Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Any big or small business owner must ensure their employees receive the hard-earned money they deserve. Nevertheless, mistakes during payroll processing are bound to happen. Thankfully, the emergence of an automated payroll system allows you to pay your employees seamlessly.

Let's delve into the depths of an automated payroll solution and how it can transform your business’s financial operations.

Before we get into the nitty-gritty of payroll automation, it's crucial to understand the processes behind it. As you might have already guessed, payroll involves giving your employees accurate salaries on time.

To do so, you have to calculate

Additionally, you have to consider several other factors, such as

To any business owner without an established finance team, these tasks may become too confusing and daunting to handle on their own. Learning to do these accounting tasks accurately also takes much time and effort.

Fortunately, you won't have to stress too much over perfecting these tiresome payroll processes. With an automated payroll, you have an organized tool for the job. A computerized payroll system will simplify and speed up how you calculate and distribute your employee's paychecks.

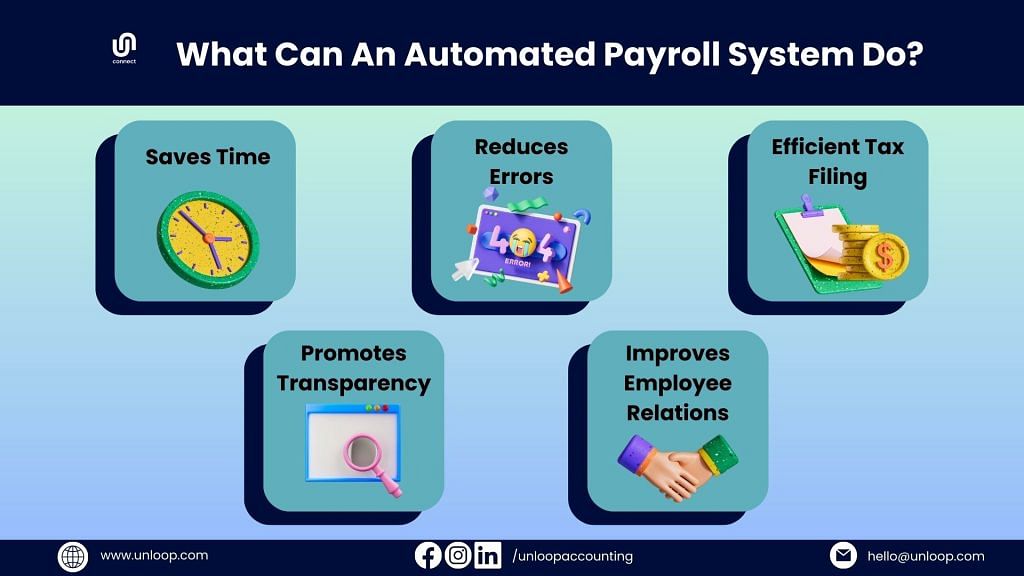

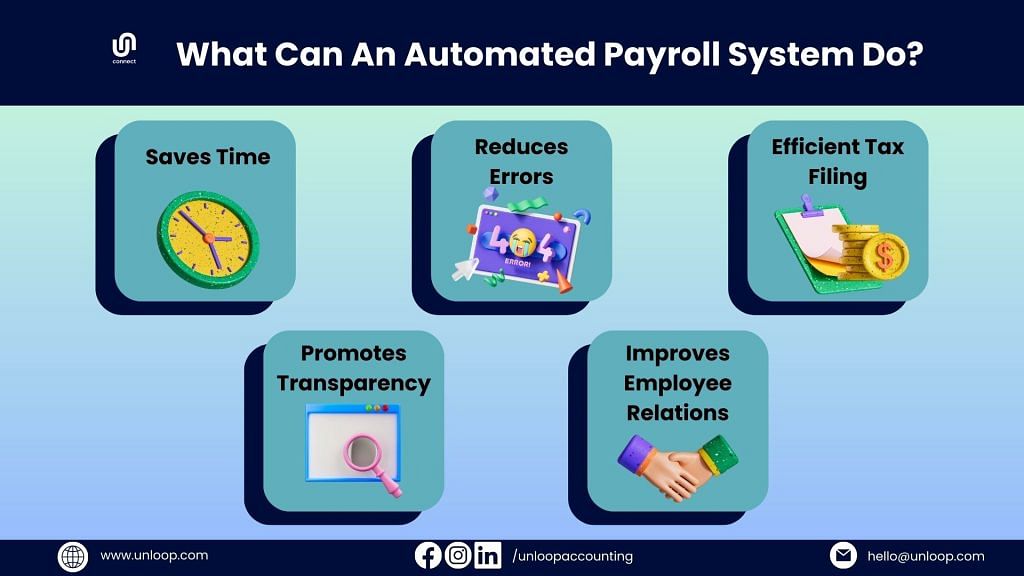

An automated system can do the following processes:

You might still be skeptical about streamlining your payroll tasks to organized software. To ease any of your worries, we've gathered a few reasons why you should automate payroll to improve your business.

Saves Time

Time is precious and should not be wasted. Even the tiniest moments count when you're operating and handling a business. Hence, it's only logical to spend every second wisely.

You would have to spend hours upon hours doing manual data entry for payroll when you should be working on important business matters. An automated payroll system allows you to allocate more time to those tasks.

Even the slightest mistake can cause grave consequences when calculating employee wages. The payroll team must ensure accurate and timely wage distribution.

However, with the dizzying amount of accounting and recordkeeping tasks involved in payroll, some people will inevitably make mistakes and unintentionally issue inaccurate employee payments. These errors can cause financial issues for both the employee and the employer and lead to severe legal penalties.

Precise and accurate payment calculations are guaranteed with a computerized payroll system. The software can correctly and swiftly compute and adjust an employee's pay while considering possible wage deductions, raises, bonuses, and more.

One of the most confusing and headache-inducing parts of payroll processing is filing and calculating tax withholdings. Getting this part right is crucial as it involves various laws and regulations. An error may likely result in legal trouble for your business.

With automated payroll systems, you don't have to calculate all of your employee's gross pay and take out tax deductions on your own. You can let the software accurately figure out and navigate the complicated world of tax filing.

Using automated payroll software can also foster employee trust. Most automated systems allow staff members to access their paychecks easily and view possible changes in their regular wages. These are possible with employee self-service portals and other employee-centric features.

They can also update and input payroll information easily using automated systems. Because of this feature, the system can smoothly adjust employee pay stubs according to real-time changes.

Paying employees with an automated system can indirectly improve your relationship with them. Receiving befitting compensation for their work is one of the primary ways to motivate employees. With computerized payroll systems, employees are guaranteed accurate and timely pay.

Moreover, with the transparency that automated systems provide, you can improve and develop trust and confidence in your employees. They will feel secure knowing that you pay them what they're due.

Manually handling your payroll may seem like a breeze at first. But as your business grows, it will become more complicated and time-consuming. The sooner you implement payroll automation, the more time and resources you'll save in the long run.

Hopefully, the benefits mentioned above are enough to convince you to start automating your payroll. Your next course of action is learning how to switch from manual to automated payroll. You can either use payroll automation software or hire a payroll service.

Take matters into your own hands by searching for payroll automation software that suits your business. Choosing payroll software will primarily depend on your company's size, business needs, and other related factors.

Besides the payroll software cost, here are some features you must consider:

Besides calculating your employee's wages, automated software can also provide regular comprehensive payroll reports to help monitor your finances. Some even use combined HR and payroll software for more efficient employee and payroll management.

Once you've made your choice, all you have to do is input the necessary payroll data and documents, such as employee information and tax forms, into the software. Ensure that what you've placed in the system is accurate to avoid financial errors.

Another option is to hire management assistance from professional payroll services. They especially come in handy for owners of large corporations and businesses handling a significant number of employees.

All you have to do is track your employees' work hours and forward this data to the service provider. The service will calculate the payroll amount based on those hours and deduct taxes from their paychecks before rolling them out during payday. Naturally, they would typically use automated software.

Payroll is part and parcel of any business, no matter the industry. Plenty of accounting tasks necessitate payroll processing, from tracking your employees' work hours to delivering their wages on time. While these tasks can be done independently and manually, doing so will be time-consuming and may lead to unintentional errors.

So, switch to stress-free automated payroll management with Unloop's payroll services. Our team of professionals uses efficient, up-to-date tools like QuickBooks to ensure automated, organized, and efficient payroll processing for your company. Book a call with us today!

Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Any big or small business owner must ensure their employees receive the hard-earned money they deserve. Nevertheless, mistakes during payroll processing are bound to happen. Thankfully, the emergence of an automated payroll system allows you to pay your employees seamlessly.

Let's delve into the depths of an automated payroll solution and how it can transform your business’s financial operations.

Before we get into the nitty-gritty of payroll automation, it's crucial to understand the processes behind it. As you might have already guessed, payroll involves giving your employees accurate salaries on time.

To do so, you have to calculate

Additionally, you have to consider several other factors, such as

To any business owner without an established finance team, these tasks may become too confusing and daunting to handle on their own. Learning to do these accounting tasks accurately also takes much time and effort.

Fortunately, you won't have to stress too much over perfecting these tiresome payroll processes. With an automated payroll, you have an organized tool for the job. A computerized payroll system will simplify and speed up how you calculate and distribute your employee's paychecks.

An automated system can do the following processes:

You might still be skeptical about streamlining your payroll tasks to organized software. To ease any of your worries, we've gathered a few reasons why you should automate payroll to improve your business.

Saves Time

Time is precious and should not be wasted. Even the tiniest moments count when you're operating and handling a business. Hence, it's only logical to spend every second wisely.

You would have to spend hours upon hours doing manual data entry for payroll when you should be working on important business matters. An automated payroll system allows you to allocate more time to those tasks.

Even the slightest mistake can cause grave consequences when calculating employee wages. The payroll team must ensure accurate and timely wage distribution.

However, with the dizzying amount of accounting and recordkeeping tasks involved in payroll, some people will inevitably make mistakes and unintentionally issue inaccurate employee payments. These errors can cause financial issues for both the employee and the employer and lead to severe legal penalties.

Precise and accurate payment calculations are guaranteed with a computerized payroll system. The software can correctly and swiftly compute and adjust an employee's pay while considering possible wage deductions, raises, bonuses, and more.

One of the most confusing and headache-inducing parts of payroll processing is filing and calculating tax withholdings. Getting this part right is crucial as it involves various laws and regulations. An error may likely result in legal trouble for your business.

With automated payroll systems, you don't have to calculate all of your employee's gross pay and take out tax deductions on your own. You can let the software accurately figure out and navigate the complicated world of tax filing.

Using automated payroll software can also foster employee trust. Most automated systems allow staff members to access their paychecks easily and view possible changes in their regular wages. These are possible with employee self-service portals and other employee-centric features.

They can also update and input payroll information easily using automated systems. Because of this feature, the system can smoothly adjust employee pay stubs according to real-time changes.

Paying employees with an automated system can indirectly improve your relationship with them. Receiving befitting compensation for their work is one of the primary ways to motivate employees. With computerized payroll systems, employees are guaranteed accurate and timely pay.

Moreover, with the transparency that automated systems provide, you can improve and develop trust and confidence in your employees. They will feel secure knowing that you pay them what they're due.

Manually handling your payroll may seem like a breeze at first. But as your business grows, it will become more complicated and time-consuming. The sooner you implement payroll automation, the more time and resources you'll save in the long run.

Hopefully, the benefits mentioned above are enough to convince you to start automating your payroll. Your next course of action is learning how to switch from manual to automated payroll. You can either use payroll automation software or hire a payroll service.

Take matters into your own hands by searching for payroll automation software that suits your business. Choosing payroll software will primarily depend on your company's size, business needs, and other related factors.

Besides the payroll software cost, here are some features you must consider:

Besides calculating your employee's wages, automated software can also provide regular comprehensive payroll reports to help monitor your finances. Some even use combined HR and payroll software for more efficient employee and payroll management.

Once you've made your choice, all you have to do is input the necessary payroll data and documents, such as employee information and tax forms, into the software. Ensure that what you've placed in the system is accurate to avoid financial errors.

Another option is to hire management assistance from professional payroll services. They especially come in handy for owners of large corporations and businesses handling a significant number of employees.

All you have to do is track your employees' work hours and forward this data to the service provider. The service will calculate the payroll amount based on those hours and deduct taxes from their paychecks before rolling them out during payday. Naturally, they would typically use automated software.

Payroll is part and parcel of any business, no matter the industry. Plenty of accounting tasks necessitate payroll processing, from tracking your employees' work hours to delivering their wages on time. While these tasks can be done independently and manually, doing so will be time-consuming and may lead to unintentional errors.

So, switch to stress-free automated payroll management with Unloop's payroll services. Our team of professionals uses efficient, up-to-date tools like QuickBooks to ensure automated, organized, and efficient payroll processing for your company. Book a call with us today!

Learning how to calculate accounts receivable is an important step towards better financial management, and the reason is obvious for anyone that owns a business; nobody wants to forget the money they're owed, especially when it's a huge amount.

In this blog, we'll discuss everything there is to know about accounts receivable, the formulas involved in calculating it, and why you need to keep tabs on this account that's on your company's balance sheet.

For starters, let's discuss what accounts receivable is. The short of it is that it's the money that customers owe a business on credit. But how does that happen exactly?

Accounts receivable are recorded on the business's books when a customer receives goods or services from the business but can't pay at the time of purchase.

For example, an Amazon seller may provide products to a client and invoice them for the products. If the client does not pay immediately, the amount owed by the client for the products is recorded as an accounts receivable.

Accounts receivable can also be accrued through installment payments or financing arrangements, such as when a customer purchases a product on credit and pays for it over time.

During the pandemic, many businesses learned that proper accounts receivable management can lead to sturdy financial positions. You see, accruing accounts receivable allows businesses to provide flexibility to their customers while still being able to track and manage the money owed to them.

Owing money can also work both ways. With accounts receivable, a business is owed by its customers for every product or service it sells on credit. Accounts payable is the opposite. It happens when the business owes its vendors or suppliers money for goods or services received but has yet to pay for them.

On the balance sheet, both accounts are recorded differently. Accounts receivable are recorded as assets, while accounts payable are considered liabilities.

A good balance between accounts receivable and accounts payable is critical for maintaining a healthy cash flow and financial stability.

Accounts receivable is only recognized as an asset when a business has a legal right to receive payment from a customer for goods or services that have been provided but not yet paid for.

Accounts receivable are classified as a current asset because it is expected to be collected relatively quickly, typically within 30 to 60 days. As such, accounts receivable represent an essential component of a business's overall financial health, as it reflects the amount of cash the business expects to receive soon.

Under the cash basis accounting method, accounts receivable are only recorded once payment is received. Any sales made on credit or outstanding invoices are recorded as revenue once the payment is received. Hence, the accounts receivable balance remains zero until the customer pays.

On the other hand, under the accrual accounting method, accounts receivable are recorded as soon as the sale is made or the service is provided, even if payment has yet to be received. This means that the revenue is recognized at the time of the sale or service, regardless of when payment is received. The accounts receivable balance reflects the total amount owed by customers as of the end of the reporting period.

So how do you calculate accounts receivable? Do you rely on accounting software to handle everything financial-related? Do you hire an accountant to deal with the math?

The truth is, it's best if new business owners like yourself understand how it's calculated to better maneuver net sales and other essential accounts in your day-to-day transactions.

Currently, there are two standard methods for accounts receivable calculation: the balance sheet method and the aging method.

The balance sheet method involves taking the total accounts receivable balance on the balance sheet and subtracting any allowances for doubtful accounts.

The allowance for doubtful accounts is an estimated amount of uncollectible debts based on experience or other factors. The result is the net accounts receivable balance, which represents the amount the business expects to collect from its customers.

Accounts Receivable (AR) - Allowance for Doubtful Accounts (ADA) = Net Accounts Receivable (NAR)

The aging method involves categorizing the accounts receivable by the age of the invoice or outstanding payment. Typically, businesses will group the accounts receivable in 30-day intervals, such as current, 1–30 days, 31–60 days, and so on.

For each age category, the business estimates the percentage of the outstanding balance likely to be collected. This percentage is based on historical data or industry averages. The sum of the estimated amounts for each age category is the total estimated accounts receivable balance.

(Amounts outstanding up to 30 days × Estimated percentage collectible) + (Amounts outstanding 31–60 days × Estimated percentage collectible) + (Amounts outstanding 61–90 days × Estimated percentage collectible) + (Amounts outstanding over 90 days × Estimated percentage collectible) = Total estimated accounts receivables

The balance sheet method is simple and quick but provides less detailed information on the accounts receivable than the aging method.

The aging method takes more time and effort to calculate, but it provides a more detailed breakdown of the accounts receivable by age, which can help determine which invoices are most overdue and require immediate attention.

Ultimately, businesses should choose the best method for their needs and resources.

Analyzing accounts receivable is vital for cash flow, financial planning, and risk management. It allows businesses to identify areas where they may be experiencing delays in payment or facing issues with collection, enabling them to take corrective action and improve their cash flow.

By understanding the trends and patterns in their accounts receivable, businesses can make more accurate financial projections and plan for future growth.

Now, there are several metrics that businesses can use to analyze accounts receivable. Here are some of the most commonly used ones.

This ratio measures how often a business collects its average accounts receivable balance during a given period. The accounts receivable turnover ratio formula is:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

A high ratio indicates that the business is collecting its receivables in a timely manner, while a low ratio indicates that the business is taking a long time to collect its receivables or needs a better collection process.

DSO measures the average number of days it takes for a business to collect payment on its sales. The formula for DSO is:

DSO = (Accounts Receivable / Net Credit Sales) x Number of Days in the Period

Unlike the accounts receivable turnover ratio, a lower DSO indicates that a business collects payment more quickly. In comparison, a higher DSO indicates that the business is taking longer to collect a payment, which can lead to cash flow problems and may require additional efforts to improve the accounts receivable collection process.

This ratio measures the percentage of accounts receivable the business writes off as bad debt. The formula is:

Bad Debt Ratio = (Total Bad Debts / Net Credit Sales) x 100

A lower lousy debt ratio indicates that the business effectively manages its accounts receivable and minimizes the risk of bad debts.

This metric measures the average number of days it takes for a business to collect payment on its accounts receivable. The formula is:

Average Collection Period = (Accounts Receivable / Net Credit Sales) x Number of Days in the Period

A lower average collection period indicates that the business is collecting payment more quickly, while a higher average collection period indicates the business is taking a long time to collect payment.

In the same way that we ought to calculate accounts receivable accurately, we want to be sure that we're managing collections responsibly. The goal is always to what your company collects so we can avoid future financial difficulties and maximize the company's ability to generate revenue.

To better manage your accounts receivables, here are a few tips that can help:

In conclusion, calculating and managing accounts receivable is critical to a business's financial health. It is important to regularly analyze accounts receivable, identify issues, and implement effective strategies to manage them.

At Unloop, we understand that and want to ensure you succeed.

By working with our accounting experts, you can focus on running your business while we handle your accounting needs, ensuring that your business stays on track and financially healthy—we’ve even got accounts payable services!

Contact us today to learn how we can help you manage your accounts receivable and achieve financial success.

Learning how to calculate accounts receivable is an important step towards better financial management, and the reason is obvious for anyone that owns a business; nobody wants to forget the money they're owed, especially when it's a huge amount.

In this blog, we'll discuss everything there is to know about accounts receivable, the formulas involved in calculating it, and why you need to keep tabs on this account that's on your company's balance sheet.

For starters, let's discuss what accounts receivable is. The short of it is that it's the money that customers owe a business on credit. But how does that happen exactly?

Accounts receivable are recorded on the business's books when a customer receives goods or services from the business but can't pay at the time of purchase.

For example, an Amazon seller may provide products to a client and invoice them for the products. If the client does not pay immediately, the amount owed by the client for the products is recorded as an accounts receivable.

Accounts receivable can also be accrued through installment payments or financing arrangements, such as when a customer purchases a product on credit and pays for it over time.

During the pandemic, many businesses learned that proper accounts receivable management can lead to sturdy financial positions. You see, accruing accounts receivable allows businesses to provide flexibility to their customers while still being able to track and manage the money owed to them.

Owing money can also work both ways. With accounts receivable, a business is owed by its customers for every product or service it sells on credit. Accounts payable is the opposite. It happens when the business owes its vendors or suppliers money for goods or services received but has yet to pay for them.

On the balance sheet, both accounts are recorded differently. Accounts receivable are recorded as assets, while accounts payable are considered liabilities.

A good balance between accounts receivable and accounts payable is critical for maintaining a healthy cash flow and financial stability.

Accounts receivable is only recognized as an asset when a business has a legal right to receive payment from a customer for goods or services that have been provided but not yet paid for.

Accounts receivable are classified as a current asset because it is expected to be collected relatively quickly, typically within 30 to 60 days. As such, accounts receivable represent an essential component of a business's overall financial health, as it reflects the amount of cash the business expects to receive soon.

Under the cash basis accounting method, accounts receivable are only recorded once payment is received. Any sales made on credit or outstanding invoices are recorded as revenue once the payment is received. Hence, the accounts receivable balance remains zero until the customer pays.

On the other hand, under the accrual accounting method, accounts receivable are recorded as soon as the sale is made or the service is provided, even if payment has yet to be received. This means that the revenue is recognized at the time of the sale or service, regardless of when payment is received. The accounts receivable balance reflects the total amount owed by customers as of the end of the reporting period.

So how do you calculate accounts receivable? Do you rely on accounting software to handle everything financial-related? Do you hire an accountant to deal with the math?

The truth is, it's best if new business owners like yourself understand how it's calculated to better maneuver net sales and other essential accounts in your day-to-day transactions.

Currently, there are two standard methods for accounts receivable calculation: the balance sheet method and the aging method.

The balance sheet method involves taking the total accounts receivable balance on the balance sheet and subtracting any allowances for doubtful accounts.

The allowance for doubtful accounts is an estimated amount of uncollectible debts based on experience or other factors. The result is the net accounts receivable balance, which represents the amount the business expects to collect from its customers.

Accounts Receivable (AR) - Allowance for Doubtful Accounts (ADA) = Net Accounts Receivable (NAR)

The aging method involves categorizing the accounts receivable by the age of the invoice or outstanding payment. Typically, businesses will group the accounts receivable in 30-day intervals, such as current, 1–30 days, 31–60 days, and so on.

For each age category, the business estimates the percentage of the outstanding balance likely to be collected. This percentage is based on historical data or industry averages. The sum of the estimated amounts for each age category is the total estimated accounts receivable balance.

(Amounts outstanding up to 30 days × Estimated percentage collectible) + (Amounts outstanding 31–60 days × Estimated percentage collectible) + (Amounts outstanding 61–90 days × Estimated percentage collectible) + (Amounts outstanding over 90 days × Estimated percentage collectible) = Total estimated accounts receivables

The balance sheet method is simple and quick but provides less detailed information on the accounts receivable than the aging method.

The aging method takes more time and effort to calculate, but it provides a more detailed breakdown of the accounts receivable by age, which can help determine which invoices are most overdue and require immediate attention.

Ultimately, businesses should choose the best method for their needs and resources.

Analyzing accounts receivable is vital for cash flow, financial planning, and risk management. It allows businesses to identify areas where they may be experiencing delays in payment or facing issues with collection, enabling them to take corrective action and improve their cash flow.

By understanding the trends and patterns in their accounts receivable, businesses can make more accurate financial projections and plan for future growth.

Now, there are several metrics that businesses can use to analyze accounts receivable. Here are some of the most commonly used ones.

This ratio measures how often a business collects its average accounts receivable balance during a given period. The accounts receivable turnover ratio formula is:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

A high ratio indicates that the business is collecting its receivables in a timely manner, while a low ratio indicates that the business is taking a long time to collect its receivables or needs a better collection process.

DSO measures the average number of days it takes for a business to collect payment on its sales. The formula for DSO is:

DSO = (Accounts Receivable / Net Credit Sales) x Number of Days in the Period

Unlike the accounts receivable turnover ratio, a lower DSO indicates that a business collects payment more quickly. In comparison, a higher DSO indicates that the business is taking longer to collect a payment, which can lead to cash flow problems and may require additional efforts to improve the accounts receivable collection process.

This ratio measures the percentage of accounts receivable the business writes off as bad debt. The formula is:

Bad Debt Ratio = (Total Bad Debts / Net Credit Sales) x 100

A lower lousy debt ratio indicates that the business effectively manages its accounts receivable and minimizes the risk of bad debts.

This metric measures the average number of days it takes for a business to collect payment on its accounts receivable. The formula is:

Average Collection Period = (Accounts Receivable / Net Credit Sales) x Number of Days in the Period

A lower average collection period indicates that the business is collecting payment more quickly, while a higher average collection period indicates the business is taking a long time to collect payment.

In the same way that we ought to calculate accounts receivable accurately, we want to be sure that we're managing collections responsibly. The goal is always to what your company collects so we can avoid future financial difficulties and maximize the company's ability to generate revenue.

To better manage your accounts receivables, here are a few tips that can help:

In conclusion, calculating and managing accounts receivable is critical to a business's financial health. It is important to regularly analyze accounts receivable, identify issues, and implement effective strategies to manage them.

At Unloop, we understand that and want to ensure you succeed.

By working with our accounting experts, you can focus on running your business while we handle your accounting needs, ensuring that your business stays on track and financially healthy—we’ve even got accounts payable services!

Contact us today to learn how we can help you manage your accounts receivable and achieve financial success.

Amazon has revolutionized the shopping process for both large and small businesses. Selling your products online allows your business to expose your products to millions of customers. However, since online selling is continuing to be popular with entrepreneurs, you also have millions of competitors out there.

If you are determined to put your business online, Amazon is the best for you. Setting up an Amazon Business account helps companies get ahead by giving Amazon-exclusive discounts on pricing, plus it offers features to aid in your business operations.

Amazon Business is a business-focused account that caters to all businesses, from small and medium to large enterprises. The main purpose of a business account is for businesses to have an approval process so they can keep their spending in check.

Business accounts allow an entity to create multiple users to make purchases for the company. Your business also enjoys the benefits of efficient and swift deliveries. But, it doesn’t stop there! Once you have a business account, you can upgrade to a Prime account which opens your business to more exclusive benefits.

But unlike business accounts (which are free), Prime members need to pay a membership fee to enjoy its features.

Amazon Prime membership fees may vary depending on the number of users that use the account. Here is a breakdown of their annual prices.

| Number of Users | 1 user | 3 users | 10 users | 100 users | Unlimited Users |

| Price | $69 | $179 | $499 | $1,299 | $10,099 |

You may be thinking that you already have a personal account, So why do you still need to get a Business account? Amazon offers many features and services exclusive to business account holders. For example, having these accounts opens you to business-only selections, bulk discounts, and a wide variety of product lines.

Once your Amazon Business account is set up, you can add multiple sellers in one central account, which anyone in your business can use. The benefits of an Amazon business account is for both the seller and buyer, and here's what you can do with it.

Amazon helps with the selling process when you set up a business account, and it's free. Whether you're a small-scale one-person business or a larger enterprise, it doesn't matter. Any company can open a business account.

To set up your account:

There are over 5 million products currently available across business accounts on Amazon. Aside from access to an unlimited number of items, you also enjoy exclusive prices for business account holders. Whether you do B2B transactions or use your business account as a buyer, you'll enjoy discounts that are not available on personal accounts.

Amazon offers lower prices for bulk purchases. Furthermore, you can ask sellers for discounts.

In 2022, there were currently 200 million active users on Amazon. This number grows each year. When you enroll in Amazon Business, your products will be listed in the vast Amazon catalog, which is accessible to millions of established customers.

Whether you sell from the US or are an international seller, you will be eligible for the FBA program. Amazon is available in numerous countries worldwide, and is continually expanding. Amazon has warehouses in different locations even outside of the US, so international sellers can enjoy the FBA program too.

Furthermore, since the primary feature of FBA is storing your products and shipping, you can save money from renting warehouse space and hiring extra workers for the shipping and packing process. You can also guarantee that the FBA program will handle your products correctly to satisfy your customers.

You can choose to upgrade to a Business Prime account if you already have a Business account. The Prime account is a membership offered by Amazon for businesses and companies. Using a Business Prime account comes with more benefits compared to a standard business account. However, Amazon charges businesses when they upgrade to Prime depending on the number of users in your account.

So is it worth upgrading to a Business Prime account? Here are a few benefits of Amazon Business Prime memberships.

With a Prime account, you can send orders to your customers faster. Customers who shop from your business can enjoy discounted shipping rates, and even free one- or two-day shipping on eligible items. Free shipping will entice shoppers to buy from your business primarily because of the savings they can get.

Free Survey and Analytics Tool

It's vital for businesses to know the feedback of their customers regarding their products and services. Amazon helps companies gather their customer's reviews by using a third-party application. The free tool Amazon provides sends surveys to your customers via SMS, emails, POS kiosks, and other integrated services.

The free analytics tool is beneficial for businesses to track their growth, and with Amazon Prime, you get to enjoy these tools for free.

You will receive an Amazon Business American Express card upon membership with Amazon Prime. This card is exclusive to Prime holders and has no annual fees. With the card, you can enjoy 5% cashback or 90 days to pay with no interest for your purchases.

Amazon Workdocs allows you to store your essential business files in one location. You can quickly locate invoices, receipts, and other documents, allowing for collaborations.

The guided buying allows you to create buying policies for your Business Prime account.

If you have staff, you might give them the responsibility of making purchases from other companies. You can control the items they buy through the guided buying feature. You can list approved items they can purchase and put up restricted categories.

If there's a way to make selling on Amazon better and more convenient, grab it. Utilize the advantages of having an Amazon Business account. If you have the budget for a Business Prime membership, you're in for more benefits and tons of savings for your business. So don't forget to sign your business up today.

Running a small ecommerce firm may also be time-consuming and labour-intensive. While you handle selling your products and launching advertisements, Unloop can help with the accounting side of things. Unloop can help your business stay on top of taxes, expenses, payroll, and several other accounting tasks.

Book a call with us and learn more about how to get started.

Amazon has revolutionized the shopping process for both large and small businesses. Selling your products online allows your business to expose your products to millions of customers. However, since online selling is continuing to be popular with entrepreneurs, you also have millions of competitors out there.

If you are determined to put your business online, Amazon is the best for you. Setting up an Amazon Business account helps companies get ahead by giving Amazon-exclusive discounts on pricing, plus it offers features to aid in your business operations.

Amazon Business is a business-focused account that caters to all businesses, from small and medium to large enterprises. The main purpose of a business account is for businesses to have an approval process so they can keep their spending in check.

Business accounts allow an entity to create multiple users to make purchases for the company. Your business also enjoys the benefits of efficient and swift deliveries. But, it doesn’t stop there! Once you have a business account, you can upgrade to a Prime account which opens your business to more exclusive benefits.

But unlike business accounts (which are free), Prime members need to pay a membership fee to enjoy its features.

Amazon Prime membership fees may vary depending on the number of users that use the account. Here is a breakdown of their annual prices.

| Number of Users | 1 user | 3 users | 10 users | 100 users | Unlimited Users |

| Price | $69 | $179 | $499 | $1,299 | $10,099 |

You may be thinking that you already have a personal account, So why do you still need to get a Business account? Amazon offers many features and services exclusive to business account holders. For example, having these accounts opens you to business-only selections, bulk discounts, and a wide variety of product lines.

Once your Amazon Business account is set up, you can add multiple sellers in one central account, which anyone in your business can use. The benefits of an Amazon business account is for both the seller and buyer, and here's what you can do with it.

Amazon helps with the selling process when you set up a business account, and it's free. Whether you're a small-scale one-person business or a larger enterprise, it doesn't matter. Any company can open a business account.

To set up your account:

There are over 5 million products currently available across business accounts on Amazon. Aside from access to an unlimited number of items, you also enjoy exclusive prices for business account holders. Whether you do B2B transactions or use your business account as a buyer, you'll enjoy discounts that are not available on personal accounts.

Amazon offers lower prices for bulk purchases. Furthermore, you can ask sellers for discounts.

In 2022, there were currently 200 million active users on Amazon. This number grows each year. When you enroll in Amazon Business, your products will be listed in the vast Amazon catalog, which is accessible to millions of established customers.

Whether you sell from the US or are an international seller, you will be eligible for the FBA program. Amazon is available in numerous countries worldwide, and is continually expanding. Amazon has warehouses in different locations even outside of the US, so international sellers can enjoy the FBA program too.

Furthermore, since the primary feature of FBA is storing your products and shipping, you can save money from renting warehouse space and hiring extra workers for the shipping and packing process. You can also guarantee that the FBA program will handle your products correctly to satisfy your customers.

You can choose to upgrade to a Business Prime account if you already have a Business account. The Prime account is a membership offered by Amazon for businesses and companies. Using a Business Prime account comes with more benefits compared to a standard business account. However, Amazon charges businesses when they upgrade to Prime depending on the number of users in your account.

So is it worth upgrading to a Business Prime account? Here are a few benefits of Amazon Business Prime memberships.

With a Prime account, you can send orders to your customers faster. Customers who shop from your business can enjoy discounted shipping rates, and even free one- or two-day shipping on eligible items. Free shipping will entice shoppers to buy from your business primarily because of the savings they can get.

Free Survey and Analytics Tool

It's vital for businesses to know the feedback of their customers regarding their products and services. Amazon helps companies gather their customer's reviews by using a third-party application. The free tool Amazon provides sends surveys to your customers via SMS, emails, POS kiosks, and other integrated services.

The free analytics tool is beneficial for businesses to track their growth, and with Amazon Prime, you get to enjoy these tools for free.

You will receive an Amazon Business American Express card upon membership with Amazon Prime. This card is exclusive to Prime holders and has no annual fees. With the card, you can enjoy 5% cashback or 90 days to pay with no interest for your purchases.

Amazon Workdocs allows you to store your essential business files in one location. You can quickly locate invoices, receipts, and other documents, allowing for collaborations.

The guided buying allows you to create buying policies for your Business Prime account.

If you have staff, you might give them the responsibility of making purchases from other companies. You can control the items they buy through the guided buying feature. You can list approved items they can purchase and put up restricted categories.

If there's a way to make selling on Amazon better and more convenient, grab it. Utilize the advantages of having an Amazon Business account. If you have the budget for a Business Prime membership, you're in for more benefits and tons of savings for your business. So don't forget to sign your business up today.

Running a small ecommerce firm may also be time-consuming and labour-intensive. While you handle selling your products and launching advertisements, Unloop can help with the accounting side of things. Unloop can help your business stay on top of taxes, expenses, payroll, and several other accounting tasks.

Book a call with us and learn more about how to get started.

Trading in your Windows-based accounting system for Apple accounting software can be daunting at first. It often requires a significant adjustment in how you oversee financial operations. You might also feel like the new application holds your potential back, leaving you stuck and frustrated.

Don’t worry! The switch may have its challenges, but it also offers exciting opportunities. There is now free accounting software specifically made for your current setup.

Start your accounting journey on the right foot with these tips for finding the right software solution designed for Mac users. Get ready to streamline and facilitate every financial aspect of running a small business.

Apple is committed to revolutionizing the business world by introducing cutting-edge features such as accounting into its operating system. They aim to simplify digital operations for enterprises and open up more opportunities that provide maximum return on investment, freeing them from compatibility problems.

Thanks to Mac-friendly accounting software, entrepreneurs everywhere can experience an exponential increase in productivity and workflows. No longer should they miss out on the huge gains of modern financial programs—software is a must-have for new Apple users who want to continue their business efficiency.

Financial statements and graph visualizations are also taken to a whole new level when using accounting software for Mac. Every table and chart a business produces showcases its best work like never before. They can even present data points without sacrificing quality.

Best of all, small business owners won't have to worry about inaccuracies that come with manually handling accounts. Like with Windows, software is automated and adaptive for Mac users everywhere.

All these factors make software an ideal solution for successful financial collaborations.

With the overwhelming variety of Mac accounting software programs, it can be challenging to choose just one. But you’ll soon discover the best accounting software for your accounting needs by considering certain key factors in your decision-making process.

Here are a few things to keep in mind.

The availability of both online and offline versions is a great starting point for your research. With cloud-based accounting software, you can get vital information from any corner, making financial processes much more manageable.

At the same time, going offline provides users with secure access free of connection errors or other technical trouble. Users can take full advantage of their informational needs and wants by having both options available.

There may be times when you’ll need to move your financial data from your Mac computer to other Apple devices such as iPads or iPhones. This extra feature can make transferring and syncing records much more accessible and smoother.

By staying connected with your accounts, you can ensure that no important update or deadline slips past unnoticed. It may be a low priority for some, but getting an iOS app can make a difference in terms of convenience.

Don't get bogged down with payroll calculations; choose an accounting software solution for your Mac desktop with integrated payroll management tools. With this feature, you can easily access employee data analytics and calculate salaries to help you breeze through those operations.

Payroll integration guarantees timely tax withholdings, employee payments, and federal and state regulations compliance. Automating these business processes improves bookkeeping tasks and offers an extra layer of assurance and peace of mind.

Keep your Mac desktop running with accounting software that includes automatic reconciliation features. As the name suggests, it allows small businesses to manage monthly transactions without the time-consuming hassle of data entry and manual reconciliations.

Automated reconciliation can verify bank accounts, credit cards, and other transactions within the accounting system against their sources. From there, users can gain insight into company finances—all in a fraction of the usual processing period.

Finding an accounting platform with unlimited user access is ideal for effective operation and future growth so your team can thrive without additional financial burdens.

Companies can control their data and collaboration efforts with unlimited access to a single account. These accounting software features also have major implications for tracking employee productivity. Integrating this with team management tools means they can maximize efficiency in their accounting tasks like never before.

For Mac desktop users, customer support is an often ignored yet fundamental element when choosing the perfect accounting software. Eye-catching interfaces and tech enhancements may be a plus, but strong customer support can address any issues or queries you may have—proving why this feature shouldn't go unnoticed.

Poor customer service can leave you feeling stranded and frustrated. Make sure your digital experience is worry-free by selecting an accounting solution that delivers reliable, patient, and knowledgeable support when dealing with account-related matters.

Good accounting software should give you easy access to the customer-facing aspects of your financials, such as professional invoices, purchase order management, and customer accounts. This way, you can prepare for conversations with clients and vendors.

Leveraging an integrated client data system can also open a world of market access. It makes it easier to manage emails, conduct follow-up interactions with customers, get an overview of the customer journey, and make data-driven decisions that propel your enterprise forward.

Here’s your chance to be resourceful without sacrificing productivity. Accounting software with excellent expense tracking, reporting capabilities, and tax calculation is much-need for any business.

You can’t go wrong with these accounting features to easily manage hundreds of transactions and sort them out quickly. By finding a way to accurately break down expenses, measure necessary data research, and initiate automated calculations, you can access any information related to expenses without intricacy.

It’s time to move on to the next step—finding the right accounting programs for your device. With all the knowledge you need, you can dive into some of the excellent options available from Apple.

Below are the best accounting solutions for Apple’s operating system. From the highly advanced to simple, user-friendly tools, there’s sure to be an accounting app that fits what you’re looking for.

QuickBooks Online is the go-to choice for small business owners looking to control their money operations. This cloud accounting software empowers entrepreneurs with features like invoice tracking, expense monitoring, and secure payment acceptance, enabling them to stay on top of their finances without inconvenience.

Another version of QuickBooks is available to many Mac Users: QuickBooks Desktop App for Mac. It can give you instant insight into cash flow and profitability. It can also link directly to bank accounts, so you don't have to load multiple financial applications. Unfortunately, you can no longer enjoy this version after May 2023. So use it while you can.

FreshBooks is another small business accounting software option for Apple. From tracking billable hours to safeguarding data integrity in the cloud, this tool offers an Apple-friendly approach to tackling all your monetary resources.

With FreshBooks, companies can trust that their accounting operations have powerful capabilities to monitor and evaluate expenses. This gives an unbeatable view of its return on investment while categorizing personal and business finances.

Sage's basic subscription offers the perfect starting point for small business owners who want to get their finances in order. Accounting and organizational tools give users a helping hand to focus on growing their business without worrying about numbers or clutter.

With its intuitive interface, 1-on-1 expert session, and secure payment processing options, this scalable accounting software is setting a new benchmark in the field, proving to be an invaluable asset for any Mac user.

Xero is the perfect pick for taking care of those pesky accounting tasks. With clear interfaces and convenient features like capturing snapshots of key accounts, you can easily reference previous versions with one click, making it perfect for even the busiest business owner.

Xero also can add additional users to their plan without increased cost. It is perfect for companies with multiple staff involved in their accounting processes. Apple users no longer have to strain over the paperwork. Instead, they can keep things efficient and organized.

Financial management through Apple can be a struggle, especially when you’re not accustomed to the PC and android environment. It takes patience, attention to detail, and organizational skills that may not come naturally to most.

But one thing is sure: those frustrating days of handling your financial operations will now be in the past. Thanks to the availability of high-quality, reliable accounting software for Mac, you can make your bookkeeping, budgeting, and project management easier than ever before.

Feeling uncertain? Unloop can help free you up! Our accounting professionals will find the perfect software for your small business to ensure everything runs smoothly and accurately.

Get in touch today, and we'll sort things out!

Trading in your Windows-based accounting system for Apple accounting software can be daunting at first. It often requires a significant adjustment in how you oversee financial operations. You might also feel like the new application holds your potential back, leaving you stuck and frustrated.

Don’t worry! The switch may have its challenges, but it also offers exciting opportunities. There is now free accounting software specifically made for your current setup.

Start your accounting journey on the right foot with these tips for finding the right software solution designed for Mac users. Get ready to streamline and facilitate every financial aspect of running a small business.

Apple is committed to revolutionizing the business world by introducing cutting-edge features such as accounting into its operating system. They aim to simplify digital operations for enterprises and open up more opportunities that provide maximum return on investment, freeing them from compatibility problems.

Thanks to Mac-friendly accounting software, entrepreneurs everywhere can experience an exponential increase in productivity and workflows. No longer should they miss out on the huge gains of modern financial programs—software is a must-have for new Apple users who want to continue their business efficiency.

Financial statements and graph visualizations are also taken to a whole new level when using accounting software for Mac. Every table and chart a business produces showcases its best work like never before. They can even present data points without sacrificing quality.

Best of all, small business owners won't have to worry about inaccuracies that come with manually handling accounts. Like with Windows, software is automated and adaptive for Mac users everywhere.

All these factors make software an ideal solution for successful financial collaborations.

With the overwhelming variety of Mac accounting software programs, it can be challenging to choose just one. But you’ll soon discover the best accounting software for your accounting needs by considering certain key factors in your decision-making process.

Here are a few things to keep in mind.

The availability of both online and offline versions is a great starting point for your research. With cloud-based accounting software, you can get vital information from any corner, making financial processes much more manageable.

At the same time, going offline provides users with secure access free of connection errors or other technical trouble. Users can take full advantage of their informational needs and wants by having both options available.

There may be times when you’ll need to move your financial data from your Mac computer to other Apple devices such as iPads or iPhones. This extra feature can make transferring and syncing records much more accessible and smoother.

By staying connected with your accounts, you can ensure that no important update or deadline slips past unnoticed. It may be a low priority for some, but getting an iOS app can make a difference in terms of convenience.

Don't get bogged down with payroll calculations; choose an accounting software solution for your Mac desktop with integrated payroll management tools. With this feature, you can easily access employee data analytics and calculate salaries to help you breeze through those operations.

Payroll integration guarantees timely tax withholdings, employee payments, and federal and state regulations compliance. Automating these business processes improves bookkeeping tasks and offers an extra layer of assurance and peace of mind.

Keep your Mac desktop running with accounting software that includes automatic reconciliation features. As the name suggests, it allows small businesses to manage monthly transactions without the time-consuming hassle of data entry and manual reconciliations.

Automated reconciliation can verify bank accounts, credit cards, and other transactions within the accounting system against their sources. From there, users can gain insight into company finances—all in a fraction of the usual processing period.

Finding an accounting platform with unlimited user access is ideal for effective operation and future growth so your team can thrive without additional financial burdens.

Companies can control their data and collaboration efforts with unlimited access to a single account. These accounting software features also have major implications for tracking employee productivity. Integrating this with team management tools means they can maximize efficiency in their accounting tasks like never before.

For Mac desktop users, customer support is an often ignored yet fundamental element when choosing the perfect accounting software. Eye-catching interfaces and tech enhancements may be a plus, but strong customer support can address any issues or queries you may have—proving why this feature shouldn't go unnoticed.

Poor customer service can leave you feeling stranded and frustrated. Make sure your digital experience is worry-free by selecting an accounting solution that delivers reliable, patient, and knowledgeable support when dealing with account-related matters.

Good accounting software should give you easy access to the customer-facing aspects of your financials, such as professional invoices, purchase order management, and customer accounts. This way, you can prepare for conversations with clients and vendors.

Leveraging an integrated client data system can also open a world of market access. It makes it easier to manage emails, conduct follow-up interactions with customers, get an overview of the customer journey, and make data-driven decisions that propel your enterprise forward.

Here’s your chance to be resourceful without sacrificing productivity. Accounting software with excellent expense tracking, reporting capabilities, and tax calculation is much-need for any business.

You can’t go wrong with these accounting features to easily manage hundreds of transactions and sort them out quickly. By finding a way to accurately break down expenses, measure necessary data research, and initiate automated calculations, you can access any information related to expenses without intricacy.

It’s time to move on to the next step—finding the right accounting programs for your device. With all the knowledge you need, you can dive into some of the excellent options available from Apple.

Below are the best accounting solutions for Apple’s operating system. From the highly advanced to simple, user-friendly tools, there’s sure to be an accounting app that fits what you’re looking for.

QuickBooks Online is the go-to choice for small business owners looking to control their money operations. This cloud accounting software empowers entrepreneurs with features like invoice tracking, expense monitoring, and secure payment acceptance, enabling them to stay on top of their finances without inconvenience.

Another version of QuickBooks is available to many Mac Users: QuickBooks Desktop App for Mac. It can give you instant insight into cash flow and profitability. It can also link directly to bank accounts, so you don't have to load multiple financial applications. Unfortunately, you can no longer enjoy this version after May 2023. So use it while you can.

FreshBooks is another small business accounting software option for Apple. From tracking billable hours to safeguarding data integrity in the cloud, this tool offers an Apple-friendly approach to tackling all your monetary resources.

With FreshBooks, companies can trust that their accounting operations have powerful capabilities to monitor and evaluate expenses. This gives an unbeatable view of its return on investment while categorizing personal and business finances.

Sage's basic subscription offers the perfect starting point for small business owners who want to get their finances in order. Accounting and organizational tools give users a helping hand to focus on growing their business without worrying about numbers or clutter.

With its intuitive interface, 1-on-1 expert session, and secure payment processing options, this scalable accounting software is setting a new benchmark in the field, proving to be an invaluable asset for any Mac user.

Xero is the perfect pick for taking care of those pesky accounting tasks. With clear interfaces and convenient features like capturing snapshots of key accounts, you can easily reference previous versions with one click, making it perfect for even the busiest business owner.

Xero also can add additional users to their plan without increased cost. It is perfect for companies with multiple staff involved in their accounting processes. Apple users no longer have to strain over the paperwork. Instead, they can keep things efficient and organized.

Financial management through Apple can be a struggle, especially when you’re not accustomed to the PC and android environment. It takes patience, attention to detail, and organizational skills that may not come naturally to most.

But one thing is sure: those frustrating days of handling your financial operations will now be in the past. Thanks to the availability of high-quality, reliable accounting software for Mac, you can make your bookkeeping, budgeting, and project management easier than ever before.

Feeling uncertain? Unloop can help free you up! Our accounting professionals will find the perfect software for your small business to ensure everything runs smoothly and accurately.

Get in touch today, and we'll sort things out!

If you want to establish or change your accounting system, you may have heard of or used two basic accounting methods: the cash and accrual accounting methods. These are the textbook methods that every business can choose from.

But there's another method that some entities use. It's called modified accrual accounting, and it can be an excellent record keeping method if you want to see your business's numbers more clearly.

Let Unloop explain the modified accrual method to you. But before we do, we'll also go over the two primary accounting methods to give you a more thorough understanding.

Most starting businesses adopt a cash basis method of accounting. This way of financial recordkeeping recognizes transactions only when the money comes in or goes out, making bookkeeping easy.

Here are some reasons why cash basis accounting is fantastic for both traditional and ecommerce businesses.

Straightforward

Accountants and bookkeepers use the double-entry method when recording transactions. But what makes it straightforward is they only use cash as a debit or credit account in each transaction.

Cash Accurate

Since transactions are only recorded when the business spends or receives cash, managers, and small business owners have an accurate view of the movement of cash assets within the business.

Simple Reporting

Bookkeeping and accounting using the cash basis make financial statement reporting simple. In a given period, there will only be a few accounts presented, making it easier to analyze. Reading the simple reports generated from a cash basis accounting method helps in quick decision-making.

Despite the ease and simplicity of cash basis accounting, it has certain drawbacks.

Challenging for Complex Transactions

When transactions become more complex in real-world events, the cash basis method may have difficulty keeping up. For example, when a business purchases a significant asset on an installment basis, this could affect multiple accounts for an extended period, and official recording may only take place after a long period.

A Narrow View of the Business

Cash basis accounting only sees transactions as they come and go. This limits the view of a manager or a business owner because, in the real world, transactions are incurred or earned earlier or later than usual.

The accrual basis method allows revenue recognition even if it has yet to be received. and recognizes expenses before anything is paid or incurred. As long as the economic event happened, accrual basis accounting will record it. That’s why large businesses with expanded activity and high annual income adopt accrual accounting rather than cash accounting.

Here's why big businesses use accrual accounting when recording business transactions.

Can Handle Complex Transactions

Accrual accounting lets accountants and bookkeepers record transactions involving multiple accounts. For example, if they are a software company that sold $100 of a single product on the current date and the buyer pays $10 initially while the rest is payable in 90 days, they can record everything on the current date and not after 90 days when the payment is completed.

Business Accurate

Using the accrual method is business accurate because it allows accountants and bookkeepers to record transactions as they happen. This gives managers and owners an accurate view of what's happening in the business in real-time.

Widely Acceptable

Generally Accepted Accounting Principles (GAAP) approves the use of accrual accounting. It is also the type of accounting method that banks and tax authorities require for any business with substantial profit earnings or loan requests.

As great as the accrual method is, it also has several drawbacks.

It Is Complex

Recording transactions using the accrual method can be complex. Putting them together in a financial statement can be more challenging than with cash basis accounting, as there can be many accounts to balance.

Prone to Fraud and Errors

Unlike the cash basis method, where you can have one debit and credit account in a double-entry transaction, accrual accounting can have multiple and the amounts in each account may vary—which is where errors occur and fraudulent transactions can sneak in.

The modified accrual accounting is a hybrid of the two methods. It uses the best features of cash and accrual basis and adapts depending on the transaction's nature. This is also known as the modified cash basis or hybrid accounting method.

Short-Term

When recording economic events in the short term, primarily if it affects the entity's cash balance, the modified accrual basis adapts the cash method.

These transactions are the ones incurred monthly or daily. Regular business expenses such as utilities and suppliers adopt a cash-based accounting method.

Long-Term

If an economic event affects the business long-term, such as in years, the accrual method is used to record the transaction.

Acquisitions of property or big-ticket equipment are recorded using the accrual method. The transaction is recognized at the date the transaction is made for more accurate recording purposes.

A critical advantage of the modified accrual method is balanced reporting. The financial statements of entities using this method will show little shortage or surplus as the more significant expenses are distributed throughout the business's life, and the more minor expenses are justified.

It can be the most complex of methods because it uses a combination of cash and accrual basis. Switching between two methods when recording transactions will test any bookkeeper or accountant.

No, they can't. GAAP and International Financial Reporting Standards (IFRS) don't allow modified accrual accounting.

Government entities generally use the modified accrual method. But private, for-profit entities such as ecommerce marketplace sellers can also use it for internal purposes to improve their vision.

You can get experts to decide which method is best for your business, given its current situation. On the other hand, if you started with either a cash or accrual basis, you can let experts continue to use those methods effectively.

Unloop can help you decide what can be done for your business. Book a call or check out our bookkeeping services to find out more.

If you want to establish or change your accounting system, you may have heard of or used two basic accounting methods: the cash and accrual accounting methods. These are the textbook methods that every business can choose from.

But there's another method that some entities use. It's called modified accrual accounting, and it can be an excellent record keeping method if you want to see your business's numbers more clearly.

Let Unloop explain the modified accrual method to you. But before we do, we'll also go over the two primary accounting methods to give you a more thorough understanding.

Most starting businesses adopt a cash basis method of accounting. This way of financial recordkeeping recognizes transactions only when the money comes in or goes out, making bookkeeping easy.

Here are some reasons why cash basis accounting is fantastic for both traditional and ecommerce businesses.

Straightforward

Accountants and bookkeepers use the double-entry method when recording transactions. But what makes it straightforward is they only use cash as a debit or credit account in each transaction.

Cash Accurate

Since transactions are only recorded when the business spends or receives cash, managers, and small business owners have an accurate view of the movement of cash assets within the business.

Simple Reporting

Bookkeeping and accounting using the cash basis make financial statement reporting simple. In a given period, there will only be a few accounts presented, making it easier to analyze. Reading the simple reports generated from a cash basis accounting method helps in quick decision-making.

Despite the ease and simplicity of cash basis accounting, it has certain drawbacks.

Challenging for Complex Transactions

When transactions become more complex in real-world events, the cash basis method may have difficulty keeping up. For example, when a business purchases a significant asset on an installment basis, this could affect multiple accounts for an extended period, and official recording may only take place after a long period.

A Narrow View of the Business

Cash basis accounting only sees transactions as they come and go. This limits the view of a manager or a business owner because, in the real world, transactions are incurred or earned earlier or later than usual.

The accrual basis method allows revenue recognition even if it has yet to be received. and recognizes expenses before anything is paid or incurred. As long as the economic event happened, accrual basis accounting will record it. That’s why large businesses with expanded activity and high annual income adopt accrual accounting rather than cash accounting.

Here's why big businesses use accrual accounting when recording business transactions.

Can Handle Complex Transactions

Accrual accounting lets accountants and bookkeepers record transactions involving multiple accounts. For example, if they are a software company that sold $100 of a single product on the current date and the buyer pays $10 initially while the rest is payable in 90 days, they can record everything on the current date and not after 90 days when the payment is completed.

Business Accurate

Using the accrual method is business accurate because it allows accountants and bookkeepers to record transactions as they happen. This gives managers and owners an accurate view of what's happening in the business in real-time.

Widely Acceptable

Generally Accepted Accounting Principles (GAAP) approves the use of accrual accounting. It is also the type of accounting method that banks and tax authorities require for any business with substantial profit earnings or loan requests.

As great as the accrual method is, it also has several drawbacks.

It Is Complex

Recording transactions using the accrual method can be complex. Putting them together in a financial statement can be more challenging than with cash basis accounting, as there can be many accounts to balance.

Prone to Fraud and Errors

Unlike the cash basis method, where you can have one debit and credit account in a double-entry transaction, accrual accounting can have multiple and the amounts in each account may vary—which is where errors occur and fraudulent transactions can sneak in.

The modified accrual accounting is a hybrid of the two methods. It uses the best features of cash and accrual basis and adapts depending on the transaction's nature. This is also known as the modified cash basis or hybrid accounting method.

Short-Term

When recording economic events in the short term, primarily if it affects the entity's cash balance, the modified accrual basis adapts the cash method.

These transactions are the ones incurred monthly or daily. Regular business expenses such as utilities and suppliers adopt a cash-based accounting method.

Long-Term

If an economic event affects the business long-term, such as in years, the accrual method is used to record the transaction.

Acquisitions of property or big-ticket equipment are recorded using the accrual method. The transaction is recognized at the date the transaction is made for more accurate recording purposes.

A critical advantage of the modified accrual method is balanced reporting. The financial statements of entities using this method will show little shortage or surplus as the more significant expenses are distributed throughout the business's life, and the more minor expenses are justified.

It can be the most complex of methods because it uses a combination of cash and accrual basis. Switching between two methods when recording transactions will test any bookkeeper or accountant.

No, they can't. GAAP and International Financial Reporting Standards (IFRS) don't allow modified accrual accounting.

Government entities generally use the modified accrual method. But private, for-profit entities such as ecommerce marketplace sellers can also use it for internal purposes to improve their vision.

You can get experts to decide which method is best for your business, given its current situation. On the other hand, if you started with either a cash or accrual basis, you can let experts continue to use those methods effectively.

Unloop can help you decide what can be done for your business. Book a call or check out our bookkeeping services to find out more.

Are you stuck in a bookkeeping pinch and don't have access to a computer or a laptop? That's a tough situation you’ve got there. As a business owner, you don't always have the luxury of sitting at your desk all day working on accounting tasks. There are other business matters to address, which may sometimes require you to be out of the office.

You can always appoint a bookkeeping and accounting team to manage financial matters. Still, staying on top of what's happening is necessary. So, is there anything you can do about it? Yes, there is! If you're using QuickBooks online, you can use the mobile app to accomplish essential bookkeeping duties.

Let us give you a quick overview of the convenience of mobile bookkeeping with QuickBooks.

Mobile devices are used for almost anything nowadays. Most people bring their smartphones around with them, whether they’re for locating areas or for completing quick transactions. Conducting business on your smartphone is no exception. It's a fast and convenient way to get things done.

This is why bookkeeping mobile apps must function correctly. It can be complicated, but a smooth mobile platform makes a significant difference. Here are eight convenient features of the QuickBooks mobile app that you'll appreciate.

The dashboard, menu, and other pages of the QuickBooks Online mobile app differ from the desktop version. They are designed to fit the restricted screen space of mobile devices perfectly.

The orientation is vertical rather than landscape for quick scrolling. Text is as concise as possible to avoid clutter. The page elements are also interactive, allowing you to expand the details when necessary.

You can view a lot of vital business data at a glance. Examples are:

Is this your first time using the mobile app? Don't worry. It is more user-friendly than other accounting or bookkeeping software. Should you experience a learning curve, seek the help of a professional bookkeeping team.

If you're in the mood for changing how your loans, sales receipts, invoices, and estimates appear, the QuickBooks Online mobile app allows you to customize them. You may change the logo and colour of an invoice or add attachments, notes, or photos for reference. You can also make them fit your branding personality.