Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

As a small business owner in Alberta, you may be looking to start selling your products or services to your locality and eventually expand across Canada. However, it's essential to be aware of the local Alberta and Canadian sales taxes to know how they affect your business finances. Whether you have begun your business or are still thinking about what to put up, this article will be helpful for you!

We'll discuss some great business ideas in Alberta, Canada, and give you the sales tax knowledge you need to be a tax-compliant business. Let us also share a few tips to ensure your small business thrives.

Alberta is home to more than 4.7 million people, and the province has various resources. Through market research, you'll know what products the population needs. The supplies easily found in Alberta can give you an idea of what products to sell. Here are some business ideas that may click in the region:

Alberta is a highly industrialized province. It is home to many professionals working 8-12 hours daily, so offering services that can assist them are great business opportunities. Here are some services you can explore:

Anything related to beef and dairy is an excellent business, as Alberta is rich in beef and dairy farms. Many individuals born and raised in the region manage their own fields. If you have recently bought or inherited land in Alberta, here are some ventures to take:

Next to food, you can utilize Alberta's prominence as a great source of construction materials. Construction businesses will never lose demand—buildings and establishments are continuously built as Canadian provinces industrialize and improve their local economies. As a small business, you can begin producing small supplies and slowly grow to become a supplier to construction businesses.

It is tempting to think that the sky's the limit when selling online, but this may not be true. There are individual considerations when selling on physical stores and eCommerce sites.

Do market research, study what sells and where they sell best, manage your inventory, and learn how to deliver your sales.

These tasks include your store launching, optimization, and product advertising and marketing. With millions of sellers on different eCommerce websites, the competition online is only getting more challenging. You need to be ahead or at par with your counterparts. For that to happen, you can do any of the following:

Go for the big eCommerce platforms: Know which platforms to launch your store in. The top eCommerce sites in Canada are:

Expanding internationally also becomes easier when you start selling on these sites.

Know what to sell: You can rely on numbers when deciding. Numbers will tell you which products are in demand.

Manage your inventory: Once you have decided what to sell, you need to plan when you'll store your products and how you will deliver them. Many eCommerce sites also offer warehousing and fulfillment, like Fulfillment By Amazon.

Your tax obligations should go hand-in-hand with your objective and creative business plans. With every sale you make, you need to charge sales taxes. You are also obliged to file your personal income tax and corporate income taxes yearly. What are these? Let's learn about them one by one.

Alberta follows the charging of General Sales Tax (GST), a federal tax charged to almost all products sold in Canada. Alberta's sales tax rate is 5%, so you have to multiply this value by the product's total price to determine how much sales tax you will add to the buyer's total cost.

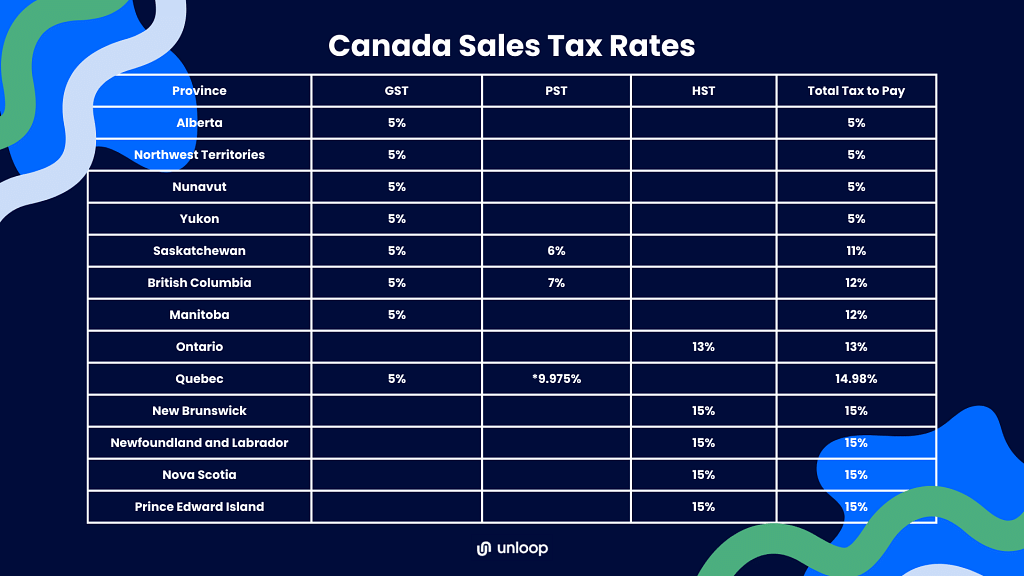

Across Canada's 13 provinces, sales tax current rates differ as some charge Goods and Services Tax (GST), while others charge Provincial Sales Tax (PST), Harmonized Sales Tax (HST), or Quebec Sales Tax (QST).

Alberta, Northwest Territories, Nunavut, and Yukon charge GST only. Saskatchewan, British Columbia, and Manitoba Charge both GST and PST. Quebec has GST and QST(Quebec is the only province with QST), and the other provinces of New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island have HST.

Knowing these different taxes is necessary once you open your business to buyers nationwide and in different provinces.

You also need to know your personal and corporate income tax returns. The two are computed similarly: You must check to which tax bracket your income belongs to know how much you need to pay. Income tax in Canada is paid either monthly, quarterly, or annually.

Now, you already have some ideas about what type of business you can launch in Alberta and the taxes you should know. Before we let you go, here are some tips to ensure your small business thrives and succeeds

And that’s it. We hope we have enlightened you with enough information on sales taxes in Alberta and other Canadian provinces. With this knowledge, you can save money by paying the right sales tax amount for your products or services sold across Canada.

If you need bookkeeping, accounting, and tax computation assistance, Unloop can be your partner. We began as a small eCommerce business, so we know the exact assistance a small business owner needs.

Give us a call now at 877-421-7270. We'd love to discuss our offers with you!

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.