We cannot overstate the importance of bookkeepers in businesses. When an accountant is absent, they perform tasks to fill in the gap. The bookkeeper’s job generally ranges from recording financial transactions and documenting payrolls to making financial statements and more.

The main objective of a bookkeeper is to remain transparent and ensure that employees and employers alike are updated about the company’s financial landscape. That being said, we want to help you understand the value of bookkeeping services, how they handle the financial decision-making of the business, and what values a successful bookkeeper possesses.

If you are an online seller without a background in financing, this is your chance to look at bookkeeping in Mississauga. Read on and find out more!

Financial information is an important variable that determines how individuals and organizations operate. Without monitoring your business’s financial resources, there is no way to fund your projects such that you can profit from them.

For this reason, businesses hire bookkeepers, particularly start-ups that cannot yet afford a licensed accountant. Wherever you go, bookkeepers will always be around, providing financial suggestions to different workplaces such as the following:

Bookkeepers are highly relevant and in demand for businesses that desire gradual but steady growth. Bookkeeping services in Mississauga also focus on evaluating and providing an overview of financial data for their respective companies. If you are fully aware of your business’s financial direction and complete transaction history, you owe this to bookkeepers.

Here are more reasons why bookkeepers are essential and why companies should appreciate their work:

Now let’s talk about the broad process of bookkeeping. How do bookkeepers stay organized despite many expectations set on them? Which ones do bookkeepers do first?

Generally speaking, bookkeepers schedule the different bookkeeping processes they undertake. There are six particular bookkeeping and administration services and processes that bookkeepers regularly monitor:

Despite the hectic responsibilities and backlogs, bookkeepers do their best to live up to workplace expectations. However, some bookkeepers can perform their job better than others because of their outlook and work ethics. Let us look more closely at the five characteristics that make bookkeeping business services successful.

As it is, the role of a bookkeeper is not easy to fill. However, as technology steadily evolves, the nature of the job changes, so the objectives of bookkeepers should adjust as well.

Unfortunately, most bookkeepers’ problems are often related to the shift in focus and increasing use of advanced technology to get the job done. So what can a bookkeeper do to surpass these issues?

The key is to fit their job to what defines a good bookkeeper. Below are the five most important traits that determine a successful bookkeeper. These can transform many bookkeepers out there for the better.

If you have a business in Mississauga, bookkeepers will always be important to you, regardless of your company size. When you think about it, the question you should be asking is, “What kind of bookkeepers should I hire?” instead of “Are bookkeepers important for my business?” Once you look at their profession from the value it adds to you, you’ll see what bookkeepers are more than capable of doing.

Did you learn anything new about Mississauga bookkeeping services? What is a successful bookkeeper to you? Share your insights by commenting below. We would love to hear from you!

We cannot overstate the importance of bookkeepers in businesses. When an accountant is absent, they perform tasks to fill in the gap. The bookkeeper’s job generally ranges from recording financial transactions and documenting payrolls to making financial statements and more.

The main objective of a bookkeeper is to remain transparent and ensure that employees and employers alike are updated about the company’s financial landscape. That being said, we want to help you understand the value of bookkeeping services, how they handle the financial decision-making of the business, and what values a successful bookkeeper possesses.

If you are an online seller without a background in financing, this is your chance to look at bookkeeping in Mississauga. Read on and find out more!

Financial information is an important variable that determines how individuals and organizations operate. Without monitoring your business’s financial resources, there is no way to fund your projects such that you can profit from them.

For this reason, businesses hire bookkeepers, particularly start-ups that cannot yet afford a licensed accountant. Wherever you go, bookkeepers will always be around, providing financial suggestions to different workplaces such as the following:

Bookkeepers are highly relevant and in demand for businesses that desire gradual but steady growth. Bookkeeping services in Mississauga also focus on evaluating and providing an overview of financial data for their respective companies. If you are fully aware of your business’s financial direction and complete transaction history, you owe this to bookkeepers.

Here are more reasons why bookkeepers are essential and why companies should appreciate their work:

Now let’s talk about the broad process of bookkeeping. How do bookkeepers stay organized despite many expectations set on them? Which ones do bookkeepers do first?

Generally speaking, bookkeepers schedule the different bookkeeping processes they undertake. There are six particular bookkeeping and administration services and processes that bookkeepers regularly monitor:

Despite the hectic responsibilities and backlogs, bookkeepers do their best to live up to workplace expectations. However, some bookkeepers can perform their job better than others because of their outlook and work ethics. Let us look more closely at the five characteristics that make bookkeeping business services successful.

As it is, the role of a bookkeeper is not easy to fill. However, as technology steadily evolves, the nature of the job changes, so the objectives of bookkeepers should adjust as well.

Unfortunately, most bookkeepers’ problems are often related to the shift in focus and increasing use of advanced technology to get the job done. So what can a bookkeeper do to surpass these issues?

The key is to fit their job to what defines a good bookkeeper. Below are the five most important traits that determine a successful bookkeeper. These can transform many bookkeepers out there for the better.

If you have a business in Mississauga, bookkeepers will always be important to you, regardless of your company size. When you think about it, the question you should be asking is, “What kind of bookkeepers should I hire?” instead of “Are bookkeepers important for my business?” Once you look at their profession from the value it adds to you, you’ll see what bookkeepers are more than capable of doing.

Did you learn anything new about Mississauga bookkeeping services? What is a successful bookkeeper to you? Share your insights by commenting below. We would love to hear from you!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Starting up or scaling a business is a high-risk, high-reward situation. You need to manage your finances to get your business off the ground. But thanks to accounting software, accounting tasks are now made easier. We know you want the best for your financial needs, so you’re most likely contemplating Sage 50 vs. QuickBooks.

These two accounting software solutions are better for your business’s bookkeeping and accounting needs. But which one suits your needs best? Explore the features, prices, and benefits of having Sage 50 and QuickBooks to see how the two fare against each other.

Both developed during the 1980’s, Sage 50 and QuickBooks have been proven to provide solid accounting and financial software. Unfortunately, business owners find it hard to choose between the two.

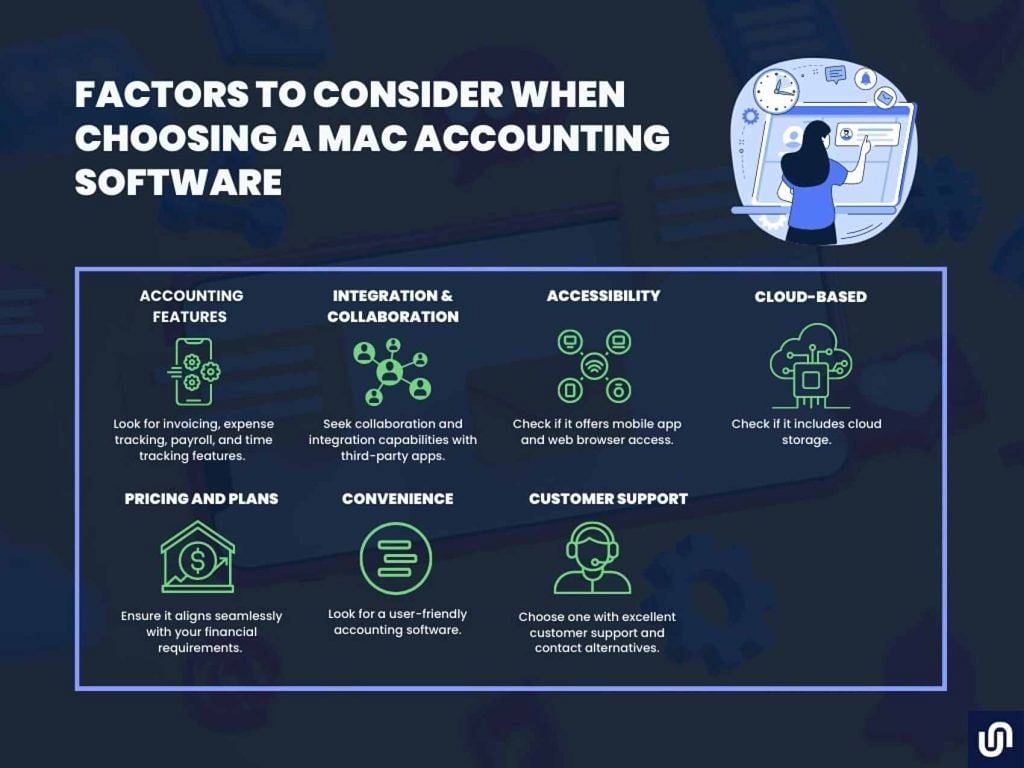

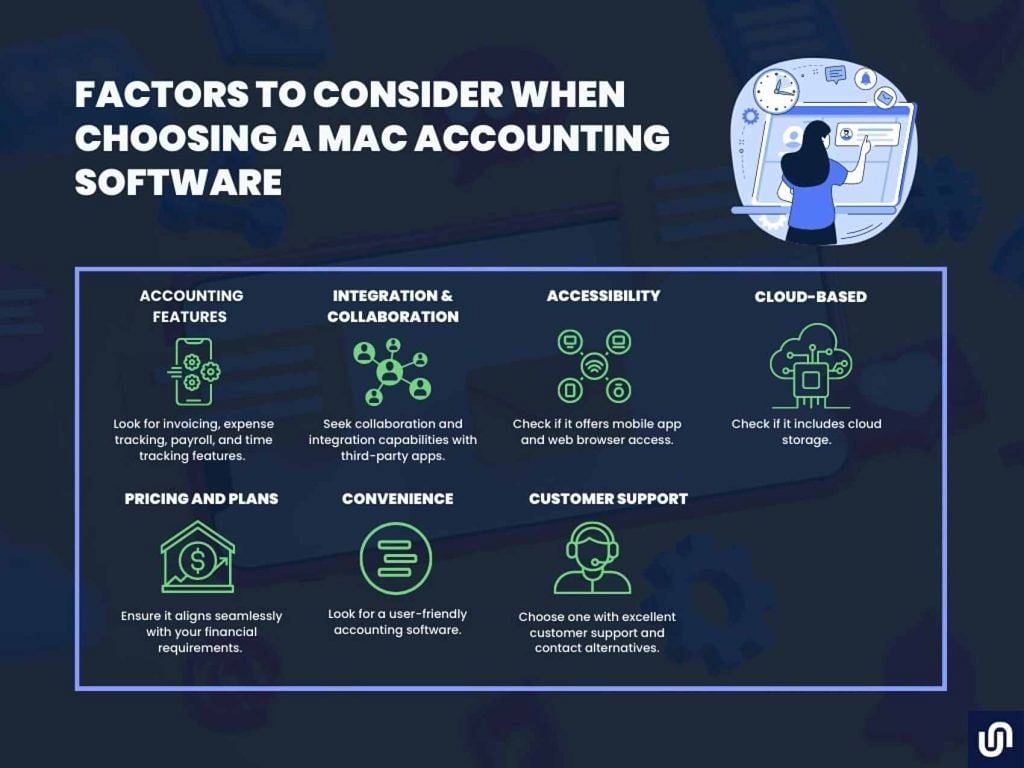

Before exploring the advantages and significant differences between Sage 50 and QuickBooks, here are a few helpful tips to help you select the right one for your business.

Check the prices of different packages. Doing this will help determine if the software package or bookkeeping program fits your business needs.

You should also know how much you are willing to invest in the software. For example, small business owners might be fine with introductory accounting solutions that can deliver basic accounting needs and inventory management at an affordable price.

Meanwhile, established businesses may be looking for accounting software that is inherently cloud-based and offers robust inventory management, even if it is expensive.

Most software comes with accounting features small businesses need, like basic inventory management, invoicing, expense tracking, and an easy-to-use balance sheet where you can see your accounts payable and other financial records.

Some accounting software solutions may also offer expense management and money management. They even have drag-and-drop functionality, allowing accountants to finish their accounting tasks more efficiently.

On the other hand, big companies may need advanced software packages that can manage more than just creating financial reports. They need accounting software that handles overall business and cloud-based project management.

Convenience plays a critical role in accounting. Financial transactions require keen attention to data, analysis, and recording. So, if your accounting department has many accountants and bookkeepers, you should assess the usability of the accounting software package you will use.

Usability is a key term in software testing that refers to how easy and user-friendly a software is. An intuitive interface not only enhances user convenience but also streamlines financial processes. This improves productivity within the business, which is why it’s important.

Aside from usability, check if the software offers remote access. This feature protects your business better against hackers and corruption, especially if the files are saved on a computer or printed on paper.

Check how secure your accounting software is. Research its accounting functions, financial reporting processes, and how it stores and retrieves financial information. The overall safety of your business relies on the software you want to purchase. So, choose a provider you can trust.

| 💡Once you understand the nature of your business and its accounting needs, you can choose the most suitable accounting software. |

Now that you know how to find the best accounting software, let’s see which accounting solution is right for your business. Below are the two most used accounting software by pioneering and modern business owners.

As one of the largest accounting software companies, Sage accounting software simplifies business transactions through its innovative financial management system. From there, any enterprise can accomplish various accounting tasks:

Sage 50 has proven itself to be an outstanding accounting tool over the years. In fact, there’s now Sage 50 cloud, bringing in more advanced features and cloud connectivity no matter the size of your business.

QuickBooks is a leading accounting solution worldwide, providing tools and functionality, from financial statements to payroll management.

For over 20 years, QuickBooks has been the prominent accounting platform, dominating the business management software market. The QuickBooks user interface is easy to use, study, and navigate.

Many rely on the functionality of QuickBooks for small, mid-sized, and large businesses. They offer distinct features and benefits along with QuickBooks essentials, such as:

Whichever you choose, QuickBooks has cost-effective, reliable, and time-saving perks for your business.

Even if Sage 50 and Intuit QuickBooks are two of the leading accounting software in the industry, one will always be more suitable for your business than the other. So, how do you identify which software meets your business needs? Sage 50 or Quickbooks?

Here’s a comparison to help you decide:

| Factors | Sage50 Accounting | QuickBooks |

| Affordability | ✅ | ❌ |

| Customer Support | ✅ | ✅ |

| Scalability | ✅ | ✅ |

| User-Friendly | ❌ | ✅ |

| Third-Party Integration | ❌ | ✅ |

| Advanced Features | ❌ | ✅ |

There are definitely upsides and downsides to investing in Sage or QuickBooks. It is all about choosing what advantages work best for you and what disadvantages are manageable.

✅Affordability: A great option for businesses on a tight budget, given that a Sage plan has unlimited user accounts and cash flow forecasting.

✅Customer Support: Sage comes with self-service resources and support via phone, email, and live chat, which is useful if you don’t have an accounting background.

✅Scalability: Though it lacks accounting features for small businesses, the Sage system has amazing inventory management and collaboration tools that many large-scale business owners appreciate.

❌User-Friendly: Easy to navigate, that’s for sure. However, using it would be stressful if not properly set up.

✅Third-Party Integration: We will be straight to the point—QuickBooks provides more third-party integration than Sage. QuickBooks can be integrated with over 700 apps, while Sage only offers up to 40.

✅Advanced Features: QuickBooks offers more premium features than Sage. For instance, QuickBooks offers on-demand online training, automated revenue recognition, and richer CRM and ERP features that Sage doesn't offer.

✅User-Friendly: QuickBooks users can attest that using the software is so easy that even a 12-year-old can do basic accounting. That’s how simple its interface is.

❌Affordability: Given that it has high-end features at low-tier plans, it is only reasonable that QuickBooks plans would cost you a bit monthly.

Now, let’s talk about the pricing. Both QuickBooks and Sage software offer multiple monthly or annual subscription plans.

| Price | Suitable for | Users | |

| Accounting Start | $10 /month | Self-employed and micro-businesses | 1 |

| Sage Accounting | $25 7.50 /month (70% off for 6 months) | Small businesses | Unlimited users |

| Price | Suitable for | Users | |

| Simple Start | $18 | Self-employed and micro-businesses | 1 |

| Essentials | $27 | Small growing businesses | 3 |

| Plus | $38 | Small to mid-sized businesses | 5 |

| Advanced | $200 | Medium-scale businesses | 25 |

If you are still coming up with the right reasons to buy one of these accounting software, both QuickBooks and Sage 50 have unique functionality that can benefit your business.

QuickBooks is the best accounting software if you own a start-up, small business, or small to mid-sized business (SMB). It focuses more on bookkeeping and accounting.

But if you own a large business, like ecommerce, manufacturing, or real estate, Sage 50 is more suitable for you, especially when you need industry-specific features and functionality.

Need more help settling your small business’s finances? Unloop can help you take control of your books. Book a call with us and let our excellent team of financial experts save you from bookkeeping-related headaches.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Starting up or scaling a business is a high-risk, high-reward situation. You need to manage your finances to get your business off the ground. But thanks to accounting software, accounting tasks are now made easier. We know you want the best for your financial needs, so you’re most likely contemplating Sage 50 vs. QuickBooks.

These two accounting software solutions are better for your business’s bookkeeping and accounting needs. But which one suits your needs best? Explore the features, prices, and benefits of having Sage 50 and QuickBooks to see how the two fare against each other.

Both developed during the 1980’s, Sage 50 and QuickBooks have been proven to provide solid accounting and financial software. Unfortunately, business owners find it hard to choose between the two.

Before exploring the advantages and significant differences between Sage 50 and QuickBooks, here are a few helpful tips to help you select the right one for your business.

Check the prices of different packages. Doing this will help determine if the software package or bookkeeping program fits your business needs.

You should also know how much you are willing to invest in the software. For example, small business owners might be fine with introductory accounting solutions that can deliver basic accounting needs and inventory management at an affordable price.

Meanwhile, established businesses may be looking for accounting software that is inherently cloud-based and offers robust inventory management, even if it is expensive.

Most software comes with accounting features small businesses need, like basic inventory management, invoicing, expense tracking, and an easy-to-use balance sheet where you can see your accounts payable and other financial records.

Some accounting software solutions may also offer expense management and money management. They even have drag-and-drop functionality, allowing accountants to finish their accounting tasks more efficiently.

On the other hand, big companies may need advanced software packages that can manage more than just creating financial reports. They need accounting software that handles overall business and cloud-based project management.

Convenience plays a critical role in accounting. Financial transactions require keen attention to data, analysis, and recording. So, if your accounting department has many accountants and bookkeepers, you should assess the usability of the accounting software package you will use.

Usability is a key term in software testing that refers to how easy and user-friendly a software is. An intuitive interface not only enhances user convenience but also streamlines financial processes. This improves productivity within the business, which is why it’s important.

Aside from usability, check if the software offers remote access. This feature protects your business better against hackers and corruption, especially if the files are saved on a computer or printed on paper.

Check how secure your accounting software is. Research its accounting functions, financial reporting processes, and how it stores and retrieves financial information. The overall safety of your business relies on the software you want to purchase. So, choose a provider you can trust.

| 💡Once you understand the nature of your business and its accounting needs, you can choose the most suitable accounting software. |

Now that you know how to find the best accounting software, let’s see which accounting solution is right for your business. Below are the two most used accounting software by pioneering and modern business owners.

As one of the largest accounting software companies, Sage accounting software simplifies business transactions through its innovative financial management system. From there, any enterprise can accomplish various accounting tasks:

Sage 50 has proven itself to be an outstanding accounting tool over the years. In fact, there’s now Sage 50 cloud, bringing in more advanced features and cloud connectivity no matter the size of your business.

QuickBooks is a leading accounting solution worldwide, providing tools and functionality, from financial statements to payroll management.

For over 20 years, QuickBooks has been the prominent accounting platform, dominating the business management software market. The QuickBooks user interface is easy to use, study, and navigate.

Many rely on the functionality of QuickBooks for small, mid-sized, and large businesses. They offer distinct features and benefits along with QuickBooks essentials, such as:

Whichever you choose, QuickBooks has cost-effective, reliable, and time-saving perks for your business.

Even if Sage 50 and Intuit QuickBooks are two of the leading accounting software in the industry, one will always be more suitable for your business than the other. So, how do you identify which software meets your business needs? Sage 50 or Quickbooks?

Here’s a comparison to help you decide:

| Factors | Sage50 Accounting | QuickBooks |

| Affordability | ✅ | ❌ |

| Customer Support | ✅ | ✅ |

| Scalability | ✅ | ✅ |

| User-Friendly | ❌ | ✅ |

| Third-Party Integration | ❌ | ✅ |

| Advanced Features | ❌ | ✅ |

There are definitely upsides and downsides to investing in Sage or QuickBooks. It is all about choosing what advantages work best for you and what disadvantages are manageable.

✅Affordability: A great option for businesses on a tight budget, given that a Sage plan has unlimited user accounts and cash flow forecasting.

✅Customer Support: Sage comes with self-service resources and support via phone, email, and live chat, which is useful if you don’t have an accounting background.

✅Scalability: Though it lacks accounting features for small businesses, the Sage system has amazing inventory management and collaboration tools that many large-scale business owners appreciate.

❌User-Friendly: Easy to navigate, that’s for sure. However, using it would be stressful if not properly set up.

✅Third-Party Integration: We will be straight to the point—QuickBooks provides more third-party integration than Sage. QuickBooks can be integrated with over 700 apps, while Sage only offers up to 40.

✅Advanced Features: QuickBooks offers more premium features than Sage. For instance, QuickBooks offers on-demand online training, automated revenue recognition, and richer CRM and ERP features that Sage doesn't offer.

✅User-Friendly: QuickBooks users can attest that using the software is so easy that even a 12-year-old can do basic accounting. That’s how simple its interface is.

❌Affordability: Given that it has high-end features at low-tier plans, it is only reasonable that QuickBooks plans would cost you a bit monthly.

Now, let’s talk about the pricing. Both QuickBooks and Sage software offer multiple monthly or annual subscription plans.

| Price | Suitable for | Users | |

| Accounting Start | $10 /month | Self-employed and micro-businesses | 1 |

| Sage Accounting | $25 7.50 /month (70% off for 6 months) | Small businesses | Unlimited users |

| Price | Suitable for | Users | |

| Simple Start | $18 | Self-employed and micro-businesses | 1 |

| Essentials | $27 | Small growing businesses | 3 |

| Plus | $38 | Small to mid-sized businesses | 5 |

| Advanced | $200 | Medium-scale businesses | 25 |

If you are still coming up with the right reasons to buy one of these accounting software, both QuickBooks and Sage 50 have unique functionality that can benefit your business.

QuickBooks is the best accounting software if you own a start-up, small business, or small to mid-sized business (SMB). It focuses more on bookkeeping and accounting.

But if you own a large business, like ecommerce, manufacturing, or real estate, Sage 50 is more suitable for you, especially when you need industry-specific features and functionality.

Need more help settling your small business’s finances? Unloop can help you take control of your books. Book a call with us and let our excellent team of financial experts save you from bookkeeping-related headaches.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

The revenue from e-commerce retail sales in Canada has seen an upward trend since 2017. According to Statista, from $28.59 billion in 2017, it rose to $62.12 billion in 2023. The data company forecasts this upward trend to continue until 2027, with predicted revenue of $94.14 billion.

Behind these numbers are millions of eCommerce sellers like you who have ventured into the industry and opened businesses to fellow Canadians and customers worldwide. If you just began selling online, you have plenty of tasks on your plate, but one thing you should prioritize is taxation.

Let us help you make your workload lighter by providing you with knowledge about Canada's online sales tax for businesses.

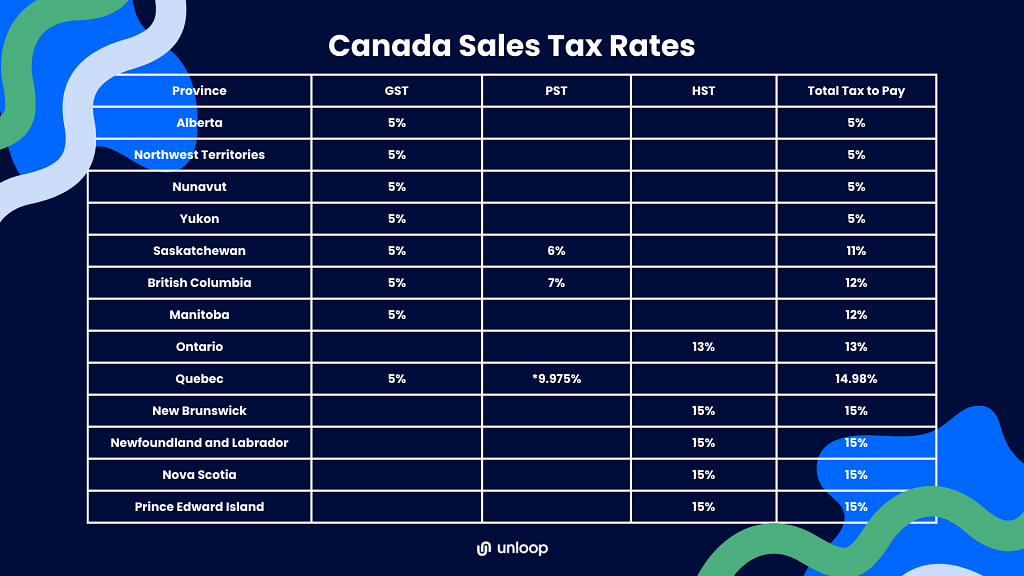

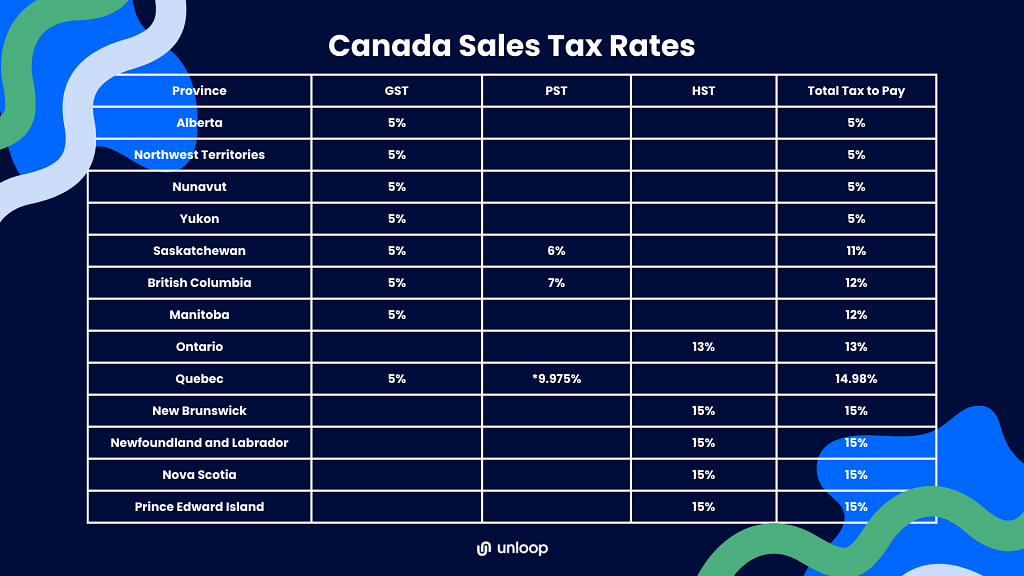

To avoid getting lost, familiarize yourself with the different terms for Canadian taxes. You need to remember four: Goods and Services Tax (GST), Provincial Sales Tax (PST), Harmonized Sales Tax (HST), and Quebec Sales Tax (QST). Let's check their definitions one by one.

The Canadian government mandates a federal tax called the GST which it levies upon all states. The GST comes at 5% of the sale price. The rate will still increase when PST or QST is added. GST is applied to almost all products sold in physical stores and online. Only those tagged as zero-rate are exempted from this taxation.

If your buyers are from Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Saskatchewan, Quebec, and Yukon, prepare to charge this sales tax. All these provinces have GST either independently or together with PST or QST.

The provincial sales tax, on the other hand, is a local sales tax working in combination with the GST. For example, if the GST is 5% and the PST is 7%, the Canada Revenue Agency (CRA) charges businesses a 12% sales tax. However, not all provinces have a PST. Some provinces charge only GST, while others apply the Harmonized Sales Tax (HST).

As the name suggests, this is the additional tax imposed by provinces like British Columbia, Manitoba, and Saskatchewan. The tax rate varies per province.

So when computing the sales tax, adding the 5% GST to the given PST rates results in the following final rates:

An example transaction goes like this: let's say you sold a pair of rubber shoes at $29.99 to a customer living in British Columbia. For this sale, you have to charge a 12% sales tax.

In place of the GST and PST, certain provinces opt for a harmonized sales tax. Aside from Ontario, participating provinces follow the same HST rate, which is a standard 15%, while Ontario uses 13%.

Lawmakers have passed the harmonization of the two through HST to skip the hassle of separately computing federal and provincial taxes. When you make sales from these provinces, you do not need to look for the GST and PST rates; apply the HST rate.

Five provinces, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, and Prince Edward Island, follow this taxation system, and the rates vary per province.

Quebec's PST is called the QST. Quebec is the only province to differ among all provinces that use PST with a sales tax rate of 9.975%.

In Quebec, the sales tax consists of the GST and QST, with the QST at 9.975% and GST still at 5%. However, you do not have to remit QST if you satisfy any of the following conditions:

For instance, a supplier that does not reside and does not have a physical store in Quebec supplies products to Quebec businesses. In this case, they should only charge their customers with the 5% GST. On the other hand, sellers must charge GST and QST for individual orders delivered to Quebec residents.

Whether you are a new resident, a maple leaf-loving local, self-employed, or a business entity, understanding your tax obligations is crucial to maintain compliance with the Canadian tax system. In Canada, here are the businesses that need to pay taxes.

Canadian businesses follow the “small supplier rule.” In this rule, if you qualify as a small business that makes less than $30,000 in annual revenue on taxable supplies, you're not required to open a GST/HST account. Collecting and remitting sales taxes is unnecessary for you.

However, most provinces under PST don't cover provincial sales taxes for small suppliers, so while you don't have to pay GST or HST, you might still have to pay the provincial portion regardless of your sales volume.

Originally, the federal government did not require businesses not physically based in Canada to collect and remit Canadian sales taxes. However, new tax policies put Canadian businesses at a disadvantage since their prices would be higher.

Because of this, currently, foreign businesses must pay the GST/HST rate and the PST if their total revenue surpasses $30,000. Foreign businesses or non-residents are not required to be physically present in Canada. They must voluntarily register with the CRA and provide personal solutions to determine where their customers live and what taxes apply to their purchases.

Taxation is undeniably complex, and the different sales taxes in Canada make it more overwhelming. With that, here are some reminders to help you know how much to pass on to your client or whether to charge them or not.

You must also know the department where you must submit your collected sales tax. So, keep reading!

The first step is to determine the buyer's address. Remember that the basis of sales tax is not where the package came from but where it is going. For instance, an order from Ontario will be delivered to a customer in Manitoba. The sales tax rate to follow is Manitoba's 12% sales tax rate.

The standard procedure in British Columbia, Manitoba, and Saskatchewan is that orders sent to residents of these provinces should be taxed accordingly. However, specific rules differ on who should pay taxes and who is exempted. If you deliver in these locations, it is best to get into the specifics of the local tax regulations.

While almost all goods have sales tax and most individuals must pay taxes for their purchases, some products are zero-rated and customers tax exempted.

These are the goods you can buy without paying any sales tax.

These specific groups are also not required to pay sales taxes.

Remember not to apply sales tax if you sell these goods or to these groups.

For individual orders, sales tax is based on the location of the buyer. But what if you are a raw materials manufacturer and sell not to end users but to product developers? Should you also charge sales tax to your customers?

The levels of resales are a common scenario in the production of goods. A resale certificate will save the business buying your raw materials from paying sales tax as they are not the end user of the final product.

In Canada, Internet sales tax regulations state that online sellers are required to charge sales tax on their orders. With that, there is no confusion about whether you should collect taxes from your buyers.

Whether selling in a mall, a stand-alone boutique, or online, sales tax applies if you made a taxable sale to a Canadian customer. However, as mentioned earlier, it's best to understand and abide by the specific ecommerce sales tax rules per province.

In Canada, you should be familiar with these two offices to pay your taxes: Revenu Quebec for the province of Quebec and the Canadian Revenue Agency (CRA) for the rest of the country.

These two offices implement tax laws and handle all tax-related transactions, from income tax, value-added tax, and excise tax to sales tax. After collecting the sales tax, you need to remit all the sales tax you collected to these agencies.

Managing sales tax in Canada involves several crucial steps to ensure compliance and smooth operations. From understanding the different tax rates in various jurisdictions to computing, collecting, and remitting taxes, this guide outlines essential steps to navigate the complexities of Canadian sales tax.

Tax time can be stressful for business owners since calculating and filing taxes can get very complicated. Fortunately, the Canada Revenue Agency has provided three easy ways to pay your sales taxes.

Nowadays, it's becoming less popular to go to the bank for all your transactions physically. Different financial institutions are normalizing electronic payment methods, and it's also become a reliable payment method for the Canada Revenue Agency.

The Canada Revenue Agency devised an online payment system called MyPayment. Check the CRA's website to see the specific guidelines for MyPayment.

Despite the rising popularity of electronic payments, bank runs aren't going out of style yet. To pay through financial institutions, fill up a form called “Form RC158 - Remittance Voucher,” which you can only get from the bank since no soft copies are available online.

Should you need to make other tax-related payments, financial institutions also provide the following forms:

If you plan on paying with foreign currency, you'll have to apply the current exchange rate to your remittance and pay that.

If the other two payment options don't work, you can always go old school and remit your sales taxes through snail mail. The Canada Revenue Agency can accept payments via mail or courier, but you'll have to keep the amount below $50,000.

Otherwise, you'll have to pay either electronically or through a bank.

Taxes are every business's responsibility; staying in business means paying taxes without error. Not filing your taxes or even filing them improperly, like miscalculating or failing to declare some expenses, could lead to serious repercussions for your business. It could lead to legal battles and, in serious cases, jail time.

Here are a few examples of tax crimes all businesses should be wary of.

Generally speaking, tax evasion is failure to pay taxes. The worst businesses intentionally commit tax evasion by undervaluing their taxable assets or not reporting taxes at all. You can get more jail time from tax evasion than tax fraud.

Tax fraud, on the other hand, is simply misreporting your taxable assets. Sometimes, people confuse which assets are taxable and allow themselves to be willfully blind to avoid reporting such assets. Assisting people in committing these acts is also considered tax fraud.

You can do your sales tax on your own if you are still beginning your business, but you can imagine the increase in the workload when your sales boom. Ecommerce sales tax solutions make your business processes more efficient and lessen your work.

Having a team of experts looking at your tax returns is important so you won't make any mistakes regarding your taxes. Here are the ways to make sales tax management easier.

Rely on sales tax software like QuickBooks, Xero, A2X, and Hubdoc. They collate sales transaction details and compute sales tax per order. They also store all transactions in the system, so you can run reports to check how much sales tax you've collected and other key performance indicators to help you make decisions.

Delegate bookkeeping to a trained bookkeeper to ensure the proper tracking and categorizing all transactions. An experienced bookkeeper will update your books timely and ensure data accuracy while you focus on business operations, product quality checks, and customer service.

Taxation is an essential task that can determine your business's success or failure. Thus, it is best to have someone well-versed in tax laws and regulations like an ecommerce sales tax accountant. Your accountant will check your sales tax compliance and create reports from the information gathered by the bookkeeper. Let them take care of tax management and payment on your business too.

As a business owner, you are now one of the millions of Canadian ecommerce sellers contributing to the growth of the industry in the country and worldwide. You can be a responsible seller by collecting the correct sales taxes as mandated by the Canadian government and remitting them on time. If you ever need assistance in this area of your business, we at Unloop offer bookkeeping business solutions. Our team of experienced bookkeepers will help you track and prepare your sales tax information before tax season. Delegate the task to us so that you can focus on scaling your business. Book a call with us now. We'd love to hear from you!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

The revenue from e-commerce retail sales in Canada has seen an upward trend since 2017. According to Statista, from $28.59 billion in 2017, it rose to $62.12 billion in 2023. The data company forecasts this upward trend to continue until 2027, with predicted revenue of $94.14 billion.

Behind these numbers are millions of eCommerce sellers like you who have ventured into the industry and opened businesses to fellow Canadians and customers worldwide. If you just began selling online, you have plenty of tasks on your plate, but one thing you should prioritize is taxation.

Let us help you make your workload lighter by providing you with knowledge about Canada's online sales tax for businesses.

To avoid getting lost, familiarize yourself with the different terms for Canadian taxes. You need to remember four: Goods and Services Tax (GST), Provincial Sales Tax (PST), Harmonized Sales Tax (HST), and Quebec Sales Tax (QST). Let's check their definitions one by one.

The Canadian government mandates a federal tax called the GST which it levies upon all states. The GST comes at 5% of the sale price. The rate will still increase when PST or QST is added. GST is applied to almost all products sold in physical stores and online. Only those tagged as zero-rate are exempted from this taxation.

If your buyers are from Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Saskatchewan, Quebec, and Yukon, prepare to charge this sales tax. All these provinces have GST either independently or together with PST or QST.

The provincial sales tax, on the other hand, is a local sales tax working in combination with the GST. For example, if the GST is 5% and the PST is 7%, the Canada Revenue Agency (CRA) charges businesses a 12% sales tax. However, not all provinces have a PST. Some provinces charge only GST, while others apply the Harmonized Sales Tax (HST).

As the name suggests, this is the additional tax imposed by provinces like British Columbia, Manitoba, and Saskatchewan. The tax rate varies per province.

So when computing the sales tax, adding the 5% GST to the given PST rates results in the following final rates:

An example transaction goes like this: let's say you sold a pair of rubber shoes at $29.99 to a customer living in British Columbia. For this sale, you have to charge a 12% sales tax.

In place of the GST and PST, certain provinces opt for a harmonized sales tax. Aside from Ontario, participating provinces follow the same HST rate, which is a standard 15%, while Ontario uses 13%.

Lawmakers have passed the harmonization of the two through HST to skip the hassle of separately computing federal and provincial taxes. When you make sales from these provinces, you do not need to look for the GST and PST rates; apply the HST rate.

Five provinces, New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, and Prince Edward Island, follow this taxation system, and the rates vary per province.

Quebec's PST is called the QST. Quebec is the only province to differ among all provinces that use PST with a sales tax rate of 9.975%.

In Quebec, the sales tax consists of the GST and QST, with the QST at 9.975% and GST still at 5%. However, you do not have to remit QST if you satisfy any of the following conditions:

For instance, a supplier that does not reside and does not have a physical store in Quebec supplies products to Quebec businesses. In this case, they should only charge their customers with the 5% GST. On the other hand, sellers must charge GST and QST for individual orders delivered to Quebec residents.

Whether you are a new resident, a maple leaf-loving local, self-employed, or a business entity, understanding your tax obligations is crucial to maintain compliance with the Canadian tax system. In Canada, here are the businesses that need to pay taxes.

Canadian businesses follow the “small supplier rule.” In this rule, if you qualify as a small business that makes less than $30,000 in annual revenue on taxable supplies, you're not required to open a GST/HST account. Collecting and remitting sales taxes is unnecessary for you.

However, most provinces under PST don't cover provincial sales taxes for small suppliers, so while you don't have to pay GST or HST, you might still have to pay the provincial portion regardless of your sales volume.

Originally, the federal government did not require businesses not physically based in Canada to collect and remit Canadian sales taxes. However, new tax policies put Canadian businesses at a disadvantage since their prices would be higher.

Because of this, currently, foreign businesses must pay the GST/HST rate and the PST if their total revenue surpasses $30,000. Foreign businesses or non-residents are not required to be physically present in Canada. They must voluntarily register with the CRA and provide personal solutions to determine where their customers live and what taxes apply to their purchases.

Taxation is undeniably complex, and the different sales taxes in Canada make it more overwhelming. With that, here are some reminders to help you know how much to pass on to your client or whether to charge them or not.

You must also know the department where you must submit your collected sales tax. So, keep reading!

The first step is to determine the buyer's address. Remember that the basis of sales tax is not where the package came from but where it is going. For instance, an order from Ontario will be delivered to a customer in Manitoba. The sales tax rate to follow is Manitoba's 12% sales tax rate.

The standard procedure in British Columbia, Manitoba, and Saskatchewan is that orders sent to residents of these provinces should be taxed accordingly. However, specific rules differ on who should pay taxes and who is exempted. If you deliver in these locations, it is best to get into the specifics of the local tax regulations.

While almost all goods have sales tax and most individuals must pay taxes for their purchases, some products are zero-rated and customers tax exempted.

These are the goods you can buy without paying any sales tax.

These specific groups are also not required to pay sales taxes.

Remember not to apply sales tax if you sell these goods or to these groups.

For individual orders, sales tax is based on the location of the buyer. But what if you are a raw materials manufacturer and sell not to end users but to product developers? Should you also charge sales tax to your customers?

The levels of resales are a common scenario in the production of goods. A resale certificate will save the business buying your raw materials from paying sales tax as they are not the end user of the final product.

In Canada, Internet sales tax regulations state that online sellers are required to charge sales tax on their orders. With that, there is no confusion about whether you should collect taxes from your buyers.

Whether selling in a mall, a stand-alone boutique, or online, sales tax applies if you made a taxable sale to a Canadian customer. However, as mentioned earlier, it's best to understand and abide by the specific ecommerce sales tax rules per province.

In Canada, you should be familiar with these two offices to pay your taxes: Revenu Quebec for the province of Quebec and the Canadian Revenue Agency (CRA) for the rest of the country.

These two offices implement tax laws and handle all tax-related transactions, from income tax, value-added tax, and excise tax to sales tax. After collecting the sales tax, you need to remit all the sales tax you collected to these agencies.

Managing sales tax in Canada involves several crucial steps to ensure compliance and smooth operations. From understanding the different tax rates in various jurisdictions to computing, collecting, and remitting taxes, this guide outlines essential steps to navigate the complexities of Canadian sales tax.

Tax time can be stressful for business owners since calculating and filing taxes can get very complicated. Fortunately, the Canada Revenue Agency has provided three easy ways to pay your sales taxes.

Nowadays, it's becoming less popular to go to the bank for all your transactions physically. Different financial institutions are normalizing electronic payment methods, and it's also become a reliable payment method for the Canada Revenue Agency.

The Canada Revenue Agency devised an online payment system called MyPayment. Check the CRA's website to see the specific guidelines for MyPayment.

Despite the rising popularity of electronic payments, bank runs aren't going out of style yet. To pay through financial institutions, fill up a form called “Form RC158 - Remittance Voucher,” which you can only get from the bank since no soft copies are available online.

Should you need to make other tax-related payments, financial institutions also provide the following forms:

If you plan on paying with foreign currency, you'll have to apply the current exchange rate to your remittance and pay that.

If the other two payment options don't work, you can always go old school and remit your sales taxes through snail mail. The Canada Revenue Agency can accept payments via mail or courier, but you'll have to keep the amount below $50,000.

Otherwise, you'll have to pay either electronically or through a bank.

Taxes are every business's responsibility; staying in business means paying taxes without error. Not filing your taxes or even filing them improperly, like miscalculating or failing to declare some expenses, could lead to serious repercussions for your business. It could lead to legal battles and, in serious cases, jail time.

Here are a few examples of tax crimes all businesses should be wary of.

Generally speaking, tax evasion is failure to pay taxes. The worst businesses intentionally commit tax evasion by undervaluing their taxable assets or not reporting taxes at all. You can get more jail time from tax evasion than tax fraud.

Tax fraud, on the other hand, is simply misreporting your taxable assets. Sometimes, people confuse which assets are taxable and allow themselves to be willfully blind to avoid reporting such assets. Assisting people in committing these acts is also considered tax fraud.

You can do your sales tax on your own if you are still beginning your business, but you can imagine the increase in the workload when your sales boom. Ecommerce sales tax solutions make your business processes more efficient and lessen your work.

Having a team of experts looking at your tax returns is important so you won't make any mistakes regarding your taxes. Here are the ways to make sales tax management easier.

Rely on sales tax software like QuickBooks, Xero, A2X, and Hubdoc. They collate sales transaction details and compute sales tax per order. They also store all transactions in the system, so you can run reports to check how much sales tax you've collected and other key performance indicators to help you make decisions.

Delegate bookkeeping to a trained bookkeeper to ensure the proper tracking and categorizing all transactions. An experienced bookkeeper will update your books timely and ensure data accuracy while you focus on business operations, product quality checks, and customer service.

Taxation is an essential task that can determine your business's success or failure. Thus, it is best to have someone well-versed in tax laws and regulations like an ecommerce sales tax accountant. Your accountant will check your sales tax compliance and create reports from the information gathered by the bookkeeper. Let them take care of tax management and payment on your business too.

As a business owner, you are now one of the millions of Canadian ecommerce sellers contributing to the growth of the industry in the country and worldwide. You can be a responsible seller by collecting the correct sales taxes as mandated by the Canadian government and remitting them on time. If you ever need assistance in this area of your business, we at Unloop offer bookkeeping business solutions. Our team of experienced bookkeepers will help you track and prepare your sales tax information before tax season. Delegate the task to us so that you can focus on scaling your business. Book a call with us now. We'd love to hear from you!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

The ecommerce landscape can be difficult to navigate, especially with many new currencies, regulations, and tax laws on the horizon. Accounting will be more challenging than it used to be. Multi-currency ecommerce accounting is a topic that scares many entrepreneurs. Luckily, multi-currency accounting software is here to help!

What do these tools have to offer for blossoming businesses like yours? This article will walk you through the basics of multi-currency accounting and show what this software can do for your business.

One of the most important things you need to know about ecommerce accounting is how it works with multi-currency transactions. If you're new to the ecommerce system, taking everything in won't be easy. So let this article help you with a quick discussion.

Let's say your company is based in the US, but you get product supplies from China and sell them to European clients. As you can guess, this will involve three currencies: USD, RMB, and EUR. Consequently, the following (but are not limited to) challenges may arise:

There are just too many things involved when dealing with foreign currency transactions. You can't simply calculate all the costs and generate a receipt in USD for these reasons.

Foreign transactions involve money more than anything else, affecting your bookkeeping and accounting operations the most. Here are specific processes that become more complicated and time-consuming when multi-currency is involved:

Suppose your ecommerce business deals with multiple currencies. In that case, you must find a way to avoid confusion and making mistakes.

Luckily, some ecommerce platforms or small business accounting software can solve your multi-currency dilemma: creating a multi-currency account.

It pays to use online accounting software that offers multi-currency features. These systems allow you to perform essential accounting functions while ensuring you accurately track and manage transactions in various currencies.

With multi-currency and entry-level accounting software, you can:

A multi-currency account is a single bank account that allows the holding, payment, and receiving of multiple money currencies. If you're selling internationally, this is a great advantage to reduce the hassle of complex rates.

Here's how it makes your business's financial operations easier when dealing with foreign payments:

Now that you understand its necessity, here's a basic overview of creating a multi-currency account. Take note that the process may differ per platform or software. Below is a general step-by-step procedure to give you a gist:

OFX is an example of an excellent international money transfer platform. The good thing about OFX is that it doesn't charge transfer fees and offers more reasonable rates than its competitors.

In addition, it supports 55 currencies and takes 1-5 days to transfer, depending on the location (unfortunately, it doesn't accept same-day transfers).

Here's an overview of how you can set up a multi-currency account on this platform:

The world is rapidly moving to digital reliance, and ecommerce is running in full force. Hence, businesses must ensure that their financial management system supports and adapts multi-currency accounting.

Otherwise, you'll have difficulty dealing with the overwhelming complexity of foreign rates. Before it gets to that, learn how to get financially native in foreign lands.

Now, we understand that this could be a lot of information. But don't fret; Unloop can extend a hand to help you organize foreign currencies! Whether you need bookkeeping in Calgary or other Canadian areas and across the US, Unloop can help ease your bookkeeping management duties through a remote setting.

We're ready to be your long-term business partner and help you with your bookkeeping tasks, such as calculating COGS and dealing with Shopify and Amazon corporate tax rates. OFX is also one of the tools we use for our services.

Book a call with us today or explore our blog section for more resources.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

The ecommerce landscape can be difficult to navigate, especially with many new currencies, regulations, and tax laws on the horizon. Accounting will be more challenging than it used to be. Multi-currency ecommerce accounting is a topic that scares many entrepreneurs. Luckily, multi-currency accounting software is here to help!

What do these tools have to offer for blossoming businesses like yours? This article will walk you through the basics of multi-currency accounting and show what this software can do for your business.

One of the most important things you need to know about ecommerce accounting is how it works with multi-currency transactions. If you're new to the ecommerce system, taking everything in won't be easy. So let this article help you with a quick discussion.

Let's say your company is based in the US, but you get product supplies from China and sell them to European clients. As you can guess, this will involve three currencies: USD, RMB, and EUR. Consequently, the following (but are not limited to) challenges may arise:

There are just too many things involved when dealing with foreign currency transactions. You can't simply calculate all the costs and generate a receipt in USD for these reasons.

Foreign transactions involve money more than anything else, affecting your bookkeeping and accounting operations the most. Here are specific processes that become more complicated and time-consuming when multi-currency is involved:

Suppose your ecommerce business deals with multiple currencies. In that case, you must find a way to avoid confusion and making mistakes.

Luckily, some ecommerce platforms or small business accounting software can solve your multi-currency dilemma: creating a multi-currency account.

It pays to use online accounting software that offers multi-currency features. These systems allow you to perform essential accounting functions while ensuring you accurately track and manage transactions in various currencies.

With multi-currency and entry-level accounting software, you can:

A multi-currency account is a single bank account that allows the holding, payment, and receiving of multiple money currencies. If you're selling internationally, this is a great advantage to reduce the hassle of complex rates.

Here's how it makes your business's financial operations easier when dealing with foreign payments:

Now that you understand its necessity, here's a basic overview of creating a multi-currency account. Take note that the process may differ per platform or software. Below is a general step-by-step procedure to give you a gist:

OFX is an example of an excellent international money transfer platform. The good thing about OFX is that it doesn't charge transfer fees and offers more reasonable rates than its competitors.

In addition, it supports 55 currencies and takes 1-5 days to transfer, depending on the location (unfortunately, it doesn't accept same-day transfers).

Here's an overview of how you can set up a multi-currency account on this platform:

The world is rapidly moving to digital reliance, and ecommerce is running in full force. Hence, businesses must ensure that their financial management system supports and adapts multi-currency accounting.

Otherwise, you'll have difficulty dealing with the overwhelming complexity of foreign rates. Before it gets to that, learn how to get financially native in foreign lands.

Now, we understand that this could be a lot of information. But don't fret; Unloop can extend a hand to help you organize foreign currencies! Whether you need bookkeeping in Calgary or other Canadian areas and across the US, Unloop can help ease your bookkeeping management duties through a remote setting.

We're ready to be your long-term business partner and help you with your bookkeeping tasks, such as calculating COGS and dealing with Shopify and Amazon corporate tax rates. OFX is also one of the tools we use for our services.

Book a call with us today or explore our blog section for more resources.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

It's no secret that people are shopping more on Amazon. This is because they offer competitive prices and items that are delivered right to your door. But more treats are waiting for both Amazon buyers and sellers. One of them is a very important benefit: saving money.

You might not be knowledgeable enough to know how easy it is to save money with a seamless buying process. This article will discuss tips for optimizing the purchase process, including the Amazon Sales Tax Exemption Program (ATEP).

A good business does its best to provide customers with a great purchasing experience. Without consumers, the business won't be there in the first place. Moreover, an easy and fair transaction process reduces questions or doubts from your customers.

Financially, it saves and earns you a lot of money. An optimized buying process reduces the likelihood of product returns. Returns can hurt the business's profit, so providing a good customer experience can minimize financial loss. It also shows you've gained customer trust and satisfaction.

Now that you know how important it is to provide a smooth purchasing process, here are some tips on optimizing the buying experience. Additionally, we'll introduce you to the ATEP feature from Amazon for tax-free and unquestionable purchases.

An online action without a response can make your customers anxious. Let's say a customer completes a checkout. From their perspective, what would you expect to receive after that? Naturally, you will look for the order acknowledgment, shipment notifications, invoice, and item receipt.

Without these things, your customer won't be able to sleep at night trying to guess if their purchase went through successfully. So keep this in mind as you work on your eCommerce transaction systems.

When it comes to the company's financial matters like policies and processes, every employee must understand how they work. Doing this can help prevent financial issues, regardless of whether they're directly or indirectly involved.

It's not ideal to just set the rules and let them comprehend things on their own. Instead, ensure everyone understands the systems step-by-step and in detail. Some examples include order approvals, purchase agreements, product information management, and many more.

It's important to hold productive discussions about the purchasing process to ensure its success. What do you want to track? What are some realistic expectations and limitations you want to set? How are you going to achieve them? The answers are called specific, measurable, achievable, relevant, and time-bound (SMART) goals.

You set and monitor KPIs to achieve these SMART goals. Some examples of aspects you can track are cost savings, average time for delivery, purchasing cycle, supplier lead, and the average cost of a purchase order.

If you're an Amazon seller, you can qualify for a sales tax exemption. Individuals and businesses can make Amazon sales tax-exempt purchases using the ATEP. Here are some rules for you to quickly understand who is eligible for it:

How to apply for tax exemption on Amazon? You can find a thorough guide on the enrollment process in the Amazon Tax Exemption Wizard.

But how do you associate it with optimizing the purchase process? Tax-free products are a benefit to the company and its customers. That being said, it doesn't apply to everyone, so you have to make it clear to your buyers.

For example, optimize your product tags or create a page about ATEP on your eCommerce website. This way, your Amazon customers will not get confused about the purchasing process.

The purchasing process can be tough work. However, it's a crucial aspect of financial management, especially for Amazon accounting. You can make the company workload lighter and more organized when done correctly, while providing a better customer experience. Consequently, you get fewer returns, fewer order issues, and reduced financial stress.

Still, it's easier said than done. For startups and small businesses venturing into the eCommerce world, this can be quite overwhelming. All kinds of costs involved have to be organized to analyze and forecast the company's financial state. Working on these will require efficient business bookkeeping and accounting.

But don't worry! If you find financial management difficult, Unloop can help you improve. We offer bookkeeping, income tax, and Quickbooks eCommerce sales tax services together with partner accounting firms. Whether you're looking for bookkeeping help, better financial management practices, or simply trying to overcome the challenges of eCommerce, we’ve got your back.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

It's no secret that people are shopping more on Amazon. This is because they offer competitive prices and items that are delivered right to your door. But more treats are waiting for both Amazon buyers and sellers. One of them is a very important benefit: saving money.

You might not be knowledgeable enough to know how easy it is to save money with a seamless buying process. This article will discuss tips for optimizing the purchase process, including the Amazon Sales Tax Exemption Program (ATEP).

A good business does its best to provide customers with a great purchasing experience. Without consumers, the business won't be there in the first place. Moreover, an easy and fair transaction process reduces questions or doubts from your customers.

Financially, it saves and earns you a lot of money. An optimized buying process reduces the likelihood of product returns. Returns can hurt the business's profit, so providing a good customer experience can minimize financial loss. It also shows you've gained customer trust and satisfaction.

Now that you know how important it is to provide a smooth purchasing process, here are some tips on optimizing the buying experience. Additionally, we'll introduce you to the ATEP feature from Amazon for tax-free and unquestionable purchases.

An online action without a response can make your customers anxious. Let's say a customer completes a checkout. From their perspective, what would you expect to receive after that? Naturally, you will look for the order acknowledgment, shipment notifications, invoice, and item receipt.

Without these things, your customer won't be able to sleep at night trying to guess if their purchase went through successfully. So keep this in mind as you work on your eCommerce transaction systems.

When it comes to the company's financial matters like policies and processes, every employee must understand how they work. Doing this can help prevent financial issues, regardless of whether they're directly or indirectly involved.

It's not ideal to just set the rules and let them comprehend things on their own. Instead, ensure everyone understands the systems step-by-step and in detail. Some examples include order approvals, purchase agreements, product information management, and many more.

It's important to hold productive discussions about the purchasing process to ensure its success. What do you want to track? What are some realistic expectations and limitations you want to set? How are you going to achieve them? The answers are called specific, measurable, achievable, relevant, and time-bound (SMART) goals.

You set and monitor KPIs to achieve these SMART goals. Some examples of aspects you can track are cost savings, average time for delivery, purchasing cycle, supplier lead, and the average cost of a purchase order.

If you're an Amazon seller, you can qualify for a sales tax exemption. Individuals and businesses can make Amazon sales tax-exempt purchases using the ATEP. Here are some rules for you to quickly understand who is eligible for it:

How to apply for tax exemption on Amazon? You can find a thorough guide on the enrollment process in the Amazon Tax Exemption Wizard.

But how do you associate it with optimizing the purchase process? Tax-free products are a benefit to the company and its customers. That being said, it doesn't apply to everyone, so you have to make it clear to your buyers.

For example, optimize your product tags or create a page about ATEP on your eCommerce website. This way, your Amazon customers will not get confused about the purchasing process.

The purchasing process can be tough work. However, it's a crucial aspect of financial management, especially for Amazon accounting. You can make the company workload lighter and more organized when done correctly, while providing a better customer experience. Consequently, you get fewer returns, fewer order issues, and reduced financial stress.

Still, it's easier said than done. For startups and small businesses venturing into the eCommerce world, this can be quite overwhelming. All kinds of costs involved have to be organized to analyze and forecast the company's financial state. Working on these will require efficient business bookkeeping and accounting.

But don't worry! If you find financial management difficult, Unloop can help you improve. We offer bookkeeping, income tax, and Quickbooks eCommerce sales tax services together with partner accounting firms. Whether you're looking for bookkeeping help, better financial management practices, or simply trying to overcome the challenges of eCommerce, we’ve got your back.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Amazon taxes are a tricky subject. There is the gray area of international taxation and how it can impact your business in Canada, or anywhere else you might be doing business. This post will help you understand what you need to know about Amazon taxes for sellers, why they matter, and how to ensure that your business is compliant with the tax code.

As an Amazon seller, you are responsible for managing your tax obligations. This includes filing and paying estimated taxes and remitting any balance of GST/HST collected on sales to the Canada Revenue Agency (CRA). You need to undertake various processes in order to report and pay your tax liabilities.

Scroll deeper and dive into the Canadian tax landscape as it relates to Amazon sellers.

If you are a non-resident who wants to sell in Canada, it is very important for you to know the ins and outs of the Canadian tax system. Not actually from cover to cover, but having the basic knowledge will give you a strong understanding of the Canadian tax landscape for your Amazon business taxes. You can always consult an accountant or firm like Unloop to help you with your Amazon taxes.

With the exemption on necessities such as food and medical supplies, most products and services in Canada are taxable. As mentioned earlier, CRA collects and sets the federal and provincial sales taxes. Once you sell goods in Canada, you are responsible for paying taxes, custom clearance fees, and destination duties before the products can be stored in an Amazon warehouse or sold to Canadian residents. In case you sell imported items, you or your agent must register as Importer of Record on customs declarations before shipping your goods to a Canadian address or fulfilment center.

A non-resident importer who wants to sell on Amazon.ca should interact with the Canada Border Services Agency (CBSA) and CRA using legit business numbers. You can acquire this Business Number (BN) from CRA before you import products into Canada. BN is composed of 15 digits with nine numbers identifying your business and two letters plus four numbers for the program and business account.

Here are the steps you need to do to apply for a BN:

NOTE: You can only use your unique import-export account for importing and exporting.

Imported goods are subjected to a 5% effective tax rate. On top of that, a duty rate is added to the total value of goods if applicable.

Remember that Canada has three types of sales taxes: the federal goods and services tax (GST), provincial sales tax (PST) and harmonized sales tax (HST). HST is the sum of GST and PST. Thus you have a basic formula of GST + PST = HST.

Refer to the table below and familiarize yourself with the taxes applicable in every Canadian territory and province.

| Sales Tax Type | Territories/Provinces |

| GST Only | Alberta, Nunavut, Northwest Territories, Yukon (5%) |

| GST and PST | British Columbia (5% GST + 7% PST)Manitoba (5% GST + 7% PST)Quebec (5% GST + 9.975% QST or Quebec Sales Tax)Saskatchewan (5% GST + 6% PST) |

| HST | Ontario (13%)New Brunswick (15%)Newfoundland (15%)Nova Scotia (15%)Prince Edward Island (15%) |

NOTE: Sales on Amazon.ca may be subjected to GST, PST or HST if you meet the federal or provincial sales tax requirements. You are required to collect GST, PST, or HST even if you don't have a nexus in Canada or a particular province. Nexus is your physical or economic presence in a specific territory. You are legally required to collect, report, and remit sales taxes to the appropriate tax authorities when you reach annual sales of $30,000.

As per the sales tax table, five Canadian provinces have HST reporting requirements which means just a single sales tax return. However, British Columbia, Manitoba, and Saskatchewan need to report GST and PST separately. You need to also separately register for PST in non-HST provinces if you have to collect sales taxes in those provinces.

The filing of sales tax returns varies from the province and the total accumulated sales. Sales taxes are filed and paid on a yearly basis. Federal tax returns are due yearly if your annual sales are less than $1.5 million. Manitoba has a yearly sales threshold of $75,000, while Saskatchewan has a threshold of $60,000. British Columbia mandates monthly filing during the first year of business operation no matter what your sales volume is. However, it allows yearly filing after the first year as long as tax liabilities are filed and paid on time. The limit is different for each province that doesn't participate in the HST approach with the federal government.

The due date for filing sales tax returns is set according to the reporting period. It usually takes one to three months after the said period. If you pay your sales tax annually, the filing must be no later than 90 days after the end of the reporting period. If the sales tax is reported more frequently, like monthly or quarterly, filing should be done by the end of the succeeding month.

Amazon Canada does not file or pay sales taxes, unlike Amazon US. However, Amazon.ca collects and sends the sales tax as part of the regular settlement. Sellers must file and remit Amazon estimated taxes to the appropriate provincial tax authorities. If you sell directly in Canada, you have to bill Canadian consumers for sales tax. Then you need to collect, file, and pay taxes to the government.

It is essential to know how the Canadian tax policy works. As an Amazon seller, you have to be responsible and pay your Amazon taxes if it's applicable; this segregates your profit better. Now that you understand the Canadian tax law, you can do your business right, starting from registration to CBSA and CRA, and up to reporting and filing your sales tax returns. You also have the rates that will guide you if you want to do a mock computation of the sales tax. Remember to be vigilant about the tax rates because CRA can change the rate annually.

Although it sounds complicated, it needs to be done. Tax avoidance will just lead you to a very difficult situation. Always report and pay your taxes on time.

Are you looking for help with your sales tax?

Read Easy Accounting: File Your Income Tax Return in Canada With the Help of a CPA and find out how a Certified Chartered Accountant (CPA) makes things easier for you during tax season.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Amazon taxes are a tricky subject. There is the gray area of international taxation and how it can impact your business in Canada, or anywhere else you might be doing business. This post will help you understand what you need to know about Amazon taxes for sellers, why they matter, and how to ensure that your business is compliant with the tax code.

As an Amazon seller, you are responsible for managing your tax obligations. This includes filing and paying estimated taxes and remitting any balance of GST/HST collected on sales to the Canada Revenue Agency (CRA). You need to undertake various processes in order to report and pay your tax liabilities.

Scroll deeper and dive into the Canadian tax landscape as it relates to Amazon sellers.

If you are a non-resident who wants to sell in Canada, it is very important for you to know the ins and outs of the Canadian tax system. Not actually from cover to cover, but having the basic knowledge will give you a strong understanding of the Canadian tax landscape for your Amazon business taxes. You can always consult an accountant or firm like Unloop to help you with your Amazon taxes.

With the exemption on necessities such as food and medical supplies, most products and services in Canada are taxable. As mentioned earlier, CRA collects and sets the federal and provincial sales taxes. Once you sell goods in Canada, you are responsible for paying taxes, custom clearance fees, and destination duties before the products can be stored in an Amazon warehouse or sold to Canadian residents. In case you sell imported items, you or your agent must register as Importer of Record on customs declarations before shipping your goods to a Canadian address or fulfilment center.

A non-resident importer who wants to sell on Amazon.ca should interact with the Canada Border Services Agency (CBSA) and CRA using legit business numbers. You can acquire this Business Number (BN) from CRA before you import products into Canada. BN is composed of 15 digits with nine numbers identifying your business and two letters plus four numbers for the program and business account.

Here are the steps you need to do to apply for a BN:

NOTE: You can only use your unique import-export account for importing and exporting.

Imported goods are subjected to a 5% effective tax rate. On top of that, a duty rate is added to the total value of goods if applicable.

Remember that Canada has three types of sales taxes: the federal goods and services tax (GST), provincial sales tax (PST) and harmonized sales tax (HST). HST is the sum of GST and PST. Thus you have a basic formula of GST + PST = HST.

Refer to the table below and familiarize yourself with the taxes applicable in every Canadian territory and province.

| Sales Tax Type | Territories/Provinces |

| GST Only | Alberta, Nunavut, Northwest Territories, Yukon (5%) |

| GST and PST | British Columbia (5% GST + 7% PST)Manitoba (5% GST + 7% PST)Quebec (5% GST + 9.975% QST or Quebec Sales Tax)Saskatchewan (5% GST + 6% PST) |

| HST | Ontario (13%)New Brunswick (15%)Newfoundland (15%)Nova Scotia (15%)Prince Edward Island (15%) |

NOTE: Sales on Amazon.ca may be subjected to GST, PST or HST if you meet the federal or provincial sales tax requirements. You are required to collect GST, PST, or HST even if you don't have a nexus in Canada or a particular province. Nexus is your physical or economic presence in a specific territory. You are legally required to collect, report, and remit sales taxes to the appropriate tax authorities when you reach annual sales of $30,000.

As per the sales tax table, five Canadian provinces have HST reporting requirements which means just a single sales tax return. However, British Columbia, Manitoba, and Saskatchewan need to report GST and PST separately. You need to also separately register for PST in non-HST provinces if you have to collect sales taxes in those provinces.