Sales trend analysis (STA) is the cornerstone of sustainable business growth, so knowing its ins and outs is essential. As a rookie in the field, you must still be in the stage of learning the ropes, so we're here to help you.

This guide will equip you with essential skills to decipher market fluctuations, customer behaviors, and emerging patterns. We delve deep into sales data analysis techniques, empowering you to make informed decisions, optimize inventory, enhance customer experiences, and boost profitability.

From leveraging advanced analytics tools to practical tips on interpreting consumer preferences, this comprehensive resource is your road map to navigating the ever-changing ecommerce terrain. So, let's begin!

Making informed decisions and developing strategies are some benefits of STA. By understanding the underlying trends, companies can anticipate market demand, identify high-performing products or services, and focus on areas that require improvement.

A comprehensive sales analysis must consider these key components and factors.

((Current Period Value - Base Period Value) / Base Period Value) * 100

Getting the answer involves gathering historical sales data and ensuring all the gathered details are accurate and updated. The answers will provide patterns or deviations over a specified period. By analyzing these trends, you’ll know the behavior of your target market and base your decisions on data instead of instinct.

| Key Metrics | |

| Revenue and Sales Growth Trends | Check sales revenue over a specific time Project business financial health Provide efficiency insights of sales strategies and marketing efforts |

| Customer Acquisition and Retention Trends | Show new customers acquisition rate Check efficiency of customer retention game plans Determine customer acquisition and retention processes pain points |

| Product or Service Performance Trends | Evaluate products and services performance based on sales and customer feedback Determine the success and popularity of specific offerings Help identify potential opportunities for product or service improvements |

| Market and Industry Trends | Assess the overall state and direction of the market and industry Identify emerging trends and changes that can impact sales and revenue Help you formulate the latest strategies at par with competitors |

| Competitor Sales Data Analysis and Benchmarking | Analyze the performance of competitors in the market Identify strengths and weaknesses of competitors' sales strategies Benchmark against industry peers to measure performance and identify areas for improvement. |

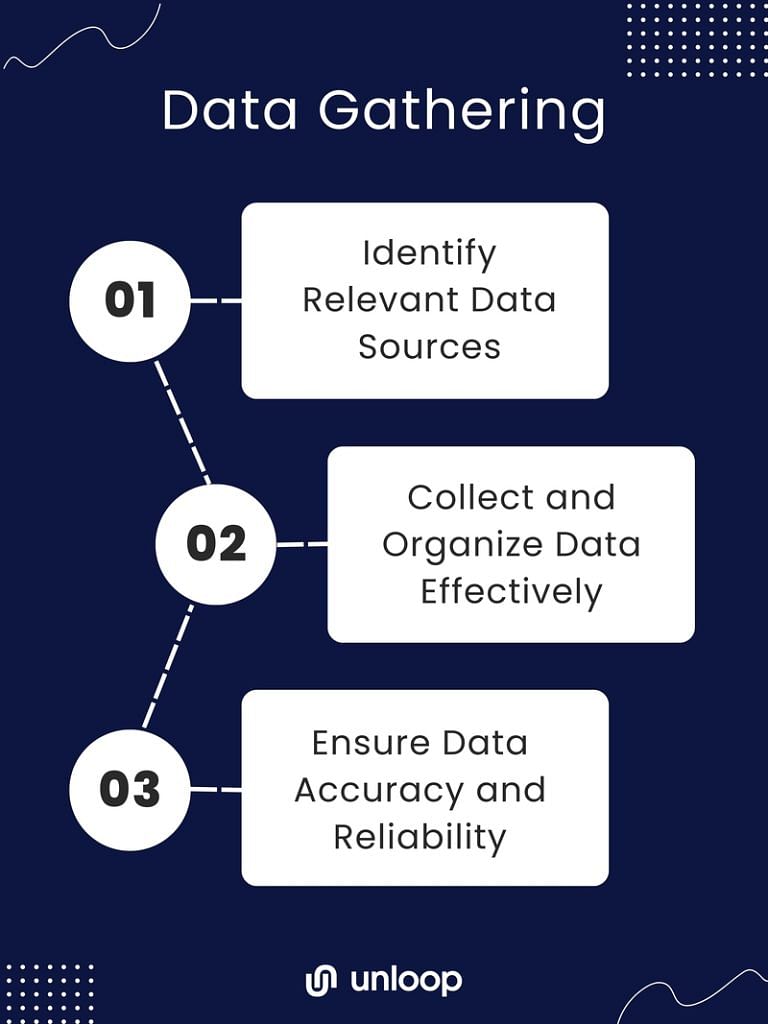

Gathering Data

If you want to make data gathering easier, keep an eye on the details and establish a process too. How so? You can check out the details below.

Identifying the sources that provide accurate and reliable data for analysis is crucial. This may include internal sources such as Customer Relationship Management (CRM) systems, different kinds of reports, and customer data. External sources like market research reports, industry publications, and competitor analysis can give you better financial judgment when monitored.

Once the relevant data sources are identified, collect and organize them. Capture data consistently over time using standardized formats, and maintain proper documentation. Because automated tools and data management systems are champions in streamlining collection, organization of information from various channels are done swiftly.

Validate the collected data to eliminate duplicates or errors and address inconsistencies. Regular audits and cross-checking with multiple sources help ensure reliable figures for analysis.

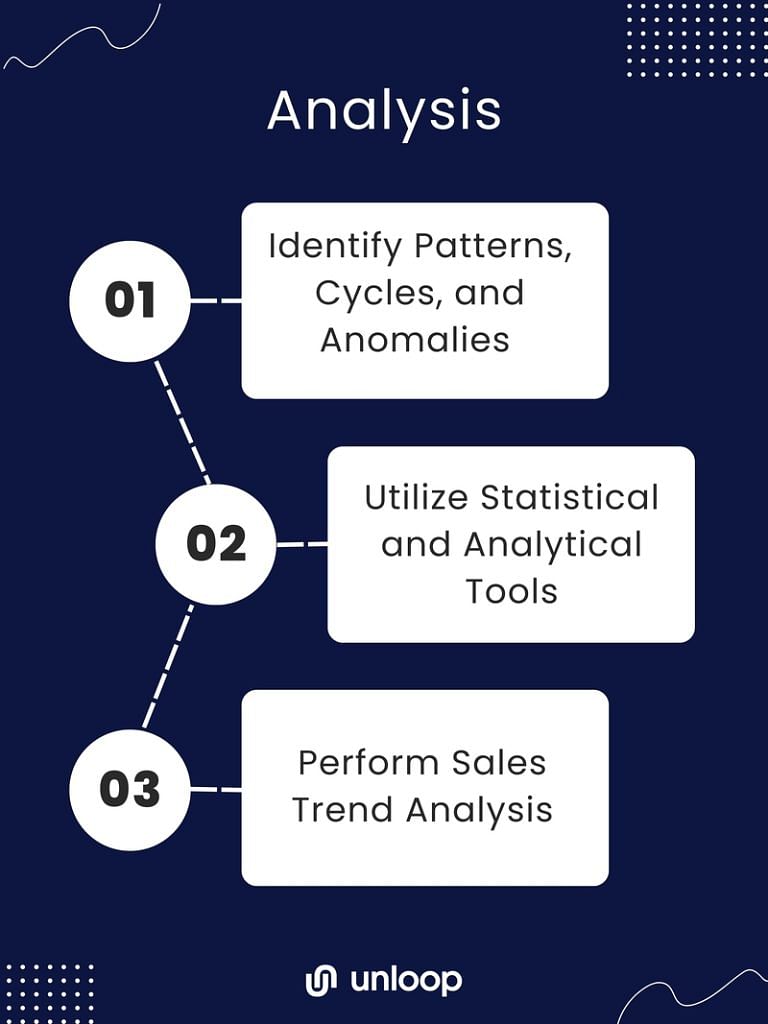

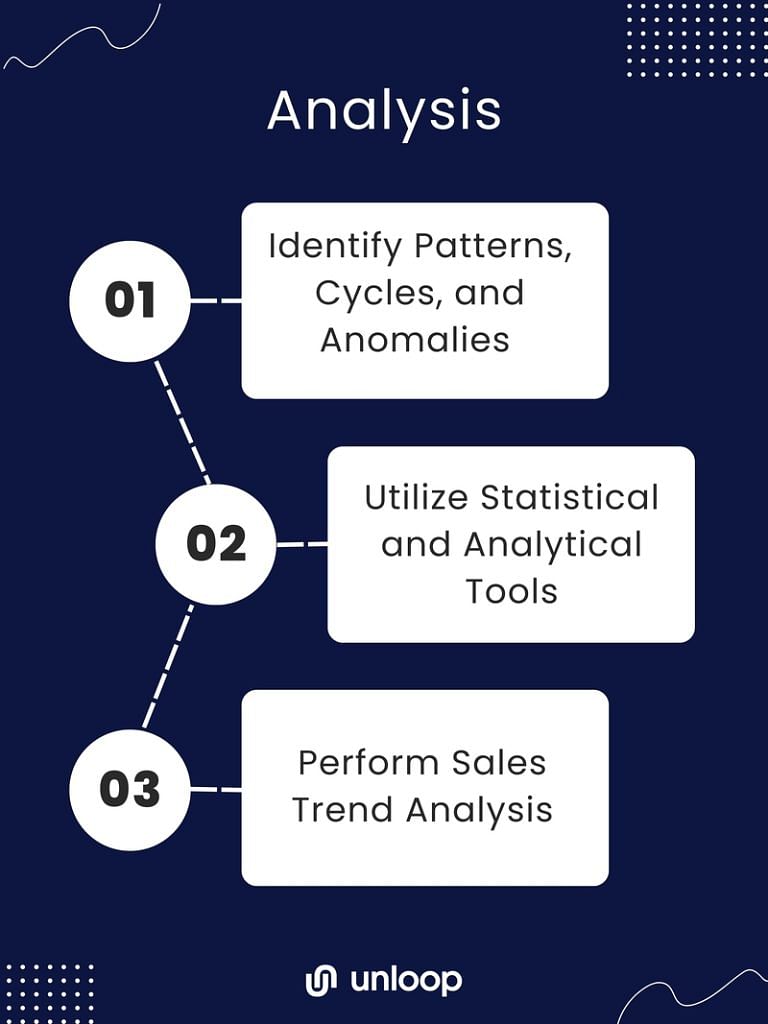

After gathering data and keeping them organized, you must know how to make sense of them, and below are just some ways to do so.

Identify patterns, cycles, and anomalies in your sales data. Once you notice the trends, you can come up with study and develop conclusions about your customers and the market.

Companies often rely on statistical and analytical tools to conduct STA effectively. These tools help to accurately measure and interpret sales patterns and fluctuations, identify key trends, and make data-driven decisions. From regression analysis to time-series forecasting models, these tools enable you to uncover hidden insights within your sales data.

However, merely identifying trends is not enough; it is equally crucial to interpret and understand the implications of these trends. You must assess whether the observed sales upwards or downwards shift trend is sustainable or just seasonal.

Understanding the implications of sales trends helps you adjust your strategies, make informed decisions, and adapt business operations accordingly. For example, a declining trend in sales may indicate the need for marketing efforts to reach new customers or develop new products. Seasonal sales cycles may need inventory levels or staffing adjustments.

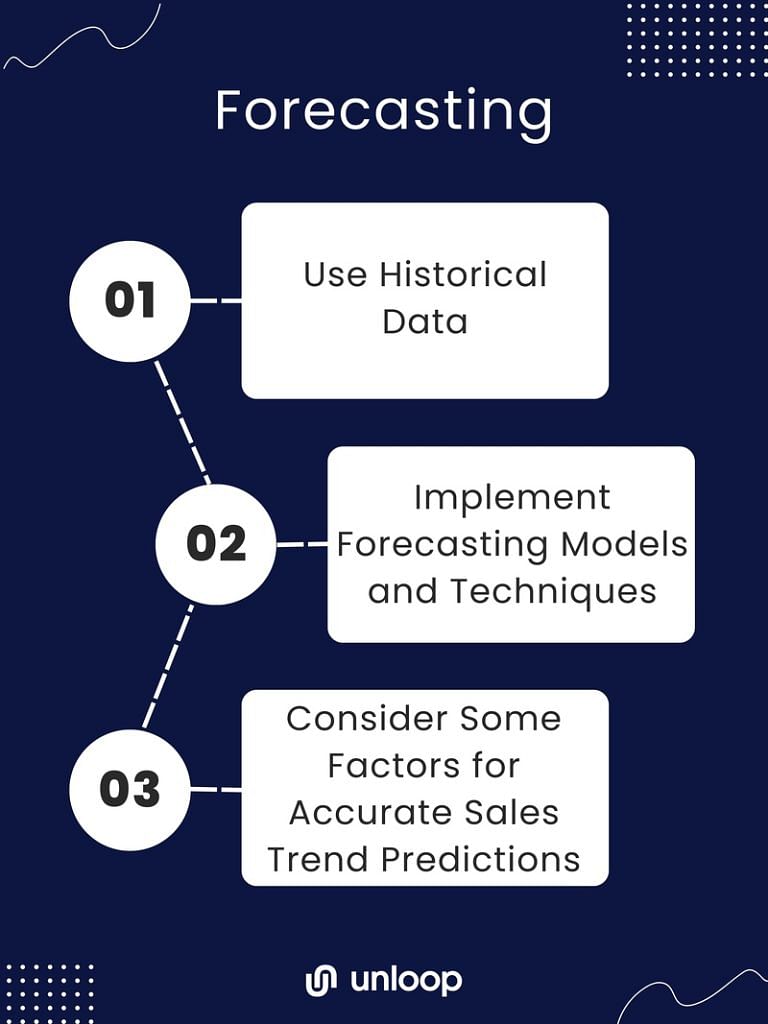

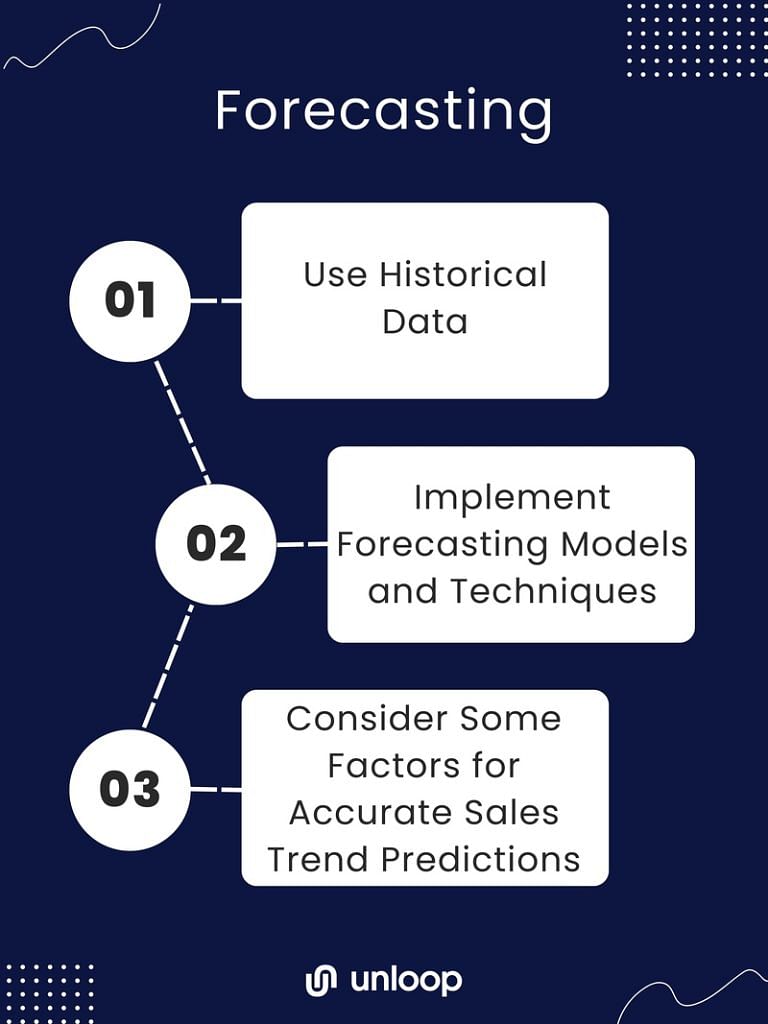

After doing an STA, you can further use data for sales forecasting. By leveraging historical data, implementing suitable forecasting models, and considering internal and external factors, you can gain meaningful insights into sales trends, facilitating better decision-making and maximizing profitability.

Historical sales data provides valuable insights into past performance, allowing you to identify patterns and trends. By analyzing previous sales figures, companies can determine seasonal fluctuations, identify successful marketing strategies, and forecast future sales based on historical patterns.

You can employ various forecasting models and techniques to predict sales trends accurately. These include quantitative methods like time series and regression analysis and qualitative methods like expert opinions and market research surveys. Employing a combination of techniques can enhance the accuracy of sales trend predictions.

To ensure accurate sales trend predictions, consider these:

Considering these components allows you to make more precise sales forecasts, enabling them to allocate resources effectively, streamline production, and adjust sales strategies accordingly.

Applying STA to business strategy provides valuable insights for improving areas of weakness, targeting the right markets, optimizing resource allocation, and staying adaptable. Businesses can leverage these insights to elevate their performance and drive sustained growth.

Analyze sales trends to identify areas for improvement. By studying patterns in customer behavior and sales data, you can pinpoint areas of weakness and take corrective measures including product feature improvement, perfecting customer service, or refining pricing strategies.

STA enables you to adjust your sales strategies and target markets. By closely monitoring trends, you can understand shifts in customer preferences, buying habits, or industry trends. With this knowledge, businesses can realign their sales tactics and focus on target markets that show growth potential.

STA helps identify high-potential areas where resources are best allocated. This ensures that marketing and sales efforts are focused on segments with the highest likelihood of yielding positive results.

Organizations like yours can identify emerging opportunities or threats by continuously evaluating sales trends and adjusting their sales strategy accordingly. Through this, you can stay flexible and adaptable to market changes.

Regarding STA, a range of software and tools are available to assist you in understanding and interpreting sales data. Some popular options include CRM software, business intelligence platforms, and data visualization tools. These tools include tracking sales metrics, generating reports, and providing predictive analytics.

Evaluating and selecting the right tools for specific needs requires careful consideration. You should assess your business requirements and goals before making a decision. Factors to consider include:

Integrate Analysis Tools Into Existing Systems

Integrate STA tools into your existing systems to ensure seamless data flow and avoid duplication of efforts. The tool you select should be able to integrate with other systems, such as CRM, ERP, or POS software, to gather data automatically.

This integration allows for you to create powerful dashboards for real-time data analysis. It also reduces manual data entry and enhances the accuracy of the insights gained. Additionally, system integration enables data sharing across different departments and management teams, facilitating collaboration and informed decision-making throughout the organization.

STA is a crucial component of strategic business planning, but it also comes with challenges and pitfalls. Knowing the difficulties in handling this task makes you more prepared in case you face them. You can also proactively avoid them by following some best practices.

| Challenges and Pitfalls | Best Practices |

Mastering STA is paramount for sustained success. We hope this guide has provided you with tools to decode market fluctuations and customer behaviors to help you decide better for your business.

The work will be lighter if you seek assistance and partner with experts, just like our team at Unloop. Our team is trained in bookkeeping, data gathering and management as well as financial reporting, so you won't find it difficult to collate, organize, and make sense of business data.

Let us help you do your trend analysis correctly. Contact us now!

Sales trend analysis (STA) is the cornerstone of sustainable business growth, so knowing its ins and outs is essential. As a rookie in the field, you must still be in the stage of learning the ropes, so we're here to help you.

This guide will equip you with essential skills to decipher market fluctuations, customer behaviors, and emerging patterns. We delve deep into sales data analysis techniques, empowering you to make informed decisions, optimize inventory, enhance customer experiences, and boost profitability.

From leveraging advanced analytics tools to practical tips on interpreting consumer preferences, this comprehensive resource is your road map to navigating the ever-changing ecommerce terrain. So, let's begin!

Making informed decisions and developing strategies are some benefits of STA. By understanding the underlying trends, companies can anticipate market demand, identify high-performing products or services, and focus on areas that require improvement.

A comprehensive sales analysis must consider these key components and factors.

((Current Period Value - Base Period Value) / Base Period Value) * 100

Getting the answer involves gathering historical sales data and ensuring all the gathered details are accurate and updated. The answers will provide patterns or deviations over a specified period. By analyzing these trends, you’ll know the behavior of your target market and base your decisions on data instead of instinct.

| Key Metrics | |

| Revenue and Sales Growth Trends | Check sales revenue over a specific time Project business financial health Provide efficiency insights of sales strategies and marketing efforts |

| Customer Acquisition and Retention Trends | Show new customers acquisition rate Check efficiency of customer retention game plans Determine customer acquisition and retention processes pain points |

| Product or Service Performance Trends | Evaluate products and services performance based on sales and customer feedback Determine the success and popularity of specific offerings Help identify potential opportunities for product or service improvements |

| Market and Industry Trends | Assess the overall state and direction of the market and industry Identify emerging trends and changes that can impact sales and revenue Help you formulate the latest strategies at par with competitors |

| Competitor Sales Data Analysis and Benchmarking | Analyze the performance of competitors in the market Identify strengths and weaknesses of competitors' sales strategies Benchmark against industry peers to measure performance and identify areas for improvement. |

Gathering Data

If you want to make data gathering easier, keep an eye on the details and establish a process too. How so? You can check out the details below.

Identifying the sources that provide accurate and reliable data for analysis is crucial. This may include internal sources such as Customer Relationship Management (CRM) systems, different kinds of reports, and customer data. External sources like market research reports, industry publications, and competitor analysis can give you better financial judgment when monitored.

Once the relevant data sources are identified, collect and organize them. Capture data consistently over time using standardized formats, and maintain proper documentation. Because automated tools and data management systems are champions in streamlining collection, organization of information from various channels are done swiftly.

Validate the collected data to eliminate duplicates or errors and address inconsistencies. Regular audits and cross-checking with multiple sources help ensure reliable figures for analysis.

After gathering data and keeping them organized, you must know how to make sense of them, and below are just some ways to do so.

Identify patterns, cycles, and anomalies in your sales data. Once you notice the trends, you can come up with study and develop conclusions about your customers and the market.

Companies often rely on statistical and analytical tools to conduct STA effectively. These tools help to accurately measure and interpret sales patterns and fluctuations, identify key trends, and make data-driven decisions. From regression analysis to time-series forecasting models, these tools enable you to uncover hidden insights within your sales data.

However, merely identifying trends is not enough; it is equally crucial to interpret and understand the implications of these trends. You must assess whether the observed sales upwards or downwards shift trend is sustainable or just seasonal.

Understanding the implications of sales trends helps you adjust your strategies, make informed decisions, and adapt business operations accordingly. For example, a declining trend in sales may indicate the need for marketing efforts to reach new customers or develop new products. Seasonal sales cycles may need inventory levels or staffing adjustments.

After doing an STA, you can further use data for sales forecasting. By leveraging historical data, implementing suitable forecasting models, and considering internal and external factors, you can gain meaningful insights into sales trends, facilitating better decision-making and maximizing profitability.

Historical sales data provides valuable insights into past performance, allowing you to identify patterns and trends. By analyzing previous sales figures, companies can determine seasonal fluctuations, identify successful marketing strategies, and forecast future sales based on historical patterns.

You can employ various forecasting models and techniques to predict sales trends accurately. These include quantitative methods like time series and regression analysis and qualitative methods like expert opinions and market research surveys. Employing a combination of techniques can enhance the accuracy of sales trend predictions.

To ensure accurate sales trend predictions, consider these:

Considering these components allows you to make more precise sales forecasts, enabling them to allocate resources effectively, streamline production, and adjust sales strategies accordingly.

Applying STA to business strategy provides valuable insights for improving areas of weakness, targeting the right markets, optimizing resource allocation, and staying adaptable. Businesses can leverage these insights to elevate their performance and drive sustained growth.

Analyze sales trends to identify areas for improvement. By studying patterns in customer behavior and sales data, you can pinpoint areas of weakness and take corrective measures including product feature improvement, perfecting customer service, or refining pricing strategies.

STA enables you to adjust your sales strategies and target markets. By closely monitoring trends, you can understand shifts in customer preferences, buying habits, or industry trends. With this knowledge, businesses can realign their sales tactics and focus on target markets that show growth potential.

STA helps identify high-potential areas where resources are best allocated. This ensures that marketing and sales efforts are focused on segments with the highest likelihood of yielding positive results.

Organizations like yours can identify emerging opportunities or threats by continuously evaluating sales trends and adjusting their sales strategy accordingly. Through this, you can stay flexible and adaptable to market changes.

Regarding STA, a range of software and tools are available to assist you in understanding and interpreting sales data. Some popular options include CRM software, business intelligence platforms, and data visualization tools. These tools include tracking sales metrics, generating reports, and providing predictive analytics.

Evaluating and selecting the right tools for specific needs requires careful consideration. You should assess your business requirements and goals before making a decision. Factors to consider include:

Integrate Analysis Tools Into Existing Systems

Integrate STA tools into your existing systems to ensure seamless data flow and avoid duplication of efforts. The tool you select should be able to integrate with other systems, such as CRM, ERP, or POS software, to gather data automatically.

This integration allows for you to create powerful dashboards for real-time data analysis. It also reduces manual data entry and enhances the accuracy of the insights gained. Additionally, system integration enables data sharing across different departments and management teams, facilitating collaboration and informed decision-making throughout the organization.

STA is a crucial component of strategic business planning, but it also comes with challenges and pitfalls. Knowing the difficulties in handling this task makes you more prepared in case you face them. You can also proactively avoid them by following some best practices.

| Challenges and Pitfalls | Best Practices |

Mastering STA is paramount for sustained success. We hope this guide has provided you with tools to decode market fluctuations and customer behaviors to help you decide better for your business.

The work will be lighter if you seek assistance and partner with experts, just like our team at Unloop. Our team is trained in bookkeeping, data gathering and management as well as financial reporting, so you won't find it difficult to collate, organize, and make sense of business data.

Let us help you do your trend analysis correctly. Contact us now!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Time-consuming, stressful, and tedious are often words associated with the manual bank reconciliation process. It is typical for businesses to do bank reconciliation every month. But other businesses choose to do them more frequently, so there are fewer transactions to check and a lesser possibility of errors and inconsistencies.

For businesses, bank reconciliations might be a hassle, but it doesn't have to be. Bank reconciliation software can speed up the process and make it easier for you. We'll discuss the automation process's benefits and give a quick overview of how to do it.

Automating the bank reconciliation process is not as challenging as it sounds. Don't forget to take notes! If you follow these simple setup processes, you'll worry less about bank reconciliation.

An automated process makes running a business more convenient. Investing in accounting software is a wise move for every business. However, other businesses, especially small ones, are reluctant to spend the money. If you're still in doubt, here are some of the advantages of automating your bank reconciliation process.

The manual reconciliation process is error-prone. No matter how careful business owners are, it is easy to misread figures and make mistakes in calculations and inputs. Not to mention, you have to go through tons of spreadsheets and documents to fix the errors. That is a significant amount of time that businesses could be using for other areas of their operations.

You can make sure everything is accurate down to the last detail with automatic reconciliation. Also, once a lapse is spotted, you will be notified so you can resolve it right away.

One of the excellent benefits of automated reconciliation is its time efficiency. With an accounting system, features that track outgoing cash, and the ability to match receipts to transactions, the reconciliation process can be completed in a matter of minutes compared to doing it manually, which can take hours.

Furthermore, you can skip combing through your spreadsheets for hours and hours. The accounting software can check the totals in the spreadsheet to see if they match your balance sheets, income statements, and other financial records.

You can achieve better cash flow management by automating your bank reconciliation process. The automatic process can quickly identify wrong and incomplete transactions, which can significantly affect a business's cash flow. Businesses can therefore decide how to manage their cash flow with confidence knowing exactly how much money they have available.

In addition, automatic bank reconciliation allows businesses to identify and resolve any outstanding issues on time, which can help them avoid late fees and other penalties that can negatively impact their cash flow. Overall, by improving the accuracy and efficiency of the reconciliation process, businesses can optimize their cash flow and improve their financial health.

Software with automatic bank reconciliation have fraud detection features that can help businesses identify early on if there are any unauthorized transactions or unusual activities that can indicate fraud. They can also alert businesses of missing or altered transactions that could be a sign of embezzlement.

With better fraud detection and prevention, businesses can protect their financial assets and maintain their integrity. When businesses detect fraud early, they can take swift action and prevent significant damage to the business. Further, automated bank reconciliations can make an audit trail for all your transactions, which is essential for investigating and resolving any fraudulent activities.

The benefits when businesses fully automate bank reconciliations go beyond the process. It can help business owners make more sound and crucial decisions. Here are some ways in which automated bank reconciliations help with decision-making.

Reconciling bank accounts is just one part of the entire accounting process. Many business owners, even seasoned ones, would prefer to avoid accounting altogether. Fortunately for entrepreneurs out there, Unloop offers the professional services you need.

We have a team of professionals that can handle all your accounting needs. Say goodbye to financial stress and hello to business growth! Experience our exceptional services, like bookkeeping, payroll, taxes, forecasting and more.

Book a call with our experts today, and see how we can help you!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Time-consuming, stressful, and tedious are often words associated with the manual bank reconciliation process. It is typical for businesses to do bank reconciliation every month. But other businesses choose to do them more frequently, so there are fewer transactions to check and a lesser possibility of errors and inconsistencies.

For businesses, bank reconciliations might be a hassle, but it doesn't have to be. Bank reconciliation software can speed up the process and make it easier for you. We'll discuss the automation process's benefits and give a quick overview of how to do it.

Automating the bank reconciliation process is not as challenging as it sounds. Don't forget to take notes! If you follow these simple setup processes, you'll worry less about bank reconciliation.

An automated process makes running a business more convenient. Investing in accounting software is a wise move for every business. However, other businesses, especially small ones, are reluctant to spend the money. If you're still in doubt, here are some of the advantages of automating your bank reconciliation process.

The manual reconciliation process is error-prone. No matter how careful business owners are, it is easy to misread figures and make mistakes in calculations and inputs. Not to mention, you have to go through tons of spreadsheets and documents to fix the errors. That is a significant amount of time that businesses could be using for other areas of their operations.

You can make sure everything is accurate down to the last detail with automatic reconciliation. Also, once a lapse is spotted, you will be notified so you can resolve it right away.

One of the excellent benefits of automated reconciliation is its time efficiency. With an accounting system, features that track outgoing cash, and the ability to match receipts to transactions, the reconciliation process can be completed in a matter of minutes compared to doing it manually, which can take hours.

Furthermore, you can skip combing through your spreadsheets for hours and hours. The accounting software can check the totals in the spreadsheet to see if they match your balance sheets, income statements, and other financial records.

You can achieve better cash flow management by automating your bank reconciliation process. The automatic process can quickly identify wrong and incomplete transactions, which can significantly affect a business's cash flow. Businesses can therefore decide how to manage their cash flow with confidence knowing exactly how much money they have available.

In addition, automatic bank reconciliation allows businesses to identify and resolve any outstanding issues on time, which can help them avoid late fees and other penalties that can negatively impact their cash flow. Overall, by improving the accuracy and efficiency of the reconciliation process, businesses can optimize their cash flow and improve their financial health.

Software with automatic bank reconciliation have fraud detection features that can help businesses identify early on if there are any unauthorized transactions or unusual activities that can indicate fraud. They can also alert businesses of missing or altered transactions that could be a sign of embezzlement.

With better fraud detection and prevention, businesses can protect their financial assets and maintain their integrity. When businesses detect fraud early, they can take swift action and prevent significant damage to the business. Further, automated bank reconciliations can make an audit trail for all your transactions, which is essential for investigating and resolving any fraudulent activities.

The benefits when businesses fully automate bank reconciliations go beyond the process. It can help business owners make more sound and crucial decisions. Here are some ways in which automated bank reconciliations help with decision-making.

Reconciling bank accounts is just one part of the entire accounting process. Many business owners, even seasoned ones, would prefer to avoid accounting altogether. Fortunately for entrepreneurs out there, Unloop offers the professional services you need.

We have a team of professionals that can handle all your accounting needs. Say goodbye to financial stress and hello to business growth! Experience our exceptional services, like bookkeeping, payroll, taxes, forecasting and more.

Book a call with our experts today, and see how we can help you!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

These days, we're seeing a lot of popular accounting software programs offering different business solutions that make entrepreneurs' lives easier. Despite this abundance, it's still best to narrow down your options. We've done that for you by pitting two of the best software against each other: Peachtree vs. QuickBooks.

In this article, Unloop will tackle two of the most talked-about accounting software in business, Peachtree—also known as Sage 50—and QuickBooks. Naturally, these two must be on top of your choices, so let us help you decide by showing you a fair comparison that will help you weigh what's best for your own business.

As small business owners and accounting professionals, we must first consider accuracy when choosing accounting software. Managing and auditing your books with highly accurate solutions is paramount, and we know that both software is worth trying, especially if you're an owner looking for a risk-free option.

For ecommerce businesses, a mid-tier software is the practical choice when setting up an accounting system for the first time. Sage 50 and QuickBooks Online each offer one with the features that every business owner or accountant will benefit from. Let’s put them side by side for comparison.

| Sage 50 vs. QuickBooks: Mid-Tier Plan Key Feature Comparison | ||

| Features | Sage 50 Premium Accounting | QuickBooks Online Essentials |

| Number of users | 1 - 5 users | 1 - 3 users |

| Inventory tracking | Yes | No |

| Job costing | Yes | Yes |

| Cloud capabilities | Yes | Yes |

| Bank account sync | Yes | Yes |

| Invoice management | Yes | Yes |

| Insights and Reports | Yes | Yes |

| Track expenses | Yes | Yes |

| Payroll subscription | Separate module | Separate module |

| Fraud Protection | Yes | No |

| Support plan | Yes | Yes |

| Audit trail | Yes | Yes |

One of the biggest advantages of QuickBooks Online is its vast app integrations across many platforms, not just for accounting but for payroll and ecommerce with over 750 apps. Compared to Sage 50 with over 120 apps available in the marketplace, QuickBooks easily takes the lead for this criteria.

| Sage 50 vs. QuickBooks: App Integrations Feature Comparison | |

| Sage 50 | QuickBooks Online |

| Process and pay your employees with Sage 50 Payroll | Pay your people with Intuit Payroll |

| Tax-filing feature available in Sage50 Pro Accounting and higher | Avalara AvaTax lets you pay taxes conveniently |

| Connect Sage 50 to Xero using a third-party integration platform | Direct Xero-QuickBooks integration |

QuickBooks Online’s interface is user-friendly. When you pull up the software, you’ll first see a sidebar menu on the left side that has all the essential options you need such as the dashboard, banking, sales, taxes, and reports, to name a few.

The main section of QuickBooks Online’s interface gives you a straightforward design with few details, yet presents you with the necessary ones in a way that’s easy to digest.

Sage 50, on the other hand, gives more detail and looks tighter compared to most accounting software. They are generous with details, so you’ll often encounter windows and dialogue boxes that contain lists, dropdown boxes, radio buttons, and other key design features. This is perfect for business owners and managers who want more information and control on how they manage their finances.

| Sage 50 vs. QuickBooks: Layout and Design Comparison | |

| Sage 50 | QuickBooks Online |

| Detailed design with multiple tabs and screens | Simple and minimal design |

| Has a shortcut section on the software’s side menu | Includes every essential option on the side menu instead |

| Detailed top bar menu with similarities to MS Office’s top bar design | Top bar menu includes only several icons on the right side of the dashboard |

| Minimal graph representations of data | Highly visual graphs matched with data |

The good news is that both Sage 50 and QuickBooks Online graciously offer special discounts. Moreover, QuickBooks has a 30-day trial period, and Sage 50 lets you take a test drive or view an on-demand demo.

If you do decide to subscribe, here are the available plans.

QuickBooks Online has four plans with varying subscription prices and user capacity.

| QuickBooks Online Plan Comparison | ||||

| Simple Start | Essentials | Plus | Advanced | |

| Pricing | $15 / Month | $30 / Month | $45 / Month | $100 / Month |

| Users up to | 1 user | 3 users | 5 users | 25 users |

| Suitable for | Freelancers, micro-businesses, beginner accountants or non-professionals | Small businesses | Businesses needed inventory and project management | SMBs (small- to medium-sized businesses) |

PeachTree offers three tiers for their online accounting software. Each of the plans are also paid on subscription basis.

| Peachtree Online Plan Comparison | |||

| Pro Accounting | Premium Accounting | Quantum Accounting | |

| Pricing | $57.17 / Month | $82.09 / Month | $136 / Month |

| Users up to | 1 user | 5 users | 40 users |

| Suitable for | Solopreneurs and micro-businesses | Small businesses | MLBs (medium-sized to large businesses) |

Sage 50 isa tool you can install on a desktop computer. When you look for tools to help you track your business finances, this name will be among the first recommendations you will see. Here are its highlights.

Sage 50 has categorized its offers for different businesses: small, medium, and businesses of any size. So, owners can easily pick the services that fit the expanse of their venture. For instance, a small business offer includes cloud-based accounting, time and billing tracking, and workforce management. More and more bookkeeping and accounting features are added to the plans for other business sizes.

Sage’s service categorization for various industries differentiates it from other small business accounting tools. The software particularly flexes its reliability by being an accounting tool for several for-profit and non-profit industries. The tool’s features are tailor-fitted to satisfy the needs of the different trades.

Nevertheless, if you do not fall into any of the industries mentioned, you can still enjoy these features of Sage 50:

These offers will be included depending on the plan you subscribe to. The greater your investment, the more features you will get.

Not far behind, the accounting tool many businesses go to is QuickBooks. Similar to most software companies, its maker, Intuit, offers several product lines such as their top-of-the line QuickBooks Enterprise and their powerful starter, QuickBooks Essentials. But the most popular among ecommerce businesses is QuickBooks Online.

You can access this software on desktop computers and mobile phones. QuickBooks is equally reliable as Sage 50 because of the following features.

When you sign up for a QuickBooks plan, you'll enjoy its live bookkeeping immediately. This feature keeps your books up-to-date by ensuring that financial data from the start of the year to the current month are collected, categorized, and stored. If you sign-up midyear, bookkeepers will track whatever data is missing. Trained bookkeepers will update your books live from then on.

You'll also get to enjoy these traditional bookkeeping and accounting features by using QuickBooks:

Keeping your finances tracked has plenty of benefits, but one is being prepared when tax season comes. With QuickBooks, you'll be equipped with all the data you need. To ensure that all the data you submit for a tax audit is accurate, QuickBooks has a tax penalty protection that guarantees up to a $25,000 payment per year if you get any tax-related inaccuracies and errors from the tool.

Another perk that sets QuickBooks apart from its competitors is the Priority Circle. This service offers QuickBooks Advanced users in-depth training about software usage and 24/7 customer support. You won’t need to go the extra mile by looking for a QuickBooks training program, which will surely cost extra.

As two highly-sought accounting software, Sage 50 and QuickBooks understand what most businesses need when it comes to management. To be competitive, they have to expand what their software is capable of, extending them beyond bookkeeping and accounting. The result is a set of four features similar to each other yet delivered in their own unique ways.

You’ll enjoy the following offerings with both QuickBooks and Sage 50.

Make sense of all the details your bookkeeper has logged in and generate reports of your business income and expenses through accounting features of both QuickBooks and Sage 50. You can rely on both software to store and create accurate reports quicker than manual accounting. Software and third-party apps make the task very simple and less complex.

There are other accounting apps available such as Photeeq, FreshBooks, and Zoho Books. If you have important documents in another software, you can integrate them easily to QuickBooks or Peachtree as both software have the capabilities.

As a result, there will be no need to open several books and Excel sheets to check data because everything you need will be in one place. With these features, you can access real-time business data remotely and generate reports from the latest numbers.

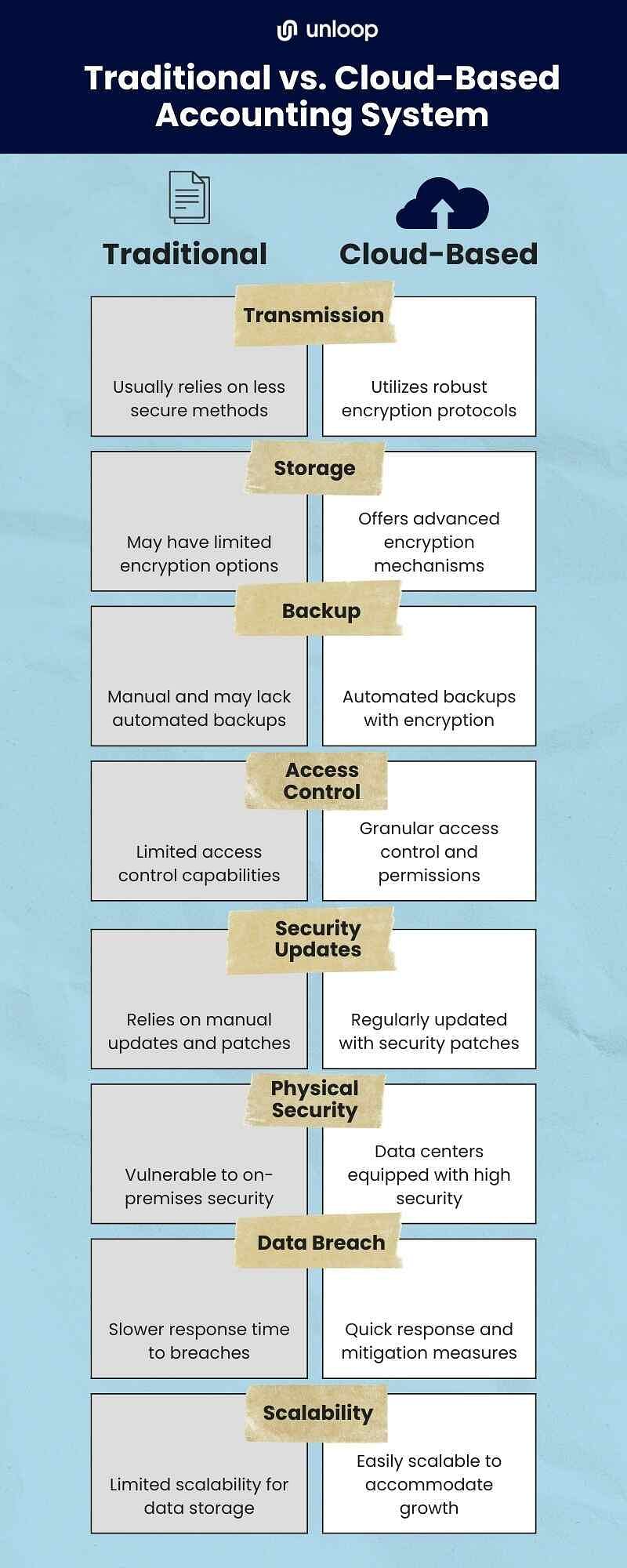

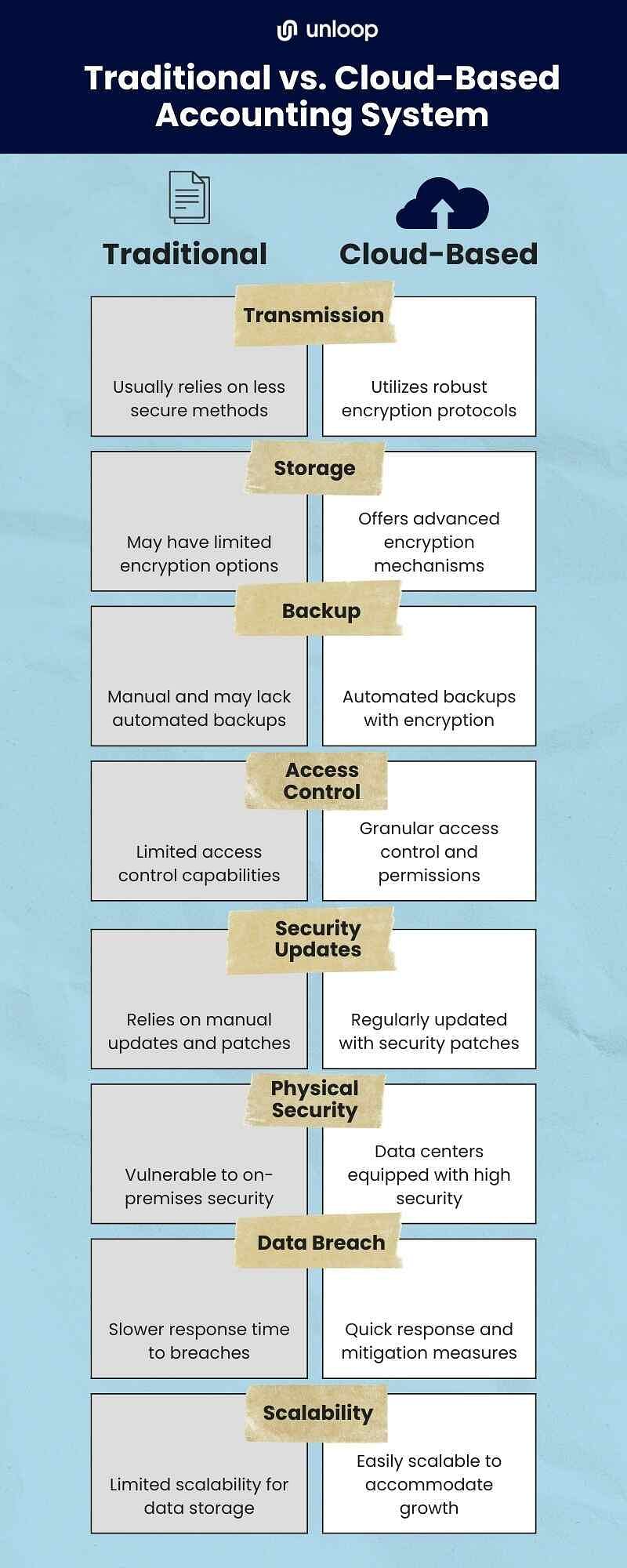

Cloud-based technology is a way to secure data. Before, you’d store important information about the company on an office desktop, which anyone can access. Now, data can be stored in the cloud with impregnable security that requires special approval for each step.

The company's manager can control who can access business information through cloud-based accounting. In most cases, the company bookkeeper, accountant, and finance teams are the only people granted access. Then, everyone with access can see the same information no matter where you access the app.

You can reap plenty of benefits with accurate time tracking and project management. Among them are the following:

A small business owner must look for these convenient features in accounting software—both Sage 50 and QuickBooks offer them.

Everything these days is automated, so if you run into software that does not offer the automation expectations you have, strike it off your list. Regarding receiving and sending payments, generating invoices, storing receipts, and sorting all these transactions into categories for accounting, both QuickBooks and Sage 50 have got you covered.

So, get ready to link your payment gateways, receiving accounts, bank accounts, and credit cards to Sage 50 and QuickBooks so the software can track all direct deposits and expenses immediately. Wherever you are, when you receive a notification of payment or request to pay, you can process them instantly as long as there is an internet connection.

Both Sage 50 and QuickBooks have a service focused on human resource (HR) management, which is essential once you've grown your business and already managed several employees.

The HR feature is especially helpful if you have a diverse team of professionals working for you. This ensures employees' wellbeing is handled well according to the laws and regulations where your business operates.

Despite their similarities, the two accounting software also have to differentiate themselves to stand out. Here are the four key differences that may determine whether you'll choose Sage 50 or QuickBooks.

A prime difference between Sage 50 and QuickBooks is bookkeeping services. QuickBooks has a team of expert bookkeepers clients can consult with via appointment to check how their business is sailing. Once you sign up for QuickBooks’s full-service live bookkeeping, these professionals can help you cleanup your accounting data and do ongoing accounting and consultation.

The live bookkeeping function, however, is different with Sage. The Sage Live feature only offers real-time collaboration with people that handle your bookkeeping. As for providing a full service accountant, you’ll need to get your own.

In terms of accounting software interface, QuickBooks focuses more on a user-friendly interface with a clean-looking dashboard and a simplified side menu which helps users easily see and navigate through the sections to find out essential information.

Sage 50 gives more detail. It packs a lot of options on its dashboard which includes a sidebar menu and a top bar menu. Users can see different sections and icons on their screen for pointing to a specific segment you need to update or manage.

Accounting and bookkeeping are needed in all business types and sizes. Aside from offering general assistance, both Sage 50 and QuickBooks provide industry-specific accounting in niches different from each other. Here are the differences in industries they serve.

| Sage 50 vs. QuickBooks: Industry Niche | |

| Sage 50 | QuickBooks Online |

| Checmicals | Churches |

| Franchise | |

| SaaS and Subscription | |

We recommend QuickBooks Online over Sage 50 because of a few critical factors. It’s cheaper than Peachtree because it doesn’t require a desktop app and the software can work online. The accounting software also has a user-friendly interface, making it easier for ecommerce business owners to learn. Many accountants also prefer the simplicity of QuickBooks Online.

Unloop’s team of bookkeepers are also experts in QuickBooks Online. It's the software we use to help out ecommerce business owners clean up and maintain their financial records so they can make better decisions. If you choose QuickBooks as your accounting software, maximize its potential by having a team who knows how to use it as if your bookkeeping is on autopilot. Give us a call now!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

These days, we're seeing a lot of popular accounting software programs offering different business solutions that make entrepreneurs' lives easier. Despite this abundance, it's still best to narrow down your options. We've done that for you by pitting two of the best software against each other: Peachtree vs. QuickBooks.

In this article, Unloop will tackle two of the most talked-about accounting software in business, Peachtree—also known as Sage 50—and QuickBooks. Naturally, these two must be on top of your choices, so let us help you decide by showing you a fair comparison that will help you weigh what's best for your own business.

As small business owners and accounting professionals, we must first consider accuracy when choosing accounting software. Managing and auditing your books with highly accurate solutions is paramount, and we know that both software is worth trying, especially if you're an owner looking for a risk-free option.

For ecommerce businesses, a mid-tier software is the practical choice when setting up an accounting system for the first time. Sage 50 and QuickBooks Online each offer one with the features that every business owner or accountant will benefit from. Let’s put them side by side for comparison.

| Sage 50 vs. QuickBooks: Mid-Tier Plan Key Feature Comparison | ||

| Features | Sage 50 Premium Accounting | QuickBooks Online Essentials |

| Number of users | 1 - 5 users | 1 - 3 users |

| Inventory tracking | Yes | No |

| Job costing | Yes | Yes |

| Cloud capabilities | Yes | Yes |

| Bank account sync | Yes | Yes |

| Invoice management | Yes | Yes |

| Insights and Reports | Yes | Yes |

| Track expenses | Yes | Yes |

| Payroll subscription | Separate module | Separate module |

| Fraud Protection | Yes | No |

| Support plan | Yes | Yes |

| Audit trail | Yes | Yes |

One of the biggest advantages of QuickBooks Online is its vast app integrations across many platforms, not just for accounting but for payroll and ecommerce with over 750 apps. Compared to Sage 50 with over 120 apps available in the marketplace, QuickBooks easily takes the lead for this criteria.

| Sage 50 vs. QuickBooks: App Integrations Feature Comparison | |

| Sage 50 | QuickBooks Online |

| Process and pay your employees with Sage 50 Payroll | Pay your people with Intuit Payroll |

| Tax-filing feature available in Sage50 Pro Accounting and higher | Avalara AvaTax lets you pay taxes conveniently |

| Connect Sage 50 to Xero using a third-party integration platform | Direct Xero-QuickBooks integration |

QuickBooks Online’s interface is user-friendly. When you pull up the software, you’ll first see a sidebar menu on the left side that has all the essential options you need such as the dashboard, banking, sales, taxes, and reports, to name a few.

The main section of QuickBooks Online’s interface gives you a straightforward design with few details, yet presents you with the necessary ones in a way that’s easy to digest.

Sage 50, on the other hand, gives more detail and looks tighter compared to most accounting software. They are generous with details, so you’ll often encounter windows and dialogue boxes that contain lists, dropdown boxes, radio buttons, and other key design features. This is perfect for business owners and managers who want more information and control on how they manage their finances.

| Sage 50 vs. QuickBooks: Layout and Design Comparison | |

| Sage 50 | QuickBooks Online |

| Detailed design with multiple tabs and screens | Simple and minimal design |

| Has a shortcut section on the software’s side menu | Includes every essential option on the side menu instead |

| Detailed top bar menu with similarities to MS Office’s top bar design | Top bar menu includes only several icons on the right side of the dashboard |

| Minimal graph representations of data | Highly visual graphs matched with data |

The good news is that both Sage 50 and QuickBooks Online graciously offer special discounts. Moreover, QuickBooks has a 30-day trial period, and Sage 50 lets you take a test drive or view an on-demand demo.

If you do decide to subscribe, here are the available plans.

QuickBooks Online has four plans with varying subscription prices and user capacity.

| QuickBooks Online Plan Comparison | ||||

| Simple Start | Essentials | Plus | Advanced | |

| Pricing | $15 / Month | $30 / Month | $45 / Month | $100 / Month |

| Users up to | 1 user | 3 users | 5 users | 25 users |

| Suitable for | Freelancers, micro-businesses, beginner accountants or non-professionals | Small businesses | Businesses needed inventory and project management | SMBs (small- to medium-sized businesses) |

PeachTree offers three tiers for their online accounting software. Each of the plans are also paid on subscription basis.

| Peachtree Online Plan Comparison | |||

| Pro Accounting | Premium Accounting | Quantum Accounting | |

| Pricing | $57.17 / Month | $82.09 / Month | $136 / Month |

| Users up to | 1 user | 5 users | 40 users |

| Suitable for | Solopreneurs and micro-businesses | Small businesses | MLBs (medium-sized to large businesses) |

Sage 50 isa tool you can install on a desktop computer. When you look for tools to help you track your business finances, this name will be among the first recommendations you will see. Here are its highlights.

Sage 50 has categorized its offers for different businesses: small, medium, and businesses of any size. So, owners can easily pick the services that fit the expanse of their venture. For instance, a small business offer includes cloud-based accounting, time and billing tracking, and workforce management. More and more bookkeeping and accounting features are added to the plans for other business sizes.

Sage’s service categorization for various industries differentiates it from other small business accounting tools. The software particularly flexes its reliability by being an accounting tool for several for-profit and non-profit industries. The tool’s features are tailor-fitted to satisfy the needs of the different trades.

Nevertheless, if you do not fall into any of the industries mentioned, you can still enjoy these features of Sage 50:

These offers will be included depending on the plan you subscribe to. The greater your investment, the more features you will get.

Not far behind, the accounting tool many businesses go to is QuickBooks. Similar to most software companies, its maker, Intuit, offers several product lines such as their top-of-the line QuickBooks Enterprise and their powerful starter, QuickBooks Essentials. But the most popular among ecommerce businesses is QuickBooks Online.

You can access this software on desktop computers and mobile phones. QuickBooks is equally reliable as Sage 50 because of the following features.

When you sign up for a QuickBooks plan, you'll enjoy its live bookkeeping immediately. This feature keeps your books up-to-date by ensuring that financial data from the start of the year to the current month are collected, categorized, and stored. If you sign-up midyear, bookkeepers will track whatever data is missing. Trained bookkeepers will update your books live from then on.

You'll also get to enjoy these traditional bookkeeping and accounting features by using QuickBooks:

Keeping your finances tracked has plenty of benefits, but one is being prepared when tax season comes. With QuickBooks, you'll be equipped with all the data you need. To ensure that all the data you submit for a tax audit is accurate, QuickBooks has a tax penalty protection that guarantees up to a $25,000 payment per year if you get any tax-related inaccuracies and errors from the tool.

Another perk that sets QuickBooks apart from its competitors is the Priority Circle. This service offers QuickBooks Advanced users in-depth training about software usage and 24/7 customer support. You won’t need to go the extra mile by looking for a QuickBooks training program, which will surely cost extra.

As two highly-sought accounting software, Sage 50 and QuickBooks understand what most businesses need when it comes to management. To be competitive, they have to expand what their software is capable of, extending them beyond bookkeeping and accounting. The result is a set of four features similar to each other yet delivered in their own unique ways.

You’ll enjoy the following offerings with both QuickBooks and Sage 50.

Make sense of all the details your bookkeeper has logged in and generate reports of your business income and expenses through accounting features of both QuickBooks and Sage 50. You can rely on both software to store and create accurate reports quicker than manual accounting. Software and third-party apps make the task very simple and less complex.

There are other accounting apps available such as Photeeq, FreshBooks, and Zoho Books. If you have important documents in another software, you can integrate them easily to QuickBooks or Peachtree as both software have the capabilities.

As a result, there will be no need to open several books and Excel sheets to check data because everything you need will be in one place. With these features, you can access real-time business data remotely and generate reports from the latest numbers.

Cloud-based technology is a way to secure data. Before, you’d store important information about the company on an office desktop, which anyone can access. Now, data can be stored in the cloud with impregnable security that requires special approval for each step.

The company's manager can control who can access business information through cloud-based accounting. In most cases, the company bookkeeper, accountant, and finance teams are the only people granted access. Then, everyone with access can see the same information no matter where you access the app.

You can reap plenty of benefits with accurate time tracking and project management. Among them are the following:

A small business owner must look for these convenient features in accounting software—both Sage 50 and QuickBooks offer them.

Everything these days is automated, so if you run into software that does not offer the automation expectations you have, strike it off your list. Regarding receiving and sending payments, generating invoices, storing receipts, and sorting all these transactions into categories for accounting, both QuickBooks and Sage 50 have got you covered.

So, get ready to link your payment gateways, receiving accounts, bank accounts, and credit cards to Sage 50 and QuickBooks so the software can track all direct deposits and expenses immediately. Wherever you are, when you receive a notification of payment or request to pay, you can process them instantly as long as there is an internet connection.

Both Sage 50 and QuickBooks have a service focused on human resource (HR) management, which is essential once you've grown your business and already managed several employees.

The HR feature is especially helpful if you have a diverse team of professionals working for you. This ensures employees' wellbeing is handled well according to the laws and regulations where your business operates.

Despite their similarities, the two accounting software also have to differentiate themselves to stand out. Here are the four key differences that may determine whether you'll choose Sage 50 or QuickBooks.

A prime difference between Sage 50 and QuickBooks is bookkeeping services. QuickBooks has a team of expert bookkeepers clients can consult with via appointment to check how their business is sailing. Once you sign up for QuickBooks’s full-service live bookkeeping, these professionals can help you cleanup your accounting data and do ongoing accounting and consultation.

The live bookkeeping function, however, is different with Sage. The Sage Live feature only offers real-time collaboration with people that handle your bookkeeping. As for providing a full service accountant, you’ll need to get your own.

In terms of accounting software interface, QuickBooks focuses more on a user-friendly interface with a clean-looking dashboard and a simplified side menu which helps users easily see and navigate through the sections to find out essential information.

Sage 50 gives more detail. It packs a lot of options on its dashboard which includes a sidebar menu and a top bar menu. Users can see different sections and icons on their screen for pointing to a specific segment you need to update or manage.

Accounting and bookkeeping are needed in all business types and sizes. Aside from offering general assistance, both Sage 50 and QuickBooks provide industry-specific accounting in niches different from each other. Here are the differences in industries they serve.

| Sage 50 vs. QuickBooks: Industry Niche | |

| Sage 50 | QuickBooks Online |

| Checmicals | Churches |

| Franchise | |

| SaaS and Subscription | |

We recommend QuickBooks Online over Sage 50 because of a few critical factors. It’s cheaper than Peachtree because it doesn’t require a desktop app and the software can work online. The accounting software also has a user-friendly interface, making it easier for ecommerce business owners to learn. Many accountants also prefer the simplicity of QuickBooks Online.

Unloop’s team of bookkeepers are also experts in QuickBooks Online. It's the software we use to help out ecommerce business owners clean up and maintain their financial records so they can make better decisions. If you choose QuickBooks as your accounting software, maximize its potential by having a team who knows how to use it as if your bookkeeping is on autopilot. Give us a call now!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

The ecommerce landscape can be difficult to navigate, especially with many new currencies, regulations, and tax laws on the horizon. Accounting will be more challenging than it used to be. Multi-currency ecommerce accounting is a topic that scares many entrepreneurs. Luckily, multi-currency accounting software is here to help!

What do these tools have to offer for blossoming businesses like yours? This article will walk you through the basics of multi-currency accounting and show what this software can do for your business.

One of the most important things you need to know about ecommerce accounting is how it works with multi-currency transactions. If you're new to the ecommerce system, taking everything in won't be easy. So let this article help you with a quick discussion.

Let's say your company is based in the US, but you get product supplies from China and sell them to European clients. As you can guess, this will involve three currencies: USD, RMB, and EUR. Consequently, the following (but are not limited to) challenges may arise:

There are just too many things involved when dealing with foreign currency transactions. You can't simply calculate all the costs and generate a receipt in USD for these reasons.

Foreign transactions involve money more than anything else, affecting your bookkeeping and accounting operations the most. Here are specific processes that become more complicated and time-consuming when multi-currency is involved:

Suppose your ecommerce business deals with multiple currencies. In that case, you must find a way to avoid confusion and making mistakes.

Luckily, some ecommerce platforms or small business accounting software can solve your multi-currency dilemma: creating a multi-currency account.

It pays to use online accounting software that offers multi-currency features. These systems allow you to perform essential accounting functions while ensuring you accurately track and manage transactions in various currencies.

With multi-currency and entry-level accounting software, you can:

A multi-currency account is a single bank account that allows the holding, payment, and receiving of multiple money currencies. If you're selling internationally, this is a great advantage to reduce the hassle of complex rates.

Here's how it makes your business's financial operations easier when dealing with foreign payments:

Now that you understand its necessity, here's a basic overview of creating a multi-currency account. Take note that the process may differ per platform or software. Below is a general step-by-step procedure to give you a gist:

OFX is an example of an excellent international money transfer platform. The good thing about OFX is that it doesn't charge transfer fees and offers more reasonable rates than its competitors.

In addition, it supports 55 currencies and takes 1-5 days to transfer, depending on the location (unfortunately, it doesn't accept same-day transfers).

Here's an overview of how you can set up a multi-currency account on this platform:

The world is rapidly moving to digital reliance, and ecommerce is running in full force. Hence, businesses must ensure that their financial management system supports and adapts multi-currency accounting.

Otherwise, you'll have difficulty dealing with the overwhelming complexity of foreign rates. Before it gets to that, learn how to get financially native in foreign lands.

Now, we understand that this could be a lot of information. But don't fret; Unloop can extend a hand to help you organize foreign currencies! Whether you need bookkeeping in Calgary or other Canadian areas and across the US, Unloop can help ease your bookkeeping management duties through a remote setting.

We're ready to be your long-term business partner and help you with your bookkeeping tasks, such as calculating COGS and dealing with Shopify and Amazon corporate tax rates. OFX is also one of the tools we use for our services.

Book a call with us today or explore our blog section for more resources.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

The ecommerce landscape can be difficult to navigate, especially with many new currencies, regulations, and tax laws on the horizon. Accounting will be more challenging than it used to be. Multi-currency ecommerce accounting is a topic that scares many entrepreneurs. Luckily, multi-currency accounting software is here to help!

What do these tools have to offer for blossoming businesses like yours? This article will walk you through the basics of multi-currency accounting and show what this software can do for your business.

One of the most important things you need to know about ecommerce accounting is how it works with multi-currency transactions. If you're new to the ecommerce system, taking everything in won't be easy. So let this article help you with a quick discussion.

Let's say your company is based in the US, but you get product supplies from China and sell them to European clients. As you can guess, this will involve three currencies: USD, RMB, and EUR. Consequently, the following (but are not limited to) challenges may arise:

There are just too many things involved when dealing with foreign currency transactions. You can't simply calculate all the costs and generate a receipt in USD for these reasons.

Foreign transactions involve money more than anything else, affecting your bookkeeping and accounting operations the most. Here are specific processes that become more complicated and time-consuming when multi-currency is involved:

Suppose your ecommerce business deals with multiple currencies. In that case, you must find a way to avoid confusion and making mistakes.

Luckily, some ecommerce platforms or small business accounting software can solve your multi-currency dilemma: creating a multi-currency account.

It pays to use online accounting software that offers multi-currency features. These systems allow you to perform essential accounting functions while ensuring you accurately track and manage transactions in various currencies.

With multi-currency and entry-level accounting software, you can:

A multi-currency account is a single bank account that allows the holding, payment, and receiving of multiple money currencies. If you're selling internationally, this is a great advantage to reduce the hassle of complex rates.

Here's how it makes your business's financial operations easier when dealing with foreign payments:

Now that you understand its necessity, here's a basic overview of creating a multi-currency account. Take note that the process may differ per platform or software. Below is a general step-by-step procedure to give you a gist:

OFX is an example of an excellent international money transfer platform. The good thing about OFX is that it doesn't charge transfer fees and offers more reasonable rates than its competitors.

In addition, it supports 55 currencies and takes 1-5 days to transfer, depending on the location (unfortunately, it doesn't accept same-day transfers).

Here's an overview of how you can set up a multi-currency account on this platform:

The world is rapidly moving to digital reliance, and ecommerce is running in full force. Hence, businesses must ensure that their financial management system supports and adapts multi-currency accounting.

Otherwise, you'll have difficulty dealing with the overwhelming complexity of foreign rates. Before it gets to that, learn how to get financially native in foreign lands.

Now, we understand that this could be a lot of information. But don't fret; Unloop can extend a hand to help you organize foreign currencies! Whether you need bookkeeping in Calgary or other Canadian areas and across the US, Unloop can help ease your bookkeeping management duties through a remote setting.

We're ready to be your long-term business partner and help you with your bookkeeping tasks, such as calculating COGS and dealing with Shopify and Amazon corporate tax rates. OFX is also one of the tools we use for our services.

Book a call with us today or explore our blog section for more resources.

Many Canadian ecommerce sellers dread handling taxes. The apprehension roots in the difficulty of understanding the many rules and regulations surrounding taxes. Adding to the challenge, especially for ecommerce sellers, are the different rates for sales taxes. Sellers offering services and products in different territories need to keep up with the ever-changing rules on sales taxes.

These troubles make every business owner, especially those new in the field and unfamiliar with taxation, abandon the possibility of understanding taxes and handling the task on their own. While you can delegate taxes to professionals, it still pays to know how it works, even in the most basic sense.

With that, here are the seven frequently asked questions ecommerce sellers ask about taxes. Knowing the answers may give you the confidence to handle your own. Let’s begin!

When you become an ecommerce seller, there are a lot of key dates you need to remember, some of which are tax deadlines. In Canada, you can file your taxes for the previous year’s income as early as February, but the tax filing deadline is on April 30.

The Canada Revenue Agency (CRA) makes the process easier, you can file taxes online. Just be ready with the complete financial details for the whole calendar year and receipts in case the CRA looks for them.

To keep yourself from cramming months before the tax due date, it is best practice to put your business bookkeeping and accounting in place as early as launching your business. This ensures that you will have all the financial transactions recorded throughout the year. You will also minimize the possibility of inaccuracy as your bookkeeper or accountant won’t need to rush.

An income tax return is a document containing a person or a company’s annual income, expenses, and other financial transactions that occurred within the year. It is from these details where the taxpayer and authorities calculate one’s tax liability, which is often paid annually. If there is any overpayment, the taxpayer can request for a tax refund.

Canadian residents, immigrants, indigenous peoples, deceased individuals, people who have left Canada temporarily or permanently, and temporary Canadian residents are all obliged to pay income tax return.

When filing for tax returns, you must declare your total annual income to know how much you need to pay. The Canadian government determines a tax rate depending on your total income. Rates may change yearly. For instance, the 2022 tax rate has already been changed for 2023, so it is best to stay updated. All provinces and territories in Canada submit their taxes to the CRA except for Quebec, where taxes are paid to the Revenu Quebec.

Sales taxes in Canada vary per province or territory, and each charges General Sales Tax (GST), Provincial Sales Tax (PST), a combination of PST and GST, or Harmonized Sales Tax (HST). Sellers and service providers who have a physical store or office and even those selling online are required to pay sales taxes when they earn at least $30,000 in a year.

Sellers are to base the rate they charge on the destination of the package, and here are the rates.

| Province | PST | GST | HST | Total Tax Rate |

| Alberta | 5% | 5% | ||

| British Columbia | 7% | 5% | 12% | |

| Manitoba | 7% | 5% | 12% | |

| New Brunswick | 15% | 15% | ||

| Newfoundland and Labrador | 15% | 15% | ||

| Northwest Territories | 5% | 5% | ||

| Nova Scotia | 15% | 15% | ||

| Nunavut | 5% | 5% | ||

| Ontario | 13% | 13% | ||

| Prince Edward Island | 15% | 15% | ||

| Quebec | 9.975% | 5% | 14.98% | |

| Saskatchewan | 6% | 5% | 11% | |

| Yukon | 5% | 5% |

These tax rates are charged for every sale made, which the buyers should shoulder. Yet, it is your duty as a seller to provide transparency in every transaction. Show your customers a breakdown of their pay, including the sales tax charges.

Although challenging, ecommerce sellers like you should always prioritize paying taxes as there are repercussions. The CRA requires one time payments, so when they find out that a business owner does not pay taxes, a collections officer will be assigned to review their case. If found guilty, they can be subjected to pay interest rates on top of the taxes they weren’t able to pay.

The good news is most Canadians are responsible taxpayers, but if the business cannot pay, the CRA can seize the company’s assets and bank accounts, garnish wages, and register a lien on the owner’s home. Tax relief can still be given to business owners (when eligible for it),, and owners can also make payment arrangements with the CRA after setting up a meeting with the agency.

Many bookkeeping and accounting software already have a tax computing feature. They can also integrate with ecommerce sites like Amazon and Shopify. These platforms compute sales taxes and send the data to your main accounting software through integration.

There are also separate software like Taxomate, Taxify, Hello Tax, and TaxJar that can give you the following assistance:

However, for the most comprehensive software, consider QuickBooks. It has features to track, collect, review, and pay your sales taxes. And even when you sell on sites that handle sales taxes for you, you can still integrate the data collected from that platform with the QuickBooks software, so all your data is in one place. Because all your financial transactions are recorded on QuickBooks, you can use it to find the amount of income tax you need to pay.

Whether you sell on Amazon or are still planning to, the first thing you should know is the platform’s Marketplace Tax Collection (MTC).

Because of the Marketplace Facilitator Law (MPF), third-party sellers like Amazon are compelled to compute, collect, report, and remit sales taxes. This is good news for sellers like you as you no longer have to worry about these tasks. All you need to do now is monitor the sales taxes and integrate the data from Amazon into your bookkeeping and accounting software for tracking.

You should also know that the platform also has the Amazon Tax Exemption Program (ATEP), which considers individuals and organizations that are eligible for tax exemption.

As an ecommerce seller, it’s a wise business move to sell on Amazon. Amazon is the largest ecommerce site in the world, and although the competition is tough, there is also a high chance of introducing and selling your products to a broader audience.

Shopify does not offer the same tax assistance as Amazon, but you can optimize the settings in the ecommerce site to make your sales tax management more efficient. You can set up Shopify to add sales taxes upon customer checkout.

To streamline the tax detail determination, collection, and remittance process, you can integrate the data from Shopify into the tax software you use. They can do the following steps after Shopify has charged the correct sales taxes to customers.

You can also integrate all the data from Shopify into your bookkeeping and accounting system so that you can compute your income tax return correctly and quickly by the end of the year.

Knowing some of the tax details can give you confidence as an ecommerce seller. It may make you realize that taxes aren’t that dreadful to handle, especially when you have the right software and tools. You’ll also realize that many ecommerce platforms have made taxes easier for sellers like you by doing the computation, collection, and remittance themselves.

If you are looking for convenience when filing for tax returns, another wise thing to do is to partner with tax experts to whom you can delegate this complex task. Unloop could be the partner you are looking for!When you partner with us, whether you are in Canada or the US, we can help you make tax season less of a worry. Don’t worry about your income tax, either! We’ll handle the bookkeeping and connect you with the best CPAs in North America for filing taxes. Beat the deadline! Connect with us now; we’d love to discuss the details with you!

Many Canadian ecommerce sellers dread handling taxes. The apprehension roots in the difficulty of understanding the many rules and regulations surrounding taxes. Adding to the challenge, especially for ecommerce sellers, are the different rates for sales taxes. Sellers offering services and products in different territories need to keep up with the ever-changing rules on sales taxes.

These troubles make every business owner, especially those new in the field and unfamiliar with taxation, abandon the possibility of understanding taxes and handling the task on their own. While you can delegate taxes to professionals, it still pays to know how it works, even in the most basic sense.

With that, here are the seven frequently asked questions ecommerce sellers ask about taxes. Knowing the answers may give you the confidence to handle your own. Let’s begin!

When you become an ecommerce seller, there are a lot of key dates you need to remember, some of which are tax deadlines. In Canada, you can file your taxes for the previous year’s income as early as February, but the tax filing deadline is on April 30.

The Canada Revenue Agency (CRA) makes the process easier, you can file taxes online. Just be ready with the complete financial details for the whole calendar year and receipts in case the CRA looks for them.

To keep yourself from cramming months before the tax due date, it is best practice to put your business bookkeeping and accounting in place as early as launching your business. This ensures that you will have all the financial transactions recorded throughout the year. You will also minimize the possibility of inaccuracy as your bookkeeper or accountant won’t need to rush.

An income tax return is a document containing a person or a company’s annual income, expenses, and other financial transactions that occurred within the year. It is from these details where the taxpayer and authorities calculate one’s tax liability, which is often paid annually. If there is any overpayment, the taxpayer can request for a tax refund.

Canadian residents, immigrants, indigenous peoples, deceased individuals, people who have left Canada temporarily or permanently, and temporary Canadian residents are all obliged to pay income tax return.

When filing for tax returns, you must declare your total annual income to know how much you need to pay. The Canadian government determines a tax rate depending on your total income. Rates may change yearly. For instance, the 2022 tax rate has already been changed for 2023, so it is best to stay updated. All provinces and territories in Canada submit their taxes to the CRA except for Quebec, where taxes are paid to the Revenu Quebec.

Sales taxes in Canada vary per province or territory, and each charges General Sales Tax (GST), Provincial Sales Tax (PST), a combination of PST and GST, or Harmonized Sales Tax (HST). Sellers and service providers who have a physical store or office and even those selling online are required to pay sales taxes when they earn at least $30,000 in a year.

Sellers are to base the rate they charge on the destination of the package, and here are the rates.

| Province | PST | GST | HST | Total Tax Rate |

| Alberta | 5% | 5% | ||

| British Columbia | 7% | 5% | 12% | |

| Manitoba | 7% | 5% | 12% | |

| New Brunswick | 15% | 15% | ||

| Newfoundland and Labrador | 15% | 15% | ||

| Northwest Territories | 5% | 5% | ||

| Nova Scotia | 15% | 15% | ||

| Nunavut | 5% | 5% | ||

| Ontario | 13% | 13% | ||

| Prince Edward Island | 15% | 15% | ||

| Quebec | 9.975% | 5% | 14.98% | |

| Saskatchewan | 6% | 5% | 11% | |

| Yukon | 5% | 5% |

These tax rates are charged for every sale made, which the buyers should shoulder. Yet, it is your duty as a seller to provide transparency in every transaction. Show your customers a breakdown of their pay, including the sales tax charges.

Although challenging, ecommerce sellers like you should always prioritize paying taxes as there are repercussions. The CRA requires one time payments, so when they find out that a business owner does not pay taxes, a collections officer will be assigned to review their case. If found guilty, they can be subjected to pay interest rates on top of the taxes they weren’t able to pay.

The good news is most Canadians are responsible taxpayers, but if the business cannot pay, the CRA can seize the company’s assets and bank accounts, garnish wages, and register a lien on the owner’s home. Tax relief can still be given to business owners (when eligible for it),, and owners can also make payment arrangements with the CRA after setting up a meeting with the agency.

Many bookkeeping and accounting software already have a tax computing feature. They can also integrate with ecommerce sites like Amazon and Shopify. These platforms compute sales taxes and send the data to your main accounting software through integration.

There are also separate software like Taxomate, Taxify, Hello Tax, and TaxJar that can give you the following assistance:

However, for the most comprehensive software, consider QuickBooks. It has features to track, collect, review, and pay your sales taxes. And even when you sell on sites that handle sales taxes for you, you can still integrate the data collected from that platform with the QuickBooks software, so all your data is in one place. Because all your financial transactions are recorded on QuickBooks, you can use it to find the amount of income tax you need to pay.