customizable reporting with a minimalist look at an affordable price? QuickBooks Online offers many features, but it is best for small businesses or freelancers.

If you’re starting your business venture, you’re lucky to have read about Peachtree Accounting’s upgrade to Sage Accounting. Being in the know is always key to staying on top of things. If you’re looking for a robust and reliable accounting solution, you now know Sage should be on your list.

If you are still looking for a team to work with, Unloop is here. We provide accounting services at affordable prices. If you want to know more about us, book a call, and we’ll help you make bookkeeping and financial management easier for your business.

After years of earning the trust of business owners and retailers, Peachtree Accounting has rebranded and is now known as Sage Accounting. Sage Accounting software also offers Sage 50, Sage 100, and more products for accounting needs.

Interested to know what’s new with Peachtree, or should we say Sage Accounting? Can we still use Peachtree Accounting software? What can businesses get from this rebranding, especially small business owners? Let’s dive deeper into this article and learn the new strengths of Sage Accounting.

Before we explore the improvements in Sage Accounting, let’s first learn the history behind this accounting software.

| 💡Before it became the Sage Accounting that we know, it was first known as Peachtree Accounting. It was released way back in the 1980s by the Sage Group. |

Everything was simple back then. Do you still remember what Windows looked like? The setup of Peachtree required Windows 95, Windows 98, or Windows NT 4. Then, you insert the Peachtree Accounting compact disc and install it. Peachtree was, in fact, a classic software.

After more than twenty years of providing powerful accounting and financial reporting capabilities, Sage released their 2011 version. Two years later, the cloud-based online accounting software Sage 50cloud was officially launched in the US market.

Now, Sage Accounting offers an excellent roster of accounting products and services for all sizes of businesses, including Sage Intacct and Sage X3.

Peachtree was well-received by many—a trusted solution, the perfect accounting software for small businesses. So, we’re pretty sure many of the product’s long-time users doubt the upgrade is any good. Why fix something that’s already perfect, right?

But, as advertised, Sage Accounting still features the same functionality and interface as Peachtree. So, believe us when we say it still looks like the ever-so-technical dashboard of Peachtree with a few tweaks in the system.

There are upsides to getting the latest software. Let’s see if the Sage business cloud accounting improvements are worth your money.

We live in the era of technology and e-commerce. As a result, no device, no mere program, does one simple function. Let’s take a look at some of the basic accounting functions and new features of Sage accounting:

| Basic accounting services: |

| New features: |

Seamless. Convenient. Collaborative.

These are the words we would use to describe today’s new and improved Sage online accounting software. Let’s take a deeper look into the strengths of this cloud-based accounting software:

Sage may not always have a user-friendly interface. However, filing payroll and income tax reports could never have been easier and simpler with Sage Accounting. Everything you need is right before you, just a click away.

Sage Accounting’s simplicity is a huge advantage, especially when not all business owners are tech-savvy. Since they’re comfortable with using this tool, it is only a matter of time before they can enjoy the other benefits of Sage Accounting completely.

The accounting software has an automated bookkeeping system that allows you to focus on other parts of your business. You don’t have to worry about losing the receipts you have on hand through the Sage Accounting plan. With your smartphone, you can take a picture of the receipt and upload it directly to the accounting software.

The Auto Entry feature automatically extracts information from the receipt and categorizes them. These categorized entries are posted accurately on Sage, eliminating the need for manual data input.

With Microsoft Office 365 Integration, Sage Accounting provides you with secure online access and financial tools on any device at any time of day. Of course, you need to have internet access, but who doesn’t have internet access in this day and age?

Financial reports from the previous year are easily traceable, and every transaction is backed up and saved. You have fewer worries about redoing your work.

Employees, customers, and suppliers are all part of your company. Therefore, it makes sense that your financial statements include paychecks, purchase orders, and deposits.

Sage Accounting allows you to invite your accountant and colleagues and manage their access settings. Such a feature gives way to a more collaborative work environment as it happens in real-time, which is more secure overall.

The built-in audit trail lets you track every user’s activity, providing peace of mind that your employees are doing their job and your books are updated on time.

Now that you know the improvements and advantages of Sage Accounting, it would also be beneficial for your business to consider the potential drawbacks of this software before using it.

Not satisfied with Sage Accounting’s makeover? No problem. We want to give you financial decisions optimal for your organization’s unique needs. So, if Sage Accounting is not the one for you, here are the top 3 accounting programs you might want to try:

Compared to Sage Accounting’s Sage 50cloud program, Wave has limited features centered around invoicing and printing receipts. Wave is suitable for business owners who use traditional accounting tools and want to try out accounting software. The tool’s accounting, invoicing, and receipt scanning features are free.

This could be the perfect alternative if your business is doing great in your industry and expansion is around the corner. FreshBooks offers great invoice-to-payment functionality integrated with e-commerce platforms such as Shopify and Stripe.

Do you want flexible and customizable reporting with a minimalist look at an affordable price? QuickBooks Online offers many features, but it is best for small businesses or freelancers.

If you’re starting your business venture, you’re lucky to have read about Peachtree Accounting’s upgrade to Sage Accounting. Being in the know is always key to staying on top of things. If you’re looking for a robust and reliable accounting solution, you now know Sage should be on your list.

If you are still looking for a team to work with, Unloop is here. We provide accounting services at affordable prices. If you want to know more about us, book a call, and we’ll help you make bookkeeping and financial management easier for your business.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Amazon is not just a regular online marketplace; it's a massive platform that facilitates countless transactions on a daily basis. And where there are transactions, there are taxes. Sellers must understand the tax obligations of selling on such a platform. The solution? Amazon seller tax software designed for e-commerce platforms.

Taxes can pose business challenges due to the varying rates across jurisdictions. One wrong move can result in penalties, fines, and potential legal issues. By harnessing the power of tax software tools, you can automate sales tax filings while staying compliant with the ever-changing tax regulations of Amazon.

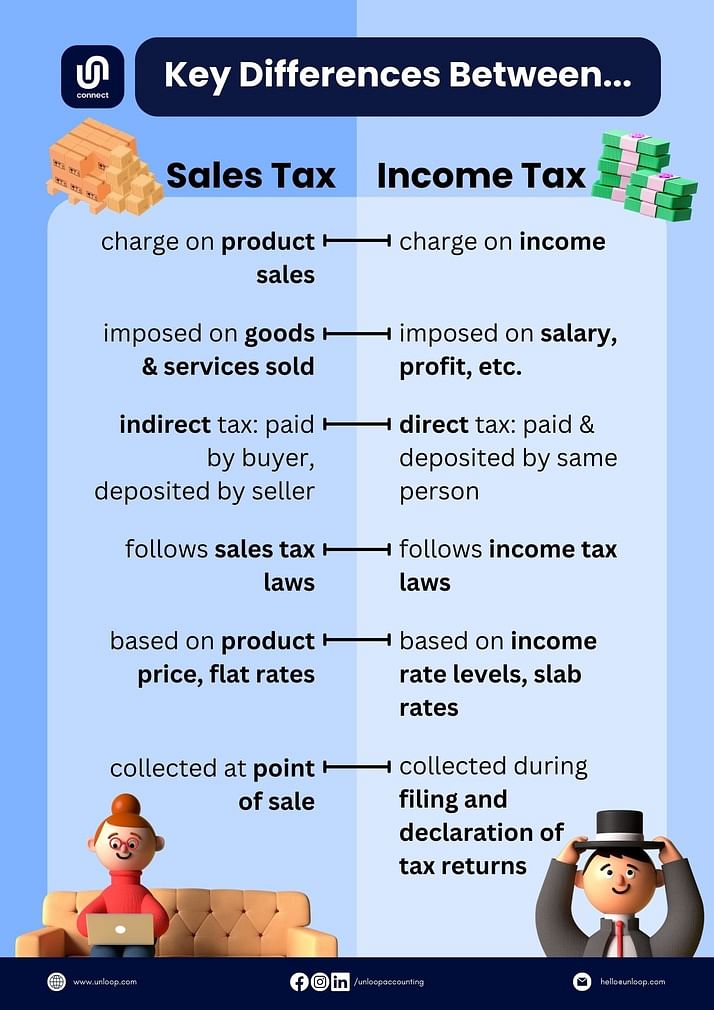

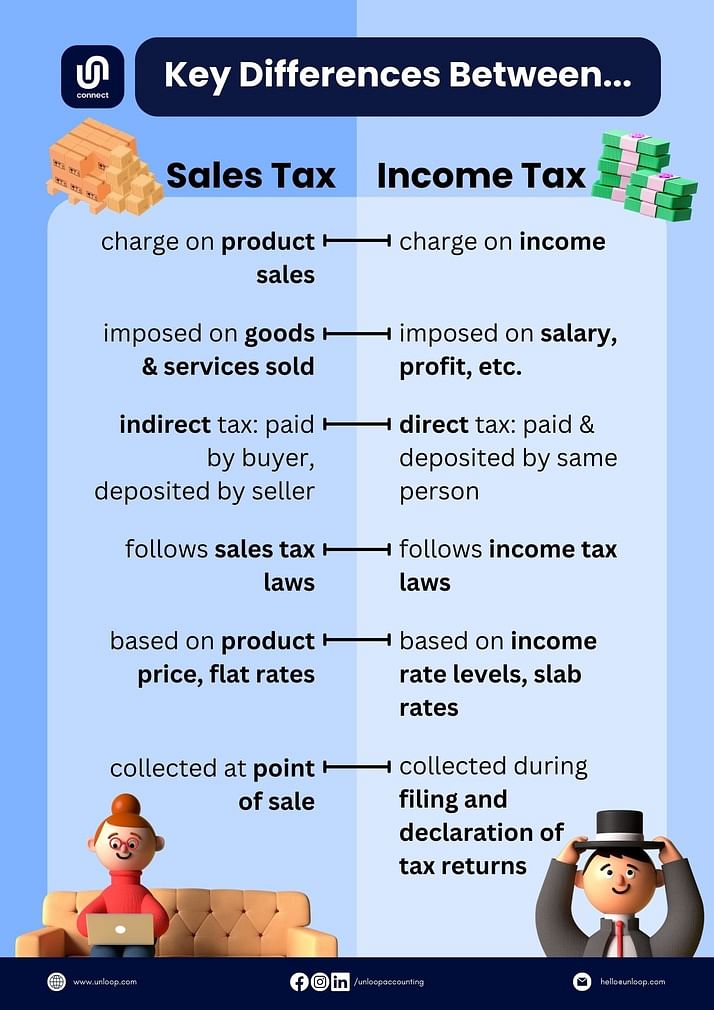

Before we delve into the best tax software for Amazon sellers, let's ensure we're all on the same page about the fundamentals of sales tax in this online marketplace.

Sales tax is a transaction-based tax that varies by state and sometimes by local jurisdictions. As an Amazon seller, you must know whether you are responsible for collecting and remitting sales tax returns based on specific rules and regulations.

In many cases, Amazon takes care of the hassle of calculating, collecting, and remitting sales tax for orders shipped to certain states. Isn't that a relief? No more stressing about manually figuring out tax processes for every transaction in those states.

But what about the other states? Sadly, the landscape changes when it comes to other states where Amazon doesn't assume the role of a facilitator. In these jurisdictions, sellers are responsible for the entire sales tax process. They must fulfill their duty accordingly to avoid any legal issues.

You can refer to this table for more information to find out which countries are covered by Amazon's marketplace legislation.

Sales tax is a topic that affects every ecommerce retailer, regardless of their size. But when it comes to Amazon FBA, the realm of sales tax can become more intricate and demanding compared to other retailers.

Amazon FBA offers numerous advantages, such as storage, packaging, and shipping services, allowing you to focus on their products and customer experience. But the convenience of FBA also brings with it a complex web of sales tax obligations that businesses must unravel.

Let’s start with the concept of Nexus. It refers to an Amazon seller's connection or presence in a particular state. With FBA, sellers often store their inventory in Amazon’s fulfillment centers across various states. This physical presence in multiple states can trigger sales tax obligations in those jurisdictions, even if the seller is based in a different state.

Another one is the dynamic nature of inventory movement within Amazon’s FBA network. Inventory may be transferred between fulfillment centers to optimize storage and shipping efficiency. While this benefits sellers in terms of logistics, it adds intricacy to sales tax compliance since the movement can impact the specific jurisdictions where sales occur.

Regulatory changes can also indicate an ongoing challenge for FBA sellers. Sales tax laws and regulations are not static; they often undergo state, country, and local modifications. These changes encompass new tax rates, adjusted thresholds, or revised exemptions. Staying updated and ensuring compliance can be demanding.

Let's not forget about physical products or tangible personal property. Sales tax obligations typically apply to the sale of physical goods, which is true for many products sold through Amazon FBA. Determining the correct sales tax rates and taxability of each item can be a lot, mainly when exemptions or special rules apply to certain things.

Navigating these hurdles requires a proactive approach to streamline sales tax management. The question now is, how will you rise to the challenge and stay on top of your tax responsibilities?

Managing Amazon sales tax compliance can quickly become overwhelming and prone to errors. Fortunately, there are solutions available to simplify the process.

You can now leverage sales tax automation software that integrates with your Amazon account. These nifty solutions take the burden off your shoulders by automatically calculating the appropriate sales tax for each transaction based on the customer's location and applicable tax rules.

As promised, here are four tax software options for Amazon sellers like you:

| TaxJar | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at $19/month |

| Sales Channels | Integrates with major ecommerce platforms, including Amazon, Shopify, Etsy, and Paypal |

| Tax Filing and Reporting | Uses TaxJar Autofile, a built-in technology that can electronically submit sales tax returns directly to the respective tax authorities. |

| Customer Support | Offers customer support via email and phone |

One of the most challenging tasks in sales tax rate computation is the first step—knowing which jurisdiction's sales tax nexus you fall under. National and local tax regulations make sales tax more complicated. But you can skip these worries with Taxjar, as the software stores information from 11,000 states, provinces, and municipalities.

Amazon also has the Marketplace Tax Collection, so even the tax acquisition and remittance are made for you. Meanwhile, Taxjar lets you export sales data in a CSV file to complete your sales taxes and have it ready for your financial reports.

| Taxomate | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at $12/month |

| Sales Channels | Integrates with Amazon and other e-commerce platforms like eBay, Shopify, and Walmart |

| Tax Filing and Reporting | Accountants can import settlements as sales receipts into QuickBooks or Xero and match them against bank deposits from Amazon. Bookkeepers can generate quarterly and yearly tax reports and verify them against the form 1099-K sent by Amazon to the IRS. |

| Customer Support | Offers customer support via email, chat, 1:1 onboarding |

Taxomate has you covered on your sales and income taxes. As your taxes are monitored, so is your inventory. You'll have data on best-selling products and when it is time for stock replenishment.

Once you purchase from Amazon and other ecommerce sites like Shopify and eBay, the details are automatically sent to Taxomate. Given that you have expanded your customers abroad and use a different currency, the multicurrency function of Taxomate will make tax computation and remittance easier.

| A2X | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at $19/month |

| Sales Channels | Integrates with Amazon and other ecommerce platforms like eBay, Shopify, Walmart, BigCommerce, and Etsy |

| Tax Filing and Reporting | A2X tells you exactly how much sales tax was collected per bank deposit. |

| Customer Support | FAQs/Forum, Phone Support, Knowledge Base, Email/Help Desk, Chat, 24/7 (Live rep) |

Another reliable software that can track your ecommerce business operations is A2X. Unlike other software that focuses on taxes, A2X's coverage is broader. It serves as automated bookkeeping for your business, which removes the need for manual input and the risk of data inaccuracy.

Amazon FBA and sales tax assistance are made possible because the software monitors FBA inventory locations and the destination of orders. These two details are the basis of sales tax rates. Because of the historical data available on the software, you can also check trends on sales tax and your business as a whole.

| HelloTax | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at 39€/month |

| Sales Channels | Integrates with Amazon and other ecommerce platforms like eBay, Shopify, WooCommerce, CDiscount, and Magento |

| Tax Filing and Reporting | Once your accounts are connected, and sales data are uploaded, HelloTax will organize your transactions and prepare reports. They will handle the filing of your VAT returns in the countries of your choice and take over communication with the tax authorities. All the necessary information and deadlines will be accessible to you on your dashboard. |

| Customer Support | FAQs/Forum, Phone Support, Knowledge Base, Email/Help Desk, Chat, 24/7 (Live rep) |

Your customers might be from countries that pay VAT, so it pays to know about it and how it is implemented. HelloTax helps you comply with requirements by offering features tailored to VAT calculations, reporting, and compliance.

Various EU countries and some provinces in Canada can benefit from this tax information reporting software. Most have distinct VAT systems and regulations requiring careful attention.

Navigating taxes, whether for local or international sales, can be a complex undertaking. You must understand how much tax is owed in each country or the recent changes in guidelines. But fear not; we're here to help!

At Unloop, we understand your challenges as an Amazon seller, so we've curated a list of exceptional software solutions to make your tax troubles a breeze. These innovative applications enable you to accurately calculate tax rates based on specific regions where your products are sold, simplifying the compliance process like never before.

But our support doesn’t stop here. We’re here to handle all your financial management needs through our reliable and efficient sales tax preparer services. You can focus on the bigger picture of your business while we handle the nitty-gritty of Amazon tax management.

Let us be your reliable partner in conquering the complexities of Amazon sales tax. Book a call now!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Amazon is not just a regular online marketplace; it's a massive platform that facilitates countless transactions on a daily basis. And where there are transactions, there are taxes. Sellers must understand the tax obligations of selling on such a platform. The solution? Amazon seller tax software designed for e-commerce platforms.

Taxes can pose business challenges due to the varying rates across jurisdictions. One wrong move can result in penalties, fines, and potential legal issues. By harnessing the power of tax software tools, you can automate sales tax filings while staying compliant with the ever-changing tax regulations of Amazon.

Before we delve into the best tax software for Amazon sellers, let's ensure we're all on the same page about the fundamentals of sales tax in this online marketplace.

Sales tax is a transaction-based tax that varies by state and sometimes by local jurisdictions. As an Amazon seller, you must know whether you are responsible for collecting and remitting sales tax returns based on specific rules and regulations.

In many cases, Amazon takes care of the hassle of calculating, collecting, and remitting sales tax for orders shipped to certain states. Isn't that a relief? No more stressing about manually figuring out tax processes for every transaction in those states.

But what about the other states? Sadly, the landscape changes when it comes to other states where Amazon doesn't assume the role of a facilitator. In these jurisdictions, sellers are responsible for the entire sales tax process. They must fulfill their duty accordingly to avoid any legal issues.

You can refer to this table for more information to find out which countries are covered by Amazon's marketplace legislation.

Sales tax is a topic that affects every ecommerce retailer, regardless of their size. But when it comes to Amazon FBA, the realm of sales tax can become more intricate and demanding compared to other retailers.

Amazon FBA offers numerous advantages, such as storage, packaging, and shipping services, allowing you to focus on their products and customer experience. But the convenience of FBA also brings with it a complex web of sales tax obligations that businesses must unravel.

Let’s start with the concept of Nexus. It refers to an Amazon seller's connection or presence in a particular state. With FBA, sellers often store their inventory in Amazon’s fulfillment centers across various states. This physical presence in multiple states can trigger sales tax obligations in those jurisdictions, even if the seller is based in a different state.

Another one is the dynamic nature of inventory movement within Amazon’s FBA network. Inventory may be transferred between fulfillment centers to optimize storage and shipping efficiency. While this benefits sellers in terms of logistics, it adds intricacy to sales tax compliance since the movement can impact the specific jurisdictions where sales occur.

Regulatory changes can also indicate an ongoing challenge for FBA sellers. Sales tax laws and regulations are not static; they often undergo state, country, and local modifications. These changes encompass new tax rates, adjusted thresholds, or revised exemptions. Staying updated and ensuring compliance can be demanding.

Let's not forget about physical products or tangible personal property. Sales tax obligations typically apply to the sale of physical goods, which is true for many products sold through Amazon FBA. Determining the correct sales tax rates and taxability of each item can be a lot, mainly when exemptions or special rules apply to certain things.

Navigating these hurdles requires a proactive approach to streamline sales tax management. The question now is, how will you rise to the challenge and stay on top of your tax responsibilities?

Managing Amazon sales tax compliance can quickly become overwhelming and prone to errors. Fortunately, there are solutions available to simplify the process.

You can now leverage sales tax automation software that integrates with your Amazon account. These nifty solutions take the burden off your shoulders by automatically calculating the appropriate sales tax for each transaction based on the customer's location and applicable tax rules.

As promised, here are four tax software options for Amazon sellers like you:

| TaxJar | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at $19/month |

| Sales Channels | Integrates with major ecommerce platforms, including Amazon, Shopify, Etsy, and Paypal |

| Tax Filing and Reporting | Uses TaxJar Autofile, a built-in technology that can electronically submit sales tax returns directly to the respective tax authorities. |

| Customer Support | Offers customer support via email and phone |

One of the most challenging tasks in sales tax rate computation is the first step—knowing which jurisdiction's sales tax nexus you fall under. National and local tax regulations make sales tax more complicated. But you can skip these worries with Taxjar, as the software stores information from 11,000 states, provinces, and municipalities.

Amazon also has the Marketplace Tax Collection, so even the tax acquisition and remittance are made for you. Meanwhile, Taxjar lets you export sales data in a CSV file to complete your sales taxes and have it ready for your financial reports.

| Taxomate | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at $12/month |

| Sales Channels | Integrates with Amazon and other e-commerce platforms like eBay, Shopify, and Walmart |

| Tax Filing and Reporting | Accountants can import settlements as sales receipts into QuickBooks or Xero and match them against bank deposits from Amazon. Bookkeepers can generate quarterly and yearly tax reports and verify them against the form 1099-K sent by Amazon to the IRS. |

| Customer Support | Offers customer support via email, chat, 1:1 onboarding |

Taxomate has you covered on your sales and income taxes. As your taxes are monitored, so is your inventory. You'll have data on best-selling products and when it is time for stock replenishment.

Once you purchase from Amazon and other ecommerce sites like Shopify and eBay, the details are automatically sent to Taxomate. Given that you have expanded your customers abroad and use a different currency, the multicurrency function of Taxomate will make tax computation and remittance easier.

| A2X | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at $19/month |

| Sales Channels | Integrates with Amazon and other ecommerce platforms like eBay, Shopify, Walmart, BigCommerce, and Etsy |

| Tax Filing and Reporting | A2X tells you exactly how much sales tax was collected per bank deposit. |

| Customer Support | FAQs/Forum, Phone Support, Knowledge Base, Email/Help Desk, Chat, 24/7 (Live rep) |

Another reliable software that can track your ecommerce business operations is A2X. Unlike other software that focuses on taxes, A2X's coverage is broader. It serves as automated bookkeeping for your business, which removes the need for manual input and the risk of data inaccuracy.

Amazon FBA and sales tax assistance are made possible because the software monitors FBA inventory locations and the destination of orders. These two details are the basis of sales tax rates. Because of the historical data available on the software, you can also check trends on sales tax and your business as a whole.

| HelloTax | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at 39€/month |

| Sales Channels | Integrates with Amazon and other ecommerce platforms like eBay, Shopify, WooCommerce, CDiscount, and Magento |

| Tax Filing and Reporting | Once your accounts are connected, and sales data are uploaded, HelloTax will organize your transactions and prepare reports. They will handle the filing of your VAT returns in the countries of your choice and take over communication with the tax authorities. All the necessary information and deadlines will be accessible to you on your dashboard. |

| Customer Support | FAQs/Forum, Phone Support, Knowledge Base, Email/Help Desk, Chat, 24/7 (Live rep) |

Your customers might be from countries that pay VAT, so it pays to know about it and how it is implemented. HelloTax helps you comply with requirements by offering features tailored to VAT calculations, reporting, and compliance.

Various EU countries and some provinces in Canada can benefit from this tax information reporting software. Most have distinct VAT systems and regulations requiring careful attention.

Navigating taxes, whether for local or international sales, can be a complex undertaking. You must understand how much tax is owed in each country or the recent changes in guidelines. But fear not; we're here to help!

At Unloop, we understand your challenges as an Amazon seller, so we've curated a list of exceptional software solutions to make your tax troubles a breeze. These innovative applications enable you to accurately calculate tax rates based on specific regions where your products are sold, simplifying the compliance process like never before.

But our support doesn’t stop here. We’re here to handle all your financial management needs through our reliable and efficient sales tax preparer services. You can focus on the bigger picture of your business while we handle the nitty-gritty of Amazon tax management.

Let us be your reliable partner in conquering the complexities of Amazon sales tax. Book a call now!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Nearly every business owner knows QuickBooks. Only three years ago, Intuit announced QuickBooks Amazon integration for small businesses to enjoy seamless payment processing and reconciliation on Amazon Business. The productivity rate has exponentially increased since this launch.

Still haven't connected your Amazon Business and QuickBooks Online accounts? We’ll show you how an Amazon-QuickBooks integration can help you achieve new levels of accounting efficiency and success.

Two is better than one, they say. So imagine the capabilities of the most powerful online market platform and the most comprehensive accounting software combined. The possibilities are endless.

QuickBooks organizes your bank accounts' order and purchase transactions into categories and links. Thus, having Amazon-QuickBooks integration is a great way to save time and keep track of your books to revisit wherever and whenever you need them.

In addition, accounting automation and reconciliation have never been easier. You can easily locate a transaction and get a complete breakdown.

Imagine your business flow if you had this kind of integration.

Do you know how to integrate Amazon with Quickbooks Online? How about your Amazon Seller account and QuickBooks Desktop? Let's help you set things up!

Currently, QuickBooks Online cannot be synced directly to your Amazon account. But you can do this through a third-party technology or an accounting and bookkeeping agency.

One of the ways to link your Amazon account and QuickBooks Online account is through Intuit’s own Amazon Marketplace Connector.

Step 1: Connect.

To start, go to Apps. Then, search Amazon Marketplace Connector by Intuit, click Get App Now, and follow the instructions. You'll then be directed to the log-in page of QuickBooks.

Step 2: Configure.

You'll need to set up the following Synchronization Options:

Step 3: Organize Your Workflow.

Now, you can begin selecting and deselecting the details you want to be part of your workflow. QuickBooks offers several useful workflow options.

Step 4: Sync.

Your QuickBooks account is ready to sync once you have mixed and matched your workflow options. First, choose between auto-sync (which syncs your account every hour) and manual sync, and then on your Synchronization Options, click Sync Now.

Is Amazon Marketplace Connector by Intuit free?

Will my data be safe and secure?

Is there customer support available?

Fortunately, Amazon Business account owners have the Amazon Business Purchases app, which makes the integration process even easier for their QuickBooks Online account.

Step 1: Connect.

Go to Apps; this time, search for the Amazon Business Purchases app and download it.

Step 2: Sync.

Next, choose how far back you want QuickBooks to go when it downloads transactions from Amazon: a week, a month, a year, or two years. Whatever you choose, you still control which downloaded transactions will be added to your books and shown on your reports.

Once you have decided, select Agree. A pop-up tab will appear, and you must enter your Amazon Business account credentials. Boom—done!

Step 3: Configure.

Your new Amazon Business purchases will appear on QuickBooks automatically. However, you must confirm them before they appear in your books.

Purchases on Amazon appear in QuickBooks, the same as your connected bank and credit card accounts.

Transactions listed under the For Review tab are up for approval. They won't appear on your reports or financial statements until you confirm them. Once you've confirmed a purchase from Amazon, you'll find it in the Review tab. It will stay there unless you undo your approval and make a change.

If you download something you don't want to add to your QuickBooks, you can exclude it.

Step 4: Manage Your Purchases.

The Source or Payee column displays the bank or credit card account used when you make a purchase.

Since you can use multiple bank accounts for these purchases, it is important to confirm what you see here to the bank accounts in your QuickBooks.

If you need to manage your bank or credit card accounts on QuickBooks, select the Account drop-down menu of each account. Don't forget to save afterward.

Select one under the For Review tab to take a closer look at a purchase transaction. With this, you'll see the products you purchased and an Amazon order link.

For each product purchased, select a category that best describes the product you bought. Once done, click Add. That transaction will automatically go to the Reviewed tab. If you want to see the transaction details again, just select them.

If you also download from your bank or credit card records, you'll also download the purchases from them. Make sure to match them at the For Review tab after you've added them from Amazon Business Purchases. Why?

Is the Amazon Business Purchases App free?

Can you use your personal Amazon.com account with QuickBooks?

Can you use Amazon Business to connect to your client's account through your QuickBooks Online account?

Like the Amazon Seller Central-QBO integration, QuickBooks Desktop doesn't directly integrate with Amazon. For now, third-party apps in the market offer this integration for QuickBooks Desktop Pro, Premier, and Enterprise, such as:

Note that these three are paid apps. A2X and Synder offer a week's worth of free trial, but Connex doesn't.

Despite using a third-party app and spending excess expenses, connecting QuickBooks Desktop and Amazon is easier than you might think. Just go through the configuration wizard, select Amazon (or any platform you prefer), and click Connect. Easy!

Intuit has decided to make life easier for Amazon sellers with the recent release of QuickBooks Desktop 2022.

The product’s new features include its swift and seamless e-commerce integration with Webgility, enabling users to track their transactions on Amazon, Shopify, and other e-commerce platforms easily and streamline other business processes.

Step 1: Sign up.

Simply register and purchase a package in Webgility to get started.

Step 2: Initiate.

In your QuickBooks Desktop interface, head to Company and click My Company. You will see an option to Get E-commerce Integration. Click this option.

Step 3: Connect.

Select and activate your preferred Webgility package. With your QuickBooks Desktop 2022 account signed in, your QuickBooks account will promptly link with Webgility.

QuickBooks Amazon integration saves up time on manual data entry and eliminates switching between QuickBooks and Amazon over and over. Time is money, as we say.

Moreover, it gives you an overview of how your business is doing. Integrating your Amazon to QuickBooks Online or Desktop is a great financial decision if you have a growing Amazon business and increasing business partners. The QuickBooks Desktop version may have some drawbacks in terms of pricing, but it's worth the money for hassle-free bookkeeping!

If you're unsure about this hip and new integration by Intuit and Amazon, you can always contact Unloop's financial experts for all your accounting needs. We're here to offer our insights and our high-quality ecommerce accounting service. Call us at 877-421-7270, and talk about the future of your Amazon business with us today.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Nearly every business owner knows QuickBooks. Only three years ago, Intuit announced QuickBooks Amazon integration for small businesses to enjoy seamless payment processing and reconciliation on Amazon Business. The productivity rate has exponentially increased since this launch.

Still haven't connected your Amazon Business and QuickBooks Online accounts? We’ll show you how an Amazon-QuickBooks integration can help you achieve new levels of accounting efficiency and success.

Two is better than one, they say. So imagine the capabilities of the most powerful online market platform and the most comprehensive accounting software combined. The possibilities are endless.

QuickBooks organizes your bank accounts' order and purchase transactions into categories and links. Thus, having Amazon-QuickBooks integration is a great way to save time and keep track of your books to revisit wherever and whenever you need them.

In addition, accounting automation and reconciliation have never been easier. You can easily locate a transaction and get a complete breakdown.

Imagine your business flow if you had this kind of integration.

Do you know how to integrate Amazon with Quickbooks Online? How about your Amazon Seller account and QuickBooks Desktop? Let's help you set things up!

Currently, QuickBooks Online cannot be synced directly to your Amazon account. But you can do this through a third-party technology or an accounting and bookkeeping agency.

One of the ways to link your Amazon account and QuickBooks Online account is through Intuit’s own Amazon Marketplace Connector.

Step 1: Connect.

To start, go to Apps. Then, search Amazon Marketplace Connector by Intuit, click Get App Now, and follow the instructions. You'll then be directed to the log-in page of QuickBooks.

Step 2: Configure.

You'll need to set up the following Synchronization Options:

Step 3: Organize Your Workflow.

Now, you can begin selecting and deselecting the details you want to be part of your workflow. QuickBooks offers several useful workflow options.

Step 4: Sync.

Your QuickBooks account is ready to sync once you have mixed and matched your workflow options. First, choose between auto-sync (which syncs your account every hour) and manual sync, and then on your Synchronization Options, click Sync Now.

Is Amazon Marketplace Connector by Intuit free?

Will my data be safe and secure?

Is there customer support available?

Fortunately, Amazon Business account owners have the Amazon Business Purchases app, which makes the integration process even easier for their QuickBooks Online account.

Step 1: Connect.

Go to Apps; this time, search for the Amazon Business Purchases app and download it.

Step 2: Sync.

Next, choose how far back you want QuickBooks to go when it downloads transactions from Amazon: a week, a month, a year, or two years. Whatever you choose, you still control which downloaded transactions will be added to your books and shown on your reports.

Once you have decided, select Agree. A pop-up tab will appear, and you must enter your Amazon Business account credentials. Boom—done!

Step 3: Configure.

Your new Amazon Business purchases will appear on QuickBooks automatically. However, you must confirm them before they appear in your books.

Purchases on Amazon appear in QuickBooks, the same as your connected bank and credit card accounts.

Transactions listed under the For Review tab are up for approval. They won't appear on your reports or financial statements until you confirm them. Once you've confirmed a purchase from Amazon, you'll find it in the Review tab. It will stay there unless you undo your approval and make a change.

If you download something you don't want to add to your QuickBooks, you can exclude it.

Step 4: Manage Your Purchases.

The Source or Payee column displays the bank or credit card account used when you make a purchase.

Since you can use multiple bank accounts for these purchases, it is important to confirm what you see here to the bank accounts in your QuickBooks.

If you need to manage your bank or credit card accounts on QuickBooks, select the Account drop-down menu of each account. Don't forget to save afterward.

Select one under the For Review tab to take a closer look at a purchase transaction. With this, you'll see the products you purchased and an Amazon order link.

For each product purchased, select a category that best describes the product you bought. Once done, click Add. That transaction will automatically go to the Reviewed tab. If you want to see the transaction details again, just select them.

If you also download from your bank or credit card records, you'll also download the purchases from them. Make sure to match them at the For Review tab after you've added them from Amazon Business Purchases. Why?

Is the Amazon Business Purchases App free?

Can you use your personal Amazon.com account with QuickBooks?

Can you use Amazon Business to connect to your client's account through your QuickBooks Online account?

Like the Amazon Seller Central-QBO integration, QuickBooks Desktop doesn't directly integrate with Amazon. For now, third-party apps in the market offer this integration for QuickBooks Desktop Pro, Premier, and Enterprise, such as:

Note that these three are paid apps. A2X and Synder offer a week's worth of free trial, but Connex doesn't.

Despite using a third-party app and spending excess expenses, connecting QuickBooks Desktop and Amazon is easier than you might think. Just go through the configuration wizard, select Amazon (or any platform you prefer), and click Connect. Easy!

Intuit has decided to make life easier for Amazon sellers with the recent release of QuickBooks Desktop 2022.

The product’s new features include its swift and seamless e-commerce integration with Webgility, enabling users to track their transactions on Amazon, Shopify, and other e-commerce platforms easily and streamline other business processes.

Step 1: Sign up.

Simply register and purchase a package in Webgility to get started.

Step 2: Initiate.

In your QuickBooks Desktop interface, head to Company and click My Company. You will see an option to Get E-commerce Integration. Click this option.

Step 3: Connect.

Select and activate your preferred Webgility package. With your QuickBooks Desktop 2022 account signed in, your QuickBooks account will promptly link with Webgility.

QuickBooks Amazon integration saves up time on manual data entry and eliminates switching between QuickBooks and Amazon over and over. Time is money, as we say.

Moreover, it gives you an overview of how your business is doing. Integrating your Amazon to QuickBooks Online or Desktop is a great financial decision if you have a growing Amazon business and increasing business partners. The QuickBooks Desktop version may have some drawbacks in terms of pricing, but it's worth the money for hassle-free bookkeeping!

If you're unsure about this hip and new integration by Intuit and Amazon, you can always contact Unloop's financial experts for all your accounting needs. We're here to offer our insights and our high-quality ecommerce accounting service. Call us at 877-421-7270, and talk about the future of your Amazon business with us today.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Are you running an ecommerce business? If yes, you know the online marketing platform is dynamic and highly competitive. Financial management can be especially tricky due to the unique characteristics and challenges associated with the businesses it caters to. You don't just need an accountant—you need an ecommerce accountant specializing in online businesses.

If you have started a business before, you may have gained some knowledge in managing and running your current venture. But when it comes to the online market, accounting works differently.

In this article, we'll learn more about the role of an expert in ecommerce accounting, why you should consider hiring one, and what makes a good accountant.

As an ecommerce business owner, many things must be done before your profit starts rolling into your bank account. Some of the most crucial processes are accounting and bookkeeping services, which are a must for your small company's financial management needs.

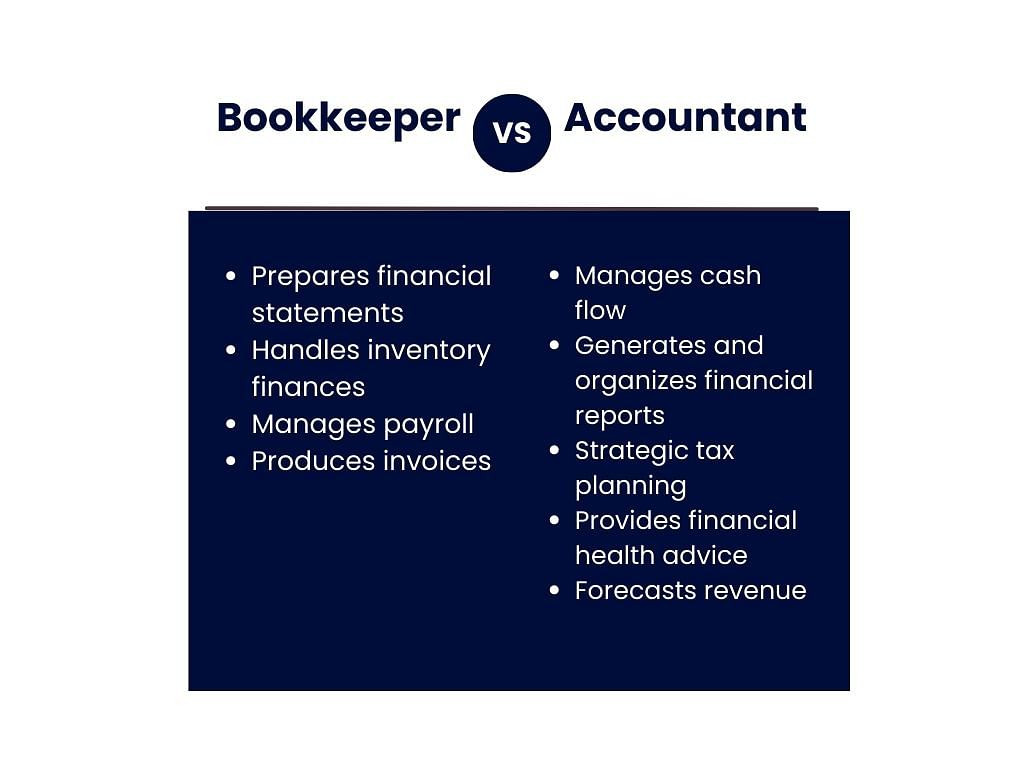

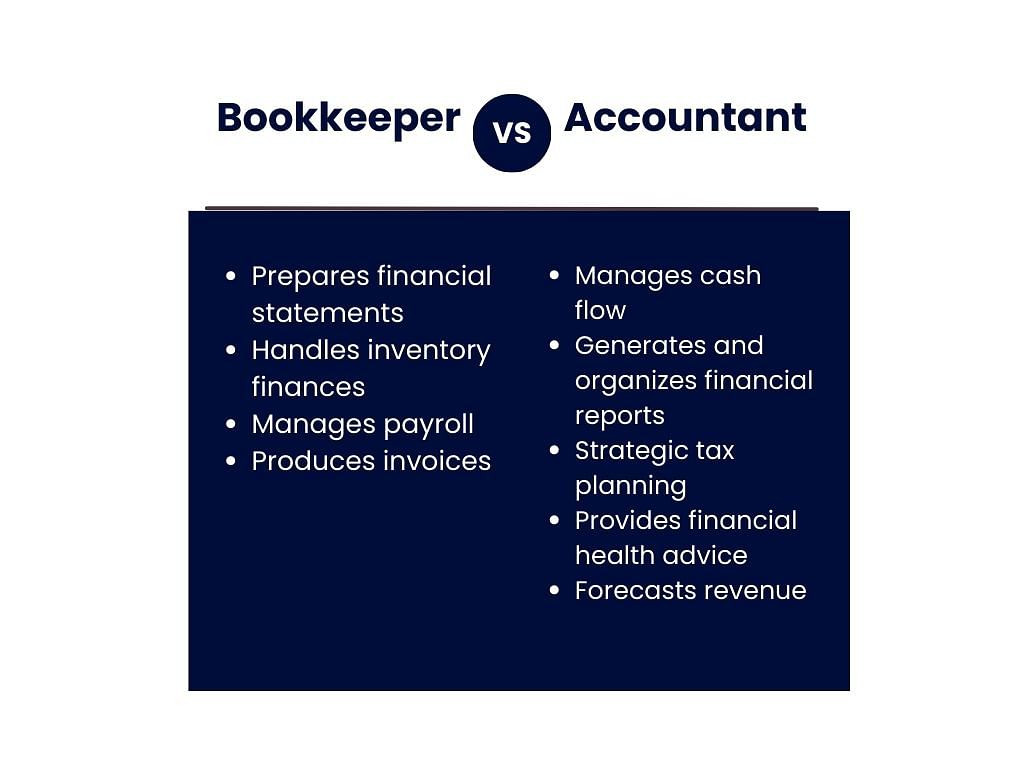

These services may sound the same if you're new to the business. But their roles are distinct, and both services are equally important for your business's success.

| 💡 To put it plainly, an expert bookkeeper keeps all the records of your business transactions. |

You can see it as keeping notes for your business expenses and income. Here are some tasks a bookkeeper does:

| 💡 On the other hand, accountants use your financial information for analysis. |

All the financial data from your bookkeeping can assess the current status of your ecommerce business. Here are some tasks an accountant can help you with:

Aside from those we mentioned above, accountants can do several vital tasks for your ecommerce business. Let's take a closer look at these tasks to see the advantages these experts in ecommerce accounting can provide you.

An accountant's job is to make sense of your business's financial records. Your initial financial records only show transactions, so the full picture remains unclear. Your accountants balance these transactions so you understand the flow of your income and expenses.

They also help track the accurate dates and times of your financial activities. In some businesses, there are scheduled financial transactions. But if you're inexperienced, you might interpret this as lost money. Accountants can help with these issues and keep your books clean and organized.

Many new sellers think that small businesses are exempted from auditing. But in reality, most tax collection agencies allocate resources to audit small businesses because these enterprises often file taxes incorrectly.

| 💡Audits are done by an independent auditor who thoroughly examines your books. They ensure all your financial statements’ data go where it's intended to as recorded in your books. |

Accountants help ensure you have accurate financial information, and they can work with the auditor to address any potential issues. Additionally, when your audit reports come out well, it opens you to loan opportunities and even sponsor partners that can help expand your business.

Collecting and filing taxes can be very confusing, especially sales tax in the ecommerce market. You'll burn through your profit by paying more than needed or incur fees if you don't know how the taxing system works. Ecommerce tax accountants ensure you avoid this and maintain smooth and compliant tax handling.

| For example, ecommerce business owners on Amazon must collect and remit sales taxes after reaching 200 separate sales transactions. However, this threshold varies depending on state sales tax laws. Policies also differ depending on the ecommerce platforms the sellers are using. |

Your accountants can help you

The data in your books are not only helpful for your past and present situation. Your accountants can also use it to forecast your future income. Recorded data creates a pattern that experts in ecommerce accounting interpret to see how much you will earn in the coming months.

Ecommerce trends also change rapidly. Ecommerce sellers like you can't have the same strategy for the whole year; doing so will make it difficult to stay on top of your competitors. Forecasting is essential in detecting these details, enabling you to assess your next move and achieve optimal results.

You can plan with your partner e commerce accountants about

Hiring external accounting and other services may seem unnecessary and not-so-secure to you, but they will benefit your business in the long run. Of course, choosing the correct expert to trust is essential. If you are to invest in external services, you should get the right one.

Here are the top things to consider when hiring an ecommerce accountant:

Look for an accountant with specialized experience in ecommerce businesses. The systems in sales channel platforms such as Amazon or Shopify differ, so managing your expenses may vary. Accountants with relevant experience in ecommerce know how to properly navigate and elevate your business through these dynamic, competitive environments.

Competent ecommerce accountants are well-versed in popular platforms like QuickBooks Online, Xero, or other accounting software. Their proficiency with such tools streamlines the accounting processes and boosts work efficiency.

Ecommerce businesses face unique tax considerations, especially when dealing with sales tax, international transactions, and nexus laws. Your chosen accountant should have a thorough understanding of tax regulations and be able to ensure compliance with relevant tax laws.

Exceptional ecommerce accountants proactively analyze financial data, identify trends, and provide strategic insights for a business's growth. Look for an accountant who offers detailed financial forecasts, cash flow analysis, and budgeting guidance.

With their support, you can make informed decisions, allocate resources effectively, and navigate online marketplace fluctuations more confidently.

Are you convinced that ecommerce accountants can help you with your business needs? Then, it's a wise move to hire ecommerce accounting services. Don't go wasting hard-earned money on mediocre service. At Unloop, we give the best service to ecommerce companies.

We have bookkeeping, income, and sales tax services perfect for small businesses. We also use the best accounting software to automate our processes. Our experts are experienced in handling ecommerce businesses, so you know you are in good hands from day one.

Book a call with us today, and let's accomplish all your ecommerce accounting needs!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Are you running an ecommerce business? If yes, you know the online marketing platform is dynamic and highly competitive. Financial management can be especially tricky due to the unique characteristics and challenges associated with the businesses it caters to. You don't just need an accountant—you need an ecommerce accountant specializing in online businesses.

If you have started a business before, you may have gained some knowledge in managing and running your current venture. But when it comes to the online market, accounting works differently.

In this article, we'll learn more about the role of an expert in ecommerce accounting, why you should consider hiring one, and what makes a good accountant.

As an ecommerce business owner, many things must be done before your profit starts rolling into your bank account. Some of the most crucial processes are accounting and bookkeeping services, which are a must for your small company's financial management needs.

These services may sound the same if you're new to the business. But their roles are distinct, and both services are equally important for your business's success.

| 💡 To put it plainly, an expert bookkeeper keeps all the records of your business transactions. |

You can see it as keeping notes for your business expenses and income. Here are some tasks a bookkeeper does:

| 💡 On the other hand, accountants use your financial information for analysis. |

All the financial data from your bookkeeping can assess the current status of your ecommerce business. Here are some tasks an accountant can help you with:

Aside from those we mentioned above, accountants can do several vital tasks for your ecommerce business. Let's take a closer look at these tasks to see the advantages these experts in ecommerce accounting can provide you.

An accountant's job is to make sense of your business's financial records. Your initial financial records only show transactions, so the full picture remains unclear. Your accountants balance these transactions so you understand the flow of your income and expenses.

They also help track the accurate dates and times of your financial activities. In some businesses, there are scheduled financial transactions. But if you're inexperienced, you might interpret this as lost money. Accountants can help with these issues and keep your books clean and organized.

Many new sellers think that small businesses are exempted from auditing. But in reality, most tax collection agencies allocate resources to audit small businesses because these enterprises often file taxes incorrectly.

| 💡Audits are done by an independent auditor who thoroughly examines your books. They ensure all your financial statements’ data go where it's intended to as recorded in your books. |

Accountants help ensure you have accurate financial information, and they can work with the auditor to address any potential issues. Additionally, when your audit reports come out well, it opens you to loan opportunities and even sponsor partners that can help expand your business.

Collecting and filing taxes can be very confusing, especially sales tax in the ecommerce market. You'll burn through your profit by paying more than needed or incur fees if you don't know how the taxing system works. Ecommerce tax accountants ensure you avoid this and maintain smooth and compliant tax handling.

| For example, ecommerce business owners on Amazon must collect and remit sales taxes after reaching 200 separate sales transactions. However, this threshold varies depending on state sales tax laws. Policies also differ depending on the ecommerce platforms the sellers are using. |

Your accountants can help you

The data in your books are not only helpful for your past and present situation. Your accountants can also use it to forecast your future income. Recorded data creates a pattern that experts in ecommerce accounting interpret to see how much you will earn in the coming months.

Ecommerce trends also change rapidly. Ecommerce sellers like you can't have the same strategy for the whole year; doing so will make it difficult to stay on top of your competitors. Forecasting is essential in detecting these details, enabling you to assess your next move and achieve optimal results.

You can plan with your partner e commerce accountants about

Hiring external accounting and other services may seem unnecessary and not-so-secure to you, but they will benefit your business in the long run. Of course, choosing the correct expert to trust is essential. If you are to invest in external services, you should get the right one.

Here are the top things to consider when hiring an ecommerce accountant:

Look for an accountant with specialized experience in ecommerce businesses. The systems in sales channel platforms such as Amazon or Shopify differ, so managing your expenses may vary. Accountants with relevant experience in ecommerce know how to properly navigate and elevate your business through these dynamic, competitive environments.

Competent ecommerce accountants are well-versed in popular platforms like QuickBooks Online, Xero, or other accounting software. Their proficiency with such tools streamlines the accounting processes and boosts work efficiency.

Ecommerce businesses face unique tax considerations, especially when dealing with sales tax, international transactions, and nexus laws. Your chosen accountant should have a thorough understanding of tax regulations and be able to ensure compliance with relevant tax laws.

Exceptional ecommerce accountants proactively analyze financial data, identify trends, and provide strategic insights for a business's growth. Look for an accountant who offers detailed financial forecasts, cash flow analysis, and budgeting guidance.

With their support, you can make informed decisions, allocate resources effectively, and navigate online marketplace fluctuations more confidently.

Are you convinced that ecommerce accountants can help you with your business needs? Then, it's a wise move to hire ecommerce accounting services. Don't go wasting hard-earned money on mediocre service. At Unloop, we give the best service to ecommerce companies.

We have bookkeeping, income, and sales tax services perfect for small businesses. We also use the best accounting software to automate our processes. Our experts are experienced in handling ecommerce businesses, so you know you are in good hands from day one.

Book a call with us today, and let's accomplish all your ecommerce accounting needs!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Did you know that we are currently experiencing an ecommerce boom? When brick and mortar stores shut down in 2019, the ecommerce industry reported record-breaking sales. As retail stores continue to open and resume normal business operations, ecommerce sales continue to enjoy a surge in growth. No wonder everyone is jumping on the commerce bandwagon!

Unless you have been living under a rock, you’ve probably made at least a single Amazon purchase. Almost every product you can imagine, you can buy on Amazon. Many people grew accustomed to how easy and fast it is to order products online and deliver them to their homes. If you wish to start a small business, an Amazon store would not be a bad place to start.

If you have ever asked how much does Amazon charge to sell products, and other similar questions, then you’ve come to the right place. Scroll down and read to learn more about being an Amazon seller!

Are you still unconvinced about starting an Amazon store? The Amazon marketplace unlocks many opportunities for a new seller like you. Understandably, you may be anxious about stepping foot on the Amazon marketplace without prior research about its good and bad sides. Below, we share some convincing reasons why it may be worth it to become an Amazon seller.

Starting a business doesn't mean you have to go all out and exhaust your savings as capital. The Amazon marketplace hosts hundreds to thousands of sellers with used and refurbished items for sale. You don't even have to source newly manufactured products from a supplier to begin selling! It's not so different from starting a garage sale, albeit with a global reach.

If you ask an Amazon seller what they like the best about selling on the Amazon marketplace, they would most likely say that their store and their products gained more exposure since they hopped on the ecommerce platform. The Amazon marketplace can be accessed by anyone (almost) anywhere, thereby widening your client base. With Amazon, your store becomes a global store.

Before ecommerce platforms like Amazon became popular, small business owners took their business online by building their websites. Today, people would easily dismiss such websites as too obscure and untrustworthy. However, by starting a business on Amazon, you share the reputable image that Amazon has maintained, making your potential clients and Amazon Prime customers trust your brand.

Fulfilling orders by yourself is tough work. For instance, you have to pack and ship your parcels individually while doing inventory management yourself. Fortunately, Amazon offers a service called Fulfillment by Amazon (FBA). Amazon FBA takes advantage of the company's extensive logistic network and their fulfillment center system, making shipping and fulfilling orders much faster.

Do you have more questions about doing business on Amazon? It's a wise move to do your due diligence and weigh the risks and benefits of being an Amazon seller before taking the plunge. We have collected some of the most often asked questions about selling on Amazon. Read the following section and let your mind be at ease as you step foot in the world of ecommerce.

Before you hop on Amazon, you should browse Amazon's different selling plans. Mainly, Amazon provides two tiers of selling plans: Individual Seller and Professional. Under the Individual Seller plan, you will have to pay $0.99 for every item you sell. Meanwhile, Amazon charges a monthly fee of $39.99 under the Professional plan. The choice depends on how large your business is.

If you have settled on which selling plan is the most appropriate for your needs, then you can proceed by creating a seller account on the platform.

If you haven't figured out a product to sell, looking at the top-selling products on Amazon may be a good place to start. Based on long-term observations, some products enjoy consistent sales throughout the year, year after year. For instance, books, clothing, shoes, jewelry, electronics, toys, and games always make it to the top of the list. So pick any of these product categories and craft a selling strategy.

You should also be wary of things like inventory management and storage fees. Stocking up and shipping your products would be much easier if you let Amazon do it for you through their fulfillment center. Shipping from an Amazon warehouse would be faster and more efficient when moving large quantities of products across the country.

Starting a business means taking risks, whether in a brick-and-mortar store or an online marketplace like Amazon. Some business owners even use their life savings as capital to launch small businesses. That's why you need to ask yourself whether attempting such an endeavour would be worth it in the long run.

According to an estimate, being an Amazon seller is highly profitable. For example, 44% or almost half of Amazon sellers make anywhere from $12,000 to $300,000 annually. In addition, around 20% of Amazon sellers enjoy profit margins of 16% to 20%.

If you want to grow your business to another stage, the answer would be a resounding yes. Instead of confining yourself to a physical store, you can take advantage of Amazon's international client base and fast logistics solutions. Becoming an Amazon FBA seller isn't as hard and capital intensive as starting a business from scratch.

If you ever Googled "what does Amazon charge to sell," it may no longer surprise you that there isn't a straightforward answer. Aside from the Amazon fee based on the selling plan you choose, they also charge a referral fee, a fulfillment fee, and other additional Amazon fees (such as storage fees). So there are layers of fees that may bite into your profit margins.

As mentioned before, Amazon sellers on the Individual Seller plan will be charged per item sold, while those on the Professional plan will be charged a fixed monthly Amazon seller fee. Meanwhile, Amazon also charges a minimum referral fee for every item bought and can range from 8% to 15%, depending on the product category. Lastly, if you opt to be an Amazon FBA seller, Amazon will also charge you an Amazon FBA fee for their fulfillment service.

Being an Amazon seller is no joke. Handling your inventory management and finances and fulfilling orders will be overwhelming as your business grows. How about letting a team of professional bookkeepers and accountants take over your books?

With Unloop you no longer have to be frustrated about sales tax, income tax and bookkeeping. So you can give your time and attention to running your business.

Get started with Unloop today, and see what it's like to run your business on autopilot.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Did you know that we are currently experiencing an ecommerce boom? When brick and mortar stores shut down in 2019, the ecommerce industry reported record-breaking sales. As retail stores continue to open and resume normal business operations, ecommerce sales continue to enjoy a surge in growth. No wonder everyone is jumping on the commerce bandwagon!

Unless you have been living under a rock, you’ve probably made at least a single Amazon purchase. Almost every product you can imagine, you can buy on Amazon. Many people grew accustomed to how easy and fast it is to order products online and deliver them to their homes. If you wish to start a small business, an Amazon store would not be a bad place to start.

If you have ever asked how much does Amazon charge to sell products, and other similar questions, then you’ve come to the right place. Scroll down and read to learn more about being an Amazon seller!

Are you still unconvinced about starting an Amazon store? The Amazon marketplace unlocks many opportunities for a new seller like you. Understandably, you may be anxious about stepping foot on the Amazon marketplace without prior research about its good and bad sides. Below, we share some convincing reasons why it may be worth it to become an Amazon seller.

Starting a business doesn't mean you have to go all out and exhaust your savings as capital. The Amazon marketplace hosts hundreds to thousands of sellers with used and refurbished items for sale. You don't even have to source newly manufactured products from a supplier to begin selling! It's not so different from starting a garage sale, albeit with a global reach.

If you ask an Amazon seller what they like the best about selling on the Amazon marketplace, they would most likely say that their store and their products gained more exposure since they hopped on the ecommerce platform. The Amazon marketplace can be accessed by anyone (almost) anywhere, thereby widening your client base. With Amazon, your store becomes a global store.

Before ecommerce platforms like Amazon became popular, small business owners took their business online by building their websites. Today, people would easily dismiss such websites as too obscure and untrustworthy. However, by starting a business on Amazon, you share the reputable image that Amazon has maintained, making your potential clients and Amazon Prime customers trust your brand.

Fulfilling orders by yourself is tough work. For instance, you have to pack and ship your parcels individually while doing inventory management yourself. Fortunately, Amazon offers a service called Fulfillment by Amazon (FBA). Amazon FBA takes advantage of the company's extensive logistic network and their fulfillment center system, making shipping and fulfilling orders much faster.

Do you have more questions about doing business on Amazon? It's a wise move to do your due diligence and weigh the risks and benefits of being an Amazon seller before taking the plunge. We have collected some of the most often asked questions about selling on Amazon. Read the following section and let your mind be at ease as you step foot in the world of ecommerce.

Before you hop on Amazon, you should browse Amazon's different selling plans. Mainly, Amazon provides two tiers of selling plans: Individual Seller and Professional. Under the Individual Seller plan, you will have to pay $0.99 for every item you sell. Meanwhile, Amazon charges a monthly fee of $39.99 under the Professional plan. The choice depends on how large your business is.

If you have settled on which selling plan is the most appropriate for your needs, then you can proceed by creating a seller account on the platform.

If you haven't figured out a product to sell, looking at the top-selling products on Amazon may be a good place to start. Based on long-term observations, some products enjoy consistent sales throughout the year, year after year. For instance, books, clothing, shoes, jewelry, electronics, toys, and games always make it to the top of the list. So pick any of these product categories and craft a selling strategy.

You should also be wary of things like inventory management and storage fees. Stocking up and shipping your products would be much easier if you let Amazon do it for you through their fulfillment center. Shipping from an Amazon warehouse would be faster and more efficient when moving large quantities of products across the country.

Starting a business means taking risks, whether in a brick-and-mortar store or an online marketplace like Amazon. Some business owners even use their life savings as capital to launch small businesses. That's why you need to ask yourself whether attempting such an endeavour would be worth it in the long run.

According to an estimate, being an Amazon seller is highly profitable. For example, 44% or almost half of Amazon sellers make anywhere from $12,000 to $300,000 annually. In addition, around 20% of Amazon sellers enjoy profit margins of 16% to 20%.

If you want to grow your business to another stage, the answer would be a resounding yes. Instead of confining yourself to a physical store, you can take advantage of Amazon's international client base and fast logistics solutions. Becoming an Amazon FBA seller isn't as hard and capital intensive as starting a business from scratch.

If you ever Googled "what does Amazon charge to sell," it may no longer surprise you that there isn't a straightforward answer. Aside from the Amazon fee based on the selling plan you choose, they also charge a referral fee, a fulfillment fee, and other additional Amazon fees (such as storage fees). So there are layers of fees that may bite into your profit margins.

As mentioned before, Amazon sellers on the Individual Seller plan will be charged per item sold, while those on the Professional plan will be charged a fixed monthly Amazon seller fee. Meanwhile, Amazon also charges a minimum referral fee for every item bought and can range from 8% to 15%, depending on the product category. Lastly, if you opt to be an Amazon FBA seller, Amazon will also charge you an Amazon FBA fee for their fulfillment service.

Being an Amazon seller is no joke. Handling your inventory management and finances and fulfilling orders will be overwhelming as your business grows. How about letting a team of professional bookkeepers and accountants take over your books?

With Unloop you no longer have to be frustrated about sales tax, income tax and bookkeeping. So you can give your time and attention to running your business.

Get started with Unloop today, and see what it's like to run your business on autopilot.

Deciding to invest in bookkeeping software for your small business is already tough enough. Add choosing the right bookkeeping software for your business to the mix, and you can quickly become overwhelmed, especially with the countless choices available.

In this article, we'll have Xero vs. Quickbooks vs. Freshbooks to help you decide which one is best for your business. We'll look at the similarities and differences in the accounting features of each program. So whether you're just starting or looking to switch to new software, read on for all the information you need to make the right choice!

The three accounting software have plenty of similarities in the features they offer that you might ask yourself if there is a need for a discussion on Quickbooks vs. Xero vs. Freshbooks. When you sign-up for a plan on one these three, you can enjoy all these benefits:

| Accounting Software Features | How It Works | Freshbooks | Quickbooks Online | Xero |

| Inventory Tracking and Management | Inventory management, integration to various eCommerce accounts, and tracking of in-stock items | ✅ | ✅ | ✅ |

| Accounts Receivable and Payable (Double-Entry Accounting) | Income and expense tracking for cash flow management | ✅ | ✅ | ✅ |

| Invoice | Includes limited or unlimited invoice customization, adding of a “Pay now” button, recurring invoices, and payment reminders | ✅ | ✅ | ✅ |

| Taxes | Data prepared for the tax season | ✅ | ✅ | ✅ |

| Project Tracking | Manage your teams and projects | ✅ | ✅ | ✅ |

| Time Tracking | Track work hours of your employees | ✅ | ✅ | ✅ |

| Bank Reconciliation | Monitors and records your bank account transactions | ✅ | ✅ | ✅ |

| Automation | Many features of the accounting software are automated and do not need manual entry | ✅ | ✅ | ✅ |

| Integrations | Integrations on eCommerce sites, other software, and apps | ✅ | ✅ | ✅ |

| Data Security, Role-based Access, Cloud-based | Cloud-based storage is used for data security | ✅ | ✅ | ✅ |

| Mobile Application | Software users on the go can check their business finances on their mobile phones | ✅ | ✅ | ✅ |

| Reporting | With all business data available, you can generate reports in an instant | ✅ | ✅ | ✅ |

| Free Trial | Try out some of the premium features of the software for free | ✅ | ✅ | ✅ |

| Payment Gateways | Users can utilize bank, credit card, online payments, and more! | ✅ | ✅ | ✅ |

If the three have many similarities, these distinct features will be the deciding factors on which one you will pick. You’ll see that the three small business accounting software only have a few differences, but they will be enough for you to know which shines brighter than the rest.

If you want something straightforward and complete with everything a beginner in bookkeeping and accounting needs, Freshbooks is the perfect accounting software for you. The software has a simple interface and no complicated features that will make first-time users have a difficult time. Yet, despite the simplicity, it still has all the features you need to start and keep your business’s bookkeeping and accounting running.

Freshbooks pricing is also excellent for a startup or small business, freelancer, and a self-employed individual. The three plans don’t cost more than $15. Nevertheless, if Freshbooks doesn’t include the accounting services you need within the plan, Freshbooks has customized pricing plans.