Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Hearing the word accounting leaves our brains in tangles. The thought of crunching numbers and organizing financial records is already enough to give us a headache. And now, we have a new beast to conquer: accounting for an ecommerce business.

From the arduous task of sorting through business transaction receipts to enduring late-night sessions in front of computer screens, the very idea of it makes us want to pack up and leave the ecommerce world even before we get started.

This leaves us wondering whether accounting for ecommerce businesses is truly simple. But don’t worry! This article aims to provide all the answers right away.

Accounting for ecommerce still functions like regular accounting, but it's specifically designed for online businesses.

In simple terms, it means keeping track of money-related activities when you sell things online. Such activities include recording, analyzing, and managing financial transactions for the digital store. From there, you can understand your finances, make smart decisions, and stay compliant with standard rules in the fast-paced online market.

Since everything happens online, you need a way to quickly collect and handle all this financial data. That's where accounting software comes in handy. It's an innovative tool that many ecommerce companies use to keep their financial reports organized and make their accounting tasks easier.

Here are some of the popular accounting software used by most ecommerce business owners:

Starting an ecommerce accounting system means choosing one of these accounting solutions. By doing so, you can effectively manage the financial aspects of your ecommerce store and set yourself up for success.

Although ecommerce business accounting requires tools and software, its core functions remain unchanged. Your business’ internal system must include these three facets to build a reliable accounting arm for your online venture.

Bookkeeping is the accounting task of recording transactions. This process follows a step-by-step cycle to keep everything accurate, starting by overseeing business transaction data.

In an ecommerce setting, data will be collected from you via electronic means. It can be gathered in different ways, including:

Once all the data is collected, the bookkeeper running the accounting tool will start creating or managing a chart of accounts. They will sort the financial information into different categories (e.g., sales and expenses) and record each transaction along with its corresponding amounts.

The bookkeeper’s job is to make sure all the numbers are right. They’ll double-check everything with a special report called a trial balance. If everything looks good and the numbers add up correctly, the process moves on to the next step.

Aside from bookkeeping tasks, generating financial statements is also important. Any ecommerce business owner can benefit from this since it gives you a clear picture of your overall performance in the market, which you can interpret later on.

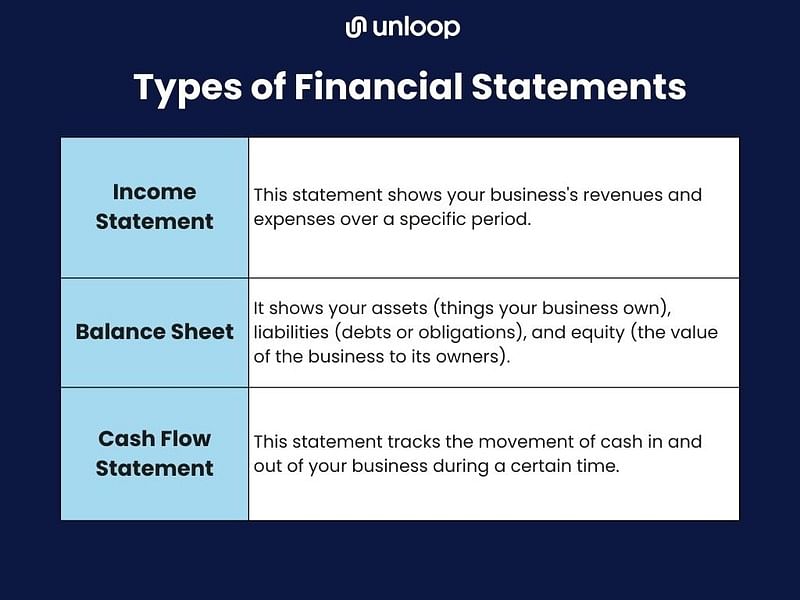

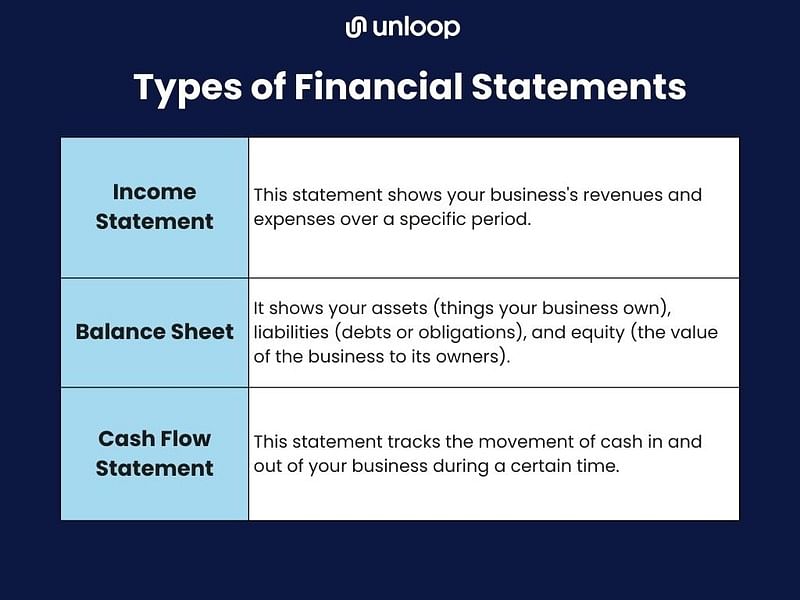

Key financial statements are composed of three:

From income to cash flow statements, you can determine if your business is making a profit, generating enough cash to cover expenses, or experiencing losses.

Ignoring sales tax responsibilities is not an option in ecommerce marketplaces.

Failing to collect and remit sales tax can result in severe repercussions, including penalties, fines, and potential legal troubles. As an ecommerce business owner, adhering to proper tax filing procedures is imperative to keep things hassle-free.

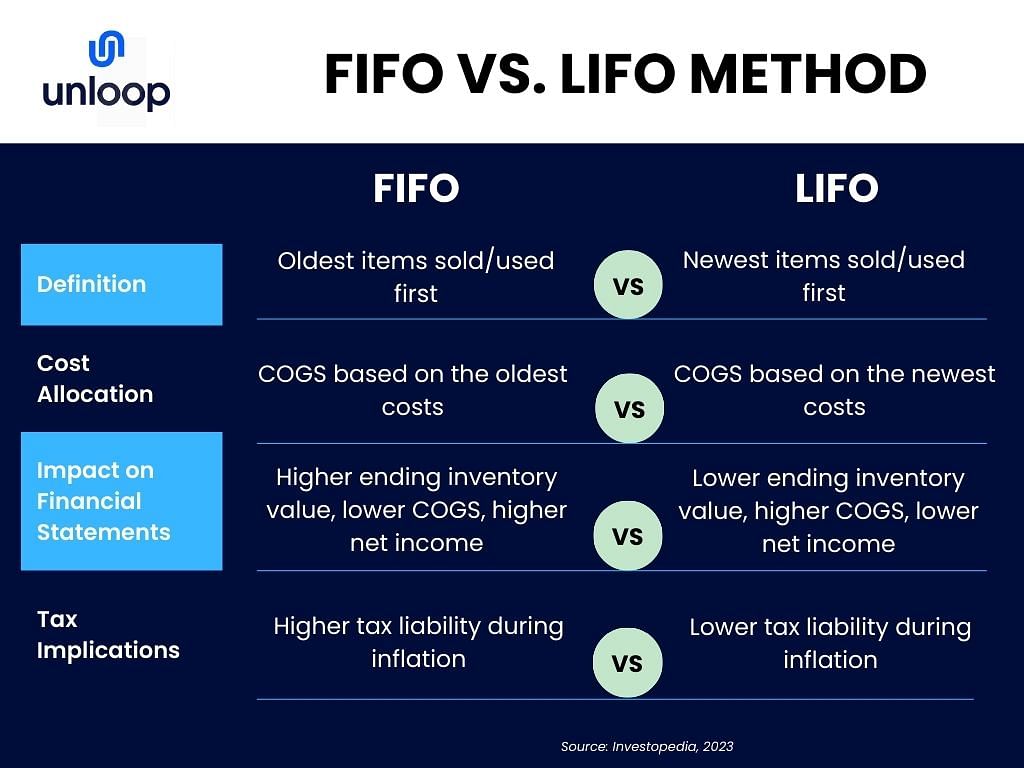

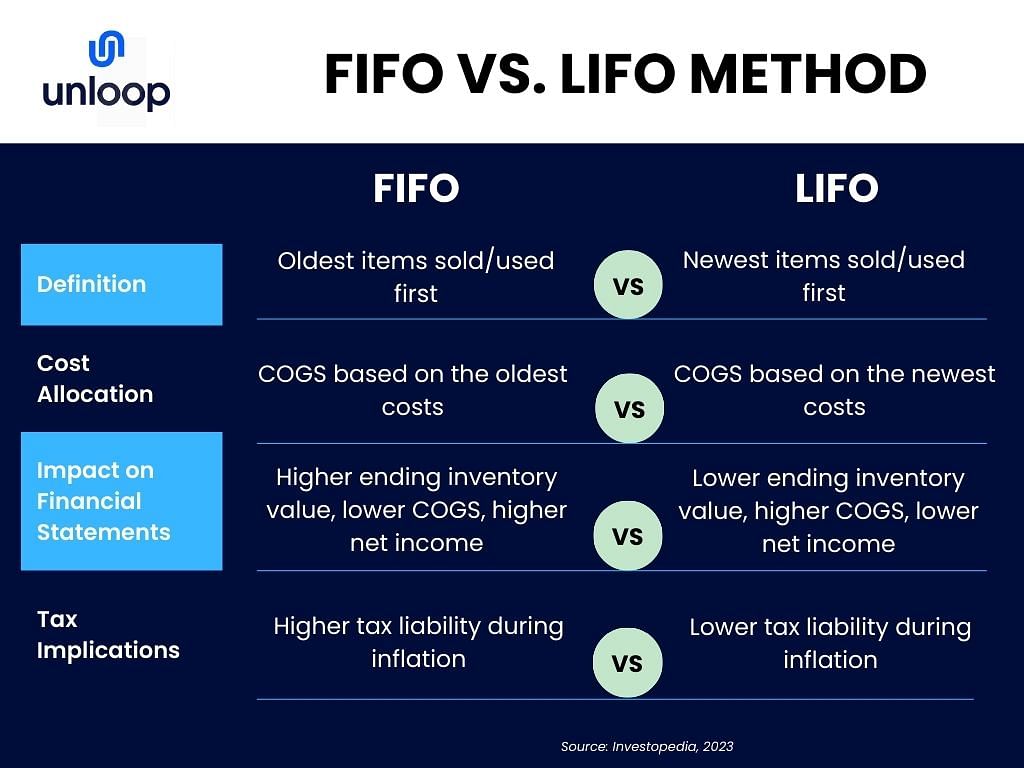

Effective inventory management ensures the right amount of products is available to meet customer demand while minimizing excess stock.

From an accounting perspective, inventory directly affects the cost of goods sold (COGS), representing the cost of producing or purchasing the goods sold during a specific period. By tracking inventory levels and associated costs, you can identify the true cost of goods sold and, subsequently, the gross profit.

Speaking of organization and management, ecommerce businesses have two primary accounting methods to choose from:

This approach records transactions when actual cash is received or paid out. Revenue is recognized at the time of payment receipt, and expenses are recorded when payments are made.

This method provides an easy way to track cash flow. It is also suitable for smaller ecommerce businesses with lower sales volumes and simpler inventory tracking needs.

This method records transactions when they occur, irrespective of the cash exchange timing. Revenue is recognized at the time of the sale, even if payment is yet to be received. Meanwhile, expenses are recognized when goods or services are received, regardless of payment timing.

The accrual accounting method offers a broader view of the business's financial status over time. It is also commonly used by larger enterprises with higher sales volumes and more complex inventory management needs.

Like traditional accounting, you can hire an ecommerce accounting service for your store. But in case you have little to no idea what to look for when shopping around for a service, take a look at these:

You're busy, and everyone understands that. But your competition won't wait for you. Even if you aim to use certain accounting systems, catching up can take some time. This is where a good accounting team can enhance your efficiency. They should know how to integrate accounting software with your online store for a smooth and synced recording.

Subscribing for the accounting software alone doesn't entitle you to a bookkeeper. While it provides you with the means to perform bookkeeping tasks, the real magic happens when you combine the power of technology with skilled human expertise.

Inclusive bookkeeping services offer you the best of both worlds—efficient accounting software combined with the insights and proficiency of a dedicated bookkeeper. Their combination ensures that your business grows and financial needs are met.

Sometimes, asking a bookkeeper to create a financial statement may cost you extra. But you always have a better option—seek a service that can give you a consistent and precise financial statement, whether you need them or not.

Reconciling can be a tedious task. It is tremendously important that the numbers on the books match the money in the business bank account. That's how you know everything is recorded accurately.

With an experienced accounting service overseeing this process, you can rest assured that your financial information is protected from suspicious activities.

Ecommerce accounting has never been easier, just like the familiar practices we used before. However, we understand that not all businesses can keep up with the increasing demands of accounting tasks.

Unloop caters to all the services mentioned above and more. We are a team of experts who know accounting software and are adept at bookkeeping. The best part is we know how ecommerce businesses work.

Let us handle the numbers while you focus on success. Book a call now!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Hearing the word accounting leaves our brains in tangles. The thought of crunching numbers and organizing financial records is already enough to give us a headache. And now, we have a new beast to conquer: accounting for an ecommerce business.

From the arduous task of sorting through business transaction receipts to enduring late-night sessions in front of computer screens, the very idea of it makes us want to pack up and leave the ecommerce world even before we get started.

This leaves us wondering whether accounting for ecommerce businesses is truly simple. But don’t worry! This article aims to provide all the answers right away.

Accounting for ecommerce still functions like regular accounting, but it's specifically designed for online businesses.

In simple terms, it means keeping track of money-related activities when you sell things online. Such activities include recording, analyzing, and managing financial transactions for the digital store. From there, you can understand your finances, make smart decisions, and stay compliant with standard rules in the fast-paced online market.

Since everything happens online, you need a way to quickly collect and handle all this financial data. That's where accounting software comes in handy. It's an innovative tool that many ecommerce companies use to keep their financial reports organized and make their accounting tasks easier.

Here are some of the popular accounting software used by most ecommerce business owners:

Starting an ecommerce accounting system means choosing one of these accounting solutions. By doing so, you can effectively manage the financial aspects of your ecommerce store and set yourself up for success.

Although ecommerce business accounting requires tools and software, its core functions remain unchanged. Your business’ internal system must include these three facets to build a reliable accounting arm for your online venture.

Bookkeeping is the accounting task of recording transactions. This process follows a step-by-step cycle to keep everything accurate, starting by overseeing business transaction data.

In an ecommerce setting, data will be collected from you via electronic means. It can be gathered in different ways, including:

Once all the data is collected, the bookkeeper running the accounting tool will start creating or managing a chart of accounts. They will sort the financial information into different categories (e.g., sales and expenses) and record each transaction along with its corresponding amounts.

The bookkeeper’s job is to make sure all the numbers are right. They’ll double-check everything with a special report called a trial balance. If everything looks good and the numbers add up correctly, the process moves on to the next step.

Aside from bookkeeping tasks, generating financial statements is also important. Any ecommerce business owner can benefit from this since it gives you a clear picture of your overall performance in the market, which you can interpret later on.

Key financial statements are composed of three:

From income to cash flow statements, you can determine if your business is making a profit, generating enough cash to cover expenses, or experiencing losses.

Ignoring sales tax responsibilities is not an option in ecommerce marketplaces.

Failing to collect and remit sales tax can result in severe repercussions, including penalties, fines, and potential legal troubles. As an ecommerce business owner, adhering to proper tax filing procedures is imperative to keep things hassle-free.

Effective inventory management ensures the right amount of products is available to meet customer demand while minimizing excess stock.

From an accounting perspective, inventory directly affects the cost of goods sold (COGS), representing the cost of producing or purchasing the goods sold during a specific period. By tracking inventory levels and associated costs, you can identify the true cost of goods sold and, subsequently, the gross profit.

Speaking of organization and management, ecommerce businesses have two primary accounting methods to choose from:

This approach records transactions when actual cash is received or paid out. Revenue is recognized at the time of payment receipt, and expenses are recorded when payments are made.

This method provides an easy way to track cash flow. It is also suitable for smaller ecommerce businesses with lower sales volumes and simpler inventory tracking needs.

This method records transactions when they occur, irrespective of the cash exchange timing. Revenue is recognized at the time of the sale, even if payment is yet to be received. Meanwhile, expenses are recognized when goods or services are received, regardless of payment timing.

The accrual accounting method offers a broader view of the business's financial status over time. It is also commonly used by larger enterprises with higher sales volumes and more complex inventory management needs.

Like traditional accounting, you can hire an ecommerce accounting service for your store. But in case you have little to no idea what to look for when shopping around for a service, take a look at these:

You're busy, and everyone understands that. But your competition won't wait for you. Even if you aim to use certain accounting systems, catching up can take some time. This is where a good accounting team can enhance your efficiency. They should know how to integrate accounting software with your online store for a smooth and synced recording.

Subscribing for the accounting software alone doesn't entitle you to a bookkeeper. While it provides you with the means to perform bookkeeping tasks, the real magic happens when you combine the power of technology with skilled human expertise.

Inclusive bookkeeping services offer you the best of both worlds—efficient accounting software combined with the insights and proficiency of a dedicated bookkeeper. Their combination ensures that your business grows and financial needs are met.

Sometimes, asking a bookkeeper to create a financial statement may cost you extra. But you always have a better option—seek a service that can give you a consistent and precise financial statement, whether you need them or not.

Reconciling can be a tedious task. It is tremendously important that the numbers on the books match the money in the business bank account. That's how you know everything is recorded accurately.

With an experienced accounting service overseeing this process, you can rest assured that your financial information is protected from suspicious activities.

Ecommerce accounting has never been easier, just like the familiar practices we used before. However, we understand that not all businesses can keep up with the increasing demands of accounting tasks.

Unloop caters to all the services mentioned above and more. We are a team of experts who know accounting software and are adept at bookkeeping. The best part is we know how ecommerce businesses work.

Let us handle the numbers while you focus on success. Book a call now!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

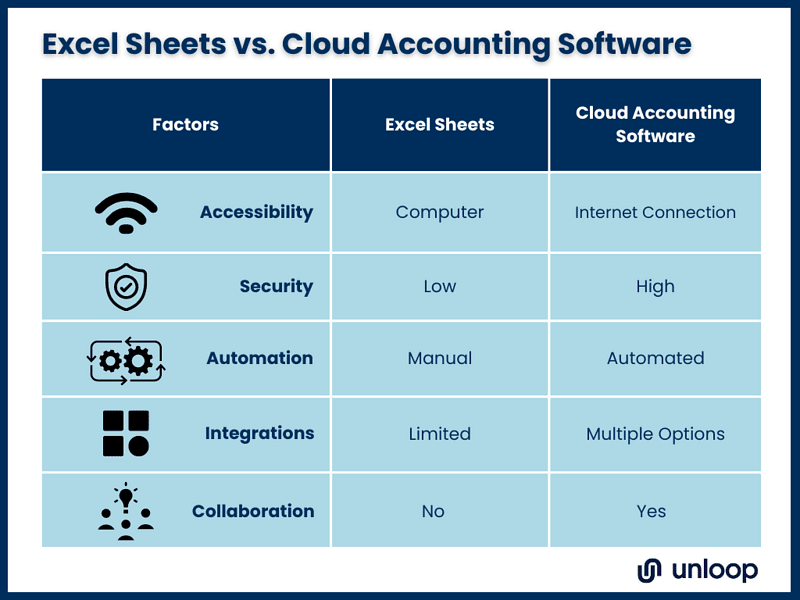

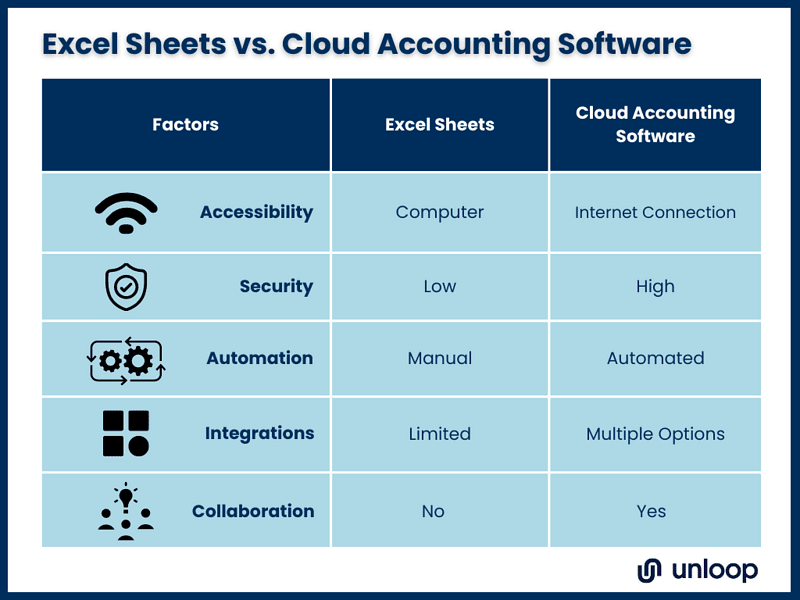

Unsurprisingly, most businesses switch to cloud-based accounting software. While very helpful, traditional manual data entry using ledgers and columnar is prone to mistakes. If there's an error, you have to find it and edit several entries as a consequence. It's a grueling process for non-accountants because it takes up a huge chunk of time.

Fortunately, the rise of computer technology has transformed the business world. Cloud accounting software has been invented and proven to help minimize errors and process financial data. The competitive online accounting software market also makes it easy to acquire them, so ecommerce business owners like you can get in the wagon easily.

Before replacing old-school ledgers and journals with a cloud-based tool, let Unloop give you tips and recommendations on how to best use cloud accounting software.

Although signing up for cloud bookkeeping and accounting software will add to company costs, the investment is worth it in the long run. Here are some top benefits you’ll reap when using bookkeeping and accounting programs.

Accounting software can make data collection and monitoring stress-free. This is because you can integrate information across all your platforms and tools.

You can also add the following in the accounting system from different ecommerce platforms like Amazon or Shopify:

When generating different financial statements, lots of computations can occur. After collecting and monitoring data that will be included in the statements, the software can also do the calculations for you. Whether it’s the computation of your company’s profit, owner’s/shareholder’s equity, taxes, assets, or liabilities, you’ll know the details immediately through help from the software.

Skip the hassle of inputting formulas on Excel sheets, which are prone to human error, and rely on accurate outputs from software instead.

When data collection, monitoring, and computation are automated, generating reports will be easier. It is more convenient when using a bookkeeping and accounting program because these tools already have templates for the different financial statements you need. Pick a report you need to generate; the software will do all the work for you.

Whether you have a physical or online business, recording transactions as accurately as possible is important. You can achieve this by enhancing your accounting processes with a cloud accounting software solution and other accounting applications run by accounting professionals. With that, let us give you a shortlist of tools you can explore and decide what fits your business needs.

QuickBooks was developed by Intuit Inc.— an American software company that also created other widely used financial tools such as TurboTax and Mint. QuickBooks was launched in 1983 for small and medium-sized businesses. As of writing, QuickBooks is now a popular accounting and financial management software in the United States, with an 80.88% market share and more than 26 million users.

QBO is an accessible cloud accounting software with guaranteed scalability, functionality, and flexibility. You can customize this application to better suit your accounting needs. Double-entry accounting is easy with QBO and allows you to enjoy simple record-keeping that generates comprehensive financial reporting capabilities.

Hundreds of third-party applications can integrate with QBO, which makes information sharing faster and easier. Many professionals in finance and accounting are familiar with QuickBooks, which means you can tap a large pool of accounting pros to handle a QBO-powered cloud-based accounting system. You can make purchases, create invoices, and send bills easier with QuickBooks.

At $15 per month, you can enjoy QBO and upgrade your subscription anytime, depending on your needs. You have nothing to worry about getting started with QBO because it is user-friendly, but it is recommended that you spend an ample amount of time familiarizing yourself with the software.

Sage has over 3 million users and is also popular, just like QBO and Xero. The software lets you manage finance, accounting, payroll, and other business aspects. Because it is cloud-based, you can access all its features from any device and manipulate records within the cloud solution.

An award-winning software because of its commitment to its customers, FreshBooks is a fantastic all-in-one accounting software. It allows you to automate many tasks that include payment collection and invoice reminders.

With Freshbooks, you can scan detailed financial reports, conduct various online transactions, connect with your team for a collaborative workflow, and access it using your mobile phone.

Zoho Books allows business owners, accountants, and bookkeepers to manage a business's finances. You can automate workflows with Zoho Books, and this software assists its end-users in working collectively in different departments to stay in control of payables and receivables.

This software has many features, including inventory management, automatic importing, matching bank feeds, and compiling real-time tracking of projects for invoicing.

Xero is one of the fastest-growing cloud accounting software companies in the market. It is a New Zealand-based and popular tool among small businesses, holding over 2.7 million users worldwide. Forbes recognized it as the "World's Most Innovative Growth Company" twice.

Xero aims to simplify traditional accounting software for small business owners and allow them to spend more time on revenue-generating activities. Its cloud software feature allows you to create invoices and pay bills by simply clicking a few command buttons.

The good thing about Xero is that it allows unlimited users in all its packages. The software is intuitive, and there are instructions on its website if you want to learn its full potential. These features provide great cost savings for the business owner.

A2X is a third-party application that allows integration to cloud-based systems such as QBO and Xero with online marketplaces such as Amazon, Shopify, Etsy, eBay, or Walmart. It was structured according to the rules and processes of leading ecommerce financial experts.

This third-party software offers accuracy, and its creators believe every business should enjoy stress-free accounting. A2X caters to small retailers, major market players, and anyone who deals with accounting data.

There are tons of cloud-based accounting applications to choose from. However, not all of them are good for your business, and you must consider a few things.

Observing the market landscape and how your business's internal processes serve it is very important. From there, identify the parts in your accounting system that need improvement and upgrade. Reviewing the processes helps you determine what your business lacks regarding sustained growth.

Talking to your fellow entrepreneurs or business owners is also a good move. Ask for tips, innovative tools, and strategies that have helped their businesses grow.

The web is always accessible. Use the internet and conduct intensive research about business applications that are in demand.

Once you find tools for your business, allocate a budget for their initial payment and subscription. You must research whether they have adequate resources to train you and your staff. Everyone must understand how to use these tools before committing to them.

Always remember that every software has a unique setup, and you have to evaluate if it's the best cloud-based accounting software for MAC OS or Windows.

Amazingly, most of the cloud-based accounting applications in our list are user-friendly and customizable. To get the most out of the software you choose, contact the provider's customer support team and allow them to help you.

After all the internet research, software evaluation, and accounting professional interviews you've done, make a shortlist of software and validate each. Determine the compatibility, price, and testimonials. This list will make assessing and choosing the software to invest in easier.

After rounding up your potential software, it is time to finalize and decide. We recommend getting a trial version of the software before you select a package that best works for your business.

Always remember: if you are unsatisfied with your decision, you can refer to your shortlist and explore the next software option. Hold onto that list for future reference.

Does the capacity to generate different financial statements sound promising to you? You’re not alone. However, the numbers and reports will only make sense when you understand their purpose. Let's explore the three fundamental financial statements you should examine and the valuable insights they can provide.

Your company income statement comprises various financial information like the revenue, cost of goods sold/cost of sales, gross profit, operating expenses, operating income, non-operating items, earnings before taxes, and net income. This type of financial report states whether or not your business is profitable.

As its name suggests, a cash flow statement gives you an idea of how the money flows in your business. You'll gain insight into incoming funds, their sources, company expenses, and their destinations. It details various operating, investing, and financing activities to give you a more in-depth look at your cash flow.

Check your balance sheet if you want to check your business assets, liabilities, and owner’s/shareholder’s equity. The premise is that your business should have more assets than liabilities to ensure you can meet all your financial obligations and make your business thrive.

On the other hand, the owner’s/shareholder’s equity shows the amount you can give to yourself or the shareholders. The higher your company equity is, the more investors you can entice to invest in your business.

By following the previous tips, you will know precisely the capabilities of bookkeeping and accounting software and how to read financial reports better. You should now be confident you'll get accurate statements and understand any financial deck.

Make your daily operations and business management even easier by complementing your tools with help from experts! These days, many bookkeeping and accounting firms offer complete services to assist you in managing your business finances. Here are some of the benefits you’ll enjoy in partnering with them.

Experts from a firm can help you make sense of the numbers and the statements through statement notes. These notes provide extra information about your company's financial statements, including methods, assumptions, guidelines, and other details for accurate calculations and decision-making. Accounting professionals add them without clouding the primary message.

When partnered with a firm, you can get financial statements and reports regularly or as often as you need. This allows for consistent monitoring of your business’s financial health. You can use these reports to know if you are hitting your goals or need adjustments to your strategies for success.

When it comes to your business finances, accuracy is a priority. Only when the numbers are correct do you make the right decisions. It is a must for business owners like yourself to make accuracy checks a part of your daily routine. You can get a helping hand in fulfilling this task with an experienced account manager.

Investing in bookkeeping and accounting software is essential for generating financial statements and running an effective accounting system for your business. These tools offer convenience and help streamline collecting, monitoring, and computing financial data.

You can improve this further by partnering with experts from bookkeeping and accounting firms. They provide additional benefits such as accurate financial statements, regular reports, and statement notes to help you make informed decisions about your business’s finances.

Partner with us here at Unloop so we can assist you with your cloud-based accounting software and financial statement needs. We offer more assistance on top of that. Contact us If you’re interested in our bookkeeping services.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Unsurprisingly, most businesses switch to cloud-based accounting software. While very helpful, traditional manual data entry using ledgers and columnar is prone to mistakes. If there's an error, you have to find it and edit several entries as a consequence. It's a grueling process for non-accountants because it takes up a huge chunk of time.

Fortunately, the rise of computer technology has transformed the business world. Cloud accounting software has been invented and proven to help minimize errors and process financial data. The competitive online accounting software market also makes it easy to acquire them, so ecommerce business owners like you can get in the wagon easily.

Before replacing old-school ledgers and journals with a cloud-based tool, let Unloop give you tips and recommendations on how to best use cloud accounting software.

Although signing up for cloud bookkeeping and accounting software will add to company costs, the investment is worth it in the long run. Here are some top benefits you’ll reap when using bookkeeping and accounting programs.

Accounting software can make data collection and monitoring stress-free. This is because you can integrate information across all your platforms and tools.

You can also add the following in the accounting system from different ecommerce platforms like Amazon or Shopify:

When generating different financial statements, lots of computations can occur. After collecting and monitoring data that will be included in the statements, the software can also do the calculations for you. Whether it’s the computation of your company’s profit, owner’s/shareholder’s equity, taxes, assets, or liabilities, you’ll know the details immediately through help from the software.

Skip the hassle of inputting formulas on Excel sheets, which are prone to human error, and rely on accurate outputs from software instead.

When data collection, monitoring, and computation are automated, generating reports will be easier. It is more convenient when using a bookkeeping and accounting program because these tools already have templates for the different financial statements you need. Pick a report you need to generate; the software will do all the work for you.

Whether you have a physical or online business, recording transactions as accurately as possible is important. You can achieve this by enhancing your accounting processes with a cloud accounting software solution and other accounting applications run by accounting professionals. With that, let us give you a shortlist of tools you can explore and decide what fits your business needs.

QuickBooks was developed by Intuit Inc.— an American software company that also created other widely used financial tools such as TurboTax and Mint. QuickBooks was launched in 1983 for small and medium-sized businesses. As of writing, QuickBooks is now a popular accounting and financial management software in the United States, with an 80.88% market share and more than 26 million users.

QBO is an accessible cloud accounting software with guaranteed scalability, functionality, and flexibility. You can customize this application to better suit your accounting needs. Double-entry accounting is easy with QBO and allows you to enjoy simple record-keeping that generates comprehensive financial reporting capabilities.

Hundreds of third-party applications can integrate with QBO, which makes information sharing faster and easier. Many professionals in finance and accounting are familiar with QuickBooks, which means you can tap a large pool of accounting pros to handle a QBO-powered cloud-based accounting system. You can make purchases, create invoices, and send bills easier with QuickBooks.

At $15 per month, you can enjoy QBO and upgrade your subscription anytime, depending on your needs. You have nothing to worry about getting started with QBO because it is user-friendly, but it is recommended that you spend an ample amount of time familiarizing yourself with the software.

Sage has over 3 million users and is also popular, just like QBO and Xero. The software lets you manage finance, accounting, payroll, and other business aspects. Because it is cloud-based, you can access all its features from any device and manipulate records within the cloud solution.

An award-winning software because of its commitment to its customers, FreshBooks is a fantastic all-in-one accounting software. It allows you to automate many tasks that include payment collection and invoice reminders.

With Freshbooks, you can scan detailed financial reports, conduct various online transactions, connect with your team for a collaborative workflow, and access it using your mobile phone.

Zoho Books allows business owners, accountants, and bookkeepers to manage a business's finances. You can automate workflows with Zoho Books, and this software assists its end-users in working collectively in different departments to stay in control of payables and receivables.

This software has many features, including inventory management, automatic importing, matching bank feeds, and compiling real-time tracking of projects for invoicing.

Xero is one of the fastest-growing cloud accounting software companies in the market. It is a New Zealand-based and popular tool among small businesses, holding over 2.7 million users worldwide. Forbes recognized it as the "World's Most Innovative Growth Company" twice.

Xero aims to simplify traditional accounting software for small business owners and allow them to spend more time on revenue-generating activities. Its cloud software feature allows you to create invoices and pay bills by simply clicking a few command buttons.

The good thing about Xero is that it allows unlimited users in all its packages. The software is intuitive, and there are instructions on its website if you want to learn its full potential. These features provide great cost savings for the business owner.

A2X is a third-party application that allows integration to cloud-based systems such as QBO and Xero with online marketplaces such as Amazon, Shopify, Etsy, eBay, or Walmart. It was structured according to the rules and processes of leading ecommerce financial experts.

This third-party software offers accuracy, and its creators believe every business should enjoy stress-free accounting. A2X caters to small retailers, major market players, and anyone who deals with accounting data.

There are tons of cloud-based accounting applications to choose from. However, not all of them are good for your business, and you must consider a few things.

Observing the market landscape and how your business's internal processes serve it is very important. From there, identify the parts in your accounting system that need improvement and upgrade. Reviewing the processes helps you determine what your business lacks regarding sustained growth.

Talking to your fellow entrepreneurs or business owners is also a good move. Ask for tips, innovative tools, and strategies that have helped their businesses grow.

The web is always accessible. Use the internet and conduct intensive research about business applications that are in demand.

Once you find tools for your business, allocate a budget for their initial payment and subscription. You must research whether they have adequate resources to train you and your staff. Everyone must understand how to use these tools before committing to them.

Always remember that every software has a unique setup, and you have to evaluate if it's the best cloud-based accounting software for MAC OS or Windows.

Amazingly, most of the cloud-based accounting applications in our list are user-friendly and customizable. To get the most out of the software you choose, contact the provider's customer support team and allow them to help you.

After all the internet research, software evaluation, and accounting professional interviews you've done, make a shortlist of software and validate each. Determine the compatibility, price, and testimonials. This list will make assessing and choosing the software to invest in easier.

After rounding up your potential software, it is time to finalize and decide. We recommend getting a trial version of the software before you select a package that best works for your business.

Always remember: if you are unsatisfied with your decision, you can refer to your shortlist and explore the next software option. Hold onto that list for future reference.

Does the capacity to generate different financial statements sound promising to you? You’re not alone. However, the numbers and reports will only make sense when you understand their purpose. Let's explore the three fundamental financial statements you should examine and the valuable insights they can provide.

Your company income statement comprises various financial information like the revenue, cost of goods sold/cost of sales, gross profit, operating expenses, operating income, non-operating items, earnings before taxes, and net income. This type of financial report states whether or not your business is profitable.

As its name suggests, a cash flow statement gives you an idea of how the money flows in your business. You'll gain insight into incoming funds, their sources, company expenses, and their destinations. It details various operating, investing, and financing activities to give you a more in-depth look at your cash flow.

Check your balance sheet if you want to check your business assets, liabilities, and owner’s/shareholder’s equity. The premise is that your business should have more assets than liabilities to ensure you can meet all your financial obligations and make your business thrive.

On the other hand, the owner’s/shareholder’s equity shows the amount you can give to yourself or the shareholders. The higher your company equity is, the more investors you can entice to invest in your business.

By following the previous tips, you will know precisely the capabilities of bookkeeping and accounting software and how to read financial reports better. You should now be confident you'll get accurate statements and understand any financial deck.

Make your daily operations and business management even easier by complementing your tools with help from experts! These days, many bookkeeping and accounting firms offer complete services to assist you in managing your business finances. Here are some of the benefits you’ll enjoy in partnering with them.

Experts from a firm can help you make sense of the numbers and the statements through statement notes. These notes provide extra information about your company's financial statements, including methods, assumptions, guidelines, and other details for accurate calculations and decision-making. Accounting professionals add them without clouding the primary message.

When partnered with a firm, you can get financial statements and reports regularly or as often as you need. This allows for consistent monitoring of your business’s financial health. You can use these reports to know if you are hitting your goals or need adjustments to your strategies for success.

When it comes to your business finances, accuracy is a priority. Only when the numbers are correct do you make the right decisions. It is a must for business owners like yourself to make accuracy checks a part of your daily routine. You can get a helping hand in fulfilling this task with an experienced account manager.

Investing in bookkeeping and accounting software is essential for generating financial statements and running an effective accounting system for your business. These tools offer convenience and help streamline collecting, monitoring, and computing financial data.

You can improve this further by partnering with experts from bookkeeping and accounting firms. They provide additional benefits such as accurate financial statements, regular reports, and statement notes to help you make informed decisions about your business’s finances.

Partner with us here at Unloop so we can assist you with your cloud-based accounting software and financial statement needs. We offer more assistance on top of that. Contact us If you’re interested in our bookkeeping services.

It takes someone with a keen eye and an open mind willing to consume a good amount of knowledge to expand a new business. So, if you’re reading an article like this, you’ve already got that part checked out, which means you’re up for something more challenging: learning how to do accounting for a small business.

A basic understanding of accounting can help small business owners:

Reading up on online business accounting is a great way to catch up on how new businesses do things in the modern world. Luckily, we’ve prepared a quick guide you can breeze through.

Are you a small business owner who struggles with accounting? Do you feel like you’re constantly playing catch-up with your finances? You’re not alone. Many small business owners have a great vision for their ventures, only to meet challenges in bookkeeping and accounting.

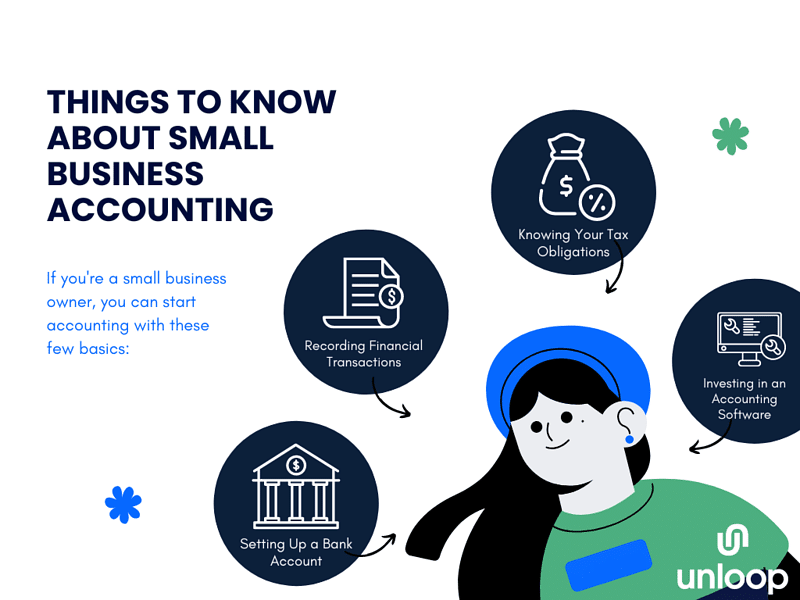

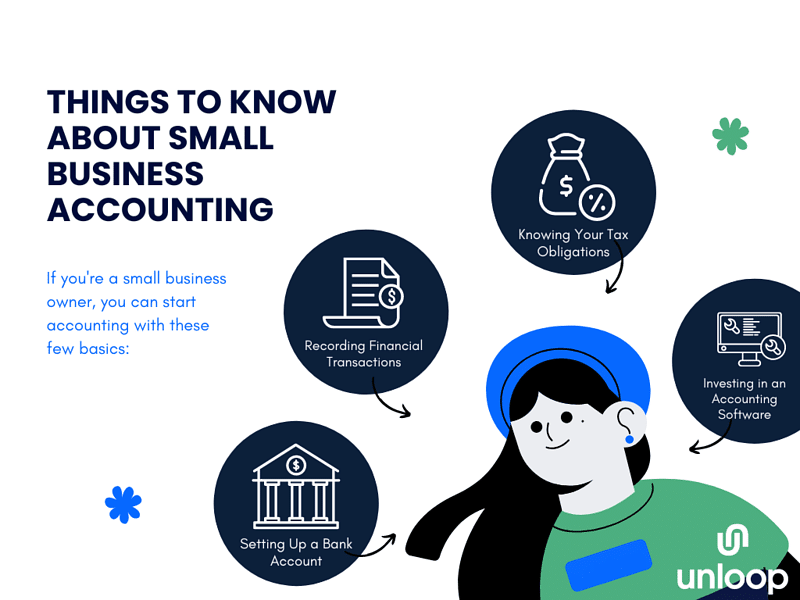

Check out these must-know small business accounting basics:

Every business needs its own business bank account. It helps establish your small business and separate your personal and business finances, making tracking business expenses and income much easier.

Before you get a separate bank account for your small business, research and compare different banks and their offerings, such as:

| 💡You will be transacting with the bank in the long run, so make sure you choose wisely. |

Besides having separate personal and business bank accounts, you should also get a business credit card.

Having a good credit score helps small businesses gain access to business assets and capital they wouldn’t have had otherwise. It allows them to make large purchases and take advantage of supplier discounts without paying upfront in cash.

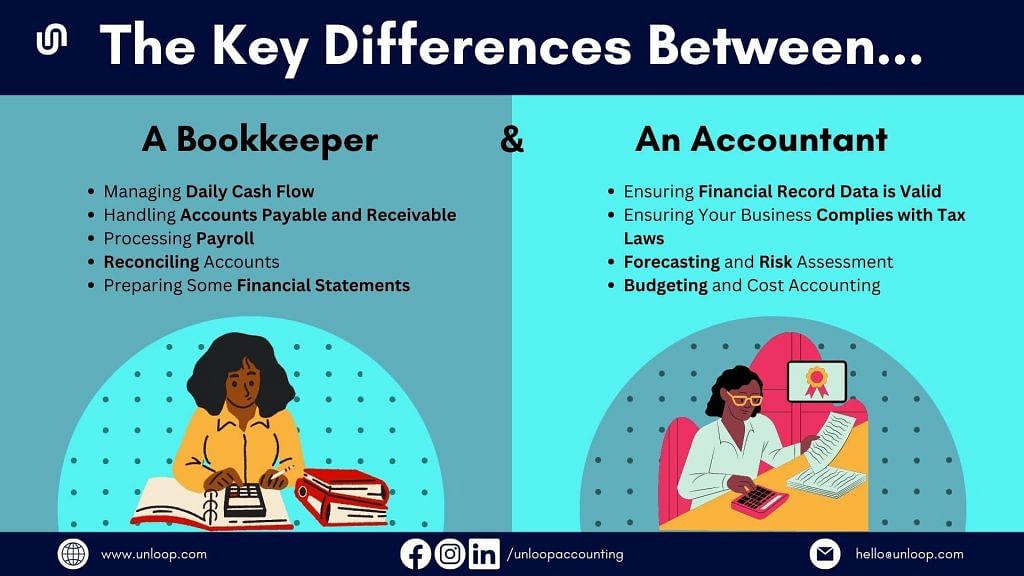

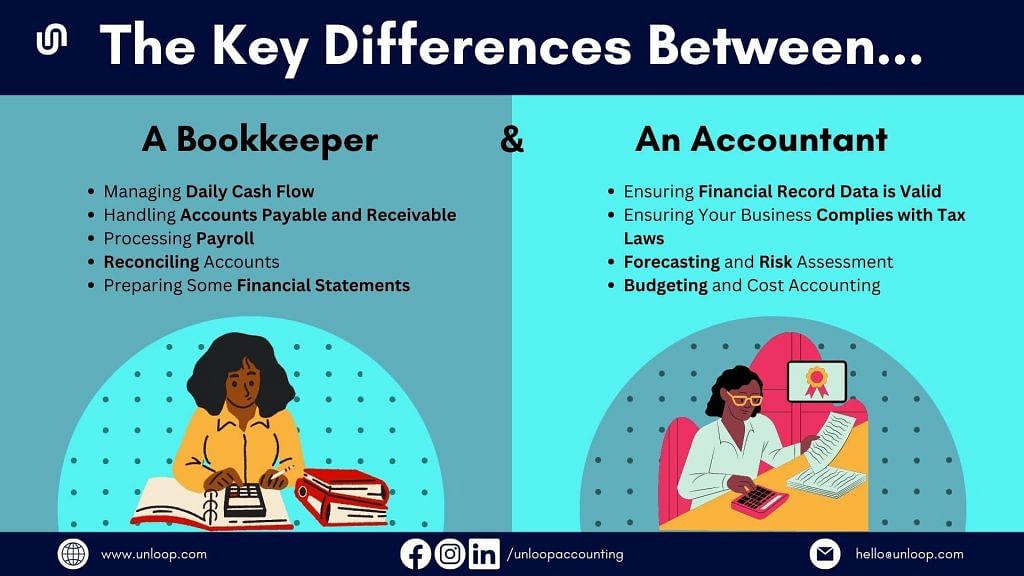

When you run a business, there must be accurate expense tracking. This is what “bookkeeping” is for. You’ve probably heard of that word and perhaps seen it being used interchangeably with “accounting,” but understand that these two services are entirely different.

Bookkeeping involves recording and tracking business transactions. This includes systematically recording financial transactions such as:

Basic bookkeeping aims to provide accurate and up-to-date financial reports of a business’s financial activities.

Accounting is analyzing and interpreting financial information generated from those financial reports to produce business financial statements. These would include income statements and balance sheets, which provide a snapshot of a business’s financial health at a given time.

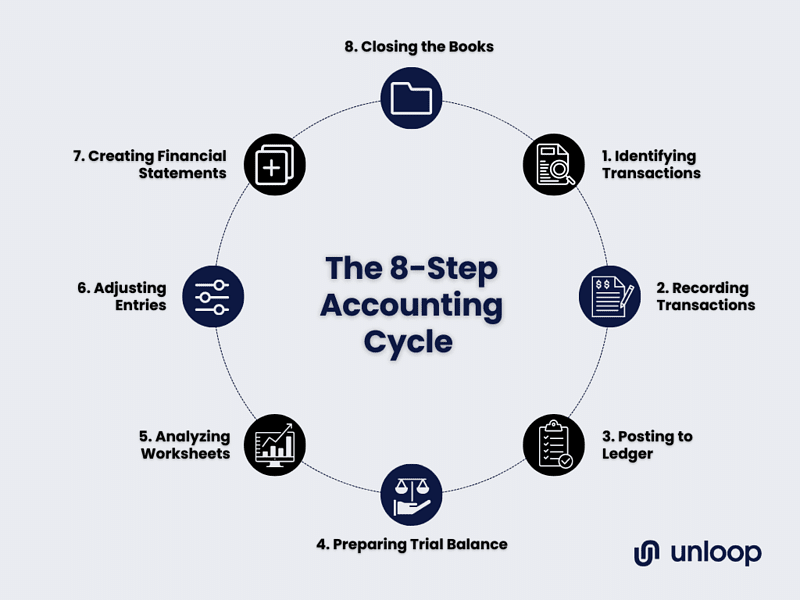

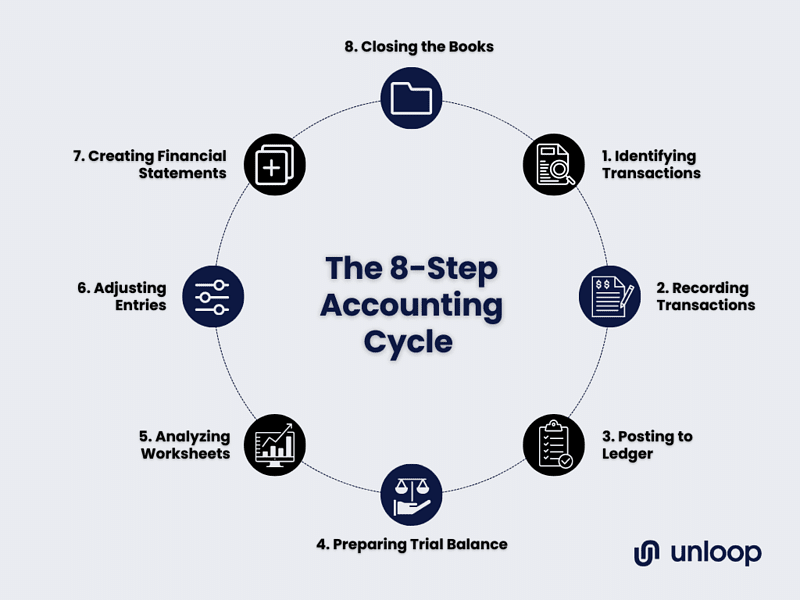

This question might have popped up as you read that previous paragraph. Yes, there is a process, and it’s referred to as “the accounting cycle.”

| 💡The accounting cycle is the series of steps a business follows to ensure its transactions are recorded, processed, and reported accurately. |

It follows eight significant accounting tasks:

There are also two methods to record financial transactions that business owners have to decide on:

Now that you’ve got a good grasp of what basic accounting for small businesses is, it’s essential to build on that knowledge. Tax and accounting are good examples, as they both deal with a business’s financial information.

An accounting system involves processing, verifying, and reporting a business’s financial transactions. In contrast, tax involves the payment of things like income taxes to the government based on the information reported by the business.

The data generated by the accounting process is used to calculate a business’s taxable income and tax liability. After which, the data is used to prepare tax returns.

| 💡Note that the legal structure of a business will determine its tax obligations. |

For example, small business owners registered as limited liability companies (LLCs) or partnerships may claim business income on their personal tax return.

Accounting and tax professionals may also provide business services in preparing tax returns. This may include advising on tax-efficient strategies to minimize a business’s tax liability, such as tax deductions and credits.

Nowadays, entrepreneurs have embraced using small business accounting software because of its convenience, efficiency, and affordability. Accounting software automates manual accounting tasks, such as:

Accounting software can cut long hours of complicated work for small businesses. Most accounting software programs also integrate with other business tools, such as payroll and invoicing software, which helps streamline financial management.

Want to know how to make your business finances easier to manage? Check out these tips:

Link your business bank account to your accounting software. Doing this makes bank payments convenient for your customers who opt for them. When your customers pay or you make any payments and withdrawals, the transaction is automatically recorded in bank statements and the books.

Fraud is also less likely to occur because your bookkeepers can easily raise the alarm when data don’t match.

When you have set up bank linking, invoicing, and receipt management for your business, making and collecting payments on time will be easier. You can give your customers discounts and incentives to encourage them to pay in advance or on the due date.

| 💡Through timely payment, the data you can generate from reports will be accurate, and cash flow management will be easier. |

Forecasting and planning your transactions is necessary instead of just recording them as they happen. As a small business owner, you need to keep your records even from previous years, as they will be useful in planning finances for the coming year.

Through historical financial data, you can project possible revenue and expenses. As a result, you can budget your money for the year and break it into quarterly, monthly, and even weekly allocations.

Here’s our last but not least tip. You can hire small business accounting services to simplify bookkeeping and accounting. Partner with trained bookkeepers and accountants to handle your business finances.

Hiring an in-house team works, too, but partnering with reliable agencies is the way to go if you want to save costs while receiving the same quality of work.

So there you have it—the small business accounting basics and how to make your finances easier to manage. We hope these tips have made you feel more confident handling your business finances.

If you ever need a hand with accounting, don’t hesitate to reach out! We at Unloop are passionate about helping growing businesses and making them succeed through our bookkeeping, income tax, and sales tax services.

Book a call with us now to get started on accounting for your business.

It takes someone with a keen eye and an open mind willing to consume a good amount of knowledge to expand a new business. So, if you’re reading an article like this, you’ve already got that part checked out, which means you’re up for something more challenging: learning how to do accounting for a small business.

A basic understanding of accounting can help small business owners:

Reading up on online business accounting is a great way to catch up on how new businesses do things in the modern world. Luckily, we’ve prepared a quick guide you can breeze through.

Are you a small business owner who struggles with accounting? Do you feel like you’re constantly playing catch-up with your finances? You’re not alone. Many small business owners have a great vision for their ventures, only to meet challenges in bookkeeping and accounting.

Check out these must-know small business accounting basics:

Every business needs its own business bank account. It helps establish your small business and separate your personal and business finances, making tracking business expenses and income much easier.

Before you get a separate bank account for your small business, research and compare different banks and their offerings, such as:

| 💡You will be transacting with the bank in the long run, so make sure you choose wisely. |

Besides having separate personal and business bank accounts, you should also get a business credit card.

Having a good credit score helps small businesses gain access to business assets and capital they wouldn’t have had otherwise. It allows them to make large purchases and take advantage of supplier discounts without paying upfront in cash.

When you run a business, there must be accurate expense tracking. This is what “bookkeeping” is for. You’ve probably heard of that word and perhaps seen it being used interchangeably with “accounting,” but understand that these two services are entirely different.

Bookkeeping involves recording and tracking business transactions. This includes systematically recording financial transactions such as:

Basic bookkeeping aims to provide accurate and up-to-date financial reports of a business’s financial activities.

Accounting is analyzing and interpreting financial information generated from those financial reports to produce business financial statements. These would include income statements and balance sheets, which provide a snapshot of a business’s financial health at a given time.

This question might have popped up as you read that previous paragraph. Yes, there is a process, and it’s referred to as “the accounting cycle.”

| 💡The accounting cycle is the series of steps a business follows to ensure its transactions are recorded, processed, and reported accurately. |

It follows eight significant accounting tasks:

There are also two methods to record financial transactions that business owners have to decide on:

Now that you’ve got a good grasp of what basic accounting for small businesses is, it’s essential to build on that knowledge. Tax and accounting are good examples, as they both deal with a business’s financial information.

An accounting system involves processing, verifying, and reporting a business’s financial transactions. In contrast, tax involves the payment of things like income taxes to the government based on the information reported by the business.

The data generated by the accounting process is used to calculate a business’s taxable income and tax liability. After which, the data is used to prepare tax returns.

| 💡Note that the legal structure of a business will determine its tax obligations. |

For example, small business owners registered as limited liability companies (LLCs) or partnerships may claim business income on their personal tax return.

Accounting and tax professionals may also provide business services in preparing tax returns. This may include advising on tax-efficient strategies to minimize a business’s tax liability, such as tax deductions and credits.

Nowadays, entrepreneurs have embraced using small business accounting software because of its convenience, efficiency, and affordability. Accounting software automates manual accounting tasks, such as:

Accounting software can cut long hours of complicated work for small businesses. Most accounting software programs also integrate with other business tools, such as payroll and invoicing software, which helps streamline financial management.

Want to know how to make your business finances easier to manage? Check out these tips:

Link your business bank account to your accounting software. Doing this makes bank payments convenient for your customers who opt for them. When your customers pay or you make any payments and withdrawals, the transaction is automatically recorded in bank statements and the books.

Fraud is also less likely to occur because your bookkeepers can easily raise the alarm when data don’t match.

When you have set up bank linking, invoicing, and receipt management for your business, making and collecting payments on time will be easier. You can give your customers discounts and incentives to encourage them to pay in advance or on the due date.

| 💡Through timely payment, the data you can generate from reports will be accurate, and cash flow management will be easier. |

Forecasting and planning your transactions is necessary instead of just recording them as they happen. As a small business owner, you need to keep your records even from previous years, as they will be useful in planning finances for the coming year.

Through historical financial data, you can project possible revenue and expenses. As a result, you can budget your money for the year and break it into quarterly, monthly, and even weekly allocations.

Here’s our last but not least tip. You can hire small business accounting services to simplify bookkeeping and accounting. Partner with trained bookkeepers and accountants to handle your business finances.

Hiring an in-house team works, too, but partnering with reliable agencies is the way to go if you want to save costs while receiving the same quality of work.

So there you have it—the small business accounting basics and how to make your finances easier to manage. We hope these tips have made you feel more confident handling your business finances.

If you ever need a hand with accounting, don’t hesitate to reach out! We at Unloop are passionate about helping growing businesses and making them succeed through our bookkeeping, income tax, and sales tax services.

Book a call with us now to get started on accounting for your business.

You're in that stage of your business journey where you need to simplify your accounting. So, you are looking for suitable online accounting software. These are the ones that will ease your business bookkeeping, accounting, and inventory management woes. After hours of looking, you're left with two options: FreshBooks vs. QuickBooks.

While both look promising, the question is, what's the right choice for your business? Let Unloop answer that by examining these two popular accounting solutions further.

FreshBooks and QuickBooks are two excellent accounting solution rivals but have unique differences. Before you decide which one of these accounting software platforms you like better, let's set the criteria from which we'll compare the two.

First on the list determines how cost-effective accounting software is. Of course, this is relative to the value they offer. But let's be square and look at this strictly from a price point perspective. That means the lower the price, the better.

Here's where it gets interesting. We'll look at the structure of each software's offerings and how much their basic accounting features bring convenience and add value to your business.

Here are some essential accounting features your software should have:

Another factor to consider before deciding what accounting software you'll get is its ability to handle volumes of transactions. As a small business owner selling on various ecommerce platforms, you'll need to think long-term and pick a tool to keep up with your growing business. The bigger it gets, the more complex transactions to manage.

You'll need inventory tracking if you own an ecommerce business enrolled in programs like Fulfillment by Amazon. Excellent software can make accurate adjustments when there's inventory movement because it ties closely to your costs and revenue.

On the other hand, inaccurate inventory management on the accounting end is a disaster that requires long hours of number crunching.

As your ecommerce business grows, you'll need more accounting-savvy people to delegate the grunt work of poring over numbers. You'll want software with multiple user capabilities to share access to trusted staff if the work becomes too time-consuming or you'd rather do something else.

Now that we've set the deciding factors for the two accounting software, let's put them to the test. Which one would be a better choice for your business? Let's start.

FreshBooks accounting software has a strong value proposition that targets small business owners and self-employed people. The brand offers quality support at any stage of your business journey and caters to several types of businesses.

So whether you're a freelancer, a professional, a traditional business, or a contractor servicing other businesses, FreshBooks will meet your needs.

Their pricing structure is based on a subscription system, with their cheapest package priced at $8.50 up to $27.50 per month. If you pay the one-off price, you'll pay $132.60 for the lowest-priced package and $429 for the highest. They announce promotions on their plans sparingly.

| Lite | Plus | Premium |

|---|---|---|

| $8.50 | $15 | $27.50 |

Browsing the offerings of FreshBooks will lead you to three different plans: Lite, Plus, and Premium. In a nutshell, here are some of the features they offer:

Once you explore FreshBooks, you can use the 30-day free trial to get a feel of how their software works. Its interface is straightforward enough for non-professionals to adapt to quickly.

QuickBooks is the child of Intuit—a software company behind many other businesses and financial solutions. This company has been around for some time and has built many products that cater to a specific consumer segment.

For example, they have software for accountants, small businesses, and individuals. However, their dominant software brand is QuickBooks.

Subscriptions also define QuickBooks' pricing structure. The cheapest plan they offer costs $15 per month, while the highest price reaches up to $100 per month. Occasionally, discounts and promotions are also offered.

| Simple Start | Essentials | Plus | Advanced |

| $15 | $30 | $45 | $100 |

Potential QuickBooks users who are business owners can choose between four plans: Simple Start, Essentials, Plus, and Advanced. Their offerings vary in scope depending on what plan you select, but to lay out some of their offerings, this is what you'll get:

QuickBooks shines in the number of plans and add-on features you can subscribe to. It offers a powerful accounting system for small businesses and even large enterprises. For example, their QuickBooks Point-of-Sale (POS) is an add-on that lets you track sales when they were made.

FreshBooks and QuickBooks both make excellent options in terms of functionality. They can connect to your business checking or savings account. Both can generate financial reports, issue invoices, track expenses, and enable bookkeepers to make journal entries.

However, depending on certain features, one tool may excel over the other. For an ecommerce business, evaluating these is crucial. What unique benefits does QuickBooks have over FreshBooks and vice versa?

| Criteria | QuickBooks | FreshBooks |

| Basic Accounting | ❌ | ✅ |

| Price | ❌ | ✅ |

| Offerings | ✅ | ❌ |

| Inventory Tracking | ✅ | ❌ |

| Scalability | ✅ | ❌ |

| Number of Users | ✅ | ❌ |

If you need only basic accounting features, FreshBooks might suit you more. This accounting software typically caters its services to freelancers and individual contractors. We recommend exploring other options like QuickBooks if you're seeking more advanced tools.

At face value, there's no doubt FreshBooks wins this criterion. Your $132.60 can get you a year's worth of FreshBooks’ Lite plan compared to QuickBooks pricing of the Advanced plan at $100 per month.

To put the subscription price in a better perspective, let's compare two of the cheapest plans from both software: FreshBooks’ Lite plan and QuickBooks’ Simple Start plan.

| QuickBooks Simple Start | Freshbooks Lite |

| $15/month | $8.50/month |

If you're pinching dollars and starting a business on a budget, Freshbooks is the better choice.

When it comes to FreshBooks and QuickBooks integration, QuickBooks is undoubtedly unbeatable. As long as you have mastered using it, you'll get a detailed cash flow, and tax preparation will become easier.

Both FreshBooks and QuickBooks offer cloud accounting with FreshBooks Cloud Accounting and QuickBooks Online.

Granted, FreshBooks can compete with similar standard offerings such as income and expense tracking, bookkeeping, and integrations, to name a few. It's also noteworthy that FreshBooks does a great job with unlimited billable clients.

However, small business owners can only enjoy this functionality when they upgrade to the Premium plan. QuickBooks also wins on the add-on features, which brings us to the next point.

QuickBooks for small businesses comprises an inventory tracking feature that exceeds expectations. While FreshBooks handles the basics, QuickBooks raises the bar with additional, more advanced features, such as low-inventory alerts and reorder functionalities. With these, you are empowered to manage your inventory on the spot.

However, in terms of inventory management, QuickBooks has the upper hand.

Small business software add-ons are available once you're subscribed to QuickBooks. As your business grows, the number of employees and the volume of your inventory follows. QuickBooks lets you upgrade your plan with additional features to adapt to this growth.

Features such as QuickBooks POS lets you track and manage large sales volumes. QuickBooks Payroll helps you accurately pay your employees' salaries. FreshBooks is yet to keep up with these sophisticated add-ons.

Another concern about scalability is the number of users allowed to access the software. Both FreshBooks and QuickBooks provide the option to add users to their self-employed and small business plans. However, FreshBooks has a base user limit of just one, and you'll have to add $10 for each additional user.

QuickBooks' plans vary in the number of permitted users, ranging from one (for their Simple Start plan) to 25 users (for their Advanced plan). You can even add accounting firms to the number of users; they all have separate slots.

QuickBooks excels over FreshBooks thanks to its superior inventory tracking, a broader range of offerings, scalability, and support for many users. This makes it a perfect choice for ecommerce business owners with complex inventory and various financial management needs.

Accounting software will significantly benefit you and your business, but only if you know how to operate it effectively. Subscribing to QuickBooks is just an initial step; you still have to invest time in learning how to use it. As a small business owner, this takes time and effort.

Let Unloop bridge that gap with our bookkeeping services. We are adept at utilizing QuickBooks, so we are confident about working efficiently with entrepreneurs like yourself to free up your time. Ready to level up your ecommerce accounting venture?

Book a call with us today to get started!

You're in that stage of your business journey where you need to simplify your accounting. So, you are looking for suitable online accounting software. These are the ones that will ease your business bookkeeping, accounting, and inventory management woes. After hours of looking, you're left with two options: FreshBooks vs. QuickBooks.

While both look promising, the question is, what's the right choice for your business? Let Unloop answer that by examining these two popular accounting solutions further.

FreshBooks and QuickBooks are two excellent accounting solution rivals but have unique differences. Before you decide which one of these accounting software platforms you like better, let's set the criteria from which we'll compare the two.

First on the list determines how cost-effective accounting software is. Of course, this is relative to the value they offer. But let's be square and look at this strictly from a price point perspective. That means the lower the price, the better.

Here's where it gets interesting. We'll look at the structure of each software's offerings and how much their basic accounting features bring convenience and add value to your business.

Here are some essential accounting features your software should have:

Another factor to consider before deciding what accounting software you'll get is its ability to handle volumes of transactions. As a small business owner selling on various ecommerce platforms, you'll need to think long-term and pick a tool to keep up with your growing business. The bigger it gets, the more complex transactions to manage.

You'll need inventory tracking if you own an ecommerce business enrolled in programs like Fulfillment by Amazon. Excellent software can make accurate adjustments when there's inventory movement because it ties closely to your costs and revenue.

On the other hand, inaccurate inventory management on the accounting end is a disaster that requires long hours of number crunching.

As your ecommerce business grows, you'll need more accounting-savvy people to delegate the grunt work of poring over numbers. You'll want software with multiple user capabilities to share access to trusted staff if the work becomes too time-consuming or you'd rather do something else.

Now that we've set the deciding factors for the two accounting software, let's put them to the test. Which one would be a better choice for your business? Let's start.

FreshBooks accounting software has a strong value proposition that targets small business owners and self-employed people. The brand offers quality support at any stage of your business journey and caters to several types of businesses.

So whether you're a freelancer, a professional, a traditional business, or a contractor servicing other businesses, FreshBooks will meet your needs.

Their pricing structure is based on a subscription system, with their cheapest package priced at $8.50 up to $27.50 per month. If you pay the one-off price, you'll pay $132.60 for the lowest-priced package and $429 for the highest. They announce promotions on their plans sparingly.

| Lite | Plus | Premium |

|---|---|---|

| $8.50 | $15 | $27.50 |

Browsing the offerings of FreshBooks will lead you to three different plans: Lite, Plus, and Premium. In a nutshell, here are some of the features they offer:

Once you explore FreshBooks, you can use the 30-day free trial to get a feel of how their software works. Its interface is straightforward enough for non-professionals to adapt to quickly.

QuickBooks is the child of Intuit—a software company behind many other businesses and financial solutions. This company has been around for some time and has built many products that cater to a specific consumer segment.

For example, they have software for accountants, small businesses, and individuals. However, their dominant software brand is QuickBooks.

Subscriptions also define QuickBooks' pricing structure. The cheapest plan they offer costs $15 per month, while the highest price reaches up to $100 per month. Occasionally, discounts and promotions are also offered.

| Simple Start | Essentials | Plus | Advanced |

| $15 | $30 | $45 | $100 |

Potential QuickBooks users who are business owners can choose between four plans: Simple Start, Essentials, Plus, and Advanced. Their offerings vary in scope depending on what plan you select, but to lay out some of their offerings, this is what you'll get:

QuickBooks shines in the number of plans and add-on features you can subscribe to. It offers a powerful accounting system for small businesses and even large enterprises. For example, their QuickBooks Point-of-Sale (POS) is an add-on that lets you track sales when they were made.

FreshBooks and QuickBooks both make excellent options in terms of functionality. They can connect to your business checking or savings account. Both can generate financial reports, issue invoices, track expenses, and enable bookkeepers to make journal entries.

However, depending on certain features, one tool may excel over the other. For an ecommerce business, evaluating these is crucial. What unique benefits does QuickBooks have over FreshBooks and vice versa?

| Criteria | QuickBooks | FreshBooks |

| Basic Accounting | ❌ | ✅ |

| Price | ❌ | ✅ |

| Offerings | ✅ | ❌ |

| Inventory Tracking | ✅ | ❌ |

| Scalability | ✅ | ❌ |

| Number of Users | ✅ | ❌ |

If you need only basic accounting features, FreshBooks might suit you more. This accounting software typically caters its services to freelancers and individual contractors. We recommend exploring other options like QuickBooks if you're seeking more advanced tools.

At face value, there's no doubt FreshBooks wins this criterion. Your $132.60 can get you a year's worth of FreshBooks’ Lite plan compared to QuickBooks pricing of the Advanced plan at $100 per month.

To put the subscription price in a better perspective, let's compare two of the cheapest plans from both software: FreshBooks’ Lite plan and QuickBooks’ Simple Start plan.

| QuickBooks Simple Start | Freshbooks Lite |

| $15/month | $8.50/month |

If you're pinching dollars and starting a business on a budget, Freshbooks is the better choice.

When it comes to FreshBooks and QuickBooks integration, QuickBooks is undoubtedly unbeatable. As long as you have mastered using it, you'll get a detailed cash flow, and tax preparation will become easier.

Both FreshBooks and QuickBooks offer cloud accounting with FreshBooks Cloud Accounting and QuickBooks Online.

Granted, FreshBooks can compete with similar standard offerings such as income and expense tracking, bookkeeping, and integrations, to name a few. It's also noteworthy that FreshBooks does a great job with unlimited billable clients.

However, small business owners can only enjoy this functionality when they upgrade to the Premium plan. QuickBooks also wins on the add-on features, which brings us to the next point.

QuickBooks for small businesses comprises an inventory tracking feature that exceeds expectations. While FreshBooks handles the basics, QuickBooks raises the bar with additional, more advanced features, such as low-inventory alerts and reorder functionalities. With these, you are empowered to manage your inventory on the spot.

However, in terms of inventory management, QuickBooks has the upper hand.

Small business software add-ons are available once you're subscribed to QuickBooks. As your business grows, the number of employees and the volume of your inventory follows. QuickBooks lets you upgrade your plan with additional features to adapt to this growth.

Features such as QuickBooks POS lets you track and manage large sales volumes. QuickBooks Payroll helps you accurately pay your employees' salaries. FreshBooks is yet to keep up with these sophisticated add-ons.

Another concern about scalability is the number of users allowed to access the software. Both FreshBooks and QuickBooks provide the option to add users to their self-employed and small business plans. However, FreshBooks has a base user limit of just one, and you'll have to add $10 for each additional user.

QuickBooks' plans vary in the number of permitted users, ranging from one (for their Simple Start plan) to 25 users (for their Advanced plan). You can even add accounting firms to the number of users; they all have separate slots.

QuickBooks excels over FreshBooks thanks to its superior inventory tracking, a broader range of offerings, scalability, and support for many users. This makes it a perfect choice for ecommerce business owners with complex inventory and various financial management needs.

Accounting software will significantly benefit you and your business, but only if you know how to operate it effectively. Subscribing to QuickBooks is just an initial step; you still have to invest time in learning how to use it. As a small business owner, this takes time and effort.

Let Unloop bridge that gap with our bookkeeping services. We are adept at utilizing QuickBooks, so we are confident about working efficiently with entrepreneurs like yourself to free up your time. Ready to level up your ecommerce accounting venture?

Book a call with us today to get started!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

You don’t aim to earn a profit in a nonprofit organization. You work with a motive to serve the general public—whether it be for educational, religious, or charitable purposes. But this doesn’t exempt you from the financial challenges that require effective management. Adopting the best accounting software for nonprofits becomes crucial to overcome these burdens.

While your organization may not be driven by profit, you still deal with monetary transactions such as donations, memberships, and grants. You must organize and comply with financial management regulations, albeit differently.

This article will guide you in understanding the importance of leveraging the right nonprofit accounting software and maximizing its benefits. But before that, let’s talk about the distinctive nature of nonprofit organizations in accounting.

Accounting for nonprofit organizations is an interesting study. It doesn’t work the same as regular accounting because its motive is to serve the community rather than earn a profit. Government authorities understand this and have made concessions in tax regulations, accounting methods, and financial reporting requirements.

Here is a basic guide on how nonprofit accounting works.

Nonprofits usually choose between cash and accrual accounting.

| Example: A financial contract was set up in January, but the payment was made or received in March. For cash-based accounting: You’ll record the expense in March. For accrual accounting: You’ll record the expense in January. |

Unlike companies and online businesses, nonprofit organizations exist to serve the public interest and fulfill a specific mission. This fundamental difference in purpose translates into various accounting practices.

In generating reports, nonprofits prioritize accountability and transparency, emphasizing proper stewardship of resources received through donations, grants, and other funding sources. They also practice specialized techniques such as fund accounting and donor management to track funds and donor-imposed restrictions.

The key financial statements commonly issued by nonprofit organizations are as follows:

| Financial Statements | |

| Statement of Financial Position | Also known as the balance sheet, it outlines the organization's liabilities, assets, and debts. |

| Statement of Activities | Shows the different income sources and expenses incurred by the organization over a specified period. |

| Cash Flow Statement | Illustrates cash movement in and out of the organization, providing insights into its liquidity. |

| Statement of Functional Expense | Lists of funds you spend on different functions within the organization, such as administrative or fundraising. |

Nonprofits apply for a tax-exempt status using Form 1023. The authority (IRS or CRA) then decides whether your organization qualifies as charitable. Once you are officially tax-exempt, you don't have to pay federal income taxes and even property and sales taxes.

However, you’re still required to pay for an annual tax return. You will still report your revenue and expenses to the tax authority.

🔔 REMINDER 🔔

| You must file and submit Form 990 on the designated payment schedule to pay for the annual tax return. |

As briefly mentioned, nonprofit accounting works differently from businesses. The accounting method, tax compliance, procedures, and types of financial documents are not similar to what authorities would require for a for-profit.

But if we talk about why you need to use software, it all goes down to the same reasons.

Choosing the best accounting software programs for nonprofit institutions lies in aligning their functions with your unique needs. Of course, everyone has different preferences, but we are here to help you find the perfect match that ticks all the boxes for your accounting tasks.

In selecting nonprofit financial software, opt for solutions that seamlessly integrate with your workflows and cater to your nonprofit's size, budget, and needs. Some of the best nonprofit fund accounting software include:

| Top Providers | Description |

| Xero | Xero, a popular cloud-based software, shines in expense tracking and management, helping you stay on top of your organization's financial health. The cash summary report provides a comprehensive cash position overview, enabling analysis of income, expenses, and available funds. |

| Aplos | As a full-featured CRM, Aplos enables you to manage your members and donors effectively. The True Fund accounting feature helps you comply with donation restrictions, promoting transparency and accountability. |

Sage Intacct | Sage Intacct has comprehensive trackingand billing capabilities for accurate management and grand funds reports. This software includes nonprofit specific features like multi-user and currency.Collaborate with your team across different locations.Effortlessly handle transactions in multiple currencies. |

QuickBooks Online | QuickBooks Online comes with easy expense sorting, allowing nonprofits to categorize revenue expenditures by fund or program. Create custom reports based on the data that matters most to the organization.Get valuable insights into your financial performance. Streamline donation processes by syncing bank accounts for instant expense tracking and cash flow updates. |

Zoho Books | Zoho Books supports collaboration by allowing users to add remote employees and volunteers as individual users, providing role-based access and facilitating seamless teamwork. Accounting features like customizable payment pages and multi-currency support enable acceptance of global donations, breaking geographical barriers. |

Netsuite ERP | NetSuite's fund accounting framework revolutionizes the stewardship of funds for nonprofits through diverse revenue streams and accurate expense tracking. Offers real-time access to over 250 standard and customized reports.Gain insights into fund balances, grant activity, inventory management, and financial performance. |

FreshBooks | FreshBooks offers a complete software package that allows users to run reports, track expenses, and log time for employees, all within one platform. Creating sleek invoices and estimates takes seconds.Convenient online payment options allow supporters to contribute and ensure faster donation processing.Automated late payment reminds you that payments are received promptly, minimizing funding delays. |

Nonprofit accounting can be tricky. You have to keep track of different sources of income while staying compliant with the regulations. Fortunately, accounting software for nonprofits is a good way to manage these tasks with minimal error (and stress).