Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

There’s no room for compromise in managing the financial aspects of a small business. From expense tracking and business transactions to customer service and marketing, small business owners understand the relentless effort required to meet success. Many would turn to QuickBooks, a tool for small business owners.

Online businesses use this popular accounting software because of its user-friendly interface and robust support system. It has plenty of features to benefit you in every part of your business.

But for some, the question still remains: Is QuickBooks a long-term solution? Or is it a potential disaster waiting to happen? This article aims to clarify and address the concerns surrounding QuickBooks for small business owners.

As a non-accountant, using tools like QuickBooks can be frustrating. That’s because you know there’s something you’re doing wrong. You can’t pinpoint what it is or even realize how you committed them. You just know something’s not adding up (literally).

Like other businesses, you may be sucking the software in, booting up the computer, and trying your best to put the numbers in. Unfortunately, that’s where the mistake is often rooted, leaving small business owners reluctant to learn, invest, and familiarize themselves with the tool.

What are these QuickBooks mistakes entrepreneurs often make? Let’s find out below:

QuickBooks Online has a bank sync feature that downloads your bank account transactions. But these are not automatically categorized.

One chaotic mistake most businesses make is adding these synced transactions as entries without sorting them. This problem leads to disorganized journals and ledgers.

When transactions aren’t properly categorized, tracking income and expenses accurately becomes challenging. You may also struggle to identify areas where cost-cutting is needed.

Small business owners place a high value on financial clarity. They want to avoid any unnecessary confusion when it comes to managing their finances.

QuickBooks offers a useful feature that allows you to create sub-accounts under your main accounts. This feature can be a real asset for organizing your expenses efficiently, but surprisingly, many businesses aren't familiar with it. Let's dive into why you should consider using sub-accounts.

Certain sub-accounts can result in redundancy and clutter within your financial statements. Knowing the nature of the income or expenses is important before creating a separate account.

Some businesses worry that they may lose their transaction history with QuickBooks, and it’s easy to see why.

Deleting transactions is like removing a piece of a puzzle in a set. Even if the rest is in order, that missing piece may throw the entire thing off.

If you delete a transaction that’s supposed to be recorded, you must recreate it and fix the transaction amount. This can be a time-consuming and potentially error-prone process.

QuickBooks includes a feature that identifies and flags duplicate transactions for security purposes. But despite the protection, there are still circumstances where double entry can occur:

Another common mistake businesses make is the incorrect recording of loan payments within their accounting records.

Principal payments fulfilling the loan obligation must be debited as loans payable instead of a business expense. That’s because a loan payment is a liability. It should reflect on the balance sheet to accurately depict the company’s financial obligations.

On the other hand, the interests you pay that don’t form part of the original loan amount should be debited under interest expenses. This will land the amount on your income statement, reflecting the cost of borrowing funds.

In addition to deleting and duplicating transactions, some companies also struggle with locking their bookkeeping periods within QuickBooks.

Once you’re confident that every transaction in a certain period is balanced and correct, you must lock it. Failure to do so leaves the door open for possible tampering or unintended modifications.

You might believe that the only solution is to tweak accounts from past periods, but that's not recommended. If all previous periods are already balanced, you can resolve the issue by focusing solely on the current transactions.

While using accounting tools like QuickBooks may present its fair share of challenges for small business owners, their benefits are simply too good to pass up. We believe QuickBooks is worth every penny. Here’s why.

Accurate financial reports are the backbone of informed decision-making in business. You must have comprehensive data about your business finances to achieve such precision.

When you sign up for a QuickBooks plan, you will first be offered up-to-date books. This feature will help you provide and gather all the receipts and documents for the past months to complete a year of income and expense tracking.

You can generate reliable reports that clearly show your financial status.

One thing is certain—there are areas in your small business you can do independently. But relying on experts or software for accounting is still better.

You must establish accounting as a foundation from the beginning, helping you track the inflow and outflow of money. Organized finances will provide relief and clarity even as a one-person team.

As your business expands and evolves, incorporating an accounting tool like QuickBooks becomes essential. You’ll need to readily interpret data for decision-making.

This proactive approach partnered with a powerful accounting tool grants you peace of mind and better financial management.

In today’s dynamic business landscape, it is common for small business owners to sell their products on various ecommerce platforms like Amazon, Shopify, Etsy, Woocommerce, and Squarespace. Given the multiple sales channels, inventory tracking becomes paramount.

QuickBooks offers a unified view of your business performance and enables you to input data from sales across different platforms and update inventory levels when you replenish your supplies. This streamlined process ensures that your inventory records remain precise and updated.

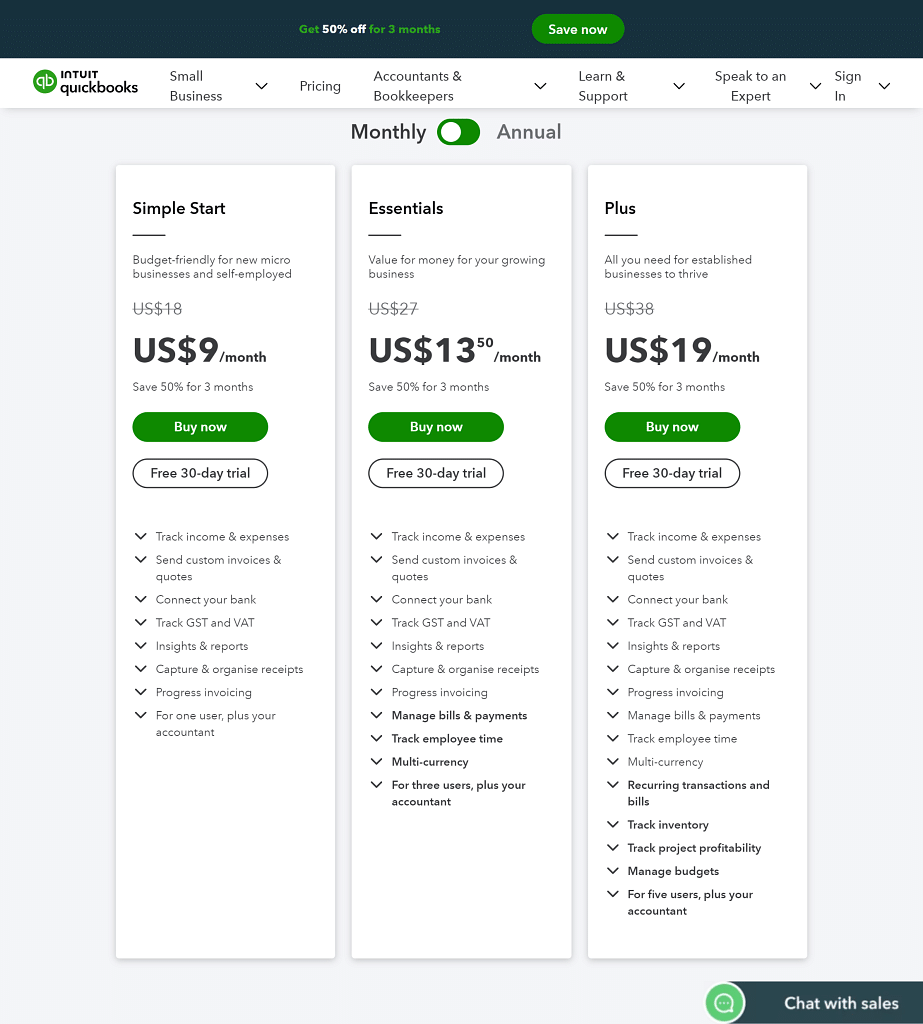

Do not compare software per dime if you are trying to decide which one to have. Check the offers in every plan as compared with another accounting software instead. By comparing the programs and their offers, you’ll see if the investment is worth it.

Here’s QuickBooks’ subscription plans as of this writing:

Some accounting software may limit expense tracking for their basic plan. Still, you’ll get this plus unlimited invoices in all QuickBooks plans.

Even with the basic plan, you can manage up to 1099 contractors, keeping your businesses committed to tax obligations. This means your tax deductions are taken care of. Cash flow and financial reporting are also all covered.

| Remember: Affordability is not solely about the price you pay but the value you receive. |

Calculating your tax is a huge challenge for seasoned and new business owners. Luckily, the best accounting software like QuickBooks is here to lend a helping hand.

QuickBooks facilitates the tax calculation process by compiling your tax return based on your net income—the difference between your total income and total expenses. Then, it will automatically provide the data you need for your tax returns.

Furthermore, QuickBooks can provide more accurate sales taxes if you provide the necessary details, such as your country's type of taxes, product or service's tax category, and shipping location. This feature helps you maintain compliance and alleviate the burden of tax-related complexities.

Gone are the days when small businesses solely relied on traditional payment methods. Today, embracing streamlined online payments is becoming the norm.

You can now experience hassle-free payment transactions with tools like QuickBooks. One of its best features is that customers can pay you online. It has integrated third-party payment apps such as Paypal, but it also has a built-in tool called QuickBooks Payments, which you can use to send an electronic invoice to your customers.

QuickBooks has scaled up and dispersed into different versions to fit every type of business out there, especially small ones. Here are the versions worth considering:

QuickBooks Online (QBO) revolutionizes how small businesses oversee their finances with cloud technology. You can access your books using the QuickBooks mobile app, downloadable from the app store. This makes it ideal for nomadic entrepreneurs or people who don't want extra hardware setup or software installation costs.

QuickBooks has kept pace with digital growth by enabling integration and access to ecommerce sites like Shopify and Amazon. Whether at home, in the office, or on the go, you can conveniently check the state of your business and make informed decisions anytime, anywhere.

Moreover, QuickBooks prioritizes the security of your business data. It provides a unique ID system granting secure access to your QuickBooks Online account, protecting your financial information.

If you spend more time on an office desk, you will enjoy QuickBooks Pro's features. This QuickBooks version is one of the three accounting software for desktops or PCs.

Despite its limited accessibility and backup, QuickBooks Pro excels in certain areas, such as in-depth payroll management and more features than QuickBooks Online. This tool helps you save time and minimize errors, from employee salary calculations to generating payroll reports.

If you’re also not confident about QBO's safety features, QuickBooks Pro is potentially more secure for your ecommerce business.

QuickBooks Premier is the second QuickBooks desktop that offers more functions than QuickBooks Pro. These are just some of the functions it offers:

QuickBooks Premier is a great tool for growing online businesses because it has tailored-fit reports for the type of industry you're in. You can predict your profitability by tracking your largest sources of income.

Third-party service providers such as freelancers or real estate agents can now use QuickBooks. This QuickBooks version is also cloud-based and available on your mobile phone.

What sets it apart from QBO or QuickBooks Desktop is it offers to track your business expenses and personal finance and create tax automation. However, you can't upgrade it to any other version. So if you have goals of expanding your remote workforce or small business, this won't work for you in the long run.

QuickBooks Mac is designed for online business owners who use Apple computers. It has similar features to the QBO and Desktop versions but is ideally suited for QuickBooks small business users on Macs.

With its compatibility with the Mac ecosystem and features geared towards small business needs, QuickBooks for Mac is an ideal choice for Apple-based online business owners seeking efficient financial management.

Whether you've been in business for a while or have only just started, you only need to set up a few things before hitting the ground running. The rest you can choose to leave to accounting experts.

Here's what you should pay attention to when you set up QuickBooks for your business.

This is where you set up all the essential information about your business, such as the type of business entity, invoice terms, accounting method, tax forms, and more. These will affect income and sales tax reporting as you move forward.

How to create an account?

The chart of accounts is mandatory information before you start recording transactions in QuickBooks because this is where you input initial business balances.

Want to view your financial transactions?

You’ll gain access to a complete list of predefined account categories, including assets, liabilities, equity, income, and expenses. You can customize these accounts based on your specific business needs.

Connecting a bank account to QuickBooks helps you sync existing transactions from your bank into QuickBooks. This process allows for easier bank reconciliation and ensures that QuickBooks' balances match the ones in the designated business accounts.

To sync bank accounts:

Setting up your balance is mainly about putting all the numbers from your books into QuickBooks. You enter the opening or current amounts of balance sheet accounts and identify unclassified transactions from the bank account synced to the accounting software. This cleans up your journal and ledger entries in QuickBooks and gives you accurate financial reporting.

To enter the opening balance:

QuickBooks users need to add buyers and vendors. This is the only way for them to record and track incoming revenues and supplier payments identified as short-term debt or credit.

For customers:

For vendors:

Adding products and services is the way to record revenue coming from physical or online sales.

To set up your products or services:

You can fill out the product or service name and enter the product's SKU number if you do inventory management. You can also enter your product or service's sales price or rate.

To sum it up, QuickBooks is a recipe for success, but effectively connecting your small business to this accounting software starts with proper knowledge and setup. If you have installed this recently and don't know how to maximize it, you might end up with expensive junk.

The success of your business all comes from using your resources optimally. Fortunately, Unloop is adept with the way this accounting software works. Once you hand over your accounting or bookkeeping, let us work while you focus on your business. Truly, it's like putting your QuickBooks software for business on autopilot.

Talk to us if you're afraid of making QuickBooks mistakes. Book a call today!

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.