Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

So you've landed a spot on Amazon to market your small business, which is excellent news! You're ready to embark on a new journey with plenty of opportunities to expand your customer base in the world's largest online retailer. But brace yourself because apart from performing the seller role, you’ll also don the Amazon bookkeeper hat to manage your business well, which is challenging.

In carving your path to success, there are some not-so-fun things you need to work through to accomplish your goals. For example, bookkeeping management; it is one of the most challenging aspects of running an Amazon business.

Amazon accounting can be challenging for any business owner. Smaller-scale ecommerce businesses—though they work on fewer transactions—aren't exempt from the grueling task of bookkeeping and accounting.

Sometimes, not having an accounting system with skilled experts to handle financial transactions adds to an online business's problems. It's difficult for Amazon sellers to take them all at once with the marketplace's complex system.

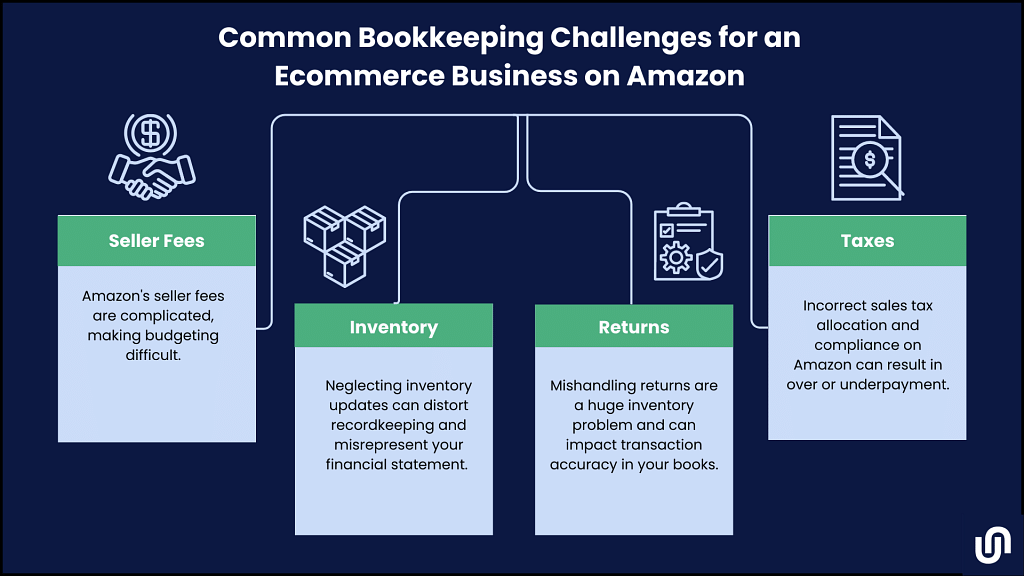

Let Unloop help you by identifying the challenges you might face when doing Amazon seller bookkeeping. It's important to be aware of these challenges so you can find methods to overcome them.

Managing an Amazon business is exciting—the convenience of managing a wide-reaching business from your screen is quite something. Still, small business owners in the marketplace face difficulties understanding bookkeeping and accounting tasks.

The most common roots of these issues are the absence of accounting software and accounting experience or a lack of them. As a result, most brands make the following Amazon accounting and bookkeeping management mistakes:

Amazon has a complex system of seller fees (monthly fees, referral fees, and shipping fees via Fulfillment by Amazon) which makes managing expenses challenging, especially if you lack adequate knowledge and experience on the platform.

These fees have a specific breakdown of charges, complicating the system further. Unfortunately, Amazon doesn't provide single-entry invoices that help you track costs, so you'll have to estimate seller fees yourself.

It impacts three aspects of your financial statements:

All these parts matter when talking about accuracy; that's why updating inventory and ensuring we get it right is crucial.

| Solution Successful inventory management requires an automated tracking system. You need its accuracy and consistency for tracking customs, FBA inventory (if you opted for it), your physical store, and product returns. Otherwise, it will be harder for you to monitor inventory and update your financial statements accurately. This results in a skewed view of your online business's financial health, preventing you from making sound business decisions. |

Product returns are stressful in the first place—they require constant adjustments to your inventory based on return requests to avoid potentially harming customer loyalty. It's the negative kind of "killing two birds with one stone."

With Amazon, things are more complicated because FBA returns are classified into various categories: sellable, damaged, customer-damaged, defective, and carrier-damaged. It may seem organized initially, but Amazon sometimes makes incorrect inventory placements, making a mess of your books and, eventually, your business bank account.

| Solution The best way to handle and reduce the likelihood of returns is to spend time managing and updating your inventory. If it takes too long, you can hire an Amazon accountant specializing in returns. |

Sales tax preparation can be challenging for small ecommerce businesses due to the demand for multi-channel tracking. This results in inaccurate remittance to internal revenue authorities and, consequently, having inaccurate income on the books and in your bank account.

Today's tax regulations are over 10,000, and the variety of these systems is confusing when updating your books. Although Amazon takes the stress of sales tax collection and remittance away from the seller, you still need to track and accurately state multi-channel transactions in the paperwork to meet tax demands.

| Solution To save resources, we recommend hiring an Amazon marketplace professional in a consulting or managing capacity. Another option is to work with an Amazon bookkeeper specializing in the marketplace's sales tax collection system. They have the skills to detail taxes because they are accountants, making it easier for you or your CPA to remit. |

If you're looking for experts offering small business bookkeeping services, Unloop is your perfect business partner!

We understand Amazon's bookkeeping and accounting challenges, so we want to help you manage them the right way. Our team of small business bookkeeping and tax services experts collaborates with reliable accounting firms to ensure the accurate recording and reporting of financial records.

Through our services, you can focus on growing your small business without worrying about documentation and analysis of financial information. If you find yourself having a hard time learning the processes of Amazon bookkeeping, you can always make things easier with us. All it takes to overcome Amazon's bookkeeping challenges is to make an appointment, so go ahead and book a call today.

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.