Sales trend analysis (STA) is the cornerstone of sustainable business growth, so knowing its ins and outs is essential. As a rookie in the field, you must still be in the stage of learning the ropes, so we're here to help you.

This guide will equip you with essential skills to decipher market fluctuations, customer behaviors, and emerging patterns. We delve deep into sales data analysis techniques, empowering you to make informed decisions, optimize inventory, enhance customer experiences, and boost profitability.

From leveraging advanced analytics tools to practical tips on interpreting consumer preferences, this comprehensive resource is your road map to navigating the ever-changing ecommerce terrain. So, let's begin!

Making informed decisions and developing strategies are some benefits of STA. By understanding the underlying trends, companies can anticipate market demand, identify high-performing products or services, and focus on areas that require improvement.

A comprehensive sales analysis must consider these key components and factors.

((Current Period Value - Base Period Value) / Base Period Value) * 100

Getting the answer involves gathering historical sales data and ensuring all the gathered details are accurate and updated. The answers will provide patterns or deviations over a specified period. By analyzing these trends, you’ll know the behavior of your target market and base your decisions on data instead of instinct.

| Key Metrics | |

| Revenue and Sales Growth Trends | Check sales revenue over a specific time Project business financial health Provide efficiency insights of sales strategies and marketing efforts |

| Customer Acquisition and Retention Trends | Show new customers acquisition rate Check efficiency of customer retention game plans Determine customer acquisition and retention processes pain points |

| Product or Service Performance Trends | Evaluate products and services performance based on sales and customer feedback Determine the success and popularity of specific offerings Help identify potential opportunities for product or service improvements |

| Market and Industry Trends | Assess the overall state and direction of the market and industry Identify emerging trends and changes that can impact sales and revenue Help you formulate the latest strategies at par with competitors |

| Competitor Sales Data Analysis and Benchmarking | Analyze the performance of competitors in the market Identify strengths and weaknesses of competitors' sales strategies Benchmark against industry peers to measure performance and identify areas for improvement. |

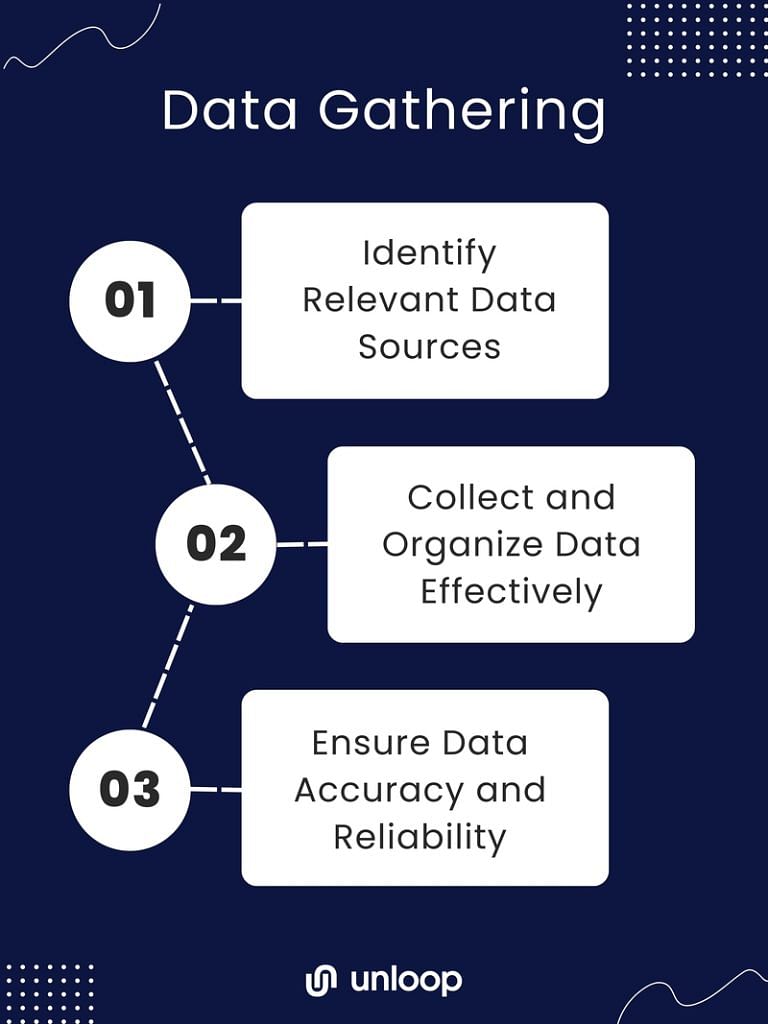

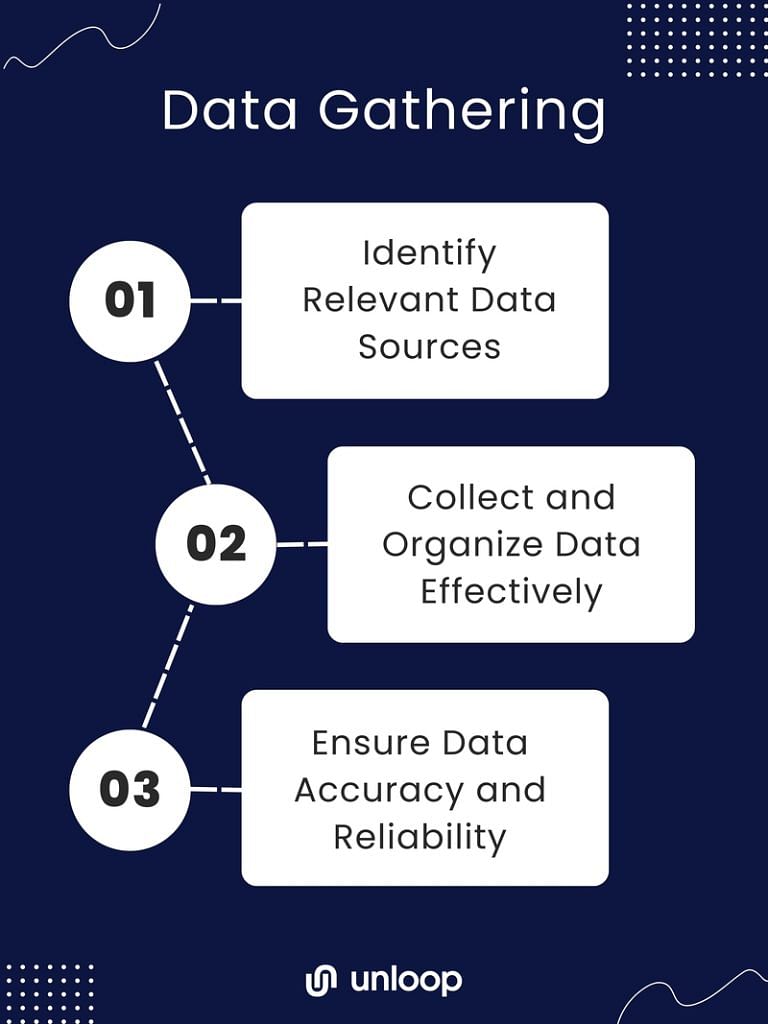

Gathering Data

If you want to make data gathering easier, keep an eye on the details and establish a process too. How so? You can check out the details below.

Identifying the sources that provide accurate and reliable data for analysis is crucial. This may include internal sources such as Customer Relationship Management (CRM) systems, different kinds of reports, and customer data. External sources like market research reports, industry publications, and competitor analysis can give you better financial judgment when monitored.

Once the relevant data sources are identified, collect and organize them. Capture data consistently over time using standardized formats, and maintain proper documentation. Because automated tools and data management systems are champions in streamlining collection, organization of information from various channels are done swiftly.

Validate the collected data to eliminate duplicates or errors and address inconsistencies. Regular audits and cross-checking with multiple sources help ensure reliable figures for analysis.

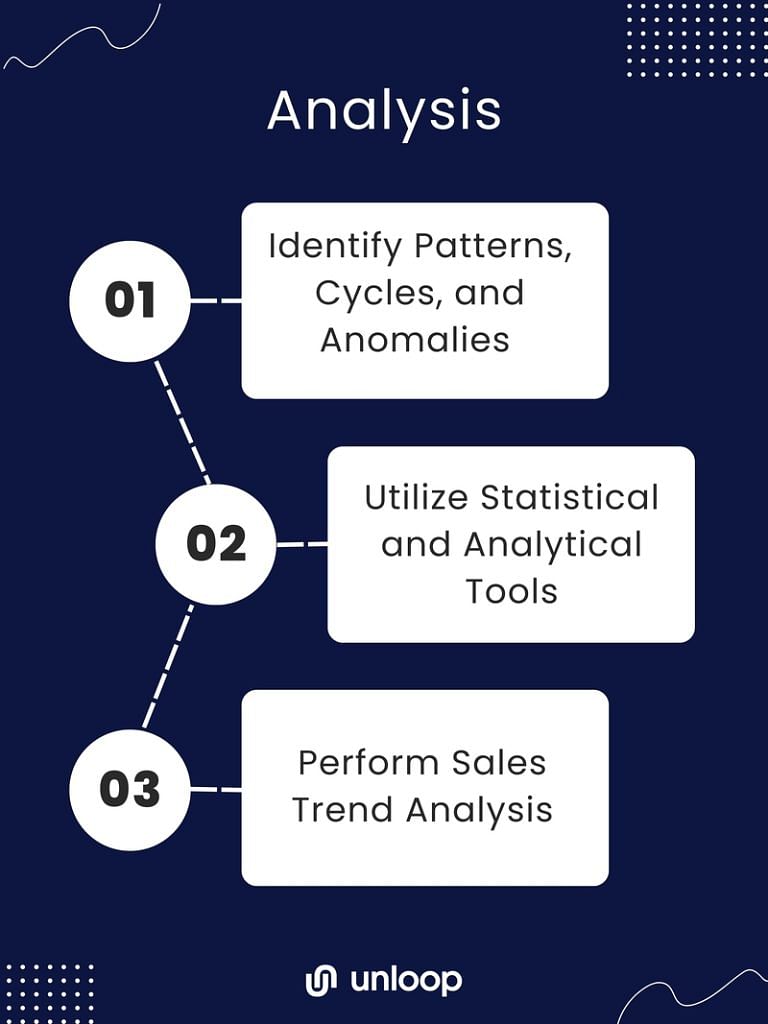

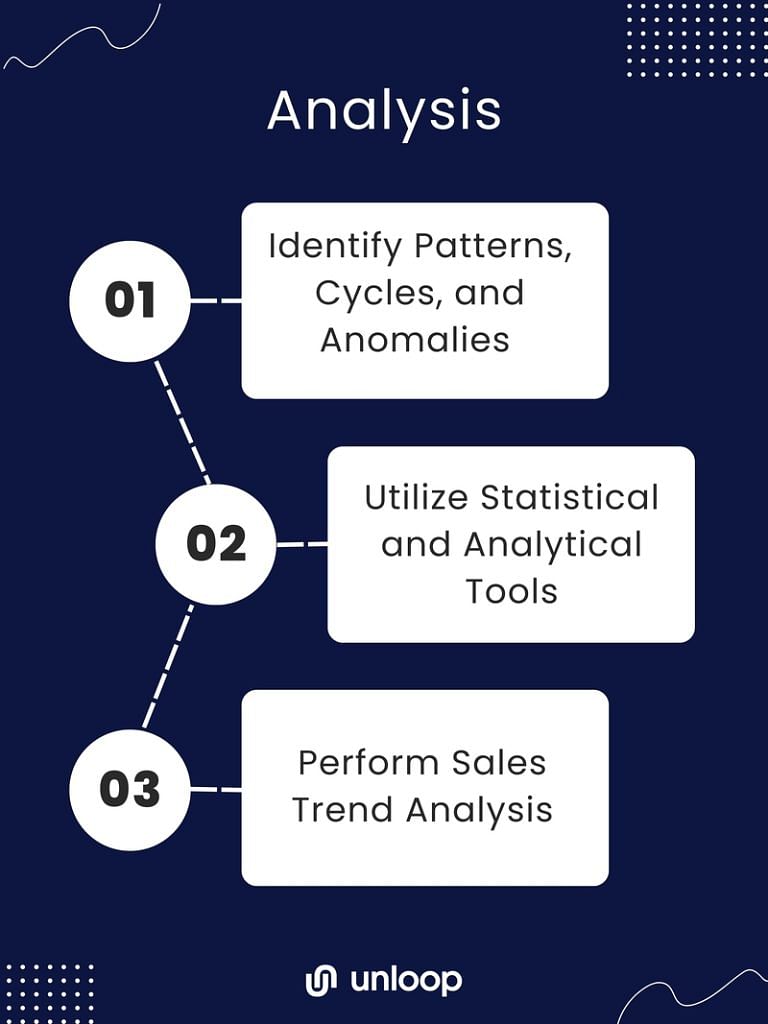

After gathering data and keeping them organized, you must know how to make sense of them, and below are just some ways to do so.

Identify patterns, cycles, and anomalies in your sales data. Once you notice the trends, you can come up with study and develop conclusions about your customers and the market.

Companies often rely on statistical and analytical tools to conduct STA effectively. These tools help to accurately measure and interpret sales patterns and fluctuations, identify key trends, and make data-driven decisions. From regression analysis to time-series forecasting models, these tools enable you to uncover hidden insights within your sales data.

However, merely identifying trends is not enough; it is equally crucial to interpret and understand the implications of these trends. You must assess whether the observed sales upwards or downwards shift trend is sustainable or just seasonal.

Understanding the implications of sales trends helps you adjust your strategies, make informed decisions, and adapt business operations accordingly. For example, a declining trend in sales may indicate the need for marketing efforts to reach new customers or develop new products. Seasonal sales cycles may need inventory levels or staffing adjustments.

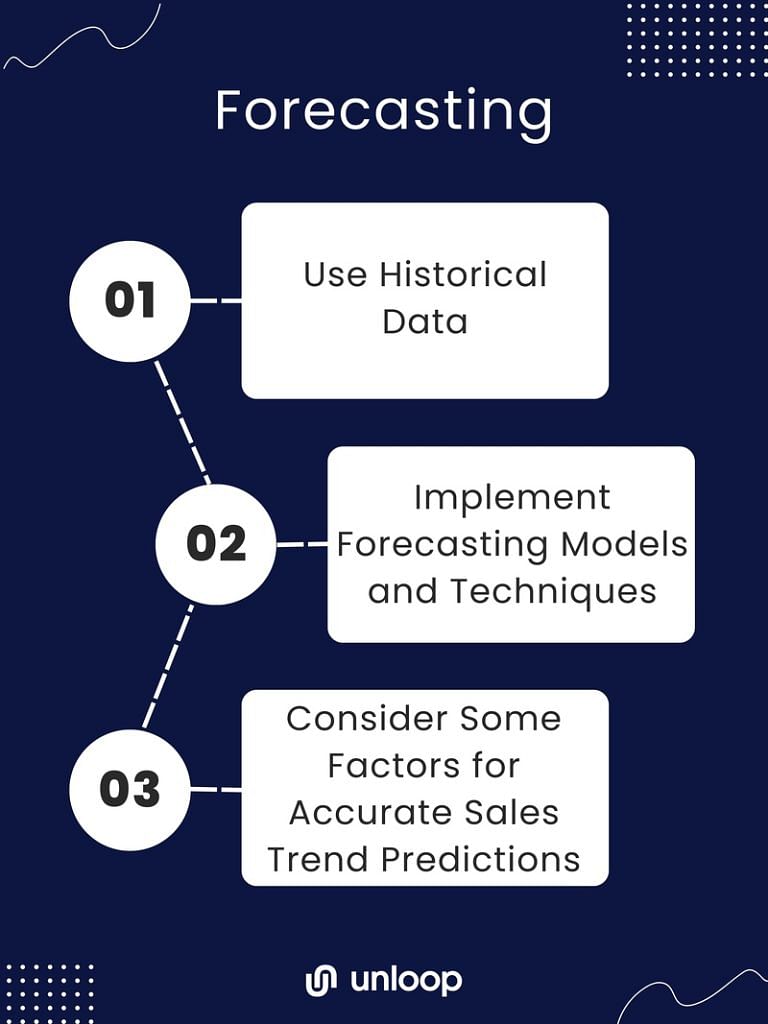

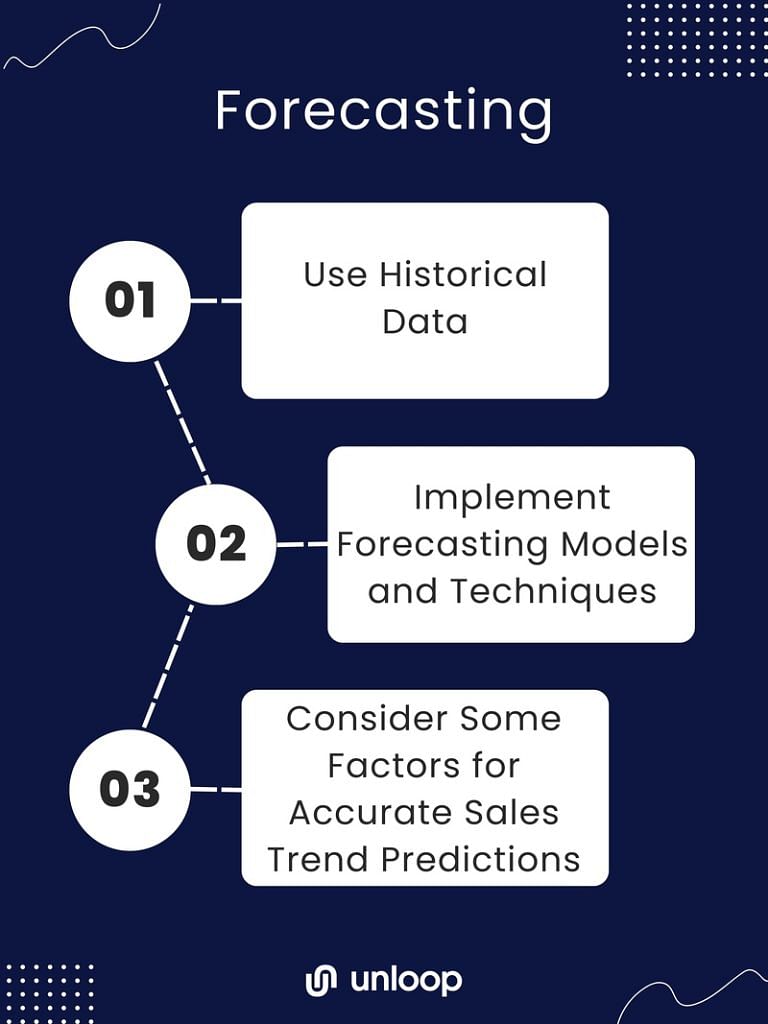

After doing an STA, you can further use data for sales forecasting. By leveraging historical data, implementing suitable forecasting models, and considering internal and external factors, you can gain meaningful insights into sales trends, facilitating better decision-making and maximizing profitability.

Historical sales data provides valuable insights into past performance, allowing you to identify patterns and trends. By analyzing previous sales figures, companies can determine seasonal fluctuations, identify successful marketing strategies, and forecast future sales based on historical patterns.

You can employ various forecasting models and techniques to predict sales trends accurately. These include quantitative methods like time series and regression analysis and qualitative methods like expert opinions and market research surveys. Employing a combination of techniques can enhance the accuracy of sales trend predictions.

To ensure accurate sales trend predictions, consider these:

Considering these components allows you to make more precise sales forecasts, enabling them to allocate resources effectively, streamline production, and adjust sales strategies accordingly.

Applying STA to business strategy provides valuable insights for improving areas of weakness, targeting the right markets, optimizing resource allocation, and staying adaptable. Businesses can leverage these insights to elevate their performance and drive sustained growth.

Analyze sales trends to identify areas for improvement. By studying patterns in customer behavior and sales data, you can pinpoint areas of weakness and take corrective measures including product feature improvement, perfecting customer service, or refining pricing strategies.

STA enables you to adjust your sales strategies and target markets. By closely monitoring trends, you can understand shifts in customer preferences, buying habits, or industry trends. With this knowledge, businesses can realign their sales tactics and focus on target markets that show growth potential.

STA helps identify high-potential areas where resources are best allocated. This ensures that marketing and sales efforts are focused on segments with the highest likelihood of yielding positive results.

Organizations like yours can identify emerging opportunities or threats by continuously evaluating sales trends and adjusting their sales strategy accordingly. Through this, you can stay flexible and adaptable to market changes.

Regarding STA, a range of software and tools are available to assist you in understanding and interpreting sales data. Some popular options include CRM software, business intelligence platforms, and data visualization tools. These tools include tracking sales metrics, generating reports, and providing predictive analytics.

Evaluating and selecting the right tools for specific needs requires careful consideration. You should assess your business requirements and goals before making a decision. Factors to consider include:

Integrate Analysis Tools Into Existing Systems

Integrate STA tools into your existing systems to ensure seamless data flow and avoid duplication of efforts. The tool you select should be able to integrate with other systems, such as CRM, ERP, or POS software, to gather data automatically.

This integration allows for you to create powerful dashboards for real-time data analysis. It also reduces manual data entry and enhances the accuracy of the insights gained. Additionally, system integration enables data sharing across different departments and management teams, facilitating collaboration and informed decision-making throughout the organization.

STA is a crucial component of strategic business planning, but it also comes with challenges and pitfalls. Knowing the difficulties in handling this task makes you more prepared in case you face them. You can also proactively avoid them by following some best practices.

| Challenges and Pitfalls | Best Practices |

Mastering STA is paramount for sustained success. We hope this guide has provided you with tools to decode market fluctuations and customer behaviors to help you decide better for your business.

The work will be lighter if you seek assistance and partner with experts, just like our team at Unloop. Our team is trained in bookkeeping, data gathering and management as well as financial reporting, so you won't find it difficult to collate, organize, and make sense of business data.

Let us help you do your trend analysis correctly. Contact us now!

Sales trend analysis (STA) is the cornerstone of sustainable business growth, so knowing its ins and outs is essential. As a rookie in the field, you must still be in the stage of learning the ropes, so we're here to help you.

This guide will equip you with essential skills to decipher market fluctuations, customer behaviors, and emerging patterns. We delve deep into sales data analysis techniques, empowering you to make informed decisions, optimize inventory, enhance customer experiences, and boost profitability.

From leveraging advanced analytics tools to practical tips on interpreting consumer preferences, this comprehensive resource is your road map to navigating the ever-changing ecommerce terrain. So, let's begin!

Making informed decisions and developing strategies are some benefits of STA. By understanding the underlying trends, companies can anticipate market demand, identify high-performing products or services, and focus on areas that require improvement.

A comprehensive sales analysis must consider these key components and factors.

((Current Period Value - Base Period Value) / Base Period Value) * 100

Getting the answer involves gathering historical sales data and ensuring all the gathered details are accurate and updated. The answers will provide patterns or deviations over a specified period. By analyzing these trends, you’ll know the behavior of your target market and base your decisions on data instead of instinct.

| Key Metrics | |

| Revenue and Sales Growth Trends | Check sales revenue over a specific time Project business financial health Provide efficiency insights of sales strategies and marketing efforts |

| Customer Acquisition and Retention Trends | Show new customers acquisition rate Check efficiency of customer retention game plans Determine customer acquisition and retention processes pain points |

| Product or Service Performance Trends | Evaluate products and services performance based on sales and customer feedback Determine the success and popularity of specific offerings Help identify potential opportunities for product or service improvements |

| Market and Industry Trends | Assess the overall state and direction of the market and industry Identify emerging trends and changes that can impact sales and revenue Help you formulate the latest strategies at par with competitors |

| Competitor Sales Data Analysis and Benchmarking | Analyze the performance of competitors in the market Identify strengths and weaknesses of competitors' sales strategies Benchmark against industry peers to measure performance and identify areas for improvement. |

Gathering Data

If you want to make data gathering easier, keep an eye on the details and establish a process too. How so? You can check out the details below.

Identifying the sources that provide accurate and reliable data for analysis is crucial. This may include internal sources such as Customer Relationship Management (CRM) systems, different kinds of reports, and customer data. External sources like market research reports, industry publications, and competitor analysis can give you better financial judgment when monitored.

Once the relevant data sources are identified, collect and organize them. Capture data consistently over time using standardized formats, and maintain proper documentation. Because automated tools and data management systems are champions in streamlining collection, organization of information from various channels are done swiftly.

Validate the collected data to eliminate duplicates or errors and address inconsistencies. Regular audits and cross-checking with multiple sources help ensure reliable figures for analysis.

After gathering data and keeping them organized, you must know how to make sense of them, and below are just some ways to do so.

Identify patterns, cycles, and anomalies in your sales data. Once you notice the trends, you can come up with study and develop conclusions about your customers and the market.

Companies often rely on statistical and analytical tools to conduct STA effectively. These tools help to accurately measure and interpret sales patterns and fluctuations, identify key trends, and make data-driven decisions. From regression analysis to time-series forecasting models, these tools enable you to uncover hidden insights within your sales data.

However, merely identifying trends is not enough; it is equally crucial to interpret and understand the implications of these trends. You must assess whether the observed sales upwards or downwards shift trend is sustainable or just seasonal.

Understanding the implications of sales trends helps you adjust your strategies, make informed decisions, and adapt business operations accordingly. For example, a declining trend in sales may indicate the need for marketing efforts to reach new customers or develop new products. Seasonal sales cycles may need inventory levels or staffing adjustments.

After doing an STA, you can further use data for sales forecasting. By leveraging historical data, implementing suitable forecasting models, and considering internal and external factors, you can gain meaningful insights into sales trends, facilitating better decision-making and maximizing profitability.

Historical sales data provides valuable insights into past performance, allowing you to identify patterns and trends. By analyzing previous sales figures, companies can determine seasonal fluctuations, identify successful marketing strategies, and forecast future sales based on historical patterns.

You can employ various forecasting models and techniques to predict sales trends accurately. These include quantitative methods like time series and regression analysis and qualitative methods like expert opinions and market research surveys. Employing a combination of techniques can enhance the accuracy of sales trend predictions.

To ensure accurate sales trend predictions, consider these:

Considering these components allows you to make more precise sales forecasts, enabling them to allocate resources effectively, streamline production, and adjust sales strategies accordingly.

Applying STA to business strategy provides valuable insights for improving areas of weakness, targeting the right markets, optimizing resource allocation, and staying adaptable. Businesses can leverage these insights to elevate their performance and drive sustained growth.

Analyze sales trends to identify areas for improvement. By studying patterns in customer behavior and sales data, you can pinpoint areas of weakness and take corrective measures including product feature improvement, perfecting customer service, or refining pricing strategies.

STA enables you to adjust your sales strategies and target markets. By closely monitoring trends, you can understand shifts in customer preferences, buying habits, or industry trends. With this knowledge, businesses can realign their sales tactics and focus on target markets that show growth potential.

STA helps identify high-potential areas where resources are best allocated. This ensures that marketing and sales efforts are focused on segments with the highest likelihood of yielding positive results.

Organizations like yours can identify emerging opportunities or threats by continuously evaluating sales trends and adjusting their sales strategy accordingly. Through this, you can stay flexible and adaptable to market changes.

Regarding STA, a range of software and tools are available to assist you in understanding and interpreting sales data. Some popular options include CRM software, business intelligence platforms, and data visualization tools. These tools include tracking sales metrics, generating reports, and providing predictive analytics.

Evaluating and selecting the right tools for specific needs requires careful consideration. You should assess your business requirements and goals before making a decision. Factors to consider include:

Integrate Analysis Tools Into Existing Systems

Integrate STA tools into your existing systems to ensure seamless data flow and avoid duplication of efforts. The tool you select should be able to integrate with other systems, such as CRM, ERP, or POS software, to gather data automatically.

This integration allows for you to create powerful dashboards for real-time data analysis. It also reduces manual data entry and enhances the accuracy of the insights gained. Additionally, system integration enables data sharing across different departments and management teams, facilitating collaboration and informed decision-making throughout the organization.

STA is a crucial component of strategic business planning, but it also comes with challenges and pitfalls. Knowing the difficulties in handling this task makes you more prepared in case you face them. You can also proactively avoid them by following some best practices.

| Challenges and Pitfalls | Best Practices |

Mastering STA is paramount for sustained success. We hope this guide has provided you with tools to decode market fluctuations and customer behaviors to help you decide better for your business.

The work will be lighter if you seek assistance and partner with experts, just like our team at Unloop. Our team is trained in bookkeeping, data gathering and management as well as financial reporting, so you won't find it difficult to collate, organize, and make sense of business data.

Let us help you do your trend analysis correctly. Contact us now!

Are there moments you find yourself asking, “How often should you reconcile your bank account?”

Bank account reconciliation is an essential practice for maintaining financial accuracy and ensuring timely reporting. The task involves comparing your business's accounting records to your bank statement, identifying any discrepancies, and making necessary adjustments.

Through bank account reconciliation, you are sure that your financial records are accurate. Regularly reconciling your bank account not only helps to identify potential errors or fraudulent activity but also provides insight into your company's cash flow. By staying on top of these reconciliations, you can confidently make informed decisions.

With these, let us know the appropriate frequency for reconciling your bank account to achieve your goals and the benefits that come with it.

Bank reconciliation should be done on a regular basis, preferably monthly or quarterly, to ensure accuracy between bank statements and accounting records and to detect any discrepancies or errors.

To help you decide better on how often you should do your business bank reconciliation, let us go through the benefits of the different schedules and the process in doing them.

Performing weekly bank reconciliations can help you maintain up-to-date financial records and monitor your cash flow effectively. By reconciling your bank account and books weekly, you can spot any discrepancies or potential fraud early on, allowing for swift resolution.

Weekly reconciliation assists you in managing your cash account and accounts receivable more effectively, avoiding overdraft fees, and ensuring sufficient funds for accounts payable.

To perform a weekly reconciliation, have a daily balance sheet and bank statement comparison. Identify and resolve any discrepancies, such as bank errors, adjusting journal entries, or unusual transactions. Reconcile each transaction individually to ensure accuracy.

Monthly reconciliation is crucial for tracking and controlling your business's cash flow and financial health. Banks typically send monthly statements for the previous month, making it essential to reconcile your books and bank balance regularly. By performing a monthly reconciliation, you can catch any missed payments, double payments, or accounting errors.

Focus on your daily and weekly cash account balance, and compare it with the bank statement balance. Make sure that outstanding checks, deposits in transit, bank charges, and interest income are all included in the details. If you find any discrepancies, make any necessary adjustments to journal entries or correct calculation errors for accuracy.

Conducting quarterly or annual reconciliations provides an opportunity to review your financial records comprehensively, identifying any possible fraud or accounting errors that may have gone unnoticed during the weekly and monthly processes.

A more in-depth review of your financial records at the end of a quarter or fiscal year allows for a thorough analysis of your cash accounts, accounts payable, and accounts receivable.

Compile the bank statements for the entire quarter or year and compare them with your cash account and general ledger. Review the bank accounts for any unexplained transactions or discrepancies not identified during the weekly or monthly reconciliations. Make any necessary adjusting journal entries to correct discrepancies.

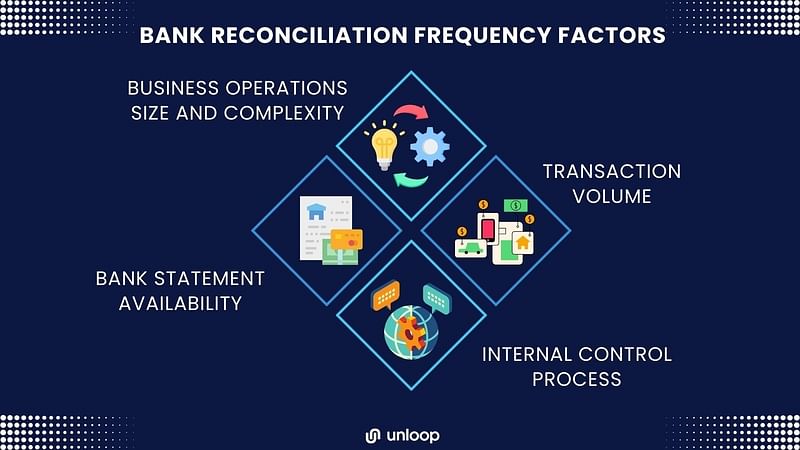

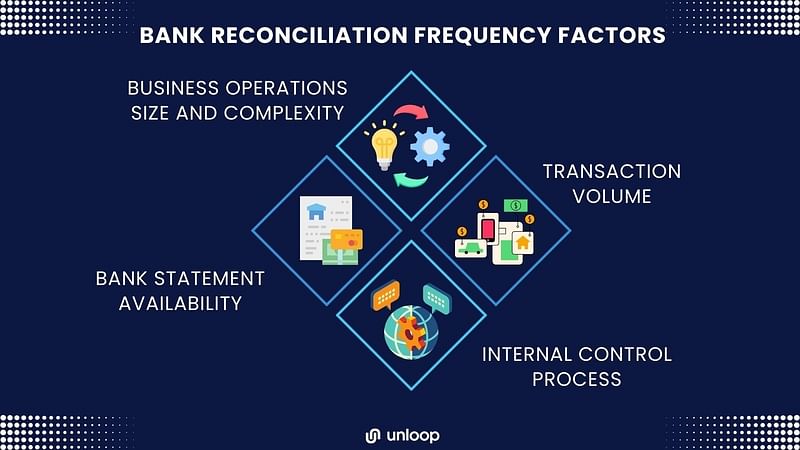

When considering how often to reconcile your bank account, consider the factors below too. These details can influence the best frequency for timely and accurate financial reporting.

Larger businesses with more complex operations may need to reconcile their bank accounts more frequently, as they are likely to have more transactions and a higher risk of fraud or accounting errors. Smaller businesses with fewer transactions, on the other hand, may be able to perform bank reconciliations less frequently, such as on a monthly basis, without sacrificing the accuracy of their financial reporting.

A higher volume of transactions can lead to more potential discrepancies between your cash account and your bank statement. Therefore, if your business has a high volume of transactions, it may be more efficient and accurate to reconcile your bank account more frequently, such as weekly or even daily. Conversely, businesses with lower transaction volumes might find it sufficient to reconcile their accounts on a monthly basis.

The frequency at which your bank provides statements will also influence reconciliation prevalence. Typically, banks send monthly statements, which aligns well with a monthly reconciliation schedule. However, with online banking and access to daily transaction updates, you may choose to reconcile your account more frequently to stay on top of your financial records.

The strength of your internal control processes will play a role in bank reconciliation frequency. Segregation of duties and a thorough review process will allow for timely identification and resolution of discrepancies. You can minimize the risk of fraud and accounting errors whether you choose to reconcile your bank account daily, weekly, or monthly.

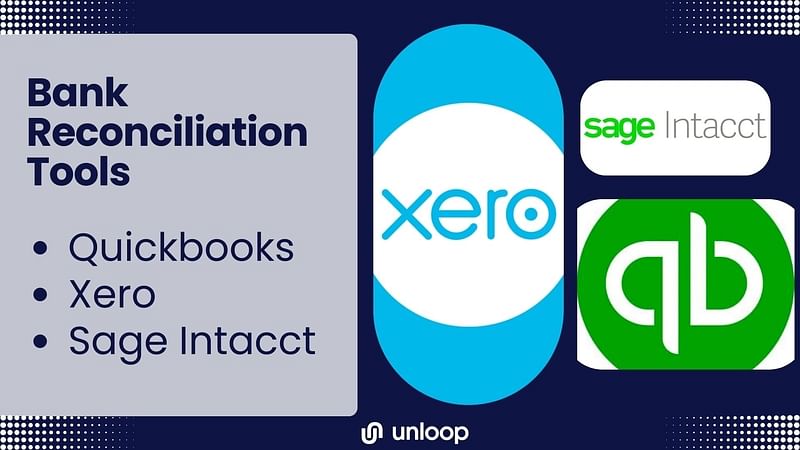

Reconciling your bank account regularly for timely and accurate financial reporting will be easier with the various software available. The tools below can help streamline your bank reconciliation process to improve efficiency and reduce errors.

You cannot miss QuickBooks in accounting. This tool offers features for reconciling bank accounts and credit card transactions, making it easier for you to identify discrepancies in your financial records and keeping financial data correct and updated.

Another accounting software that can assist in your reconciliation process is Xero. Xero provides tools for bank reconciliation, allowing you to efficiently track and match transactions. Its bank feed feature also reduces manual effort and increases accuracy.

Sage Intacct offers automated bank reconciliation capabilities. This cloud-based accounting tool helps you streamline the process and identify bank errors or discrepancies in your financial records quickly and efficiently.

BlackLine Account Reconciliation is an enterprise-grade solution that enables users to streamline the reconciliation process, improve productivity, and ensure accuracy.

ReconArt is a comprehensive reconciliation software that provides a unified platform for performing reconciliations across various accounts and sources.

FloQast is an accounting workflow automation platform that includes reconciliation capabilities, facilitating collaboration and ensuring accuracy during the process.

SAP S/4HANA is an integrated enterprise resource planning (ERP) system that includes built-in reconciliation functionality, minimizing manual effort and maximizing efficiency.

By now, you already have an idea on how often you should do your bank reconciliation for your business. But before you get going check out these mistakes and challenges first. By being aware of these common mistakes and challenges, you can ensure a more timely and accurate bank reconciliation process.

Bank account reconciliation is essential for maintaining accurate financial records and identifying discrepancies before they escalate. By reconciling your accounts on a regular basis, you can ensure the integrity of your cash flow and make informed financial decisions.

For seamless bookkeeping and expert assistance with bank reconciliations, consider partnering with us here Unloop. With our range of financial services, from accounts payable, payroll, and tax assistance, we'll help you keep your records up to date and accurate, giving you peace of mind and more time to focus on growing your business.

Contact us now to get started!

Are there moments you find yourself asking, “How often should you reconcile your bank account?”

Bank account reconciliation is an essential practice for maintaining financial accuracy and ensuring timely reporting. The task involves comparing your business's accounting records to your bank statement, identifying any discrepancies, and making necessary adjustments.

Through bank account reconciliation, you are sure that your financial records are accurate. Regularly reconciling your bank account not only helps to identify potential errors or fraudulent activity but also provides insight into your company's cash flow. By staying on top of these reconciliations, you can confidently make informed decisions.

With these, let us know the appropriate frequency for reconciling your bank account to achieve your goals and the benefits that come with it.

Bank reconciliation should be done on a regular basis, preferably monthly or quarterly, to ensure accuracy between bank statements and accounting records and to detect any discrepancies or errors.

To help you decide better on how often you should do your business bank reconciliation, let us go through the benefits of the different schedules and the process in doing them.

Performing weekly bank reconciliations can help you maintain up-to-date financial records and monitor your cash flow effectively. By reconciling your bank account and books weekly, you can spot any discrepancies or potential fraud early on, allowing for swift resolution.

Weekly reconciliation assists you in managing your cash account and accounts receivable more effectively, avoiding overdraft fees, and ensuring sufficient funds for accounts payable.

To perform a weekly reconciliation, have a daily balance sheet and bank statement comparison. Identify and resolve any discrepancies, such as bank errors, adjusting journal entries, or unusual transactions. Reconcile each transaction individually to ensure accuracy.

Monthly reconciliation is crucial for tracking and controlling your business's cash flow and financial health. Banks typically send monthly statements for the previous month, making it essential to reconcile your books and bank balance regularly. By performing a monthly reconciliation, you can catch any missed payments, double payments, or accounting errors.

Focus on your daily and weekly cash account balance, and compare it with the bank statement balance. Make sure that outstanding checks, deposits in transit, bank charges, and interest income are all included in the details. If you find any discrepancies, make any necessary adjustments to journal entries or correct calculation errors for accuracy.

Conducting quarterly or annual reconciliations provides an opportunity to review your financial records comprehensively, identifying any possible fraud or accounting errors that may have gone unnoticed during the weekly and monthly processes.

A more in-depth review of your financial records at the end of a quarter or fiscal year allows for a thorough analysis of your cash accounts, accounts payable, and accounts receivable.

Compile the bank statements for the entire quarter or year and compare them with your cash account and general ledger. Review the bank accounts for any unexplained transactions or discrepancies not identified during the weekly or monthly reconciliations. Make any necessary adjusting journal entries to correct discrepancies.

When considering how often to reconcile your bank account, consider the factors below too. These details can influence the best frequency for timely and accurate financial reporting.

Larger businesses with more complex operations may need to reconcile their bank accounts more frequently, as they are likely to have more transactions and a higher risk of fraud or accounting errors. Smaller businesses with fewer transactions, on the other hand, may be able to perform bank reconciliations less frequently, such as on a monthly basis, without sacrificing the accuracy of their financial reporting.

A higher volume of transactions can lead to more potential discrepancies between your cash account and your bank statement. Therefore, if your business has a high volume of transactions, it may be more efficient and accurate to reconcile your bank account more frequently, such as weekly or even daily. Conversely, businesses with lower transaction volumes might find it sufficient to reconcile their accounts on a monthly basis.

The frequency at which your bank provides statements will also influence reconciliation prevalence. Typically, banks send monthly statements, which aligns well with a monthly reconciliation schedule. However, with online banking and access to daily transaction updates, you may choose to reconcile your account more frequently to stay on top of your financial records.

The strength of your internal control processes will play a role in bank reconciliation frequency. Segregation of duties and a thorough review process will allow for timely identification and resolution of discrepancies. You can minimize the risk of fraud and accounting errors whether you choose to reconcile your bank account daily, weekly, or monthly.

Reconciling your bank account regularly for timely and accurate financial reporting will be easier with the various software available. The tools below can help streamline your bank reconciliation process to improve efficiency and reduce errors.

You cannot miss QuickBooks in accounting. This tool offers features for reconciling bank accounts and credit card transactions, making it easier for you to identify discrepancies in your financial records and keeping financial data correct and updated.

Another accounting software that can assist in your reconciliation process is Xero. Xero provides tools for bank reconciliation, allowing you to efficiently track and match transactions. Its bank feed feature also reduces manual effort and increases accuracy.

Sage Intacct offers automated bank reconciliation capabilities. This cloud-based accounting tool helps you streamline the process and identify bank errors or discrepancies in your financial records quickly and efficiently.

BlackLine Account Reconciliation is an enterprise-grade solution that enables users to streamline the reconciliation process, improve productivity, and ensure accuracy.

ReconArt is a comprehensive reconciliation software that provides a unified platform for performing reconciliations across various accounts and sources.

FloQast is an accounting workflow automation platform that includes reconciliation capabilities, facilitating collaboration and ensuring accuracy during the process.

SAP S/4HANA is an integrated enterprise resource planning (ERP) system that includes built-in reconciliation functionality, minimizing manual effort and maximizing efficiency.

By now, you already have an idea on how often you should do your bank reconciliation for your business. But before you get going check out these mistakes and challenges first. By being aware of these common mistakes and challenges, you can ensure a more timely and accurate bank reconciliation process.

Bank account reconciliation is essential for maintaining accurate financial records and identifying discrepancies before they escalate. By reconciling your accounts on a regular basis, you can ensure the integrity of your cash flow and make informed financial decisions.

For seamless bookkeeping and expert assistance with bank reconciliations, consider partnering with us here Unloop. With our range of financial services, from accounts payable, payroll, and tax assistance, we'll help you keep your records up to date and accurate, giving you peace of mind and more time to focus on growing your business.

Contact us now to get started!

Tax collection and calculation can be a complex and overwhelming process for Amazon sellers like you. It’s especially challenging if you are operating across international borders, between the US and Canada. You surely have wondered, "How is tax calculated on Amazon?"

Let us answer that question and provide you with a comprehensive overview of how taxes are calculated on Amazon for transacting between the US and Canada. From explaining the different types of taxes imposed by both countries to outlining the necessary steps for tax collection, this guide will equip you with the knowledge and tools to navigate the tax landscape on Amazon effortlessly and efficiently.

Amazon calculates its tax based on the applicable tax laws and regulations of the jurisdictions where it operates, taking into account factors such as sales, income, and other taxable criteria.

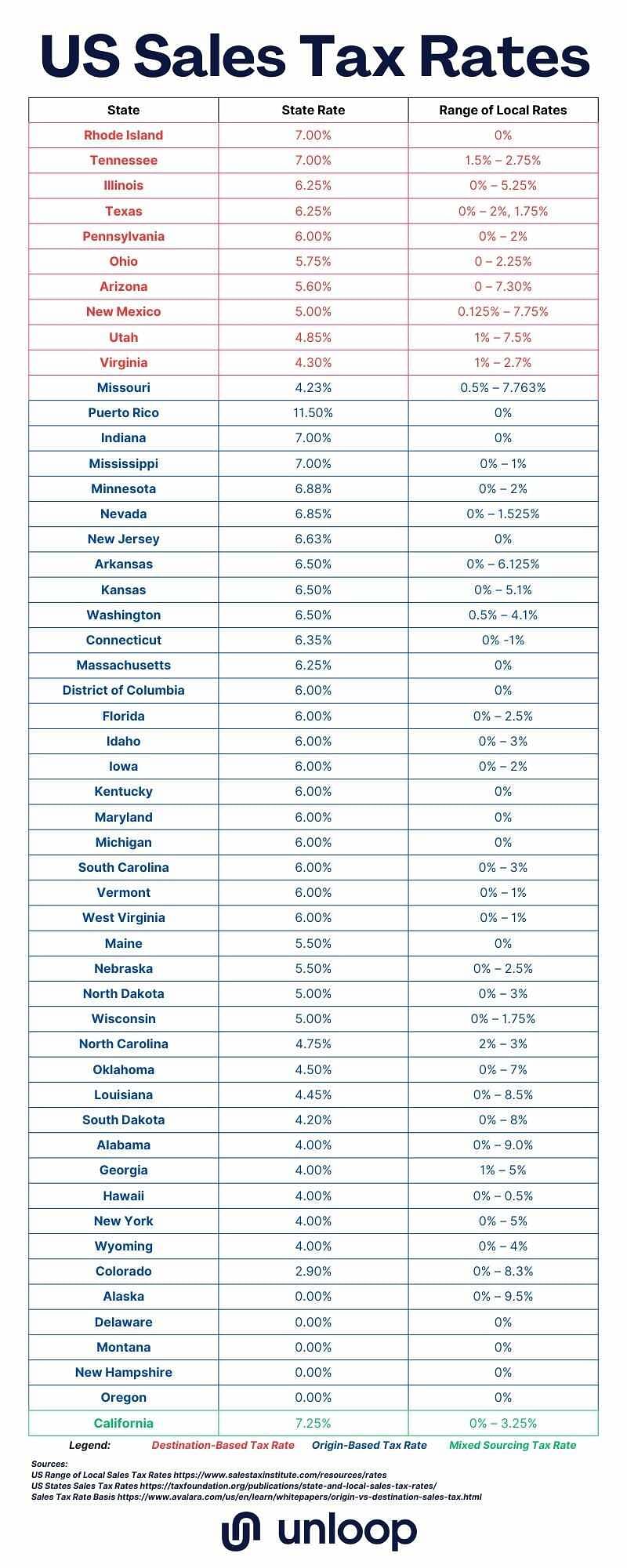

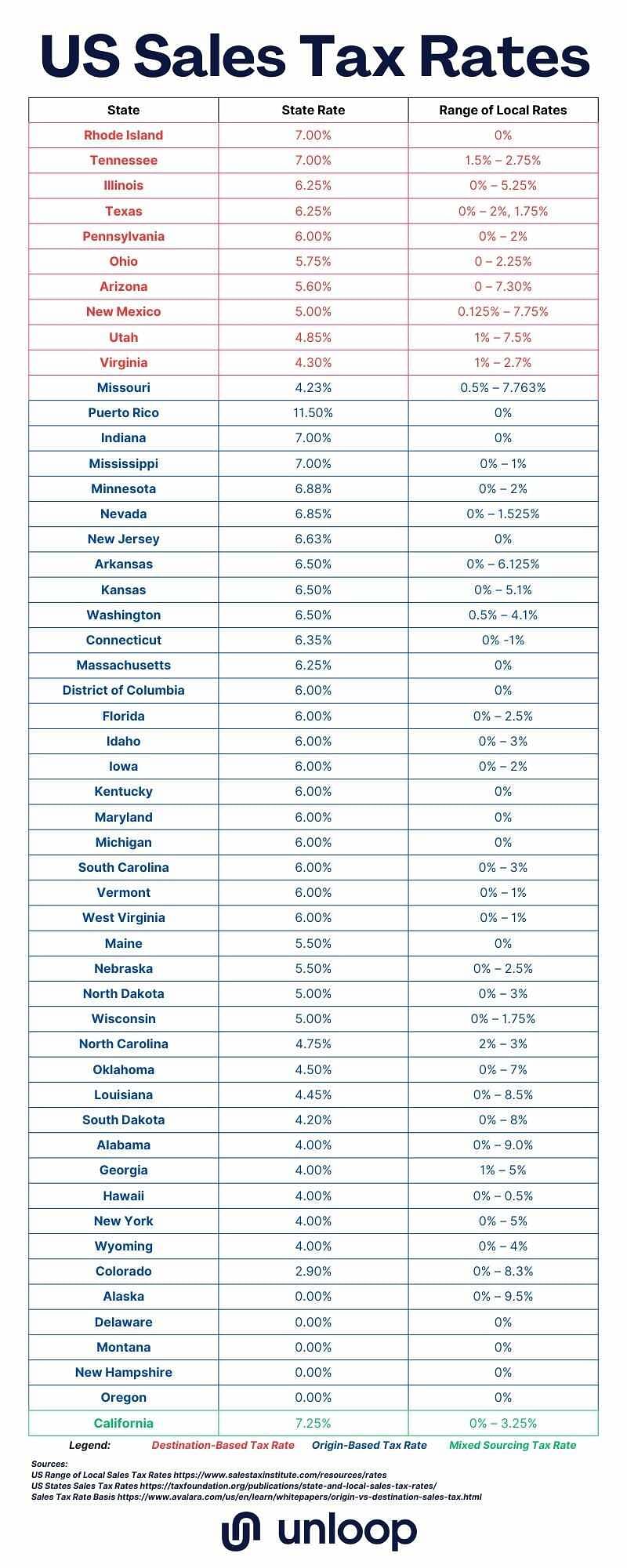

In the United States, tax charges on Amazon orders depend on various factors, such as the type of item or service sold and the shipping destination or origin. Each state has its own set of sales and use tax rates that need to be considered when calculating taxes on transactions.

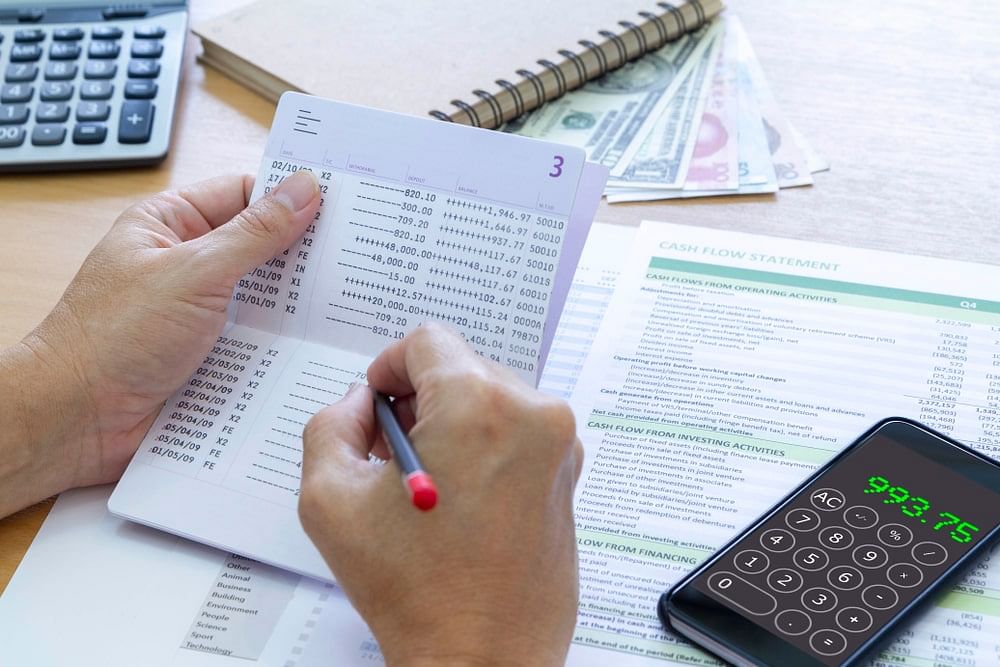

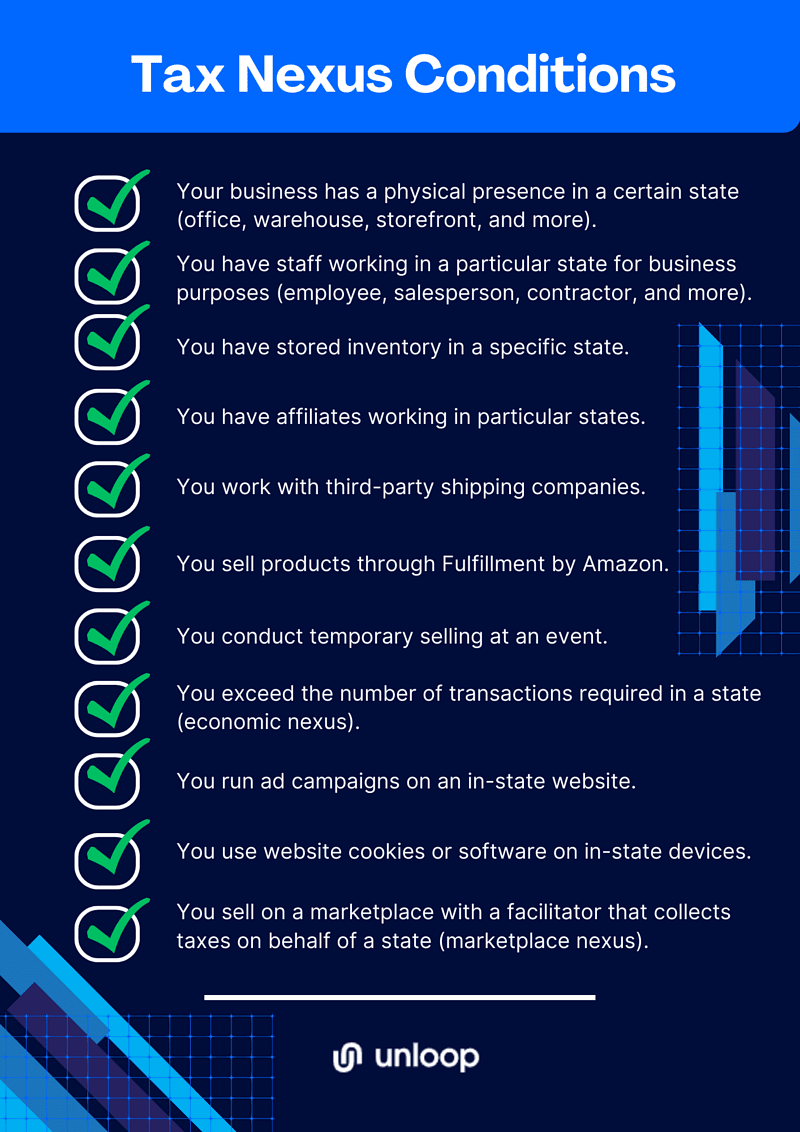

There are two main factors affecting sales taxes in the US: tax nexus and the Marketplace Facilitator Laws (MPF). Let us know what these two mean for your business.

A nexus is a legal term used to describe a significant presence in a state. It can be based on several factors, such as the location of your offices, employees, warehouses, or fulfillment centers. If your business has a nexus in a state where it sells products, you must collect and remit sales taxes for that state.

You can skip the hassle of collecting and remitting sales taxes on Amazon as the MPF mandates the e-commerce giant do this. Nevertheless, Amazon does not cover local sales taxes not listed on the MPF. In these cases, you have to collect and remit them yourself.

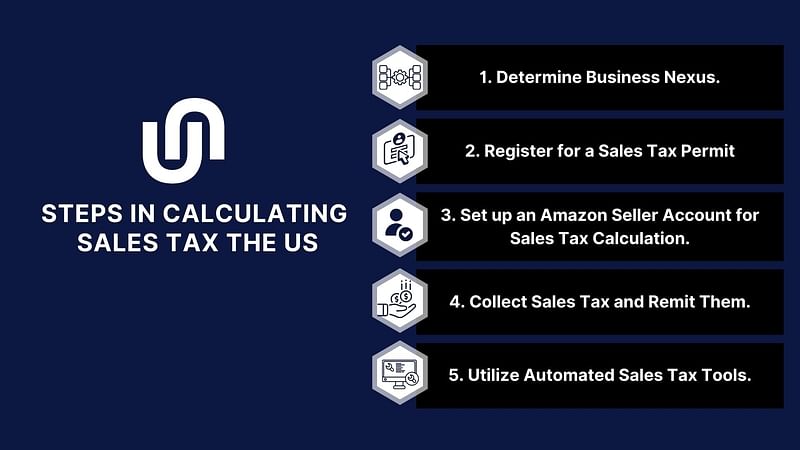

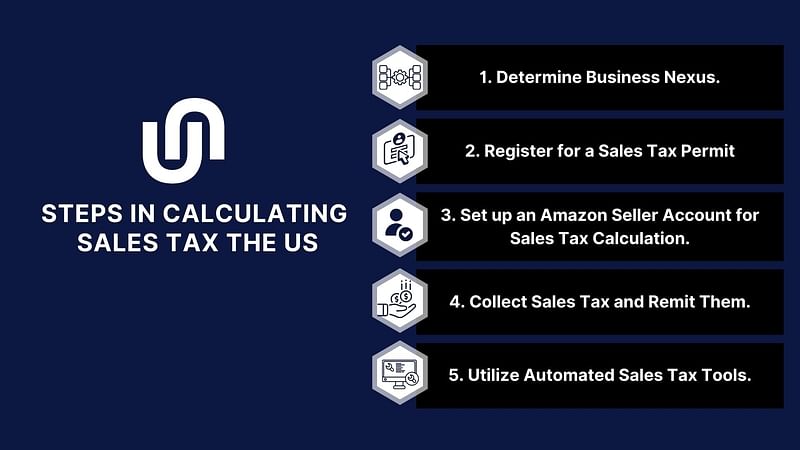

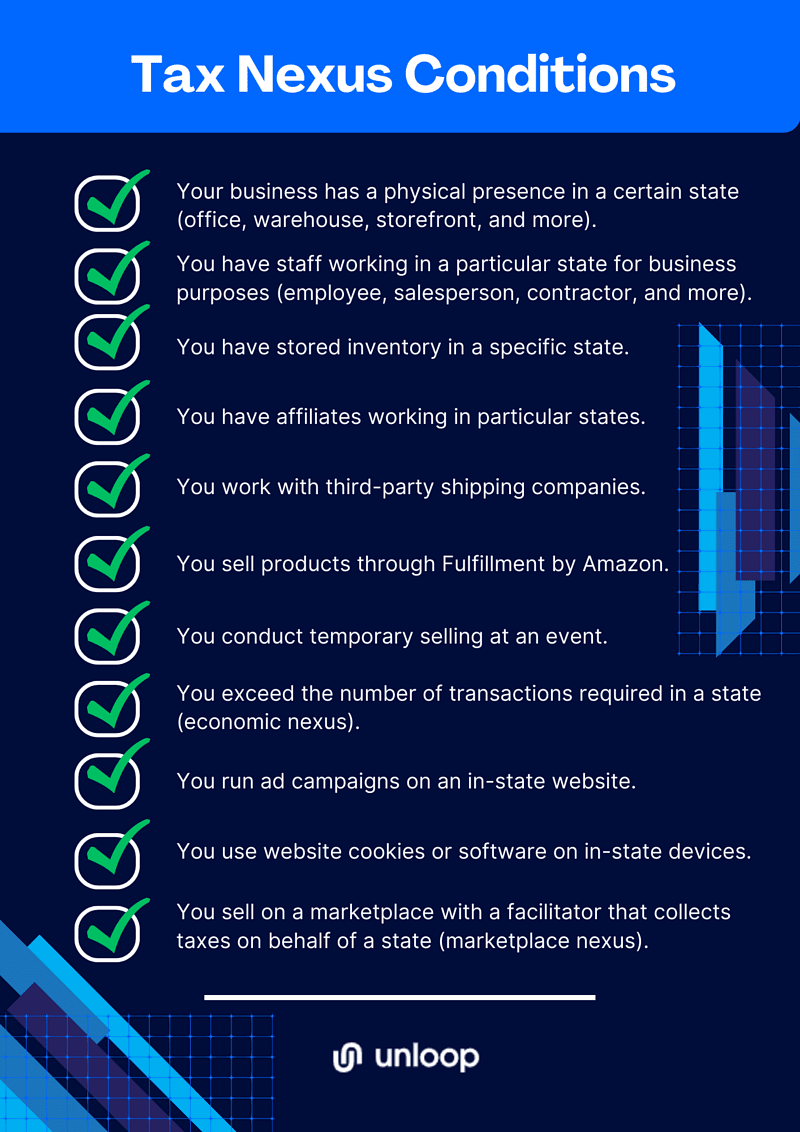

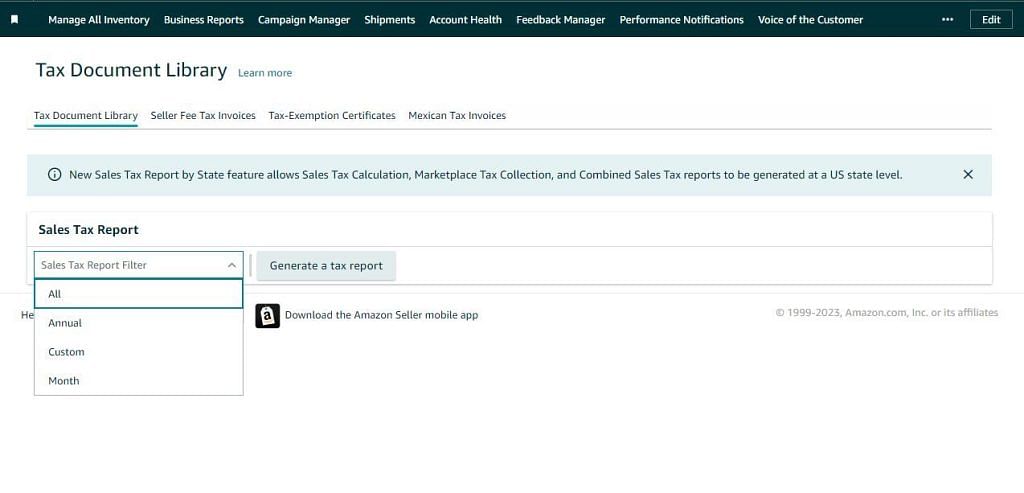

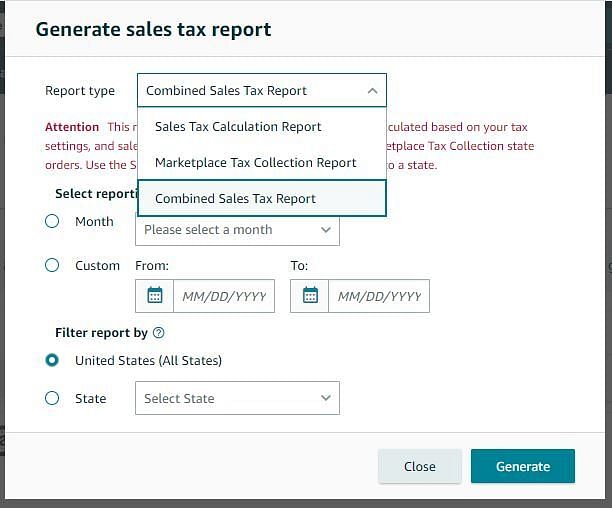

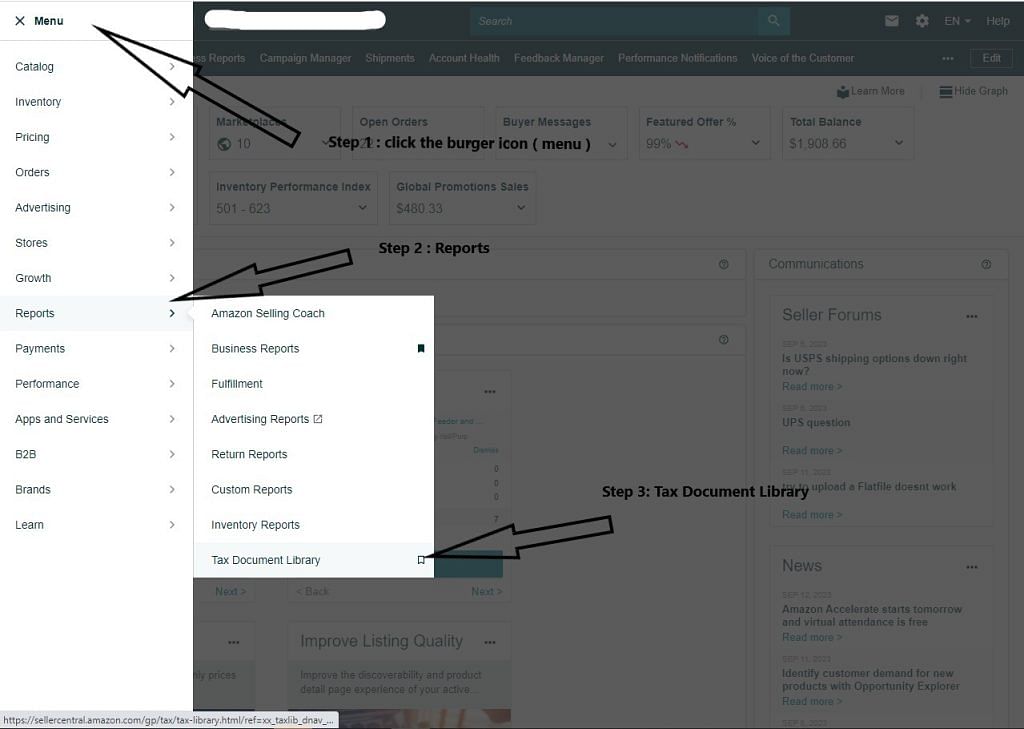

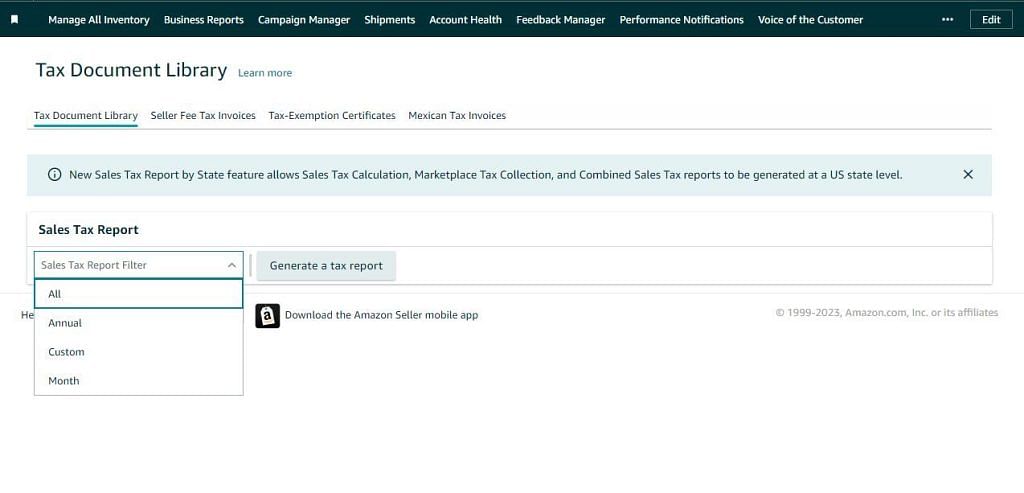

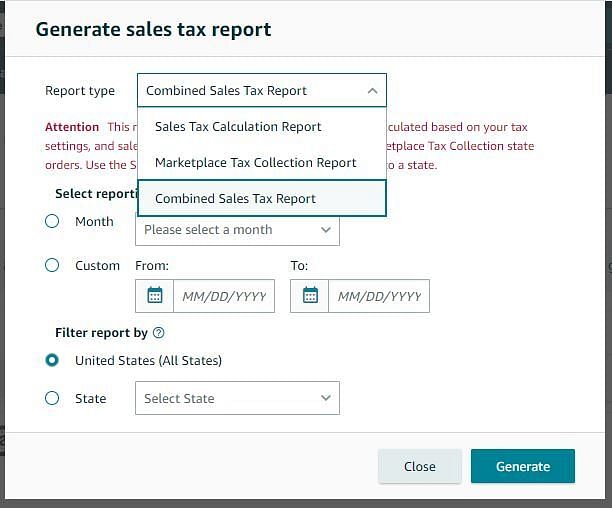

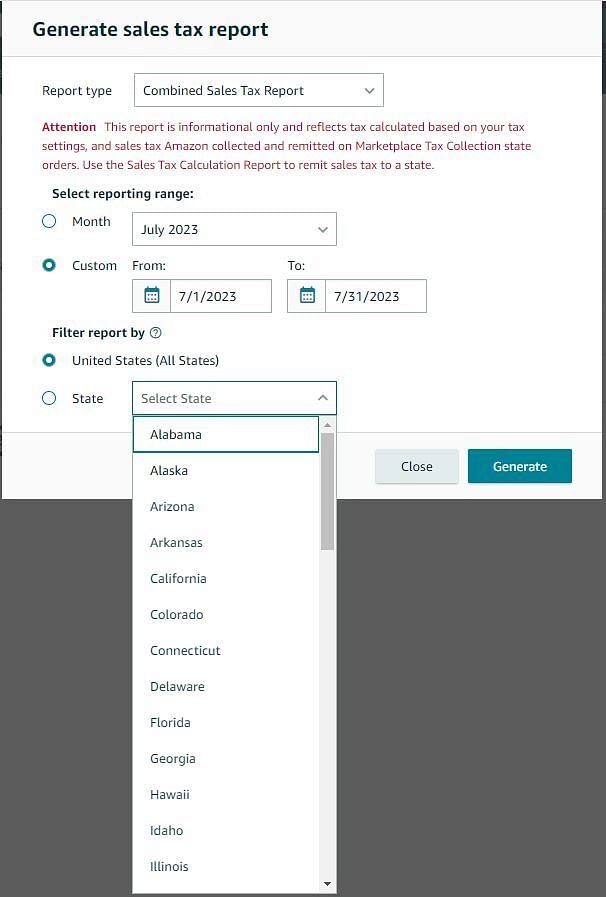

To make your US sales tax calculation and compliance on the platform easier, here are some steps you can follow.

Identify if you have a sales tax nexus in the states where you sell your products. This includes evaluating if you have a physical presence or economic nexus.

Remember that it's illegal to collect Amazon sales tax without a permit, so make sure to register at the state's revenue department.

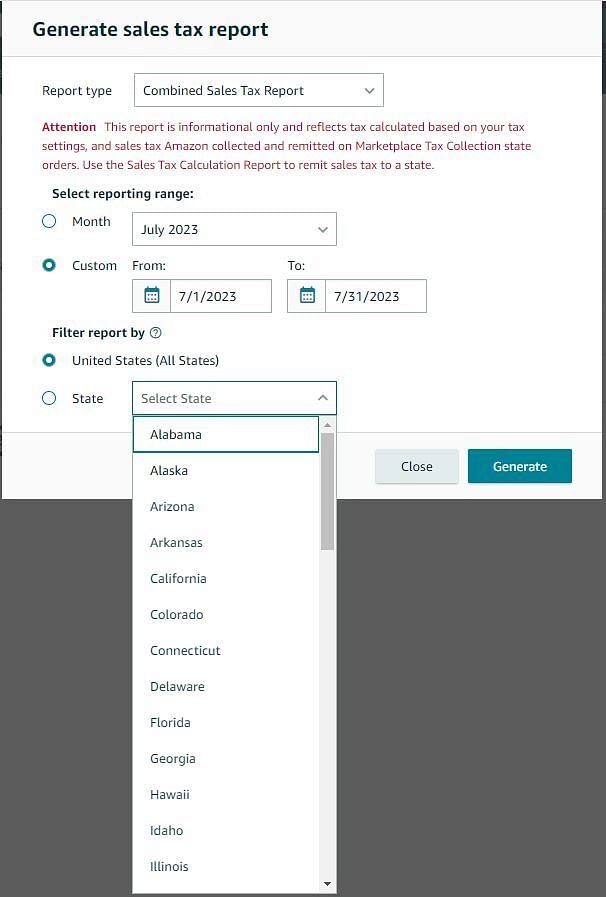

In your Amazon Seller Central account, set up your sales tax settings. Input the states where you need to collect sales tax, and assign product tax codes to your items to ensure the correct tax rates are applied.

Once your tax settings are configured, Amazon will automatically collect the appropriate sales tax based on the applicable tax rates for each state. Amazon will be responsible for remitting collected sales tax to the relevant tax authorities.

Consider using automated sales tax tools to help you in tracking, sales tax reporting, and filing your sales tax return. These tools can minimize human errors, save time, and help you comply with ever-changing sales tax laws.

Sales tax in Canada includes the different provincial taxes. With different rates applied to individual provinces, you must know the specific tax breakdown. Taxes include the Goods and Services Tax (GST), Provincial Sales Tax (PST), Harmonized Sales Tax (HST), and Quebec Sales Tax (QST). Each of which is determined by the selling price and shipping destination unless stated otherwise.

There are three main types of sales taxes in Canada. Each province and territory has its own PST rate and rules. Some locations have combined GST and PST into an HST.

The GST rate is 5%, and it is applied to most goods and services sold in the country. The collected taxes are used to fund public services and programs.

PST is a sales tax levied by individual provinces in Canada on the retail sale or lease of most goods and some services.

HST, on the other hand, is a combined federal and provincial sales tax that applies in provinces that have chosen to harmonize their sales tax with the federal GST. HST rates can be up to 15%.

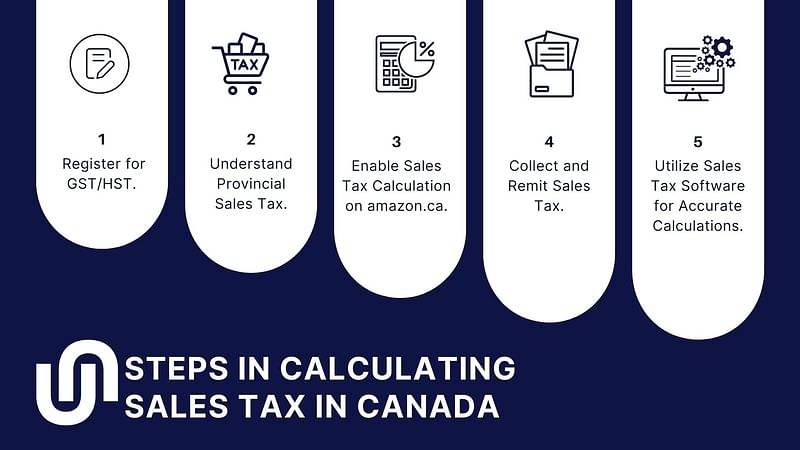

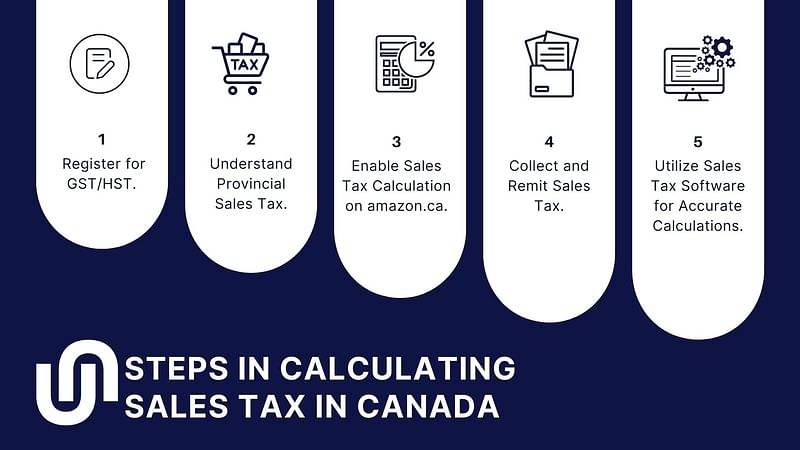

To ensure compliance with Canadian tax laws, follow these steps:

To collect and remit sales taxes, register to the Canada Revenue Agency (CRA), especially if your annual sales meet or exceed CAD 30,000.

Research the tax rates and rules for each location where you have a nexus to understand the specific PST or HST rates for each province or territory where you have a tax nexus.

Customize your tax settings in your Amazon Seller Central account to reflect the tax rates and rules of the provinces or territories where you have a nexus.

For tax-liable transactions on Amazon, the platform will automatically collect sales tax from customers at the specified rates in your tax settings. Amazon, through the MPF, files sales tax reports, and remits collected taxes to the CRA accordingly.

To make the sales tax calculation process easier and maintain accuracy, consider using sales tax software. These tools can automatically track tax rates, generate reports, and assist with the filing process if you integrate them into your Amazon Seller Central account.

You are well on your way now that you know how sales taxes work in the US and Canada. To ensure you'll do the tax calculation, collection, and remittance properly, here are some of the best practices you can follow.

To successfully navigate the US and Canadian sales tax on Amazon, stay updated with the latest tax laws and regulations in both countries. US sales tax is based on the combined state and local rates where your order is delivered to or from, while in Canada, businesses are obligated to register and collect GST, PST, or HST.

Using tax automation software can help simplify the tax calculation process on Amazon. These tools integrate with your Amazon Seller Central account and help to ensure accurate sales tax collection, management, and reporting. Through automation, you can minimize errors and allot saved time to essential business tasks.

Some tax software worth trying are the following:

Before selecting a tax software, consider your specific tax needs and consult with a tax professional or advisor to determine which software is best suited for your business.

Proper record-keeping is essential for tax compliance and accurate financial reporting. Maintain detailed records of your sales data, tax rates, and collected taxes. This practice will prove useful when filing sales tax returns, generating tax reports, and ensuring you remit the correct sales tax amount to the relevant tax authorities.

If you're unsure about tax laws or have complex tax situations, don't hesitate to seek professional assistance. Tax experts can help you navigate the intricacies of US and Canadian sales tax regulations, maintain compliance with tax requirements, and guide you in making informed decisions.

Calculating tax accurately on your Amazon sales is crucial to maintaining compliance with tax laws in the US and Canada. With proper tax calculation, you can avoid overcharging or undercharging sales tax on your transactions, ensuring smooth business operations and keeping customers satisfied and loyal.

To implement best practices for effective sales tax calculation, you can get valuable assistance from us here at Unloop. We offer comprehensive guidance on navigating taxes, helping you avoid common pitfalls and maintain compliance with tax authorities.

Take the first step in managing your sales tax obligations effectively by partnering with us. Let our expertise guide you through the complexities of tax calculation and compliance on Amazon, allowing you to focus on growing your business.

Book a call now!

Tax collection and calculation can be a complex and overwhelming process for Amazon sellers like you. It’s especially challenging if you are operating across international borders, between the US and Canada. You surely have wondered, "How is tax calculated on Amazon?"

Let us answer that question and provide you with a comprehensive overview of how taxes are calculated on Amazon for transacting between the US and Canada. From explaining the different types of taxes imposed by both countries to outlining the necessary steps for tax collection, this guide will equip you with the knowledge and tools to navigate the tax landscape on Amazon effortlessly and efficiently.

Amazon calculates its tax based on the applicable tax laws and regulations of the jurisdictions where it operates, taking into account factors such as sales, income, and other taxable criteria.

In the United States, tax charges on Amazon orders depend on various factors, such as the type of item or service sold and the shipping destination or origin. Each state has its own set of sales and use tax rates that need to be considered when calculating taxes on transactions.

There are two main factors affecting sales taxes in the US: tax nexus and the Marketplace Facilitator Laws (MPF). Let us know what these two mean for your business.

A nexus is a legal term used to describe a significant presence in a state. It can be based on several factors, such as the location of your offices, employees, warehouses, or fulfillment centers. If your business has a nexus in a state where it sells products, you must collect and remit sales taxes for that state.

You can skip the hassle of collecting and remitting sales taxes on Amazon as the MPF mandates the e-commerce giant do this. Nevertheless, Amazon does not cover local sales taxes not listed on the MPF. In these cases, you have to collect and remit them yourself.

To make your US sales tax calculation and compliance on the platform easier, here are some steps you can follow.

Identify if you have a sales tax nexus in the states where you sell your products. This includes evaluating if you have a physical presence or economic nexus.

Remember that it's illegal to collect Amazon sales tax without a permit, so make sure to register at the state's revenue department.

In your Amazon Seller Central account, set up your sales tax settings. Input the states where you need to collect sales tax, and assign product tax codes to your items to ensure the correct tax rates are applied.

Once your tax settings are configured, Amazon will automatically collect the appropriate sales tax based on the applicable tax rates for each state. Amazon will be responsible for remitting collected sales tax to the relevant tax authorities.

Consider using automated sales tax tools to help you in tracking, sales tax reporting, and filing your sales tax return. These tools can minimize human errors, save time, and help you comply with ever-changing sales tax laws.

Sales tax in Canada includes the different provincial taxes. With different rates applied to individual provinces, you must know the specific tax breakdown. Taxes include the Goods and Services Tax (GST), Provincial Sales Tax (PST), Harmonized Sales Tax (HST), and Quebec Sales Tax (QST). Each of which is determined by the selling price and shipping destination unless stated otherwise.

There are three main types of sales taxes in Canada. Each province and territory has its own PST rate and rules. Some locations have combined GST and PST into an HST.

The GST rate is 5%, and it is applied to most goods and services sold in the country. The collected taxes are used to fund public services and programs.

PST is a sales tax levied by individual provinces in Canada on the retail sale or lease of most goods and some services.

HST, on the other hand, is a combined federal and provincial sales tax that applies in provinces that have chosen to harmonize their sales tax with the federal GST. HST rates can be up to 15%.

To ensure compliance with Canadian tax laws, follow these steps:

To collect and remit sales taxes, register to the Canada Revenue Agency (CRA), especially if your annual sales meet or exceed CAD 30,000.

Research the tax rates and rules for each location where you have a nexus to understand the specific PST or HST rates for each province or territory where you have a tax nexus.

Customize your tax settings in your Amazon Seller Central account to reflect the tax rates and rules of the provinces or territories where you have a nexus.

For tax-liable transactions on Amazon, the platform will automatically collect sales tax from customers at the specified rates in your tax settings. Amazon, through the MPF, files sales tax reports, and remits collected taxes to the CRA accordingly.

To make the sales tax calculation process easier and maintain accuracy, consider using sales tax software. These tools can automatically track tax rates, generate reports, and assist with the filing process if you integrate them into your Amazon Seller Central account.

You are well on your way now that you know how sales taxes work in the US and Canada. To ensure you'll do the tax calculation, collection, and remittance properly, here are some of the best practices you can follow.

To successfully navigate the US and Canadian sales tax on Amazon, stay updated with the latest tax laws and regulations in both countries. US sales tax is based on the combined state and local rates where your order is delivered to or from, while in Canada, businesses are obligated to register and collect GST, PST, or HST.

Using tax automation software can help simplify the tax calculation process on Amazon. These tools integrate with your Amazon Seller Central account and help to ensure accurate sales tax collection, management, and reporting. Through automation, you can minimize errors and allot saved time to essential business tasks.

Some tax software worth trying are the following:

Before selecting a tax software, consider your specific tax needs and consult with a tax professional or advisor to determine which software is best suited for your business.

Proper record-keeping is essential for tax compliance and accurate financial reporting. Maintain detailed records of your sales data, tax rates, and collected taxes. This practice will prove useful when filing sales tax returns, generating tax reports, and ensuring you remit the correct sales tax amount to the relevant tax authorities.

If you're unsure about tax laws or have complex tax situations, don't hesitate to seek professional assistance. Tax experts can help you navigate the intricacies of US and Canadian sales tax regulations, maintain compliance with tax requirements, and guide you in making informed decisions.

Calculating tax accurately on your Amazon sales is crucial to maintaining compliance with tax laws in the US and Canada. With proper tax calculation, you can avoid overcharging or undercharging sales tax on your transactions, ensuring smooth business operations and keeping customers satisfied and loyal.

To implement best practices for effective sales tax calculation, you can get valuable assistance from us here at Unloop. We offer comprehensive guidance on navigating taxes, helping you avoid common pitfalls and maintain compliance with tax authorities.

Take the first step in managing your sales tax obligations effectively by partnering with us. Let our expertise guide you through the complexities of tax calculation and compliance on Amazon, allowing you to focus on growing your business.

Book a call now!

Taxes can be very challenging because they're very complicated and daunting. It can feel like you pay too much attention to too many things—all at once. Fortunately, the standard deduction is there to simplify things and lessen one's taxable income.

In this article, we will dive into what the standard deduction is, who is eligible for it, and how much it's worth in the federal income tax system this 2023.

The standard deduction is the government's way of conveniently lessening people's taxes. It works by providing a set deductible income per annual accounting period to decrease a payer's taxable income. Standard deduction eliminates the hassle of itemizing deductions annually and gives the lower class more breathing room for taxes.

Age, filing status, and income are the three critical characteristics from your taxpayer's profile that ensure standard deductions are levied fairly by the government. Let’s discuss them one by one.

Age, while not a requirement by the IRS or any related government agencies for tax return filing, can play a role in your standard deductions. For example, being over sixty-five lets taxpayers claim the standard deduction with an additional deduction amount. The same applies to taxpayers who are married and filing jointly, with at least one of them being above sixty-five years old.

Your filing status also affects the standard deduction and whether or not you can use it instead of itemizing deductions. For example, single filers have different standard deductions from married filers, and usually, married filers are given a bigger standard deduction.

Those married filing jointly must decide whether or not to use the standard deduction or lessen their taxable income using itemized deductions instead. For example, if a spouse itemizes deductions, their partner must follow suit. The same goes for the standard deduction.

But this does not mean all married taxpayers are required to file together; taxpayers married filing separately can still file their taxes without following their spouse's preference.

Since the standard deduction decreases your overall taxable income, your earnings play a huge role in determining it. This can be done by subtracting the year's rate of the standard deduction from your income, creating tax exemption, and lowering your overall r income tax.

Using your income also makes using the standard deduction advantageous compared to itemized deductions since the standard deduction is easier. Using your income provides you with a much larger deduction amount than itemizing each qualifying expense.

While age, filing status, and income significantly impact your standard deduction, the rate can still change due to other factors. Here are some characteristics that warrant an increase in standard deduction:

On the other hand, being declared dependent on someone else's federal income tax return reduces one's standard deduction instead of increasing it.

As mentioned in the section about spouses, taxpayers must only use one of the two forms of tax deductions used in a federal tax return for an accounting period: the standard deduction or itemized deductions. But what exactly is the main difference between the two?

| Standard Deduction | Itemized Deduction |

If you choose instead to itemize deductions instead of using the standard deduction, here are some expenses that qualify for tax cuts.

The standard deduction and itemized deductions are essentially the same—they both give people tax cuts and provide them with a fair way of deducting taxes. However, most people tend to gravitate towards using the standard deduction since it usually grants a larger amount, especially after the 2017 Tax Cuts and Job Acts, which inflated the standard deduction and lessened incentives for itemized deductions.

So, in a way, there is no better method of lessening your tax bill. What you can do is calculate your tax bill using both methods and choose the larger amount to ensure you maximize your right to minimize your taxes.

No, the standard deduction rate is not fixed; it changes yearly, as mandated, based on the annual accounting period. What remains the same annually are the qualifications for extra tax deductions, such as differences in filing status and other factors. However, these can change, too, depending again on the tax year.

| Standard Deduction: 2023 Rates |

Taxes, while each citizen's legal responsibility, can be such a hassle. Even with certain deductions in place, it can still be a headache trying to account for them. Fortunately, certain services in the market don't shy away from the numbers.

Unloop is one of the premier accounting services in the market. If you're having trouble with your taxes, try calling us at Unloop—we do taxes, too. Book a call with us here to know more of our services.

Taxes can be very challenging because they're very complicated and daunting. It can feel like you pay too much attention to too many things—all at once. Fortunately, the standard deduction is there to simplify things and lessen one's taxable income.

In this article, we will dive into what the standard deduction is, who is eligible for it, and how much it's worth in the federal income tax system this 2023.

The standard deduction is the government's way of conveniently lessening people's taxes. It works by providing a set deductible income per annual accounting period to decrease a payer's taxable income. Standard deduction eliminates the hassle of itemizing deductions annually and gives the lower class more breathing room for taxes.

Age, filing status, and income are the three critical characteristics from your taxpayer's profile that ensure standard deductions are levied fairly by the government. Let’s discuss them one by one.

Age, while not a requirement by the IRS or any related government agencies for tax return filing, can play a role in your standard deductions. For example, being over sixty-five lets taxpayers claim the standard deduction with an additional deduction amount. The same applies to taxpayers who are married and filing jointly, with at least one of them being above sixty-five years old.

Your filing status also affects the standard deduction and whether or not you can use it instead of itemizing deductions. For example, single filers have different standard deductions from married filers, and usually, married filers are given a bigger standard deduction.

Those married filing jointly must decide whether or not to use the standard deduction or lessen their taxable income using itemized deductions instead. For example, if a spouse itemizes deductions, their partner must follow suit. The same goes for the standard deduction.

But this does not mean all married taxpayers are required to file together; taxpayers married filing separately can still file their taxes without following their spouse's preference.

Since the standard deduction decreases your overall taxable income, your earnings play a huge role in determining it. This can be done by subtracting the year's rate of the standard deduction from your income, creating tax exemption, and lowering your overall r income tax.

Using your income also makes using the standard deduction advantageous compared to itemized deductions since the standard deduction is easier. Using your income provides you with a much larger deduction amount than itemizing each qualifying expense.

While age, filing status, and income significantly impact your standard deduction, the rate can still change due to other factors. Here are some characteristics that warrant an increase in standard deduction:

On the other hand, being declared dependent on someone else's federal income tax return reduces one's standard deduction instead of increasing it.

As mentioned in the section about spouses, taxpayers must only use one of the two forms of tax deductions used in a federal tax return for an accounting period: the standard deduction or itemized deductions. But what exactly is the main difference between the two?

| Standard Deduction | Itemized Deduction |

If you choose instead to itemize deductions instead of using the standard deduction, here are some expenses that qualify for tax cuts.

The standard deduction and itemized deductions are essentially the same—they both give people tax cuts and provide them with a fair way of deducting taxes. However, most people tend to gravitate towards using the standard deduction since it usually grants a larger amount, especially after the 2017 Tax Cuts and Job Acts, which inflated the standard deduction and lessened incentives for itemized deductions.

So, in a way, there is no better method of lessening your tax bill. What you can do is calculate your tax bill using both methods and choose the larger amount to ensure you maximize your right to minimize your taxes.

No, the standard deduction rate is not fixed; it changes yearly, as mandated, based on the annual accounting period. What remains the same annually are the qualifications for extra tax deductions, such as differences in filing status and other factors. However, these can change, too, depending again on the tax year.

| Standard Deduction: 2023 Rates |

Taxes, while each citizen's legal responsibility, can be such a hassle. Even with certain deductions in place, it can still be a headache trying to account for them. Fortunately, certain services in the market don't shy away from the numbers.

Unloop is one of the premier accounting services in the market. If you're having trouble with your taxes, try calling us at Unloop—we do taxes, too. Book a call with us here to know more of our services.

Most capital used in starting a business goes into buying assets for the company. These assets are then used to generate income for the business. However, tangible assets tend to lose value over time and garner a hefty tax bill for a business expense, making it important to learn how to calculate depreciation.

In this article, we'll discuss depreciation, the four ways of calculating it, and the kind of assets you can expect to save money on.

Depreciation is when tangible assets a company invests in loses its value over time due to the typical wear-and-tear of products or equipment. It is an accounting term that determines what an asset is worth. Knowing an item's value is important for businesses to save money from depreciation expenses. It is also essential in monitoring your financial records.

Assets depreciate at different rates. For example, factory equipment may depreciate faster than a company car. There are different ways of calculating depreciation for both. Different factors like asset cost and salvage value come into play to determine the depreciation value of an asset.

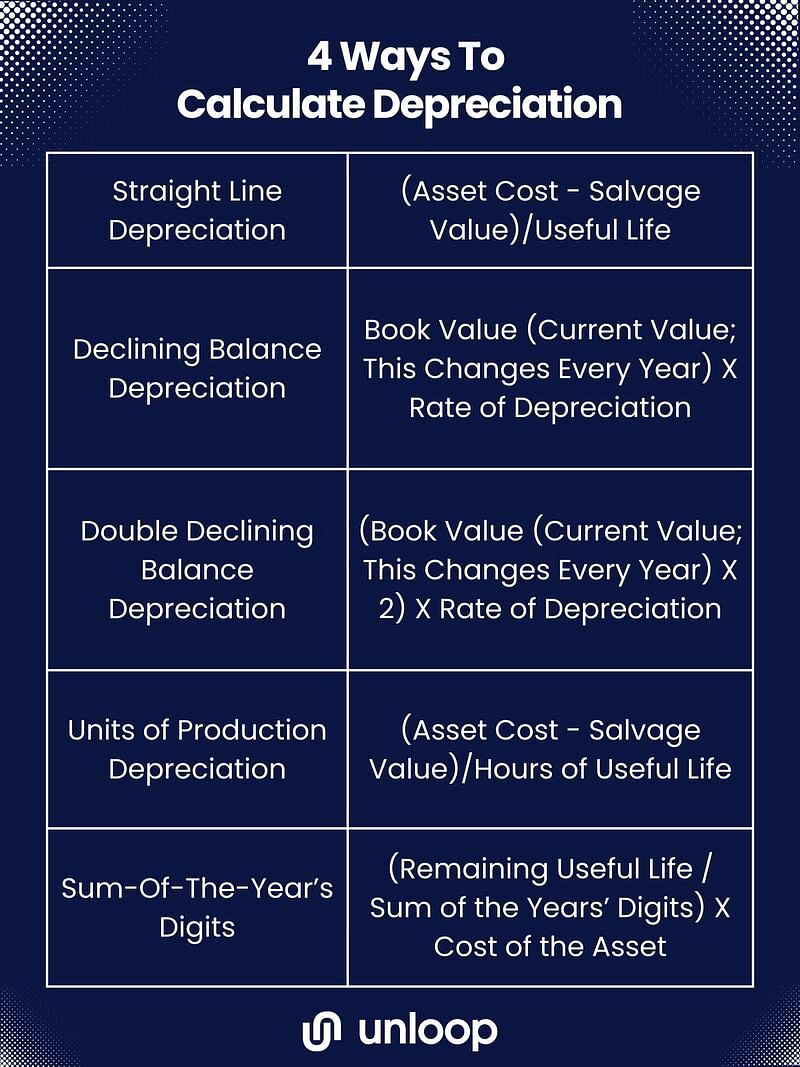

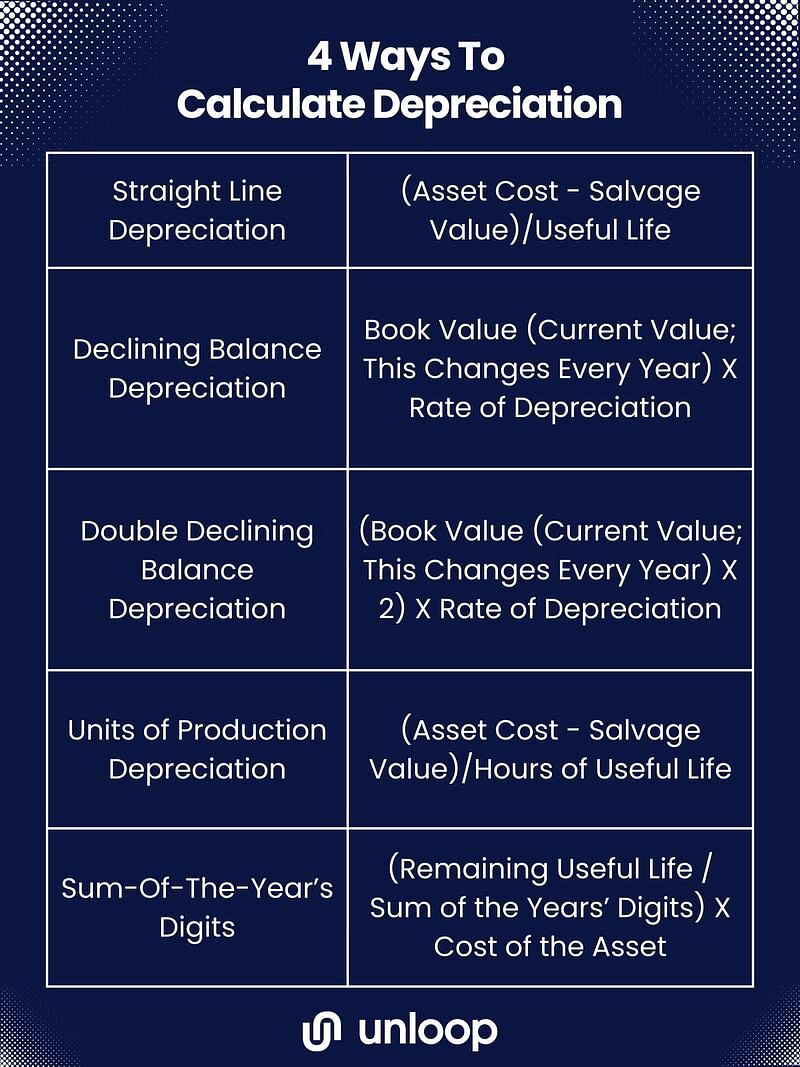

Here are four methods to determine depreciation with their respective formulas.

The straight-line depreciation method is the most common form of calculating depreciation, and it's pretty straightforward. All you have to do is subtract the salvage value from the asset's cost and divide the difference using the asset's useful life in years. The company determines the salvage value, and should be a reasonable amount based on IRS rules.

If a business or organization wants to dispose of assets that lose value quicker, like a company car, the declining balance depreciation method is the best way to go. The declining and double-declining balance methods show assets that depreciate faster, so companies can get more value from depreciation deductions sooner.

To get the depreciation value for a declining balance, you have to multiply the beginning book value of an asset by the rate of depreciation. (To get the depreciation rate, divide 100% by the years of an asset's expected life.)

The same formula applies to the double declining balance method, except you double the amount of the book value. The double declining balance method is typically used to accelerate an asset's depreciation value for taxable income.

Machinery or equipment depreciates at a different rate than other assets because they are used constantly. Their production function defines how much these tools have been used. The method used for depreciating production units is called units of production depreciation.

To get units of production depreciation, follow the straight-line depreciation formula, except use an asset's useful life in hours instead of years.

The sum-of-the-year's digits method, also known as the accelerated depreciation method, is used to depreciate an asset without losing its value, allowing it to retain its value upon disposal. You can get a more even depreciation value over the years using the SYD method.

Getting the depreciation using the SYD method can be complicated. To calculate SYD, divide what's left of an asset's useful life by the sum of years. The SYD is an asset's productive life added together. For example, if an asset is expected to be useful for five years, you can get the SYD by adding 1+2+3+4+5.

Afterward, multiply the asset cost and salvage value. The answer will be your SYD for the first year. Calculating depreciation using the SYD method means having to do it yearly.

In accounting, not all business expenses carrying value are depreciable assets. Here are different kinds of assets in accounting and why or why not they are considered depreciable.

| Tangible Assets | Intangible Assets | Immaterial Assets |

Tangible assets are visible, physical objects and are the only type that can depreciate because they can lose value over time, unlike intangible assets. Some examples of tangible assets are company-owned buildings or houses, vehicles, and equipment.

Intangible assets cannot be seen or touched, like the value of a brand or image and an organization's intellectual property. Intangible assets cannot depreciate and are instead amortized. There are intangible assets that do not depreciate over time. For example, software created by the company will stay valuable since it cannot be destroyed and does not downgrade from use.

Intangible assets are not mentioned in the balance sheet unless they are acquired. For example, if an organization sells its brand image, that will naturally be included in the balance sheet. Certain expenses that contribute to an intangible asset can be credited to the balance sheet and added to an intangible asset's value.

Immaterial assets are tangible or intangible assets acquired for no more than 5% of the purchase price of the said asset. Immaterial assets are bought for a cost too little to be considered significant and can thus be included in miscellaneous or other expenses.

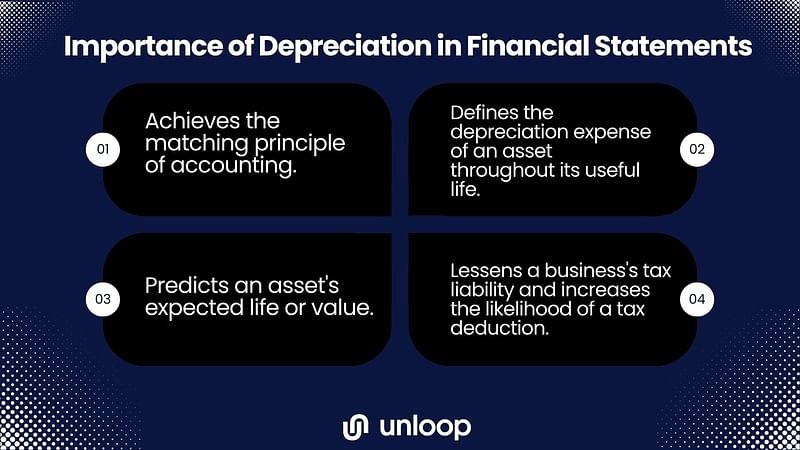

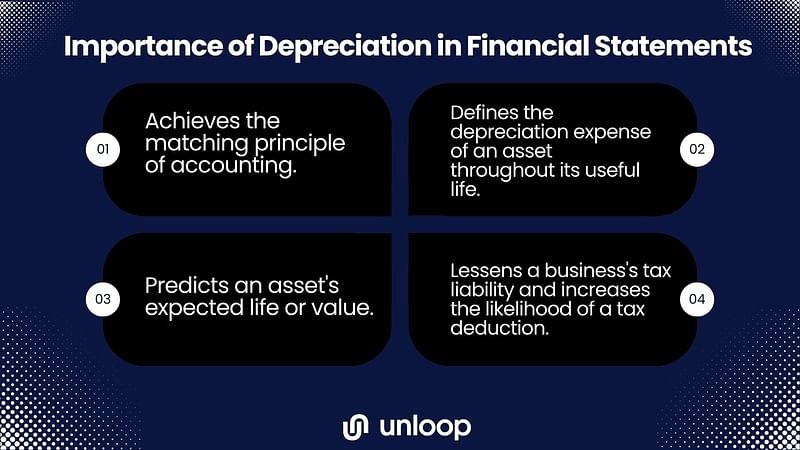

Calculating cumulative depreciation expense is an important task for any business. Depreciation does four things for a business and its financial statements:

Depreciating assets are a valuable accounting detail, especially for tax purposes. If you want to calculate depreciation accurately and make the most out of your company's investments, hire Unloop, one of the prime accounting services in the market.

Let's figure out what your assets’ worth. Book a free discovery call with us here.

Most capital used in starting a business goes into buying assets for the company. These assets are then used to generate income for the business. However, tangible assets tend to lose value over time and garner a hefty tax bill for a business expense, making it important to learn how to calculate depreciation.

In this article, we'll discuss depreciation, the four ways of calculating it, and the kind of assets you can expect to save money on.

Depreciation is when tangible assets a company invests in loses its value over time due to the typical wear-and-tear of products or equipment. It is an accounting term that determines what an asset is worth. Knowing an item's value is important for businesses to save money from depreciation expenses. It is also essential in monitoring your financial records.

Assets depreciate at different rates. For example, factory equipment may depreciate faster than a company car. There are different ways of calculating depreciation for both. Different factors like asset cost and salvage value come into play to determine the depreciation value of an asset.

Here are four methods to determine depreciation with their respective formulas.

The straight-line depreciation method is the most common form of calculating depreciation, and it's pretty straightforward. All you have to do is subtract the salvage value from the asset's cost and divide the difference using the asset's useful life in years. The company determines the salvage value, and should be a reasonable amount based on IRS rules.

If a business or organization wants to dispose of assets that lose value quicker, like a company car, the declining balance depreciation method is the best way to go. The declining and double-declining balance methods show assets that depreciate faster, so companies can get more value from depreciation deductions sooner.

To get the depreciation value for a declining balance, you have to multiply the beginning book value of an asset by the rate of depreciation. (To get the depreciation rate, divide 100% by the years of an asset's expected life.)

The same formula applies to the double declining balance method, except you double the amount of the book value. The double declining balance method is typically used to accelerate an asset's depreciation value for taxable income.

Machinery or equipment depreciates at a different rate than other assets because they are used constantly. Their production function defines how much these tools have been used. The method used for depreciating production units is called units of production depreciation.

To get units of production depreciation, follow the straight-line depreciation formula, except use an asset's useful life in hours instead of years.

The sum-of-the-year's digits method, also known as the accelerated depreciation method, is used to depreciate an asset without losing its value, allowing it to retain its value upon disposal. You can get a more even depreciation value over the years using the SYD method.

Getting the depreciation using the SYD method can be complicated. To calculate SYD, divide what's left of an asset's useful life by the sum of years. The SYD is an asset's productive life added together. For example, if an asset is expected to be useful for five years, you can get the SYD by adding 1+2+3+4+5.

Afterward, multiply the asset cost and salvage value. The answer will be your SYD for the first year. Calculating depreciation using the SYD method means having to do it yearly.

In accounting, not all business expenses carrying value are depreciable assets. Here are different kinds of assets in accounting and why or why not they are considered depreciable.

| Tangible Assets | Intangible Assets | Immaterial Assets |

Tangible assets are visible, physical objects and are the only type that can depreciate because they can lose value over time, unlike intangible assets. Some examples of tangible assets are company-owned buildings or houses, vehicles, and equipment.

Intangible assets cannot be seen or touched, like the value of a brand or image and an organization's intellectual property. Intangible assets cannot depreciate and are instead amortized. There are intangible assets that do not depreciate over time. For example, software created by the company will stay valuable since it cannot be destroyed and does not downgrade from use.

Intangible assets are not mentioned in the balance sheet unless they are acquired. For example, if an organization sells its brand image, that will naturally be included in the balance sheet. Certain expenses that contribute to an intangible asset can be credited to the balance sheet and added to an intangible asset's value.

Immaterial assets are tangible or intangible assets acquired for no more than 5% of the purchase price of the said asset. Immaterial assets are bought for a cost too little to be considered significant and can thus be included in miscellaneous or other expenses.

Calculating cumulative depreciation expense is an important task for any business. Depreciation does four things for a business and its financial statements:

Depreciating assets are a valuable accounting detail, especially for tax purposes. If you want to calculate depreciation accurately and make the most out of your company's investments, hire Unloop, one of the prime accounting services in the market.

Let's figure out what your assets’ worth. Book a free discovery call with us here.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Time-consuming, stressful, and tedious are often words associated with the manual bank reconciliation process. It is typical for businesses to do bank reconciliation every month. But other businesses choose to do them more frequently, so there are fewer transactions to check and a lesser possibility of errors and inconsistencies.

For businesses, bank reconciliations might be a hassle, but it doesn't have to be. Bank reconciliation software can speed up the process and make it easier for you. We'll discuss the automation process's benefits and give a quick overview of how to do it.

Automating the bank reconciliation process is not as challenging as it sounds. Don't forget to take notes! If you follow these simple setup processes, you'll worry less about bank reconciliation.

An automated process makes running a business more convenient. Investing in accounting software is a wise move for every business. However, other businesses, especially small ones, are reluctant to spend the money. If you're still in doubt, here are some of the advantages of automating your bank reconciliation process.

The manual reconciliation process is error-prone. No matter how careful business owners are, it is easy to misread figures and make mistakes in calculations and inputs. Not to mention, you have to go through tons of spreadsheets and documents to fix the errors. That is a significant amount of time that businesses could be using for other areas of their operations.

You can make sure everything is accurate down to the last detail with automatic reconciliation. Also, once a lapse is spotted, you will be notified so you can resolve it right away.

One of the excellent benefits of automated reconciliation is its time efficiency. With an accounting system, features that track outgoing cash, and the ability to match receipts to transactions, the reconciliation process can be completed in a matter of minutes compared to doing it manually, which can take hours.

Furthermore, you can skip combing through your spreadsheets for hours and hours. The accounting software can check the totals in the spreadsheet to see if they match your balance sheets, income statements, and other financial records.

You can achieve better cash flow management by automating your bank reconciliation process. The automatic process can quickly identify wrong and incomplete transactions, which can significantly affect a business's cash flow. Businesses can therefore decide how to manage their cash flow with confidence knowing exactly how much money they have available.

In addition, automatic bank reconciliation allows businesses to identify and resolve any outstanding issues on time, which can help them avoid late fees and other penalties that can negatively impact their cash flow. Overall, by improving the accuracy and efficiency of the reconciliation process, businesses can optimize their cash flow and improve their financial health.

Software with automatic bank reconciliation have fraud detection features that can help businesses identify early on if there are any unauthorized transactions or unusual activities that can indicate fraud. They can also alert businesses of missing or altered transactions that could be a sign of embezzlement.

With better fraud detection and prevention, businesses can protect their financial assets and maintain their integrity. When businesses detect fraud early, they can take swift action and prevent significant damage to the business. Further, automated bank reconciliations can make an audit trail for all your transactions, which is essential for investigating and resolving any fraudulent activities.

The benefits when businesses fully automate bank reconciliations go beyond the process. It can help business owners make more sound and crucial decisions. Here are some ways in which automated bank reconciliations help with decision-making.

Reconciling bank accounts is just one part of the entire accounting process. Many business owners, even seasoned ones, would prefer to avoid accounting altogether. Fortunately for entrepreneurs out there, Unloop offers the professional services you need.

We have a team of professionals that can handle all your accounting needs. Say goodbye to financial stress and hello to business growth! Experience our exceptional services, like bookkeeping, payroll, taxes, forecasting and more.

Book a call with our experts today, and see how we can help you!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Time-consuming, stressful, and tedious are often words associated with the manual bank reconciliation process. It is typical for businesses to do bank reconciliation every month. But other businesses choose to do them more frequently, so there are fewer transactions to check and a lesser possibility of errors and inconsistencies.

For businesses, bank reconciliations might be a hassle, but it doesn't have to be. Bank reconciliation software can speed up the process and make it easier for you. We'll discuss the automation process's benefits and give a quick overview of how to do it.

Automating the bank reconciliation process is not as challenging as it sounds. Don't forget to take notes! If you follow these simple setup processes, you'll worry less about bank reconciliation.

An automated process makes running a business more convenient. Investing in accounting software is a wise move for every business. However, other businesses, especially small ones, are reluctant to spend the money. If you're still in doubt, here are some of the advantages of automating your bank reconciliation process.

The manual reconciliation process is error-prone. No matter how careful business owners are, it is easy to misread figures and make mistakes in calculations and inputs. Not to mention, you have to go through tons of spreadsheets and documents to fix the errors. That is a significant amount of time that businesses could be using for other areas of their operations.

You can make sure everything is accurate down to the last detail with automatic reconciliation. Also, once a lapse is spotted, you will be notified so you can resolve it right away.

One of the excellent benefits of automated reconciliation is its time efficiency. With an accounting system, features that track outgoing cash, and the ability to match receipts to transactions, the reconciliation process can be completed in a matter of minutes compared to doing it manually, which can take hours.

Furthermore, you can skip combing through your spreadsheets for hours and hours. The accounting software can check the totals in the spreadsheet to see if they match your balance sheets, income statements, and other financial records.

You can achieve better cash flow management by automating your bank reconciliation process. The automatic process can quickly identify wrong and incomplete transactions, which can significantly affect a business's cash flow. Businesses can therefore decide how to manage their cash flow with confidence knowing exactly how much money they have available.

In addition, automatic bank reconciliation allows businesses to identify and resolve any outstanding issues on time, which can help them avoid late fees and other penalties that can negatively impact their cash flow. Overall, by improving the accuracy and efficiency of the reconciliation process, businesses can optimize their cash flow and improve their financial health.