Financial forecasting is the backbone of good financial planning. Many things can affect a financial forecast other than numbers and some formulas. Fortunately for business owners, technology makes forecasting easier through financial forecasting software tools.

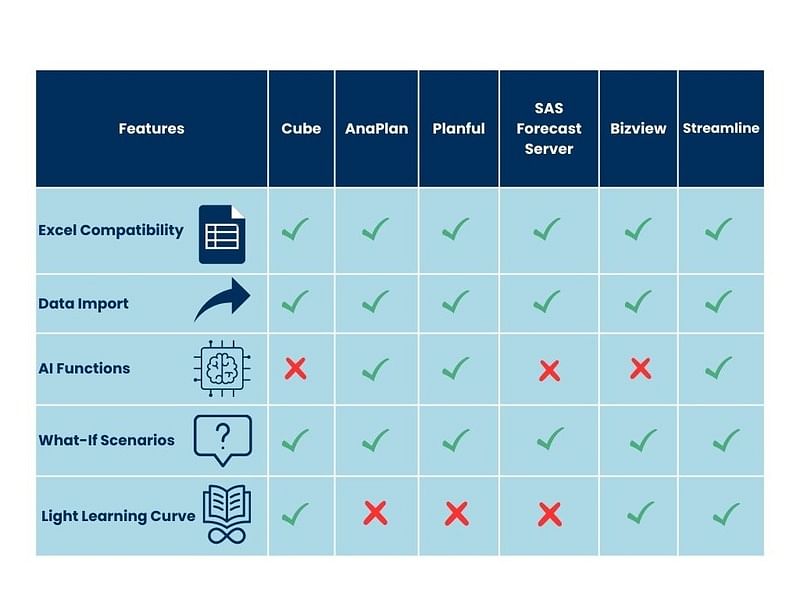

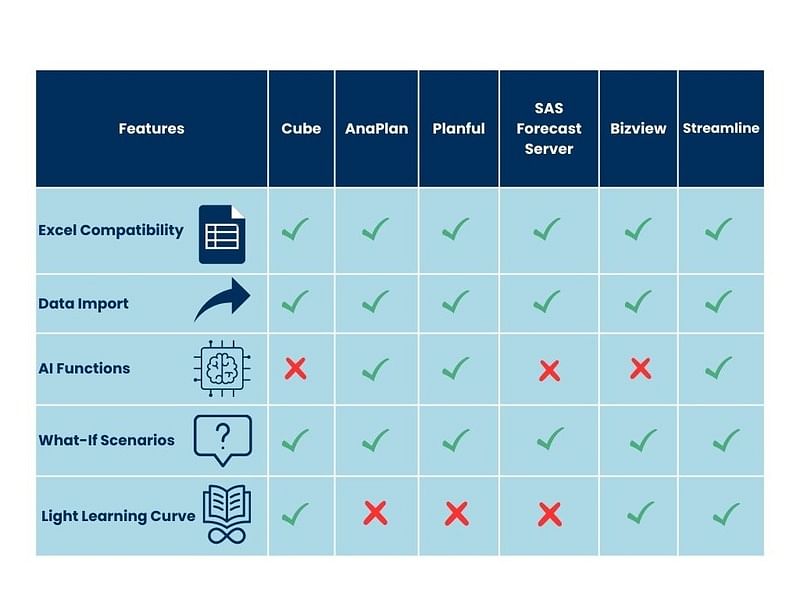

Businesses use several budgeting and forecasting software to help predict future performance and plan future budgets. To help you choose which is best for your business, we've listed some of the best forecasting software options.

Financial forecasting directly affects your budget planning, business strategy, and investments. Even a structured business model needs financial forecasting to prepare for the future.

It's a big problem when businesses run out of cash or are unprepared for the surge of expenses to keep their business running and retain their clients. Accurate financial forecasts are valuable to every business, whether big or small.

Most businesses start with an Excel spreadsheet to develop their financial forecasting. However, forecasting in spreadsheets can be complicated and restrictive due to the following reasons:

Forecasting in Excel is doable, but it is time-consuming and may not always be reliable. Developers continually make software solutions for more progressive, innovative, and convenient forecasting.

Here are the top budgeting and forecasting software products you should check out.

Cube is one of the top-rated forecasting software for businesses. It is the best budgeting and forecasting software for startup businesses that want to quickly transfer their data from manual spreadsheets to forecasting software without studying complicated interfaces. Here is a quick overview of its benefits:

Some of the noteworthy functions of this financial planning software include:

| ✅Automatic data consolidation ✅Bidirectional Microsoft Excel and Google Sheets integrations ✅User-based controls ✅A centralized database for formulas and other data ✅Customizable dashboards and reports |

AnaPlan forecasting software is designed to plan for complex scenarios and do intelligent forecasting for faster and more accurate decision-making. It is ideal for bigger businesses with a dedicated IT team that can handle complex software controls. Here are some key benefits of using AnaPlan:

| ✅It lets you overcome financial and operational planning challenges using user-owned business models. ✅It keeps you updated with the ever-changing marketing conditions using AnaPlan's model engine. ✅Allows you to view business plans on detailed levels to see how they can affect your business in real-time. ✅Increases the accuracy of your decisions and business outcomes by using predictive analysis and what-if analysis. |

Planful is an affordable cloud-based solution for structured and dynamic planning, consolidation, and reporting that suits mid-market companies. Planful offers the following features and benefits:

| ✅ An annual operating plan to help define your company's blueprint for a year. ✅ Workforce planning helps an organization hone employees to work at their best performance. ✅ Scenario analysis to explore every possible option and steer towards it at a moment's notice. ✅ Financial reporting for key financial insights to make better and quicker decisions: This reporting is fully automated and eliminates errors, so you can trust the data you have on hand. |

Planful also has AI-enhanced operations and functions that allow businesses to lessen the number of people they need to hire in the financial department. This reduces expenses in hiring staff.

SAS Forecast Server is one of the popular business forecasting tools because of its ability to generate accurate forecasts quickly. But more than quick forecasts, SAS has many great features to let you be in full control of your business financials:

| The forecasting software has an easy-to-use GUI that can: ✅Generate automatic forecasts in batches or interactively. ✅Build and reconcile forecasts created in varying time intervals. ✅Publish forecasting results via the company's portal, the internet, or hard copy. |

| Its scalability and modeling also offer the following: ✅Freedom to choose the level of automation for the forecasting process ✅Creation of new models by combining two older business models to create more accurate forecasting results ✅Enhanced performance capabilities through the multi-threading of forecasting and diagnostic engines |

The SAS forecasting software has many great and advanced features, which makes this forecasting software good for small businesses and large enterprises. However, it can take some time for business owners to familiarize themselves with the software, but the product has official demo videos to help new users.

Bizview is another cloud-based solution that can streamline your planning, forecasting, and budgeting processes in one software. With a stable internet connection, you can access this software anytime and on any device.

Here are some of the features of Insight Software's Bizview:

| ✅Flexibility, so you can control the software to match your business's needs. ✅It continuously monitors and updates forecasts for the entire year to give your business better insights. ✅It develops accurate financial plans across your entire business, including sales budgets, productions budgets, employee budgets, etc. ✅It allows you to access data from your ERP system and other data sources to create reports without relying on ITs. |

Bizview has an interactive Excel-like interface, so many business owners prefer this software. It is also the most affordable software you can use for small businesses.

Streamline is the leading forecasting software for the first quarter of 2023. Its revenue forecasting processes are realistic, innovative, and quick to ensure that your business is on the right track when planning budgets and making strategic decisions. This budgeting and forecasting software suits big and small businesses.

Here are some of the key features of this forecasting tool:

| ✅The software provides seamless integration of your financial data. You can easily import operational data from your system to Streamline and automatically export financial projections to your ERP system. ✅The software has a scenario planning feature to analyze data and pinpoint potential issues that could happen so you can consider them in your business planning. ✅Financial predictions can involve inventory, cash flow forecasting, and other factors affecting your finances. ✅It has AI-based forecasting capabilities, which ensure 99% accurate budget forecasting at all times. |

There are hundreds of financial budgeting software available for businesses to use. It is just a matter of choosing the right software for your needs. The forecasting tools discussed are some of the best examples you can get for your business. But don't be afraid to explore and find budgeting and forecasting tools to suit your liking and needs.

If you need a budgeting, forecasting, and accounting professional, Unloop can do the job! Our services include revenue forecasting so that we can help small businesses like yours in their growth trajectory.

We use your business's historical data to determine and fix any pain points before they happen. We will also set your business up with an excellent and suitable reporting tool for accurate financial forecasts and continuous planning.

Book a call with our experts today and monitor your financial performance!

Financial forecasting is the backbone of good financial planning. Many things can affect a financial forecast other than numbers and some formulas. Fortunately for business owners, technology makes forecasting easier through financial forecasting software tools.

Businesses use several budgeting and forecasting software to help predict future performance and plan future budgets. To help you choose which is best for your business, we've listed some of the best forecasting software options.

Financial forecasting directly affects your budget planning, business strategy, and investments. Even a structured business model needs financial forecasting to prepare for the future.

It's a big problem when businesses run out of cash or are unprepared for the surge of expenses to keep their business running and retain their clients. Accurate financial forecasts are valuable to every business, whether big or small.

Most businesses start with an Excel spreadsheet to develop their financial forecasting. However, forecasting in spreadsheets can be complicated and restrictive due to the following reasons:

Forecasting in Excel is doable, but it is time-consuming and may not always be reliable. Developers continually make software solutions for more progressive, innovative, and convenient forecasting.

Here are the top budgeting and forecasting software products you should check out.

Cube is one of the top-rated forecasting software for businesses. It is the best budgeting and forecasting software for startup businesses that want to quickly transfer their data from manual spreadsheets to forecasting software without studying complicated interfaces. Here is a quick overview of its benefits:

Some of the noteworthy functions of this financial planning software include:

| ✅Automatic data consolidation ✅Bidirectional Microsoft Excel and Google Sheets integrations ✅User-based controls ✅A centralized database for formulas and other data ✅Customizable dashboards and reports |

AnaPlan forecasting software is designed to plan for complex scenarios and do intelligent forecasting for faster and more accurate decision-making. It is ideal for bigger businesses with a dedicated IT team that can handle complex software controls. Here are some key benefits of using AnaPlan:

| ✅It lets you overcome financial and operational planning challenges using user-owned business models. ✅It keeps you updated with the ever-changing marketing conditions using AnaPlan's model engine. ✅Allows you to view business plans on detailed levels to see how they can affect your business in real-time. ✅Increases the accuracy of your decisions and business outcomes by using predictive analysis and what-if analysis. |

Planful is an affordable cloud-based solution for structured and dynamic planning, consolidation, and reporting that suits mid-market companies. Planful offers the following features and benefits:

| ✅ An annual operating plan to help define your company's blueprint for a year. ✅ Workforce planning helps an organization hone employees to work at their best performance. ✅ Scenario analysis to explore every possible option and steer towards it at a moment's notice. ✅ Financial reporting for key financial insights to make better and quicker decisions: This reporting is fully automated and eliminates errors, so you can trust the data you have on hand. |

Planful also has AI-enhanced operations and functions that allow businesses to lessen the number of people they need to hire in the financial department. This reduces expenses in hiring staff.

SAS Forecast Server is one of the popular business forecasting tools because of its ability to generate accurate forecasts quickly. But more than quick forecasts, SAS has many great features to let you be in full control of your business financials:

| The forecasting software has an easy-to-use GUI that can: ✅Generate automatic forecasts in batches or interactively. ✅Build and reconcile forecasts created in varying time intervals. ✅Publish forecasting results via the company's portal, the internet, or hard copy. |

| Its scalability and modeling also offer the following: ✅Freedom to choose the level of automation for the forecasting process ✅Creation of new models by combining two older business models to create more accurate forecasting results ✅Enhanced performance capabilities through the multi-threading of forecasting and diagnostic engines |

The SAS forecasting software has many great and advanced features, which makes this forecasting software good for small businesses and large enterprises. However, it can take some time for business owners to familiarize themselves with the software, but the product has official demo videos to help new users.

Bizview is another cloud-based solution that can streamline your planning, forecasting, and budgeting processes in one software. With a stable internet connection, you can access this software anytime and on any device.

Here are some of the features of Insight Software's Bizview:

| ✅Flexibility, so you can control the software to match your business's needs. ✅It continuously monitors and updates forecasts for the entire year to give your business better insights. ✅It develops accurate financial plans across your entire business, including sales budgets, productions budgets, employee budgets, etc. ✅It allows you to access data from your ERP system and other data sources to create reports without relying on ITs. |

Bizview has an interactive Excel-like interface, so many business owners prefer this software. It is also the most affordable software you can use for small businesses.

Streamline is the leading forecasting software for the first quarter of 2023. Its revenue forecasting processes are realistic, innovative, and quick to ensure that your business is on the right track when planning budgets and making strategic decisions. This budgeting and forecasting software suits big and small businesses.

Here are some of the key features of this forecasting tool:

| ✅The software provides seamless integration of your financial data. You can easily import operational data from your system to Streamline and automatically export financial projections to your ERP system. ✅The software has a scenario planning feature to analyze data and pinpoint potential issues that could happen so you can consider them in your business planning. ✅Financial predictions can involve inventory, cash flow forecasting, and other factors affecting your finances. ✅It has AI-based forecasting capabilities, which ensure 99% accurate budget forecasting at all times. |

There are hundreds of financial budgeting software available for businesses to use. It is just a matter of choosing the right software for your needs. The forecasting tools discussed are some of the best examples you can get for your business. But don't be afraid to explore and find budgeting and forecasting tools to suit your liking and needs.

If you need a budgeting, forecasting, and accounting professional, Unloop can do the job! Our services include revenue forecasting so that we can help small businesses like yours in their growth trajectory.

We use your business's historical data to determine and fix any pain points before they happen. We will also set your business up with an excellent and suitable reporting tool for accurate financial forecasts and continuous planning.

Book a call with our experts today and monitor your financial performance!

Cash flow forecasting can be tricky—it requires skills, attention to detail, and dedication. But when done right, cash flow forecasting can offer tremendous value and invaluable insight into the future of your startup business or project.

Many organizations face significant challenges while attempting this exercise, but some workarounds can help you achieve success in predicting your financial future with confidence.

In this blog post, we'll explore some common cash flow forecasting challenges and solutions for improving your forecasts' accuracy. With these tips, you'll have valuable information to make better decisions about where to allocate resources and set appropriate expectations for revenue and expenses.

As an owner of a startup business, at the beginning, your cash flow may be slow and manageable using manual bookkeeping and accounting. A common mistake would be sticking to this day-to-day cash flow monitoring system and not forecasting. Seeing only daily cash flow and having no visibility about your company's future income and expenses is like operating a business in the dark.

Understand that cash flow management is essential for all businesses, even startups. Know that with it, you can see how much income and expenses you’ll have daily, weekly, monthly, quarterly, or annually. As a result, you can use the data as the basis of your financial game plans. You can use it to decide the following:

Having limited historical data is common to startups either because owners have failed to store financial data in the past or because the business hasn’t been running for a significant period of time yet. Historical data is the most basic information needed when creating a cash flow forecast, and the absence of these numbers makes the forecast result less reliable.

Despite the absence of historical data, there are still ways to get a reliable cash flow forecast. To begin, whether you lack past numbers because of a personal choice or not, it is time to invest in software and applications to help you track your business finances.

These apps and software can also help you conveniently create simulations, or before and after trials. Use the following data for your forecasts:

The biggest enemy of a cash flow forecast is inaccurate data, which can happen when tracking income and expenses manually. Although Excel sheets are readily available (and free), they may lose your business money in the long run as human errors bring costly damages to your finances.

Inaccurate data leads to making bigger loans, being overconfident in forecasting income, making fewer investments, and saving less—all detrimental to your business growth.

The most efficient workaround to the data inaccuracy problem is bidding goodbye to your company's manual systems. Accept that part of growth is optimizing your bookkeeping and accounting technology so that you can track your finances better.

Accounting software is highly automated, and you can also integrate various apps. As a result, you can minimize or even eradicate manual inputs, which can cause inaccurate data.

If there are a couple of teams in your company, you’ll need input for their income and expenses. This task becomes a roadblock when there is no collaboration between different departments. When different teams do not practise open communication, you might get incomplete or erroneous financial data from them. Another challenge is not having an established system for workflow and data submission processes in the company.

Excellent accountants and bookkeepers need to be well-versed in their tasks or have certifications and training to perform them correctly. On top of that, they should have communication skills and be team players. This is to make sure that they can connect to the various departments in your company to get the needed data. They also need to be forward thinkers to suggest and enact the best systems to make this data acquisition as smooth as possible for everyone.

Expect that a cash flow forecast doesn’t mean you’ll get 100% accuracy, as the following variables are prone to changes:

As a result, the final accounts receivable and payable won’t be exactly as what you forecasted.

The best workaround to ensure that you get the forecast closest to the truth is keeping numbers and data updated. Be in the know with the latest interest and foreign exchange rates. Know if there are changes in sales taxes and other tax dues you need to pay. If there are updates on commodity and raw material prices, they should also be reflected in your forecast. And do not forget about your customers too. Check sales trends to know when your peak sales occur.

Successfully launching a cash flow forecast is not the end of the cash forecasting process, but it becomes a problem if you make it so. As we’ve learned, some variables are subject to change, so if one variable adjusts, the income and expenses will as well. If you keep on using the old data without any adjustments, your business finances will suffer these consequences:

The best way to do a cash flow projection and actual cash flow analysis is through the help of software. An accounting software already has the forecast and the latest data of your business stored. They also have templates to show a comparison of current cash flow and forecast data. With software, generating reports is easier, and you can regularly analyze data to see if you need to optimize your cash flow plans and strategies.

Creating and maintaining a cash flow forecast is a major task for every company. Not having a dedicated team to handle it makes report generation impossible. And if even one is created, there wouldn’t be anyone to update it and let you know the latest data analysis results. Like a snowball, a series of the above mentioned challenges will surely accumulate.

There are plenty of choices a company can go for to hire a bookkeeper and accountant to handle forecasts. An in-house accountant is the traditional choice, but you can also choose to work with remote team members and freelancers. With these choices, building a dedicated team to handle forecasting becomes easier.

Your finance team will ensure your business has a defined forecasting process, an efficient way to acquire and manage data, and the best software to make forecasting cash flow easier and more accurate.

With cash forecasting being so important to any business’s success, startups must understand common challenges and how to avoid them. We hope that these common challenges startups face when forecasting cash flow and some workarounds have helped you. At Unloop, we have seen firsthand how important cash flow forecasts are to businesses. Proper forecasts can help businesses stretch their budgets and stay ahead of payments. With that in mind, take advantage of our forecasting services to experience the power of having a reliable and secure forecasting platform at your fingertips. Call us today!

Cash flow forecasting can be tricky—it requires skills, attention to detail, and dedication. But when done right, cash flow forecasting can offer tremendous value and invaluable insight into the future of your startup business or project.

Many organizations face significant challenges while attempting this exercise, but some workarounds can help you achieve success in predicting your financial future with confidence.

In this blog post, we'll explore some common cash flow forecasting challenges and solutions for improving your forecasts' accuracy. With these tips, you'll have valuable information to make better decisions about where to allocate resources and set appropriate expectations for revenue and expenses.

As an owner of a startup business, at the beginning, your cash flow may be slow and manageable using manual bookkeeping and accounting. A common mistake would be sticking to this day-to-day cash flow monitoring system and not forecasting. Seeing only daily cash flow and having no visibility about your company's future income and expenses is like operating a business in the dark.

Understand that cash flow management is essential for all businesses, even startups. Know that with it, you can see how much income and expenses you’ll have daily, weekly, monthly, quarterly, or annually. As a result, you can use the data as the basis of your financial game plans. You can use it to decide the following:

Having limited historical data is common to startups either because owners have failed to store financial data in the past or because the business hasn’t been running for a significant period of time yet. Historical data is the most basic information needed when creating a cash flow forecast, and the absence of these numbers makes the forecast result less reliable.

Despite the absence of historical data, there are still ways to get a reliable cash flow forecast. To begin, whether you lack past numbers because of a personal choice or not, it is time to invest in software and applications to help you track your business finances.

These apps and software can also help you conveniently create simulations, or before and after trials. Use the following data for your forecasts:

The biggest enemy of a cash flow forecast is inaccurate data, which can happen when tracking income and expenses manually. Although Excel sheets are readily available (and free), they may lose your business money in the long run as human errors bring costly damages to your finances.

Inaccurate data leads to making bigger loans, being overconfident in forecasting income, making fewer investments, and saving less—all detrimental to your business growth.

The most efficient workaround to the data inaccuracy problem is bidding goodbye to your company's manual systems. Accept that part of growth is optimizing your bookkeeping and accounting technology so that you can track your finances better.

Accounting software is highly automated, and you can also integrate various apps. As a result, you can minimize or even eradicate manual inputs, which can cause inaccurate data.

If there are a couple of teams in your company, you’ll need input for their income and expenses. This task becomes a roadblock when there is no collaboration between different departments. When different teams do not practise open communication, you might get incomplete or erroneous financial data from them. Another challenge is not having an established system for workflow and data submission processes in the company.

Excellent accountants and bookkeepers need to be well-versed in their tasks or have certifications and training to perform them correctly. On top of that, they should have communication skills and be team players. This is to make sure that they can connect to the various departments in your company to get the needed data. They also need to be forward thinkers to suggest and enact the best systems to make this data acquisition as smooth as possible for everyone.

Expect that a cash flow forecast doesn’t mean you’ll get 100% accuracy, as the following variables are prone to changes:

As a result, the final accounts receivable and payable won’t be exactly as what you forecasted.

The best workaround to ensure that you get the forecast closest to the truth is keeping numbers and data updated. Be in the know with the latest interest and foreign exchange rates. Know if there are changes in sales taxes and other tax dues you need to pay. If there are updates on commodity and raw material prices, they should also be reflected in your forecast. And do not forget about your customers too. Check sales trends to know when your peak sales occur.

Successfully launching a cash flow forecast is not the end of the cash forecasting process, but it becomes a problem if you make it so. As we’ve learned, some variables are subject to change, so if one variable adjusts, the income and expenses will as well. If you keep on using the old data without any adjustments, your business finances will suffer these consequences:

The best way to do a cash flow projection and actual cash flow analysis is through the help of software. An accounting software already has the forecast and the latest data of your business stored. They also have templates to show a comparison of current cash flow and forecast data. With software, generating reports is easier, and you can regularly analyze data to see if you need to optimize your cash flow plans and strategies.

Creating and maintaining a cash flow forecast is a major task for every company. Not having a dedicated team to handle it makes report generation impossible. And if even one is created, there wouldn’t be anyone to update it and let you know the latest data analysis results. Like a snowball, a series of the above mentioned challenges will surely accumulate.

There are plenty of choices a company can go for to hire a bookkeeper and accountant to handle forecasts. An in-house accountant is the traditional choice, but you can also choose to work with remote team members and freelancers. With these choices, building a dedicated team to handle forecasting becomes easier.

Your finance team will ensure your business has a defined forecasting process, an efficient way to acquire and manage data, and the best software to make forecasting cash flow easier and more accurate.

With cash forecasting being so important to any business’s success, startups must understand common challenges and how to avoid them. We hope that these common challenges startups face when forecasting cash flow and some workarounds have helped you. At Unloop, we have seen firsthand how important cash flow forecasts are to businesses. Proper forecasts can help businesses stretch their budgets and stay ahead of payments. With that in mind, take advantage of our forecasting services to experience the power of having a reliable and secure forecasting platform at your fingertips. Call us today!

Monitoring your business's accounts payable is crucial to determine the state of its financial health. Accurate forecasting allows you to gain control of your cash flow. In addition, knowing when your payments are due builds a good relationship with your suppliers and opens up strategies for money-saving plans for your payables.

Forecasting accounts payable may not be your priority when handling business accounting, but it can benefit your business. In this blog post, we'll talk more about forecasting accounts payable so you know how to do it for your business.

Accounts payable refers to short-term liabilities a business needs to pay off within a year or a shorter time frame. Understanding and seeing your business expenses fully allows you to do the groundwork for building a suitable budget for your business.

Forecasting will help you prepare to meet your payments by considering different scenarios. For example, if the price of raw materials increase or third-party fees change their rates, you can ensure your business can still fulfill its obligations and make wise decisions regarding your business finances.

You can monitor the money going out of your business in several ways. Here are some things you can do to help you build an accurate accounts payable forecast.

The payment patterns for your business are an important piece of information in creating an accurate forecast. Your expenses on payroll and inventory are relatively consistent month to month and easier to track. But always look at past spending data to see accurate patterns.

For example, look at the months you spend more on inventory. Some of your items may be in demand in certain months, so be mindful of that so you can plan your budget accordingly. You can also accumulate your past invoices to have a picture of where your money is going.

Noticing the patterns will also help you see where you can save, which can be good for your cash flow.

Understanding trends in the marketplace, like technological advances and consumer behaviour, will help determine if these changes can affect your business payables. Changes in the industry are quick, and if you're not keen enough to see them, you may fall behind, which can make your forecast less accurate.

You can track some marketing trends by:

Using historical data is advantageous for forecasting because many methods maximize historical data. The most common way of using past data is through extrapolation. However, there's room for error with this method because it doesn't consider the changes that happened in your business.

Statistical modelling is a more accurate method for creating accounts payable forecasts. This method helps business owners identify behavior in ways businesses do their payments and create a forecast based on its current conditions. This forecasting method is the most accurate but requires a huge investment in time and resources.

If you're new to forecasting, it is best to use both methods for the best results. Then, play with the strength of each method to make better business decisions.

You need all the data to create an accurate forecast. That's why it is crucial that you keep track of your invoices and dues. Here are some ways to do it effectively:

Accounting software is a valuable tool for businesses. Think of it as a virtual assistant that handles certain tasks that you can't because your hands are full. For example, you can start with a Microsoft Excel spreadsheet to organize your cash flow in a certain accounting period. Although this may keep things organized, you still have to input data and create financial statements manually when needed.

If you want something more convenient, there are several accounting software you can choose from. These software options can perform basic accounting tasks and even more complex ones. Furthermore, they can produce financial statements like income statements, balance sheets, and other reports in just a few clicks.

Some even have a feature to create financial models for your business based on the data you input into the system. The right accounting software will help create your business's accurate accounts payable forecast.

Knowing how much you need to pay at the end of each period will help you plan your budget. Fortunately, there is a simple calculation method that allows you to get an overview of your expected accounts payables.

Here is how to do it:

Once you have this data, you can simply follow the formula:

(Current liabilities)/(Total operating cash/Number of days) = Expected accounts payable

So, for example, if your business has an outstanding liability of $10,000 and your total

operating cost is $25,000, and you have 25 days to complete your payments. You can calculate your expected payables by:

(10,000)/(25,000/25) = $10,000

You can expect your business needs to pay $10,000 by the end of 25 days.

Forecasting is an optional part of accounting, and some business owners find it unnecessary. However, forecasting is a good move for your business if you want a clearer view of your financial ratios. Here are some benefits of doing it.

The results of the accounts payable forecast are valuable for improving your cash flow forecasting. This will help get key insights into how much of your working capital is available for business growth and investment. In addition, a clear picture of your forecast will help you maximize your working capital more confidently and risk-free.

Nothing makes your suppliers happier than you paying them on time. Forecasting accounts payable will help you see your deliverables ahead of time so you won't incur late payments. In addition, timely payments build trust and good relationships with your suppliers.

Moreover, forecasting helps you identify if you will run into problems with your payments. This way, you can give your suppliers a warning if there's no choice but to delay your payments.

Knowing your expected liabilities will help prevent disruptions in your payments. Understanding how much working capital comes in and out of your business in a specific period will help you eliminate risks and other potential disruptions.

Now that you have an overview of how forecasting accounts payable can benefit your business, you should start planning how you can forecast. Forecasting is not an easy task, so it is better to have a professional handle this for you.

Unloop offers AP forecasting for small ecommerce businesses. Our team of experts will ensure:

Unloop can handle all your accounts payable needs and even other accounting needs. Our team is ready to work with you on your bookkeeping, income tax, payroll, financial forecasts, and accounting. Book a call and work with us today!

Monitoring your business's accounts payable is crucial to determine the state of its financial health. Accurate forecasting allows you to gain control of your cash flow. In addition, knowing when your payments are due builds a good relationship with your suppliers and opens up strategies for money-saving plans for your payables.

Forecasting accounts payable may not be your priority when handling business accounting, but it can benefit your business. In this blog post, we'll talk more about forecasting accounts payable so you know how to do it for your business.

Accounts payable refers to short-term liabilities a business needs to pay off within a year or a shorter time frame. Understanding and seeing your business expenses fully allows you to do the groundwork for building a suitable budget for your business.

Forecasting will help you prepare to meet your payments by considering different scenarios. For example, if the price of raw materials increase or third-party fees change their rates, you can ensure your business can still fulfill its obligations and make wise decisions regarding your business finances.

You can monitor the money going out of your business in several ways. Here are some things you can do to help you build an accurate accounts payable forecast.

The payment patterns for your business are an important piece of information in creating an accurate forecast. Your expenses on payroll and inventory are relatively consistent month to month and easier to track. But always look at past spending data to see accurate patterns.

For example, look at the months you spend more on inventory. Some of your items may be in demand in certain months, so be mindful of that so you can plan your budget accordingly. You can also accumulate your past invoices to have a picture of where your money is going.

Noticing the patterns will also help you see where you can save, which can be good for your cash flow.

Understanding trends in the marketplace, like technological advances and consumer behaviour, will help determine if these changes can affect your business payables. Changes in the industry are quick, and if you're not keen enough to see them, you may fall behind, which can make your forecast less accurate.

You can track some marketing trends by:

Using historical data is advantageous for forecasting because many methods maximize historical data. The most common way of using past data is through extrapolation. However, there's room for error with this method because it doesn't consider the changes that happened in your business.

Statistical modelling is a more accurate method for creating accounts payable forecasts. This method helps business owners identify behavior in ways businesses do their payments and create a forecast based on its current conditions. This forecasting method is the most accurate but requires a huge investment in time and resources.

If you're new to forecasting, it is best to use both methods for the best results. Then, play with the strength of each method to make better business decisions.

You need all the data to create an accurate forecast. That's why it is crucial that you keep track of your invoices and dues. Here are some ways to do it effectively:

Accounting software is a valuable tool for businesses. Think of it as a virtual assistant that handles certain tasks that you can't because your hands are full. For example, you can start with a Microsoft Excel spreadsheet to organize your cash flow in a certain accounting period. Although this may keep things organized, you still have to input data and create financial statements manually when needed.

If you want something more convenient, there are several accounting software you can choose from. These software options can perform basic accounting tasks and even more complex ones. Furthermore, they can produce financial statements like income statements, balance sheets, and other reports in just a few clicks.

Some even have a feature to create financial models for your business based on the data you input into the system. The right accounting software will help create your business's accurate accounts payable forecast.

Knowing how much you need to pay at the end of each period will help you plan your budget. Fortunately, there is a simple calculation method that allows you to get an overview of your expected accounts payables.

Here is how to do it:

Once you have this data, you can simply follow the formula:

(Current liabilities)/(Total operating cash/Number of days) = Expected accounts payable

So, for example, if your business has an outstanding liability of $10,000 and your total

operating cost is $25,000, and you have 25 days to complete your payments. You can calculate your expected payables by:

(10,000)/(25,000/25) = $10,000

You can expect your business needs to pay $10,000 by the end of 25 days.

Forecasting is an optional part of accounting, and some business owners find it unnecessary. However, forecasting is a good move for your business if you want a clearer view of your financial ratios. Here are some benefits of doing it.

The results of the accounts payable forecast are valuable for improving your cash flow forecasting. This will help get key insights into how much of your working capital is available for business growth and investment. In addition, a clear picture of your forecast will help you maximize your working capital more confidently and risk-free.

Nothing makes your suppliers happier than you paying them on time. Forecasting accounts payable will help you see your deliverables ahead of time so you won't incur late payments. In addition, timely payments build trust and good relationships with your suppliers.

Moreover, forecasting helps you identify if you will run into problems with your payments. This way, you can give your suppliers a warning if there's no choice but to delay your payments.

Knowing your expected liabilities will help prevent disruptions in your payments. Understanding how much working capital comes in and out of your business in a specific period will help you eliminate risks and other potential disruptions.

Now that you have an overview of how forecasting accounts payable can benefit your business, you should start planning how you can forecast. Forecasting is not an easy task, so it is better to have a professional handle this for you.

Unloop offers AP forecasting for small ecommerce businesses. Our team of experts will ensure:

Unloop can handle all your accounts payable needs and even other accounting needs. Our team is ready to work with you on your bookkeeping, income tax, payroll, financial forecasts, and accounting. Book a call and work with us today!

Revenue and expenses are a core part of running a business. You can operate your day-to-day business activities smoothly if you keep them in balance. You can employ several strategies to control your expenses and help grow your revenue.

The path to business success is a long and tedious one, but it's not impossible. Business finances are messy, and here we have some tips to help manage them effectively. Revenue and expenses go hand in hand. Take note of these tips to help you handle them better.

Expenses will play a huge role in your financial health. Expenses are costs that a business incurs to pay and run business operations. This covers everything from paying your rent and buying equipment to costs for packing and shipping.

Here are some suggestions for managing your company's expenses.

One of the most effective ways to have control over your budget is to start with a plan and stick to it. Creating a budget should be practical and applicable to your industry. You need to research your spending patterns and behaviors in order to develop a successful plan.

Annual budgeting is most common, but unforeseen circumstances could make you go off budget. You can control your expenses by drawing up monthly budget plans. This way, you can review and see if you are on track with your overall budget.

But more significantly, you must adhere to your spending plan. Making a budget is useless if you're not committed to sticking to it.

Make it a habit to keep all your receipts. You can record them manually or invest in software to help keep track of your expenses. Software features allow you to capture photos of receipts and store them as data so you can guarantee you don't lose your records.

Furthermore, documentation of expenses is also helpful for taxes. Certain operating expenses can be eligible for tax deductions to lessen your tax liabilities. Keeping a detailed track of your expenses helps you see the areas when you could be overspending to help you strategize your spending patterns.

Many business owners don't pay mind to fixed costs since they are recurring payments. Fixed costs often come from partnerships between merchants and suppliers. After a while, you will think you have a good deal with your suppliers if they don't change their prices. But it would help if you check market offers periodically.

You can start reducing expenses by finding better deals regarding your fixed costs. Get regular quotes to ensure that you are spending your finances correctly.

It's understandable that most business owners believe manual processes are cheaper. Imagine if you have a small business with a dedicated team for packing and shipping orders.

Advanced equipment may look like massive investments at first, but machines can do repetitive tasks equivalent to several people. This means you'll need fewer people to hire, which saves money in the long run.

Business revenue is the total income a business generates from its product sales or by providing services. Revenue is also known as gross income and referred to as the top line because it is typically seen on top of an income statement.

On the other hand, profit or net income is a company's total earnings after business expenses have been deducted. The balance between gains and losses will keep a business running. Here are some helpful tips to generate revenue.

Most companies spend time and assets to gain new customers but often neglect customers to repeat business. Building trust with your consumers will drive them to use your services again.

One effective way to persuade your customers to repeat their purchases from your business is through email. Once your clients join your email list, it allows you to communicate with them. You can solicit their opinion and keep them informed about special offers and new products. They are more inclined to repurchase your goods or services once you have earned their confidence.

Who can resist coupons and discounts? You can use this strategy to funnel sales to your business. Of course, you have to be smart about it. You won't be making sales if all of your customers are granted discounts.

Your most devoted and active clients may receive discounts. These can be used as a thank you gift for buying your products. You can also give discounts to people who purchase a certain amount. For example, you can have promos for people who purchase more than $300.

Coupons, on the other hand, are great for new customers. For example, first-time buyers can have a 5% discount on their first purchase. Coupons such as this will entice new customers to try and purchase your products.

In the United States, over 70% of people prefer to shop online, if you don’t have a well-built website, your competitors will surely outshine your business. Easy navigation and positive user experience can encourage customers to purchase from your business.

Make sure all elements in your website are working and reflect the branding of your business. It should contain all the information your customer needs and make the purchasing process easy for them—from choosing the product or service to processing their payment.

Juggling and managing your time with running a business is a difficult task. You may not want to admit it, but there are other aspects of your business that you fail to give attention to. Marketing your business allows you to gain customers. More customers mean more income.

However, marketing is challenging with so many things on your plate. Instead of forcing yourself, outsource your marketing needs to a professional. These services can guarantee that your investment is worth the price and will help scale your businesses.

You reach more customers as you venture further. Consider opening new branches in different cities if you have a physical store to attract more clients. For your ecommerce counterpart, you can widen your shipping options.

Small businesses usually start deliveries locally, but you can extend your reach nationwide or internationally. Look for shipping partners that will give the best deals to help you reach more customers.

Even big companies use this strategy to increase their total revenue. Offering a higher-priced product can help simple transactions turn into valuable ones. The process of upselling is offering your customer a better version of their original choice. A great example is mobile phones. Companies usually offer products with bigger memory or better performance for a higher price.

Just remember, when you upsell your products, it should be something related to the original choice to find success in your upsell strategy. If they are buying a mobile phone, upsell a better version—not a laptop or other types of gadgets.

Managing your expenses and revenue also includes accounting. Accounting helps owners see their company's financial performance and prepares their business for tax season. When it comes to accounting, Unloop offers different services for small ecommerce businesses.

If you need help managing your revenue and expenses, our bookkeeping services will help you keep up with your business finances. Our services include:

Keeping track of how much your company earns and spends in a specific period keeps your business operations steady and running. Managing expenses and revenue is a challenge, and we hope these tips help you understand and handle your finances better.

For more accounting services, Unloop also offers payroll, taxes, forecasting and accounts payables. Book a call with us now and talk to an expert for free!

Revenue and expenses are a core part of running a business. You can operate your day-to-day business activities smoothly if you keep them in balance. You can employ several strategies to control your expenses and help grow your revenue.

The path to business success is a long and tedious one, but it's not impossible. Business finances are messy, and here we have some tips to help manage them effectively. Revenue and expenses go hand in hand. Take note of these tips to help you handle them better.

Expenses will play a huge role in your financial health. Expenses are costs that a business incurs to pay and run business operations. This covers everything from paying your rent and buying equipment to costs for packing and shipping.

Here are some suggestions for managing your company's expenses.

One of the most effective ways to have control over your budget is to start with a plan and stick to it. Creating a budget should be practical and applicable to your industry. You need to research your spending patterns and behaviors in order to develop a successful plan.

Annual budgeting is most common, but unforeseen circumstances could make you go off budget. You can control your expenses by drawing up monthly budget plans. This way, you can review and see if you are on track with your overall budget.

But more significantly, you must adhere to your spending plan. Making a budget is useless if you're not committed to sticking to it.

Make it a habit to keep all your receipts. You can record them manually or invest in software to help keep track of your expenses. Software features allow you to capture photos of receipts and store them as data so you can guarantee you don't lose your records.

Furthermore, documentation of expenses is also helpful for taxes. Certain operating expenses can be eligible for tax deductions to lessen your tax liabilities. Keeping a detailed track of your expenses helps you see the areas when you could be overspending to help you strategize your spending patterns.

Many business owners don't pay mind to fixed costs since they are recurring payments. Fixed costs often come from partnerships between merchants and suppliers. After a while, you will think you have a good deal with your suppliers if they don't change their prices. But it would help if you check market offers periodically.

You can start reducing expenses by finding better deals regarding your fixed costs. Get regular quotes to ensure that you are spending your finances correctly.

It's understandable that most business owners believe manual processes are cheaper. Imagine if you have a small business with a dedicated team for packing and shipping orders.

Advanced equipment may look like massive investments at first, but machines can do repetitive tasks equivalent to several people. This means you'll need fewer people to hire, which saves money in the long run.

Business revenue is the total income a business generates from its product sales or by providing services. Revenue is also known as gross income and referred to as the top line because it is typically seen on top of an income statement.

On the other hand, profit or net income is a company's total earnings after business expenses have been deducted. The balance between gains and losses will keep a business running. Here are some helpful tips to generate revenue.

Most companies spend time and assets to gain new customers but often neglect customers to repeat business. Building trust with your consumers will drive them to use your services again.

One effective way to persuade your customers to repeat their purchases from your business is through email. Once your clients join your email list, it allows you to communicate with them. You can solicit their opinion and keep them informed about special offers and new products. They are more inclined to repurchase your goods or services once you have earned their confidence.

Who can resist coupons and discounts? You can use this strategy to funnel sales to your business. Of course, you have to be smart about it. You won't be making sales if all of your customers are granted discounts.

Your most devoted and active clients may receive discounts. These can be used as a thank you gift for buying your products. You can also give discounts to people who purchase a certain amount. For example, you can have promos for people who purchase more than $300.

Coupons, on the other hand, are great for new customers. For example, first-time buyers can have a 5% discount on their first purchase. Coupons such as this will entice new customers to try and purchase your products.

In the United States, over 70% of people prefer to shop online, if you don’t have a well-built website, your competitors will surely outshine your business. Easy navigation and positive user experience can encourage customers to purchase from your business.

Make sure all elements in your website are working and reflect the branding of your business. It should contain all the information your customer needs and make the purchasing process easy for them—from choosing the product or service to processing their payment.

Juggling and managing your time with running a business is a difficult task. You may not want to admit it, but there are other aspects of your business that you fail to give attention to. Marketing your business allows you to gain customers. More customers mean more income.

However, marketing is challenging with so many things on your plate. Instead of forcing yourself, outsource your marketing needs to a professional. These services can guarantee that your investment is worth the price and will help scale your businesses.

You reach more customers as you venture further. Consider opening new branches in different cities if you have a physical store to attract more clients. For your ecommerce counterpart, you can widen your shipping options.

Small businesses usually start deliveries locally, but you can extend your reach nationwide or internationally. Look for shipping partners that will give the best deals to help you reach more customers.

Even big companies use this strategy to increase their total revenue. Offering a higher-priced product can help simple transactions turn into valuable ones. The process of upselling is offering your customer a better version of their original choice. A great example is mobile phones. Companies usually offer products with bigger memory or better performance for a higher price.

Just remember, when you upsell your products, it should be something related to the original choice to find success in your upsell strategy. If they are buying a mobile phone, upsell a better version—not a laptop or other types of gadgets.

Managing your expenses and revenue also includes accounting. Accounting helps owners see their company's financial performance and prepares their business for tax season. When it comes to accounting, Unloop offers different services for small ecommerce businesses.

If you need help managing your revenue and expenses, our bookkeeping services will help you keep up with your business finances. Our services include:

Keeping track of how much your company earns and spends in a specific period keeps your business operations steady and running. Managing expenses and revenue is a challenge, and we hope these tips help you understand and handle your finances better.

For more accounting services, Unloop also offers payroll, taxes, forecasting and accounts payables. Book a call with us now and talk to an expert for free!

Debit or credit? The question can confuse most beginner business owners since, to the average person, it can mean the same thing in certain situations. However, debit and credit are far more different than they are similar. This article will help you settle the debits vs. credits question once and for all.

To understand debit and credit, we have to go back to the basics of business finances: money coming in, and money coming out. It is the inevitable truth of business—you can't earn without spending, and you shouldn’t spend money without expecting returns.

This brings us to our main point: the credit and debit difference. It's an ongoing cycle, give and take. Debit and credit just give us a sharper idea of which goes where.

At first glance, the difference between debit and credit seems pretty straightforward. Debit, since it brings in money for the business, is the one that gives, while credit, which connotes loans and payments, takes.

But if you keep track of your financial transactions and look closely enough, you'll realize that debit and credit are not just fancy accounting jargon, and accounting for each can get pretty complicated. So what's the main difference between the two accounts?

Let's go back to give and take. Businesses live off customers' payments in exchange for goods and services and make investments to maintain or even improve their operations. Customers give you money, and you take money from your budget to pay for necessary expenses.

When a customer pays for services, their money becomes the company's money to do with as they see fit. Such payments can be considered “assets”—resources under a company's control. Assets can be anything from hard cash to vehicles or properties.

But when it's the company's turn to make payments to other entities—whether in the form of investments, expenses, or refunds—they relinquish control of the money in their possession, turning them into a “liability”: a resource or amount a business owes to another individual or business.

The main difference between debit and credit lies in assets and liabilities. A debit increases the value of assets while credit accounting increases the value of liabilities. So while the two both give in some areas, they also take in others, depending on the account.

Here are some examples of assets:

Here are some examples of expense accounts or liability accounts:

To better understand debit and credit, here are some examples of how they function in different accounts.

The balances in a bank and cash account are the simplest way to explain debit and credit. When someone deposits an amount into your bank account, you consider that a debit transaction because cash is an asset, and a deposit increases the amount or value of that asset. Essentially, bank debits are transactions wherein the asset account increases.

But when you pay for something, like bills or expenses, then those are considered credit transactions because you owe certain amounts to other individuals or businesses, taking away your control of the asset. Monthly payments on your prepaid debit cards or credit card bill increase your amount owed, making it a credit.

Revenue includes expenses in the equation, making it a liability. So when a client pays a business a certain amount, that amount is entered into the books as a credit, even if it adds to your business's total income after expenses.

Debits in revenue are made when a customer returns an item or asks for a refund, increasing what your business owes to other entities.

Equity is what remains from the revenue after expenses. It is your profit to be divided among shareholders as their portion. Because it takes money from a business, equity accounts are considered liability accounts on the balance sheet. So if someone invests in your business, even if it helps your company financially, that will still be considered credit because the equity accounts increase.

If you're having trouble determining your profit, remember the accounting equation: liabilities minus expenses equals assets. Usually, the profit's dividends will depend on shareholders' equity.

Accounts receivable are simply your business's earned but unpaid sales. Accounts receivable is considered an asset account because when customers pay for the services, the payments turn into cash for your company. Naturally, logging sales into the accounts receivable is considered a debit entry.

Accounts payable keeps track of how much the business owes, making it a liability. So money sent into this account guarantees it will be spent elsewhere, like suppliers or the company's bills, which is considered a credit transaction. This is usually how a credit card company does business.

You probably think that debits and credits complicate the whole accounting process, which is true to some extent. It is complicated, but not without reason. Debits and credits give context to your business's financial health.

For example, in the two account systems, single-entry and double-entry accounting, borrowing money or a bank loan can be interpreted in different ways. In single-entry accounting, the loan is logged as income since it increases your company's funds. But in double-entry accounting, where transactions are labeled as a debit or credit entry, a loan is considered an expense, or a credit that the business will have to pay in the future.

See, if you only logged the loan as additional cash (which it is, but only temporarily), you risk forgetting it in the future and hurting your company's financial health. But if you log it as an expense now, you can better prepare for it in the future.

One of the best decisions you can make in favor of your business's financial health is deciding on an accounting method to use to track your finances.

If you run your business account on a single-entry system, you won’t have much of an issue since it's simpler: separate income and expense accounts; nothing more, nothing less. You can even manage your books with a single journal entry. You log incoming and outgoing money and mark the difference, which will be your profit.

However simple as it may be, single-entry bookkeeping or accounting poses problems for a businessman accounting for their finances using this process. First, single-entry accounting lacks context. Since you only account for income and expenses, you have only a vague idea of your business finances. Second, because of the lack of context, single-entry accounting cannot produce balance sheets, which leads to problems regarding taxes.

So what's a better choice?

Double-entry bookkeeping or accounting fixes the common problems with single-entry bookkeeping. A better financial context in a double-entry system allows you to make more accurate financial predictions. Consequently, you'll have fewer problems with the tax authorities since you'll be able to provide much needed details with a balance sheet.

Double-entry accounting takes assets, liabilities, and equity into consideration when assessing a company's financial situation. It takes asset and expense accounts and marks the debits and credits properly to make an accurate financial assessment.

With double-entry bookkeeping, you won't have to worry about making it to the end of your financial period since your accounting method keeps you up-to-date. Also, accounting software is usually optimized to record debits and credits properly, so it becomes less of a headache to do.

Learning the difference between debit and credit is essential to the survival of your business finances. The average person will have trouble seeing which—they may even label the same transaction as both debit or credit without noticing.If doing your own accounting isn’t optimal, try a bookkeeping service. A good bookkeeping service can keep your books flawless and your business in great financial shape. Unloop can do this for you. Give us a call to find out how.

Debit or credit? The question can confuse most beginner business owners since, to the average person, it can mean the same thing in certain situations. However, debit and credit are far more different than they are similar. This article will help you settle the debits vs. credits question once and for all.

To understand debit and credit, we have to go back to the basics of business finances: money coming in, and money coming out. It is the inevitable truth of business—you can't earn without spending, and you shouldn’t spend money without expecting returns.

This brings us to our main point: the credit and debit difference. It's an ongoing cycle, give and take. Debit and credit just give us a sharper idea of which goes where.

At first glance, the difference between debit and credit seems pretty straightforward. Debit, since it brings in money for the business, is the one that gives, while credit, which connotes loans and payments, takes.

But if you keep track of your financial transactions and look closely enough, you'll realize that debit and credit are not just fancy accounting jargon, and accounting for each can get pretty complicated. So what's the main difference between the two accounts?

Let's go back to give and take. Businesses live off customers' payments in exchange for goods and services and make investments to maintain or even improve their operations. Customers give you money, and you take money from your budget to pay for necessary expenses.

When a customer pays for services, their money becomes the company's money to do with as they see fit. Such payments can be considered “assets”—resources under a company's control. Assets can be anything from hard cash to vehicles or properties.

But when it's the company's turn to make payments to other entities—whether in the form of investments, expenses, or refunds—they relinquish control of the money in their possession, turning them into a “liability”: a resource or amount a business owes to another individual or business.

The main difference between debit and credit lies in assets and liabilities. A debit increases the value of assets while credit accounting increases the value of liabilities. So while the two both give in some areas, they also take in others, depending on the account.

Here are some examples of assets:

Here are some examples of expense accounts or liability accounts:

To better understand debit and credit, here are some examples of how they function in different accounts.

The balances in a bank and cash account are the simplest way to explain debit and credit. When someone deposits an amount into your bank account, you consider that a debit transaction because cash is an asset, and a deposit increases the amount or value of that asset. Essentially, bank debits are transactions wherein the asset account increases.

But when you pay for something, like bills or expenses, then those are considered credit transactions because you owe certain amounts to other individuals or businesses, taking away your control of the asset. Monthly payments on your prepaid debit cards or credit card bill increase your amount owed, making it a credit.

Revenue includes expenses in the equation, making it a liability. So when a client pays a business a certain amount, that amount is entered into the books as a credit, even if it adds to your business's total income after expenses.

Debits in revenue are made when a customer returns an item or asks for a refund, increasing what your business owes to other entities.

Equity is what remains from the revenue after expenses. It is your profit to be divided among shareholders as their portion. Because it takes money from a business, equity accounts are considered liability accounts on the balance sheet. So if someone invests in your business, even if it helps your company financially, that will still be considered credit because the equity accounts increase.

If you're having trouble determining your profit, remember the accounting equation: liabilities minus expenses equals assets. Usually, the profit's dividends will depend on shareholders' equity.

Accounts receivable are simply your business's earned but unpaid sales. Accounts receivable is considered an asset account because when customers pay for the services, the payments turn into cash for your company. Naturally, logging sales into the accounts receivable is considered a debit entry.

Accounts payable keeps track of how much the business owes, making it a liability. So money sent into this account guarantees it will be spent elsewhere, like suppliers or the company's bills, which is considered a credit transaction. This is usually how a credit card company does business.

You probably think that debits and credits complicate the whole accounting process, which is true to some extent. It is complicated, but not without reason. Debits and credits give context to your business's financial health.

For example, in the two account systems, single-entry and double-entry accounting, borrowing money or a bank loan can be interpreted in different ways. In single-entry accounting, the loan is logged as income since it increases your company's funds. But in double-entry accounting, where transactions are labeled as a debit or credit entry, a loan is considered an expense, or a credit that the business will have to pay in the future.

See, if you only logged the loan as additional cash (which it is, but only temporarily), you risk forgetting it in the future and hurting your company's financial health. But if you log it as an expense now, you can better prepare for it in the future.

One of the best decisions you can make in favor of your business's financial health is deciding on an accounting method to use to track your finances.

If you run your business account on a single-entry system, you won’t have much of an issue since it's simpler: separate income and expense accounts; nothing more, nothing less. You can even manage your books with a single journal entry. You log incoming and outgoing money and mark the difference, which will be your profit.

However simple as it may be, single-entry bookkeeping or accounting poses problems for a businessman accounting for their finances using this process. First, single-entry accounting lacks context. Since you only account for income and expenses, you have only a vague idea of your business finances. Second, because of the lack of context, single-entry accounting cannot produce balance sheets, which leads to problems regarding taxes.

So what's a better choice?

Double-entry bookkeeping or accounting fixes the common problems with single-entry bookkeeping. A better financial context in a double-entry system allows you to make more accurate financial predictions. Consequently, you'll have fewer problems with the tax authorities since you'll be able to provide much needed details with a balance sheet.

Double-entry accounting takes assets, liabilities, and equity into consideration when assessing a company's financial situation. It takes asset and expense accounts and marks the debits and credits properly to make an accurate financial assessment.

With double-entry bookkeeping, you won't have to worry about making it to the end of your financial period since your accounting method keeps you up-to-date. Also, accounting software is usually optimized to record debits and credits properly, so it becomes less of a headache to do.

Learning the difference between debit and credit is essential to the survival of your business finances. The average person will have trouble seeing which—they may even label the same transaction as both debit or credit without noticing.If doing your own accounting isn’t optimal, try a bookkeeping service. A good bookkeeping service can keep your books flawless and your business in great financial shape. Unloop can do this for you. Give us a call to find out how.

Finances keep your business running. That's why managing it can make or break a business. But as new business owners, it can be confusing to handle money, and you might be spending them on things that could be devastating for your business.

For small businesses in particular, every penny counts, and managing finances is not always simple. In this article, we'll outline a few of the most typical errors that small business owners make that might hurt their company.

It is alright to feel excited about opening your business. But often, this excitement turns into unnecessary spending. Buying office space or furniture to make the area cozy can be tempting. There are also pieces of equipment and technology to splurge on. But before buying these things, make sure you need them.

When you have a small business, you can start with the basics. As your business grows and you earn more, you can continuously upgrade. Moreover, don't get business loans you can't pay back. The money you get will allow you to buy things, but if you don't have enough income to pay it back, your business won't generate profit or have the finances to keep operations running.

All businesses should have prepared emergency funds. There's always a possibility that an unwanted event will happen, and most of the time, it will cost you money. You can't always rely on the daily profits since you always have expenses to settle.

With emergency funds, preventing damages to your business will be easier. For example, when a piece of your equipment malfunctions or breaks, you’ll need a large sum of money to repair it. In worse scenarios, you’ll need to replace it. There will also be months when business is slow, and emergency funds can keep your operations running.

Every payment is essential for a small business. But many businesses need to pay more attention to their unpaid invoices. According to recent studies, almost 65% of businesses have unpaid invoices from their clients. That is a lot of money you lose if you're not settling with your clients.

Make it a habit to track your invoices. Send regular notifications to your clients regarding their dues. You can add penalties to overdue payments so clients are forced to pay your business more diligently.

Running a business also means you have tax obligations to fulfill. Many business owners focus on marketing strategies, sales, and other aspects that they often forget to consider taxes. Business taxes can be heavy when you pay them all at the end of the fiscal year.

You can plan them quarterly, so your business's cash flow will not be interrupted. Planning for your taxes will also help you distribute your business finances equally for your required expenses.

Many business owners fail to realize the importance of a positive cash flow. The main focus of cash flow is the money that enters and exits your company. Of course, it's good for your business's finances if cash continues to go into your business. The profit and loss statement can help you identify any cash flow problems early on.

However, there are also business-related expenses you should know of. There's inventory you need to track so you can keep selling and meeting your customers' needs. There are bills to pay, like rent, electricity, and other fees for business operations. Managing small business finances properly can help you balance your income and expenses.

Small business owners often think they have sound financial management if their expenses are paid. Always check your balance sheet to see if the money going out and in is balanced and will still make you profitable.

One of the most common mistakes of business owners is confusing cash and profit. For example, your business generates $1000 per week, and your expenses add up to $450. The cash you have on hand is $1000, and the profit you generate is $550.

In a month, you can expect to earn $4000 with $2200 to pay in expenses. If the business is stable and income is consistent, your expenses will be covered. But remember, business can be slow and unpredictable things can happen. The $4000 may not come in time, and you may not have enough to cover your expenses, leading to your business's downfall.

When business is doing good, and you are earning a lot, buying the things you want and using business profit for personal expenses can be tempting. But it is most practical to keep your personal and professional accounts separate which a lot of small business owners find it challenging to do.

While it makes sense to use your profit for your personal needs since you own the business, remember that a part of your profits should be invested for future growth. Moreover, business profits are used to assess your business's financial health.

Creating a budget is crucial for every business. When you have a clearly drawn budget for your business, you’ll have an accurate expectation of your future expenses. From business loans to buying inventory, paying your tax obligations, and employee payroll, you can ensure to fulfill all your business expenses.