Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Bookkeeping is fundamental to any business, including those operating on Amazon. Effective bookkeeping for Amazon sellers is essential to accurately track sales, expenses, and profits, which is especially crucial for small business owners wanting to grow their businesses.

Tracking finances will help you better understand your business's financial health. The net profit predicts whether your business is earning or failing, so you must update your books regularly. Bookkeeping for Amazon also ensures that you are on top of your tax obligations. You can't compute your taxes when your accounts and business transactions are everywhere.

This handy primer provides a comprehensive overview of bookkeeping practices specifically tailored for Amazon sellers. We'll cover key concepts such as the importance of bookkeeping on the eCommerce platform, some terms to know for beginner Amazon sellers, bookkeeping and accounting software, and the assistance you can get from a bookkeeping and accounting firm.

Whether you are a newbie or a seasoned Amazon seller, understanding bookkeeping fundamentals is crucial in maintaining financial health and achieving long-term success on this eCommerce platform. So, keep reading!

Let's begin by knowing the different bookkeeping terms on financial statements, income statements, balance sheets, credit card statements, or even on an Excel spreadsheet.

Checking Amazon reports and creating customized financial reports will be part of your daily tasks as a business owner. Understanding the basic bookkeeping terms below will allow you to make sense of the numbers and make wise decisions for your eCommerce business.

Cash basis accounting is a method wherein the revenue is only recorded when the monetary payment is received. Accrual accounting, on the other hand, records the revenue in the book as soon as the transaction happens, even before the payment is received.

In business terms, sales are transactions wherein an exchange of goods or services for a specific amount of money or asset has occurred. From the business owner's perspective, it is the number of goods or products the business has successfully sold.

Payment not yet received during the transaction and instead promised later falls under accounts receivable. Recording the transaction ensures that you monitor that the payment is sent on the agreed date and time.

Accounts payable refers to the money you owe to other people. Only short-term liabilities or debts not exceeding a year before settling fall under accounts payable. This may include delayed payroll and unpaid raw materials from suppliers.

When you borrow money through a loan, the transaction will fall under a separate account called Loans Payable. It is not included in the Accounts Payable category, which only caters to short-term debts. These do not cover loans that take more than a year to be paid.

If you're an Amazon seller, which is a type of merchandise business, purchasing inventory is a very important aspect. Inventory is the number of products and raw materials you have in store. Being aware of external factors such as the environment and industry can help you decide how many items you should keep or sell to maintain balance in your inventory.

Purchases are business-related expenses like office supplies, merchandise, raw materials, etc. If you pay it upfront, it will fall under this account.

The details above may come from an Amazon balance sheet through your Amazon seller account. Still, there are also details you'll acquire from different payment channels like your credit card, bank account, and various debit cards. An Amazon accounting software would significantly help you track all transactions from different gateways. Among the many accounting software options, here are the tools we think are the best:

GoDaddy is a web hosting company that offers bookkeeping services. This software has all the essential tools every Amazon business needs, from invoices to tracking profit and loss and establishing financial reports. GoDaddy's services are basic yet useful for small Amazon sellers who still don’t need that many bookkeeping and accounting functions.

GoDaddy's forte is to provide easy-to-use and stress-free accounting software. It is directly connected to your Amazon Seller Central account, so you don't need to integrate it. This software can also generate various reports that enable the user to visualize sales, inventory, and other data.

It is also more affordable than other software, but you must note that the tool lacks double-entry accounting.

Quickbooks Online always makes it to the list whenever we talk about the best cloud-based accounting software in the market. Their target market is large Amazon sellers or enterprises eyeing to increase profits. However, it also provides a complete accounting solution for small businesses.

QuickBooks follows the double-entry accounting method, producing highly accurate reports. Their inventory management feature also changes the game with its excellent product tracking. You can even create a master inventory list to ensure everything's included.

When it comes to taxation, QuickBooks automatically computes your sales taxes according to the tax laws of the city you reside in. You can also manually input the custom rate if needed. This makes paying taxes stress-free.

Quickbooks also produces impressively detailed reports and financial statements like profit and loss, cash flow, and sales reports.

AccountEdge Pro is a mixture of GoDaddy and a bit of QuickBooks with a wide variety of functions to offer to beginner eCommerce sellers. The software is impressive because of its banking, inventory management, and time-tracking features. It is also affordable, which benefits beginner entrepreneurs.

Just like QuickBooks, it uses a double-entry accounting system to ensure the accuracy of accounts. Its banking system is outstanding since it allows almost every bank transaction, like receiving and sending money and making e-payments in the software.

Its inventory management system is also notable since it helps third-party sellers or wholesalers prevent oversupply or undersupply. This matters greatly since Amazon sellers are charged whenever excess stocks stay for over a year.

Kashoo appeals to both beginner and seasoned Amazon sellers because of its simplicity and user-friendly features. It can track expenses, create invoices, and provide updated bank statements.

Its expense tracking feature is very efficient, allowing users to conveniently upload a digital copy of paper receipts and plan their payment schedule monthly or weekly. These features are available on iPhone or iPad. It also allows integrations with third-party banking applications such as PayPal, Stripe, and Square, making bank feed access easier.

Like Kashoo, Fetcher targets small to medium-sized businesses. It offers new sellers a good set of features but comes at a reasonable price.

Fetcher’s way of analyzing profit and loss is unique. It already deducts sales and all other expenses from the total revenue, leaving the net profit. This process makes data more understandable for users, especially those unfamiliar with accounting terms.

Fetcher also closely monitors all expenses and leaves nothing out of the list: sales tax, shipping costs, cost of inventory, subscription costs, and even Amazon FBA fees. Everything's recorded to ensure that no charges remain hidden. It also provides reports for better visualization of figures.

However, if you choose Fetcher, note that it lacks an inventory management feature and double-entry accounting.

Instead of relying on your own Amazon bookkeeping, it would be more efficient to delegate the complex task to experts. An online bookkeeping and accounting service team will apply their knowledge and skills and utilize Amazon bookkeeping software to organize your financial data.

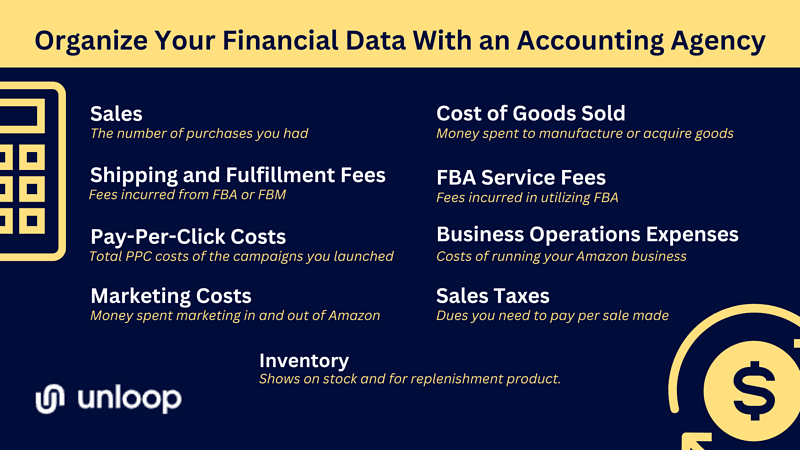

A bookkeeping firm's assistance will streamline your accounting process, allowing you to have accurate data on the following:

The first detail you will see and be interested in is your sales. You’ll see a per-item breakdown in the books, which determines your bestsellers and low-performing products.

Aside from the in-depth view, you can also see a dashboard of sales summaries. An Amazon seller bookkeeping firm can run weekly or monthly financial reports for you. You can also get daily updates with the right accounting software.

When selling on Amazon, you must choose between Fulfilled by a Merchant (FBM) or Fulfillment By Amazon (FBA). FBM means you, the seller, will handle the storage and shipment of all your orders from Amazon. Meanwhile, FBA is when Amazon handles everything for you: from product storage, packing, and shipping, to returns and refunds.

Both methods have their costs. If you are new to the business, updated books can give you a view of which is more efficient. Some sellers find FBM helpful initially, especially with only a few orders. On the other hand, Amazon FBA sellers with rapidly growing numbers find fulfillment assistance extremely helpful as they expand their businesses.

You won’t find it difficult to advertise on Amazon as the platform has various sponsored ad offers:

As the name Pay-Per-Click (PPC) suggests, you only need to pay for the advertisement whenever you get a click. If you launch different sponsored ads simultaneously, you’ll have visibility of the clicks and the cost per type. You'll know which ad type gets the most impressions, clicks, and sales, helping you decide which campaign to focus on to save costs and maintain high sales.

Social media advertising is one of the most effective methods today, as everyone is on Facebook, Instagram, Twitter, or LinkedIn. Vlogs and videos are also booming, so partnering with vloggers is another efficient way to make your products and brand known.

What’s good about tracking all your advertising and marketing expenses is seeing the costs and return on investment in real-time. You’ll know which campaigns are effective and you should invest more in and which ones need to be cut or revised for better performance.

When you begin selling on Amazon, you must always keep an eye on what products are in stock and which ones are for replenishing. Amazon has your back when it comes to inventory management. You have a view of the monetary value of the goods sold and stocks you are about to purchase, giving you insights into which products sell faster.

You can make the most of this feature by having a proper accounting system from your partner accounting and bookkeeping firm. They can integrate Amazon analytics into their accounting software, so you’ll have a single place to see all data on your Amazon business.

Before a product comes to life, it undergoes manufacturing, and the costs you need to pay to bring your products to life are called the Cost of Goods Sold (COGS). COGS vary per seller: some manufacture from scratch, so they must pay for raw materials and labor costs. Meanwhile, some sell ready-made products, so they only need to worry about the shipment fee from factory to warehouse or Amazon fulfillment center.

Whatever you classify your production as, you can monitor your COGS efficiently when your books are organized. You’ll see the breakdown of raw material costs, labor fees, and shipping fees incurred.

FBA has a lot of benefits. You won’t have to worry about renting a warehouse to store your products, as FBA centers have space. You become more credible with an FBA badge on your product listing, strengthening your customers’ trust in your brand because they know that Amazon will handle shipping the products they buy.

You also won’t need to worry about customer inquiries; Amazon handles this for you. Amazon also handles returns and refunds if there are damaged items. They will repackage perfectly working products that have been returned.

Nevertheless, these conveniences come at a price. You’ll see the FBA services fees you must pay when your books are updated.

Finally, although you are selling online, you also incur fees in operating your business, especially when you have an office and employees. You’ll see these all in the books, categorized neatly.

When you see your office’s average monthly expenses, you can see how you can lower your business operating costs. A dedicated team of bookkeepers and accountants will help you take control of the expenses you will incur in the coming months. If you think you’ve spent more than you should, through the help of a bookkeeper, there is always a chance to redeem your business finances.

Taxation is never easy, so many businesses rely on a tax professional from outsourced tax services. You’ll be forced to understand sales taxes when you sell on Amazon. Unlike income tax, where rates are the same and rarely change, sales taxes vary per place, which makes computation more difficult.

The good news is that Amazon is equipped with a system that immediately computes and shows sales taxes. When this data is integrated into your accounting system, it will also reflect on your financial records.

Although Amazon is the one to collect and remit the taxes in most financial transactions, you’ll still see the sales tax data collected through Amazon Marketplace Tax Collection, the platform’s tax filing service.

Bookkeeping and accounting for Amazon play an essential part in the success of your Amazon store. By keeping up-to-date and accurate records of sales and expenses, you can ensure that your business is on track and making the most profit.

With the help of a good bookkeeping agency, you can build the foundations of a successful Amazon business. And this is where Unloop comes in.

We offer helpful resources about Amazon bookkeeping and accounting to get you started. We can also help you manage income, expenses, and other bookkeeping matters you are worried about. Stress no more, and get assistance in your bookkeeping and other accounting struggles with the help of professionals in the field.

Book a call with us today!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Bookkeeping is fundamental to any business, including those operating on Amazon. Effective bookkeeping for Amazon sellers is essential to accurately track sales, expenses, and profits, which is especially crucial for small business owners wanting to grow their businesses.

Tracking finances will help you better understand your business's financial health. The net profit predicts whether your business is earning or failing, so you must update your books regularly. Bookkeeping for Amazon also ensures that you are on top of your tax obligations. You can't compute your taxes when your accounts and business transactions are everywhere.

This handy primer provides a comprehensive overview of bookkeeping practices specifically tailored for Amazon sellers. We'll cover key concepts such as the importance of bookkeeping on the eCommerce platform, some terms to know for beginner Amazon sellers, bookkeeping and accounting software, and the assistance you can get from a bookkeeping and accounting firm.

Whether you are a newbie or a seasoned Amazon seller, understanding bookkeeping fundamentals is crucial in maintaining financial health and achieving long-term success on this eCommerce platform. So, keep reading!

Let's begin by knowing the different bookkeeping terms on financial statements, income statements, balance sheets, credit card statements, or even on an Excel spreadsheet.

Checking Amazon reports and creating customized financial reports will be part of your daily tasks as a business owner. Understanding the basic bookkeeping terms below will allow you to make sense of the numbers and make wise decisions for your eCommerce business.

Cash basis accounting is a method wherein the revenue is only recorded when the monetary payment is received. Accrual accounting, on the other hand, records the revenue in the book as soon as the transaction happens, even before the payment is received.

In business terms, sales are transactions wherein an exchange of goods or services for a specific amount of money or asset has occurred. From the business owner's perspective, it is the number of goods or products the business has successfully sold.

Payment not yet received during the transaction and instead promised later falls under accounts receivable. Recording the transaction ensures that you monitor that the payment is sent on the agreed date and time.

Accounts payable refers to the money you owe to other people. Only short-term liabilities or debts not exceeding a year before settling fall under accounts payable. This may include delayed payroll and unpaid raw materials from suppliers.

When you borrow money through a loan, the transaction will fall under a separate account called Loans Payable. It is not included in the Accounts Payable category, which only caters to short-term debts. These do not cover loans that take more than a year to be paid.

If you're an Amazon seller, which is a type of merchandise business, purchasing inventory is a very important aspect. Inventory is the number of products and raw materials you have in store. Being aware of external factors such as the environment and industry can help you decide how many items you should keep or sell to maintain balance in your inventory.

Purchases are business-related expenses like office supplies, merchandise, raw materials, etc. If you pay it upfront, it will fall under this account.

The details above may come from an Amazon balance sheet through your Amazon seller account. Still, there are also details you'll acquire from different payment channels like your credit card, bank account, and various debit cards. An Amazon accounting software would significantly help you track all transactions from different gateways. Among the many accounting software options, here are the tools we think are the best:

GoDaddy is a web hosting company that offers bookkeeping services. This software has all the essential tools every Amazon business needs, from invoices to tracking profit and loss and establishing financial reports. GoDaddy's services are basic yet useful for small Amazon sellers who still don’t need that many bookkeeping and accounting functions.

GoDaddy's forte is to provide easy-to-use and stress-free accounting software. It is directly connected to your Amazon Seller Central account, so you don't need to integrate it. This software can also generate various reports that enable the user to visualize sales, inventory, and other data.

It is also more affordable than other software, but you must note that the tool lacks double-entry accounting.

Quickbooks Online always makes it to the list whenever we talk about the best cloud-based accounting software in the market. Their target market is large Amazon sellers or enterprises eyeing to increase profits. However, it also provides a complete accounting solution for small businesses.

QuickBooks follows the double-entry accounting method, producing highly accurate reports. Their inventory management feature also changes the game with its excellent product tracking. You can even create a master inventory list to ensure everything's included.

When it comes to taxation, QuickBooks automatically computes your sales taxes according to the tax laws of the city you reside in. You can also manually input the custom rate if needed. This makes paying taxes stress-free.

Quickbooks also produces impressively detailed reports and financial statements like profit and loss, cash flow, and sales reports.

AccountEdge Pro is a mixture of GoDaddy and a bit of QuickBooks with a wide variety of functions to offer to beginner eCommerce sellers. The software is impressive because of its banking, inventory management, and time-tracking features. It is also affordable, which benefits beginner entrepreneurs.

Just like QuickBooks, it uses a double-entry accounting system to ensure the accuracy of accounts. Its banking system is outstanding since it allows almost every bank transaction, like receiving and sending money and making e-payments in the software.

Its inventory management system is also notable since it helps third-party sellers or wholesalers prevent oversupply or undersupply. This matters greatly since Amazon sellers are charged whenever excess stocks stay for over a year.

Kashoo appeals to both beginner and seasoned Amazon sellers because of its simplicity and user-friendly features. It can track expenses, create invoices, and provide updated bank statements.

Its expense tracking feature is very efficient, allowing users to conveniently upload a digital copy of paper receipts and plan their payment schedule monthly or weekly. These features are available on iPhone or iPad. It also allows integrations with third-party banking applications such as PayPal, Stripe, and Square, making bank feed access easier.

Like Kashoo, Fetcher targets small to medium-sized businesses. It offers new sellers a good set of features but comes at a reasonable price.

Fetcher’s way of analyzing profit and loss is unique. It already deducts sales and all other expenses from the total revenue, leaving the net profit. This process makes data more understandable for users, especially those unfamiliar with accounting terms.

Fetcher also closely monitors all expenses and leaves nothing out of the list: sales tax, shipping costs, cost of inventory, subscription costs, and even Amazon FBA fees. Everything's recorded to ensure that no charges remain hidden. It also provides reports for better visualization of figures.

However, if you choose Fetcher, note that it lacks an inventory management feature and double-entry accounting.

Instead of relying on your own Amazon bookkeeping, it would be more efficient to delegate the complex task to experts. An online bookkeeping and accounting service team will apply their knowledge and skills and utilize Amazon bookkeeping software to organize your financial data.

A bookkeeping firm's assistance will streamline your accounting process, allowing you to have accurate data on the following:

The first detail you will see and be interested in is your sales. You’ll see a per-item breakdown in the books, which determines your bestsellers and low-performing products.

Aside from the in-depth view, you can also see a dashboard of sales summaries. An Amazon seller bookkeeping firm can run weekly or monthly financial reports for you. You can also get daily updates with the right accounting software.

When selling on Amazon, you must choose between Fulfilled by a Merchant (FBM) or Fulfillment By Amazon (FBA). FBM means you, the seller, will handle the storage and shipment of all your orders from Amazon. Meanwhile, FBA is when Amazon handles everything for you: from product storage, packing, and shipping, to returns and refunds.

Both methods have their costs. If you are new to the business, updated books can give you a view of which is more efficient. Some sellers find FBM helpful initially, especially with only a few orders. On the other hand, Amazon FBA sellers with rapidly growing numbers find fulfillment assistance extremely helpful as they expand their businesses.

You won’t find it difficult to advertise on Amazon as the platform has various sponsored ad offers:

As the name Pay-Per-Click (PPC) suggests, you only need to pay for the advertisement whenever you get a click. If you launch different sponsored ads simultaneously, you’ll have visibility of the clicks and the cost per type. You'll know which ad type gets the most impressions, clicks, and sales, helping you decide which campaign to focus on to save costs and maintain high sales.

Social media advertising is one of the most effective methods today, as everyone is on Facebook, Instagram, Twitter, or LinkedIn. Vlogs and videos are also booming, so partnering with vloggers is another efficient way to make your products and brand known.

What’s good about tracking all your advertising and marketing expenses is seeing the costs and return on investment in real-time. You’ll know which campaigns are effective and you should invest more in and which ones need to be cut or revised for better performance.

When you begin selling on Amazon, you must always keep an eye on what products are in stock and which ones are for replenishing. Amazon has your back when it comes to inventory management. You have a view of the monetary value of the goods sold and stocks you are about to purchase, giving you insights into which products sell faster.

You can make the most of this feature by having a proper accounting system from your partner accounting and bookkeeping firm. They can integrate Amazon analytics into their accounting software, so you’ll have a single place to see all data on your Amazon business.

Before a product comes to life, it undergoes manufacturing, and the costs you need to pay to bring your products to life are called the Cost of Goods Sold (COGS). COGS vary per seller: some manufacture from scratch, so they must pay for raw materials and labor costs. Meanwhile, some sell ready-made products, so they only need to worry about the shipment fee from factory to warehouse or Amazon fulfillment center.

Whatever you classify your production as, you can monitor your COGS efficiently when your books are organized. You’ll see the breakdown of raw material costs, labor fees, and shipping fees incurred.

FBA has a lot of benefits. You won’t have to worry about renting a warehouse to store your products, as FBA centers have space. You become more credible with an FBA badge on your product listing, strengthening your customers’ trust in your brand because they know that Amazon will handle shipping the products they buy.

You also won’t need to worry about customer inquiries; Amazon handles this for you. Amazon also handles returns and refunds if there are damaged items. They will repackage perfectly working products that have been returned.

Nevertheless, these conveniences come at a price. You’ll see the FBA services fees you must pay when your books are updated.

Finally, although you are selling online, you also incur fees in operating your business, especially when you have an office and employees. You’ll see these all in the books, categorized neatly.

When you see your office’s average monthly expenses, you can see how you can lower your business operating costs. A dedicated team of bookkeepers and accountants will help you take control of the expenses you will incur in the coming months. If you think you’ve spent more than you should, through the help of a bookkeeper, there is always a chance to redeem your business finances.

Taxation is never easy, so many businesses rely on a tax professional from outsourced tax services. You’ll be forced to understand sales taxes when you sell on Amazon. Unlike income tax, where rates are the same and rarely change, sales taxes vary per place, which makes computation more difficult.

The good news is that Amazon is equipped with a system that immediately computes and shows sales taxes. When this data is integrated into your accounting system, it will also reflect on your financial records.

Although Amazon is the one to collect and remit the taxes in most financial transactions, you’ll still see the sales tax data collected through Amazon Marketplace Tax Collection, the platform’s tax filing service.

Bookkeeping and accounting for Amazon play an essential part in the success of your Amazon store. By keeping up-to-date and accurate records of sales and expenses, you can ensure that your business is on track and making the most profit.

With the help of a good bookkeeping agency, you can build the foundations of a successful Amazon business. And this is where Unloop comes in.

We offer helpful resources about Amazon bookkeeping and accounting to get you started. We can also help you manage income, expenses, and other bookkeeping matters you are worried about. Stress no more, and get assistance in your bookkeeping and other accounting struggles with the help of professionals in the field.

Book a call with us today!

Staying organized, advanced, and efficient is more important than ever, especially in today’s fast-paced business environment. Large companies and businesses often have the resources to hire an in-house bookkeeper. But how do you redefine modern entrepreneurship if you’re a small business owner? Enter remote bookkeeping services.

Gone are the days when small business owners were limited by budget constraints that hindered their ability to access professional assistance. With online bookkeeping services, you can modernize your business operations and ensure your company’s financial health is always in check.

Transform the way you run your small business. Read this article now and discover how remote bookkeeping services can empower you to thrive in the digital age.

Thanks to technology, bookkeeping services are now available virtually.

Virtual bookkeeping agencies specialize in remote bookkeeping services. They work with you by relying on the financial data you send them online. They bring a human touch to the digital world, combining their knowledge with advanced technology to provide accurate, reliable, and efficient online bookkeeping services for small business owners.

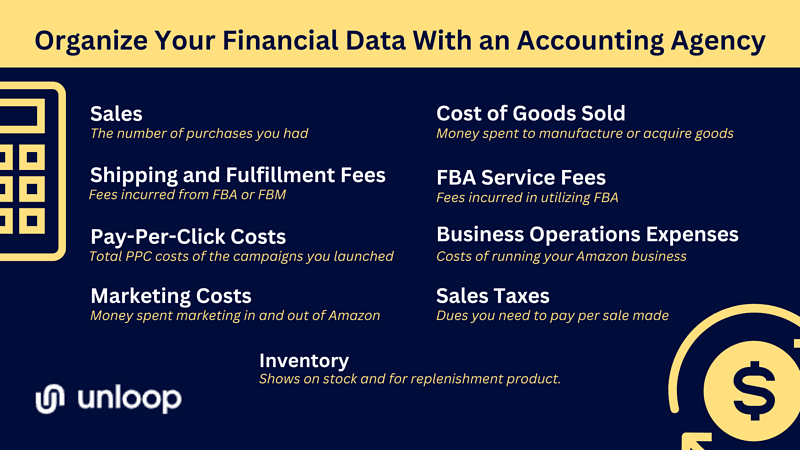

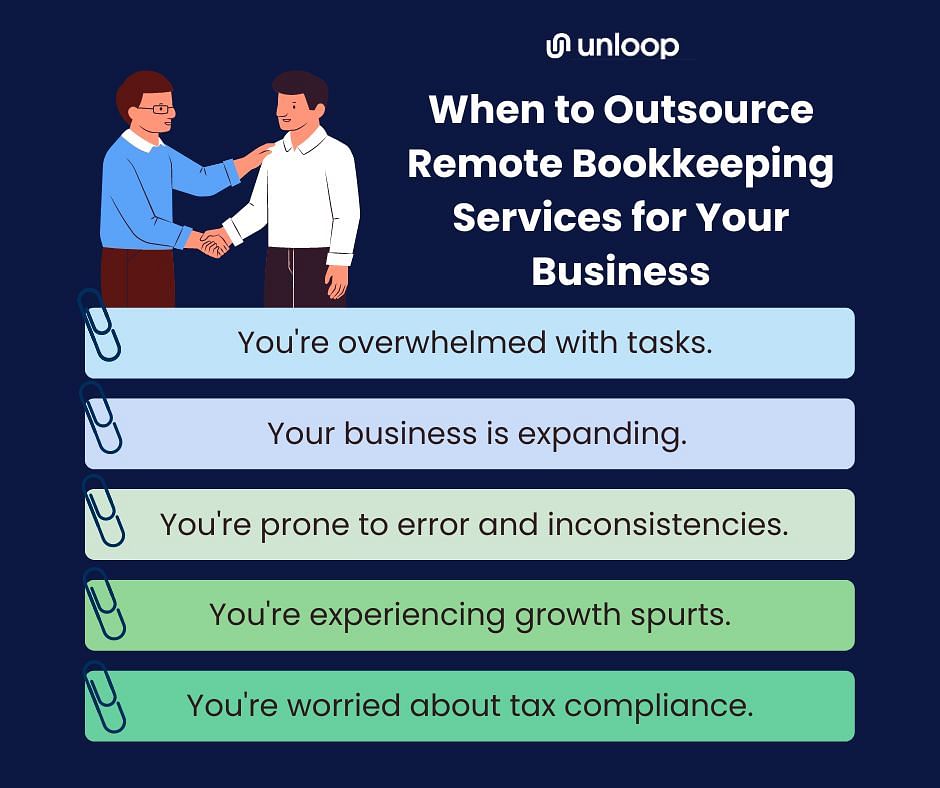

There are certain scenarios when outsourcing bookkeeping services makes the most sense for your business:

Transacting with a virtual bookkeeping business does not mean a computer will do your job. The people working behind an online bookkeeping service are freelance bookkeepers responsible for overseeing your transactions. They are the ones who will explain everything to you.

Are online bookkeeping services secure? Absolutely! You can communicate with your virtual bookkeeper via email, phone, or video, ensuring a smooth and transparent experience. These people may also provide integrations with other business tools to streamline processes while prioritizing the confidentiality and protection of your financial data.

Like an on-site bookkeeper other companies employ, these skilled individuals can prepare various financial documents for you. These include:

| Tasks and Services | |

| Bank Reconciliation | Keeping your financial records match your bank statements |

| Invoicing | Creating and sending invoices to your clients |

| Bill Payment | Managing and paying your business expenses |

| Financial Reporting | Producing monthly financial statements, such as balance sheets and profit and loss reports |

| Accounts Payable and Accounts Receivable | Tracking funds entering and leaving your business |

| Payroll Management | Making sure employees are paid accurately and on time |

In addition to these tasks, some bookkeeping companies offer additional features like:

With reduced errors, compliance support, and valuable business insights, virtual bookkeeping services empower you to make confident decisions and drive your small business forward.

Modern times and the presence of technology have changed how things work. The choice between in-house and remote bookkeeping services has become more relevant and important for many companies.

We believe that remote bookkeeping is now the name of the game. Apart from its cost-saving advantages, here's why it is gaining prominence.

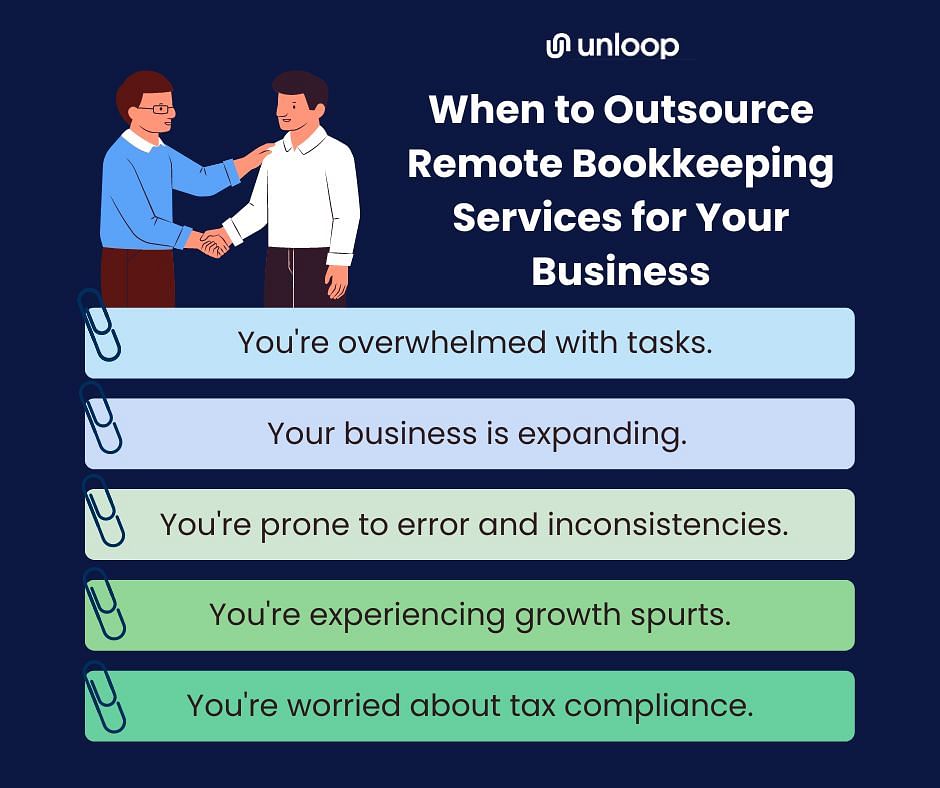

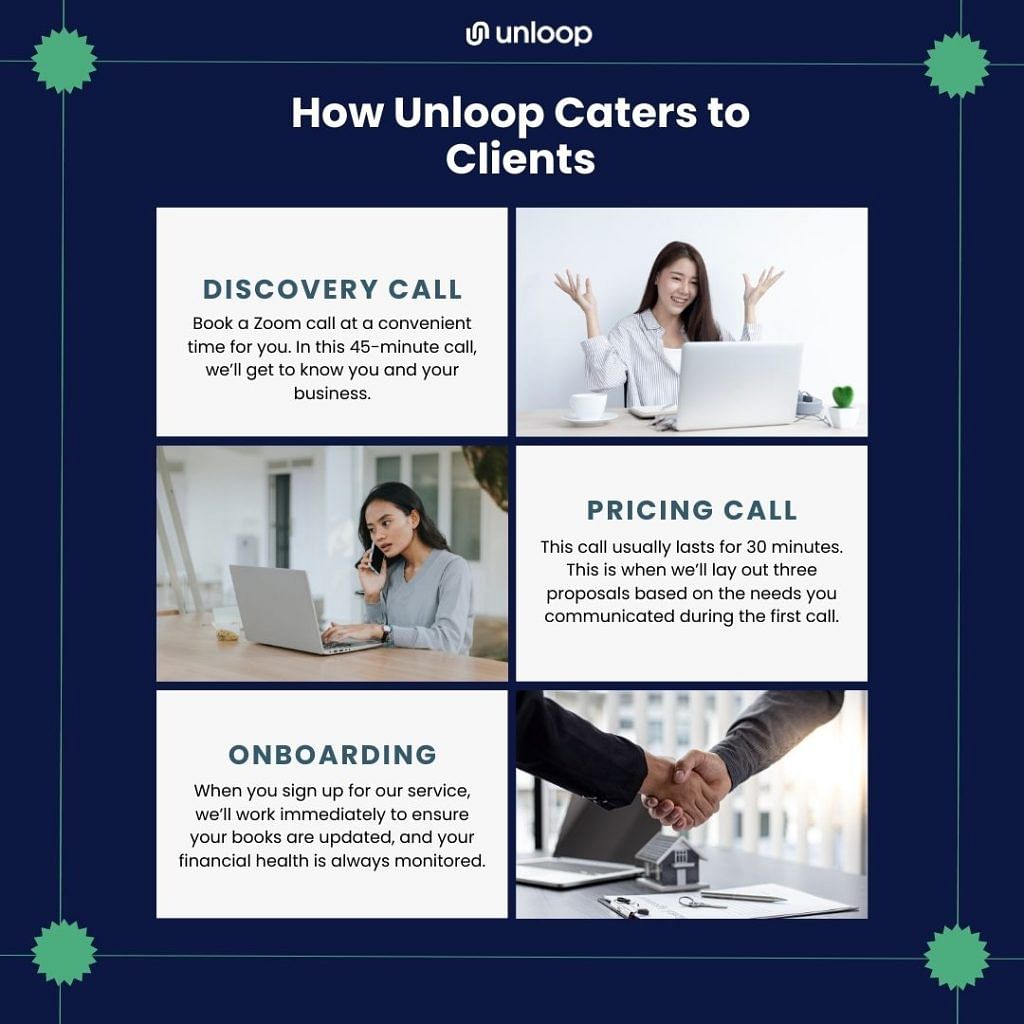

Here’s an example of how Unloop’s bookkeeping services help clients online:

As you can see, remote bookkeeping services are a game-changer for your small business. But aside from the advantages mentioned above, here’s why we're so confident in recommending them.

✅ Business Size: Whether you’re a solopreneur or a growing company, remote bookkeeping services have your back. They're designed to cater to the needs of businesses like yours, ensuring your financial records are impeccably managed.

✅ Business Entity: Remote bookkeeping services are perfectly aligned for small enterprises that operate as ecommerce businesses. They can provide the advanced tools and knowledge to handle financial operations effectively.

✅ Flexibility and Scalability: A dedicated bookkeeper from accounting services will keep your financial activities sleek and polished, no matter how much your business expands.

✅ Comfort with Technology: Remote bookkeeping relies on accounting software and other digital tools. Small business owners who aspire to innovate their performances are keen on adopting and using these tools.

✅ Data Privacy and Security: The financial industry is no exception to data breaches, as sensitive information such as account numbers and financial records are often stored electronically. With remote bookkeeping, you can ensure that their data is properly protected.

✅ Training and Resources: Hiring a remote bookkeeping service provider can free up training resources better spent on hiring key personnel to grow and maintain your business, especially in today’s job environment and economy.

✅ Less Mistake: Money is the lifeblood of any business. But keeping track of your income and expenses can be a full-time job and may rob you of other vital activities. A good bookkeeper will help you comply with tax laws and avoid costly mistakes that could jeopardize your business.

In the modern era of bookkeeping, embracing the right tools and solutions is essential for smarter financial management. Cloud-based accounting software, in particular, is built to have less room for errors. With its integration feature, you can record financial transactions automatically.

For remote bookkeepers, selecting the right bookkeeping software is a breeze as long as it caters to your preferences. But aside from suitability, more common factors are used to evaluate a software's overall effectiveness.

With the right software in place, bookkeepers can simplify the business process, allowing you to help focus on what matters most—meeting the digital demands of today's business landscape.

Here are a few top contenders:

QuickBooks Online is one of the most reputable bookkeeping software. Renowned for its reliability and versatility, this software is scalable to the needs of your business. With an industry-specific solution, QuickBooks Online can seamlessly adapt to various business types—wholesale, nonprofit, contractual, retail, or others.

QuickBooks Online proves to be an invaluable asset to remote bookkeepers. The software manages data transfer and enhances communication between bookkeepers and their clients. It simplifies collaboration, allowing them to generate financial reports and give real-time insights to their clients.

The key selling point of Xero is its ability to integrate over 1,000 apps, making it convenient and accessible for monitoring finances anywhere. This software is perfect for small businesses due to its affordable price and collaborative features available at a low price point.

Xero matches the transactions you enter on the application and your bank transactions. However, it’s still essential to cross-check and confirm the matches to maintain accuracy and control over your financial transactions.

Inventory management presents a unique challenge for small business owners, but Xero rises. It offers comprehensive inventory management capabilities across all plans with no additional costs. You can track your stock levels, manage orders, and stay on top of your inventory from the comfort of your home.

From sending invoices and tracking your bills and expenses to securing organized and categorized reports for your business, Zoho Books can ease your accounting workload. It offers excellent customer service support and a beginner-friendly interface, making it attractive for small business owners on a budget.

Managing taxes can be a daunting task. But with Zoho Books, you can confidently handle tax filing and ensure accurate tax preparation, saving you time and stress during tax season.

Fathom is an accounting software offering multiple features such as different analyses, financial statements, performance metrics, etc. All of its features are available in all its packages.

Fathom is unique because it allows unlimited users to collaborate and use its features, even with the lowest subscription fee. Their pricing depends on the number of companies you would like to include. They also offer custom plans upon request.

It allows clients to see how changes and movements in their finances will affect each other with the "What If" scenario analysis. This is especially useful for small business owners who want to forecast with little knowledge of finance.

Do you have any inquiries about remote bookkeeping services? Don't worry; we have the answers you need!

The cost of outsourcing bookkeeping will differ depending on the size of your organization and the specific services you need. Although bookkeeping service providers charge much less than in-house bookkeepers, not all companies offer the same rates.

There are several ways to outsource a reputable bookkeeper, including asking for recommendations from other business owners, searching online directories, or contacting professional associations. Once you've found a few potential service providers, check references and get quotes before making your final decision.

Yes, you can typically choose to outsource only certain aspects of your bookkeeping, such as preparing financial statements or tracking payables. This is ideal if you want to maintain some control over your finances but don't have the time, skills, or resources to do everything yourself.

Embracing the presence of remote bookkeeping services signifies a transformative opportunity for your small business. You can modernize your operations, optimize efficiency with powerful bookkeeping tools, and shift your focus toward growth and profitability. After all, who wouldn't want to stand out in this competitive landscape?

At Unloop, your business finances are in good hands. Even if you’re a small-scale business, we can provide expert remote bookkeeping services that rival larger enterprises.

Our services include:

| 📌 Bookkeeping Tasks 📌 Advisory Services 📌 Tax Advice 📌 Sales Tax Services 📌 Financial Statements 📌 Forecasting 📌 Accounts Payable 📌 And More! |

Achieve sound financial planning with the help of our qualified remote bookkeepers. Book a call now!

Staying organized, advanced, and efficient is more important than ever, especially in today’s fast-paced business environment. Large companies and businesses often have the resources to hire an in-house bookkeeper. But how do you redefine modern entrepreneurship if you’re a small business owner? Enter remote bookkeeping services.

Gone are the days when small business owners were limited by budget constraints that hindered their ability to access professional assistance. With online bookkeeping services, you can modernize your business operations and ensure your company’s financial health is always in check.

Transform the way you run your small business. Read this article now and discover how remote bookkeeping services can empower you to thrive in the digital age.

Thanks to technology, bookkeeping services are now available virtually.

Virtual bookkeeping agencies specialize in remote bookkeeping services. They work with you by relying on the financial data you send them online. They bring a human touch to the digital world, combining their knowledge with advanced technology to provide accurate, reliable, and efficient online bookkeeping services for small business owners.

There are certain scenarios when outsourcing bookkeeping services makes the most sense for your business:

Transacting with a virtual bookkeeping business does not mean a computer will do your job. The people working behind an online bookkeeping service are freelance bookkeepers responsible for overseeing your transactions. They are the ones who will explain everything to you.

Are online bookkeeping services secure? Absolutely! You can communicate with your virtual bookkeeper via email, phone, or video, ensuring a smooth and transparent experience. These people may also provide integrations with other business tools to streamline processes while prioritizing the confidentiality and protection of your financial data.

Like an on-site bookkeeper other companies employ, these skilled individuals can prepare various financial documents for you. These include:

| Tasks and Services | |

| Bank Reconciliation | Keeping your financial records match your bank statements |

| Invoicing | Creating and sending invoices to your clients |

| Bill Payment | Managing and paying your business expenses |

| Financial Reporting | Producing monthly financial statements, such as balance sheets and profit and loss reports |

| Accounts Payable and Accounts Receivable | Tracking funds entering and leaving your business |

| Payroll Management | Making sure employees are paid accurately and on time |

In addition to these tasks, some bookkeeping companies offer additional features like:

With reduced errors, compliance support, and valuable business insights, virtual bookkeeping services empower you to make confident decisions and drive your small business forward.

Modern times and the presence of technology have changed how things work. The choice between in-house and remote bookkeeping services has become more relevant and important for many companies.

We believe that remote bookkeeping is now the name of the game. Apart from its cost-saving advantages, here's why it is gaining prominence.

Here’s an example of how Unloop’s bookkeeping services help clients online:

As you can see, remote bookkeeping services are a game-changer for your small business. But aside from the advantages mentioned above, here’s why we're so confident in recommending them.

✅ Business Size: Whether you’re a solopreneur or a growing company, remote bookkeeping services have your back. They're designed to cater to the needs of businesses like yours, ensuring your financial records are impeccably managed.

✅ Business Entity: Remote bookkeeping services are perfectly aligned for small enterprises that operate as ecommerce businesses. They can provide the advanced tools and knowledge to handle financial operations effectively.

✅ Flexibility and Scalability: A dedicated bookkeeper from accounting services will keep your financial activities sleek and polished, no matter how much your business expands.

✅ Comfort with Technology: Remote bookkeeping relies on accounting software and other digital tools. Small business owners who aspire to innovate their performances are keen on adopting and using these tools.

✅ Data Privacy and Security: The financial industry is no exception to data breaches, as sensitive information such as account numbers and financial records are often stored electronically. With remote bookkeeping, you can ensure that their data is properly protected.

✅ Training and Resources: Hiring a remote bookkeeping service provider can free up training resources better spent on hiring key personnel to grow and maintain your business, especially in today’s job environment and economy.

✅ Less Mistake: Money is the lifeblood of any business. But keeping track of your income and expenses can be a full-time job and may rob you of other vital activities. A good bookkeeper will help you comply with tax laws and avoid costly mistakes that could jeopardize your business.

In the modern era of bookkeeping, embracing the right tools and solutions is essential for smarter financial management. Cloud-based accounting software, in particular, is built to have less room for errors. With its integration feature, you can record financial transactions automatically.

For remote bookkeepers, selecting the right bookkeeping software is a breeze as long as it caters to your preferences. But aside from suitability, more common factors are used to evaluate a software's overall effectiveness.

With the right software in place, bookkeepers can simplify the business process, allowing you to help focus on what matters most—meeting the digital demands of today's business landscape.

Here are a few top contenders:

QuickBooks Online is one of the most reputable bookkeeping software. Renowned for its reliability and versatility, this software is scalable to the needs of your business. With an industry-specific solution, QuickBooks Online can seamlessly adapt to various business types—wholesale, nonprofit, contractual, retail, or others.

QuickBooks Online proves to be an invaluable asset to remote bookkeepers. The software manages data transfer and enhances communication between bookkeepers and their clients. It simplifies collaboration, allowing them to generate financial reports and give real-time insights to their clients.

The key selling point of Xero is its ability to integrate over 1,000 apps, making it convenient and accessible for monitoring finances anywhere. This software is perfect for small businesses due to its affordable price and collaborative features available at a low price point.

Xero matches the transactions you enter on the application and your bank transactions. However, it’s still essential to cross-check and confirm the matches to maintain accuracy and control over your financial transactions.

Inventory management presents a unique challenge for small business owners, but Xero rises. It offers comprehensive inventory management capabilities across all plans with no additional costs. You can track your stock levels, manage orders, and stay on top of your inventory from the comfort of your home.

From sending invoices and tracking your bills and expenses to securing organized and categorized reports for your business, Zoho Books can ease your accounting workload. It offers excellent customer service support and a beginner-friendly interface, making it attractive for small business owners on a budget.

Managing taxes can be a daunting task. But with Zoho Books, you can confidently handle tax filing and ensure accurate tax preparation, saving you time and stress during tax season.

Fathom is an accounting software offering multiple features such as different analyses, financial statements, performance metrics, etc. All of its features are available in all its packages.

Fathom is unique because it allows unlimited users to collaborate and use its features, even with the lowest subscription fee. Their pricing depends on the number of companies you would like to include. They also offer custom plans upon request.

It allows clients to see how changes and movements in their finances will affect each other with the "What If" scenario analysis. This is especially useful for small business owners who want to forecast with little knowledge of finance.

Do you have any inquiries about remote bookkeeping services? Don't worry; we have the answers you need!

The cost of outsourcing bookkeeping will differ depending on the size of your organization and the specific services you need. Although bookkeeping service providers charge much less than in-house bookkeepers, not all companies offer the same rates.

There are several ways to outsource a reputable bookkeeper, including asking for recommendations from other business owners, searching online directories, or contacting professional associations. Once you've found a few potential service providers, check references and get quotes before making your final decision.

Yes, you can typically choose to outsource only certain aspects of your bookkeeping, such as preparing financial statements or tracking payables. This is ideal if you want to maintain some control over your finances but don't have the time, skills, or resources to do everything yourself.

Embracing the presence of remote bookkeeping services signifies a transformative opportunity for your small business. You can modernize your operations, optimize efficiency with powerful bookkeeping tools, and shift your focus toward growth and profitability. After all, who wouldn't want to stand out in this competitive landscape?

At Unloop, your business finances are in good hands. Even if you’re a small-scale business, we can provide expert remote bookkeeping services that rival larger enterprises.

Our services include:

| 📌 Bookkeeping Tasks 📌 Advisory Services 📌 Tax Advice 📌 Sales Tax Services 📌 Financial Statements 📌 Forecasting 📌 Accounts Payable 📌 And More! |

Achieve sound financial planning with the help of our qualified remote bookkeepers. Book a call now!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Sales tax is an obligation with the heaviest burden. In every sale business owners make, they have to determine and remit the right sales tax amount. It's only reasonable for them to find efficient ways to file a sales tax return. In this department, two names compete: TaxJar vs. QuickBooks.

But should they be rivals in the sales tax game, or is collaboration better? Let Unloop help you answer this question.

Before we can compare, it’s best to introduce our challengers and list their exceptional features. What can TaxJar and QuickBooks do, and what edge do they have against each other?

Photo by rawpixel.com on Freepik

For many ecommerce businesses, especially small business owners, sales tax is one of the most tedious and confusing tasks to account for and remit. That's because sales taxes vary based on region, products sold, and tax codes.

TaxJar sees this burden and resolves it with its sales tax collection technology. It offers additional support to its users by providing online webinars, documentation videos, and informational blogs.

It’s worth noting that while the tool is available for a web-based desktop, platforms like iPhone or Android mobile aren’t supported.

Let’s further discuss TaxJar’s capabilities that make it a sales tax specialist.

Built into the TaxJar system are different sales tax information from 11,000 jurisdictions. It ensures that wherever your sales may come, your business collects sales tax according to that jurisdiction's sales tax code or policy.

TaxJar tracks sales revenue and location to calculate tax exposure. When tax collection reaches a certain nexus threshold, TaxJar will notify you, helping you with accurate sales tax filing.

TaxJar assists in sales tax registration when notified of your nexus exposure. It offers resources on how you can register your business in the nexus. Alternatively, you can also tap TaxJar for registration assistance.

TaxJar has an API that integrates with your ecommerce store. This feature allows your ecommerce business to do accurate sales tax calculations upon the customer's checkout, ensuring your business collects the right sales tax that will reflect on the checkout page.

TaxJar can automate sales tax filing for your ecommerce business. As soon as you enroll in a nexus state, it can use the data collected by their system while it's integrated into your ecommerce account.

With this integration, TaxJar can calculate the correct sales tax based on the products you've sold, making tax returns a breeze. Additionally, it lets you check (and approve) the sales tax amount before it pushes through.

What's so great about TaxJar is its multichannel feature. Their application integrates into many marketplace platforms such as Amazon, Shopify, WooCommerce, Walmart, Square, eBay, Etsy, etc. You won't have to worry about getting another application for another ecommerce business on another marketplace.

Source: Photo by Pixabay from Pexels.com

On the other hand, QuickBooks offers an accounting solution, which means a little bit of everything (including sales tax) and has broader coverage for ecommerce businesses. QuickBooks supports platforms such as Mac desktop, iPhone mobile, Linux desktop or mobile, and more.

Here's what this amazing software can do.

Small business owners instantly get digital accounting and bookkeeping systems, enabling them to transition from hard copy books and spreadsheets into software that can integrate online.

Within the software, the user can generate an invoice and receive them. QuickBooks's invoice management gives sellers an accurate picture of their short-term debt and credits, which will help them manage their cash flow better.

QuickBooks lets users record and track bills and their payments. Additionally, sellers can integrate third-party apps that can automate their bill payments at the click of a button.

Part of bookkeeping is financial statement generation. When done manually, it can take time to complete. With QuickBooks, a bookkeeper can generate them in real time. It can instantly create income statements and balance sheets by taking stock of all system transactions.

One of the struggles of any small business owner is bank reconciliation. Balancing transactions can be challenging, as locating each bank account entry and records isn't easy.

QuickBooks makes bank reconciliation a breeze by syncing your bank data to the software. That means every expense and income aligns with both the accounting software and your bank account balance.

Yes, but not quite, at least in terms of sales tax.

QuickBooks has been around for a long time and has built a strong reputation for meeting the accounting needs of businesses of all sizes. While it offers tax forms for filing income tax and income tax automation features for your employee payroll taxes, its primary focus is accounting, not taxes.

Let's discuss the sales tax filing feature the accounting software offers.

QuickBooks can make calculations on sales tax rates, including the following information:

The rest (including the sales tax return) will fall within your scope.

To set up this feature, follow the steps in the tutorial below.

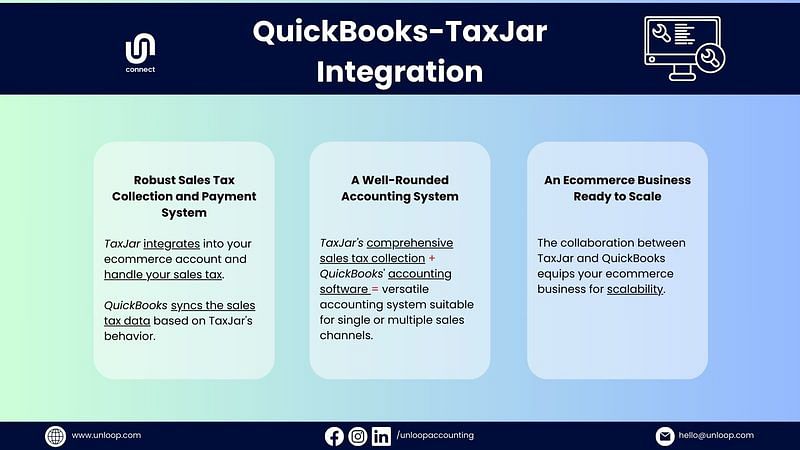

So, what's the final verdict? In the showdown QuickBooks vs. TaxJar, who is the worthy victor? If you ask us what's better for your business, we'll say both. TaxJar and QuickBooks can compete, but their collaboration offers your business the best of both worlds.

Here's what will happen when you do a TaxJar-QuickBooks Online integration.

At Unloop, we use QuickBooks as our main accounting software. We also specialize in seamlessly integrating TaxJar with this tool to help leverage our expertise in ecommerce accounting.

Our professionals ensure efficient management of both software, saving you time for other business matters and maximizing software benefits. Trust Unloop to make your accounting feel like it's on autopilot.

Call us at 877-421-7270 for a consultation, or check out our ecommerce services.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Sales tax is an obligation with the heaviest burden. In every sale business owners make, they have to determine and remit the right sales tax amount. It's only reasonable for them to find efficient ways to file a sales tax return. In this department, two names compete: TaxJar vs. QuickBooks.

But should they be rivals in the sales tax game, or is collaboration better? Let Unloop help you answer this question.

Before we can compare, it’s best to introduce our challengers and list their exceptional features. What can TaxJar and QuickBooks do, and what edge do they have against each other?

Photo by rawpixel.com on Freepik

For many ecommerce businesses, especially small business owners, sales tax is one of the most tedious and confusing tasks to account for and remit. That's because sales taxes vary based on region, products sold, and tax codes.

TaxJar sees this burden and resolves it with its sales tax collection technology. It offers additional support to its users by providing online webinars, documentation videos, and informational blogs.

It’s worth noting that while the tool is available for a web-based desktop, platforms like iPhone or Android mobile aren’t supported.

Let’s further discuss TaxJar’s capabilities that make it a sales tax specialist.

Built into the TaxJar system are different sales tax information from 11,000 jurisdictions. It ensures that wherever your sales may come, your business collects sales tax according to that jurisdiction's sales tax code or policy.

TaxJar tracks sales revenue and location to calculate tax exposure. When tax collection reaches a certain nexus threshold, TaxJar will notify you, helping you with accurate sales tax filing.

TaxJar assists in sales tax registration when notified of your nexus exposure. It offers resources on how you can register your business in the nexus. Alternatively, you can also tap TaxJar for registration assistance.

TaxJar has an API that integrates with your ecommerce store. This feature allows your ecommerce business to do accurate sales tax calculations upon the customer's checkout, ensuring your business collects the right sales tax that will reflect on the checkout page.

TaxJar can automate sales tax filing for your ecommerce business. As soon as you enroll in a nexus state, it can use the data collected by their system while it's integrated into your ecommerce account.

With this integration, TaxJar can calculate the correct sales tax based on the products you've sold, making tax returns a breeze. Additionally, it lets you check (and approve) the sales tax amount before it pushes through.

What's so great about TaxJar is its multichannel feature. Their application integrates into many marketplace platforms such as Amazon, Shopify, WooCommerce, Walmart, Square, eBay, Etsy, etc. You won't have to worry about getting another application for another ecommerce business on another marketplace.

Source: Photo by Pixabay from Pexels.com

On the other hand, QuickBooks offers an accounting solution, which means a little bit of everything (including sales tax) and has broader coverage for ecommerce businesses. QuickBooks supports platforms such as Mac desktop, iPhone mobile, Linux desktop or mobile, and more.

Here's what this amazing software can do.

Small business owners instantly get digital accounting and bookkeeping systems, enabling them to transition from hard copy books and spreadsheets into software that can integrate online.

Within the software, the user can generate an invoice and receive them. QuickBooks's invoice management gives sellers an accurate picture of their short-term debt and credits, which will help them manage their cash flow better.

QuickBooks lets users record and track bills and their payments. Additionally, sellers can integrate third-party apps that can automate their bill payments at the click of a button.

Part of bookkeeping is financial statement generation. When done manually, it can take time to complete. With QuickBooks, a bookkeeper can generate them in real time. It can instantly create income statements and balance sheets by taking stock of all system transactions.

One of the struggles of any small business owner is bank reconciliation. Balancing transactions can be challenging, as locating each bank account entry and records isn't easy.

QuickBooks makes bank reconciliation a breeze by syncing your bank data to the software. That means every expense and income aligns with both the accounting software and your bank account balance.

Yes, but not quite, at least in terms of sales tax.

QuickBooks has been around for a long time and has built a strong reputation for meeting the accounting needs of businesses of all sizes. While it offers tax forms for filing income tax and income tax automation features for your employee payroll taxes, its primary focus is accounting, not taxes.

Let's discuss the sales tax filing feature the accounting software offers.

QuickBooks can make calculations on sales tax rates, including the following information:

The rest (including the sales tax return) will fall within your scope.

To set up this feature, follow the steps in the tutorial below.

So, what's the final verdict? In the showdown QuickBooks vs. TaxJar, who is the worthy victor? If you ask us what's better for your business, we'll say both. TaxJar and QuickBooks can compete, but their collaboration offers your business the best of both worlds.

Here's what will happen when you do a TaxJar-QuickBooks Online integration.

At Unloop, we use QuickBooks as our main accounting software. We also specialize in seamlessly integrating TaxJar with this tool to help leverage our expertise in ecommerce accounting.

Our professionals ensure efficient management of both software, saving you time for other business matters and maximizing software benefits. Trust Unloop to make your accounting feel like it's on autopilot.

Call us at 877-421-7270 for a consultation, or check out our ecommerce services.

Bookkeeping and payroll services are two of the most important financial aspects in a business. Bookkeeping tracks all transactions, data, and important documents regarding your business. Meanwhile, payroll ensures you fulfill your responsibility to your employees by paying them on time and giving them their benefits.

Yet, many small business owners don't know what to expect from a bookkeeping and payroll service. Many are confused about who to partner with for these vital services. This blog post will discuss what you can expect from a good bookkeeping and payroll service and how to choose the right partner worth what good bookkeeping and payroll services cost. Let’s begin!

Bookkeeping is the task of tracking the money that is coming in and out of your business. The data is categorized and organized in books to be used by the accountant for financial reporting. As you grow your business, the income and expenses to track pile up. A great bookkeeping service will give your business these benefits.

As a starter, a bookkeeping and accounting agency uses reliable bookkeeping and accounting software like QuickBooks, Xero, or Sage50 Cloud. An agency acknowledges the conveniences that technology brings: accuracy, automation, integration, and data security. Hence, the first thing they’ll do is set up an accounting software account for your business.

After that, the work begins. You do not have to worry about the transactions you weren’t able to track before signing up for the service, as the agency should be able to backtrack all those transactions. As a result, when tax season comes, you’ll have complete data to declare and the correct dues to pay.

Your partner agency also keeps your books up-to-date. The software will help automate data collection from various income and expense channels. Transactions from your bank accounts and various payment channels will be jotted down on the books. As the business owner, all you have to do is double-check the details in case there are any errors.

Bookkeeping and accounting are there to ensure that whenever you need to check the financial status of your business, you’ll get the latest numbers. Some of the statements you can receive with the help of an agency are the following:

A business bank account left unchecked is more prone to fraud and other financial malpractices. But the bank reconciliation service offered by bookkeeping and accounting agencies will record all the money deposited in or withdrawn from your bank account in the books. Simply investigate if you see any anomalies.

Agencies go the extra mile to add a human touch to their service. This comes from 24/7 customer service in multiple channels. If you have questions regarding the software or any book details, you can set up a meeting or get reports. They are always just a message away.

Payroll is as essential as bookkeeping. When you process your payroll smoothly, you’ll keep your workforce happy and driven to help your business succeed. Hence, investing in a payroll service is worth it. Either get it separately, or sign up for a payroll service together with bookkeeping. This is what you can get with a dedicated service.

Even in payroll, data and documentation are everything. So, the first task of the payroll expert you are partnered with is to collect all essential employee information like names, addresses, civil statuses, and tax statuses. They may ask your employees to accomplish tax forms for withholding tax and any bank information where you will send their salary.

Through the help of bookkeeping and accounting software, the payroll expert will calculate your employees’ gross and net pay. Gross salary is the amount workers receive before deductions, while the net pay deducts taxes and benefits. You should include all these details in employees’ payslips for transparency. They should also be included in the books for your reference.

You’ll rely on software to process payroll if partnered with an agency. This method is better than manual payment as it is less prone to mistakes and can be integrated into your bookkeeping and accounting software for faster computation and tracking. After the computation, you can send the salary straight to your employees’ accounts.

Every worker is responsible for paying taxes, and one thing you can do for them is handling income tax, deductions, collection, and remittance. An agency is equipped with tax software with the latest tax information, so you are sure that your computations are accurate. It can again be integrated into your accounting system for tracking.

When it comes to bookkeeping and payroll services, you want to ensure that you’re partnering with a company that understands the ins and outs of both. Doing so can keep your books in order, and process your employees’ pay accurately and on time.

We've outlined what you can expect from each service, but the question remains: who should you partner with?

If you are looking for an agency that offers bookkeeping and payroll services, look no further than Unloop. Our bookkeeping services include book updates, financial statement preparation, and tax management. We’ll do your payroll and taxes for you! We are just a call away if you are interested in accounting, tax preparation, bookkeeping, and payroll services. Talk to you soon!

Bookkeeping and payroll services are two of the most important financial aspects in a business. Bookkeeping tracks all transactions, data, and important documents regarding your business. Meanwhile, payroll ensures you fulfill your responsibility to your employees by paying them on time and giving them their benefits.

Yet, many small business owners don't know what to expect from a bookkeeping and payroll service. Many are confused about who to partner with for these vital services. This blog post will discuss what you can expect from a good bookkeeping and payroll service and how to choose the right partner worth what good bookkeeping and payroll services cost. Let’s begin!

Bookkeeping is the task of tracking the money that is coming in and out of your business. The data is categorized and organized in books to be used by the accountant for financial reporting. As you grow your business, the income and expenses to track pile up. A great bookkeeping service will give your business these benefits.

As a starter, a bookkeeping and accounting agency uses reliable bookkeeping and accounting software like QuickBooks, Xero, or Sage50 Cloud. An agency acknowledges the conveniences that technology brings: accuracy, automation, integration, and data security. Hence, the first thing they’ll do is set up an accounting software account for your business.

After that, the work begins. You do not have to worry about the transactions you weren’t able to track before signing up for the service, as the agency should be able to backtrack all those transactions. As a result, when tax season comes, you’ll have complete data to declare and the correct dues to pay.

Your partner agency also keeps your books up-to-date. The software will help automate data collection from various income and expense channels. Transactions from your bank accounts and various payment channels will be jotted down on the books. As the business owner, all you have to do is double-check the details in case there are any errors.

Bookkeeping and accounting are there to ensure that whenever you need to check the financial status of your business, you’ll get the latest numbers. Some of the statements you can receive with the help of an agency are the following:

A business bank account left unchecked is more prone to fraud and other financial malpractices. But the bank reconciliation service offered by bookkeeping and accounting agencies will record all the money deposited in or withdrawn from your bank account in the books. Simply investigate if you see any anomalies.

Agencies go the extra mile to add a human touch to their service. This comes from 24/7 customer service in multiple channels. If you have questions regarding the software or any book details, you can set up a meeting or get reports. They are always just a message away.

Payroll is as essential as bookkeeping. When you process your payroll smoothly, you’ll keep your workforce happy and driven to help your business succeed. Hence, investing in a payroll service is worth it. Either get it separately, or sign up for a payroll service together with bookkeeping. This is what you can get with a dedicated service.

Even in payroll, data and documentation are everything. So, the first task of the payroll expert you are partnered with is to collect all essential employee information like names, addresses, civil statuses, and tax statuses. They may ask your employees to accomplish tax forms for withholding tax and any bank information where you will send their salary.

Through the help of bookkeeping and accounting software, the payroll expert will calculate your employees’ gross and net pay. Gross salary is the amount workers receive before deductions, while the net pay deducts taxes and benefits. You should include all these details in employees’ payslips for transparency. They should also be included in the books for your reference.

You’ll rely on software to process payroll if partnered with an agency. This method is better than manual payment as it is less prone to mistakes and can be integrated into your bookkeeping and accounting software for faster computation and tracking. After the computation, you can send the salary straight to your employees’ accounts.

Every worker is responsible for paying taxes, and one thing you can do for them is handling income tax, deductions, collection, and remittance. An agency is equipped with tax software with the latest tax information, so you are sure that your computations are accurate. It can again be integrated into your accounting system for tracking.

When it comes to bookkeeping and payroll services, you want to ensure that you’re partnering with a company that understands the ins and outs of both. Doing so can keep your books in order, and process your employees’ pay accurately and on time.

We've outlined what you can expect from each service, but the question remains: who should you partner with?

If you are looking for an agency that offers bookkeeping and payroll services, look no further than Unloop. Our bookkeeping services include book updates, financial statement preparation, and tax management. We’ll do your payroll and taxes for you! We are just a call away if you are interested in accounting, tax preparation, bookkeeping, and payroll services. Talk to you soon!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Are you ready to enter the ecommerce world? It's a huge step considering that most shoppers today rely heavily on technology. Meanwhile, for sellers, it's an opportunity to expand the customer base internationally. But, we must address a common challenge among online sellers: ecommerce sales tax.

With ecommerce, distance won't hinder a business from selling to another state or country. That's an incredible advantage of technology, but it’s also not without challenges. As a first-time ecommerce seller, you might ask yourself: "Do remote businesses need to pay sales tax?" Yes, they do.

Tax collection and remittance are now part of the requirements in ecommerce. Everyone in the industry knows the struggle, and no one expects you to digest everything in a day or two. But we’re here to help.

This article breaks down the fundamentals of sales tax in the USA. Know the basics and read some valuable tips on managing tax compliance.

Here are some of the points we will be covering:

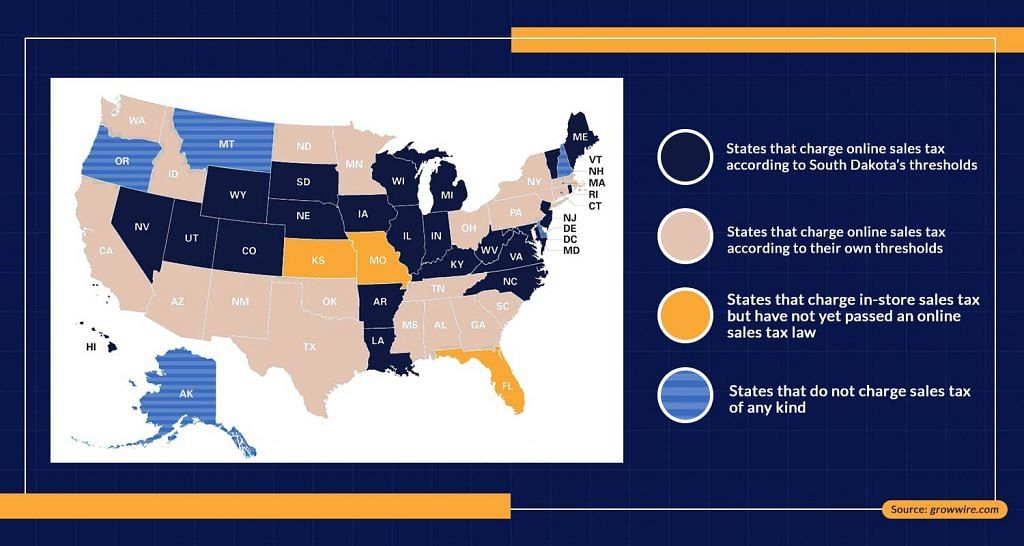

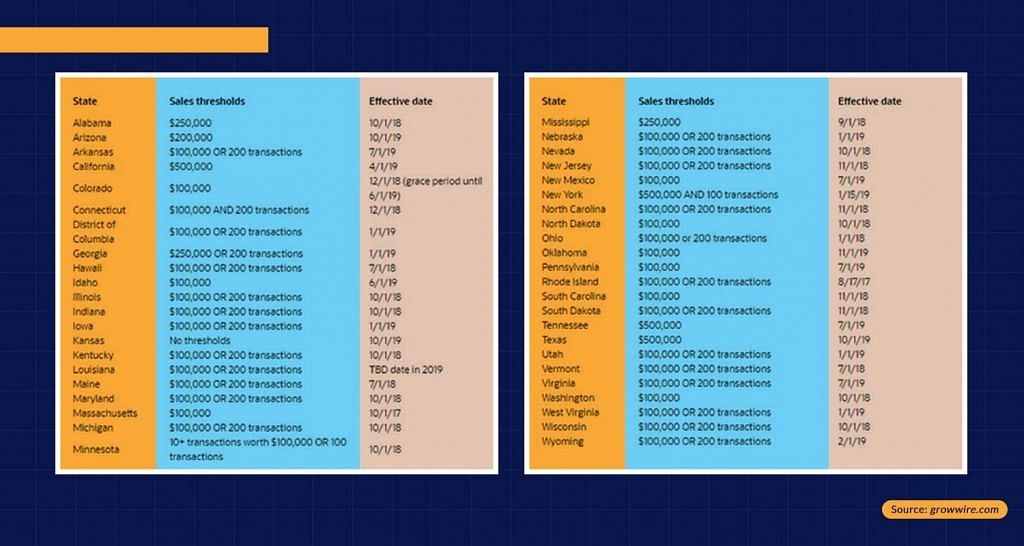

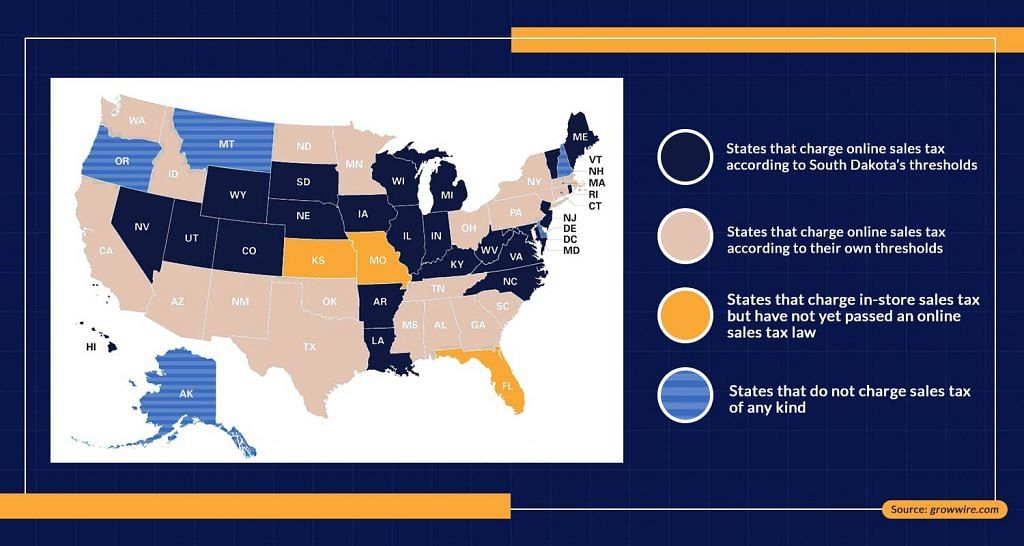

If your business has a physical storefront, office, or warehouse in a certain state, you must pay and remit sales tax. That was the golden rule until the South Dakota v. Wayfair, Inc. happened in 2018, which states that online businesses must collect sales tax regardless of physical presence.

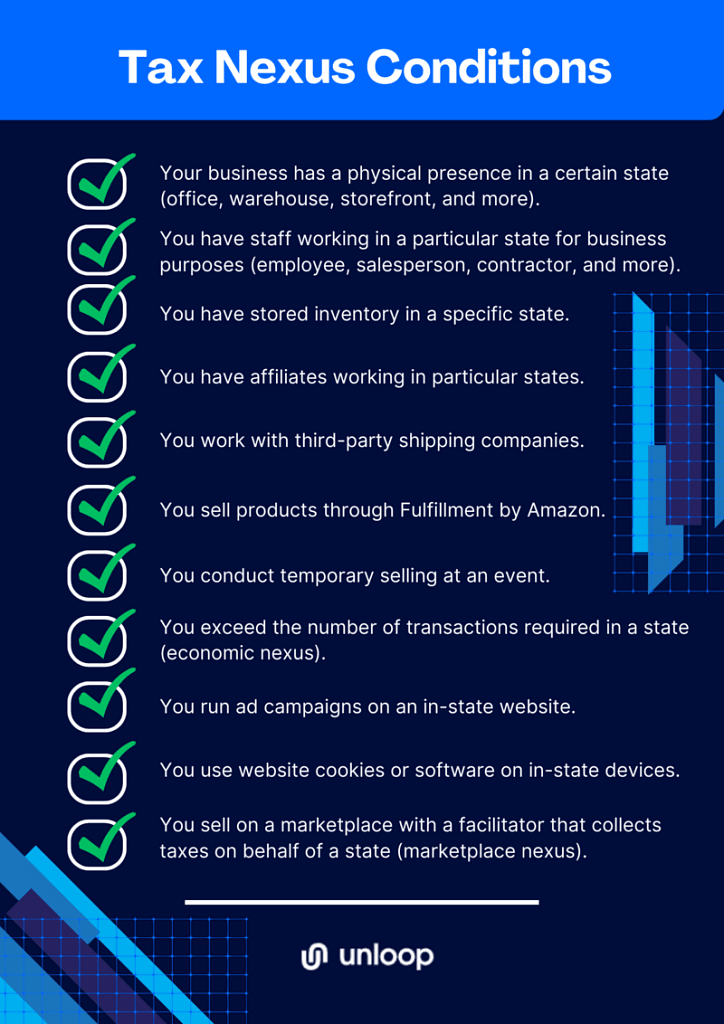

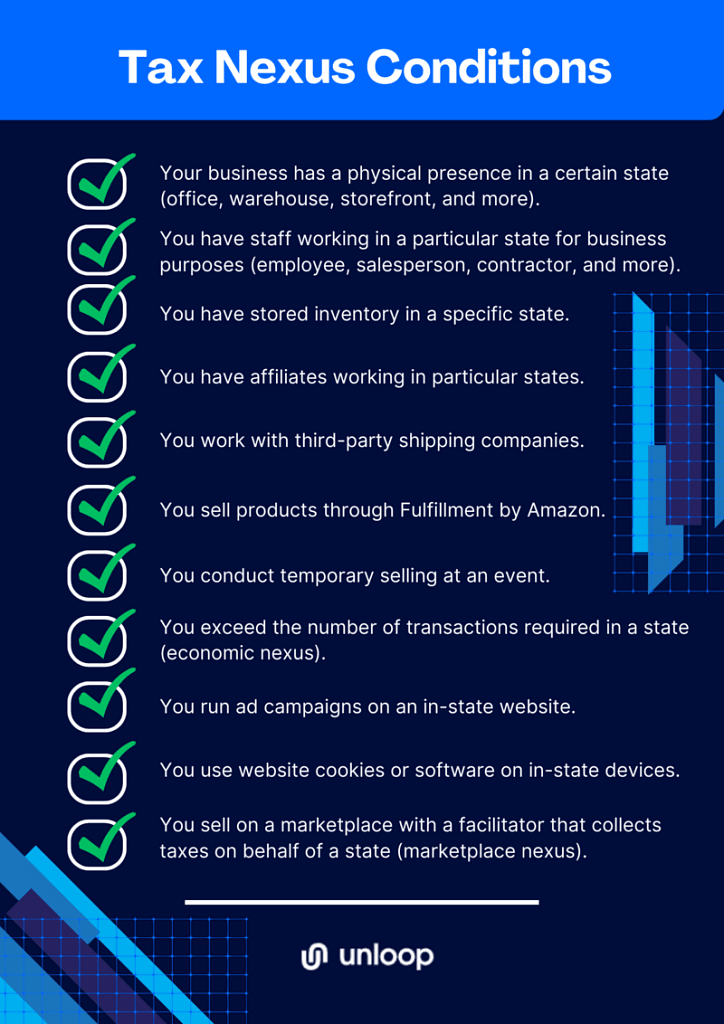

In addition, states can redefine the "sales tax nexus" from a broader perspective so that ecommerce retailers become a part of the scope. Economic nexus or tax nexus happens when a seller has to collect tax in certain states where they exceed the revenue threshold.

The development of ecommerce sales tax laws makes the system immensely complicated—one of the most challenging aspects of ecommerce tax in compliance with constantly changing state policies.

Ecommerce sales tax differs by state, and businesses must learn and comply with all that. It's not easy, and it gets more complicated internationally. Each country has a different tax law, which you must also consider.

Because of the ever-changing tax policies, businesses are pushed to reassess their processing systems and implement operational changes as necessary. If not, sellers can be at risk of financial trouble.

Now that you understand how crucial sales tax is in your ecommerce venture, it's time to learn the basic terms and processes:

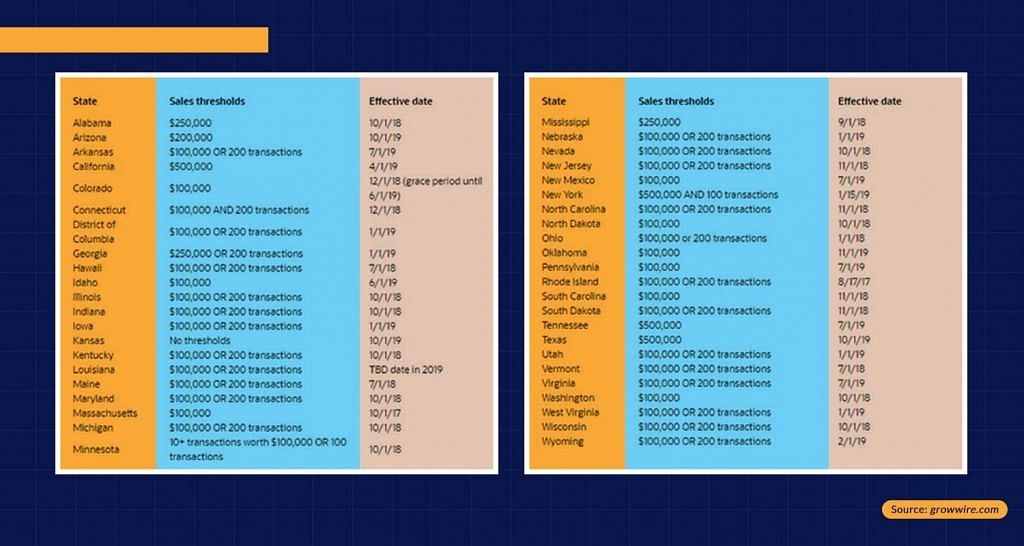

Sales tax is a minor percentage of an online retailer's sales. It is a consumer or consumption tax, meaning consumers pay sales tax only on taxable goods. In the US, 45 states have implemented this tax.

Moreover, there are combined sales taxes because counties, cities, and other local areas have "special taxing districts." Special taxing districts, also known as limited-purpose districts, provide special benefits to the residents of a certain local area.

The state where you sell and the destination point are the main factors in charging sales tax. You'll charge customers the sales tax required and remit it to the particular state.

A rule of thumb in product taxability is that any tangible item is automatically taxable. Still, some states have exceptions, such as products with or without a reduced sales tax rate. Your customers will have to pay for these, so ensure they only pay as necessary.

Here's a quick guide on how to calculate sales tax for Ecommerce.

In a formula structure:

Tax nexus is the connection between your business, a state, or any other taxing authority. Naturally, you get a tax nexus in your home state, but some conditions may also prompt other sales tax nexus in some states, such as high revenue. Once you confirm a sales tax nexus, you can begin registering with the state's tax department, collect and remit sales tax, and file a tax return.

We hope the discussions above have helped you understand the online sales tax system better. It may be overwhelming and stressful, but that's much better than getting into a heap of financial trouble later on. Now that you have the basic knowledge let's move on to tax compliance.

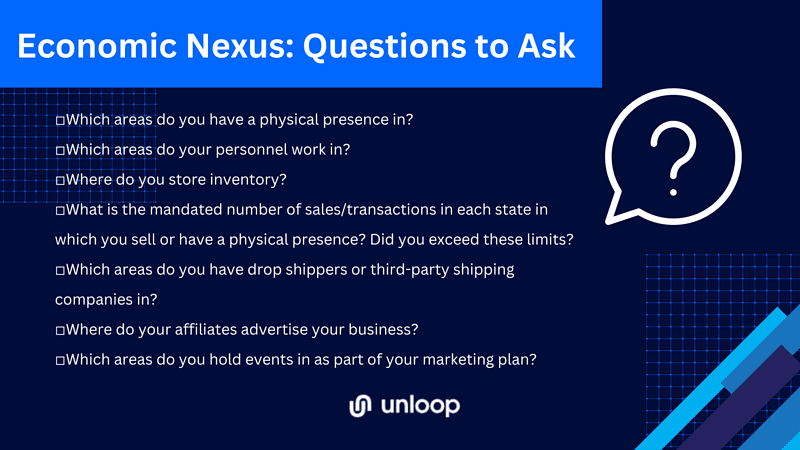

Tax compliance can be extremely confusing, and the smallest mistake can snowball into a huge financial mess. To prevent the confusion and stress of your ecommerce taxes, we've provided a step-by-step procedure to serve as your to-do list.

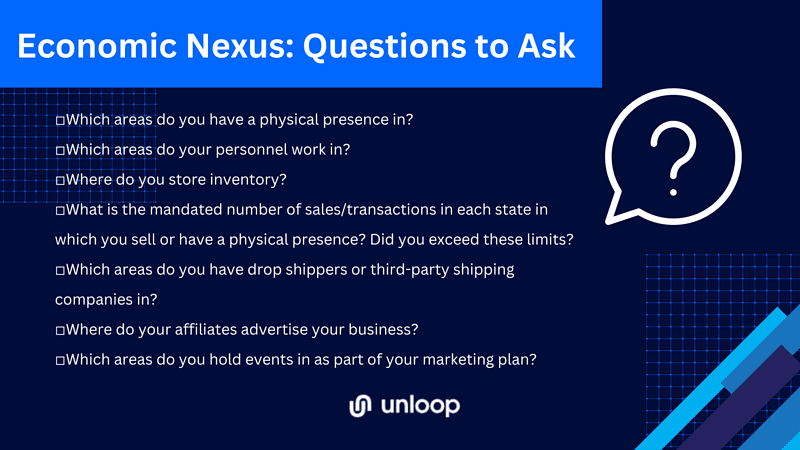

Before proceeding to action, ask yourself some important questions first. Your answers will determine which states you have an economic nexus in. We also recommend you consult with each state you're involved with to confirm these details.

Next, register with the tax authority for a sales permit. This is the document that allows you to collect taxes legally. Contact your state's tax authority to obtain a sales tax permit. Then, you'll be asked to provide the following (not limited to) information:

Depending on the state, these permits may be free or can cost up to $100. The renewal of a sales permit depends on the tax authority you're associated with. For example, some sales tax permits need renewal every one or two years. Meanwhile, others don't require renewal as long as your business still operates.

Some states consider seller's permits as "resale certificates." Generally, resale certificates are signed documents that allow you to buy tax-free goods to resell.

Like sales tax regulations, policies for resale certificates also differ by state. For example, one state considers your sales tax permit the resale certificate. Meanwhile, another requires you to have an independent reseller's permit number.

Ensure your shopping carts, online checkouts, and other marketplace processing systems function properly. There are different bases for tax rates, so your platforms must charge the correct amounts.

Each state makes its own tax rules, hence, the different sales tax sourcing bases. Sales tax sourcing is the basis of charging sales tax, namely, origin-based, destination-based, and mixed sourcing.

Origin-based states follow the tax rate where the business or seller is located. Here are the states that collect origin-based sales tax rates:

| Origin-Based Sales Tax Rates | ||

| STATE | SALES TAX RATES | RANGE OF LOCAL SALES TAX RATES |