Most capital used in starting a business goes into buying assets for the company. These assets are then used to generate income for the business. However, tangible assets tend to lose value over time and garner a hefty tax bill for a business expense, making it important to learn how to calculate depreciation.

In this article, we'll discuss depreciation, the four ways of calculating it, and the kind of assets you can expect to save money on.

Depreciation is when tangible assets a company invests in loses its value over time due to the typical wear-and-tear of products or equipment. It is an accounting term that determines what an asset is worth. Knowing an item's value is important for businesses to save money from depreciation expenses. It is also essential in monitoring your financial records.

Assets depreciate at different rates. For example, factory equipment may depreciate faster than a company car. There are different ways of calculating depreciation for both. Different factors like asset cost and salvage value come into play to determine the depreciation value of an asset.

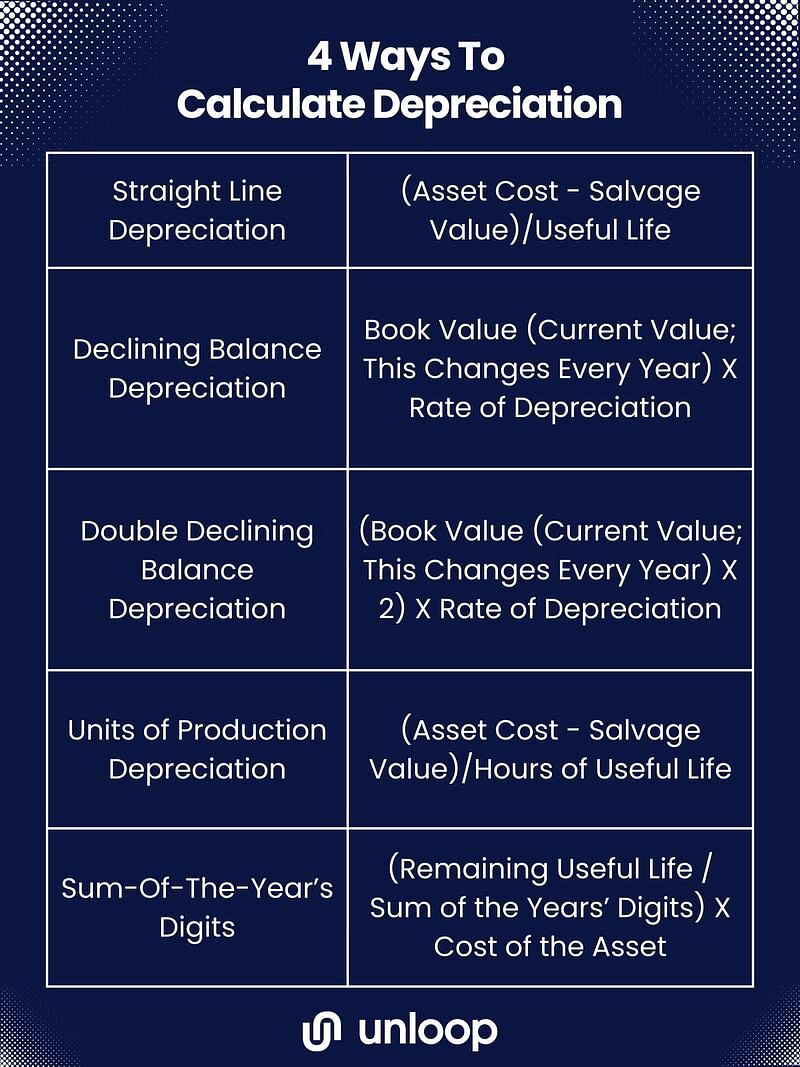

Here are four methods to determine depreciation with their respective formulas.

The straight-line depreciation method is the most common form of calculating depreciation, and it's pretty straightforward. All you have to do is subtract the salvage value from the asset's cost and divide the difference using the asset's useful life in years. The company determines the salvage value, and should be a reasonable amount based on IRS rules.

If a business or organization wants to dispose of assets that lose value quicker, like a company car, the declining balance depreciation method is the best way to go. The declining and double-declining balance methods show assets that depreciate faster, so companies can get more value from depreciation deductions sooner.

To get the depreciation value for a declining balance, you have to multiply the beginning book value of an asset by the rate of depreciation. (To get the depreciation rate, divide 100% by the years of an asset's expected life.)

The same formula applies to the double declining balance method, except you double the amount of the book value. The double declining balance method is typically used to accelerate an asset's depreciation value for taxable income.

Machinery or equipment depreciates at a different rate than other assets because they are used constantly. Their production function defines how much these tools have been used. The method used for depreciating production units is called units of production depreciation.

To get units of production depreciation, follow the straight-line depreciation formula, except use an asset's useful life in hours instead of years.

The sum-of-the-year's digits method, also known as the accelerated depreciation method, is used to depreciate an asset without losing its value, allowing it to retain its value upon disposal. You can get a more even depreciation value over the years using the SYD method.

Getting the depreciation using the SYD method can be complicated. To calculate SYD, divide what's left of an asset's useful life by the sum of years. The SYD is an asset's productive life added together. For example, if an asset is expected to be useful for five years, you can get the SYD by adding 1+2+3+4+5.

Afterward, multiply the asset cost and salvage value. The answer will be your SYD for the first year. Calculating depreciation using the SYD method means having to do it yearly.

In accounting, not all business expenses carrying value are depreciable assets. Here are different kinds of assets in accounting and why or why not they are considered depreciable.

| Tangible Assets | Intangible Assets | Immaterial Assets |

Tangible assets are visible, physical objects and are the only type that can depreciate because they can lose value over time, unlike intangible assets. Some examples of tangible assets are company-owned buildings or houses, vehicles, and equipment.

Intangible assets cannot be seen or touched, like the value of a brand or image and an organization's intellectual property. Intangible assets cannot depreciate and are instead amortized. There are intangible assets that do not depreciate over time. For example, software created by the company will stay valuable since it cannot be destroyed and does not downgrade from use.

Intangible assets are not mentioned in the balance sheet unless they are acquired. For example, if an organization sells its brand image, that will naturally be included in the balance sheet. Certain expenses that contribute to an intangible asset can be credited to the balance sheet and added to an intangible asset's value.

Immaterial assets are tangible or intangible assets acquired for no more than 5% of the purchase price of the said asset. Immaterial assets are bought for a cost too little to be considered significant and can thus be included in miscellaneous or other expenses.

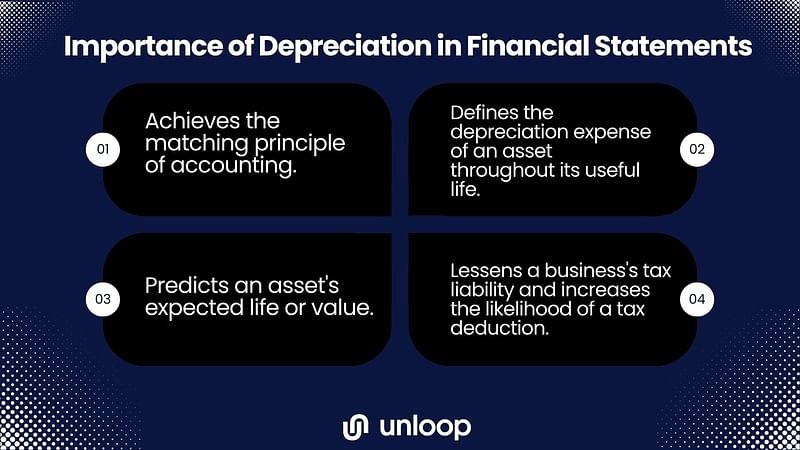

Calculating cumulative depreciation expense is an important task for any business. Depreciation does four things for a business and its financial statements:

Depreciating assets are a valuable accounting detail, especially for tax purposes. If you want to calculate depreciation accurately and make the most out of your company's investments, hire Unloop, one of the prime accounting services in the market.

Let's figure out what your assets’ worth. Book a free discovery call with us here.

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.