As an entrepreneur running an online business, understanding the critical differences between accrual and cash accounting is essential. These two accounting methods seem similar but fundamentally different in how financial transactions are recorded.

Accrual accounting income and expenses as transactions happen, whether you have or have not received cash.

In contrast, cash accounting records revenues and expenses only when cash transactions have been made.

This article will provide an overview of these two accounting methods and their respective strengths and weaknesses to help you choose the right approach for your online business. So, hang on to learn more!

Cash accounting is when you record revenue and expenses when the cash is in. Accrual accounting is when you record transactions as soon as you earn or owe them.

To give you a better idea, let's bring out a sample transaction from MPOM Pet Supplies' general journal.

| Cash Basis Accounting | ||

| Date 2022 | Account Title and Remarks | Amount |

| July 30 | Cash Sales Revenue(to record cash collected) | $5,000 |

| Accrual Accounting | ||

| Date 2022 | Account Title and Remarks | Amount |

| July 1 | Accountable receivable Sales Revenue(to record sales) | $5,000 |

| July 30 | Cash Accounts receivable(to record cash collected) | $5,000 |

The cash basis accounting table shows that the transaction was only recorded on July 30. That's because that is the only time they received actual money. However, in an accrual accounting table, the accounts receivable are already recorded on July 1, even if the funds are only received on July 30.

Cash basis accounting has no accounts receivable and accounts payable. You input the transaction only when cash is available and when you receive payment. Meanwhile, in accrual accounting, the transaction is recorded the moment the transaction is made, even without the actual money.

Cash-based accounting is the simplest and most straightforward way to track financial transactions. The central idea is to record revenue as soon as it's received and expenses as soon as they're paid instead of waiting for invoices or withdrawals. Check the great things about using the cash-based accounting method:

Money goes in, and money goes out. When it does, you record it. It's easy to manage your online business this way, and you don't need to hire a professional accountant to do the job. You don't need to adjust if a customer doesn't pay or you haven't paid your supplier yet. It's because there's no initial record of it while it’s unpaid.

With the cash basis accounting method, you get an upfront report of how much you earned or paid during that period. This is perfect when making short-term cash flow statements since you only record ongoing and outgoing cash transactions. You get the net income or net loss quickly.

If you only keep records of cash transactions, you may have the upper hand when you need to file for your business taxes. It's because you can lower your tax liabilities by slowing down your revenues or speeding up your expenses. Of course, this is all legal.

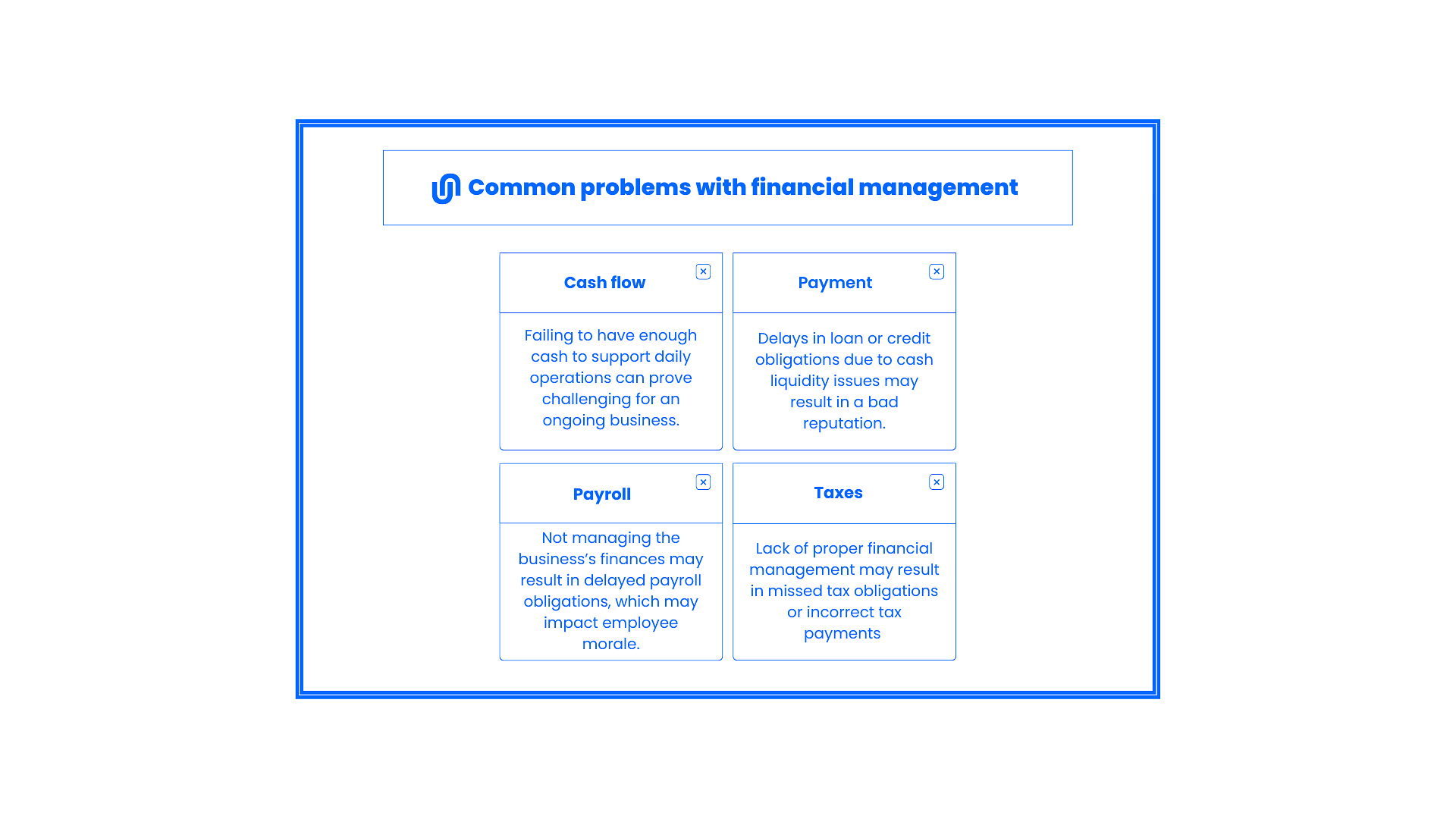

Cash-based accounting is a recording method that relies solely on cash inflows and outflows. This may offer a straightforward approach but can have significant drawbacks. These would include a lack of real-time insights, difficulty tracking accounts receivable, and potential inaccuracies in financial reporting.

| Month | May | June | July |

| Revenue | $15,000 | $2,000 | $5,000 |

***MPOM Pet Supplies Comparative Income Statement for May, June, July (in thousands of US dollars)

In this comparative income statement, MPOM received the most income during May, making it look like the online business is doing well. On the other hand, coming June and July, its profits fluctuated. This might suggest the company was busy in May, but the additional two months were stale.

What happens if it only gives a rough idea of your business standing in given periods?

The small business owner might make wrong business decisions. They may reduce inventory in June and July since no one was buying their products during those months. They could also make more purchase orders for May since it's the busiest, thus adding more billables that month. When in truth, there were accounts payable and accounts receivable that weren't taken into consideration in all months.

You can make the best decisions for your company when you only see revenue and not the totality of your business's financial health.

Whether your online business is slow or not, it's impossible to remember every cash transaction coming in and going out of your business. So, if you review your last year's income statement, you won't even remember why your revenue was low, or your expenses were high back then.

Generally Accepted Accounting Principles (GAAP) are accounting standards businesses and the US SEC commonly adopt. Cash-basis accounting is a non-GAAP-compliant method, but it doesn't mean it is illegal.

GAAP does not function as legal regulations. Instead, they serve as the standard accounting guidelines set by accounting boards that businesses adhere to. According to the IRS, if you earn over $25 million in sales in over three years, you must use the accrual accounting method.

Are you a sole proprietor starting an online business? You may have a passion for running a business but don't know how to do accounting. If so, the cash method is for you.

Meanwhile, you can use cash basis accounting if you are still a low-income or cash-strapped company. With cash basis accounting, you'll have lower taxes since your income during this period is expectedly low.

Accrual accounting recognizes revenue and expenses as soon as they are earned or billed. Once your customer buys your product on installment, you record the transaction when the order is completed.

Meanwhile, expenses, such as raw materials for inventory, are recorded as soon as you receive them. Therefore, line items such as accounts payable and accounts receivable are particulars in your books.

Accrual accounting is not known for ease of use, but there are many advantages to using the accrual method of accounting for your online business. Here are some of them:

When accounts payable and accounts receivable are reflected on a financial statement, you have a more accurate view of your company's assets and liabilities. You'll be provided with these details when you practice accrual accounting. Having a holistic view of your company's finances will allow you to make accurate decisions that will positively impact your finances.

Accrual basis accounting allows you to gauge and plan for peak months of your business operations as you can see your business's profitability and performance clearer.

Did you receive a lot of orders for the month? Or did you make several dealings with the supplier at that time? The accrual method shows you the exact movements of your business operations so you can make better financial decisions in the long run.

If you're not hitting the $25 million mark yet, you can still use the cash basis method for recording your income and expenses. But beyond that, accrual accounting is what the board of accounting regards as a standard. Moreover, banks, lenders, and investors prefer this GAAP-compliant accounting method over cash basis accounting.

Your business may just be starting, but you can triple your revenue in a few years, thus earning over $25 million. So, if you use accrual accounting from the beginning, you do not need to change accounting methods as you already comply with IRS regulations.

Accrual basis accounting can help business owners like you determine your financial position accurately, but it also has several drawbacks. Knowing these significant drawbacks will allow you to work on your accounting system to ensure smooth accounting proactively.

For some, bookkeeping is already daunting, and it gets even more complicated with accrual accounting's daily records, end-of-the-month, and end-of-the-year reports. You need to learn this accounting method well to use it properly.

You can see that your income or profit and loss statement looks good using the accrual method. However, upon checking your cash flow statement, your cash is almost $0. That's because when you look closely at your P&L statement, your accounts receivable is relatively high. After all, your customers haven't fully paid yet.

Following the accrual accounting method keeps track of your profitability but not your actual cash. Thus, making cash flow statements that go hand-in-hand with your P&L is essential.

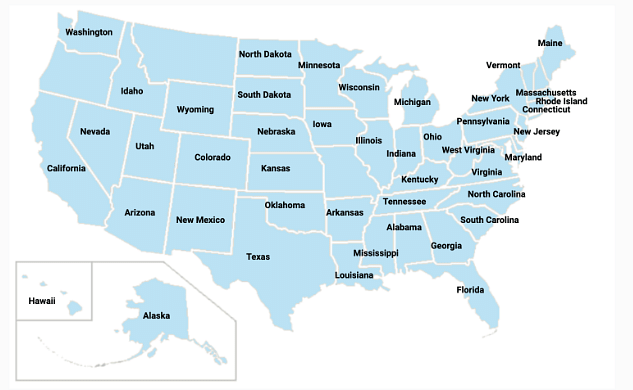

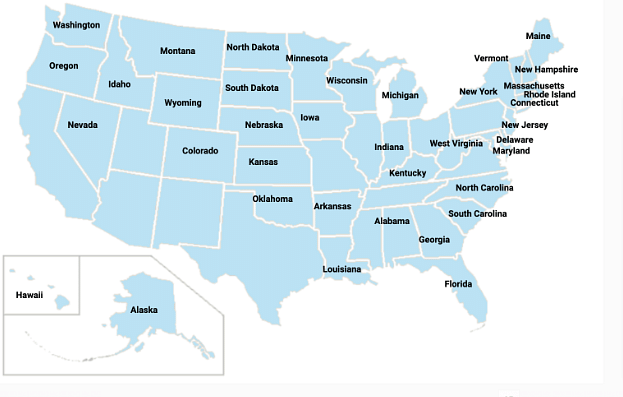

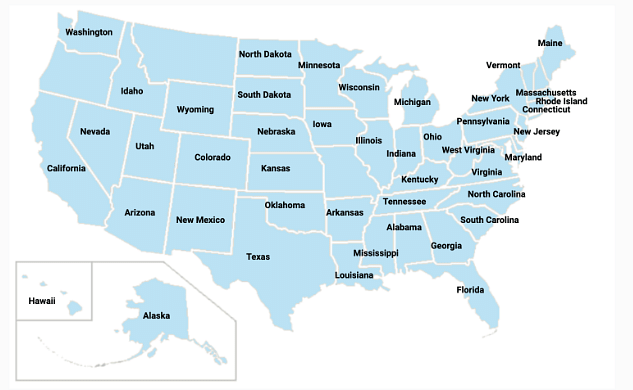

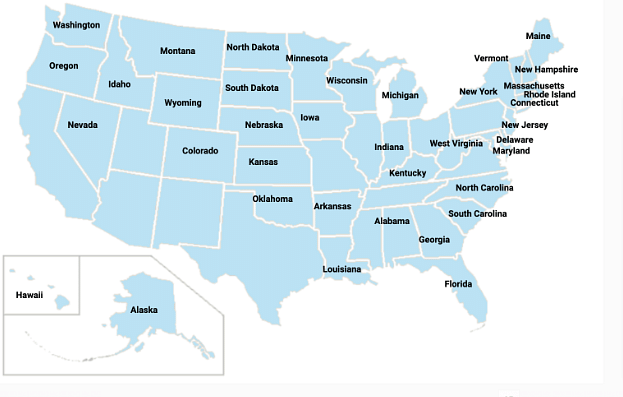

Despite its tedious workflow, accrual accounting is still the standard. Small business owners choose to work with this method because they live in some states in America, like New York, requiring accrual basis tax returns. You can select accrual accounting at your own will, as you must switch to the accrual method once you begin earning larger profits.

Each method has its strengths and weaknesses, and choosing the right approach for your online business depends on your specific needs and goals.

Cash accounting is straightforward. It is perfect for small business owners with limited resources who have just launched their venture. In contrast, accrual accounting provides accurate financial reporting that reflects your business's current financial position, making it ideal for business owners looking for better projections and decision-making in the long run.

Whether you choose cash accounting or accrual accounting, it's essential to understand the method's drawbacks and ensure that your accounting system works smoothly.

Don't waste your time deciding which accounting method to use. We here at Unloop can assist you with your bookkeeping and accounting needs. Book a call with us today!

As an entrepreneur running an online business, understanding the critical differences between accrual and cash accounting is essential. These two accounting methods seem similar but fundamentally different in how financial transactions are recorded.

Accrual accounting income and expenses as transactions happen, whether you have or have not received cash.

In contrast, cash accounting records revenues and expenses only when cash transactions have been made.

This article will provide an overview of these two accounting methods and their respective strengths and weaknesses to help you choose the right approach for your online business. So, hang on to learn more!

Cash accounting is when you record revenue and expenses when the cash is in. Accrual accounting is when you record transactions as soon as you earn or owe them.

To give you a better idea, let's bring out a sample transaction from MPOM Pet Supplies' general journal.

| Cash Basis Accounting | ||

| Date 2022 | Account Title and Remarks | Amount |

| July 30 | Cash Sales Revenue(to record cash collected) | $5,000 |

| Accrual Accounting | ||

| Date 2022 | Account Title and Remarks | Amount |

| July 1 | Accountable receivable Sales Revenue(to record sales) | $5,000 |

| July 30 | Cash Accounts receivable(to record cash collected) | $5,000 |

The cash basis accounting table shows that the transaction was only recorded on July 30. That's because that is the only time they received actual money. However, in an accrual accounting table, the accounts receivable are already recorded on July 1, even if the funds are only received on July 30.

Cash basis accounting has no accounts receivable and accounts payable. You input the transaction only when cash is available and when you receive payment. Meanwhile, in accrual accounting, the transaction is recorded the moment the transaction is made, even without the actual money.

Cash-based accounting is the simplest and most straightforward way to track financial transactions. The central idea is to record revenue as soon as it's received and expenses as soon as they're paid instead of waiting for invoices or withdrawals. Check the great things about using the cash-based accounting method:

Money goes in, and money goes out. When it does, you record it. It's easy to manage your online business this way, and you don't need to hire a professional accountant to do the job. You don't need to adjust if a customer doesn't pay or you haven't paid your supplier yet. It's because there's no initial record of it while it’s unpaid.

With the cash basis accounting method, you get an upfront report of how much you earned or paid during that period. This is perfect when making short-term cash flow statements since you only record ongoing and outgoing cash transactions. You get the net income or net loss quickly.

If you only keep records of cash transactions, you may have the upper hand when you need to file for your business taxes. It's because you can lower your tax liabilities by slowing down your revenues or speeding up your expenses. Of course, this is all legal.

Cash-based accounting is a recording method that relies solely on cash inflows and outflows. This may offer a straightforward approach but can have significant drawbacks. These would include a lack of real-time insights, difficulty tracking accounts receivable, and potential inaccuracies in financial reporting.

| Month | May | June | July |

| Revenue | $15,000 | $2,000 | $5,000 |

***MPOM Pet Supplies Comparative Income Statement for May, June, July (in thousands of US dollars)

In this comparative income statement, MPOM received the most income during May, making it look like the online business is doing well. On the other hand, coming June and July, its profits fluctuated. This might suggest the company was busy in May, but the additional two months were stale.

What happens if it only gives a rough idea of your business standing in given periods?

The small business owner might make wrong business decisions. They may reduce inventory in June and July since no one was buying their products during those months. They could also make more purchase orders for May since it's the busiest, thus adding more billables that month. When in truth, there were accounts payable and accounts receivable that weren't taken into consideration in all months.

You can make the best decisions for your company when you only see revenue and not the totality of your business's financial health.

Whether your online business is slow or not, it's impossible to remember every cash transaction coming in and going out of your business. So, if you review your last year's income statement, you won't even remember why your revenue was low, or your expenses were high back then.

Generally Accepted Accounting Principles (GAAP) are accounting standards businesses and the US SEC commonly adopt. Cash-basis accounting is a non-GAAP-compliant method, but it doesn't mean it is illegal.

GAAP does not function as legal regulations. Instead, they serve as the standard accounting guidelines set by accounting boards that businesses adhere to. According to the IRS, if you earn over $25 million in sales in over three years, you must use the accrual accounting method.

Are you a sole proprietor starting an online business? You may have a passion for running a business but don't know how to do accounting. If so, the cash method is for you.

Meanwhile, you can use cash basis accounting if you are still a low-income or cash-strapped company. With cash basis accounting, you'll have lower taxes since your income during this period is expectedly low.

Accrual accounting recognizes revenue and expenses as soon as they are earned or billed. Once your customer buys your product on installment, you record the transaction when the order is completed.

Meanwhile, expenses, such as raw materials for inventory, are recorded as soon as you receive them. Therefore, line items such as accounts payable and accounts receivable are particulars in your books.

Accrual accounting is not known for ease of use, but there are many advantages to using the accrual method of accounting for your online business. Here are some of them:

When accounts payable and accounts receivable are reflected on a financial statement, you have a more accurate view of your company's assets and liabilities. You'll be provided with these details when you practice accrual accounting. Having a holistic view of your company's finances will allow you to make accurate decisions that will positively impact your finances.

Accrual basis accounting allows you to gauge and plan for peak months of your business operations as you can see your business's profitability and performance clearer.

Did you receive a lot of orders for the month? Or did you make several dealings with the supplier at that time? The accrual method shows you the exact movements of your business operations so you can make better financial decisions in the long run.

If you're not hitting the $25 million mark yet, you can still use the cash basis method for recording your income and expenses. But beyond that, accrual accounting is what the board of accounting regards as a standard. Moreover, banks, lenders, and investors prefer this GAAP-compliant accounting method over cash basis accounting.

Your business may just be starting, but you can triple your revenue in a few years, thus earning over $25 million. So, if you use accrual accounting from the beginning, you do not need to change accounting methods as you already comply with IRS regulations.

Accrual basis accounting can help business owners like you determine your financial position accurately, but it also has several drawbacks. Knowing these significant drawbacks will allow you to work on your accounting system to ensure smooth accounting proactively.

For some, bookkeeping is already daunting, and it gets even more complicated with accrual accounting's daily records, end-of-the-month, and end-of-the-year reports. You need to learn this accounting method well to use it properly.

You can see that your income or profit and loss statement looks good using the accrual method. However, upon checking your cash flow statement, your cash is almost $0. That's because when you look closely at your P&L statement, your accounts receivable is relatively high. After all, your customers haven't fully paid yet.

Following the accrual accounting method keeps track of your profitability but not your actual cash. Thus, making cash flow statements that go hand-in-hand with your P&L is essential.

Despite its tedious workflow, accrual accounting is still the standard. Small business owners choose to work with this method because they live in some states in America, like New York, requiring accrual basis tax returns. You can select accrual accounting at your own will, as you must switch to the accrual method once you begin earning larger profits.

Each method has its strengths and weaknesses, and choosing the right approach for your online business depends on your specific needs and goals.

Cash accounting is straightforward. It is perfect for small business owners with limited resources who have just launched their venture. In contrast, accrual accounting provides accurate financial reporting that reflects your business's current financial position, making it ideal for business owners looking for better projections and decision-making in the long run.

Whether you choose cash accounting or accrual accounting, it's essential to understand the method's drawbacks and ensure that your accounting system works smoothly.

Don't waste your time deciding which accounting method to use. We here at Unloop can assist you with your bookkeeping and accounting needs. Book a call with us today!

Starting a business is a risk. However, it is exciting and it might be tempting to swim ahead into new waters in an attempt to achieve success. Unfortunately, small business owners will have a million things to do. The process of creating a product to sell is only one facet of a business. There's finances, marketing, and advertising, and business owners only have themselves to rely on most of the time.

You often need a second set of hands to help you run a business. Moreover, if there are areas of the business that you're not familiar with, getting an expert may be a wise move for your success. But many business owners are reluctant to hire professionals because of the cost. o you really need one?

Here are some important questions to ask yourself to help you decide if you need a professional accountant.

If you're a certified accountant, managing your business finances will be easy. But let's say you're a beginner in the ecommerce industry. Can you do the accounting by yourself? Assess how much you know about accounting and how sure you are that you can handle your finances efficiently and error-free.

When you encounter double-entry bookkeeping, income statements, cash flows, accounts payable and receivable, and fixed expenses, can you differentiate and identify their purposes? Business finance covers many things, so make sure you can handle whatever applies to your business if you opt not to hire a professional.

If accounting for small businesses fits in your skill set, the next thing you need to ask yourself is if you can dedicate time to manage your finances. As a business owner, you have to oversee the different parts of your business, and business owners often get heavily involved in different processes of their business.

Tasks like talking and striking deals with your suppliers, picking up goods from warehouses, fulfilling deliveries, meetings with potential partners, managing your business webpage, and answering messages about your products are just a few of the jobs you must complete daily—especially if you work alone.

After all these tasks, can you still see yourself managing your finances? Finances require accuracy and complete concentration. After a tiring day, are you still up to the task?

Handling finances also means managing your taxes. Even seasoned people in the business dread managing taxes. There are many taxes levied when you start a business, and different taxes require different declarations and forms. How well-versed are you when it comes to business taxation?

Do you know how to file income taxes? How about sales tax? Do you know the sales tax rate and laws? Do you know how sales tax collection works? You should also be familiar with filing due dates, depending if you file taxes annually or quarterly.

Furthermore, there are also tax exemptions. Do you know the laws that make your products eligible for exemption? Tax exemption can lessen the taxes you pay to the collection agency. You can allocate these funds to further develop your business through investments.

Professional accountants do have a standard rate. It may vary depending on whether you hire from accounting firms or look for a private accountant. Of course, the more experience the accountant has, the higher they will charge.

Budget is one of the factors why many business owners opt to forgo hiring professionals. On average, an accountant's hourly rate is $117. Other services like small business bookkeeping cost an average of $200. Research shows that business owners spend anywhere from $1,000 to $20,000 on accounting annually.

This price point may be daunting for individuals fresh on the market. One thing you can do is hire accountants in a part-time position. This way, you'll still get the help you need without breaking your budget. You can create a schedule when you need your accountant, instead of having them on-call five days a week.

It's easier to handle finances at the beginning of your business. But maybe you need help in other things like organizing and keeping your records clean. An accountant is distinct from a bookkeeper. A bookkeeper does not need to pass state-mandated licensing examinations or a professional accounting degree.

Bookkeepers are trained to organize and record your business’s cash flow. They record all the financial transactions so you can track the money that goes in and out of your business. In addition, they can produce financial statements and reports which can say a lot about the health of your industry.

They can provide you with balance sheets to see if your expenses are parallel with your sales so that you can plan your finances strategically. In addition, bookkeeping costs significantly less than accounting, and there are even automated bookkeeping software that won’t break the bank.

However, bookkeepers can't do what accountants do. Their main goal is to record all your financial transactions; it is an accountant's duty to interpret and analyze the data. So maybe once a month or every quarter, have your bookkeeper meet a professional accountant for a consultation.

Bookkeeping for small businesses is an advantage, but a bookkeeper’s role is limited to your cash flow—no more, no less. So what difference does a certified accountant make? Here are some of the crucial duties a qualified accountant has to perform for your business.

Ask yourselves again, “Do I need an accountant for my small business?” It's not a requirement for every business, but it's a huge advantage. At the beginning, hiring an accountant may seem unnecessary. But as your business grows and a lot of cash comes in and out, an accountant will make sense of all the financial data to make sure your business’s overall financial health is in order.

If you’re considering getting an accountant, Unloop offers the best services for ecommerce sellers. We have professionals that can help you navigate different aspects of your business. Our services include payroll management, income tax, sales tax, accounting, and bookkeeping.

Book a call with us now and consult with our experts. Let us help you carve your way to success.

Starting a business is a risk. However, it is exciting and it might be tempting to swim ahead into new waters in an attempt to achieve success. Unfortunately, small business owners will have a million things to do. The process of creating a product to sell is only one facet of a business. There's finances, marketing, and advertising, and business owners only have themselves to rely on most of the time.

You often need a second set of hands to help you run a business. Moreover, if there are areas of the business that you're not familiar with, getting an expert may be a wise move for your success. But many business owners are reluctant to hire professionals because of the cost. o you really need one?

Here are some important questions to ask yourself to help you decide if you need a professional accountant.

If you're a certified accountant, managing your business finances will be easy. But let's say you're a beginner in the ecommerce industry. Can you do the accounting by yourself? Assess how much you know about accounting and how sure you are that you can handle your finances efficiently and error-free.

When you encounter double-entry bookkeeping, income statements, cash flows, accounts payable and receivable, and fixed expenses, can you differentiate and identify their purposes? Business finance covers many things, so make sure you can handle whatever applies to your business if you opt not to hire a professional.

If accounting for small businesses fits in your skill set, the next thing you need to ask yourself is if you can dedicate time to manage your finances. As a business owner, you have to oversee the different parts of your business, and business owners often get heavily involved in different processes of their business.

Tasks like talking and striking deals with your suppliers, picking up goods from warehouses, fulfilling deliveries, meetings with potential partners, managing your business webpage, and answering messages about your products are just a few of the jobs you must complete daily—especially if you work alone.

After all these tasks, can you still see yourself managing your finances? Finances require accuracy and complete concentration. After a tiring day, are you still up to the task?

Handling finances also means managing your taxes. Even seasoned people in the business dread managing taxes. There are many taxes levied when you start a business, and different taxes require different declarations and forms. How well-versed are you when it comes to business taxation?

Do you know how to file income taxes? How about sales tax? Do you know the sales tax rate and laws? Do you know how sales tax collection works? You should also be familiar with filing due dates, depending if you file taxes annually or quarterly.

Furthermore, there are also tax exemptions. Do you know the laws that make your products eligible for exemption? Tax exemption can lessen the taxes you pay to the collection agency. You can allocate these funds to further develop your business through investments.

Professional accountants do have a standard rate. It may vary depending on whether you hire from accounting firms or look for a private accountant. Of course, the more experience the accountant has, the higher they will charge.

Budget is one of the factors why many business owners opt to forgo hiring professionals. On average, an accountant's hourly rate is $117. Other services like small business bookkeeping cost an average of $200. Research shows that business owners spend anywhere from $1,000 to $20,000 on accounting annually.

This price point may be daunting for individuals fresh on the market. One thing you can do is hire accountants in a part-time position. This way, you'll still get the help you need without breaking your budget. You can create a schedule when you need your accountant, instead of having them on-call five days a week.

It's easier to handle finances at the beginning of your business. But maybe you need help in other things like organizing and keeping your records clean. An accountant is distinct from a bookkeeper. A bookkeeper does not need to pass state-mandated licensing examinations or a professional accounting degree.

Bookkeepers are trained to organize and record your business’s cash flow. They record all the financial transactions so you can track the money that goes in and out of your business. In addition, they can produce financial statements and reports which can say a lot about the health of your industry.

They can provide you with balance sheets to see if your expenses are parallel with your sales so that you can plan your finances strategically. In addition, bookkeeping costs significantly less than accounting, and there are even automated bookkeeping software that won’t break the bank.

However, bookkeepers can't do what accountants do. Their main goal is to record all your financial transactions; it is an accountant's duty to interpret and analyze the data. So maybe once a month or every quarter, have your bookkeeper meet a professional accountant for a consultation.

Bookkeeping for small businesses is an advantage, but a bookkeeper’s role is limited to your cash flow—no more, no less. So what difference does a certified accountant make? Here are some of the crucial duties a qualified accountant has to perform for your business.

Ask yourselves again, “Do I need an accountant for my small business?” It's not a requirement for every business, but it's a huge advantage. At the beginning, hiring an accountant may seem unnecessary. But as your business grows and a lot of cash comes in and out, an accountant will make sense of all the financial data to make sure your business’s overall financial health is in order.

If you’re considering getting an accountant, Unloop offers the best services for ecommerce sellers. We have professionals that can help you navigate different aspects of your business. Our services include payroll management, income tax, sales tax, accounting, and bookkeeping.

Book a call with us now and consult with our experts. Let us help you carve your way to success.

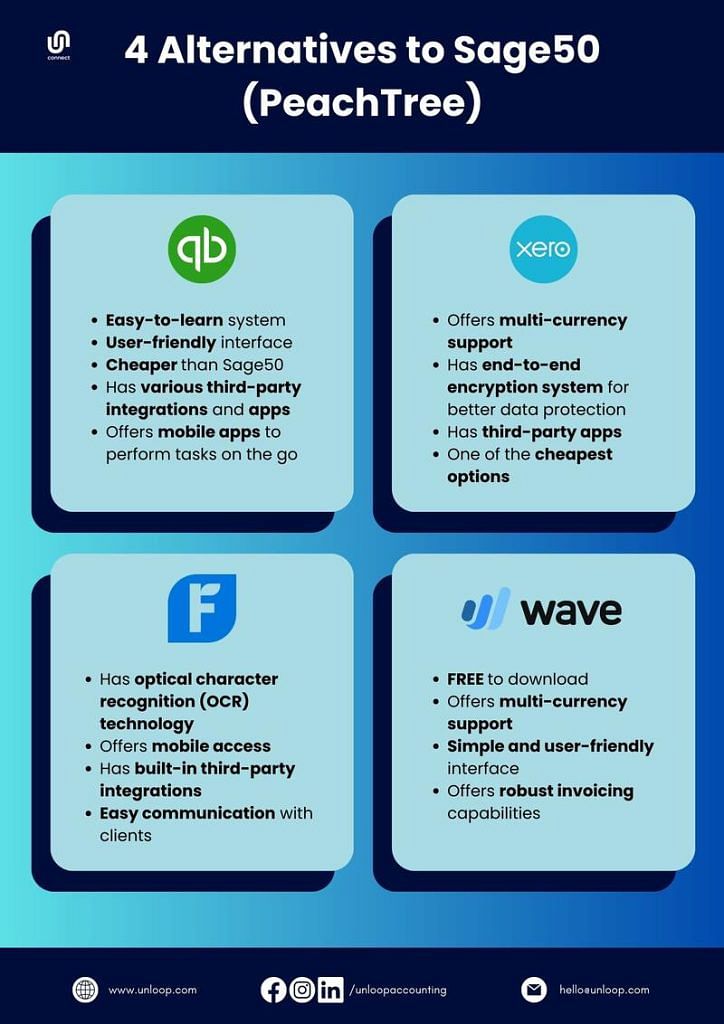

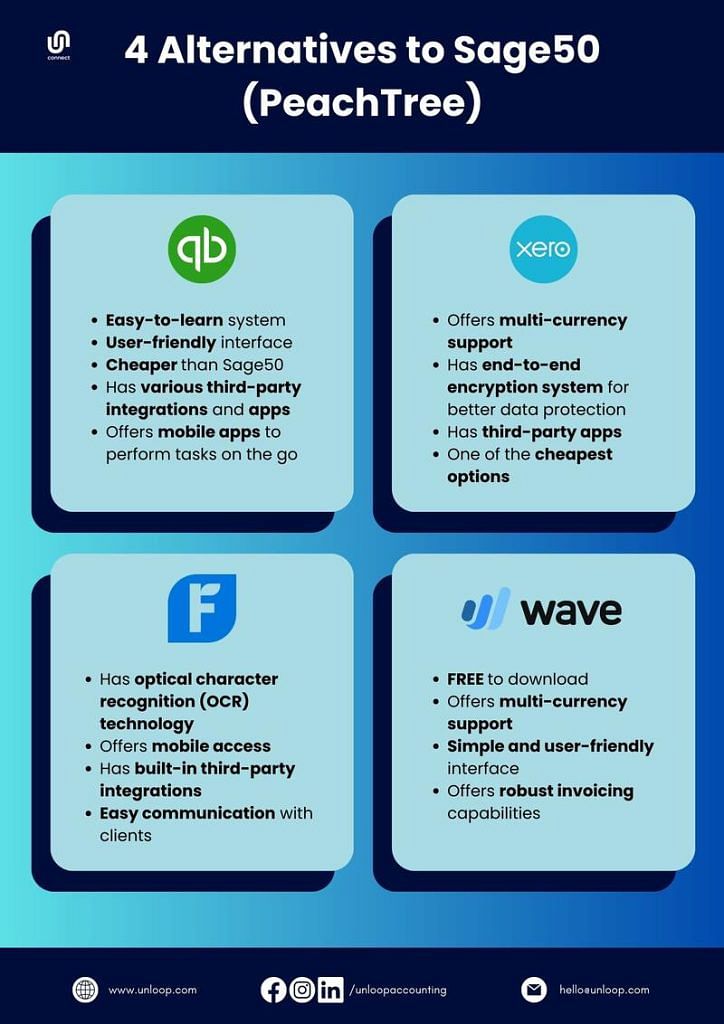

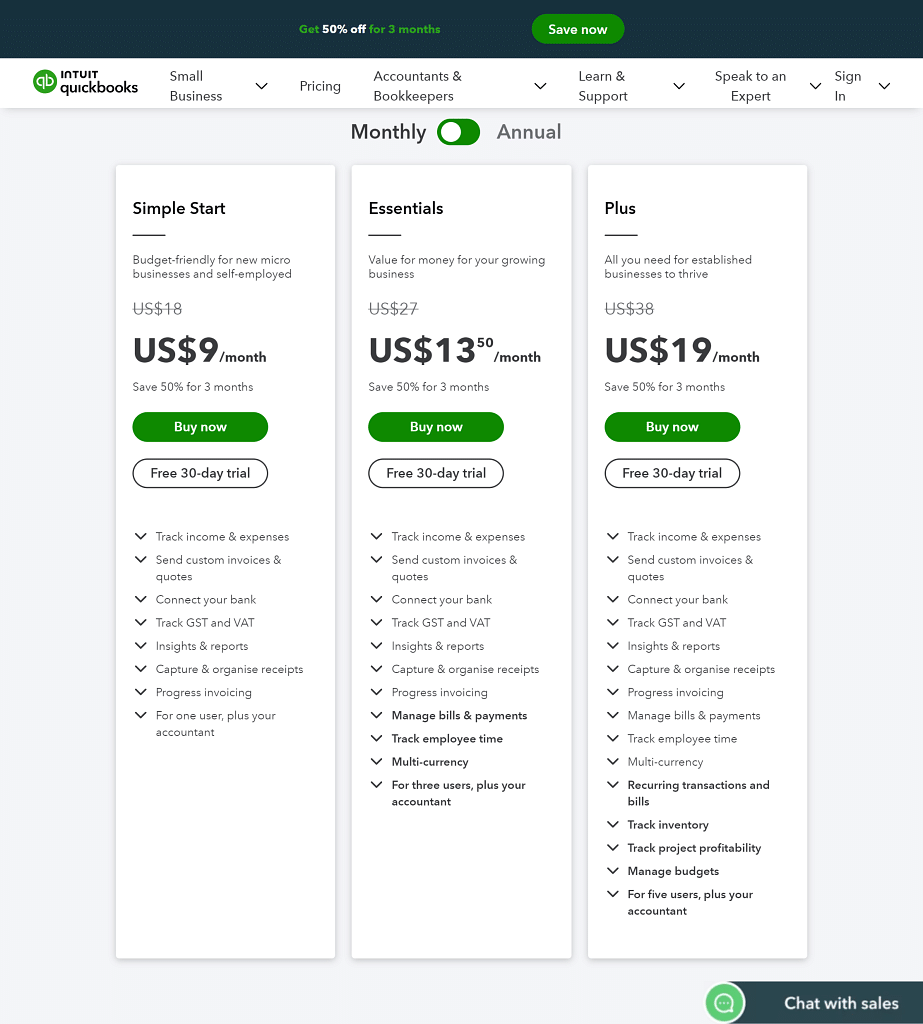

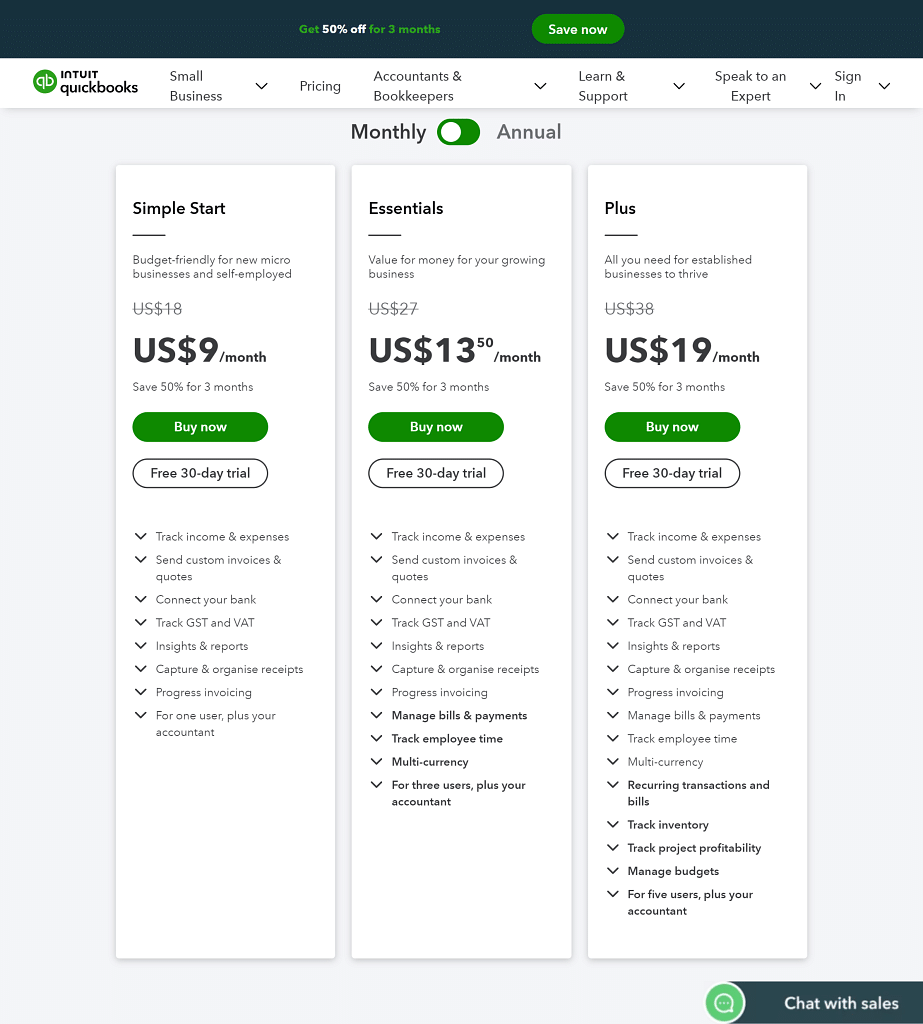

Invoicing is a business essential and a feature included in the best accounting software. Business owners like you looking for software with invoicing are probably wondering which between Sage and QuickBooks Online is the better option. Both of these programs will have unique offerings, but in the end, one will be better for your business.

In this blog post, we'll compare Sage Accounting vs. QuickBooks to show you which one is best for you. But first, let’s get to know the types of invoices in accounting and your store’s finances.

An invoice can be a hard copy or digitized document that contains information about the seller and the buyer, the date of the transaction, and payment details. There are different types like:

These invoices serve as documentation that will help in income and expense tracking and cash flow management. With the right software, you can collect the details from these invoices for categorization and later run a report for analysis.

The good news is that the comparison between Sage accounting software vs. QuickBooks Online isn’t too drastic, as both offer competitive invoicing features. Either will be a great choice. Nevertheless, you only need one accounting software for your business, so we’ll help you decide.

Sage/Sage50 Cloud/Peachtree stands out among the many choices of accounting and financial management tools because of its industry-based assistance. The software assists accounting for companies in construction, real estate, human resources, manufacturing, chemical, wholesale, food and beverage, and even in the nonprofit sector. It addresses different small business accounting software needs, especially with its invoicing feature.

Say hello to Sage’s business cloud accounting invoicing. In only a few clicks, you can generate invoices and send them to customers. You surely won’t miss the traditional way of sending hard copy invoices which takes time for data entry, printing, and delivery.

When your customers receive their invoices, they can send their payments online. The Sage accounting software partners with Stripe, an online payment processing software. After paying, the money will be transferred into your business account. The customer’s payment and your receipt will be done without any hassle.

You can automatically turn the estimates and quotes you have into invoices and send them to your customers in just a few clicks. Regular invoice creation can also be done quickly because the data you need, from the customer’s contact information, your business details, and the details of the products, are all stored in the online accounting software.

Sage50 Cloud used to only be for desktop use, but now, it is also available on mobile. So, if you ever need to generate invoices or stay on top of your small business’s financial management, you can easily do it on your phone. This data is kept safe as Sage is a cloud-based accounting software.

Meanwhile, Intuit QuickBooks is also a great choice for your business’s accounting and financial management. It has a live bookkeeping service that keeps all financial transactions up-to-date. Payroll and payment tracking, bank accounts, credit cards, integrations with other applications, project management, and inventory management are some of the accounting tasks this tool can accomplish. For invoicing, here is what QuickBooks Online offers:

QuickBooks Online can generate invoices, but more than this, the software can also send bulk invoices as the system can store all customer and product information. You can save a lot of time doing this instead of creating invoices one by one.

If you have regular transactions, skip the hassle of creating invoices again and again or forgetting to send one through the help of recurring invoices. This accounting feature schedules the sending of the invoice. It also avoids late payments as customers can send their payments timely as well.

If it is your first time creating an invoice or using accounting software, QuickBooks Online can assist you through the Priority Circle. This training tool is completely free for those using QuickBooks Pro/Advanced. With Priority Circle, you’ll learn how to create different invoices, make templates, and send them to customers. QuickBooks also offers customer support for your invoice and accounting-related questions.

The “Pay Now” link can work magic in encouraging customers to pay on time. Since QuickBooks welcomes integration with various payment methods, your customers can pay in ways convenient to them. The money goes straight to your account and reflects on your bank feed with no hassle!

QuickBooks Online is on par with Sage50 Cloud regarding software mobile access. You can create and send invoices as long as you have your phone and an internet connection. You’ll also have your business’s financial information in your pocket anywhere you go.

Both are great accounting software, but when it comes to Sage/Peachtree vs. QuickBooks for small businesses, we believe that QuickBooks Online takes the top spot. QuickBooks has more advanced features like invoice training that is much needed by beginners, and it allows the creation and sending of bulk invoices. The accounting software also has more choices when it comes to payment methods.

Of course, your store may have unique needs that could sway you towards choosing Sage. But for the average small business, QuickBooks Online is likely the better option for invoicing and beyond.

If you need assistance with keeping your books in order, Unloop offers bookkeeping services. We have a team of professionals well-versed with QuickBooks and other accounting and bookkeeping tools like Xero. Be sure to give us a call—we’d love to discuss our offers with you.

Invoicing is a business essential and a feature included in the best accounting software. Business owners like you looking for software with invoicing are probably wondering which between Sage and QuickBooks Online is the better option. Both of these programs will have unique offerings, but in the end, one will be better for your business.

In this blog post, we'll compare Sage Accounting vs. QuickBooks to show you which one is best for you. But first, let’s get to know the types of invoices in accounting and your store’s finances.

An invoice can be a hard copy or digitized document that contains information about the seller and the buyer, the date of the transaction, and payment details. There are different types like:

These invoices serve as documentation that will help in income and expense tracking and cash flow management. With the right software, you can collect the details from these invoices for categorization and later run a report for analysis.

The good news is that the comparison between Sage accounting software vs. QuickBooks Online isn’t too drastic, as both offer competitive invoicing features. Either will be a great choice. Nevertheless, you only need one accounting software for your business, so we’ll help you decide.

Sage/Sage50 Cloud/Peachtree stands out among the many choices of accounting and financial management tools because of its industry-based assistance. The software assists accounting for companies in construction, real estate, human resources, manufacturing, chemical, wholesale, food and beverage, and even in the nonprofit sector. It addresses different small business accounting software needs, especially with its invoicing feature.

Say hello to Sage’s business cloud accounting invoicing. In only a few clicks, you can generate invoices and send them to customers. You surely won’t miss the traditional way of sending hard copy invoices which takes time for data entry, printing, and delivery.

When your customers receive their invoices, they can send their payments online. The Sage accounting software partners with Stripe, an online payment processing software. After paying, the money will be transferred into your business account. The customer’s payment and your receipt will be done without any hassle.

You can automatically turn the estimates and quotes you have into invoices and send them to your customers in just a few clicks. Regular invoice creation can also be done quickly because the data you need, from the customer’s contact information, your business details, and the details of the products, are all stored in the online accounting software.

Sage50 Cloud used to only be for desktop use, but now, it is also available on mobile. So, if you ever need to generate invoices or stay on top of your small business’s financial management, you can easily do it on your phone. This data is kept safe as Sage is a cloud-based accounting software.

Meanwhile, Intuit QuickBooks is also a great choice for your business’s accounting and financial management. It has a live bookkeeping service that keeps all financial transactions up-to-date. Payroll and payment tracking, bank accounts, credit cards, integrations with other applications, project management, and inventory management are some of the accounting tasks this tool can accomplish. For invoicing, here is what QuickBooks Online offers:

QuickBooks Online can generate invoices, but more than this, the software can also send bulk invoices as the system can store all customer and product information. You can save a lot of time doing this instead of creating invoices one by one.

If you have regular transactions, skip the hassle of creating invoices again and again or forgetting to send one through the help of recurring invoices. This accounting feature schedules the sending of the invoice. It also avoids late payments as customers can send their payments timely as well.

If it is your first time creating an invoice or using accounting software, QuickBooks Online can assist you through the Priority Circle. This training tool is completely free for those using QuickBooks Pro/Advanced. With Priority Circle, you’ll learn how to create different invoices, make templates, and send them to customers. QuickBooks also offers customer support for your invoice and accounting-related questions.

The “Pay Now” link can work magic in encouraging customers to pay on time. Since QuickBooks welcomes integration with various payment methods, your customers can pay in ways convenient to them. The money goes straight to your account and reflects on your bank feed with no hassle!

QuickBooks Online is on par with Sage50 Cloud regarding software mobile access. You can create and send invoices as long as you have your phone and an internet connection. You’ll also have your business’s financial information in your pocket anywhere you go.

Both are great accounting software, but when it comes to Sage/Peachtree vs. QuickBooks for small businesses, we believe that QuickBooks Online takes the top spot. QuickBooks has more advanced features like invoice training that is much needed by beginners, and it allows the creation and sending of bulk invoices. The accounting software also has more choices when it comes to payment methods.

Of course, your store may have unique needs that could sway you towards choosing Sage. But for the average small business, QuickBooks Online is likely the better option for invoicing and beyond.

If you need assistance with keeping your books in order, Unloop offers bookkeeping services. We have a team of professionals well-versed with QuickBooks and other accounting and bookkeeping tools like Xero. Be sure to give us a call—we’d love to discuss our offers with you.

Ecommerce accounting can be tedious, time-consuming, and error-prone, especially if you’re just new to the industry. Automated ecommerce accounting software, like A2X eCom Accounting, are just the thing you need to ease your worries. And we’ll tell you why.

Plenty of tools are available online, and there’s more being developed, but in this blog post, we'll discuss why A2X remains one of the best accounting software options available. What makes A2X stand out?

Let’s take a deeper look at what A2X Accounting is, its features, and its possible lowlights to determine if this is the right choice for your ecommerce business.

Businesses are already aware of the income-generating potential of online selling. If you are one of the brave souls to venture into the ecommerce space, you can rely on A2X as it is specifically designed for ecommerce sites.

A2X for Amazon accounting covers your basic needs on the world's largest ecommerce site, but it also assists traders and auctioneers with their products on eBay. Likewise, A2X supports selling on other ecommerce channels like Walmart, Etsy, and Shopify.

Besides multi-channel support, A2X also caters to a range of business sizes and types, from businesses that have just opened their first ecommerce store to those that have already successfully scaled their ventures.

The table below will give you an overview of what A2X can offer.

| Mini | Starter | Standard | Premium |

| $19/month | $49/month | $69/month | $139/month |

| 1 Shopify/Amazon Marketplace | Unlimited marketplaces per region | Unlimited marketplaces per region | Unlimited marketplaces per region |

| 200 orders/month | 1000 orders/month | 5000 orders/month | 10,000 orders/month |

| 3 months of transaction history | 12 months of transaction history | 24 months of transaction history | Maximum number of transaction history |

| Email support | Email, live, tickets, and chat support | Email, live, tickets, and chat support | Email, live, tickets, and chat support with priority |

The inclusions listed above are just the tip of the A2X iceberg. There are many more ways the accounting software can elevate your business and bring it to success.

To give you a glimpse of its magic, here are eight reasons why the A2X Accounting software is an excellent addition to your business's financial management tools:

Accurate ecommerce accounting is a must for every online business. It can tell you if your business is generating a profit, taking a loss, or if there are any discrepancies in your business finances. You can count on A2X to automatically reconcile the transactions in your online store platform to your accounting system.

Financial reconciliation also extends to your bank account. You can ensure that your sales are deposited to your bank accounts and spot if there are missing amounts before they can do damage to your business.

A dedicated ecommerce business owner will find a way to generate more sales. Hence, most online retailers have more than one Amazon account. Another excellent business strategy is to sell on different marketplaces simultaneously.

While these game plans can undeniably increase sales, monitoring additional accounts and sites can be confusing. Thankfully, A2X would be of great help.

A2X accounting can support up to five Amazon accounts and reconcile all your financial data in one accounting software. In addition, A2X tracks all the essential data from different sites and allows you to reconcile and migrate your data from two different ecommerce platforms.

For example, if you have Shopify store sales and accounts and Amazon accounts, A2X can track the finances of both platforms and import the data on the software.

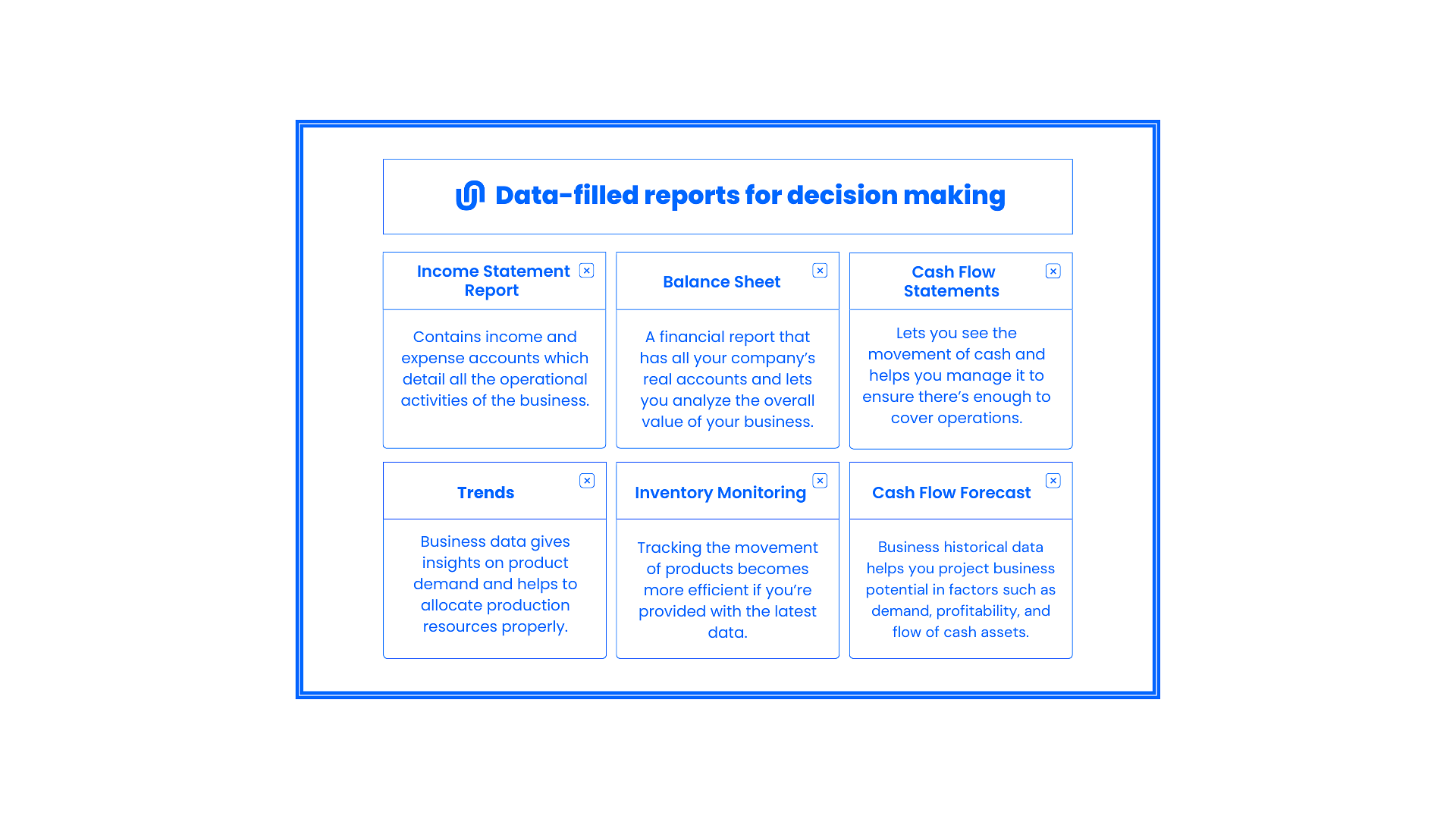

For a small business, detailed reports of ecommerce financials are a starting point for improvement. These reports are essential for gauging your company’s financial performance and growth accounting.

You can count on A2X to produce tidy summaries of finances at the end of each month. Whether it's reporting inventory, a record of sales or expenses, a balance sheet, or other business matters, keeping track of your operations becomes easier and more accurate.

You can connect A2X to your ecommerce seller account to acquire data. A2X will then categorize the numbers it gets according to the details you want to see. Below is a step-by-step guide from A2X itself on connecting the tool to your Amazon Seller Central account.

Shopify, Amazon, and other ecommerce platforms are available globally. You may expand your consumer base internationally, and A2X can simplify managing payments for your company.

A2X can handle and recognize different currencies regardless of the default currency of the originating sales transactions.

Moreover, A2X also lets users manage tax liability more effectively. Different countries have various rates when it comes to sales and fees. A2X automatically deducts the correct sales tax and records it on the system to avoid confusion during tax season.

You can keep track of how many inventory stocks you have in various locations thanks to A2X’s inventory management tool. It can give you detailed inventory reports and show you which products run out faster and which stay in your inventory longer.

With this feature also comes monitoring your business's sales margin. The accounting software will show you if your sales record matches your cost of goods, enabling you to create strategies for poor-performing and top-performing products.

Perhaps you manage more businesses, including physical stores and online selling sites not included in A2X's services.

You'll find the best accounting tools like Quickbooks, Xero, and Sage business cloud accounting more helpful because you can integrate these three premium tools with A2X. With all your business data in one place, you can have a holistic view of your finances in a single click.

If you want a side-by-side comparison of your stores to see and learn from each account's highlights and areas for improvement, you should utilize this A2X feature.

To give you an overview of the feature, check out the tutorial below on integrating Xero with A2X.

Not every Amazon FBA seller or eBay seller dives into business bookkeeping and accounting equipped with knowledge and training. Also, not all accounting tools include teaching sessions in their program. So, eCommerce sellers often rely on self-education or paid tutorials.

When you use A2X, you can also utilize its live chat support and customer service to assist you. This service is included in all plans, so you do not have to guess or learn from your mistakes. You can do your monthly bookkeeping and accounting swiftly with available customer support.

Besides ecommerce sellers, A2X is also reliable for accounting firms. If your plate is full of tasks in running your ecommerce business, you can delegate bookkeeping and accounting to expert ecommerce accountants.

Pick a firm that uses A2X, especially if your accountant uses a cloud-based accounting software that extracts data from your Amazon, Shopify, Etsy, Walmart, and eBay accounts.

You can rely on the firm for data accuracy and timely financial updates with the proper software. You can also check other accounting tools your partner firm uses. Seeing Quickbooks, Xero, and Sage accounting tools is a good sign that the agency knows what they're doing.

A2X accounting software sounds like the perfect tool to manage ecommerce accounting. To some, A2X is even the gold standard. However, there may be features that can be off-putting to some users. Consider those first before using this software.

Most people that use A2X are accounting firms and professionals. According to some ecommerce business owners, learning and understanding how to use and navigate the interface takes some time. If you subscribe to the Mini plan, you must experiment and learn the software independently.

However, when you subscribe to higher plans, you can enjoy one-on-one onboarding with an A2X specialist to teach you how to use the software and its features. So if you have the budget to upgrade your plan, go for it!

A2X could be pricey if you run a small business. There are free accounting software options, and some software starting plans are not more than $5. A2X software's most basic plan starts at $19 a month. Their pricing is almost four times more compared to other software.

However, A2X is very convenient for Amazon and Shopify sellers. Its features are designed to automate and address your accounting needs with just a few clicks. If you can stretch your budget a few more dollars, you'll know that your accounting is in good hands with A2X.

Source: Photo by fauxels from Pexels.com

A2X Accounting is a great tool for managing your business finances, and we highly recommend using it. It offers a wide range of features, including integration with other financial management tools, generating detailed reports, inventory management, financial reconciliation, and more.

In addition, the customer support team is available 24/7 to help you with any questions or problems that may arise. So, if you're looking for a way to keep track of your business finances, give A2X Accounting a try!

Suppose you don't feel confident implementing these changes yourself, no problem! Unloop can help.

We have a team of bookkeepers well-versed with A2X, and we also use reliable accounting tools, including Quickbooks and Xero. We would love to partner with you to take your ecommerce businesses to the next level. So call us today, and we'll let you know how we can help!

Ecommerce accounting can be tedious, time-consuming, and error-prone, especially if you’re just new to the industry. Automated ecommerce accounting software, like A2X eCom Accounting, are just the thing you need to ease your worries. And we’ll tell you why.

Plenty of tools are available online, and there’s more being developed, but in this blog post, we'll discuss why A2X remains one of the best accounting software options available. What makes A2X stand out?

Let’s take a deeper look at what A2X Accounting is, its features, and its possible lowlights to determine if this is the right choice for your ecommerce business.

Businesses are already aware of the income-generating potential of online selling. If you are one of the brave souls to venture into the ecommerce space, you can rely on A2X as it is specifically designed for ecommerce sites.

A2X for Amazon accounting covers your basic needs on the world's largest ecommerce site, but it also assists traders and auctioneers with their products on eBay. Likewise, A2X supports selling on other ecommerce channels like Walmart, Etsy, and Shopify.

Besides multi-channel support, A2X also caters to a range of business sizes and types, from businesses that have just opened their first ecommerce store to those that have already successfully scaled their ventures.

The table below will give you an overview of what A2X can offer.

| Mini | Starter | Standard | Premium |

| $19/month | $49/month | $69/month | $139/month |

| 1 Shopify/Amazon Marketplace | Unlimited marketplaces per region | Unlimited marketplaces per region | Unlimited marketplaces per region |

| 200 orders/month | 1000 orders/month | 5000 orders/month | 10,000 orders/month |

| 3 months of transaction history | 12 months of transaction history | 24 months of transaction history | Maximum number of transaction history |

| Email support | Email, live, tickets, and chat support | Email, live, tickets, and chat support | Email, live, tickets, and chat support with priority |

The inclusions listed above are just the tip of the A2X iceberg. There are many more ways the accounting software can elevate your business and bring it to success.

To give you a glimpse of its magic, here are eight reasons why the A2X Accounting software is an excellent addition to your business's financial management tools:

Accurate ecommerce accounting is a must for every online business. It can tell you if your business is generating a profit, taking a loss, or if there are any discrepancies in your business finances. You can count on A2X to automatically reconcile the transactions in your online store platform to your accounting system.

Financial reconciliation also extends to your bank account. You can ensure that your sales are deposited to your bank accounts and spot if there are missing amounts before they can do damage to your business.

A dedicated ecommerce business owner will find a way to generate more sales. Hence, most online retailers have more than one Amazon account. Another excellent business strategy is to sell on different marketplaces simultaneously.

While these game plans can undeniably increase sales, monitoring additional accounts and sites can be confusing. Thankfully, A2X would be of great help.

A2X accounting can support up to five Amazon accounts and reconcile all your financial data in one accounting software. In addition, A2X tracks all the essential data from different sites and allows you to reconcile and migrate your data from two different ecommerce platforms.

For example, if you have Shopify store sales and accounts and Amazon accounts, A2X can track the finances of both platforms and import the data on the software.

For a small business, detailed reports of ecommerce financials are a starting point for improvement. These reports are essential for gauging your company’s financial performance and growth accounting.

You can count on A2X to produce tidy summaries of finances at the end of each month. Whether it's reporting inventory, a record of sales or expenses, a balance sheet, or other business matters, keeping track of your operations becomes easier and more accurate.

You can connect A2X to your ecommerce seller account to acquire data. A2X will then categorize the numbers it gets according to the details you want to see. Below is a step-by-step guide from A2X itself on connecting the tool to your Amazon Seller Central account.

Shopify, Amazon, and other ecommerce platforms are available globally. You may expand your consumer base internationally, and A2X can simplify managing payments for your company.

A2X can handle and recognize different currencies regardless of the default currency of the originating sales transactions.

Moreover, A2X also lets users manage tax liability more effectively. Different countries have various rates when it comes to sales and fees. A2X automatically deducts the correct sales tax and records it on the system to avoid confusion during tax season.

You can keep track of how many inventory stocks you have in various locations thanks to A2X’s inventory management tool. It can give you detailed inventory reports and show you which products run out faster and which stay in your inventory longer.

With this feature also comes monitoring your business's sales margin. The accounting software will show you if your sales record matches your cost of goods, enabling you to create strategies for poor-performing and top-performing products.

Perhaps you manage more businesses, including physical stores and online selling sites not included in A2X's services.

You'll find the best accounting tools like Quickbooks, Xero, and Sage business cloud accounting more helpful because you can integrate these three premium tools with A2X. With all your business data in one place, you can have a holistic view of your finances in a single click.

If you want a side-by-side comparison of your stores to see and learn from each account's highlights and areas for improvement, you should utilize this A2X feature.

To give you an overview of the feature, check out the tutorial below on integrating Xero with A2X.

Not every Amazon FBA seller or eBay seller dives into business bookkeeping and accounting equipped with knowledge and training. Also, not all accounting tools include teaching sessions in their program. So, eCommerce sellers often rely on self-education or paid tutorials.

When you use A2X, you can also utilize its live chat support and customer service to assist you. This service is included in all plans, so you do not have to guess or learn from your mistakes. You can do your monthly bookkeeping and accounting swiftly with available customer support.

Besides ecommerce sellers, A2X is also reliable for accounting firms. If your plate is full of tasks in running your ecommerce business, you can delegate bookkeeping and accounting to expert ecommerce accountants.

Pick a firm that uses A2X, especially if your accountant uses a cloud-based accounting software that extracts data from your Amazon, Shopify, Etsy, Walmart, and eBay accounts.

You can rely on the firm for data accuracy and timely financial updates with the proper software. You can also check other accounting tools your partner firm uses. Seeing Quickbooks, Xero, and Sage accounting tools is a good sign that the agency knows what they're doing.

A2X accounting software sounds like the perfect tool to manage ecommerce accounting. To some, A2X is even the gold standard. However, there may be features that can be off-putting to some users. Consider those first before using this software.

Most people that use A2X are accounting firms and professionals. According to some ecommerce business owners, learning and understanding how to use and navigate the interface takes some time. If you subscribe to the Mini plan, you must experiment and learn the software independently.

However, when you subscribe to higher plans, you can enjoy one-on-one onboarding with an A2X specialist to teach you how to use the software and its features. So if you have the budget to upgrade your plan, go for it!

A2X could be pricey if you run a small business. There are free accounting software options, and some software starting plans are not more than $5. A2X software's most basic plan starts at $19 a month. Their pricing is almost four times more compared to other software.

However, A2X is very convenient for Amazon and Shopify sellers. Its features are designed to automate and address your accounting needs with just a few clicks. If you can stretch your budget a few more dollars, you'll know that your accounting is in good hands with A2X.

Source: Photo by fauxels from Pexels.com

A2X Accounting is a great tool for managing your business finances, and we highly recommend using it. It offers a wide range of features, including integration with other financial management tools, generating detailed reports, inventory management, financial reconciliation, and more.

In addition, the customer support team is available 24/7 to help you with any questions or problems that may arise. So, if you're looking for a way to keep track of your business finances, give A2X Accounting a try!

Suppose you don't feel confident implementing these changes yourself, no problem! Unloop can help.

We have a team of bookkeepers well-versed with A2X, and we also use reliable accounting tools, including Quickbooks and Xero. We would love to partner with you to take your ecommerce businesses to the next level. So call us today, and we'll let you know how we can help!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Most business owners and experts agree that payroll management is tough, but it doesn't have to be. Take advantage of technology and use an employee payroll management system.

Learn the key benefits of payroll management software and why you should invest in one for your small business now.

What exactly is payroll software? To simplify things, it manages everything that has to do with payroll. Payroll software automates everything from employee pay to attendance and all other necessary human resource records.

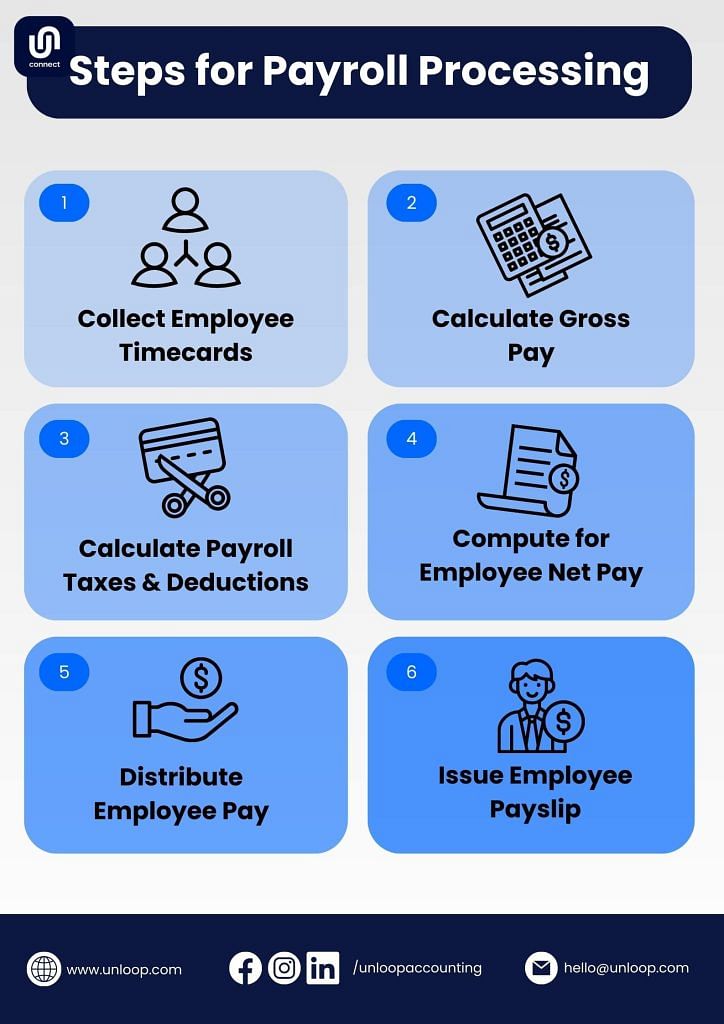

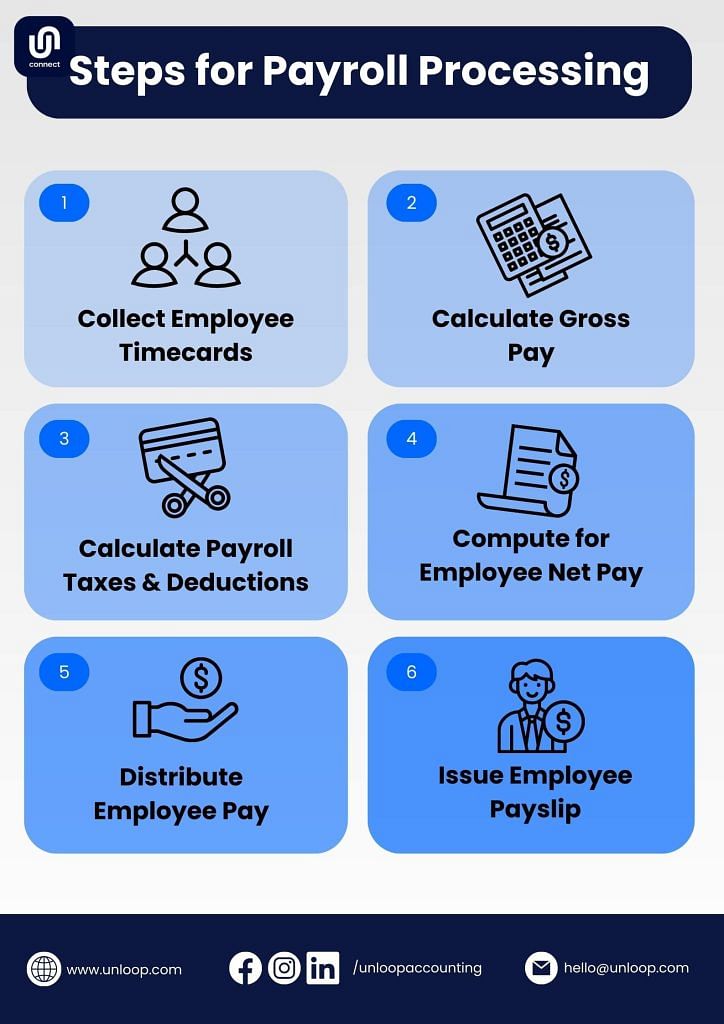

In other words, it elevates the basic payroll functions and makes the entire payroll management process easier and faster for employers and business owners. To give you a bit of reference, check out the usual payroll flow below.

Some steps may take hours to fulfill with manual payroll management. However, by using payroll software, employers can accomplish these tasks in a flash with just a few clicks.

Not only can a payroll system save time for human resource personnel, but they are also less likely to make errors with such software. With this, employees are more likely to be satisfied with the management of their pay. Applications such as these make it convenient to run a business.

Different companies offer online payroll management systems. If you are interested in getting one for your business, there are two things to look for:

As your business grows and employees increase, the human resource department will only get more swamped. Payroll software will lessen their workload and let them focus on other aspects of employee management. Here are reasons to ditch manual payroll and switch to automated payroll systems.

On average, HR personnel may spend up to 21 days annually on payroll processing alone. However, this much time can be spent on other areas of your business. For example, many successful companies allocate a chunk for employee development, goal setting, and strategic planning.

Take advantage of the convenience of payroll software so you can focus more on how to develop and grow your business further. Payroll software helps you skip manually entering long pay stubs, doing calculations, and individually depositing pay into your employees’ accounts. This lets you go through your usual payroll routine hassle-free and more quickly.

Payroll software promotes transparency that can help build trust among your employees. The software lets your employees see how much they are paid and the breakdown of any deductions, giving them confidence that they will always receive their pay on schedule.

But don't worry; even if your employees can track their records, you can still restrict access to important information like attendance, benefits, and time logs. They can view them, but only the admin can make changes.

Every year, numerous employees are affected by errors made by manual payroll processing. To make matters worse, these payroll errors take days for management to fix. Payroll problems can be frustrating for both the side of the management and employees.

An employee payroll management system can significantly decrease the risk of making errors from manual payroll processes. You can ensure that your employee receives the exact amount of their salary every pay period.

Additionally, using the best payroll solution with top-notch security can ensure that payroll data is only accessible to the human resources department and other authorized personnel. After all, the payroll employee database contains sensitive information such as addresses, birth dates, bank account numbers, Social Security numbers, and more.

If you have many employees, keeping track of them all can be challenging. It will be more difficult if your employees work remotely and have irregular schedules. Payroll software can do the tracking for you. It can store your employee's time data, whether they have to work overtime or under time, and note days when they are late or out from work.

Moreover, payroll software can track your employees anywhere around the globe. So if you have a big business or an international branch, you can manage all the payroll in one software even when you're not in the same locale.

If this is your first time hearing about payroll software companies and their tools, you obviously have little to no idea how it works. To convince you to get an automated payroll manager for your business, here are five of the best features of payroll software.

The software can easily do all the calculations for you. From bonuses, holiday pay, employee benefits, tax deductions, overtime, to other factors that can affect an employee's salary. You can also print payslips provided by the software once the payment is processed.

Moreover, you can print checks directly from the software for employees whose pay is not directly transferred to their bank accounts.

Payroll software can manage direct deposits of your employee's pay. All you need to do is input the important details of the payment and when it's scheduled. From there, the software will do it all for you. So you don't have to worry if the payment has been processed on time or if you missed an employee on payday.

Automated software is less prone to errors, so you can avoid issues that translate to employee confidence in the system and the company's management.

Attendance is the number one factor that affects the employee's pay. Therefore, it will be a great convenience for the HR department when you consolidate attendance checking with the pay. In addition, with this feature, the HR department will have an easier time in case employees have inquiries about certain deductions and changes in their pay.

Managing employee and payroll taxes is another headache for the human resource department. Payroll services can handle all tax calculations, including an employee's withholdings, insurance, and other necessary contributions. It can also generate tax forms and records of tax payments.

These are necessary documents for income tax filing, so you file and remit properly.

Several payroll services allow employees to update their information anytime. So, for example, if there are any changes in their bank forms or errors in the information, employees can immediately change them without going through the many requests and processes.

This transparency can answer minor inquiries from employees regarding their pay without needing to talk directly to someone from the HR department.

To make your company’s payroll process even more efficient, we’ve made a list of tips from top payroll specialists. With these tips, you can make accurate payroll computations and avoid payroll processing errors.

If you want to make your payroll processes easier while reducing the risk of human error, you should consider automating your payroll system with cloud-based tools. With these tools, you’re sure to pay employees accurately and on time.

Additionally, cloud-based tools can help improve compliance with government regulations. With real-time updates and automatic filings, businesses can be confident that they are always up to date with the latest requirements.

Establishing strict payroll policies helps ensure that all employees are treated fairly and helps avoid the likelihood of workplace disputes. This will also promote a culture of transparency and trust within your company.

With firm payroll policies, you can ensure that accurate records are kept for each employee and that they are paid promptly. Additionally, it can reduce accounting and administrative costs while avoiding disruptions and maximizing efficiency.

Staying up-to-date on tax laws and regulations can be challenging because they are constantly changing. However, by ensuring that you know the latest changes, your company can maintain its compliance with the law, and your employees can get the right calculation of tax withheld from their paychecks.

Finally, staying up-to-date on tax laws can help you identify potential deductions and credits that your company may be eligible for.

The automated payroll managing software is a huge convenience for your business. It makes the flow of money in your business smoother and error-free. If your business is continuously growing, investing in a web-based payroll management system is a step forward in handling your business better.

If you have decided on getting an automated payroll software, experts at Unloop can help you run your payroll process smoothly. Our experts will link your payroll to cloud-based software so that we can do everything for you. Our software also generates reports you can use for proper tax filing.

Book a call with us now and put your payroll needs in our hands!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Most business owners and experts agree that payroll management is tough, but it doesn't have to be. Take advantage of technology and use an employee payroll management system.

Learn the key benefits of payroll management software and why you should invest in one for your small business now.

What exactly is payroll software? To simplify things, it manages everything that has to do with payroll. Payroll software automates everything from employee pay to attendance and all other necessary human resource records.

In other words, it elevates the basic payroll functions and makes the entire payroll management process easier and faster for employers and business owners. To give you a bit of reference, check out the usual payroll flow below.

Some steps may take hours to fulfill with manual payroll management. However, by using payroll software, employers can accomplish these tasks in a flash with just a few clicks.

Not only can a payroll system save time for human resource personnel, but they are also less likely to make errors with such software. With this, employees are more likely to be satisfied with the management of their pay. Applications such as these make it convenient to run a business.

Different companies offer online payroll management systems. If you are interested in getting one for your business, there are two things to look for:

As your business grows and employees increase, the human resource department will only get more swamped. Payroll software will lessen their workload and let them focus on other aspects of employee management. Here are reasons to ditch manual payroll and switch to automated payroll systems.

On average, HR personnel may spend up to 21 days annually on payroll processing alone. However, this much time can be spent on other areas of your business. For example, many successful companies allocate a chunk for employee development, goal setting, and strategic planning.

Take advantage of the convenience of payroll software so you can focus more on how to develop and grow your business further. Payroll software helps you skip manually entering long pay stubs, doing calculations, and individually depositing pay into your employees’ accounts. This lets you go through your usual payroll routine hassle-free and more quickly.

Payroll software promotes transparency that can help build trust among your employees. The software lets your employees see how much they are paid and the breakdown of any deductions, giving them confidence that they will always receive their pay on schedule.

But don't worry; even if your employees can track their records, you can still restrict access to important information like attendance, benefits, and time logs. They can view them, but only the admin can make changes.

Every year, numerous employees are affected by errors made by manual payroll processing. To make matters worse, these payroll errors take days for management to fix. Payroll problems can be frustrating for both the side of the management and employees.

An employee payroll management system can significantly decrease the risk of making errors from manual payroll processes. You can ensure that your employee receives the exact amount of their salary every pay period.

Additionally, using the best payroll solution with top-notch security can ensure that payroll data is only accessible to the human resources department and other authorized personnel. After all, the payroll employee database contains sensitive information such as addresses, birth dates, bank account numbers, Social Security numbers, and more.

If you have many employees, keeping track of them all can be challenging. It will be more difficult if your employees work remotely and have irregular schedules. Payroll software can do the tracking for you. It can store your employee's time data, whether they have to work overtime or under time, and note days when they are late or out from work.

Moreover, payroll software can track your employees anywhere around the globe. So if you have a big business or an international branch, you can manage all the payroll in one software even when you're not in the same locale.

If this is your first time hearing about payroll software companies and their tools, you obviously have little to no idea how it works. To convince you to get an automated payroll manager for your business, here are five of the best features of payroll software.

The software can easily do all the calculations for you. From bonuses, holiday pay, employee benefits, tax deductions, overtime, to other factors that can affect an employee's salary. You can also print payslips provided by the software once the payment is processed.

Moreover, you can print checks directly from the software for employees whose pay is not directly transferred to their bank accounts.

Payroll software can manage direct deposits of your employee's pay. All you need to do is input the important details of the payment and when it's scheduled. From there, the software will do it all for you. So you don't have to worry if the payment has been processed on time or if you missed an employee on payday.

Automated software is less prone to errors, so you can avoid issues that translate to employee confidence in the system and the company's management.

Attendance is the number one factor that affects the employee's pay. Therefore, it will be a great convenience for the HR department when you consolidate attendance checking with the pay. In addition, with this feature, the HR department will have an easier time in case employees have inquiries about certain deductions and changes in their pay.

Managing employee and payroll taxes is another headache for the human resource department. Payroll services can handle all tax calculations, including an employee's withholdings, insurance, and other necessary contributions. It can also generate tax forms and records of tax payments.

These are necessary documents for income tax filing, so you file and remit properly.

Several payroll services allow employees to update their information anytime. So, for example, if there are any changes in their bank forms or errors in the information, employees can immediately change them without going through the many requests and processes.

This transparency can answer minor inquiries from employees regarding their pay without needing to talk directly to someone from the HR department.

To make your company’s payroll process even more efficient, we’ve made a list of tips from top payroll specialists. With these tips, you can make accurate payroll computations and avoid payroll processing errors.