Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Have you recently migrated your physical store to digital platforms? And are you already familiar with online business accounting? If not, then it’s understandable, as most of us prioritize business operations over financial aspects like this.

Nevertheless, cash flow is what keeps your business afloat. This is one of the key indicators that your online business is profiting or losing money. Without solid tracking, you won’t have a clear view of your financial health.

If you’re still unfamiliar with online business accounting, the different software you can use, and their corresponding benefits to your venture, this article will be your handy guide. Read on to learn more about the process and why you must invest in your accounting.

Online business accounting encompasses two interconnected processes. One pertains to accounting for online businesses. It can also mean using internet technology to carry out the accounting process. These may have different meanings, but you can experience both through online business accounting software programs.

In the past, we followed traditional accounting practices wherein you had to hire a bookkeeper or accountant and meet with them. But now, things are more seamless and precise. You don’t have to schedule meetings and personally give them your business’s financial data.

Online business accounting (or e-accounting) means that all your accounting operations are done and saved online through the cloud, making it more accessible for you, your team, and your accountants. It performs all traditional accounting functions but with added convenience and accuracy.

Small business owners can benefit the most from online business accounting. It eliminates the need for dedicated in-house accountants, reducing overhead expenses. Most accounting software providers also offer user-friendly and accessible tools, allowing you to manage finances and track income efficiently.

But these advantages are just the beginning. Explore some additional ways it can be of help.

Doing all your processes online is logical, especially if you sell on Amazon, Shopify, or other ecommerce platforms. From there, you can easily consolidate your information, simplifying your record-keeping and financial reporting.

Doing a quick run-through of your overall performance is also a part of your business. Having accurate data will back you up in presenting your progress and profitability to potential investors. It can boost credibility, attract funding opportunities, and seize growth prospects.

Printing data and writing on a ledger can be an exhausting task. Not to mention that finishing your books is time-sensitive. These data have to be accurately consolidated for them to be properly analyzed.

Gone are the days through dozens of purchase receipts or checking how many sales went in each of your revenue streams for that month. With online business accounting, data entry is a breeze. Its automation skills can effortlessly log everything into the system, including:

| ✅ Income and Expense Tracking ✅ Invoicing and Payment Processing ✅ Sales Tax Calculation ✅ Inventory Management ✅ Payments Payable |

Automating tasks makes things more efficient and error-free. It lets you breathe easily, knowing your financial records are reliable and authentic.

Going digital means you can save a ton of paperwork. All financial data and records are securely stored in the cloud—no need for mountains of physical documents, receipts, or ledgers.

The shift to a paperless system also aligns with sustainable activities, reflecting an eco-friendly approach. Minimizing paper usage reduces the environmental impact and sends a clear message about your brand’s commitment to responsible business practices. This resonates strongly with today’s eco-conscious consumers.

This is how business grows: not only are your sales skyrocketing, your inventory is too! Scaling entails catering to more SKUs or increased stock orders, so you’ll have to deal with a lot of cash coming in and out. You will also make additional payments here and there.

It’s different from online business accounting. Even with high orders, tracking finances becomes manageable through automated and synced processes.

You may not be at your desired business size currently. Still, it’s one less problem to worry about in the future, all because you switched to online accounting.

How many times do you check your sales and expenses tally once a month? Most companies that still use traditional accounting may only be provided with this data at the end of the month.

With e-accounting, you can bid farewell to such frustrations. Real-time, updated, and accurate financial information is ready at your fingertips. You can make well-informed decisions based on actual numbers, eliminating the need for rash choices unsupported by data.

You can also adjust your performance anytime, as it offers an updated overview of your business’s finances.

With the rise of small businesses come numerous online accounting services, each claiming to be the best solution for your financial needs and long-term goals. How do you know if an accounting service can cater to your needs? Below are key points to consider.

You should have your monthly revenue data before signing up with an online accounting service. These services base their pricing on how much your business earns.

It’s reasonable for online accounting services to price services based on earnings because their workload will depend on your revenue. It is expected that the more money your business makes, the more work needs to be done.

An online accounting service may also charge you depending on the number of accounts and transactions you will let them handle. Some charge per account enrolled in the service, while others offer unlimited transactions, with the pricing depending mostly on your monthly revenue.

Some small businesses think hiring an accounting service that charges per account or transaction is best. This is a good way to start, but it might not be sustainable and scalable.

It’s still a lot cheaper for you to invest in a service that offers unlimited transactions. It can accommodate your business’s expansion without any unexpected financial burdens.

Online accounting software is one way to facilitate bookkeeping and accounting activities. Different small business accounting software are available, each with pros and cons.

| Best Accounting Software for Small Businesses | |

| QuickBooks Online | The gold standard for cloud-based accounting. It offers accounting features like invoicing, expense tracking, inventory management, financial reporting, and bank reconciliation. |

| Xero | A double-entry accounting software. This approach guarantees that every transaction is accounted for twice. It can maintain a perfect balance between debits and credits. |

| FreshBooks | Ideal for service-based businesses. FreshBooks excels in time tracking and project management. It simplifies billing and client collaboration, making it suitable for freelancers and small service providers. |

| Zoho Books | A free accounting software. Despite being free, it still offers core accounting functionalities, making it an ideal starting point for businesses on a tight budget. |

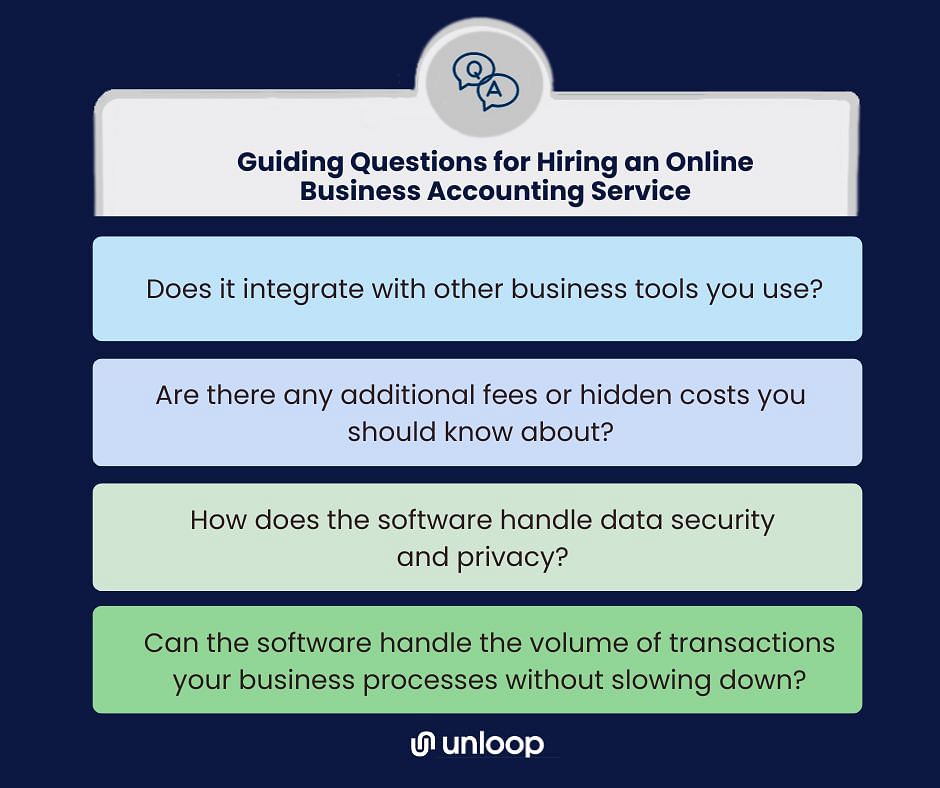

Before hiring an online accounting service, create strong guiding questions about their tools and software. Here are some to consider.

You can confidently assess the capabilities and compatibility of various online accounting services by seeking answers to these guiding questions. Rest assured that your financial management processes will be in capable hands, allowing you to focus on growing and succeeding in your business endeavors.

Accounting can be a complex process, especially if you lack a background. The technicalities involved in software and process flow might seem overwhelming to learn.

It’s crucial to recognize that not all accounting services offer guidance, from onboarding your files to receiving your financial statements. Therefore, selecting an accounting team with whom you can communicate openly is essential.

Having a line of communication with their team will help you better understand the financial management process. Their support and guidance can make your business journey smoother, even if you are not well-versed in accounting practices.

The short answer is yes and no. Most online accounting and bookkeeping services do not file taxes since you must work with a CPA firm for that. But at the end of the day, they can expedite your business processes. They can produce the most accurate financial statements with the help of the different accounting software mentioned above.

Unloop is one such online accounting team that recognizes the challenges online sellers face in finding affordable accountants. Our services go beyond providing financial statements; we collaborate with CPA firms at discounted partner rates, saving you the hassle of searching for one on your own.

We offer unlimited transactions and access to Quickbooks Online and A2X. This way, you can base any decisions you make now and in the future on actual data derived from your business.

Get all of these and more when you sign on with us. Book a call today!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Have you recently migrated your physical store to digital platforms? And are you already familiar with online business accounting? If not, then it’s understandable, as most of us prioritize business operations over financial aspects like this.

Nevertheless, cash flow is what keeps your business afloat. This is one of the key indicators that your online business is profiting or losing money. Without solid tracking, you won’t have a clear view of your financial health.

If you’re still unfamiliar with online business accounting, the different software you can use, and their corresponding benefits to your venture, this article will be your handy guide. Read on to learn more about the process and why you must invest in your accounting.

Online business accounting encompasses two interconnected processes. One pertains to accounting for online businesses. It can also mean using internet technology to carry out the accounting process. These may have different meanings, but you can experience both through online business accounting software programs.

In the past, we followed traditional accounting practices wherein you had to hire a bookkeeper or accountant and meet with them. But now, things are more seamless and precise. You don’t have to schedule meetings and personally give them your business’s financial data.

Online business accounting (or e-accounting) means that all your accounting operations are done and saved online through the cloud, making it more accessible for you, your team, and your accountants. It performs all traditional accounting functions but with added convenience and accuracy.

Small business owners can benefit the most from online business accounting. It eliminates the need for dedicated in-house accountants, reducing overhead expenses. Most accounting software providers also offer user-friendly and accessible tools, allowing you to manage finances and track income efficiently.

But these advantages are just the beginning. Explore some additional ways it can be of help.

Doing all your processes online is logical, especially if you sell on Amazon, Shopify, or other ecommerce platforms. From there, you can easily consolidate your information, simplifying your record-keeping and financial reporting.

Doing a quick run-through of your overall performance is also a part of your business. Having accurate data will back you up in presenting your progress and profitability to potential investors. It can boost credibility, attract funding opportunities, and seize growth prospects.

Printing data and writing on a ledger can be an exhausting task. Not to mention that finishing your books is time-sensitive. These data have to be accurately consolidated for them to be properly analyzed.

Gone are the days through dozens of purchase receipts or checking how many sales went in each of your revenue streams for that month. With online business accounting, data entry is a breeze. Its automation skills can effortlessly log everything into the system, including:

| ✅ Income and Expense Tracking ✅ Invoicing and Payment Processing ✅ Sales Tax Calculation ✅ Inventory Management ✅ Payments Payable |

Automating tasks makes things more efficient and error-free. It lets you breathe easily, knowing your financial records are reliable and authentic.

Going digital means you can save a ton of paperwork. All financial data and records are securely stored in the cloud—no need for mountains of physical documents, receipts, or ledgers.

The shift to a paperless system also aligns with sustainable activities, reflecting an eco-friendly approach. Minimizing paper usage reduces the environmental impact and sends a clear message about your brand’s commitment to responsible business practices. This resonates strongly with today’s eco-conscious consumers.

This is how business grows: not only are your sales skyrocketing, your inventory is too! Scaling entails catering to more SKUs or increased stock orders, so you’ll have to deal with a lot of cash coming in and out. You will also make additional payments here and there.

It’s different from online business accounting. Even with high orders, tracking finances becomes manageable through automated and synced processes.

You may not be at your desired business size currently. Still, it’s one less problem to worry about in the future, all because you switched to online accounting.

How many times do you check your sales and expenses tally once a month? Most companies that still use traditional accounting may only be provided with this data at the end of the month.

With e-accounting, you can bid farewell to such frustrations. Real-time, updated, and accurate financial information is ready at your fingertips. You can make well-informed decisions based on actual numbers, eliminating the need for rash choices unsupported by data.

You can also adjust your performance anytime, as it offers an updated overview of your business’s finances.

With the rise of small businesses come numerous online accounting services, each claiming to be the best solution for your financial needs and long-term goals. How do you know if an accounting service can cater to your needs? Below are key points to consider.

You should have your monthly revenue data before signing up with an online accounting service. These services base their pricing on how much your business earns.

It’s reasonable for online accounting services to price services based on earnings because their workload will depend on your revenue. It is expected that the more money your business makes, the more work needs to be done.

An online accounting service may also charge you depending on the number of accounts and transactions you will let them handle. Some charge per account enrolled in the service, while others offer unlimited transactions, with the pricing depending mostly on your monthly revenue.

Some small businesses think hiring an accounting service that charges per account or transaction is best. This is a good way to start, but it might not be sustainable and scalable.

It’s still a lot cheaper for you to invest in a service that offers unlimited transactions. It can accommodate your business’s expansion without any unexpected financial burdens.

Online accounting software is one way to facilitate bookkeeping and accounting activities. Different small business accounting software are available, each with pros and cons.

| Best Accounting Software for Small Businesses | |

| QuickBooks Online | The gold standard for cloud-based accounting. It offers accounting features like invoicing, expense tracking, inventory management, financial reporting, and bank reconciliation. |

| Xero | A double-entry accounting software. This approach guarantees that every transaction is accounted for twice. It can maintain a perfect balance between debits and credits. |

| FreshBooks | Ideal for service-based businesses. FreshBooks excels in time tracking and project management. It simplifies billing and client collaboration, making it suitable for freelancers and small service providers. |

| Zoho Books | A free accounting software. Despite being free, it still offers core accounting functionalities, making it an ideal starting point for businesses on a tight budget. |

Before hiring an online accounting service, create strong guiding questions about their tools and software. Here are some to consider.

You can confidently assess the capabilities and compatibility of various online accounting services by seeking answers to these guiding questions. Rest assured that your financial management processes will be in capable hands, allowing you to focus on growing and succeeding in your business endeavors.

Accounting can be a complex process, especially if you lack a background. The technicalities involved in software and process flow might seem overwhelming to learn.

It’s crucial to recognize that not all accounting services offer guidance, from onboarding your files to receiving your financial statements. Therefore, selecting an accounting team with whom you can communicate openly is essential.

Having a line of communication with their team will help you better understand the financial management process. Their support and guidance can make your business journey smoother, even if you are not well-versed in accounting practices.

The short answer is yes and no. Most online accounting and bookkeeping services do not file taxes since you must work with a CPA firm for that. But at the end of the day, they can expedite your business processes. They can produce the most accurate financial statements with the help of the different accounting software mentioned above.

Unloop is one such online accounting team that recognizes the challenges online sellers face in finding affordable accountants. Our services go beyond providing financial statements; we collaborate with CPA firms at discounted partner rates, saving you the hassle of searching for one on your own.

We offer unlimited transactions and access to Quickbooks Online and A2X. This way, you can base any decisions you make now and in the future on actual data derived from your business.

Get all of these and more when you sign on with us. Book a call today!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

It’s the era of ecommerce, and we’re just living in it. As online shoppers continue to soar and online retailers like Amazon grow even bigger, a seller’s financial affairs can get overwhelming really quick. Streamlining financial operations, reconciling transactions from various sales channels, and maintaining bookkeeping records become crucial. Enter the A2X accounting app.

Do you want to know more about A2X? This blog post will explore some critical aspects of this accounting solution and why it’s becoming an indispensable tool for online sellers.

A2X is a cloud-based accounting tool meticulously designed for small business owners, major market players, online retailers, and anyone seeking streamlined cash flow management. This third-party application offers great features that deliver stress-free accounting, particularly within a huge marketplace like Amazon.

Gone are the days of manual data entry and painstaking calculations. A2X handles all the heavy lifting by summarizing your sales data and generating accurate financial reports. These reports provide a detailed overview of your financial performance and help you stay on top of your business's finances.

Amazon’s dominance in the ecommerce industry presents lucrative opportunities for business. With a staggering 220.49 million visitors from mobile and desktop connections, selling on this platform can exponentially expand your reach and revenue potential.

But capitalizing on these benefits also brings significant accounting responsibilities. You must diligently manage your tasks and keep up with the complexities of this thriving field.

Fortunately, A2X steps in as the ultimate solution. Being used and highly recommended by the most trusted accountants, A2X is proven to solve bookkeeping issues, such as payment reconciliation and cash flow tracking. Its efficacy in simplifying financial operations sets it apart from competitors in the market.

Let’s delve further into the factors that position A2X as a competent accounting solution for Amazon sellers:

A2X establishes a reliable integration to each platform when connecting to different Amazon marketplaces. It retrieves the transaction details from each market and consolidates them into a unified format for further processing.

Since A2X can deal with multiple marketplaces, it can manage transactions in various currencies. This multi-currency capability automatically converts and reconciles sales data from different currencies to a single currency within the accounting software.

A2X generates journals for each settlement and posts them to your accounting software. When a settlement is detected, A2X efficiently loads the corresponding transactions. It generates a complete outline of revenue, expenses, and other vital data specific to that sales channel. This organized approach ensures the accessibility of your financial information.

A2X can also aggregate sales by SKU (Stock Keeping Unit), product type, country, or other relevant parameters. This level of customization allows you to analyze and track sales performance based on the specific metrics that hold the utmost importance to your business.

Receiving payments from Amazon can be complex, as funds are often deposited in batches, combining transactions from multiple orders. This consolidation can pose challenges for sellers who strive to accurately reconcile their transactions from their accounts.

A2X makes this process easier by compiling the transaction data and summing it up to match the bank deposits. The application considers factors such as fees and refunds to create a summary that accurately reflects the funds deposited by Amazon.

Businesses can easily trace and verify cash flow by comparing the rundown against the bank deposit records. This level of transparency promotes financial integrity and facilitates effective financial reporting and analysis.

A2X is built to handle large transaction volumes, ensuring you can process financial activities as you scale your business. You won't have to worry about outgrowing the tool’s capabilities or experiencing performance issues.

The accounting app also adapts to changes in your business structure or operational requirements. Whether you expand to new Amazon marketplaces, diversify your product offerings, or adjust your accounting processes, A2X is easily configurable to meet your changing needs.

Numerous tasks within Amazon operations can be a major time drain. Because A2X recognizes the importance of saving time, it efficiently manages repetitive processes on your behalf through automation.

By leveraging A2X's time-saving and complexity-reducing features, you can free up valuable resources and devote more energy to boosting Amazon sales. Spend less on manual accounting tasks and more on strategic initiatives that drive success.

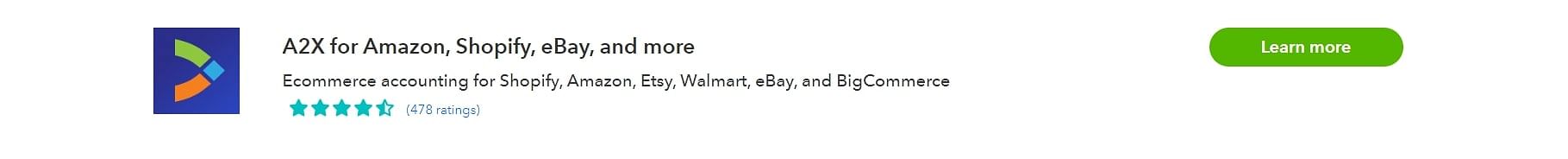

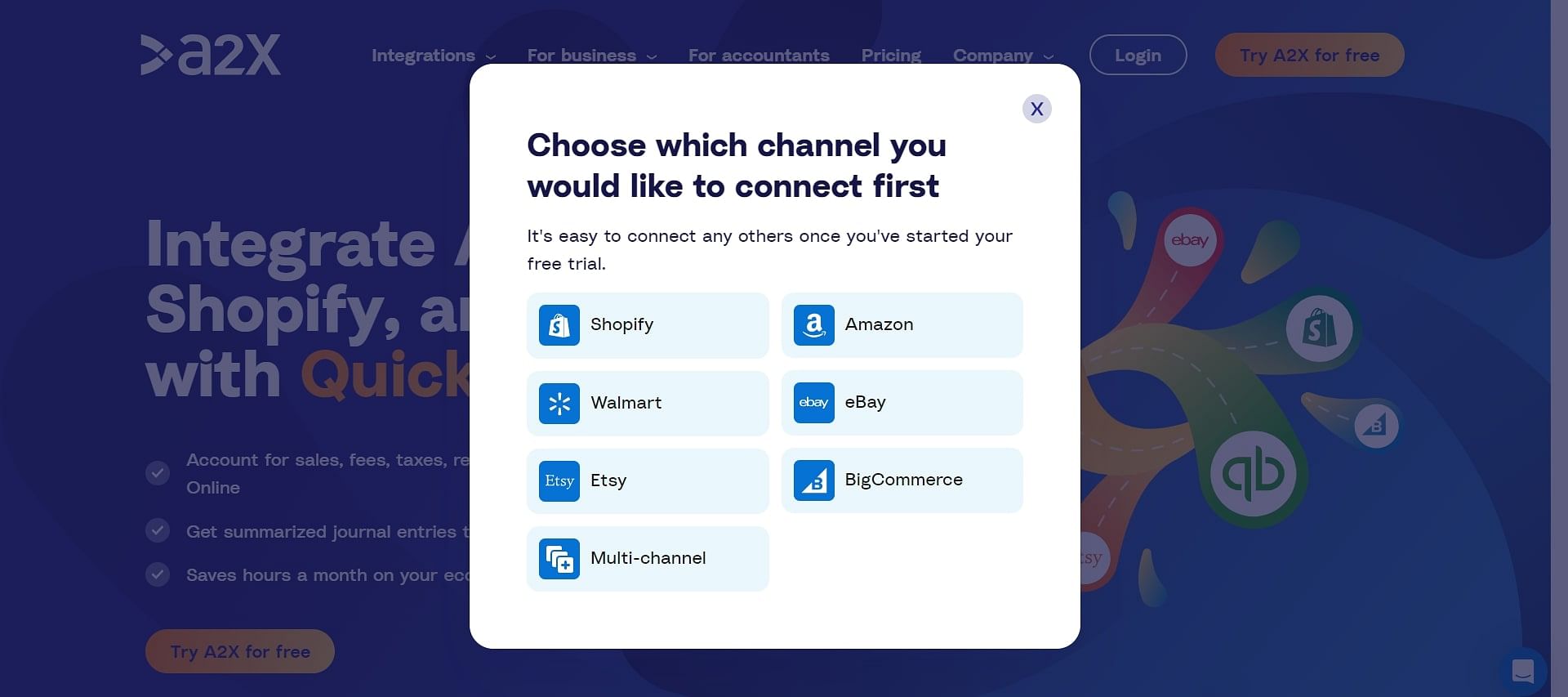

One way to save time is by harnessing the potential of tools and technology. Luckily, you can integrate A2X with popular financial software like QuickBooks Online (QBO) and Xero. It automatically fetches and organizes complex details, such as sales, fees, refunds, and other transaction data, into a format that aligns with these cloud-based accounting platforms.

The integration reduces the chances of errors or discrepancies. You can enjoy the peace of mind of having reconciled financial records month after month without breaking a sweat.

Intuit, the developer of QuickBooks, has approved A2X as an integration application for the Amazon marketplace and QuickBooks Online accounts.

Integrating Amazon with QuickBooks Online through A2X is a straightforward process. Here's how it works:

After you've completed this step, you are now good to integrate your Amazon account and QBO.

Accounting is complicated, especially for sellers on the world’s largest ecommerce platform. But, there is a solution that can simplify your accounting processes: A2X. It can help you connect your Amazon account to QuickBooks Online and other software while organizing your transactions.

If you're still unsure about updating your accounting processes and need additional support, Unloop is here to help. Say hi to better and easier Amazon accounting with our dedicated team—no need to worry about the stress and confusion of managing your accounts alone.

So what are you waiting for? Book a call today!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

It’s the era of ecommerce, and we’re just living in it. As online shoppers continue to soar and online retailers like Amazon grow even bigger, a seller’s financial affairs can get overwhelming really quick. Streamlining financial operations, reconciling transactions from various sales channels, and maintaining bookkeeping records become crucial. Enter the A2X accounting app.

Do you want to know more about A2X? This blog post will explore some critical aspects of this accounting solution and why it’s becoming an indispensable tool for online sellers.

A2X is a cloud-based accounting tool meticulously designed for small business owners, major market players, online retailers, and anyone seeking streamlined cash flow management. This third-party application offers great features that deliver stress-free accounting, particularly within a huge marketplace like Amazon.

Gone are the days of manual data entry and painstaking calculations. A2X handles all the heavy lifting by summarizing your sales data and generating accurate financial reports. These reports provide a detailed overview of your financial performance and help you stay on top of your business's finances.

Amazon’s dominance in the ecommerce industry presents lucrative opportunities for business. With a staggering 220.49 million visitors from mobile and desktop connections, selling on this platform can exponentially expand your reach and revenue potential.

But capitalizing on these benefits also brings significant accounting responsibilities. You must diligently manage your tasks and keep up with the complexities of this thriving field.

Fortunately, A2X steps in as the ultimate solution. Being used and highly recommended by the most trusted accountants, A2X is proven to solve bookkeeping issues, such as payment reconciliation and cash flow tracking. Its efficacy in simplifying financial operations sets it apart from competitors in the market.

Let’s delve further into the factors that position A2X as a competent accounting solution for Amazon sellers:

A2X establishes a reliable integration to each platform when connecting to different Amazon marketplaces. It retrieves the transaction details from each market and consolidates them into a unified format for further processing.

Since A2X can deal with multiple marketplaces, it can manage transactions in various currencies. This multi-currency capability automatically converts and reconciles sales data from different currencies to a single currency within the accounting software.

A2X generates journals for each settlement and posts them to your accounting software. When a settlement is detected, A2X efficiently loads the corresponding transactions. It generates a complete outline of revenue, expenses, and other vital data specific to that sales channel. This organized approach ensures the accessibility of your financial information.

A2X can also aggregate sales by SKU (Stock Keeping Unit), product type, country, or other relevant parameters. This level of customization allows you to analyze and track sales performance based on the specific metrics that hold the utmost importance to your business.

Receiving payments from Amazon can be complex, as funds are often deposited in batches, combining transactions from multiple orders. This consolidation can pose challenges for sellers who strive to accurately reconcile their transactions from their accounts.

A2X makes this process easier by compiling the transaction data and summing it up to match the bank deposits. The application considers factors such as fees and refunds to create a summary that accurately reflects the funds deposited by Amazon.

Businesses can easily trace and verify cash flow by comparing the rundown against the bank deposit records. This level of transparency promotes financial integrity and facilitates effective financial reporting and analysis.

A2X is built to handle large transaction volumes, ensuring you can process financial activities as you scale your business. You won't have to worry about outgrowing the tool’s capabilities or experiencing performance issues.

The accounting app also adapts to changes in your business structure or operational requirements. Whether you expand to new Amazon marketplaces, diversify your product offerings, or adjust your accounting processes, A2X is easily configurable to meet your changing needs.

Numerous tasks within Amazon operations can be a major time drain. Because A2X recognizes the importance of saving time, it efficiently manages repetitive processes on your behalf through automation.

By leveraging A2X's time-saving and complexity-reducing features, you can free up valuable resources and devote more energy to boosting Amazon sales. Spend less on manual accounting tasks and more on strategic initiatives that drive success.

One way to save time is by harnessing the potential of tools and technology. Luckily, you can integrate A2X with popular financial software like QuickBooks Online (QBO) and Xero. It automatically fetches and organizes complex details, such as sales, fees, refunds, and other transaction data, into a format that aligns with these cloud-based accounting platforms.

The integration reduces the chances of errors or discrepancies. You can enjoy the peace of mind of having reconciled financial records month after month without breaking a sweat.

Intuit, the developer of QuickBooks, has approved A2X as an integration application for the Amazon marketplace and QuickBooks Online accounts.

Integrating Amazon with QuickBooks Online through A2X is a straightforward process. Here's how it works:

After you've completed this step, you are now good to integrate your Amazon account and QBO.

Accounting is complicated, especially for sellers on the world’s largest ecommerce platform. But, there is a solution that can simplify your accounting processes: A2X. It can help you connect your Amazon account to QuickBooks Online and other software while organizing your transactions.

If you're still unsure about updating your accounting processes and need additional support, Unloop is here to help. Say hi to better and easier Amazon accounting with our dedicated team—no need to worry about the stress and confusion of managing your accounts alone.

So what are you waiting for? Book a call today!

Today, we will talk about one of the best accounting software in the market: Xero Accounting Software—a means for accountants and bookkeepers to track data and transactions easier and safer than manual means.

If you are already considering signing up, let us encourage you further and help weigh your options by providing eleven benefits to reap using Xero small business software.

Accounting is a broad and difficult area to traverse in business, especially for those with little experience and knowledge. Tasks like invoice creation, expense or income tracking, payroll, and transaction processing can often be headache-inducing.

Thankfully, accounting systems like Xero have begun popping up recently to assist mid-sized and small businesses in need. But what makes Xero among the top accounting solutions?

Among the accounting tasks you or your accountants and bookkeepers need to accomplish are income and expense tracking, which are much better done automatically.

Through Xero Software, your bills are tracked through automated online payments or by taking photos of the receipts.

The payments from your clients are also automatically stored in the system, especially when they pay bank-to-bank or via credit and debit cards. The multicurrency feature lets you enjoy this regardless of the currency used.

A wide range of payment options benefits you and your clients. You can quickly pay vendor dues, and your clients conveniently pay you through these payment options:

Bank-to-bank transactions | Credit cards | Debit cards | GoCardless |

Stripe | PayPal | ApplePay | Transferwise |

Through Xero, your business can adapt to the trend of cashless transactions. All the money coming in and out of these payment options is automatically tracked by Xero through bank, Stripe, Paypal, and Transferwise feeds.

Below is a breakdown of Xero software's project and employee time-tracking benefits.

🕜 Organizing Projects and Employee Time: If you work on different projects with several employees, you can organize the projects together with the time rendered by each worker through Xero.

🧾 Automated Invoicing: By the end of every cutoff, the data you get from the timesheet automatically turns into an invoice for payment. It then falls under your expense data.

🤝 Client Quotes and Collaboration: Send client quotes about projects for approval before collaboration begins.

📨 Electronic Payments: Clients can swiftly send electronic payments at the end of a transaction.

📞 Contact Management: Xero’s contact management feature makes client and project tracking easier. This feature allows you to add contacts and list essential details about them, such as their name, email address, phone number, etc.

🗒️ Notes Field: Suppose specific information needs attention with an invoice or bill, like a payment due date or special instructions for payment processing. Xero allows you to create essential notes for each contact and ensure easy access.

You can easily reconcile bank transactions with Xero. Once your bank account is connected to Xero, business transactions are automatically imported to the software, neatly sorted, and categorized for tracking and reporting. If some details are not indexed, Xero will send you an alert. These transactions either required tagging or investigation in case of issues like fraud.

Reconciliation should be done daily to keep your system up-to-date. You can also bulk reconcile transactions to check if the bank money matches the data on Xero.

To easily track these activities, Xero provides a Bank Transactions tab, where you can do the following:

Taxes are one of the most complicated business areas every business owner must go through. Much information goes into sales tax compliance: rates, exemptions, rules, and regulations. It can be overwhelming to track how these different factors impact your business.

Fortunately, they are made easier through Xero's automatic sales tax and returns calculation. With Xero, you must input as many tax rates as possible for each item for the accounting system to automatically calculate the sales tax.

You can also optimize your data by adding tax rates for specific contacts, products, or accounts. Then, you can generate a sales tax report which you can also use to generate tax returns.

Are you tired of creating online invoices over and over from scratch, especially for recurring transactions? With Xero’s invoicing capabilities, you can easily create a template, schedule the invoices, and automatically remind your clients about the dues they need to pay.

Moreover, you can instantly receive customer payments as invoices appear with a “Pay Now” call-to-action button. The money that enters your account will be tracked accordingly by the system. Note that you can send these invoices whether you are on a computer or your phone.

If you're a small business owner, inventory management is essential. However, the cost of keeping track of your stock can be a big burden for your cash flow, especially if the quantity of your inventory is too high.

Xero allows you to import and update CSV files directly from marketplaces like Amazon and eBay so you can keep track of your inventory immediately. You can also see how much cash flow has been earned through sales or returns on these platforms and even receive notifications when new purchases are made.

Bonus: Xero's built-in search feature makes it easier to find items from across all areas of your business, including customers, suppliers, and contacts.

Xero’s software integration allows you to look at a single software to assess your business's financial health instead of going back and forth. Here are some of the tools you can integrate:

Many reports are generated automatically on Xero's dashboard, such as expense claims, income, profitability, unreconciled bank transactions, and your company snapshot. Business owners and managers can use these reports to set budgets, plan investment strategies, and make other essential business decisions.

Plenty of templates exist; you can customize the reports to check specific data or key performance indicators.

On top of these reports is Xero Analytics. It focuses on tracking your cash flow. The feature generates reports based on all the data tracked by the system. It can also show a forecast report on your cash flow if the same trends continue.

Xero has passed different data security standards, so rest assured confidential business information is protected.

You can share financial information through a multi-faceted feature, allowing team members to view their own data and select data from others, including customers, suppliers, and other teams. This might raise some data privacy and security concerns on your end. Luckily, you can still protect the financial particulars of your business using the access control function.

For example, you can enable multi-factor authentication to get a notification and accompanying authentication code whenever anyone tries to log into your account.

With all the assistance you can get from the software, you will surely get your money's worth. Xero offers various plans to suit your business size, but from just $25 per month, you can already enjoy some of its top features.

If you want unlimited access, you can sign up for the $54 monthly plan. Before deciding, check out the details of each plan and consider what your business needs the most.

The capabilities of the Xero software are impressive with all the manual tasks it can take from your or your accountant's and bookkeeper's hands. You can use the time and effort you save to plan your next steps in growing your business.

If you are still wondering how to use Xero software, we at Unloop will gladly assist you. Thinking of moving to other accounting software like QuickBooks Online? Unloop experts are also experienced in running such tools!

Book a call now. We have a remote accounting and bookkeeping team ready to help you anytime!

Today, we will talk about one of the best accounting software in the market: Xero Accounting Software—a means for accountants and bookkeepers to track data and transactions easier and safer than manual means.

If you are already considering signing up, let us encourage you further and help weigh your options by providing eleven benefits to reap using Xero small business software.

Accounting is a broad and difficult area to traverse in business, especially for those with little experience and knowledge. Tasks like invoice creation, expense or income tracking, payroll, and transaction processing can often be headache-inducing.

Thankfully, accounting systems like Xero have begun popping up recently to assist mid-sized and small businesses in need. But what makes Xero among the top accounting solutions?

Among the accounting tasks you or your accountants and bookkeepers need to accomplish are income and expense tracking, which are much better done automatically.

Through Xero Software, your bills are tracked through automated online payments or by taking photos of the receipts.

The payments from your clients are also automatically stored in the system, especially when they pay bank-to-bank or via credit and debit cards. The multicurrency feature lets you enjoy this regardless of the currency used.

A wide range of payment options benefits you and your clients. You can quickly pay vendor dues, and your clients conveniently pay you through these payment options:

Bank-to-bank transactions | Credit cards | Debit cards | GoCardless |

Stripe | PayPal | ApplePay | Transferwise |

Through Xero, your business can adapt to the trend of cashless transactions. All the money coming in and out of these payment options is automatically tracked by Xero through bank, Stripe, Paypal, and Transferwise feeds.

Below is a breakdown of Xero software's project and employee time-tracking benefits.

🕜 Organizing Projects and Employee Time: If you work on different projects with several employees, you can organize the projects together with the time rendered by each worker through Xero.

🧾 Automated Invoicing: By the end of every cutoff, the data you get from the timesheet automatically turns into an invoice for payment. It then falls under your expense data.

🤝 Client Quotes and Collaboration: Send client quotes about projects for approval before collaboration begins.

📨 Electronic Payments: Clients can swiftly send electronic payments at the end of a transaction.

📞 Contact Management: Xero’s contact management feature makes client and project tracking easier. This feature allows you to add contacts and list essential details about them, such as their name, email address, phone number, etc.

🗒️ Notes Field: Suppose specific information needs attention with an invoice or bill, like a payment due date or special instructions for payment processing. Xero allows you to create essential notes for each contact and ensure easy access.

You can easily reconcile bank transactions with Xero. Once your bank account is connected to Xero, business transactions are automatically imported to the software, neatly sorted, and categorized for tracking and reporting. If some details are not indexed, Xero will send you an alert. These transactions either required tagging or investigation in case of issues like fraud.

Reconciliation should be done daily to keep your system up-to-date. You can also bulk reconcile transactions to check if the bank money matches the data on Xero.

To easily track these activities, Xero provides a Bank Transactions tab, where you can do the following:

Taxes are one of the most complicated business areas every business owner must go through. Much information goes into sales tax compliance: rates, exemptions, rules, and regulations. It can be overwhelming to track how these different factors impact your business.

Fortunately, they are made easier through Xero's automatic sales tax and returns calculation. With Xero, you must input as many tax rates as possible for each item for the accounting system to automatically calculate the sales tax.

You can also optimize your data by adding tax rates for specific contacts, products, or accounts. Then, you can generate a sales tax report which you can also use to generate tax returns.

Are you tired of creating online invoices over and over from scratch, especially for recurring transactions? With Xero’s invoicing capabilities, you can easily create a template, schedule the invoices, and automatically remind your clients about the dues they need to pay.

Moreover, you can instantly receive customer payments as invoices appear with a “Pay Now” call-to-action button. The money that enters your account will be tracked accordingly by the system. Note that you can send these invoices whether you are on a computer or your phone.

If you're a small business owner, inventory management is essential. However, the cost of keeping track of your stock can be a big burden for your cash flow, especially if the quantity of your inventory is too high.

Xero allows you to import and update CSV files directly from marketplaces like Amazon and eBay so you can keep track of your inventory immediately. You can also see how much cash flow has been earned through sales or returns on these platforms and even receive notifications when new purchases are made.

Bonus: Xero's built-in search feature makes it easier to find items from across all areas of your business, including customers, suppliers, and contacts.

Xero’s software integration allows you to look at a single software to assess your business's financial health instead of going back and forth. Here are some of the tools you can integrate:

Many reports are generated automatically on Xero's dashboard, such as expense claims, income, profitability, unreconciled bank transactions, and your company snapshot. Business owners and managers can use these reports to set budgets, plan investment strategies, and make other essential business decisions.

Plenty of templates exist; you can customize the reports to check specific data or key performance indicators.

On top of these reports is Xero Analytics. It focuses on tracking your cash flow. The feature generates reports based on all the data tracked by the system. It can also show a forecast report on your cash flow if the same trends continue.

Xero has passed different data security standards, so rest assured confidential business information is protected.

You can share financial information through a multi-faceted feature, allowing team members to view their own data and select data from others, including customers, suppliers, and other teams. This might raise some data privacy and security concerns on your end. Luckily, you can still protect the financial particulars of your business using the access control function.

For example, you can enable multi-factor authentication to get a notification and accompanying authentication code whenever anyone tries to log into your account.

With all the assistance you can get from the software, you will surely get your money's worth. Xero offers various plans to suit your business size, but from just $25 per month, you can already enjoy some of its top features.

If you want unlimited access, you can sign up for the $54 monthly plan. Before deciding, check out the details of each plan and consider what your business needs the most.

The capabilities of the Xero software are impressive with all the manual tasks it can take from your or your accountant's and bookkeeper's hands. You can use the time and effort you save to plan your next steps in growing your business.

If you are still wondering how to use Xero software, we at Unloop will gladly assist you. Thinking of moving to other accounting software like QuickBooks Online? Unloop experts are also experienced in running such tools!

Book a call now. We have a remote accounting and bookkeeping team ready to help you anytime!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

With over 50,000 active businesses, Calgary’s business scene doesn’t seem to show signs of faltering anytime soon. For this reason, it won’t come as a surprise if some (or most) businesses delegate their accounting tasks to top-quality accounting and bookkeeping services, especially those without any background in the field.

Let’s list the best accounting firms Calgary has in store for business owners and entrepreneurs like you.

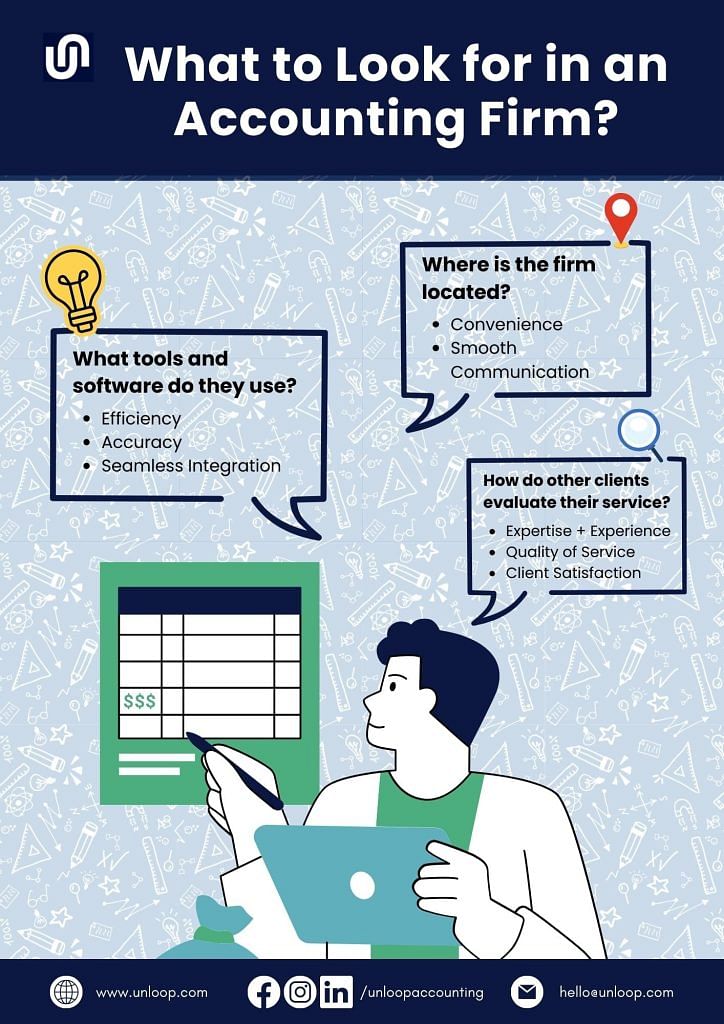

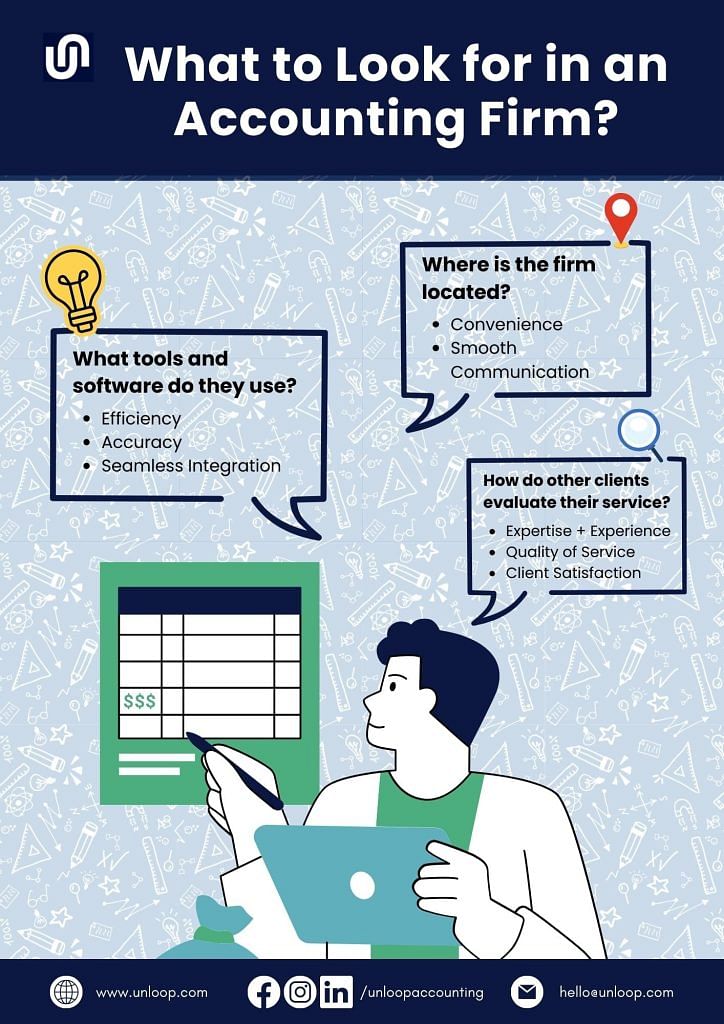

Before you start, it’s best to outline the fundamental factors an ideal professional accounting firm must possess. What should you look for to find the best one?

Logically, the first factor that most clients try to assess is the type of accounting services the firm offers. Be it payroll services or managing personal and business taxes, they’ll want an accounting firm to lift those heavy burdens off their shoulders.

But searching for the right accounting firm doesn’t end with simply checking a firm’s services; it’s how well they do it. To highlight the key qualities of an ideal accounting firm, we’ve listed some questions to find the right services for your company.

Once you’ve identified which services your business requires, you will naturally start thinking about the firm's tools to manage essential accounting tasks efficiently and accurately.

Knowing what tools and software they use impacts not only their task efficiency but also seamless data sharing and management.

With that, you must ensure their software matches yours for seamless data integration. You and your hired firm can collaborate in real time, allowing quick accounting resolution. Most importantly, having the same tools and software with your firm ensures data security and protection, considering you will have a similar data security system with the firm upon data integration.

Like how an interested customer would read product reviews, running a background check on the firm through client testimonials is crucial. From this brief check, you can assess their

These reviews can show you how well they communicate with their clients. They can also reveal how the firm handles inevitable road bumps and indicate the overall level of client satisfaction.

You may think that location won’t matter when selecting an accounting firm, but plenty of factors are linked to where the firm is. Most companies prefer to hire nearby firms for convenience, improved efficiency, and smooth communication.

The firm’s location isn’t limited to where it is physically situated. With the advancement of technology and the internet, running an accounting firm remotely and through cloud-based systems is possible.

Piggybacking off of the previous discussion, learning the accounting firm’s tools, testimonials, and even location is just as critical as knowing their services.

If your business is Calgary-based, today’s your lucky day. Below are the best seven accounting firms in the area.

Ideally, tax registration is a must the moment you open for business. However, many entrepreneurs choose to delay this step until tax season comes.

Do not make the same mistake and save yourself from the stress. Versatile Accounting & Tax is an accounting firm in Calgary that can handle corporate taxes, goods and services tax, personal tax planning, filing, and compliance.

The firm's bookkeeping services include monitoring your business or nonprofit organization's financial status and payroll processing. They also offer audit and review engagement as part of their assurance services.

Whether you are a doctor, a lawyer, a dentist, a real estate agent, or a business owner, you'll find the services offered by MMT Chartered Professional Accountants satisfactory to your needs. Here’s a preview.

Analyzing, planning, and forecasting your finances are just as necessary as monitoring your cash flow and staying on top of ever-changing tax regulations. Luckily, you can get all these services from Shajani LLP Professional Accountants.

A Calgary-based chartered accountant from the firm can help you with the following:

That’s right! You can now minimize your tax expenditure or keep your records well-organized, all while setting a course for financial success.

Businesses should always have accounting, whether a startup or a big one. For fledgling enterprises, it ensures sound decision-making and business growth. For larger businesses, it contributes to long-term stability and success.

Jibe Accounting caters to both—ranging from physical and online startups to small businesses. Professionals like consultants, real estate brokers, and investors can also access their services.

Some of them include:

Family businesses tend to be informal, but that doesn't mean you don’t need to track your expenses, income, losses, and profit. Geib & Company’s services are for family businesses, among other sectors. Their expertise spans around the following areas:

Under each leading service are bookkeeping tasks, where you can keep your financial records in order. They also offer assurance and financial reporting to guide you in your current business status.

KD Professional Accounting Services (Calgary) is your go-to for comprehensive financial management, from accounting needs to strategic decision-making. It covers services for business and insurance, turning money into gold, and other benefits.

The firm is also extremely helpful for small to medium businesses. Their range of services includes the following:

If you are looking for small business tax accountants who speak your language and have firsthand experience in ecommerce business management, Unloop has them all.

Unloop has successfully established an accounting business. They aim to replicate its success with other startups and small business owners by delivering custom accounting solutions.

What distinguishes Unloop is its blend of experience and technical expertise, providing accounting services such as:

Best of all, Unloop offers a risk-free trial of their services, and you can cancel anytime.

Starting with accounting early on is a smart move. It will keep track of your finances through the reports, which you can then use to make better business decisions. If you run into any financial issues, early forecasting can help you catch them before they become big problems. With the right planning, you can solve or avoid these issues altogether.

You've seen our list of top accounting firms in Calgary, each offering various accounting and bookkeeping services. Now, it's time to make your choice and create a partnership.

Unloop offers exceptional consulting services and can be the accounting firm you are looking for. We provide excellent accounting support for small to mid-sized businesses all over Canada, including Calgary.

Contact us at 877-421-7270 so that we can discuss our services.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

With over 50,000 active businesses, Calgary’s business scene doesn’t seem to show signs of faltering anytime soon. For this reason, it won’t come as a surprise if some (or most) businesses delegate their accounting tasks to top-quality accounting and bookkeeping services, especially those without any background in the field.

Let’s list the best accounting firms Calgary has in store for business owners and entrepreneurs like you.

Before you start, it’s best to outline the fundamental factors an ideal professional accounting firm must possess. What should you look for to find the best one?

Logically, the first factor that most clients try to assess is the type of accounting services the firm offers. Be it payroll services or managing personal and business taxes, they’ll want an accounting firm to lift those heavy burdens off their shoulders.

But searching for the right accounting firm doesn’t end with simply checking a firm’s services; it’s how well they do it. To highlight the key qualities of an ideal accounting firm, we’ve listed some questions to find the right services for your company.

Once you’ve identified which services your business requires, you will naturally start thinking about the firm's tools to manage essential accounting tasks efficiently and accurately.

Knowing what tools and software they use impacts not only their task efficiency but also seamless data sharing and management.

With that, you must ensure their software matches yours for seamless data integration. You and your hired firm can collaborate in real time, allowing quick accounting resolution. Most importantly, having the same tools and software with your firm ensures data security and protection, considering you will have a similar data security system with the firm upon data integration.

Like how an interested customer would read product reviews, running a background check on the firm through client testimonials is crucial. From this brief check, you can assess their

These reviews can show you how well they communicate with their clients. They can also reveal how the firm handles inevitable road bumps and indicate the overall level of client satisfaction.

You may think that location won’t matter when selecting an accounting firm, but plenty of factors are linked to where the firm is. Most companies prefer to hire nearby firms for convenience, improved efficiency, and smooth communication.

The firm’s location isn’t limited to where it is physically situated. With the advancement of technology and the internet, running an accounting firm remotely and through cloud-based systems is possible.

Piggybacking off of the previous discussion, learning the accounting firm’s tools, testimonials, and even location is just as critical as knowing their services.

If your business is Calgary-based, today’s your lucky day. Below are the best seven accounting firms in the area.

Ideally, tax registration is a must the moment you open for business. However, many entrepreneurs choose to delay this step until tax season comes.

Do not make the same mistake and save yourself from the stress. Versatile Accounting & Tax is an accounting firm in Calgary that can handle corporate taxes, goods and services tax, personal tax planning, filing, and compliance.

The firm's bookkeeping services include monitoring your business or nonprofit organization's financial status and payroll processing. They also offer audit and review engagement as part of their assurance services.

Whether you are a doctor, a lawyer, a dentist, a real estate agent, or a business owner, you'll find the services offered by MMT Chartered Professional Accountants satisfactory to your needs. Here’s a preview.

Analyzing, planning, and forecasting your finances are just as necessary as monitoring your cash flow and staying on top of ever-changing tax regulations. Luckily, you can get all these services from Shajani LLP Professional Accountants.

A Calgary-based chartered accountant from the firm can help you with the following:

That’s right! You can now minimize your tax expenditure or keep your records well-organized, all while setting a course for financial success.

Businesses should always have accounting, whether a startup or a big one. For fledgling enterprises, it ensures sound decision-making and business growth. For larger businesses, it contributes to long-term stability and success.

Jibe Accounting caters to both—ranging from physical and online startups to small businesses. Professionals like consultants, real estate brokers, and investors can also access their services.

Some of them include:

Family businesses tend to be informal, but that doesn't mean you don’t need to track your expenses, income, losses, and profit. Geib & Company’s services are for family businesses, among other sectors. Their expertise spans around the following areas:

Under each leading service are bookkeeping tasks, where you can keep your financial records in order. They also offer assurance and financial reporting to guide you in your current business status.

KD Professional Accounting Services (Calgary) is your go-to for comprehensive financial management, from accounting needs to strategic decision-making. It covers services for business and insurance, turning money into gold, and other benefits.

The firm is also extremely helpful for small to medium businesses. Their range of services includes the following:

If you are looking for small business tax accountants who speak your language and have firsthand experience in ecommerce business management, Unloop has them all.

Unloop has successfully established an accounting business. They aim to replicate its success with other startups and small business owners by delivering custom accounting solutions.

What distinguishes Unloop is its blend of experience and technical expertise, providing accounting services such as:

Best of all, Unloop offers a risk-free trial of their services, and you can cancel anytime.

Starting with accounting early on is a smart move. It will keep track of your finances through the reports, which you can then use to make better business decisions. If you run into any financial issues, early forecasting can help you catch them before they become big problems. With the right planning, you can solve or avoid these issues altogether.

You've seen our list of top accounting firms in Calgary, each offering various accounting and bookkeeping services. Now, it's time to make your choice and create a partnership.

Unloop offers exceptional consulting services and can be the accounting firm you are looking for. We provide excellent accounting support for small to mid-sized businesses all over Canada, including Calgary.

Contact us at 877-421-7270 so that we can discuss our services.

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting.. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.