Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Not every business has the resources to implement advanced technologies like barcode scanners that match products in your accounting and inventory system. Luckily, the first in, first out or FIFO method formula exists! By embracing this inventory valuation method, you can maintain a natural flow in your inventory management processes.

Indulge yourself in this article as it walks you through the ins and outs of the FIFO method.

In the accounting world, the FIFO method is important in managing inventory and keeping an accurate cost determination. Let’s examine its key aspects and how they impact your business.

When applying the first in, first out (FIFO) in your inventory management system, the items bought or produced earliest are sold or consumed first. From there, your remaining inventory will include the more recently acquired goods.

Inventory valuation is a fundamental accounting practice used by companies to determine the value of unsold inventory when preparing financial statements.

In the context of the FIFO method, you need to allocate costs to your inventory in a way that reflects the order acquisition. The first produced items are the first to be used or sold. You’ll record these costs chronologically, ensuring that the expenses of earlier items are primarily accounted for.

COGS refers to the expenses directly associated with producing or acquiring the goods sold during a specific period.

With FIFO, the earliest costs incurred for acquiring or producing the goods sold help you obtain a more accurate representation of the expenses directly related to those items. This calculation allows you to assess profitability and make confident decisions based on the cost-effectiveness of your sales.

You sell a cap for $85 per piece. Then, assume you have sold 50 pieces from 100 caps in your inventory. You want to see how much profit you have made from the 50 pieces you sold. However, the 100 caps in your inventory were purchased from the same supplier at different prices. See the table below for more information.

| Date of Purchase | Quantity | Price | Total |

| 1/1/2023 | 25 | $50 | $1,250 |

| 2/2/2023 | 50 | $55 | $2,750 |

| 3/3/2023 | 25 | $60 | $1,500 |

Notice the data in the table: You purchased three sets of caps from January to March. You initially had 25 caps for $50 each, and you ordered a second batch that contained 50 caps with a $5 increase for each one. In March, you ordered 25 caps to be in stock with another $5 increase, making a total of $60 in the base price of each cap.

“Demand and inflation are the major factors that affect the price increase of goods and services.“

Since you have sold identical caps and you don't have a barcode system that tells you which ones are from January, February, or March, the FIFO method is one of the best options you have to determine your profit.

Again, you had sold 50 caps at $85 each. All in all, you have a total sale of $4,250. Going back to the table, we need to mark out the 25 pieces in January and another 25 pieces from February to satisfy the total of 50 caps. In January, the 25 caps were purchased for $1,250. Then, you need to get another 25 caps from February, multiply them by $55, and get $1,375.

The formula for calculating the gross profit is as follows:

In this case, your revenue is $4,250. Your cost of goods sold is the sum of $1,250 and $1,375. Plugging these values into the formula:

Your gross profit is $1,625 for the 50 caps sold using the FIFO method.

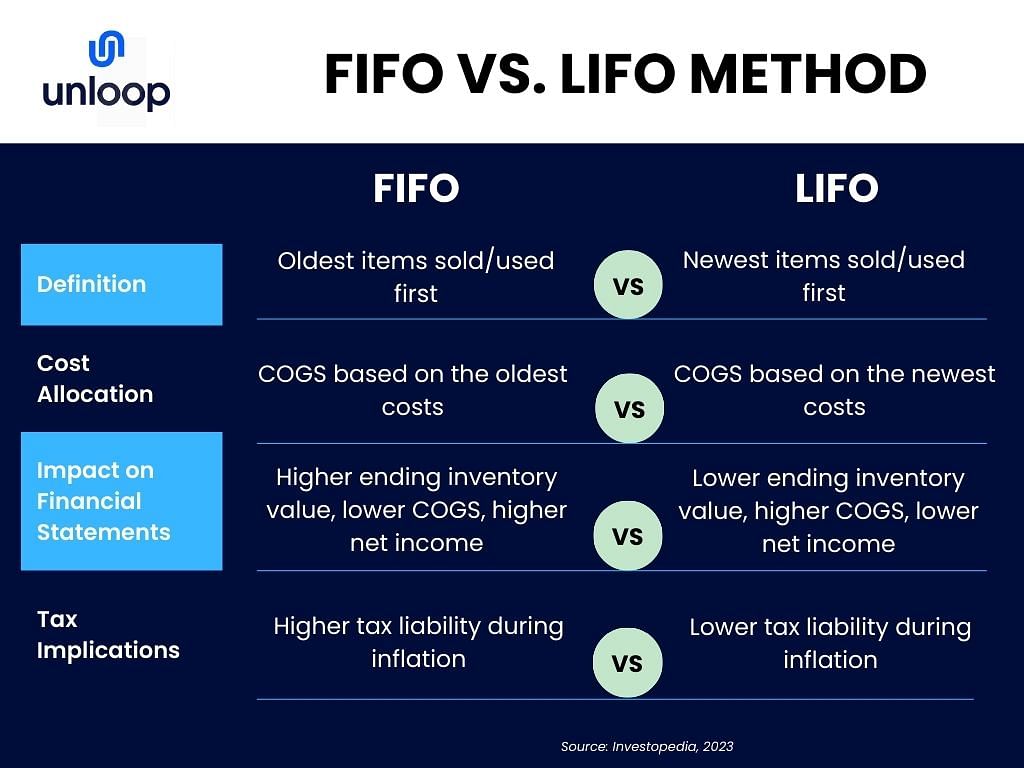

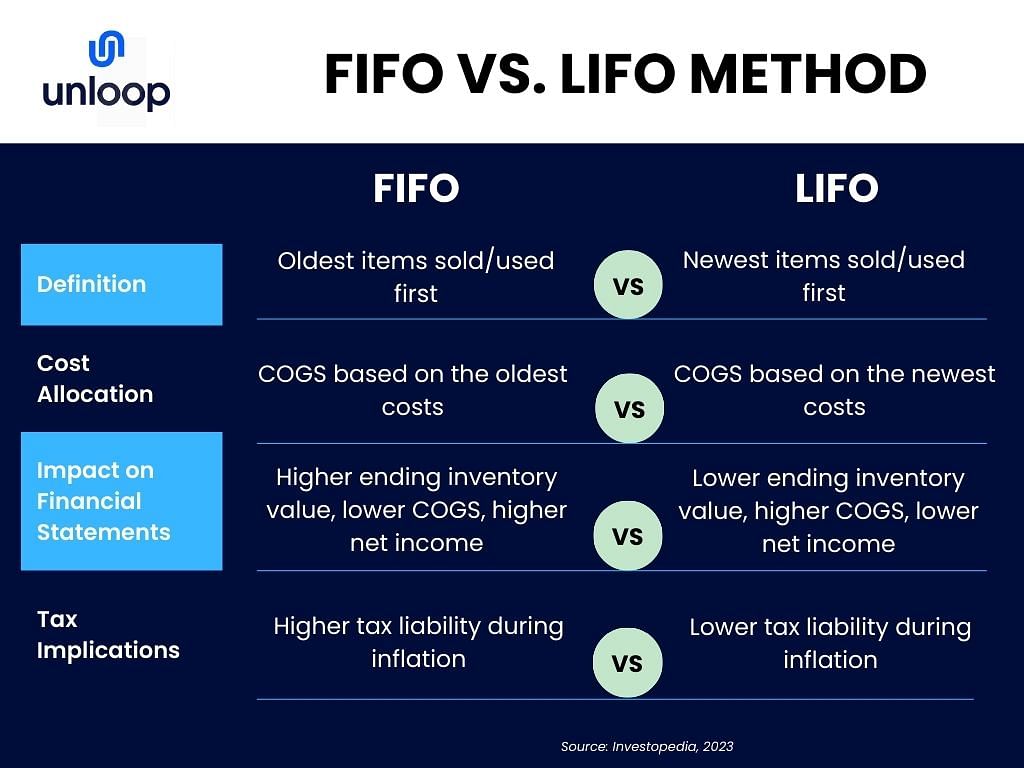

It’s only natural to seek clarification on how FIFO compares with other inventory costing methods, such as the LIFO method.

To provide a comprehensive understanding, we present a concise and insightful comparison between FIFO and LIFO in the following table. This analysis encompasses crucial aspects, from inventory value to its impact on your financial statements.

By assessing the two, you can decide about your inventory management approach.

The FIFO inventory method is one of the most utilized cost flow assumptions. Companies use this calculation to determine which costs go into inventory and which go into expense.

Both costs are essential for accurate financial reporting, better decision-making, and effective inventory management. You can ensure that you allocate sufficient resources while responding swiftly to changing market demands.

The table below provides a useful example of specific cost allocations under inventory and expense categories. They are classified in this manner for accounting purposes.

| Inventory Costs | Expense Costs |

| Direct Materials: Raw materials and other intermediate materials can be physically and directly traced to a specific product. | Administrative Expenses: Include office salaries and wages, advertising costs, and telephone bills. |

| Direct Labor: This cost is usually applied when the company uses variable costs, such as employee wages or salaries. | Selling Costs/Selling Expenses: Commissions for salespeople or efforts to secure new customers, promotional materials, postage, and shipping charges paid by the company to gain more business. |

| Manufacturing Overhead: This consists of overheads for utilities (gas, electricity, etc.), repairs and maintenance of equipment, insurance, rent on factory building and floor space, general office expenses, depreciation on factory machinery, and equipment. |

By knowing this information, you can optimize your inventory strategies, manage your day-to-day work, gain accurate business insights, and assess the profitability of your operations.

There are a few steps in FIFO method accounting:

Once you familiarize yourself with the FIFO method, you can enjoy the following advantages:

The FIFO method is an inventory management formula that helps companies track their products and accurately calculate the COGS to file financial statements or tax returns.

Suppose you have an online business like a shop on the Amazon marketplace. In that case, you can use FIFO if you don't have a barcode system to track your sales and inventory better.

But if you’re hesitant about adopting the inventory method, don’t worry! You can always ask Unloop for professional help. We can help you confidently embrace the benefits of FIFO for your online business. Book a call now!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Not every business has the resources to implement advanced technologies like barcode scanners that match products in your accounting and inventory system. Luckily, the first in, first out or FIFO method formula exists! By embracing this inventory valuation method, you can maintain a natural flow in your inventory management processes.

Indulge yourself in this article as it walks you through the ins and outs of the FIFO method.

In the accounting world, the FIFO method is important in managing inventory and keeping an accurate cost determination. Let’s examine its key aspects and how they impact your business.

When applying the first in, first out (FIFO) in your inventory management system, the items bought or produced earliest are sold or consumed first. From there, your remaining inventory will include the more recently acquired goods.

Inventory valuation is a fundamental accounting practice used by companies to determine the value of unsold inventory when preparing financial statements.

In the context of the FIFO method, you need to allocate costs to your inventory in a way that reflects the order acquisition. The first produced items are the first to be used or sold. You’ll record these costs chronologically, ensuring that the expenses of earlier items are primarily accounted for.

COGS refers to the expenses directly associated with producing or acquiring the goods sold during a specific period.

With FIFO, the earliest costs incurred for acquiring or producing the goods sold help you obtain a more accurate representation of the expenses directly related to those items. This calculation allows you to assess profitability and make confident decisions based on the cost-effectiveness of your sales.

You sell a cap for $85 per piece. Then, assume you have sold 50 pieces from 100 caps in your inventory. You want to see how much profit you have made from the 50 pieces you sold. However, the 100 caps in your inventory were purchased from the same supplier at different prices. See the table below for more information.

| Date of Purchase | Quantity | Price | Total |

| 1/1/2023 | 25 | $50 | $1,250 |

| 2/2/2023 | 50 | $55 | $2,750 |

| 3/3/2023 | 25 | $60 | $1,500 |

Notice the data in the table: You purchased three sets of caps from January to March. You initially had 25 caps for $50 each, and you ordered a second batch that contained 50 caps with a $5 increase for each one. In March, you ordered 25 caps to be in stock with another $5 increase, making a total of $60 in the base price of each cap.

“Demand and inflation are the major factors that affect the price increase of goods and services.“

Since you have sold identical caps and you don't have a barcode system that tells you which ones are from January, February, or March, the FIFO method is one of the best options you have to determine your profit.

Again, you had sold 50 caps at $85 each. All in all, you have a total sale of $4,250. Going back to the table, we need to mark out the 25 pieces in January and another 25 pieces from February to satisfy the total of 50 caps. In January, the 25 caps were purchased for $1,250. Then, you need to get another 25 caps from February, multiply them by $55, and get $1,375.

The formula for calculating the gross profit is as follows:

In this case, your revenue is $4,250. Your cost of goods sold is the sum of $1,250 and $1,375. Plugging these values into the formula:

Your gross profit is $1,625 for the 50 caps sold using the FIFO method.

It’s only natural to seek clarification on how FIFO compares with other inventory costing methods, such as the LIFO method.

To provide a comprehensive understanding, we present a concise and insightful comparison between FIFO and LIFO in the following table. This analysis encompasses crucial aspects, from inventory value to its impact on your financial statements.

By assessing the two, you can decide about your inventory management approach.

The FIFO inventory method is one of the most utilized cost flow assumptions. Companies use this calculation to determine which costs go into inventory and which go into expense.

Both costs are essential for accurate financial reporting, better decision-making, and effective inventory management. You can ensure that you allocate sufficient resources while responding swiftly to changing market demands.

The table below provides a useful example of specific cost allocations under inventory and expense categories. They are classified in this manner for accounting purposes.

| Inventory Costs | Expense Costs |

| Direct Materials: Raw materials and other intermediate materials can be physically and directly traced to a specific product. | Administrative Expenses: Include office salaries and wages, advertising costs, and telephone bills. |

| Direct Labor: This cost is usually applied when the company uses variable costs, such as employee wages or salaries. | Selling Costs/Selling Expenses: Commissions for salespeople or efforts to secure new customers, promotional materials, postage, and shipping charges paid by the company to gain more business. |

| Manufacturing Overhead: This consists of overheads for utilities (gas, electricity, etc.), repairs and maintenance of equipment, insurance, rent on factory building and floor space, general office expenses, depreciation on factory machinery, and equipment. |

By knowing this information, you can optimize your inventory strategies, manage your day-to-day work, gain accurate business insights, and assess the profitability of your operations.

There are a few steps in FIFO method accounting:

Once you familiarize yourself with the FIFO method, you can enjoy the following advantages:

The FIFO method is an inventory management formula that helps companies track their products and accurately calculate the COGS to file financial statements or tax returns.

Suppose you have an online business like a shop on the Amazon marketplace. In that case, you can use FIFO if you don't have a barcode system to track your sales and inventory better.

But if you’re hesitant about adopting the inventory method, don’t worry! You can always ask Unloop for professional help. We can help you confidently embrace the benefits of FIFO for your online business. Book a call now!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Income tax can be a complicated topic for a taxpayer. But not to worry—income tax accountants can help you navigate through the process and take care of your finances to free up space for the more important things in your life. The accounting profession can be lucrative and rewarding. Accountants help people manage, track, and report their earnings to the government on time. They also provide advice on how to best spend money for maximum income tax benefits.

Income tax accounting firms offer a wide range of services, including the following:

consultations on how to reduce your income tax liability legally

Dig deeper and have a better understanding of the accounting profession in Canada.

Canada has a robust economy, and the country is currently enjoying the tenth spot on the world's largest economies ranking syndicated by the International Monetary Fund (IMF). With a very competitive business landscape, entrepreneurs have to keep up and be always in trend. Marketing approaches changed dramatically with the advent of computer technology. Businessmen and advisers alike took advantage of the different systems and applications available on the web.

Facebook, Instagram, YouTube, and other platforms are powerful media tools for marketing. QuickBooks, Sage, and Xero are just a few accounting applications that help business owners track their cash flow, financial statements, and sales and reports generation purposes. However, experts and the right professionals are essential for better results and interpretation. Like the accounting software, an accountant is needed to provide accurate data.

Business owners are very meticulous in the people they hire, and accountants are not exempted. To become a full-fledged and competent accountant, one should become a Chartered Professional Accountant (CPA) after receiving a degree in accounting.

Before becoming a CPA, an aspirant must go through a rigorous undergraduate program in accounting that usually lasts for four years. For four years, an accounting student will be studying accounting principles, finance, taxation, laws, audit, and performance management. On top of that, there are electives, capstones, modules, quizzes, case studies, and exercises to validate all the accounting theories and further training.

After all the academic requirements, the accounting student must pass the Common Final Examination (CFE)—a three-day examination that allows the examinee to demonstrate the depth and breadth of competency development required on the CPA Competency Map. Another important requirement is having 30 hours of accounting experience.

NOTE: Canada has three different accounting designations before, which are Chartered Accountants (CA), Certified General Accountants (CGA), and Certified Management Accountants (CMA). To remove confusion and provide simplicity, over 40 provincial and national accounting associations thought of unifying the three designations in 2012. Two years later, a single designation, the Chartered Professional Accountants (CPA), was introduced in 2014.

It is never easy to become a CPA, and being one means that person has gone through the needle's eye. A CPA has proficiency in delivering accurate financial projections and analysis. That's why a CPA earns an average salary of nearly $79,000 annually.

Aside from financial reports, your income tax and accountant come hand-in-hand. CPAs are tax experts, and they can do your tax preparation on time as long as you provide the right data. They can even give you professional advice on how you will lower your tax legally.

When you hire a CPA, this tax professional can give you feasible financial decisions for the betterment of your financial management. A CPA knows everything about books and can prevent scams and other fraudulent activities.

If you are an employee or a start-up business owner, you need a CPA for the following reasons:

Whether you need to CPA for your personal income tax, income tax benefit accounting, or business consultation, the said expert will never let you down because a CPA is equipped with the knowledge and practical experience. CPAs know how to talk with the CRA and set your business on the right track.

You can also partner with income tax services like Unloop to help you with your tax preparation.

Would you like to know more about income tax? Read the article Here Are The Assistance You Need To Process Your Business Income Tax Rates Smoothly written by Michael Pignatelli, one of our CPAs here in Unloop.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Income tax can be a complicated topic for a taxpayer. But not to worry—income tax accountants can help you navigate through the process and take care of your finances to free up space for the more important things in your life. The accounting profession can be lucrative and rewarding. Accountants help people manage, track, and report their earnings to the government on time. They also provide advice on how to best spend money for maximum income tax benefits.

Income tax accounting firms offer a wide range of services, including the following:

consultations on how to reduce your income tax liability legally

Dig deeper and have a better understanding of the accounting profession in Canada.

Canada has a robust economy, and the country is currently enjoying the tenth spot on the world's largest economies ranking syndicated by the International Monetary Fund (IMF). With a very competitive business landscape, entrepreneurs have to keep up and be always in trend. Marketing approaches changed dramatically with the advent of computer technology. Businessmen and advisers alike took advantage of the different systems and applications available on the web.

Facebook, Instagram, YouTube, and other platforms are powerful media tools for marketing. QuickBooks, Sage, and Xero are just a few accounting applications that help business owners track their cash flow, financial statements, and sales and reports generation purposes. However, experts and the right professionals are essential for better results and interpretation. Like the accounting software, an accountant is needed to provide accurate data.

Business owners are very meticulous in the people they hire, and accountants are not exempted. To become a full-fledged and competent accountant, one should become a Chartered Professional Accountant (CPA) after receiving a degree in accounting.

Before becoming a CPA, an aspirant must go through a rigorous undergraduate program in accounting that usually lasts for four years. For four years, an accounting student will be studying accounting principles, finance, taxation, laws, audit, and performance management. On top of that, there are electives, capstones, modules, quizzes, case studies, and exercises to validate all the accounting theories and further training.

After all the academic requirements, the accounting student must pass the Common Final Examination (CFE)—a three-day examination that allows the examinee to demonstrate the depth and breadth of competency development required on the CPA Competency Map. Another important requirement is having 30 hours of accounting experience.

NOTE: Canada has three different accounting designations before, which are Chartered Accountants (CA), Certified General Accountants (CGA), and Certified Management Accountants (CMA). To remove confusion and provide simplicity, over 40 provincial and national accounting associations thought of unifying the three designations in 2012. Two years later, a single designation, the Chartered Professional Accountants (CPA), was introduced in 2014.

It is never easy to become a CPA, and being one means that person has gone through the needle's eye. A CPA has proficiency in delivering accurate financial projections and analysis. That's why a CPA earns an average salary of nearly $79,000 annually.

Aside from financial reports, your income tax and accountant come hand-in-hand. CPAs are tax experts, and they can do your tax preparation on time as long as you provide the right data. They can even give you professional advice on how you will lower your tax legally.

When you hire a CPA, this tax professional can give you feasible financial decisions for the betterment of your financial management. A CPA knows everything about books and can prevent scams and other fraudulent activities.

If you are an employee or a start-up business owner, you need a CPA for the following reasons:

Whether you need to CPA for your personal income tax, income tax benefit accounting, or business consultation, the said expert will never let you down because a CPA is equipped with the knowledge and practical experience. CPAs know how to talk with the CRA and set your business on the right track.

You can also partner with income tax services like Unloop to help you with your tax preparation.

Would you like to know more about income tax? Read the article Here Are The Assistance You Need To Process Your Business Income Tax Rates Smoothly written by Michael Pignatelli, one of our CPAs here in Unloop.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Full-cycle accounting is a vital aspect of managing finances for small businesses. It is the process of completing all accounting tasks needed in an accounting quarter—from recording financial transactions to preparing financial statements. It ensures accurate and up-to-date records, helps make informed business decisions, and ensures compliance with tax regulations.

This guide will help you determine your business reporting period and break down the steps of full cycle accounting and highlight the importance of financial management for small business owners.

Before setting up any bookkeeping or accounting system for your business, you must first determine your preferred accounting reporting period. The accounting period spans twelve months in which business transactions are recorded. You have two options when choosing an accounting period.

The calendar method is the default method used if you have no preferences. In this method, your accounting period follows the year's calendar in chronological order. That means you start recording on January 1 and then finish the recording period on December 31.

In this method, your accounting period is based on your preferred month. For example, If you choose your accounting period to start on April 1 of the current year, the ending period would be March 31 of next year. Big businesses and public accounting firms commonly use the fiscal year.

The chosen starting month can be arbitrary, or it can be based on multiple factors. For example, some choose their starting month strategically so that the ending month period would fall on a lean period. That way, they can focus more on the accounting part while the business is slow.

Accounting firms choose a fiscal period when the ending month falls on the tax-payment period, hitting two birds in one stone—create financial statements and pay appropriate taxes in one effort.

If you're not sure how your business behaves, it's okay to stick to the calendar period. Accounting periods can be changed in the future depending on your state's policy, so be sure to double check. Either way, you must choose wisely as accounting period changes may involve considerable paperwork.

After determining which accounting period you'll use, let's arm you with the knowledge of the full cycle accounting process, which includes recording and reporting transactions using financial statements.

Before you put any amount on paper, you'll need to identify your business's accounts first. These accounts are what the entire accounting cycle depends on.

In financial accounting, they are collectively known as the Chart of Accounts. Establish certain labels for transactions such as revenue, rent expenses, supplies expenses, utilities, and many more.

After all the accounts relevant to your business are set, you can start recording transactions. In your accounting journal, record every business-related activity with financial bearing, including receipts of payments you make for your business and payments your business receives from sales. Each entry is composed of at least two accounts, known as the double-entry method.

Your business should also have a general ledger for all the transactions and a sub-ledger to categorize them. For example, if you have a receipt acknowledging your payment to one of your suppliers, record that under the accounts payable ledger accounts. Depending on your business size, you can add different categories to your general ledger.

After all your business transactions are recorded in order, you have to validate them. First, see if all entries like assets, liabilities, cost of goods, sales, expenses, taxes, and other transactions are correct. Next, ensure both columns are balanced for credit and debit entries.

There are three types of journal entries to record in business transactions:

After recording transactions in the journal, you must post their respective amounts in the ledger account. Each account on the general ledger has a credit and a debit side where you can place the amount similar to where it is placed on the journal entry.

After an accounting period, you'll have to look at your general ledger again. Each account will have to be totaled. Get the sum of the ledger account debit and credit columns and then subtract them from each other. The difference will be the net amount of a particular account.

An unadjusted trial balance or entries are the transactions in your ledger by the end of the accounting period. These entries are untouched and are usually used by business managers and accountants to identify which ledgers need modifications to create financial statements.

After finding out the net total of all the ledger accounts, you'll have to line them all up again into the debit column and the credit column. The debit side net amount should be placed on the left column while the credit net amount should be on the right.

From there, you'll have to record the net total of all accounts. In the end, the sum of the debit column and the credit column must match each other. This is how you prepare the initial trial balance.

To generate the adjusted trial balance, you must modify journal entries as needed. This is the step where you or your accountants modify your ledgers to create financial reports.

The adjusted trial balance is the number that will appear on your financial statements, which you can use to create strategies, make business improvements, and pinpoint potential issues in your business.

After all the adjusting entries have been accounted for, you will create another trial balance to check if all the accounts and their net total post-adjustment will still be equal.

In most cases, businesses tend to have a lot of ongoing transactions during the accounting period. So it can be easy to lose track of the correct adjusting amounts. That's why an adjusted trial balance is necessary to ensure everything is balanced after the adjustment.

There are different financial statements you can produce for your business. These may differ depending on your business needs, but here are some of the common financial statements you will have to generate.

Balance Sheet

Balance sheets contain reports of the business's assets, liabilities, and stakeholders’ equity in a certain accounting period. These data points are used to evaluate the financial position of your business. Simply put, the balance sheet accounts for all that your business owns and owes, and the money invested by your stakeholders.

Cash Flow Statement

The cash flow statement shows the movement of cash in and out of your business. This financial statement shows how well you distribute your monetary resources, like how you generate cash and use it to fulfill your full cycle accounts payables. This financial report can also be the basis for some investors to know whether it's worth investing in your business.

Cash flow statements include cash flow from business activities like operations, financing, and investments. Furthermore, this data can be used by creditors to determine if they can give you credit and loans for your business.

Income Statement

Income statements are also known as profit and loss statements. This financial report shows your company's income and gains in a specific period. This statement shows all income and expenses whether from cash or credit receipts that there's no way to tell them apart.

Nevertheless, income statements are useful to know if your current operations are generating business income. It also helps determine which aspects of your business are underperforming, so you can make improvements.

If the adjusted trial balance yields an identical amount on the credit and debit side, you can prepare financial statements. You'll have to determine which of the accounts are nominal and real so you can place them in the proper column on the worksheet.

Before closing the books, you will ignore all the temporary like income statement accounts and collect the real accounts like the balance sheet again for a final trial balance.

In this phase, all your business revenue and expense accounts should be zeroed out in preparation for the next accounting period. This is necessary to verify if your credits and debits are balanced. These accounts will also be your starting point for the next accounting period, so transfer temporary account balances to permanent accounts.

All the financial transactions and their respective accounts on the previous books are reversed. Afterward, the books are closed. This leaves only the real accounts.

You will open new books, and the first journal entries are the real accounts from the pre-closing trial balance. Similarly, you will open a new general ledger, and the balance sheet accounts will have an opening amount.

Once all accounts are recorded in the proper places, the accounting cycle steps will restart and conclude in the next period.

An accounting cycle can also refer to other business activities besides income and expenses. Compared to a full cycle that usually lasts three months, these specific cycles can be shorter. Here are some of them.

The purchasing cycle is the process of acquiring goods for your business, from ordering to receiving. Full cycle accounts payable happens in this particular accounting cycle where your company makes a request or an order to purchase goods for your business.

Then, the supplier receives your order, you pay for it, and you acquire the goods.

The sales cycle is the full cycle accounts receivable of a business and it involves the following:

The payroll cycle involves every process between the employee and the business until the salary is received. The cycle starts with the employee submitting their time cards to human resources.

From there, the admin will make adjustments and approve them for payment. Then, the payroll is processed by computing the gross pay and all necessary deductions.

You don't need to feel like you're swimming in paperwork to optimize your business. You can successfully manage the accounting cycle and keep your business finances on track with these tips:

If you are a small business owner, doing all the tasks in the accounting cycle may be too much for you to handle. After all, accounting is not the only thing you do when running a business. If you need professional help, Unloop offers several accounting and bookkeeping services for busy business owners like you.

Here are some of the services we offer.

Unloop is your one-stop shop for bookkeeping and accounting solutions. Book a call with us today, and work with our experts!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Full-cycle accounting is a vital aspect of managing finances for small businesses. It is the process of completing all accounting tasks needed in an accounting quarter—from recording financial transactions to preparing financial statements. It ensures accurate and up-to-date records, helps make informed business decisions, and ensures compliance with tax regulations.

This guide will help you determine your business reporting period and break down the steps of full cycle accounting and highlight the importance of financial management for small business owners.

Before setting up any bookkeeping or accounting system for your business, you must first determine your preferred accounting reporting period. The accounting period spans twelve months in which business transactions are recorded. You have two options when choosing an accounting period.

The calendar method is the default method used if you have no preferences. In this method, your accounting period follows the year's calendar in chronological order. That means you start recording on January 1 and then finish the recording period on December 31.

In this method, your accounting period is based on your preferred month. For example, If you choose your accounting period to start on April 1 of the current year, the ending period would be March 31 of next year. Big businesses and public accounting firms commonly use the fiscal year.

The chosen starting month can be arbitrary, or it can be based on multiple factors. For example, some choose their starting month strategically so that the ending month period would fall on a lean period. That way, they can focus more on the accounting part while the business is slow.

Accounting firms choose a fiscal period when the ending month falls on the tax-payment period, hitting two birds in one stone—create financial statements and pay appropriate taxes in one effort.

If you're not sure how your business behaves, it's okay to stick to the calendar period. Accounting periods can be changed in the future depending on your state's policy, so be sure to double check. Either way, you must choose wisely as accounting period changes may involve considerable paperwork.

After determining which accounting period you'll use, let's arm you with the knowledge of the full cycle accounting process, which includes recording and reporting transactions using financial statements.

Before you put any amount on paper, you'll need to identify your business's accounts first. These accounts are what the entire accounting cycle depends on.

In financial accounting, they are collectively known as the Chart of Accounts. Establish certain labels for transactions such as revenue, rent expenses, supplies expenses, utilities, and many more.

After all the accounts relevant to your business are set, you can start recording transactions. In your accounting journal, record every business-related activity with financial bearing, including receipts of payments you make for your business and payments your business receives from sales. Each entry is composed of at least two accounts, known as the double-entry method.

Your business should also have a general ledger for all the transactions and a sub-ledger to categorize them. For example, if you have a receipt acknowledging your payment to one of your suppliers, record that under the accounts payable ledger accounts. Depending on your business size, you can add different categories to your general ledger.

After all your business transactions are recorded in order, you have to validate them. First, see if all entries like assets, liabilities, cost of goods, sales, expenses, taxes, and other transactions are correct. Next, ensure both columns are balanced for credit and debit entries.

There are three types of journal entries to record in business transactions:

After recording transactions in the journal, you must post their respective amounts in the ledger account. Each account on the general ledger has a credit and a debit side where you can place the amount similar to where it is placed on the journal entry.

After an accounting period, you'll have to look at your general ledger again. Each account will have to be totaled. Get the sum of the ledger account debit and credit columns and then subtract them from each other. The difference will be the net amount of a particular account.

An unadjusted trial balance or entries are the transactions in your ledger by the end of the accounting period. These entries are untouched and are usually used by business managers and accountants to identify which ledgers need modifications to create financial statements.

After finding out the net total of all the ledger accounts, you'll have to line them all up again into the debit column and the credit column. The debit side net amount should be placed on the left column while the credit net amount should be on the right.

From there, you'll have to record the net total of all accounts. In the end, the sum of the debit column and the credit column must match each other. This is how you prepare the initial trial balance.

To generate the adjusted trial balance, you must modify journal entries as needed. This is the step where you or your accountants modify your ledgers to create financial reports.

The adjusted trial balance is the number that will appear on your financial statements, which you can use to create strategies, make business improvements, and pinpoint potential issues in your business.

After all the adjusting entries have been accounted for, you will create another trial balance to check if all the accounts and their net total post-adjustment will still be equal.

In most cases, businesses tend to have a lot of ongoing transactions during the accounting period. So it can be easy to lose track of the correct adjusting amounts. That's why an adjusted trial balance is necessary to ensure everything is balanced after the adjustment.

There are different financial statements you can produce for your business. These may differ depending on your business needs, but here are some of the common financial statements you will have to generate.

Balance Sheet

Balance sheets contain reports of the business's assets, liabilities, and stakeholders’ equity in a certain accounting period. These data points are used to evaluate the financial position of your business. Simply put, the balance sheet accounts for all that your business owns and owes, and the money invested by your stakeholders.

Cash Flow Statement

The cash flow statement shows the movement of cash in and out of your business. This financial statement shows how well you distribute your monetary resources, like how you generate cash and use it to fulfill your full cycle accounts payables. This financial report can also be the basis for some investors to know whether it's worth investing in your business.

Cash flow statements include cash flow from business activities like operations, financing, and investments. Furthermore, this data can be used by creditors to determine if they can give you credit and loans for your business.

Income Statement

Income statements are also known as profit and loss statements. This financial report shows your company's income and gains in a specific period. This statement shows all income and expenses whether from cash or credit receipts that there's no way to tell them apart.

Nevertheless, income statements are useful to know if your current operations are generating business income. It also helps determine which aspects of your business are underperforming, so you can make improvements.

If the adjusted trial balance yields an identical amount on the credit and debit side, you can prepare financial statements. You'll have to determine which of the accounts are nominal and real so you can place them in the proper column on the worksheet.

Before closing the books, you will ignore all the temporary like income statement accounts and collect the real accounts like the balance sheet again for a final trial balance.

In this phase, all your business revenue and expense accounts should be zeroed out in preparation for the next accounting period. This is necessary to verify if your credits and debits are balanced. These accounts will also be your starting point for the next accounting period, so transfer temporary account balances to permanent accounts.

All the financial transactions and their respective accounts on the previous books are reversed. Afterward, the books are closed. This leaves only the real accounts.

You will open new books, and the first journal entries are the real accounts from the pre-closing trial balance. Similarly, you will open a new general ledger, and the balance sheet accounts will have an opening amount.

Once all accounts are recorded in the proper places, the accounting cycle steps will restart and conclude in the next period.

An accounting cycle can also refer to other business activities besides income and expenses. Compared to a full cycle that usually lasts three months, these specific cycles can be shorter. Here are some of them.

The purchasing cycle is the process of acquiring goods for your business, from ordering to receiving. Full cycle accounts payable happens in this particular accounting cycle where your company makes a request or an order to purchase goods for your business.

Then, the supplier receives your order, you pay for it, and you acquire the goods.

The sales cycle is the full cycle accounts receivable of a business and it involves the following:

The payroll cycle involves every process between the employee and the business until the salary is received. The cycle starts with the employee submitting their time cards to human resources.

From there, the admin will make adjustments and approve them for payment. Then, the payroll is processed by computing the gross pay and all necessary deductions.

You don't need to feel like you're swimming in paperwork to optimize your business. You can successfully manage the accounting cycle and keep your business finances on track with these tips:

If you are a small business owner, doing all the tasks in the accounting cycle may be too much for you to handle. After all, accounting is not the only thing you do when running a business. If you need professional help, Unloop offers several accounting and bookkeeping services for busy business owners like you.

Here are some of the services we offer.

Unloop is your one-stop shop for bookkeeping and accounting solutions. Book a call with us today, and work with our experts!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Have you recently migrated your physical store to digital platforms? And are you already familiar with online business accounting? If not, then it’s understandable, as most of us prioritize business operations over financial aspects like this.

Nevertheless, cash flow is what keeps your business afloat. This is one of the key indicators that your online business is profiting or losing money. Without solid tracking, you won’t have a clear view of your financial health.

If you’re still unfamiliar with online business accounting, the different software you can use, and their corresponding benefits to your venture, this article will be your handy guide. Read on to learn more about the process and why you must invest in your accounting.

Online business accounting encompasses two interconnected processes. One pertains to accounting for online businesses. It can also mean using internet technology to carry out the accounting process. These may have different meanings, but you can experience both through online business accounting software programs.

In the past, we followed traditional accounting practices wherein you had to hire a bookkeeper or accountant and meet with them. But now, things are more seamless and precise. You don’t have to schedule meetings and personally give them your business’s financial data.

Online business accounting (or e-accounting) means that all your accounting operations are done and saved online through the cloud, making it more accessible for you, your team, and your accountants. It performs all traditional accounting functions but with added convenience and accuracy.

Small business owners can benefit the most from online business accounting. It eliminates the need for dedicated in-house accountants, reducing overhead expenses. Most accounting software providers also offer user-friendly and accessible tools, allowing you to manage finances and track income efficiently.

But these advantages are just the beginning. Explore some additional ways it can be of help.

Doing all your processes online is logical, especially if you sell on Amazon, Shopify, or other ecommerce platforms. From there, you can easily consolidate your information, simplifying your record-keeping and financial reporting.

Doing a quick run-through of your overall performance is also a part of your business. Having accurate data will back you up in presenting your progress and profitability to potential investors. It can boost credibility, attract funding opportunities, and seize growth prospects.

Printing data and writing on a ledger can be an exhausting task. Not to mention that finishing your books is time-sensitive. These data have to be accurately consolidated for them to be properly analyzed.

Gone are the days through dozens of purchase receipts or checking how many sales went in each of your revenue streams for that month. With online business accounting, data entry is a breeze. Its automation skills can effortlessly log everything into the system, including:

| ✅ Income and Expense Tracking ✅ Invoicing and Payment Processing ✅ Sales Tax Calculation ✅ Inventory Management ✅ Payments Payable |

Automating tasks makes things more efficient and error-free. It lets you breathe easily, knowing your financial records are reliable and authentic.

Going digital means you can save a ton of paperwork. All financial data and records are securely stored in the cloud—no need for mountains of physical documents, receipts, or ledgers.

The shift to a paperless system also aligns with sustainable activities, reflecting an eco-friendly approach. Minimizing paper usage reduces the environmental impact and sends a clear message about your brand’s commitment to responsible business practices. This resonates strongly with today’s eco-conscious consumers.

This is how business grows: not only are your sales skyrocketing, your inventory is too! Scaling entails catering to more SKUs or increased stock orders, so you’ll have to deal with a lot of cash coming in and out. You will also make additional payments here and there.

It’s different from online business accounting. Even with high orders, tracking finances becomes manageable through automated and synced processes.

You may not be at your desired business size currently. Still, it’s one less problem to worry about in the future, all because you switched to online accounting.

How many times do you check your sales and expenses tally once a month? Most companies that still use traditional accounting may only be provided with this data at the end of the month.

With e-accounting, you can bid farewell to such frustrations. Real-time, updated, and accurate financial information is ready at your fingertips. You can make well-informed decisions based on actual numbers, eliminating the need for rash choices unsupported by data.

You can also adjust your performance anytime, as it offers an updated overview of your business’s finances.

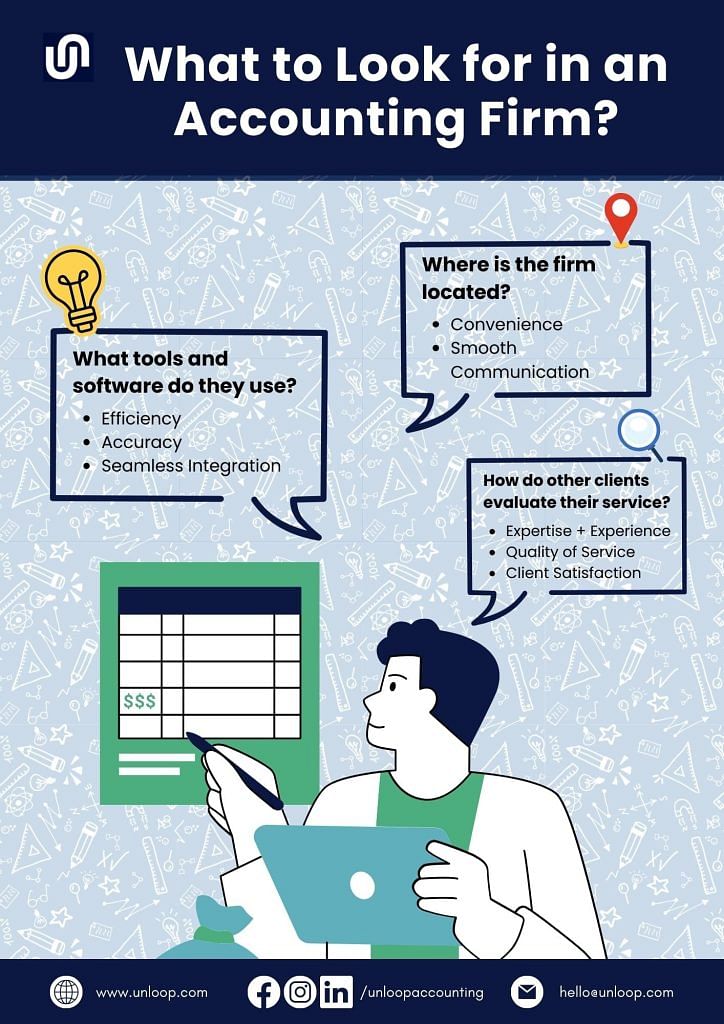

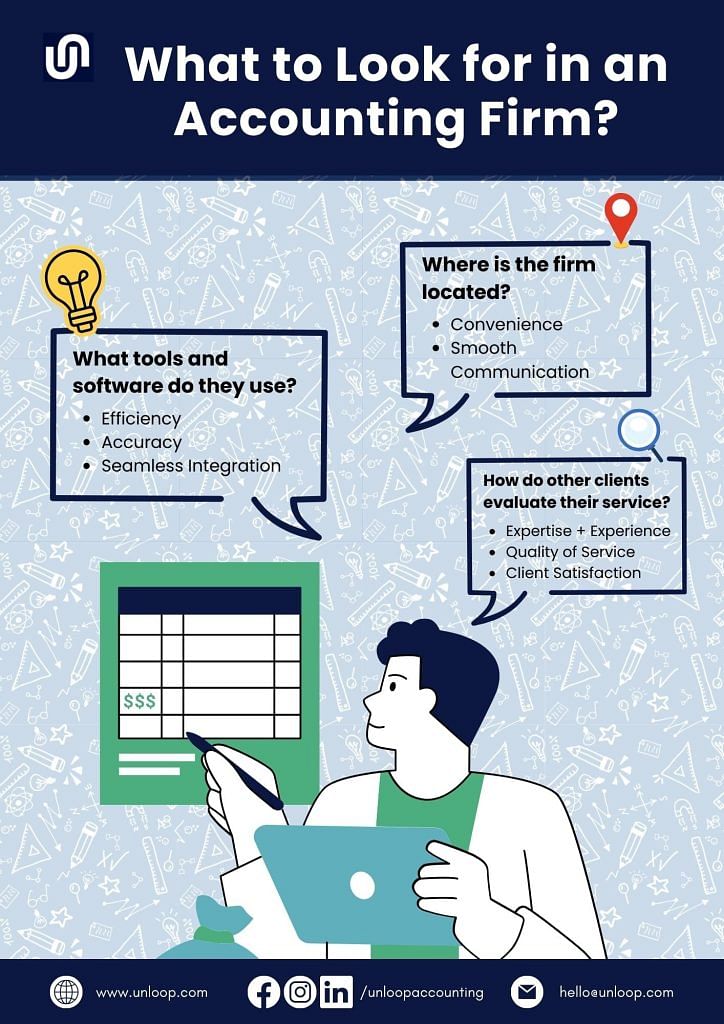

With the rise of small businesses come numerous online accounting services, each claiming to be the best solution for your financial needs and long-term goals. How do you know if an accounting service can cater to your needs? Below are key points to consider.

You should have your monthly revenue data before signing up with an online accounting service. These services base their pricing on how much your business earns.

It’s reasonable for online accounting services to price services based on earnings because their workload will depend on your revenue. It is expected that the more money your business makes, the more work needs to be done.

An online accounting service may also charge you depending on the number of accounts and transactions you will let them handle. Some charge per account enrolled in the service, while others offer unlimited transactions, with the pricing depending mostly on your monthly revenue.

Some small businesses think hiring an accounting service that charges per account or transaction is best. This is a good way to start, but it might not be sustainable and scalable.

It’s still a lot cheaper for you to invest in a service that offers unlimited transactions. It can accommodate your business’s expansion without any unexpected financial burdens.

Online accounting software is one way to facilitate bookkeeping and accounting activities. Different small business accounting software are available, each with pros and cons.

| Best Accounting Software for Small Businesses | |

| QuickBooks Online | The gold standard for cloud-based accounting. It offers accounting features like invoicing, expense tracking, inventory management, financial reporting, and bank reconciliation. |

| Xero | A double-entry accounting software. This approach guarantees that every transaction is accounted for twice. It can maintain a perfect balance between debits and credits. |

| FreshBooks | Ideal for service-based businesses. FreshBooks excels in time tracking and project management. It simplifies billing and client collaboration, making it suitable for freelancers and small service providers. |

| Zoho Books | A free accounting software. Despite being free, it still offers core accounting functionalities, making it an ideal starting point for businesses on a tight budget. |

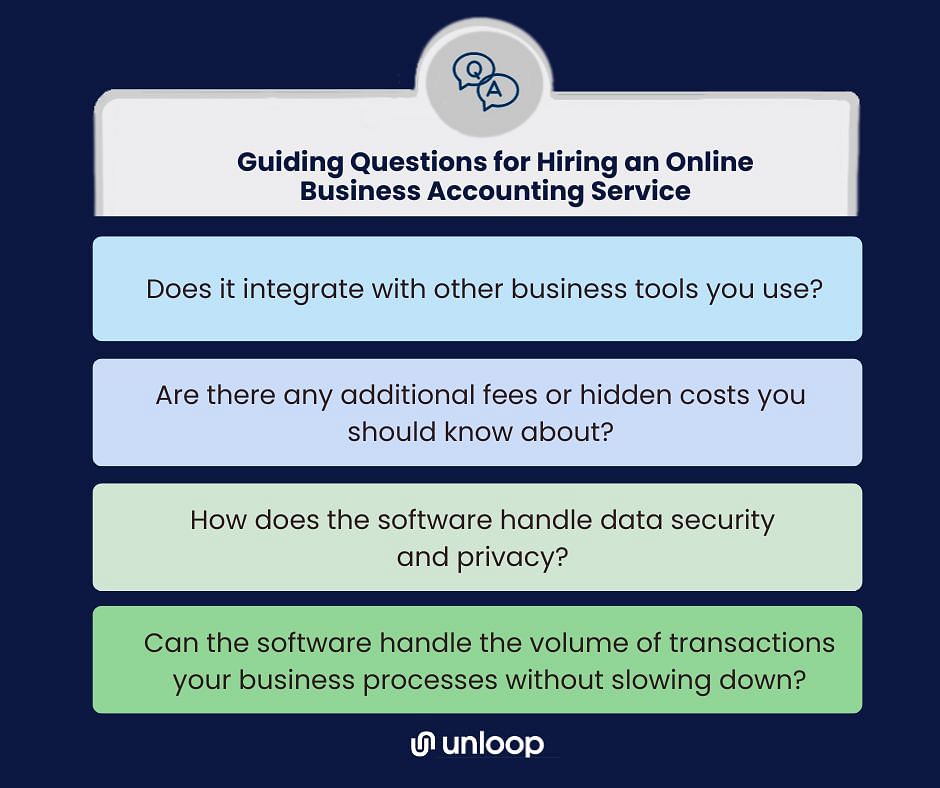

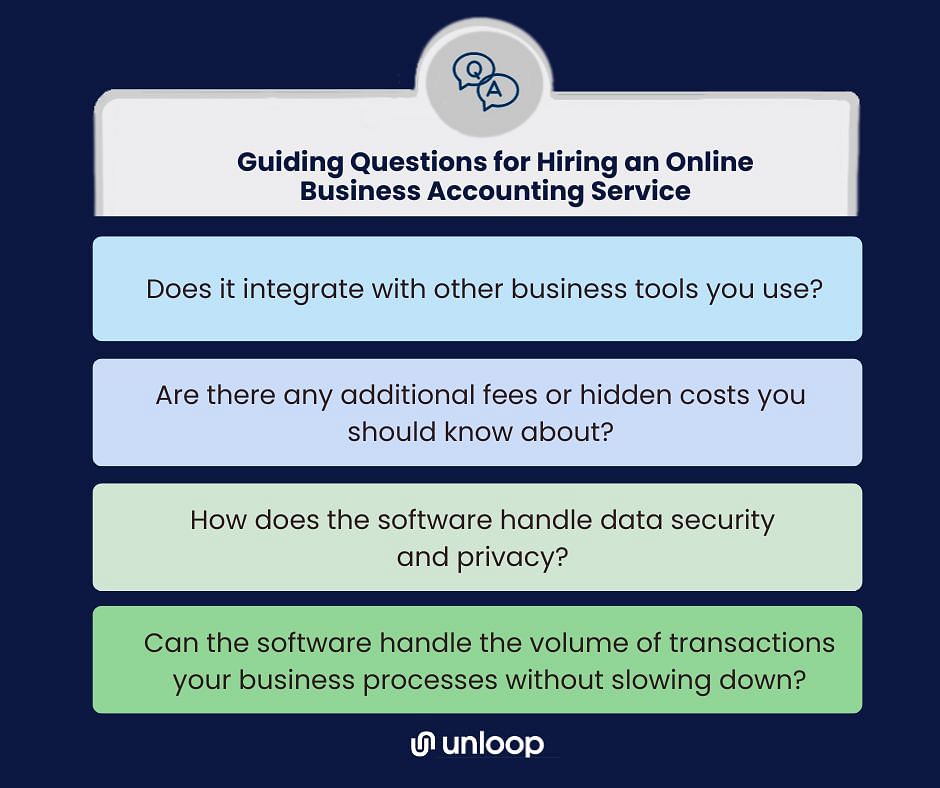

Before hiring an online accounting service, create strong guiding questions about their tools and software. Here are some to consider.

You can confidently assess the capabilities and compatibility of various online accounting services by seeking answers to these guiding questions. Rest assured that your financial management processes will be in capable hands, allowing you to focus on growing and succeeding in your business endeavors.

Accounting can be a complex process, especially if you lack a background. The technicalities involved in software and process flow might seem overwhelming to learn.

It’s crucial to recognize that not all accounting services offer guidance, from onboarding your files to receiving your financial statements. Therefore, selecting an accounting team with whom you can communicate openly is essential.

Having a line of communication with their team will help you better understand the financial management process. Their support and guidance can make your business journey smoother, even if you are not well-versed in accounting practices.

The short answer is yes and no. Most online accounting and bookkeeping services do not file taxes since you must work with a CPA firm for that. But at the end of the day, they can expedite your business processes. They can produce the most accurate financial statements with the help of the different accounting software mentioned above.

Unloop is one such online accounting team that recognizes the challenges online sellers face in finding affordable accountants. Our services go beyond providing financial statements; we collaborate with CPA firms at discounted partner rates, saving you the hassle of searching for one on your own.

We offer unlimited transactions and access to Quickbooks Online and A2X. This way, you can base any decisions you make now and in the future on actual data derived from your business.

Get all of these and more when you sign on with us. Book a call today!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Have you recently migrated your physical store to digital platforms? And are you already familiar with online business accounting? If not, then it’s understandable, as most of us prioritize business operations over financial aspects like this.

Nevertheless, cash flow is what keeps your business afloat. This is one of the key indicators that your online business is profiting or losing money. Without solid tracking, you won’t have a clear view of your financial health.

If you’re still unfamiliar with online business accounting, the different software you can use, and their corresponding benefits to your venture, this article will be your handy guide. Read on to learn more about the process and why you must invest in your accounting.

Online business accounting encompasses two interconnected processes. One pertains to accounting for online businesses. It can also mean using internet technology to carry out the accounting process. These may have different meanings, but you can experience both through online business accounting software programs.

In the past, we followed traditional accounting practices wherein you had to hire a bookkeeper or accountant and meet with them. But now, things are more seamless and precise. You don’t have to schedule meetings and personally give them your business’s financial data.

Online business accounting (or e-accounting) means that all your accounting operations are done and saved online through the cloud, making it more accessible for you, your team, and your accountants. It performs all traditional accounting functions but with added convenience and accuracy.

Small business owners can benefit the most from online business accounting. It eliminates the need for dedicated in-house accountants, reducing overhead expenses. Most accounting software providers also offer user-friendly and accessible tools, allowing you to manage finances and track income efficiently.

But these advantages are just the beginning. Explore some additional ways it can be of help.

Doing all your processes online is logical, especially if you sell on Amazon, Shopify, or other ecommerce platforms. From there, you can easily consolidate your information, simplifying your record-keeping and financial reporting.

Doing a quick run-through of your overall performance is also a part of your business. Having accurate data will back you up in presenting your progress and profitability to potential investors. It can boost credibility, attract funding opportunities, and seize growth prospects.

Printing data and writing on a ledger can be an exhausting task. Not to mention that finishing your books is time-sensitive. These data have to be accurately consolidated for them to be properly analyzed.

Gone are the days through dozens of purchase receipts or checking how many sales went in each of your revenue streams for that month. With online business accounting, data entry is a breeze. Its automation skills can effortlessly log everything into the system, including:

| ✅ Income and Expense Tracking ✅ Invoicing and Payment Processing ✅ Sales Tax Calculation ✅ Inventory Management ✅ Payments Payable |

Automating tasks makes things more efficient and error-free. It lets you breathe easily, knowing your financial records are reliable and authentic.

Going digital means you can save a ton of paperwork. All financial data and records are securely stored in the cloud—no need for mountains of physical documents, receipts, or ledgers.

The shift to a paperless system also aligns with sustainable activities, reflecting an eco-friendly approach. Minimizing paper usage reduces the environmental impact and sends a clear message about your brand’s commitment to responsible business practices. This resonates strongly with today’s eco-conscious consumers.

This is how business grows: not only are your sales skyrocketing, your inventory is too! Scaling entails catering to more SKUs or increased stock orders, so you’ll have to deal with a lot of cash coming in and out. You will also make additional payments here and there.

It’s different from online business accounting. Even with high orders, tracking finances becomes manageable through automated and synced processes.

You may not be at your desired business size currently. Still, it’s one less problem to worry about in the future, all because you switched to online accounting.

How many times do you check your sales and expenses tally once a month? Most companies that still use traditional accounting may only be provided with this data at the end of the month.

With e-accounting, you can bid farewell to such frustrations. Real-time, updated, and accurate financial information is ready at your fingertips. You can make well-informed decisions based on actual numbers, eliminating the need for rash choices unsupported by data.

You can also adjust your performance anytime, as it offers an updated overview of your business’s finances.

With the rise of small businesses come numerous online accounting services, each claiming to be the best solution for your financial needs and long-term goals. How do you know if an accounting service can cater to your needs? Below are key points to consider.

You should have your monthly revenue data before signing up with an online accounting service. These services base their pricing on how much your business earns.

It’s reasonable for online accounting services to price services based on earnings because their workload will depend on your revenue. It is expected that the more money your business makes, the more work needs to be done.

An online accounting service may also charge you depending on the number of accounts and transactions you will let them handle. Some charge per account enrolled in the service, while others offer unlimited transactions, with the pricing depending mostly on your monthly revenue.

Some small businesses think hiring an accounting service that charges per account or transaction is best. This is a good way to start, but it might not be sustainable and scalable.

It’s still a lot cheaper for you to invest in a service that offers unlimited transactions. It can accommodate your business’s expansion without any unexpected financial burdens.

Online accounting software is one way to facilitate bookkeeping and accounting activities. Different small business accounting software are available, each with pros and cons.

| Best Accounting Software for Small Businesses | |

| QuickBooks Online | The gold standard for cloud-based accounting. It offers accounting features like invoicing, expense tracking, inventory management, financial reporting, and bank reconciliation. |

| Xero | A double-entry accounting software. This approach guarantees that every transaction is accounted for twice. It can maintain a perfect balance between debits and credits. |

| FreshBooks | Ideal for service-based businesses. FreshBooks excels in time tracking and project management. It simplifies billing and client collaboration, making it suitable for freelancers and small service providers. |

| Zoho Books | A free accounting software. Despite being free, it still offers core accounting functionalities, making it an ideal starting point for businesses on a tight budget. |

Before hiring an online accounting service, create strong guiding questions about their tools and software. Here are some to consider.

You can confidently assess the capabilities and compatibility of various online accounting services by seeking answers to these guiding questions. Rest assured that your financial management processes will be in capable hands, allowing you to focus on growing and succeeding in your business endeavors.

Accounting can be a complex process, especially if you lack a background. The technicalities involved in software and process flow might seem overwhelming to learn.

It’s crucial to recognize that not all accounting services offer guidance, from onboarding your files to receiving your financial statements. Therefore, selecting an accounting team with whom you can communicate openly is essential.

Having a line of communication with their team will help you better understand the financial management process. Their support and guidance can make your business journey smoother, even if you are not well-versed in accounting practices.

The short answer is yes and no. Most online accounting and bookkeeping services do not file taxes since you must work with a CPA firm for that. But at the end of the day, they can expedite your business processes. They can produce the most accurate financial statements with the help of the different accounting software mentioned above.

Unloop is one such online accounting team that recognizes the challenges online sellers face in finding affordable accountants. Our services go beyond providing financial statements; we collaborate with CPA firms at discounted partner rates, saving you the hassle of searching for one on your own.

We offer unlimited transactions and access to Quickbooks Online and A2X. This way, you can base any decisions you make now and in the future on actual data derived from your business.

Get all of these and more when you sign on with us. Book a call today!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

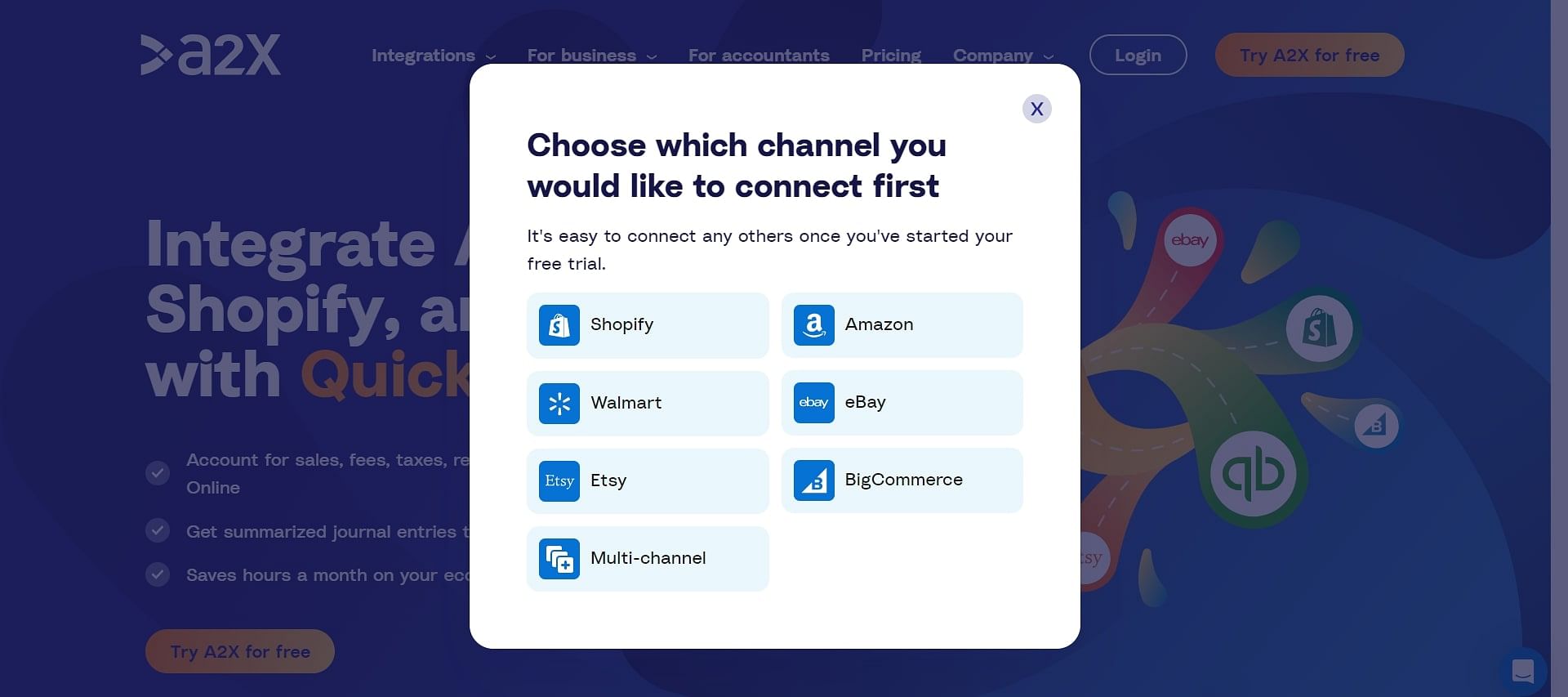

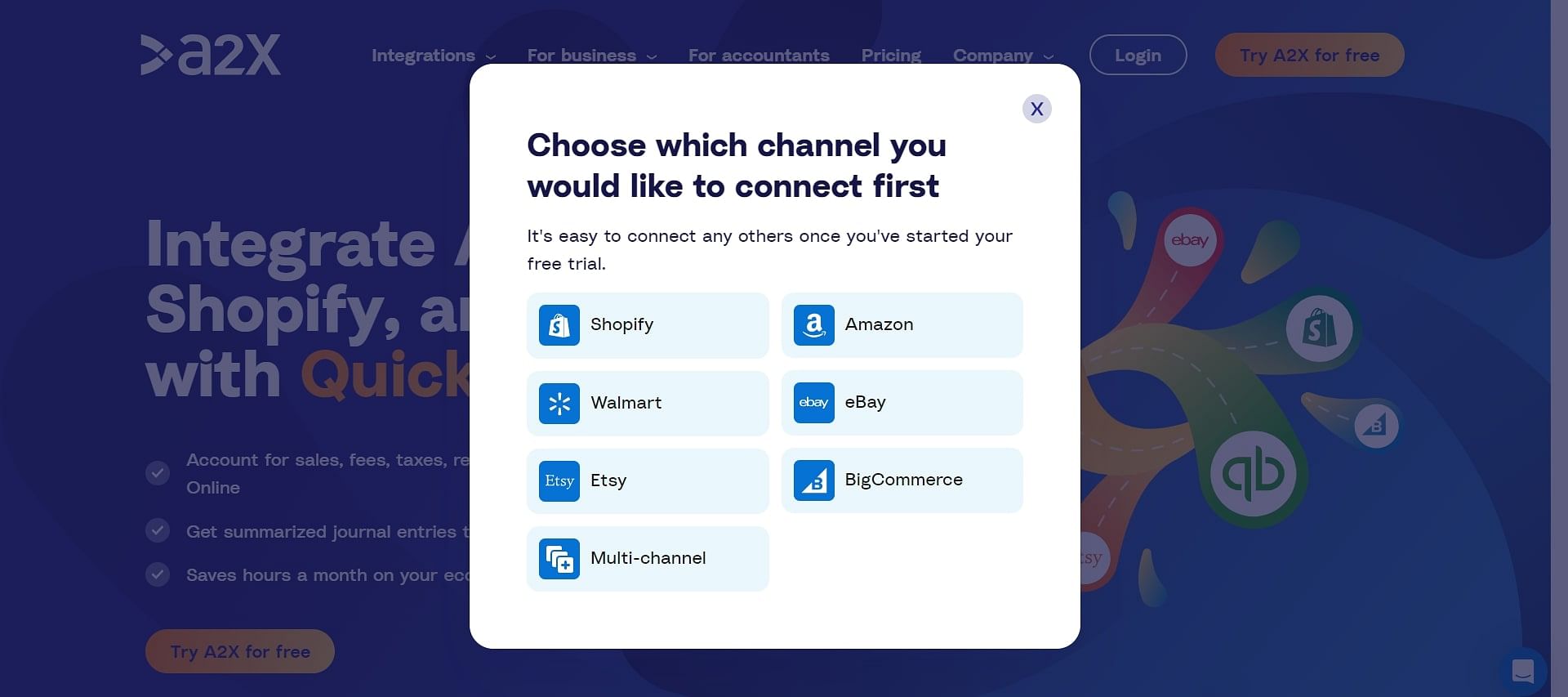

It’s the era of ecommerce, and we’re just living in it. As online shoppers continue to soar and online retailers like Amazon grow even bigger, a seller’s financial affairs can get overwhelming really quick. Streamlining financial operations, reconciling transactions from various sales channels, and maintaining bookkeeping records become crucial. Enter the A2X accounting app.

Do you want to know more about A2X? This blog post will explore some critical aspects of this accounting solution and why it’s becoming an indispensable tool for online sellers.

A2X is a cloud-based accounting tool meticulously designed for small business owners, major market players, online retailers, and anyone seeking streamlined cash flow management. This third-party application offers great features that deliver stress-free accounting, particularly within a huge marketplace like Amazon.

Gone are the days of manual data entry and painstaking calculations. A2X handles all the heavy lifting by summarizing your sales data and generating accurate financial reports. These reports provide a detailed overview of your financial performance and help you stay on top of your business's finances.

Amazon’s dominance in the ecommerce industry presents lucrative opportunities for business. With a staggering 220.49 million visitors from mobile and desktop connections, selling on this platform can exponentially expand your reach and revenue potential.

But capitalizing on these benefits also brings significant accounting responsibilities. You must diligently manage your tasks and keep up with the complexities of this thriving field.

Fortunately, A2X steps in as the ultimate solution. Being used and highly recommended by the most trusted accountants, A2X is proven to solve bookkeeping issues, such as payment reconciliation and cash flow tracking. Its efficacy in simplifying financial operations sets it apart from competitors in the market.

Let’s delve further into the factors that position A2X as a competent accounting solution for Amazon sellers:

A2X establishes a reliable integration to each platform when connecting to different Amazon marketplaces. It retrieves the transaction details from each market and consolidates them into a unified format for further processing.

Since A2X can deal with multiple marketplaces, it can manage transactions in various currencies. This multi-currency capability automatically converts and reconciles sales data from different currencies to a single currency within the accounting software.

A2X generates journals for each settlement and posts them to your accounting software. When a settlement is detected, A2X efficiently loads the corresponding transactions. It generates a complete outline of revenue, expenses, and other vital data specific to that sales channel. This organized approach ensures the accessibility of your financial information.

A2X can also aggregate sales by SKU (Stock Keeping Unit), product type, country, or other relevant parameters. This level of customization allows you to analyze and track sales performance based on the specific metrics that hold the utmost importance to your business.

Receiving payments from Amazon can be complex, as funds are often deposited in batches, combining transactions from multiple orders. This consolidation can pose challenges for sellers who strive to accurately reconcile their transactions from their accounts.

A2X makes this process easier by compiling the transaction data and summing it up to match the bank deposits. The application considers factors such as fees and refunds to create a summary that accurately reflects the funds deposited by Amazon.

Businesses can easily trace and verify cash flow by comparing the rundown against the bank deposit records. This level of transparency promotes financial integrity and facilitates effective financial reporting and analysis.

A2X is built to handle large transaction volumes, ensuring you can process financial activities as you scale your business. You won't have to worry about outgrowing the tool’s capabilities or experiencing performance issues.

The accounting app also adapts to changes in your business structure or operational requirements. Whether you expand to new Amazon marketplaces, diversify your product offerings, or adjust your accounting processes, A2X is easily configurable to meet your changing needs.

Numerous tasks within Amazon operations can be a major time drain. Because A2X recognizes the importance of saving time, it efficiently manages repetitive processes on your behalf through automation.

By leveraging A2X's time-saving and complexity-reducing features, you can free up valuable resources and devote more energy to boosting Amazon sales. Spend less on manual accounting tasks and more on strategic initiatives that drive success.

One way to save time is by harnessing the potential of tools and technology. Luckily, you can integrate A2X with popular financial software like QuickBooks Online (QBO) and Xero. It automatically fetches and organizes complex details, such as sales, fees, refunds, and other transaction data, into a format that aligns with these cloud-based accounting platforms.

The integration reduces the chances of errors or discrepancies. You can enjoy the peace of mind of having reconciled financial records month after month without breaking a sweat.

Intuit, the developer of QuickBooks, has approved A2X as an integration application for the Amazon marketplace and QuickBooks Online accounts.

Integrating Amazon with QuickBooks Online through A2X is a straightforward process. Here's how it works:

After you've completed this step, you are now good to integrate your Amazon account and QBO.

Accounting is complicated, especially for sellers on the world’s largest ecommerce platform. But, there is a solution that can simplify your accounting processes: A2X. It can help you connect your Amazon account to QuickBooks Online and other software while organizing your transactions.

If you're still unsure about updating your accounting processes and need additional support, Unloop is here to help. Say hi to better and easier Amazon accounting with our dedicated team—no need to worry about the stress and confusion of managing your accounts alone.

So what are you waiting for? Book a call today!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

It’s the era of ecommerce, and we’re just living in it. As online shoppers continue to soar and online retailers like Amazon grow even bigger, a seller’s financial affairs can get overwhelming really quick. Streamlining financial operations, reconciling transactions from various sales channels, and maintaining bookkeeping records become crucial. Enter the A2X accounting app.

Do you want to know more about A2X? This blog post will explore some critical aspects of this accounting solution and why it’s becoming an indispensable tool for online sellers.

A2X is a cloud-based accounting tool meticulously designed for small business owners, major market players, online retailers, and anyone seeking streamlined cash flow management. This third-party application offers great features that deliver stress-free accounting, particularly within a huge marketplace like Amazon.

Gone are the days of manual data entry and painstaking calculations. A2X handles all the heavy lifting by summarizing your sales data and generating accurate financial reports. These reports provide a detailed overview of your financial performance and help you stay on top of your business's finances.

Amazon’s dominance in the ecommerce industry presents lucrative opportunities for business. With a staggering 220.49 million visitors from mobile and desktop connections, selling on this platform can exponentially expand your reach and revenue potential.

But capitalizing on these benefits also brings significant accounting responsibilities. You must diligently manage your tasks and keep up with the complexities of this thriving field.

Fortunately, A2X steps in as the ultimate solution. Being used and highly recommended by the most trusted accountants, A2X is proven to solve bookkeeping issues, such as payment reconciliation and cash flow tracking. Its efficacy in simplifying financial operations sets it apart from competitors in the market.

Let’s delve further into the factors that position A2X as a competent accounting solution for Amazon sellers:

A2X establishes a reliable integration to each platform when connecting to different Amazon marketplaces. It retrieves the transaction details from each market and consolidates them into a unified format for further processing.

Since A2X can deal with multiple marketplaces, it can manage transactions in various currencies. This multi-currency capability automatically converts and reconciles sales data from different currencies to a single currency within the accounting software.

A2X generates journals for each settlement and posts them to your accounting software. When a settlement is detected, A2X efficiently loads the corresponding transactions. It generates a complete outline of revenue, expenses, and other vital data specific to that sales channel. This organized approach ensures the accessibility of your financial information.

A2X can also aggregate sales by SKU (Stock Keeping Unit), product type, country, or other relevant parameters. This level of customization allows you to analyze and track sales performance based on the specific metrics that hold the utmost importance to your business.

Receiving payments from Amazon can be complex, as funds are often deposited in batches, combining transactions from multiple orders. This consolidation can pose challenges for sellers who strive to accurately reconcile their transactions from their accounts.

A2X makes this process easier by compiling the transaction data and summing it up to match the bank deposits. The application considers factors such as fees and refunds to create a summary that accurately reflects the funds deposited by Amazon.

Businesses can easily trace and verify cash flow by comparing the rundown against the bank deposit records. This level of transparency promotes financial integrity and facilitates effective financial reporting and analysis.

A2X is built to handle large transaction volumes, ensuring you can process financial activities as you scale your business. You won't have to worry about outgrowing the tool’s capabilities or experiencing performance issues.

The accounting app also adapts to changes in your business structure or operational requirements. Whether you expand to new Amazon marketplaces, diversify your product offerings, or adjust your accounting processes, A2X is easily configurable to meet your changing needs.

Numerous tasks within Amazon operations can be a major time drain. Because A2X recognizes the importance of saving time, it efficiently manages repetitive processes on your behalf through automation.

By leveraging A2X's time-saving and complexity-reducing features, you can free up valuable resources and devote more energy to boosting Amazon sales. Spend less on manual accounting tasks and more on strategic initiatives that drive success.

One way to save time is by harnessing the potential of tools and technology. Luckily, you can integrate A2X with popular financial software like QuickBooks Online (QBO) and Xero. It automatically fetches and organizes complex details, such as sales, fees, refunds, and other transaction data, into a format that aligns with these cloud-based accounting platforms.

The integration reduces the chances of errors or discrepancies. You can enjoy the peace of mind of having reconciled financial records month after month without breaking a sweat.

Intuit, the developer of QuickBooks, has approved A2X as an integration application for the Amazon marketplace and QuickBooks Online accounts.

Integrating Amazon with QuickBooks Online through A2X is a straightforward process. Here's how it works:

After you've completed this step, you are now good to integrate your Amazon account and QBO.

Accounting is complicated, especially for sellers on the world’s largest ecommerce platform. But, there is a solution that can simplify your accounting processes: A2X. It can help you connect your Amazon account to QuickBooks Online and other software while organizing your transactions.

If you're still unsure about updating your accounting processes and need additional support, Unloop is here to help. Say hi to better and easier Amazon accounting with our dedicated team—no need to worry about the stress and confusion of managing your accounts alone.

So what are you waiting for? Book a call today!

Today, we will talk about one of the best accounting software in the market: Xero Accounting Software—a means for accountants and bookkeepers to track data and transactions easier and safer than manual means.

If you are already considering signing up, let us encourage you further and help weigh your options by providing eleven benefits to reap using Xero small business software.

Accounting is a broad and difficult area to traverse in business, especially for those with little experience and knowledge. Tasks like invoice creation, expense or income tracking, payroll, and transaction processing can often be headache-inducing.

Thankfully, accounting systems like Xero have begun popping up recently to assist mid-sized and small businesses in need. But what makes Xero among the top accounting solutions?

Among the accounting tasks you or your accountants and bookkeepers need to accomplish are income and expense tracking, which are much better done automatically.

Through Xero Software, your bills are tracked through automated online payments or by taking photos of the receipts.

The payments from your clients are also automatically stored in the system, especially when they pay bank-to-bank or via credit and debit cards. The multicurrency feature lets you enjoy this regardless of the currency used.

A wide range of payment options benefits you and your clients. You can quickly pay vendor dues, and your clients conveniently pay you through these payment options:

Bank-to-bank transactions | Credit cards | Debit cards | GoCardless |

Stripe | PayPal | ApplePay | Transferwise |

Through Xero, your business can adapt to the trend of cashless transactions. All the money coming in and out of these payment options is automatically tracked by Xero through bank, Stripe, Paypal, and Transferwise feeds.

Below is a breakdown of Xero software's project and employee time-tracking benefits.

🕜 Organizing Projects and Employee Time: If you work on different projects with several employees, you can organize the projects together with the time rendered by each worker through Xero.