Tax collection and calculation can be a complex and overwhelming process for Amazon sellers like you. It’s especially challenging if you are operating across international borders, between the US and Canada. You surely have wondered, "How is tax calculated on Amazon?"

Let us answer that question and provide you with a comprehensive overview of how taxes are calculated on Amazon for transacting between the US and Canada. From explaining the different types of taxes imposed by both countries to outlining the necessary steps for tax collection, this guide will equip you with the knowledge and tools to navigate the tax landscape on Amazon effortlessly and efficiently.

Amazon calculates its tax based on the applicable tax laws and regulations of the jurisdictions where it operates, taking into account factors such as sales, income, and other taxable criteria.

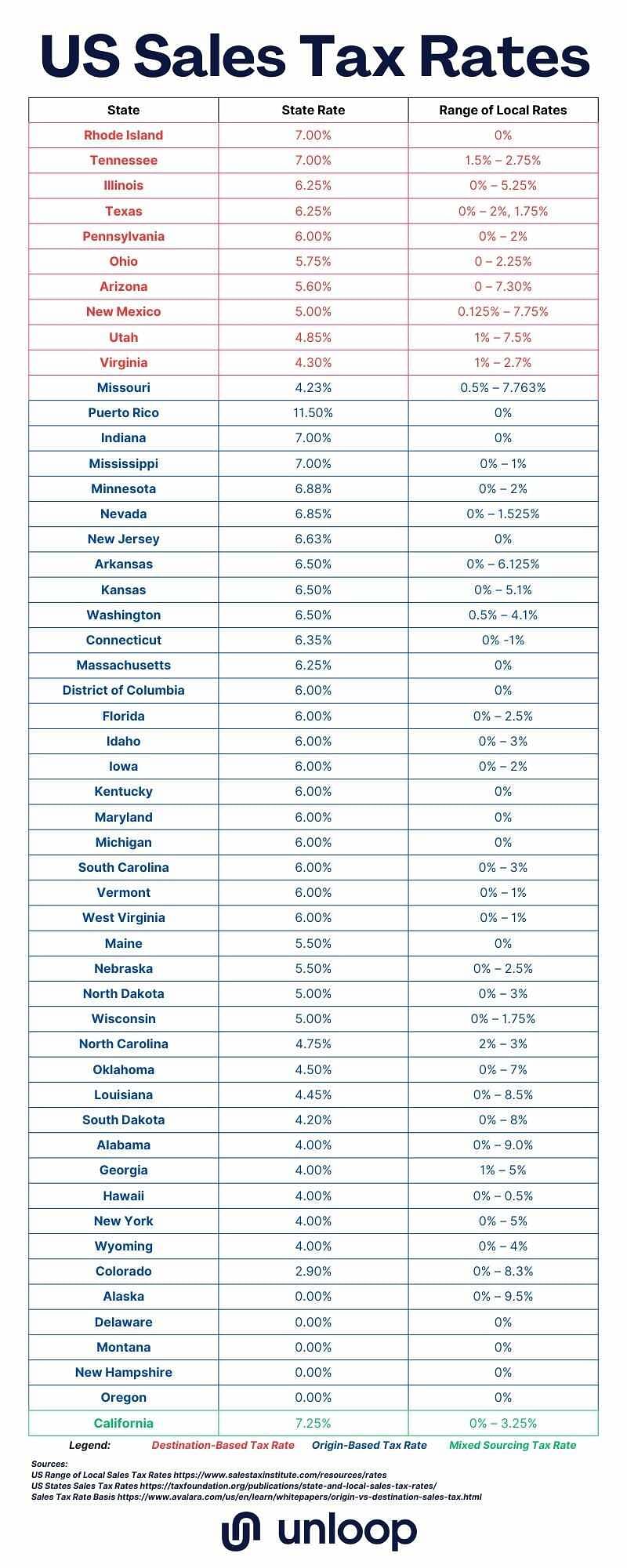

In the United States, tax charges on Amazon orders depend on various factors, such as the type of item or service sold and the shipping destination or origin. Each state has its own set of sales and use tax rates that need to be considered when calculating taxes on transactions.

There are two main factors affecting sales taxes in the US: tax nexus and the Marketplace Facilitator Laws (MPF). Let us know what these two mean for your business.

A nexus is a legal term used to describe a significant presence in a state. It can be based on several factors, such as the location of your offices, employees, warehouses, or fulfillment centers. If your business has a nexus in a state where it sells products, you must collect and remit sales taxes for that state.

You can skip the hassle of collecting and remitting sales taxes on Amazon as the MPF mandates the e-commerce giant do this. Nevertheless, Amazon does not cover local sales taxes not listed on the MPF. In these cases, you have to collect and remit them yourself.

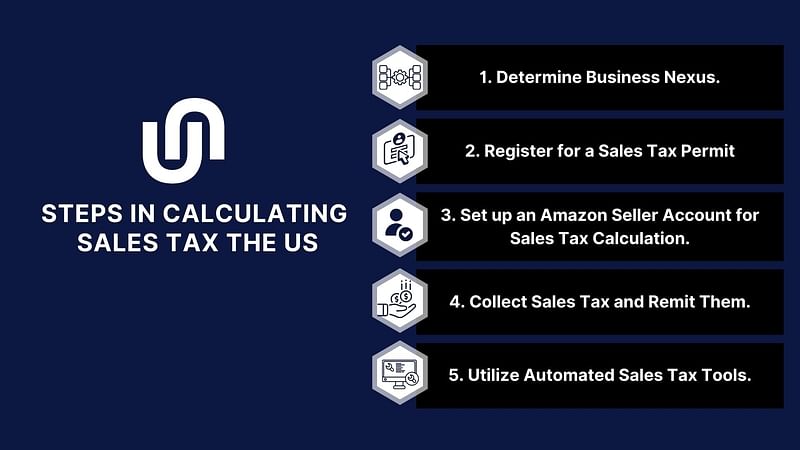

To make your US sales tax calculation and compliance on the platform easier, here are some steps you can follow.

Identify if you have a sales tax nexus in the states where you sell your products. This includes evaluating if you have a physical presence or economic nexus.

Remember that it's illegal to collect Amazon sales tax without a permit, so make sure to register at the state's revenue department.

In your Amazon Seller Central account, set up your sales tax settings. Input the states where you need to collect sales tax, and assign product tax codes to your items to ensure the correct tax rates are applied.

Once your tax settings are configured, Amazon will automatically collect the appropriate sales tax based on the applicable tax rates for each state. Amazon will be responsible for remitting collected sales tax to the relevant tax authorities.

Consider using automated sales tax tools to help you in tracking, sales tax reporting, and filing your sales tax return. These tools can minimize human errors, save time, and help you comply with ever-changing sales tax laws.

Sales tax in Canada includes the different provincial taxes. With different rates applied to individual provinces, you must know the specific tax breakdown. Taxes include the Goods and Services Tax (GST), Provincial Sales Tax (PST), Harmonized Sales Tax (HST), and Quebec Sales Tax (QST). Each of which is determined by the selling price and shipping destination unless stated otherwise.

There are three main types of sales taxes in Canada. Each province and territory has its own PST rate and rules. Some locations have combined GST and PST into an HST.

The GST rate is 5%, and it is applied to most goods and services sold in the country. The collected taxes are used to fund public services and programs.

PST is a sales tax levied by individual provinces in Canada on the retail sale or lease of most goods and some services.

HST, on the other hand, is a combined federal and provincial sales tax that applies in provinces that have chosen to harmonize their sales tax with the federal GST. HST rates can be up to 15%.

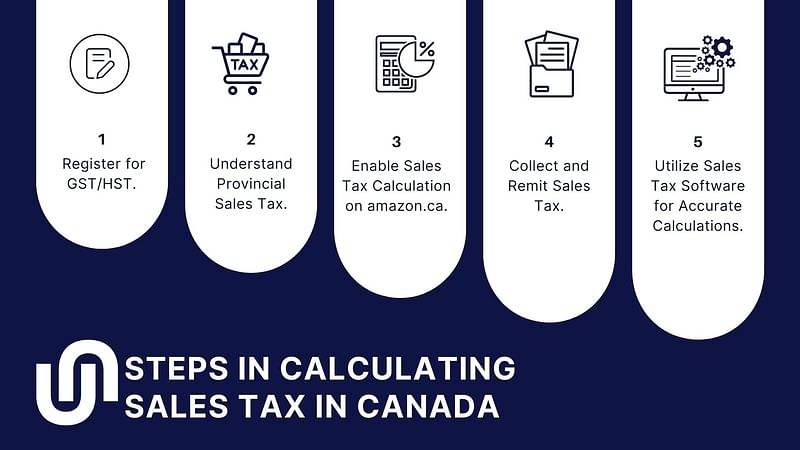

To ensure compliance with Canadian tax laws, follow these steps:

To collect and remit sales taxes, register to the Canada Revenue Agency (CRA), especially if your annual sales meet or exceed CAD 30,000.

Research the tax rates and rules for each location where you have a nexus to understand the specific PST or HST rates for each province or territory where you have a tax nexus.

Customize your tax settings in your Amazon Seller Central account to reflect the tax rates and rules of the provinces or territories where you have a nexus.

For tax-liable transactions on Amazon, the platform will automatically collect sales tax from customers at the specified rates in your tax settings. Amazon, through the MPF, files sales tax reports, and remits collected taxes to the CRA accordingly.

To make the sales tax calculation process easier and maintain accuracy, consider using sales tax software. These tools can automatically track tax rates, generate reports, and assist with the filing process if you integrate them into your Amazon Seller Central account.

You are well on your way now that you know how sales taxes work in the US and Canada. To ensure you'll do the tax calculation, collection, and remittance properly, here are some of the best practices you can follow.

To successfully navigate the US and Canadian sales tax on Amazon, stay updated with the latest tax laws and regulations in both countries. US sales tax is based on the combined state and local rates where your order is delivered to or from, while in Canada, businesses are obligated to register and collect GST, PST, or HST.

Using tax automation software can help simplify the tax calculation process on Amazon. These tools integrate with your Amazon Seller Central account and help to ensure accurate sales tax collection, management, and reporting. Through automation, you can minimize errors and allot saved time to essential business tasks.

Some tax software worth trying are the following:

Before selecting a tax software, consider your specific tax needs and consult with a tax professional or advisor to determine which software is best suited for your business.

Proper record-keeping is essential for tax compliance and accurate financial reporting. Maintain detailed records of your sales data, tax rates, and collected taxes. This practice will prove useful when filing sales tax returns, generating tax reports, and ensuring you remit the correct sales tax amount to the relevant tax authorities.

If you're unsure about tax laws or have complex tax situations, don't hesitate to seek professional assistance. Tax experts can help you navigate the intricacies of US and Canadian sales tax regulations, maintain compliance with tax requirements, and guide you in making informed decisions.

Calculating tax accurately on your Amazon sales is crucial to maintaining compliance with tax laws in the US and Canada. With proper tax calculation, you can avoid overcharging or undercharging sales tax on your transactions, ensuring smooth business operations and keeping customers satisfied and loyal.

To implement best practices for effective sales tax calculation, you can get valuable assistance from us here at Unloop. We offer comprehensive guidance on navigating taxes, helping you avoid common pitfalls and maintain compliance with tax authorities.

Take the first step in managing your sales tax obligations effectively by partnering with us. Let our expertise guide you through the complexities of tax calculation and compliance on Amazon, allowing you to focus on growing your business.

Book a call now!

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.