Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

It's easy to familiarize yourself with your state's tax laws and apply these duties to the sales you make. But what about other states' sales tax regulations such as the Amazon Marketplace Facilitator Tax? As you expand your business, your sales tax obligations scale as well.

You may be wondering if Amazon is collecting sales tax and other duties. Getting these details right is crucial to your business because you can accurately jot down details on the books. Also, you can declare your correct taxable income when tax season comes.

Let Unloop help you by answering the most pressing questions about Amazon taxes and duties. So whether you're an Amazon newbie or a seasoned seller who has some questions, this post has got you covered!

As a seller, it would be best to know the ins and outs of sales tax collection, but if you are still learning, there is no need to halt your plans for your Amazon business.

The Marketplace Facilitator law assigns Amazon as a marketplace facilitator. All marketplace facilitators have a sales tax collection obligation. This means they must collect and remit sales tax to authorities on the sellers' behalf.

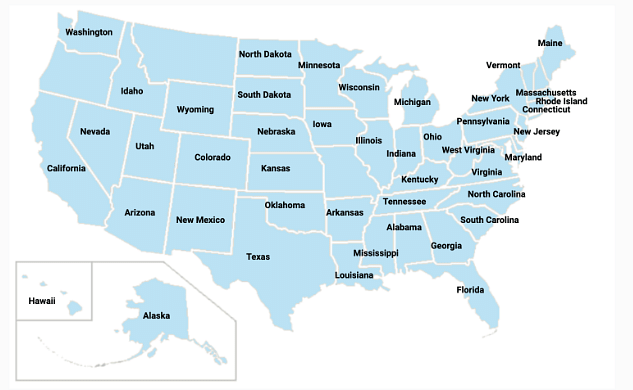

The eCommerce giant will handle sales taxes for you in the following sales tax nexus where the Marketplace Facilitator Laws are in effect:

With your sales taxes handled, you can focus on optimizing your store and growing your business.

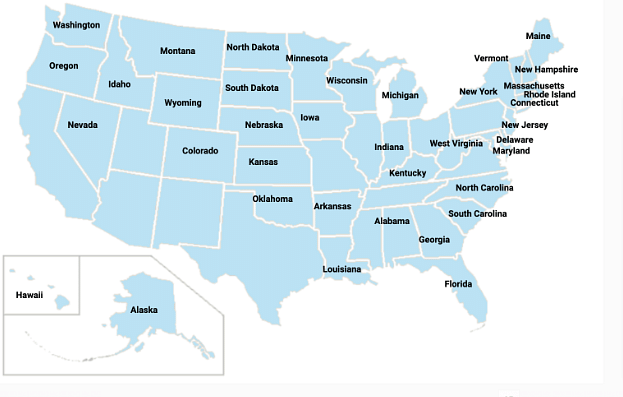

Each US state has its Marketplace Facilitator legislation for remitting sales tax. For some states like the ones below, the sales tax rate is destination-based.

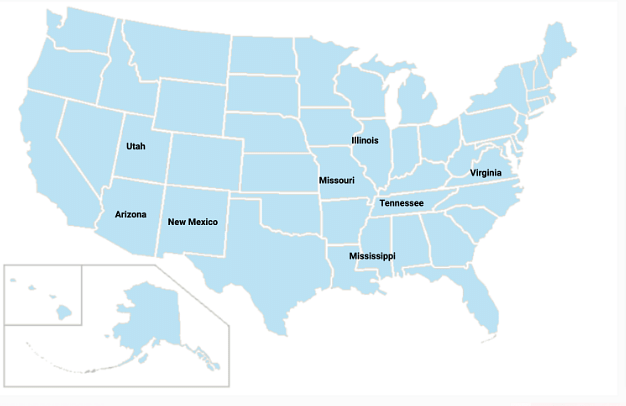

Meanwhile, sales tax rates for these states are origin-based.

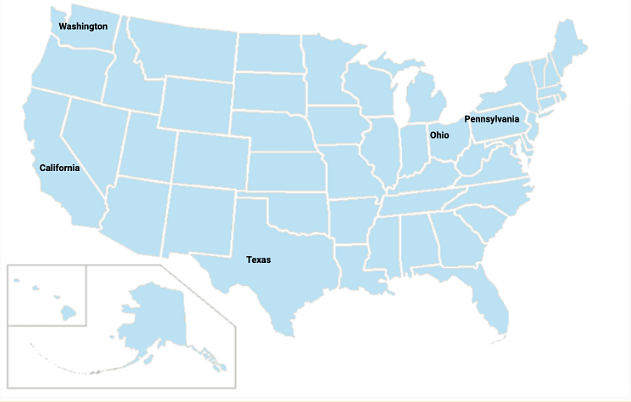

Some states, like the ones below, have unique sales tax laws that govern the remittance of their local sales taxes.

Sales are sensitive to change, so seek assistance when it comes to identifying sales tax you must remit. It's a good thing that the marketplace facilitator has a tax monitoring system capable of detecting these changes. With this, remitting sales tax will always be accurate.

You can access the Marketplace Tax Collection Report and other sales tax reports on your Amazon Seller Central account. You can check out this report to see how much sales taxes Amazon has remitted to various tax authorities.

To access it, click the "Reports" category and "Tax Document Library." Next, choose "Marketplace Tax Collection Report" after clicking the "Generate a tax report" button.

You can use the data you will get in various ways, but initially, you'll get an idea of how much sales taxes you will collect if you are selling on other platforms. Then, through it, you can generate your after-tax income.

As third party sellers on Amazon, taxes you need to pay are among what you need to check during tax season. Amazon will monitor your gross third party sales. If it reaches $20,000 and beyond 200 transactions, Amazon will report it to the Internal Revenue Service (IRS) through the 1099 form.

The form includes all your self-fulfilled or Amazon FBA sales, buyers' shipping and gift-wrapping payments, and promotional rebates.

This will be the basis of your income tax. However, you have to note that Amazon reports unadjusted gross sales. The platform includes refunds, but with the help of accountants, you can reconcile your final income to be taxed.

It's important to note that third party sellers can be exempted from sales tax liability. Sellers can check if they are eligible for sales tax permits before they pay sales tax.

Log in to your Amazon Seller Central account as a primary user so you can click the "Tax Document Library" in the "Reports" category. Then, pick the year you wish to see and the "Form 1099." You'll only get the report when you've reached $20,000 or more than 200 transactions.

While accessing it online is the most encouraged form of 1099 acquisition, Amazon can also send the form via email and delivery. Just make sure to indicate this request during the tax interview. Provide valid email and physical addresses to ensure you'll receive the form.

Amazon seller sales tax and duties can be daunting, but we hope this article has answered some of your questions. If you still need assistance or have more questions, our team here at Unloop would be happy to help you navigate these waters and ensure sales tax compliance. We have a team of bookkeepers and accountants ready to assist you in your bookkeeping, accounts payable, forecasting, payroll, and tax needs. Feel free to give us a call. We'd love to discuss all the details with you!

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.