With millions of customers and countless purchases, Amazon has been the go-to platform for eCommerce sellers. No surprise there. Curious about how they deal with taxes? The Amazon sales tax report for purchases is a document that details the taxes levied on Amazon transactions. And these reports do not go unchecked.

In this deep dive, we will unravel the complexities of this report, exploring some of the most important details it should contain. Let’s shed some light on the tax collection process and sales tax rates.

So, what are the details in an Amazon sales tax report? Here are some!

A sales tax is a consumption tax levied on goods and services. It is the kind of tax that should be collected from the final consumer of goods and services sold in a marketplace.

Sales tax rates vary depending on a country's sales tax law. There is no national sales tax law in the United States. Hence, there is no uniform rate, and it will depend on the state where you have nexus.

Unless you live in states or provinces that don't charge sales tax, a purchase will be subject to two kinds of sales tax: the state or federal tax rate and the local tax rate of the area to which it was sent. Some goods may be exempt from sales tax. For example, many governments generally exempt sales tax for necessary goods, like food, drinks, or groceries.

Not remitting sales tax or the wrong amount can get your business audited and fined. Therefore, staying on top of your sales tax is extremely important. With that, here are the tax rates for Canada and the US, respectively.

Canada has three tax types: General Sales Tax (GST), Provincial Sales Tax (PST), and Harmonized Sales Tax (HST). Quebec Sales Tax (QST) is a rate specifically charged for this province, while Retail Sales Tax (RST) is specifically applied in Manitoba.

Here are the rates for all sales taxes in Canada. You'll see these in the Amazon sales tax report. It pays to know the rates, as not all marketplaces handle sales tax calculation, collection, and remittances. Also, in case Amazon does not cover the other sales tax applied in a province, you’ll know.

| Province | GST | PST | HST | Total Tax to Pay |

| Alberta | 5% | 5% | ||

| Northwest Territories | 5% | 5% | ||

| Nunavut | 5% | 5% | ||

| Yukon | 5% | 5% | ||

| Saskatchewan | 5% | 6% | 11% | |

| British Columbia | 5% | 7% | 12% | |

| Manitoba | 5% | 12% | ||

| Ontario | 13% | 13% | ||

| Quebec | 5% | *9.975% | 14.98% | |

| New Brunswick | 15% | 15% | ||

| Newfoundland and Labrador | 15% | 15% | ||

| Nova Scotia | 15% | 15% | ||

| Prince Edward Island | 15% | 15% |

Source: Sales Tax Rates by Province, https://www.retailcouncil.org/resources/quick-facts/sales-tax-rates-by-province/

Sales Tax Rules Depend on the US State

The United States has 50 states, each with its own sales tax rates, rules, and regulations. Unlike Canada, where the package destination is the basis of the sales tax rate (unless stated otherwise), US states have different rules.

Some states base the rate on the package's source and others on the destination. Hence, aside from the different rates, check whether to apply the rate in the location of your business address or the rate of the state where your customer resides.

Here are the details of sales tax rates in America:

| State | State Rate | Range of Local Rates |

| Puerto Rico | 11.50% | 0% |

| California | 7.25% | 0% – 3.25% |

| Indiana | 7.00% | 0% |

| Mississippi | 7.00% | 0% – 1% |

| Rhode Island | 7.00% | 0% |

| Tennessee | 7.00% | 1.5% – 2.75% |

| Minnesota | 6.88% | 0% – 2% |

| Nevada | 6.85% | 0% – 1.525% |

| New Jersey | 6.63% | 0% |

| Arkansas | 6.50% | 0% – 6.125% |

| Kansas | 6.50% | 0% – 5.1% |

| Washington | 6.50% | 0.5% – 4.1% |

| Connecticut | 6.35% | 0% -1% |

| Illinois | 6.25% | 0% – 5.25% |

| Massachusetts | 6.25% | 0% |

| Texas | 6.25% | 0% – 2%1.75% local rate for remote sellers, 10-12/19 |

| District of Columbia | 6.00% | 0% |

| Florida | 6.00% | 0% – 2.5% |

| Idaho | 6.00% | 0% – 3% |

| Iowa | 6.00% | 0% – 2% |

| Kentucky | 6.00% | 0% |

| Maryland | 6.00% | 0% |

| Michigan | 6.00% | 0% |

| Pennsylvania | 6.00% | 0% – 2% |

| South Carolina | 6.00% | 0% – 3% |

| Vermont | 6.00% | 0% – 1% |

| West Virginia | 6.00% | 0% – 1% |

| Ohio | 5.75% | 0 – 2.25% |

| Arizona | 5.60% | 0 – 7.30% |

| Maine | 5.50% | 0% |

| Nebraska | 5.50% | 0% – 2.5% |

| New Mexico | 5.00% | 0.125% – 7.75% |

| North Dakota | 5.00% | 0% – 3% |

| Wisconsin | 5.00% | 0% – 1.75% |

| Utah | 4.85% | 1% – 7.5% |

| North Carolina | 4.75% | 2% – 3% |

| Oklahoma | 4.50% | 0% – 7% |

| Louisiana | 4.45% | 0% – 8.5% |

| Virginia | 4.30% | 1% – 2.7% |

| Missouri | 4.23% | 0.5% – 7.763% |

| South Dakota | 4.20% | 0% – 8% |

| Alabama | 4.00% | 0% – 9.0% |

| Georgia | 4.00% | 1% – 5% |

| Hawaii | 4.00% | 0% – 0.5% |

| New York | 4.00% | 0% – 5% |

| Wyoming | 4.00% | 0% – 4% |

| Colorado | 2.90% | 0% – 8.3% |

| Alaska | 0.00% | 0% – 9.5% |

| Delaware | 0.00% | 0% |

| Montana | 0.00% | 0% |

| New Hampshire | 0.00% | 0% |

| Oregon | 0.00% | 0% |

Sources:

US Range of Local Sales Tax Rates, https://www.salestaxinstitute.com/resources/rates

US States Sales Tax Rates, https://taxfoundation.org/publications/state-and-local-sales-tax-rates/

Knowing which products are taxable and which are not will help you understand sales tax reports. Only tax-levied products show up on these documents.

Most products are taxable; you must charge your customers' sales tax if you sell a taxable item. If you do business in several jurisdictions, especially when selling online, you must charge different sales tax rates depending on the state or province. To do this, you have to establish a sales tax nexus.

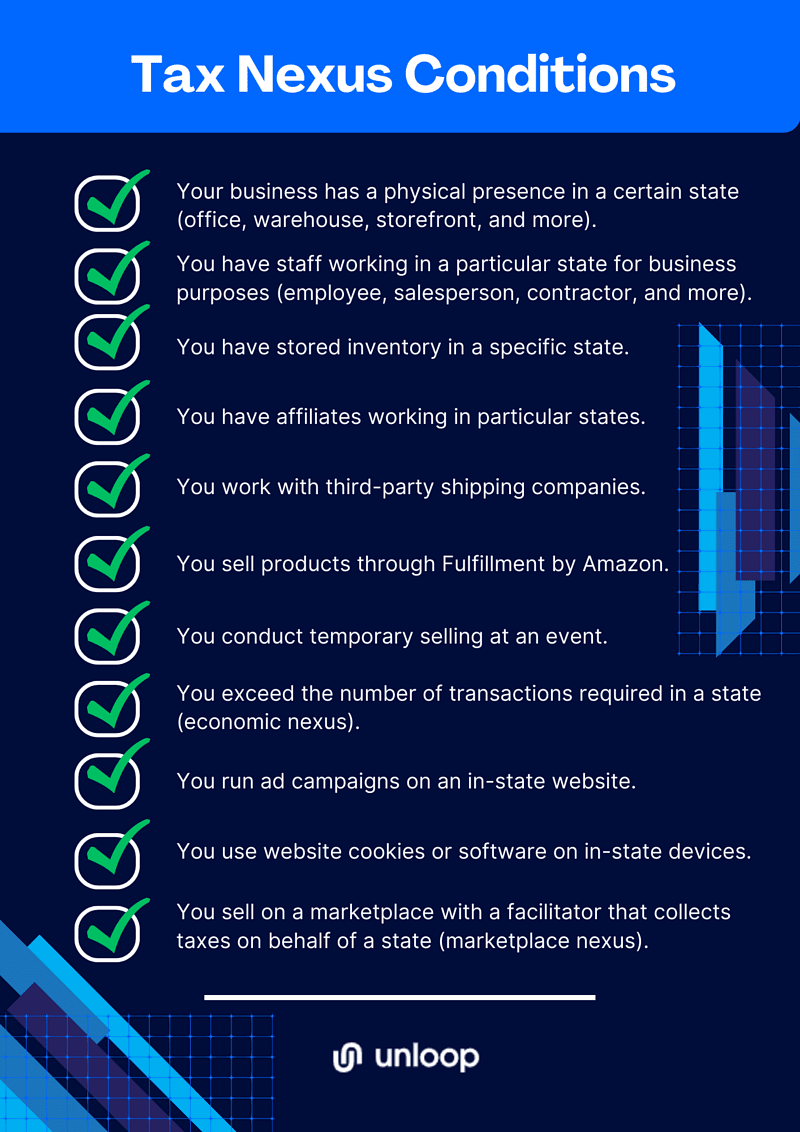

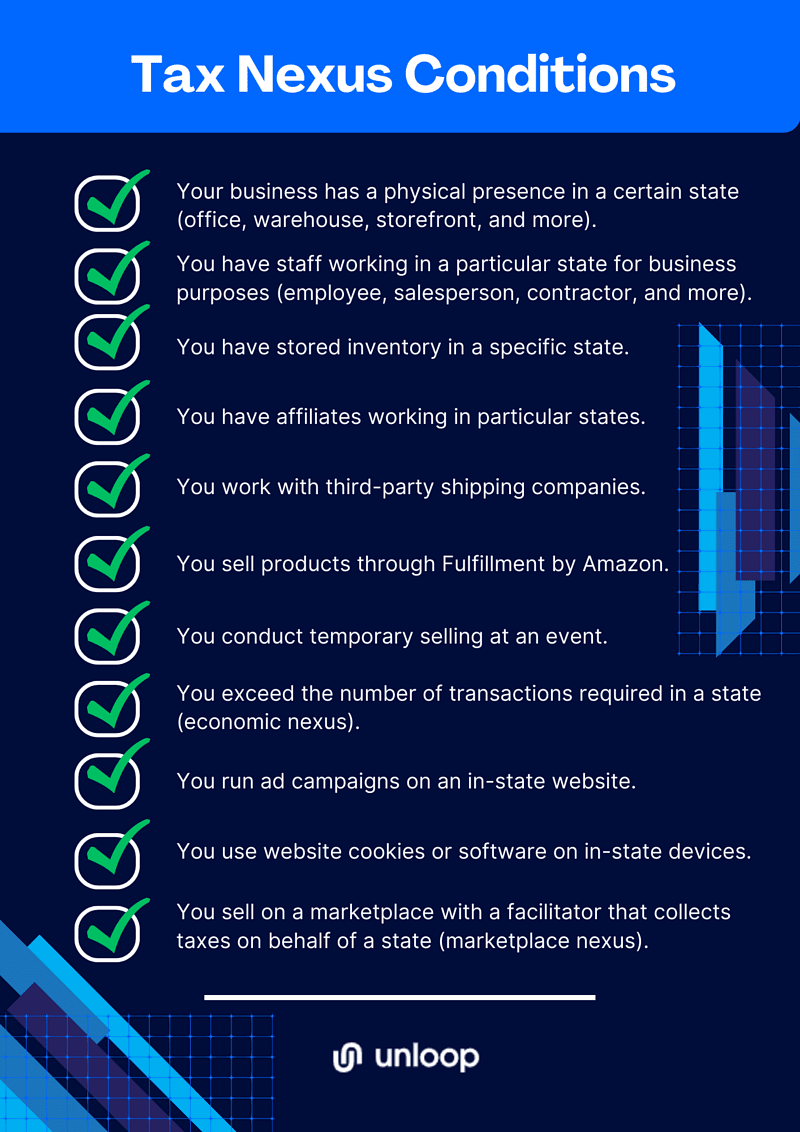

A sales tax nexus means your business has a “presence” in a particular jurisdiction. This presence subjects your business to that state's prevailing income and sales tax rules. For instance, if you sell products that need to be stored or shipped to a particular California, you must establish a nexus in that area and collect sales tax too.

Another way to establish a sales tax nexus is through intercompany transactions. For example, if you sell goods used by another company and delivered on behalf of its customers, you may be required to file taxes in that company's jurisdiction.

On the other hand, if you sell digital goods like music downloads, software subscriptions, or other intangible property, you don't need to report these transactions because they do not require storage space and physical delivery.

Aside from not having a nexus, another reason why some items won't be charged with sales taxes is because they are tax-exempt. No sales tax amount will be attributed to these purchases in the report.

Amazon has the Tax-Exempt Program that exempts individuals and groups from paying sales tax. To enjoy this benefit, your customers must submit complete tax information and documents on the Amazon platform.

In Canada, there are three basic instances when buyers can be tax-exempt:

Like in Canada, there are also tax-exempt individuals and groups in the US:

These clients must upload a tax-exempt certificate and other necessary documents to Amazon. Then, Amazon processes the documents through the platform’s Tax-Exempt Program.

After knowing the details in an Amazon sales tax report, let's check out some of your questions as a newbie seller. After going through these, you'll be ready to view your sales tax report and understand who's in charge and what happens during its calculation, collection, and remittance.

Yes, because of the Marketplace Facilitator (MPF) Law, which is unique to each state. This law cites that third-party sellers like Amazon should handle the collection, filing, and remittance of sales taxes.

Customers pay a one-time sales tax whenever they buy products and services on Amazon. The buyer will pay the sales tax for the purchased goods and services, and Amazon will only collect, calculate, and remit the sales tax.

The sales tax collection services provided by Amazon as a marketplace facilitator are free. The process is streamlined and requires minimal participation and input from the sellers—making it efficient for business.

There was a time when this law didn't cover Canada. Thankfully, MPF now applies to the country. Unless otherwise declared by specific provinces, Amazon will handle the collection, filing, and remittance of the sales taxes charged to your customers. All you have to do is track and ensure accuracy.

There are three main steps in filing taxes:

Let's check the steps one by one.

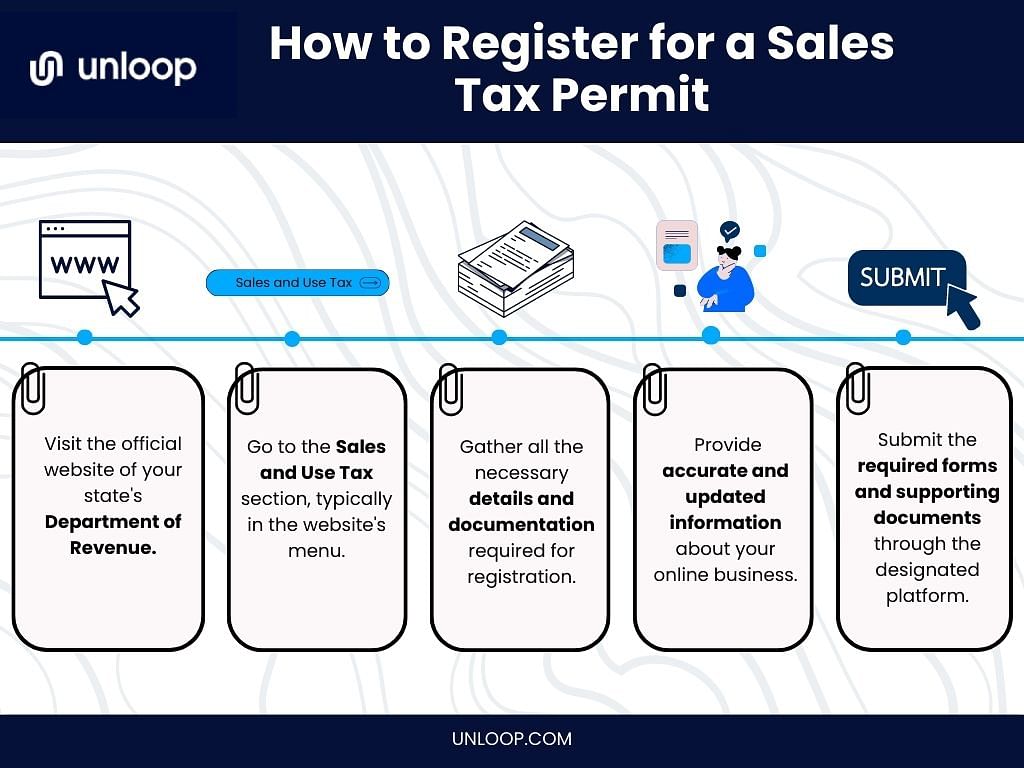

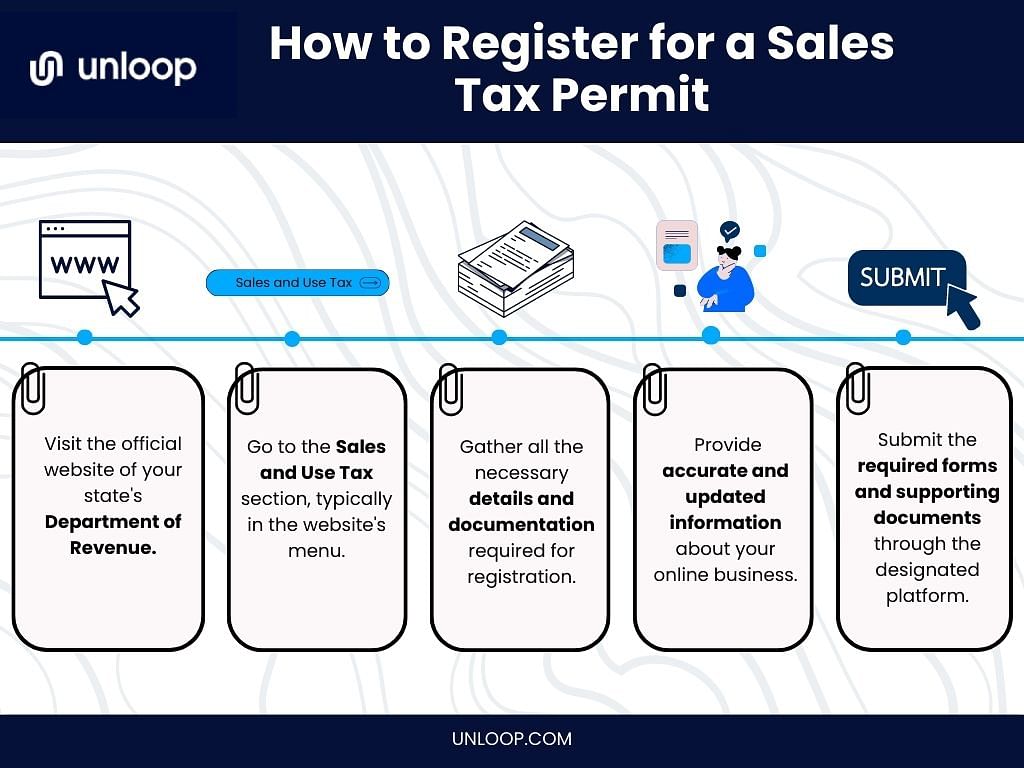

Before you can collect sales tax, you have to secure a permit. Without a permit, sales tax collection is illegal. You can find forms on your local revenue website and register your business.

Once you complete your registration, the tax collection agency will give your filing frequency. It can be monthly, quarterly, or annually, depending on your business's sales volume in a certain period.

After securing the permit, you can now legally collect sales tax. Amazon has a tax collection system that will handle collection for you once you input the correct settings. Tax charges may depend on whether the product sales are origin-based or destination-based.

Origin-based tax calculations mean that you follow the tax rate of where your business is located.

In comparison, destination-based calculations will consider the tax rate of where your products go, regardless of location.

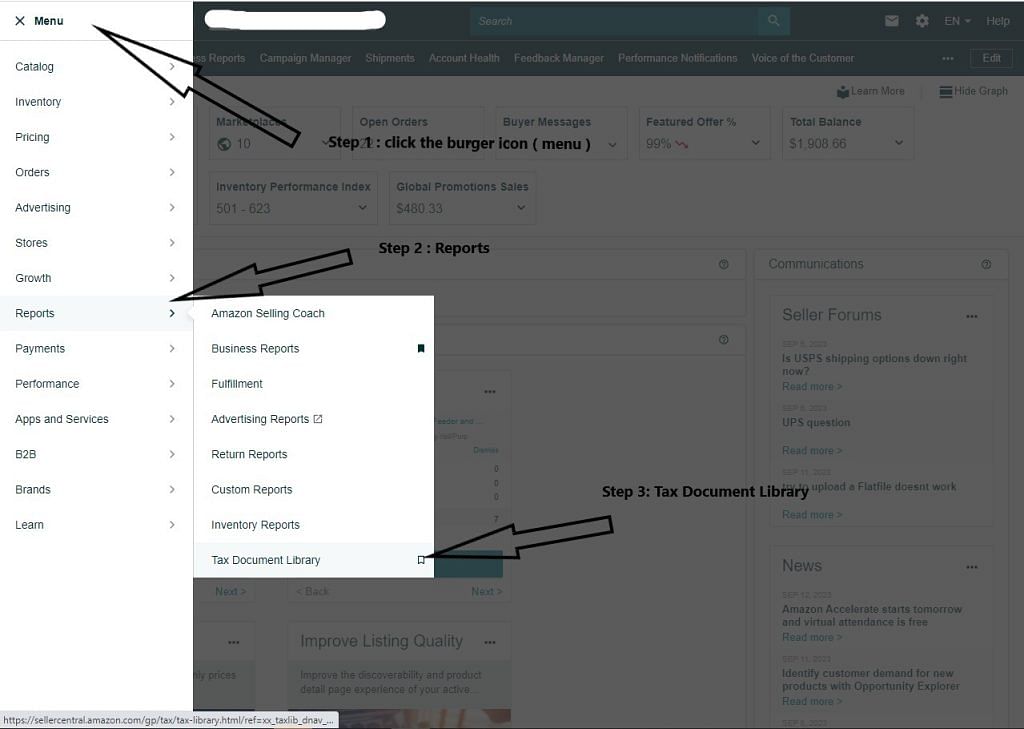

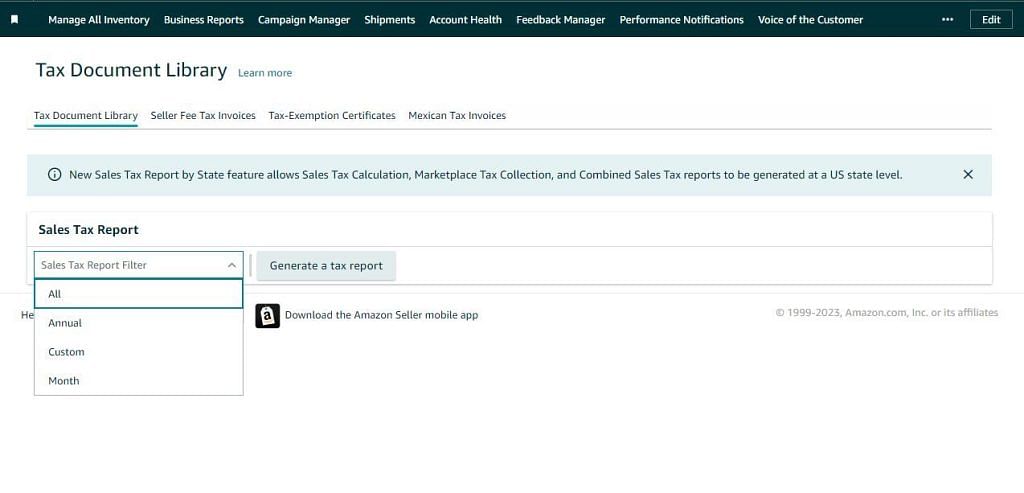

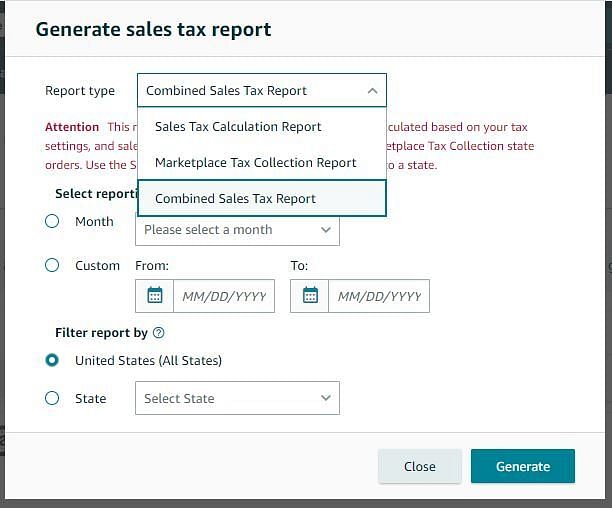

Tax collection authorities will usually ask for sales tax reports and other business statements when you file for sales tax returns. You can easily find different reports in your Amazon Seller Central account. If you want comprehensive reports, you use accounting software to generate more detailed ones for your business. In addition, make sure that all the data in your tax returns are valid to avoid any issues and penalties.

Amazon sales tax reports are useful in helping sellers provide transparency to their customers. Although sales taxes are already handled on Amazon, they aren't the same as other platforms, so you must run them independently.

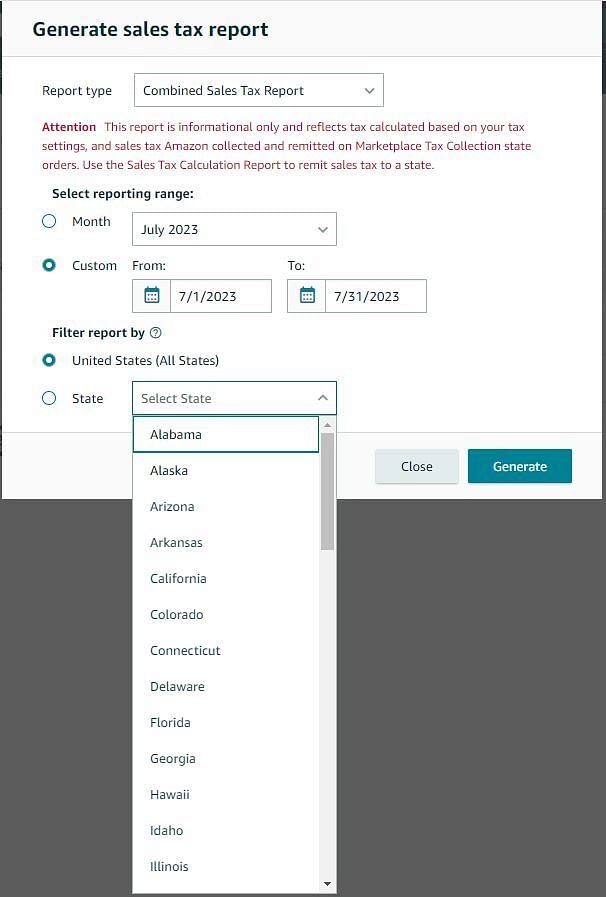

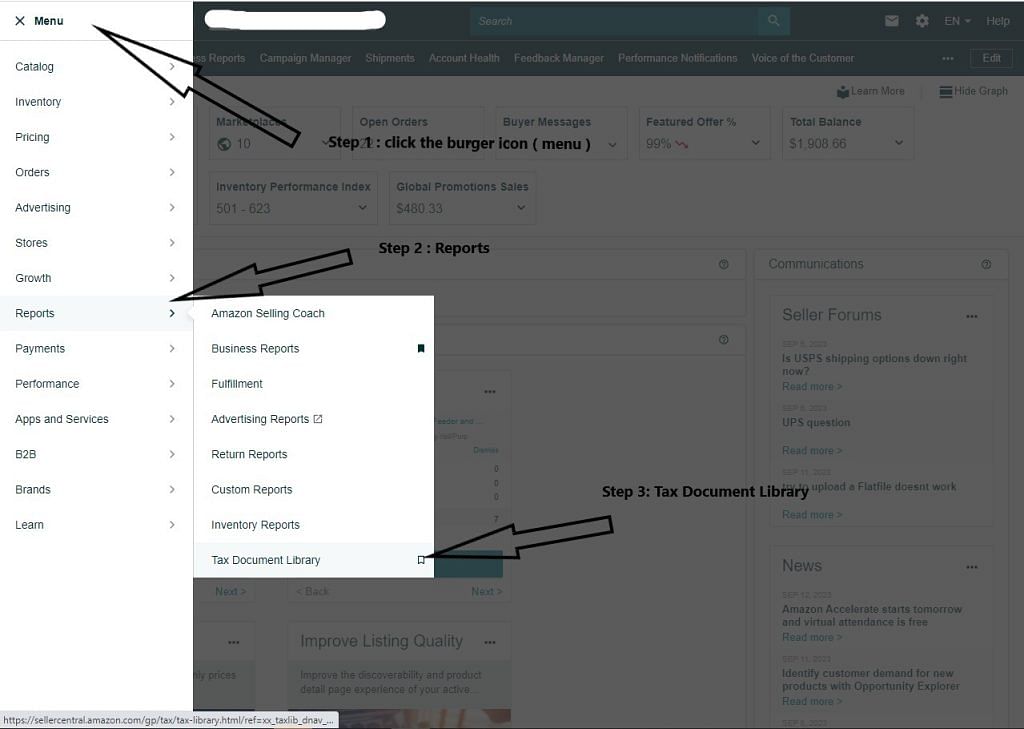

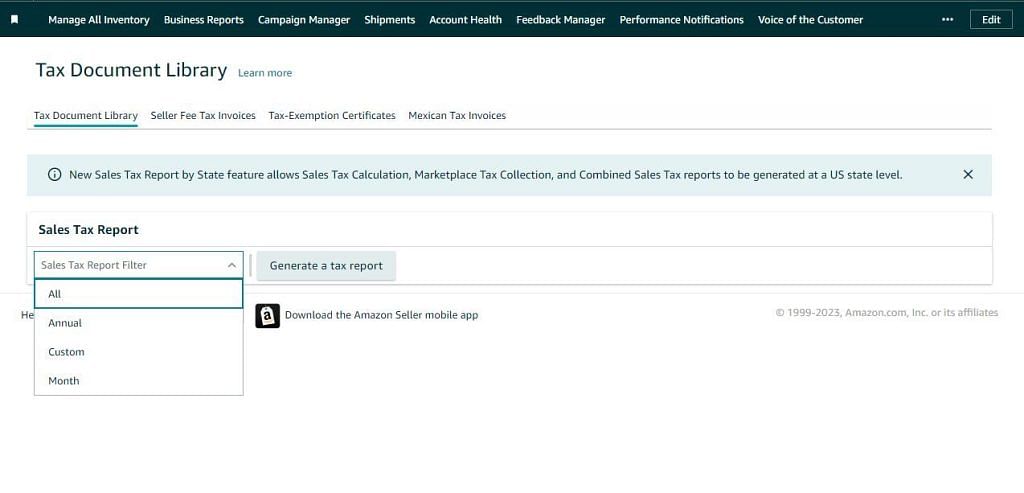

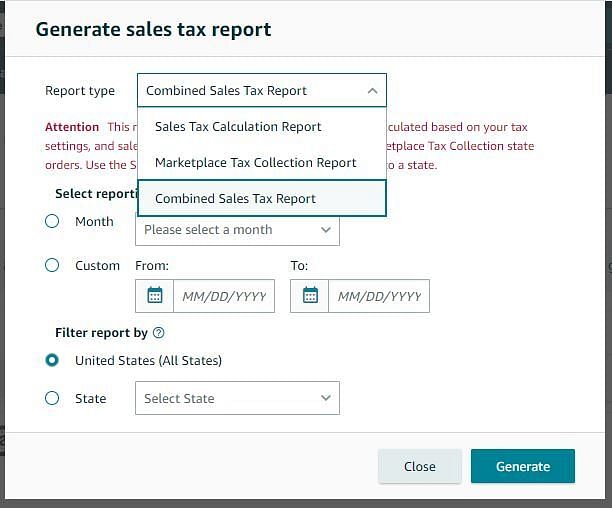

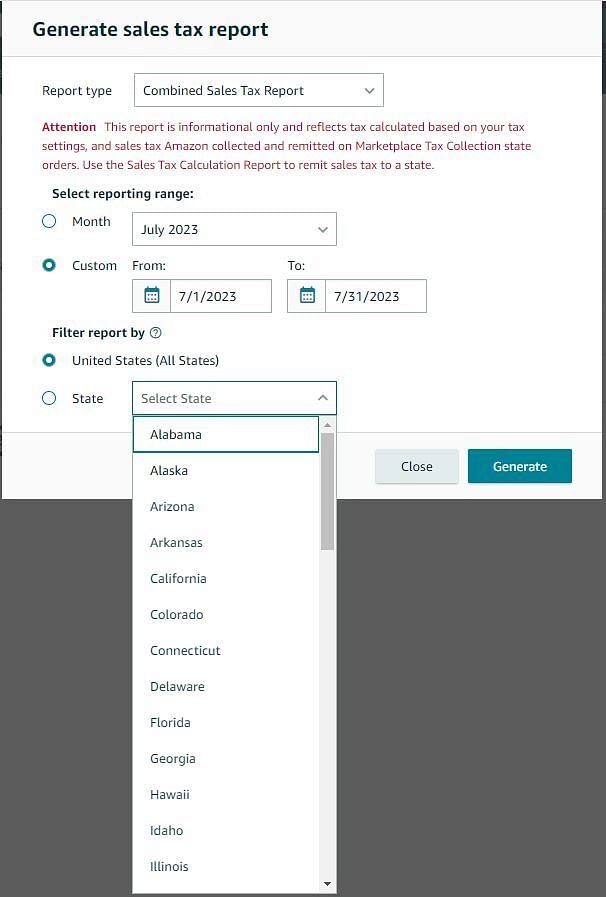

If you are wondering where to get such reports, you can do it through Amazon Seller Central Account Settings. To download any Amazon sales tax report, follow these steps:

The Amazon sales tax report is a great way to help you stay compliant with relevant tax laws. You should also generate this report if you are responsible for collecting sales taxes, especially outside Amazon.

Are you still confused about sales taxes? Outsourcing tax support helps simplify running your ecommerce business.

Whatever ecommerce platform you use, adopting industry-specific tax and accounting methods is critical to achieving your business objectives. With the right accounting service, you can grasp these numbers and make more informed business decisions.

Unloop can be your partner as you grow your ecommerce business. Our team of experts can provide you with a wide range of services, from accounting to automating your sales tax collection and other important financial tasks.

Book a call with us, and we'll help you get started.

With millions of customers and countless purchases, Amazon has been the go-to platform for eCommerce sellers. No surprise there. Curious about how they deal with taxes? The Amazon sales tax report for purchases is a document that details the taxes levied on Amazon transactions. And these reports do not go unchecked.

In this deep dive, we will unravel the complexities of this report, exploring some of the most important details it should contain. Let’s shed some light on the tax collection process and sales tax rates.

So, what are the details in an Amazon sales tax report? Here are some!

A sales tax is a consumption tax levied on goods and services. It is the kind of tax that should be collected from the final consumer of goods and services sold in a marketplace.

Sales tax rates vary depending on a country's sales tax law. There is no national sales tax law in the United States. Hence, there is no uniform rate, and it will depend on the state where you have nexus.

Unless you live in states or provinces that don't charge sales tax, a purchase will be subject to two kinds of sales tax: the state or federal tax rate and the local tax rate of the area to which it was sent. Some goods may be exempt from sales tax. For example, many governments generally exempt sales tax for necessary goods, like food, drinks, or groceries.

Not remitting sales tax or the wrong amount can get your business audited and fined. Therefore, staying on top of your sales tax is extremely important. With that, here are the tax rates for Canada and the US, respectively.

Canada has three tax types: General Sales Tax (GST), Provincial Sales Tax (PST), and Harmonized Sales Tax (HST). Quebec Sales Tax (QST) is a rate specifically charged for this province, while Retail Sales Tax (RST) is specifically applied in Manitoba.

Here are the rates for all sales taxes in Canada. You'll see these in the Amazon sales tax report. It pays to know the rates, as not all marketplaces handle sales tax calculation, collection, and remittances. Also, in case Amazon does not cover the other sales tax applied in a province, you’ll know.

| Province | GST | PST | HST | Total Tax to Pay |

| Alberta | 5% | 5% | ||

| Northwest Territories | 5% | 5% | ||

| Nunavut | 5% | 5% | ||

| Yukon | 5% | 5% | ||

| Saskatchewan | 5% | 6% | 11% | |

| British Columbia | 5% | 7% | 12% | |

| Manitoba | 5% | 12% | ||

| Ontario | 13% | 13% | ||

| Quebec | 5% | *9.975% | 14.98% | |

| New Brunswick | 15% | 15% | ||

| Newfoundland and Labrador | 15% | 15% | ||

| Nova Scotia | 15% | 15% | ||

| Prince Edward Island | 15% | 15% |

Source: Sales Tax Rates by Province, https://www.retailcouncil.org/resources/quick-facts/sales-tax-rates-by-province/

Sales Tax Rules Depend on the US State

The United States has 50 states, each with its own sales tax rates, rules, and regulations. Unlike Canada, where the package destination is the basis of the sales tax rate (unless stated otherwise), US states have different rules.

Some states base the rate on the package's source and others on the destination. Hence, aside from the different rates, check whether to apply the rate in the location of your business address or the rate of the state where your customer resides.

Here are the details of sales tax rates in America:

| State | State Rate | Range of Local Rates |

| Puerto Rico | 11.50% | 0% |

| California | 7.25% | 0% – 3.25% |

| Indiana | 7.00% | 0% |

| Mississippi | 7.00% | 0% – 1% |

| Rhode Island | 7.00% | 0% |

| Tennessee | 7.00% | 1.5% – 2.75% |

| Minnesota | 6.88% | 0% – 2% |

| Nevada | 6.85% | 0% – 1.525% |

| New Jersey | 6.63% | 0% |

| Arkansas | 6.50% | 0% – 6.125% |

| Kansas | 6.50% | 0% – 5.1% |

| Washington | 6.50% | 0.5% – 4.1% |

| Connecticut | 6.35% | 0% -1% |

| Illinois | 6.25% | 0% – 5.25% |

| Massachusetts | 6.25% | 0% |

| Texas | 6.25% | 0% – 2%1.75% local rate for remote sellers, 10-12/19 |

| District of Columbia | 6.00% | 0% |

| Florida | 6.00% | 0% – 2.5% |

| Idaho | 6.00% | 0% – 3% |

| Iowa | 6.00% | 0% – 2% |

| Kentucky | 6.00% | 0% |

| Maryland | 6.00% | 0% |

| Michigan | 6.00% | 0% |

| Pennsylvania | 6.00% | 0% – 2% |

| South Carolina | 6.00% | 0% – 3% |

| Vermont | 6.00% | 0% – 1% |

| West Virginia | 6.00% | 0% – 1% |

| Ohio | 5.75% | 0 – 2.25% |

| Arizona | 5.60% | 0 – 7.30% |

| Maine | 5.50% | 0% |

| Nebraska | 5.50% | 0% – 2.5% |

| New Mexico | 5.00% | 0.125% – 7.75% |

| North Dakota | 5.00% | 0% – 3% |

| Wisconsin | 5.00% | 0% – 1.75% |

| Utah | 4.85% | 1% – 7.5% |

| North Carolina | 4.75% | 2% – 3% |

| Oklahoma | 4.50% | 0% – 7% |

| Louisiana | 4.45% | 0% – 8.5% |

| Virginia | 4.30% | 1% – 2.7% |

| Missouri | 4.23% | 0.5% – 7.763% |

| South Dakota | 4.20% | 0% – 8% |

| Alabama | 4.00% | 0% – 9.0% |

| Georgia | 4.00% | 1% – 5% |

| Hawaii | 4.00% | 0% – 0.5% |

| New York | 4.00% | 0% – 5% |

| Wyoming | 4.00% | 0% – 4% |

| Colorado | 2.90% | 0% – 8.3% |

| Alaska | 0.00% | 0% – 9.5% |

| Delaware | 0.00% | 0% |

| Montana | 0.00% | 0% |

| New Hampshire | 0.00% | 0% |

| Oregon | 0.00% | 0% |

Sources:

US Range of Local Sales Tax Rates, https://www.salestaxinstitute.com/resources/rates

US States Sales Tax Rates, https://taxfoundation.org/publications/state-and-local-sales-tax-rates/

Knowing which products are taxable and which are not will help you understand sales tax reports. Only tax-levied products show up on these documents.

Most products are taxable; you must charge your customers' sales tax if you sell a taxable item. If you do business in several jurisdictions, especially when selling online, you must charge different sales tax rates depending on the state or province. To do this, you have to establish a sales tax nexus.

A sales tax nexus means your business has a “presence” in a particular jurisdiction. This presence subjects your business to that state's prevailing income and sales tax rules. For instance, if you sell products that need to be stored or shipped to a particular California, you must establish a nexus in that area and collect sales tax too.

Another way to establish a sales tax nexus is through intercompany transactions. For example, if you sell goods used by another company and delivered on behalf of its customers, you may be required to file taxes in that company's jurisdiction.

On the other hand, if you sell digital goods like music downloads, software subscriptions, or other intangible property, you don't need to report these transactions because they do not require storage space and physical delivery.

Aside from not having a nexus, another reason why some items won't be charged with sales taxes is because they are tax-exempt. No sales tax amount will be attributed to these purchases in the report.

Amazon has the Tax-Exempt Program that exempts individuals and groups from paying sales tax. To enjoy this benefit, your customers must submit complete tax information and documents on the Amazon platform.

In Canada, there are three basic instances when buyers can be tax-exempt:

Like in Canada, there are also tax-exempt individuals and groups in the US:

These clients must upload a tax-exempt certificate and other necessary documents to Amazon. Then, Amazon processes the documents through the platform’s Tax-Exempt Program.

After knowing the details in an Amazon sales tax report, let's check out some of your questions as a newbie seller. After going through these, you'll be ready to view your sales tax report and understand who's in charge and what happens during its calculation, collection, and remittance.

Yes, because of the Marketplace Facilitator (MPF) Law, which is unique to each state. This law cites that third-party sellers like Amazon should handle the collection, filing, and remittance of sales taxes.

Customers pay a one-time sales tax whenever they buy products and services on Amazon. The buyer will pay the sales tax for the purchased goods and services, and Amazon will only collect, calculate, and remit the sales tax.

The sales tax collection services provided by Amazon as a marketplace facilitator are free. The process is streamlined and requires minimal participation and input from the sellers—making it efficient for business.

There was a time when this law didn't cover Canada. Thankfully, MPF now applies to the country. Unless otherwise declared by specific provinces, Amazon will handle the collection, filing, and remittance of the sales taxes charged to your customers. All you have to do is track and ensure accuracy.

There are three main steps in filing taxes:

Let's check the steps one by one.

Before you can collect sales tax, you have to secure a permit. Without a permit, sales tax collection is illegal. You can find forms on your local revenue website and register your business.

Once you complete your registration, the tax collection agency will give your filing frequency. It can be monthly, quarterly, or annually, depending on your business's sales volume in a certain period.

After securing the permit, you can now legally collect sales tax. Amazon has a tax collection system that will handle collection for you once you input the correct settings. Tax charges may depend on whether the product sales are origin-based or destination-based.

Origin-based tax calculations mean that you follow the tax rate of where your business is located.

In comparison, destination-based calculations will consider the tax rate of where your products go, regardless of location.

Tax collection authorities will usually ask for sales tax reports and other business statements when you file for sales tax returns. You can easily find different reports in your Amazon Seller Central account. If you want comprehensive reports, you use accounting software to generate more detailed ones for your business. In addition, make sure that all the data in your tax returns are valid to avoid any issues and penalties.

Amazon sales tax reports are useful in helping sellers provide transparency to their customers. Although sales taxes are already handled on Amazon, they aren't the same as other platforms, so you must run them independently.

If you are wondering where to get such reports, you can do it through Amazon Seller Central Account Settings. To download any Amazon sales tax report, follow these steps:

The Amazon sales tax report is a great way to help you stay compliant with relevant tax laws. You should also generate this report if you are responsible for collecting sales taxes, especially outside Amazon.

Are you still confused about sales taxes? Outsourcing tax support helps simplify running your ecommerce business.

Whatever ecommerce platform you use, adopting industry-specific tax and accounting methods is critical to achieving your business objectives. With the right accounting service, you can grasp these numbers and make more informed business decisions.

Unloop can be your partner as you grow your ecommerce business. Our team of experts can provide you with a wide range of services, from accounting to automating your sales tax collection and other important financial tasks.

Book a call with us, and we'll help you get started.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

You're probably familiar with sales tax. It's that pesky thing you have to pay on most purchases, depending on your location. Many online sellers have asked themselves, "Do I need to collect sales tax for selling online?"

The answer is overwhelming, but it's not complicated as long as you have a tax guide like this one. Inside, we'll break down the basics of sales tax for online sellers and help clear up any confusion.

It's important for small business owners to be aware of their legal obligations. Fortunately, with a little knowledge about how tax law works, you can avoid many headaches by being compliant. We'll explain each part step by step so that by the time you finish this post, you'll be a bona fide sales tax expert. Let's get started!

Also known as ecommerce sales tax, internet sales tax is the small percentage you collect when you make an income from selling your product online. You must accurately assess sales taxes and pay them to the proper state tax authorities.

In the US, most states require online businesses to collect sales tax. On top of this, you need to check the cities and countries you sell in and see if they have special taxing districts, AKA special assessment districts.

Let's say your online business is currently located in Los Angeles, California.

| Los Angeles Tax Breakdown as of 2022 | |

| California | 6% |

| Los Angeles City | 0.25% |

| Los Angeles County Local Tax Sl. | 1% |

| Los Angeles County District Tax Sp. | 2.25% |

| Minimum Total of Sales Tax Rate | 9.5% |

As of 2022, the city of Los Angeles, California, requires businesses to pay a 9.6% tax rate from their sales and revenue. The final computation of your tax rate is determined by the exact location of your business.

The exact location of your business determines the taxes you have to file. You're responsible for charging the correct sales tax and remitting the right amount of tax rate back to your respective state. But what does this fancy term "sales tax nexus" even mean?

It's a legal term of the state that means "to be on the hook." If you have a place of business, it means you have a physical presence that the state can tax you on. It could be a:

Generally speaking, online businesses don't pay sales taxes if they don't have a nexus. But for many years, states have been arguing about not being able to collect sales taxes from online business owners simply because these marketplace sellers don't have enough sales within their located state to generate taxes.

But the burden shifted back to the seller since the US Supreme Court ruling over South Dakota v. Wayfair in June 2018. Sales tax nexus laws have changed on when and how to collect taxes. As a result, complying with tax prerequisites for online retailers, especially small to medium businesses, has gotten much messier.

The ruling changed how online businesses collect and charge sales taxes. Many states have the power to charge sales taxes on online businesses even without a nexus. But as of now, the status of this new tax law hasn't been passed as a federal law, which is good news for small businesses in some states.

Yes, you still need to collect sales taxes in different states if you have:

Most tangible property is taxable. But some states make tax exemptions for certain products.

Let's go back to California once more. If you are a marketplace seller that offers furniture, toys, and clothing, your products are subject to sales tax. In addition, some labor services and costs associated are even taxable if they are connected to producing new personal property.

But there are sales tax exemptions in California, such as:

Once you have learned that your business is taxable, you must take steps to ensure tax compliance. This means filing the appropriate tax forms and making sure that your tax liability is up to date. By taking the time to file for tax compliance, you can help protect your business and avoid costly penalties.

Don't skip this crucial step when collecting sales tax. Unfortunately, most states consider it illegal and penalize businesses that collect sales tax without a tax permit. So instead, we suggest you contact the Department of Revenue of your state to learn more about registering your business for sales tax collection.

Like each state's calculation of sales tax nexus, the state assigns how frequently you will file your sales tax—either monthly, quarterly, or annually. When your sales tax due date comes, it is your job to state how much you've collected.

Reporting your sales tax is easy if they want to see only the total of your sales tax collection. However, most states want to know how much you've collected in each county, city, state, and other special taxing districts in your nexus.

The verdict is in, and, as expected, the Supreme Court's decision in South Dakota v. Wayfair has had a massive impact on online sales tax laws across the US. As a result, states are now scrambling to put new rules and regulations governing how and when sellers must collect sales tax based on their customers' physical location.

Suppose you're an online seller doing business in more than one state. In that case, it's important to understand the implications of this ruling and take action to ensure you are compliant with all applicable sales tax laws.

Contact financial experts from Unloop today for help in navigating these murky waters and staying ahead of the curve for internet sales tax compliance.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

You're probably familiar with sales tax. It's that pesky thing you have to pay on most purchases, depending on your location. Many online sellers have asked themselves, "Do I need to collect sales tax for selling online?"

The answer is overwhelming, but it's not complicated as long as you have a tax guide like this one. Inside, we'll break down the basics of sales tax for online sellers and help clear up any confusion.

It's important for small business owners to be aware of their legal obligations. Fortunately, with a little knowledge about how tax law works, you can avoid many headaches by being compliant. We'll explain each part step by step so that by the time you finish this post, you'll be a bona fide sales tax expert. Let's get started!

Also known as ecommerce sales tax, internet sales tax is the small percentage you collect when you make an income from selling your product online. You must accurately assess sales taxes and pay them to the proper state tax authorities.

In the US, most states require online businesses to collect sales tax. On top of this, you need to check the cities and countries you sell in and see if they have special taxing districts, AKA special assessment districts.

Let's say your online business is currently located in Los Angeles, California.

| Los Angeles Tax Breakdown as of 2022 | |

| California | 6% |

| Los Angeles City | 0.25% |

| Los Angeles County Local Tax Sl. | 1% |

| Los Angeles County District Tax Sp. | 2.25% |

| Minimum Total of Sales Tax Rate | 9.5% |

As of 2022, the city of Los Angeles, California, requires businesses to pay a 9.6% tax rate from their sales and revenue. The final computation of your tax rate is determined by the exact location of your business.

The exact location of your business determines the taxes you have to file. You're responsible for charging the correct sales tax and remitting the right amount of tax rate back to your respective state. But what does this fancy term "sales tax nexus" even mean?

It's a legal term of the state that means "to be on the hook." If you have a place of business, it means you have a physical presence that the state can tax you on. It could be a:

Generally speaking, online businesses don't pay sales taxes if they don't have a nexus. But for many years, states have been arguing about not being able to collect sales taxes from online business owners simply because these marketplace sellers don't have enough sales within their located state to generate taxes.

But the burden shifted back to the seller since the US Supreme Court ruling over South Dakota v. Wayfair in June 2018. Sales tax nexus laws have changed on when and how to collect taxes. As a result, complying with tax prerequisites for online retailers, especially small to medium businesses, has gotten much messier.

The ruling changed how online businesses collect and charge sales taxes. Many states have the power to charge sales taxes on online businesses even without a nexus. But as of now, the status of this new tax law hasn't been passed as a federal law, which is good news for small businesses in some states.

Yes, you still need to collect sales taxes in different states if you have:

Most tangible property is taxable. But some states make tax exemptions for certain products.

Let's go back to California once more. If you are a marketplace seller that offers furniture, toys, and clothing, your products are subject to sales tax. In addition, some labor services and costs associated are even taxable if they are connected to producing new personal property.

But there are sales tax exemptions in California, such as:

Once you have learned that your business is taxable, you must take steps to ensure tax compliance. This means filing the appropriate tax forms and making sure that your tax liability is up to date. By taking the time to file for tax compliance, you can help protect your business and avoid costly penalties.

Don't skip this crucial step when collecting sales tax. Unfortunately, most states consider it illegal and penalize businesses that collect sales tax without a tax permit. So instead, we suggest you contact the Department of Revenue of your state to learn more about registering your business for sales tax collection.

Like each state's calculation of sales tax nexus, the state assigns how frequently you will file your sales tax—either monthly, quarterly, or annually. When your sales tax due date comes, it is your job to state how much you've collected.

Reporting your sales tax is easy if they want to see only the total of your sales tax collection. However, most states want to know how much you've collected in each county, city, state, and other special taxing districts in your nexus.

The verdict is in, and, as expected, the Supreme Court's decision in South Dakota v. Wayfair has had a massive impact on online sales tax laws across the US. As a result, states are now scrambling to put new rules and regulations governing how and when sellers must collect sales tax based on their customers' physical location.

Suppose you're an online seller doing business in more than one state. In that case, it's important to understand the implications of this ruling and take action to ensure you are compliant with all applicable sales tax laws.

Contact financial experts from Unloop today for help in navigating these murky waters and staying ahead of the curve for internet sales tax compliance.

Dominating the FBA business goes beyond intuition—it demands data-driven insights, predictive analytics, and a strategic approach. Fortunately, FBA forecasting is not merely an option for sellers; it’s now necessary for business success.

From inventory management to sales, harnessing the power of forecasting can accurately predict future demand to ensure you are well-prepared to meet customer expectations while maintaining healthy stock levels.

This article provides an in-depth look at the relevance of forecasting on Amazon and the strategies you can use to grow your FBA business. Knowing the dynamics will help you steer your business to sustainable growth.

Amazon FBA, or "Fulfillment by Amazon," has transformed how sellers conduct ecommerce operations. This powerful service taps into Amazon's extensive network of warehouses and logistics infrastructure, allowing sellers to scale their businesses without the burden of managing complex logistics.

One critical area where forecasting can take center stage is FBA inventory management. As you entrust your products to fulfillment centers, you must plan and strategize your inventory to meet customer demands while optimizing costs and resources.

Let’s know more about its inventory role:

Inventory forecasting uses sales history, market trends, and pricing information to anticipate the future demands for a company’s products. By analyzing past sales patterns and external market factors, you can determine how much inventory to maintain, when to restock, and how to strengthen the supply chain.

You can get a clear picture of your current inventory status through inventory forecasting software. Its informed predictions help you identify if your business can fulfill its long-term and short-term obligations to Amazon FBA.

Unlike inventory forecasting, demand forecasting involves analyzing customer demand to envision future market needs. You can make strategic decisions about production, marketing, and resource allocation by assessing customer behavior.

With an accurate demand forecast, you can maintain the right inventory level, keep your supply chain running smoothly, and address any potential issues before they arise.

Running out of stock can severely impact your FBA business, resulting in lost sales and disappointed customers. A well-optimized inventory management system, fueled by accurate forecasting insights, minimizes the risk of stockouts, helping you maintain a consistent supply of products.

Sufficient inventory is vital, but over-ordering can lead to excess inventory and increased storage costs. This is where forecasting works. With this technique, you can review your past sales data, seasonal patterns, and other factors affecting your inventory planning. You can also avoid any surplus in the future.

Sales are the lifeblood of any Amazon FBA business. Without consistent sales, the entire FBA model would be rendered ineffective. As a seller leveraging FBA service, your primary goal is to present products that deeply resonate with customers, spurring high conversion rates.

Sales forecasting is the key to building a thriving enterprise in the marketplace. But how does it contribute to your transformation?

A precise sales forecast can establish meaningful KPIs (Key Performance Indicators), track your progress, and measure the success of your strategies. These important metrics and KPIs may include:

| Metrics and KPIs | |

| 📈 | Sales History: Evaluate your historical sales data to identify patterns and fluctuations in demand. |

| 🏆 | Sales Rank: Measure the performance of your product categories against competitors in the marketplace. |

| 📊 | Product Sales Forecasts: Estimate future sales based on historical data and sales trends. |

Advertising and social media are business components that improve demand forecast accuracy. By running ad campaigns on search engines like Google, you can generate data on customer engagement and behavior, which can be integrated into demand forecasting models.

Social media platforms also have much information on customer sentiment, interests, and feedback. From there, you can fine-tune your product line and promotional tactics.

3. Competitor Analysis

Even in the world of Amazon FBA, competition remains fierce. Sellers must navigate through various challenges to stand out and succeed. These challenges include: optimizing pricing strategies, enhancing product listings, and boosting product rankings to secure visibility.

Adding competitor analysis into your forecasting process boosts your knowledge of competitors' successful tactics. By benchmarking against industry peers, sellers can set realistic goals and determine where to outperform others, thus gaining a competitive advantage.

In order fulfillment, strong management is critical for maintaining a smooth and efficient supply chain. This process encompasses every step, from customer order to final delivery. It involves coordinating inventory levels, managing order fulfillment, and ensuring timely and accurate customer shipping.

Effective order management relies on data-driven insights and proactive planning, which can be achieved through forecasting. Let’s find out how forecasting functions in order management.

A purchase order (PO) is a legal document that outlines the items or services a buyer intends to purchase from a supplier. In the context of FBA forecasting, purchase orders play a significant role in managing inventory replenishment. Creating and tracking POs allow you to maintain accurate order records and negotiate favorable procurement terms with suppliers.

You can effectively take advantage of forecasting management if you pay close attention to the following:

| Purchase Orders | |

| 🛒 | Product Details: Include precise information about the items you order, such as SKU, quantity, and unit price. |

| 🚚 | Delivery Terms: Specify the terms, shipping method, and expected delivery date. |

| 💰 | Payment Terms: Agree upon the payment terms with your supplier, including the payment method and due date. |

Determining optimal order intervals and minimum order quantities (MOQ) is important for efficient inventory management. The order interval is the period between two consecutive purchase orders, while the MOQ is the lowest quantity of a product that a supplier agrees to sell.

Striking a balance between MOQ and order frequency can refine your purchasing costs and inventory carrying costs.

Service levels represent the percentage of orders that can be fulfilled upon customer request. High service levels signify substantial orders being fulfilled without delays or stockouts, leading to satisfied customers and positive experiences.

Monitoring service levels is an ongoing process, demanding continuous evaluation and adjustment. In this case, accurate forecasting is a reliable ally, alleviating stress and burden by furnishing invaluable insights into inventory management and order processing.

Product development in the Amazon FBA business focuses on introducing novel products or enhancing existing ones to cater to buyers’ preferences. Accurate forecasting equips sellers to make smarter decisions throughout the product development lifecycle.

Allow us to explore the workings of forecasting in this FBA area.

New products are essential for keeping your Amazon FBA store fresh and appealing to customers. But sometimes, it is prone to inherent uncertainties and risks. This is where forecasting becomes invaluable.

Before launching a new product, you can conduct market research on customer demand, competition, and potential sales opportunities. Making educated projections about the new product's potential success is also attainable.

By studying the performance of similar products in the market, you can gauge customer preferences, expect sales trends, and align your brand to meet those expectations.

Vendor relations thrive when sellers maximize forecasting to its fullest potential. By incorporating forecasting into their operations, they can cultivate strong and transparent relationships with their vendors, modifying various aspects of collaboration.

Forecasting allows sellers to communicate their demand and production requirements to vendors, boosting transparency and aligning expectations. This situation facilitates smoother procurement processes, as vendors can plan and allocate resources to meet the projected demand.

Forecasting also aids in negotiating favorable terms with vendors. Armed with projections of future sales and order volumes, you can get an advantage in negotiating pricing, knowing minimum order quantities, and getting lead times—all of which are useful in your overall profitability.

Financial planning in Amazon entails projecting future revenues, expenses, and cash flow to sustain business operations, particularly with the fees associated with selling on the platform.

Accurate forecasting is fundamental to effective financial planning, enabling strategic resource allocation, well-informed investment strategies, and a healthy financial position.

Delve into the intricate dynamics of forecasting within this specific area of Amazon FBA.

The right pricing strategy can directly impact sales, customer perception, and overall business performance. Setting prices too high may lead to limited sales and potential loss of customers to competitors, while pricing products too low may result in reduced profit margins.

Accurate pricing, guided by market research, competitor analysis, and data-driven insights, allows FBA sellers to position their products competitively, attract customers, and optimize revenue.

As cash flow refers to the movement of funds in and out of business, managing it efficiently ensures that FBA sellers have the necessary liquidity to cover expenses, invest in growth opportunities, and fulfill financial obligations promptly.

By accurately forecasting cash inflows and outflows, sellers can make better financial decisions, maintain financial stability, and seize possibilities for expansion and innovation.

Expense management involves assessing and diminishing costs across various areas, including inventory sourcing, storage fees, advertising, packaging, shipping, and operational expenses.

With forecasting, you know where to implement cost-saving measures, negotiate better terms with suppliers, and streamline operations.

Developing and refining your forecasting strategies means staying agile and responsive. A proactive approach to growth and anticipating market changes will be instrumental in cementing your brand's success in the competitive FBA world. Keep working at it with confidence and knowledge, and your business will have a higher chance of thriving.

If you are pressed for time or uncertain about handling data and numbers, fret not, for Unloop is here to lend a helping hand. We can help you project into the future and make quick, informed changes to manage your business outcomes.

As your business evolves, so do your future sales with the help of our comprehensive forecasting service. Book a discovery call now!

Dominating the FBA business goes beyond intuition—it demands data-driven insights, predictive analytics, and a strategic approach. Fortunately, FBA forecasting is not merely an option for sellers; it’s now necessary for business success.

From inventory management to sales, harnessing the power of forecasting can accurately predict future demand to ensure you are well-prepared to meet customer expectations while maintaining healthy stock levels.

This article provides an in-depth look at the relevance of forecasting on Amazon and the strategies you can use to grow your FBA business. Knowing the dynamics will help you steer your business to sustainable growth.

Amazon FBA, or "Fulfillment by Amazon," has transformed how sellers conduct ecommerce operations. This powerful service taps into Amazon's extensive network of warehouses and logistics infrastructure, allowing sellers to scale their businesses without the burden of managing complex logistics.

One critical area where forecasting can take center stage is FBA inventory management. As you entrust your products to fulfillment centers, you must plan and strategize your inventory to meet customer demands while optimizing costs and resources.

Let’s know more about its inventory role:

Inventory forecasting uses sales history, market trends, and pricing information to anticipate the future demands for a company’s products. By analyzing past sales patterns and external market factors, you can determine how much inventory to maintain, when to restock, and how to strengthen the supply chain.

You can get a clear picture of your current inventory status through inventory forecasting software. Its informed predictions help you identify if your business can fulfill its long-term and short-term obligations to Amazon FBA.

Unlike inventory forecasting, demand forecasting involves analyzing customer demand to envision future market needs. You can make strategic decisions about production, marketing, and resource allocation by assessing customer behavior.

With an accurate demand forecast, you can maintain the right inventory level, keep your supply chain running smoothly, and address any potential issues before they arise.

Running out of stock can severely impact your FBA business, resulting in lost sales and disappointed customers. A well-optimized inventory management system, fueled by accurate forecasting insights, minimizes the risk of stockouts, helping you maintain a consistent supply of products.

Sufficient inventory is vital, but over-ordering can lead to excess inventory and increased storage costs. This is where forecasting works. With this technique, you can review your past sales data, seasonal patterns, and other factors affecting your inventory planning. You can also avoid any surplus in the future.

Sales are the lifeblood of any Amazon FBA business. Without consistent sales, the entire FBA model would be rendered ineffective. As a seller leveraging FBA service, your primary goal is to present products that deeply resonate with customers, spurring high conversion rates.

Sales forecasting is the key to building a thriving enterprise in the marketplace. But how does it contribute to your transformation?

A precise sales forecast can establish meaningful KPIs (Key Performance Indicators), track your progress, and measure the success of your strategies. These important metrics and KPIs may include:

| Metrics and KPIs | |

| 📈 | Sales History: Evaluate your historical sales data to identify patterns and fluctuations in demand. |

| 🏆 | Sales Rank: Measure the performance of your product categories against competitors in the marketplace. |

| 📊 | Product Sales Forecasts: Estimate future sales based on historical data and sales trends. |

Advertising and social media are business components that improve demand forecast accuracy. By running ad campaigns on search engines like Google, you can generate data on customer engagement and behavior, which can be integrated into demand forecasting models.

Social media platforms also have much information on customer sentiment, interests, and feedback. From there, you can fine-tune your product line and promotional tactics.

3. Competitor Analysis

Even in the world of Amazon FBA, competition remains fierce. Sellers must navigate through various challenges to stand out and succeed. These challenges include: optimizing pricing strategies, enhancing product listings, and boosting product rankings to secure visibility.

Adding competitor analysis into your forecasting process boosts your knowledge of competitors' successful tactics. By benchmarking against industry peers, sellers can set realistic goals and determine where to outperform others, thus gaining a competitive advantage.

In order fulfillment, strong management is critical for maintaining a smooth and efficient supply chain. This process encompasses every step, from customer order to final delivery. It involves coordinating inventory levels, managing order fulfillment, and ensuring timely and accurate customer shipping.

Effective order management relies on data-driven insights and proactive planning, which can be achieved through forecasting. Let’s find out how forecasting functions in order management.

A purchase order (PO) is a legal document that outlines the items or services a buyer intends to purchase from a supplier. In the context of FBA forecasting, purchase orders play a significant role in managing inventory replenishment. Creating and tracking POs allow you to maintain accurate order records and negotiate favorable procurement terms with suppliers.

You can effectively take advantage of forecasting management if you pay close attention to the following:

| Purchase Orders | |

| 🛒 | Product Details: Include precise information about the items you order, such as SKU, quantity, and unit price. |

| 🚚 | Delivery Terms: Specify the terms, shipping method, and expected delivery date. |

| 💰 | Payment Terms: Agree upon the payment terms with your supplier, including the payment method and due date. |

Determining optimal order intervals and minimum order quantities (MOQ) is important for efficient inventory management. The order interval is the period between two consecutive purchase orders, while the MOQ is the lowest quantity of a product that a supplier agrees to sell.

Striking a balance between MOQ and order frequency can refine your purchasing costs and inventory carrying costs.

Service levels represent the percentage of orders that can be fulfilled upon customer request. High service levels signify substantial orders being fulfilled without delays or stockouts, leading to satisfied customers and positive experiences.

Monitoring service levels is an ongoing process, demanding continuous evaluation and adjustment. In this case, accurate forecasting is a reliable ally, alleviating stress and burden by furnishing invaluable insights into inventory management and order processing.

Product development in the Amazon FBA business focuses on introducing novel products or enhancing existing ones to cater to buyers’ preferences. Accurate forecasting equips sellers to make smarter decisions throughout the product development lifecycle.

Allow us to explore the workings of forecasting in this FBA area.

New products are essential for keeping your Amazon FBA store fresh and appealing to customers. But sometimes, it is prone to inherent uncertainties and risks. This is where forecasting becomes invaluable.

Before launching a new product, you can conduct market research on customer demand, competition, and potential sales opportunities. Making educated projections about the new product's potential success is also attainable.

By studying the performance of similar products in the market, you can gauge customer preferences, expect sales trends, and align your brand to meet those expectations.

Vendor relations thrive when sellers maximize forecasting to its fullest potential. By incorporating forecasting into their operations, they can cultivate strong and transparent relationships with their vendors, modifying various aspects of collaboration.

Forecasting allows sellers to communicate their demand and production requirements to vendors, boosting transparency and aligning expectations. This situation facilitates smoother procurement processes, as vendors can plan and allocate resources to meet the projected demand.

Forecasting also aids in negotiating favorable terms with vendors. Armed with projections of future sales and order volumes, you can get an advantage in negotiating pricing, knowing minimum order quantities, and getting lead times—all of which are useful in your overall profitability.

Financial planning in Amazon entails projecting future revenues, expenses, and cash flow to sustain business operations, particularly with the fees associated with selling on the platform.

Accurate forecasting is fundamental to effective financial planning, enabling strategic resource allocation, well-informed investment strategies, and a healthy financial position.

Delve into the intricate dynamics of forecasting within this specific area of Amazon FBA.

The right pricing strategy can directly impact sales, customer perception, and overall business performance. Setting prices too high may lead to limited sales and potential loss of customers to competitors, while pricing products too low may result in reduced profit margins.

Accurate pricing, guided by market research, competitor analysis, and data-driven insights, allows FBA sellers to position their products competitively, attract customers, and optimize revenue.

As cash flow refers to the movement of funds in and out of business, managing it efficiently ensures that FBA sellers have the necessary liquidity to cover expenses, invest in growth opportunities, and fulfill financial obligations promptly.

By accurately forecasting cash inflows and outflows, sellers can make better financial decisions, maintain financial stability, and seize possibilities for expansion and innovation.

Expense management involves assessing and diminishing costs across various areas, including inventory sourcing, storage fees, advertising, packaging, shipping, and operational expenses.

With forecasting, you know where to implement cost-saving measures, negotiate better terms with suppliers, and streamline operations.

Developing and refining your forecasting strategies means staying agile and responsive. A proactive approach to growth and anticipating market changes will be instrumental in cementing your brand's success in the competitive FBA world. Keep working at it with confidence and knowledge, and your business will have a higher chance of thriving.

If you are pressed for time or uncertain about handling data and numbers, fret not, for Unloop is here to lend a helping hand. We can help you project into the future and make quick, informed changes to manage your business outcomes.

As your business evolves, so do your future sales with the help of our comprehensive forecasting service. Book a discovery call now!

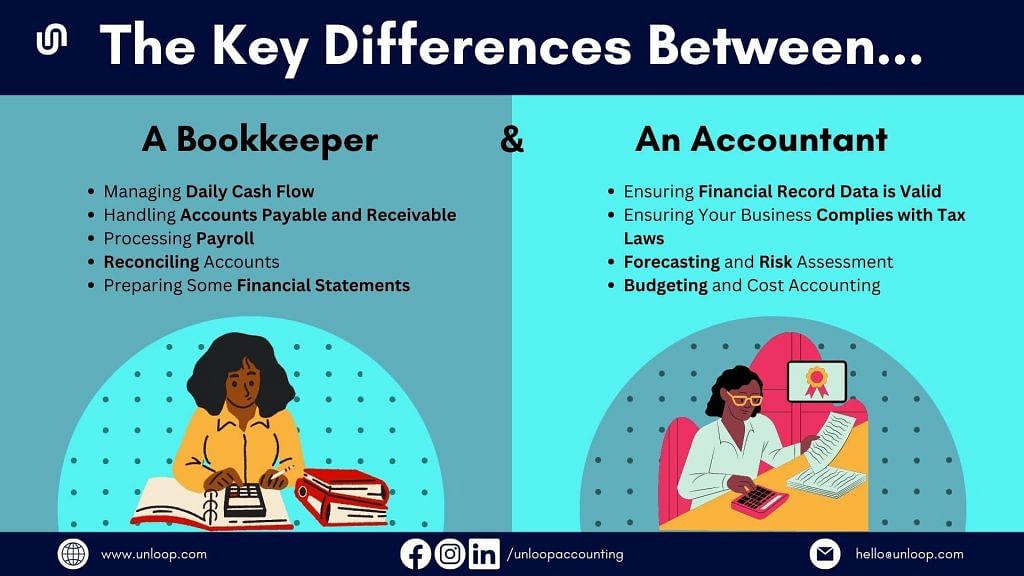

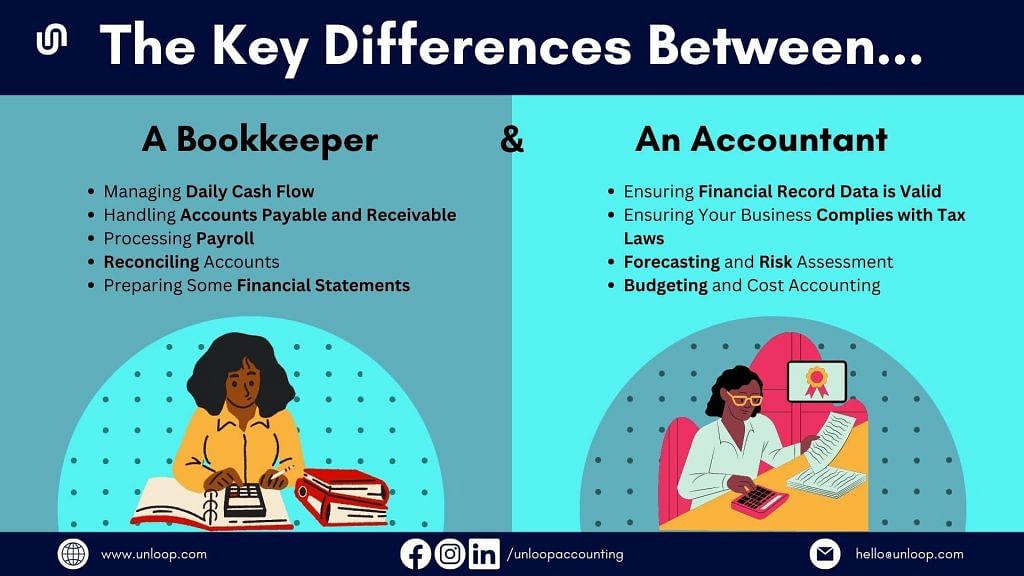

Outsourcing tasks for different business areas can be beneficial, especially when you're not well-versed in doing such things. When it comes to finances, you can get a bookkeeper or an accountant to help you. But what’s the difference between bookkeeping and accounting in the first place?

You've come to the right place if you're considering hiring either of the two (or both). We'll list the different responsibilities of bookkeepers and accountants so you can hire the proper help for your growing business.

Since they both involve managing a company's financial position, many use the terms bookkeeping and accounting interchangeably. However, they are vastly different.

Bookkeeping focuses on collecting, filing, and recording financial transactions. Bookkeepers focus on keeping things organized while accurately recording these business transactions.

The discipline of bookkeeping follows this cycle when recording business transactions.

There are two ways to do bookkeeping: single-entry and double-entry bookkeeping.

In the simplest sense, bookkeeping for startups means jotting down expenses and evening them out at the end of the week with the sales. This type of bookkeeping is called single-entry bookkeeping, which tracks only how much money goes in and out of the company without diving into the specifics.

While acceptable for small business owners, single-entry bookkeeping can leave much room for error, especially in financial reports. Since it lacks data, single-entry bookkeeping cannot produce a balance sheet. It will also be difficult to do taxes since the IRS does not allow single-entry bookkeeping to be used as a record for tax returns.

Compared to the previous type, double-entry bookkeeping is much more complicated. However, it can give you much more accurate financial reports. In double-entry bookkeeping, transactions are entered twice: once each for different accounting tools, debit and credit.

For example, if you make a loan, single-entry bookkeeping will label it as income. However, the interest attached to that loan will also become an expense.

On the other hand, if you enter a loan in double-entry bookkeeping, the system will label it as a debit, which is a liability more than an asset.

Double-entry bookkeeping can provide business owners with much more accurate reports and, since it logs debit and credit, can also provide a company with a balance sheet.

Accounting aims to evaluate financial information for a company or organization. It is about having an overall look at the business's financial data and interpreting that data to create sound decisions, such as acquiring business loans and expanding the business.

Accountants are more focused on understanding and analyzing the provided financial data. They provide consultations based on said data and are tasked to give out advice regarding financial decisions in business operations.

There are several subdisciplines under accounting, some of them are:

Accounting can be performed in two ways, depending on the company's financial situation.

Cash-basis accounting is a type of accounting that bases the business's current financial position on its immediate transactions. In cash-basis accounting, accountants record how much money goes directly into a business and how much they spend on expenses and figure out their net profit.

When accounting on a cash basis, accountants don't include delayed payments as part of the company's cash flow, making this method more limited than accrual accounting.

On the other hand, accrual accounting is a type of accounting that accounts for all assets and liabilities of a company. In this type of accounting, sales that have not been fulfilled yet are also included in the cash flow while also keeping track of expenses that have not yet been fulfilled.

With accrual accounting, business owners are given the whole picture of their company's financial situation. And with fulfilled and unfulfilled payments in their company's financial data, they can make long-term plans for their financial transactions and better understand their company's overall financial health.

Here are a few examples of accruals.

| Accrued Revenues | Accrued revenue is the money companies are expected to receive even before payment. Once revenue has been earned, a company’s accounting considers it the company’s money. |

| Deferred Revenues | Deferred revenue is the money a company receives for goods or services even before they have fulfilled their client’s demands. When a business makes deferred revenues, the amount is postponed from being included in a company’s revenue until the client’s demands have been met. |

| Accrued Income | Accrued income is the profit earned before payment. Unlike accrued revenue, accrued income is a company’s net profit. Accounting for accrued income does not include expenses attached to the sale of the goods or services that provided the income. |

| Accrued Expenses | Accrued expenses is the amount of money a company owes. When companies make loans or make purchases with long-term payment schedules, they log these expenses regardless of whether or not they fit the same accounting period. |

| Accounts Receivable | Accounts receivable is the amount of money a company expects to be paid. Invoices have already been sent for the money in accounts receivable, giving the company a concrete timeframe of when they expect to get the money. |

| Accounts Payable | Accounts payable is the amount of money a company owes to other people or businesses when they make purchases from them (in the form of goods or services). |

Hiring a trained professional to help you manage your business means allocating resources to pay them. But, of course, you want your hard-earned money to be worthy of the service you are getting.

So let's look at the different responsibilities of accountants and bookkeepers to help you further differentiate bookkeeping and accounting tasks.

Although they don’t necessarily need an accounting degree to perform the job, most people prefer hiring bookkeepers who have finished an associate’s or bachelor’s degree related to accounting or business.

Bookkeepers are trained and do not need state-mandated exams and certifications to do their job. On average, a bookkeeper's rate starts at $30 per hour.

Whether cash flow comes in plenty or slows down, tracking everything that comes in and out of your business is a way of telling if your business is doing well. Part of a bookkeeper's job is recording weekly business sales and expense transactions.

Because of modern technology, automated bookkeeping software is now available, making it easier for bookkeepers to record your data. Moreover, bookkeeping software instantly summarizes your transactions whether you want monthly, quarterly, or annual data.

It's common for small businesses to have suppliers instead of producing their own goods. Of course, you need to pay the suppliers for the goods they manufacture for you. You can work with several suppliers if your company sells various goods.

The bookkeeper must make payments to your suppliers. They can also make payments on behalf of your business for other necessary expenses.

In addition, as they make payments for your business, they are in charge of the collection. They send invoices to your clients to ensure all payments are made on time. They also record if payments and receivables come in late to ensure that your sheets remain balanced.

A bookkeeper's service may vary, and it can include processing payroll. For small businesses, bookkeepers can perform some duties of the HR department. For example, they can assist in processing paychecks and ensure employees get their pay accurately and on time.

Bookkeepers also reconcile accounts to maintain a company's financial integrity. They are well-equipped in identifying and finding errors in the books they maintain. Reconciling your accounts can fish out any inconsistencies in your company's accounting, which could single out any fraud or theft attempts within your business.

Businesses produce several financial statements. The data on these statements can tell if your business is stable or on the verge of failing. These statements are then given to licensed accountants to review and analyze.

Balance sheets, cash flow statements, income statements, and statements of equity are a few crucial financial documents that bookkeepers can produce.

A certified public accountant goes through a rigorous accounting degree and must pass state-mandated licensure examinations before offering services. A certified accountant's average rate is between $50–$100. It can go higher depending on their work experience.

The accountant's role is to ensure all data in the business's financial records are valid and accurate. Accountants are responsible for tracking any statement inconsistencies and pinpointing any problems. They will also be in charge of consulting with a bookkeeper when they see these inconsistencies.

Once everything is verified, accountants will be the ones to answer if auditors check on your business. They also present these statements to stakeholders and potential investors to help grow your business.

If bookkeepers record the cash flow in a business, the accountant makes sure you pay up correctly—especially taxes. Taxation is an important part of business, and you must comply with tax laws to run your business legally and smoothly.

Accountants file all tax returns for your business. Tax filing is done quarterly or annually, depending on the rule of your country's tax collection agency. Accountants ensure you file and declare taxes on time so you won't have to pay fines and other unnecessary expenses.

An accountant can examine your business's financial records to forecast your business's future. Besides records, there are other ways accountants can predict the direction of your business.

For example, the market research method uses how many people are potential buyers when a product is launched. This information can help you significantly enhance your sales.

Other forecasting methods may include factors like GDP, economic factors, trending, and data models, which can be used for long-term forecasts. Accountants can also help you plan your business's next step. Risk assessment lets you see if your actions will benefit your business growth.

Many small business owners tend to go big and be reckless with their decisions, causing failure. Accountants will be able to strategize with you along the way so your business resources won't go to waste. Their financial advice will help you allocate your resources to the right department.

Small businesses strive to make their processes more efficient to lessen their expenses. Budgeting within the business process is also in the job description of an accountant. They can pinpoint your business areas with unnecessary expenses that they think you can lessen.

Accountants can help you save money and allocate them to the other areas of your business you can improve.

As mentioned, modern technology has made accounting and bookkeeping easier. If you aren’t fond of letting other people handle the work, looking for affordable accounting and bookkeeping software with easy-to-use features is ideal.

These tools may vary according to their uses and features. Choosing the one most suited to your business is crucial.

This software is best for small businesses because it is affordable and, at the same time, effective. One of the best things about QuickBooks is its tools for different accounting tasks, such as creating professional invoices, taking payments, keeping tabs on expenses, and monitoring your cash flow.

Besides these, what makes QuickBooks attractive is its scalability. You can adjust your plan according to your business's size and needs. It is recommended for small businesses that wish to expand later on.

Another great choice of accounting software for small business owners is NetSuite because of its variety of features, including enterprise resource planning tools. Its automation makes it simple for businesses to collect and send invoices and get a clear picture of how they are doing financially.

FreshBooks is one of the best choices for those who still can't afford expensive plans. Despite its affordable price, this software is an all-in-one accounting solution that can provide essential bookkeeping services for your business.

FreshBooks also boasts easy-to-use features, which benefit those who don't have a background in accounting. FreshBooks is recommended for freelancers and new business owners.

This simple accounting software is best for microbusinesses with its basic features and affordability, allowing businesses to grow without spending big on accounting software programs. Its basic features include tax services and generating financial reports.

The difference between accounting and bookkeeping may be hard to spot as they both focus on the financial aspect of the business. To simplify, bookkeepers keep all financial transactions in an organized record. In comparison, accountants are the ones to analyze and interpret the data.

So which one is better for a small business? As you start, bookkeeping will be easier for you to handle. The accounting process can be a little trickier but still manageable. However, hiring both may be a good decision as your business grows and more cash flows into your company. For trusted bookkeepers and professional partnered accountants, book a call with Unloop at +1 877-421-7270 and talk to our professionals. We offer many different financial services to fit a small business's budget.

Outsourcing tasks for different business areas can be beneficial, especially when you're not well-versed in doing such things. When it comes to finances, you can get a bookkeeper or an accountant to help you. But what’s the difference between bookkeeping and accounting in the first place?

You've come to the right place if you're considering hiring either of the two (or both). We'll list the different responsibilities of bookkeepers and accountants so you can hire the proper help for your growing business.

Since they both involve managing a company's financial position, many use the terms bookkeeping and accounting interchangeably. However, they are vastly different.

Bookkeeping focuses on collecting, filing, and recording financial transactions. Bookkeepers focus on keeping things organized while accurately recording these business transactions.

The discipline of bookkeeping follows this cycle when recording business transactions.

There are two ways to do bookkeeping: single-entry and double-entry bookkeeping.

In the simplest sense, bookkeeping for startups means jotting down expenses and evening them out at the end of the week with the sales. This type of bookkeeping is called single-entry bookkeeping, which tracks only how much money goes in and out of the company without diving into the specifics.

While acceptable for small business owners, single-entry bookkeeping can leave much room for error, especially in financial reports. Since it lacks data, single-entry bookkeeping cannot produce a balance sheet. It will also be difficult to do taxes since the IRS does not allow single-entry bookkeeping to be used as a record for tax returns.

Compared to the previous type, double-entry bookkeeping is much more complicated. However, it can give you much more accurate financial reports. In double-entry bookkeeping, transactions are entered twice: once each for different accounting tools, debit and credit.

For example, if you make a loan, single-entry bookkeeping will label it as income. However, the interest attached to that loan will also become an expense.

On the other hand, if you enter a loan in double-entry bookkeeping, the system will label it as a debit, which is a liability more than an asset.

Double-entry bookkeeping can provide business owners with much more accurate reports and, since it logs debit and credit, can also provide a company with a balance sheet.

Accounting aims to evaluate financial information for a company or organization. It is about having an overall look at the business's financial data and interpreting that data to create sound decisions, such as acquiring business loans and expanding the business.

Accountants are more focused on understanding and analyzing the provided financial data. They provide consultations based on said data and are tasked to give out advice regarding financial decisions in business operations.

There are several subdisciplines under accounting, some of them are:

Accounting can be performed in two ways, depending on the company's financial situation.

Cash-basis accounting is a type of accounting that bases the business's current financial position on its immediate transactions. In cash-basis accounting, accountants record how much money goes directly into a business and how much they spend on expenses and figure out their net profit.

When accounting on a cash basis, accountants don't include delayed payments as part of the company's cash flow, making this method more limited than accrual accounting.

On the other hand, accrual accounting is a type of accounting that accounts for all assets and liabilities of a company. In this type of accounting, sales that have not been fulfilled yet are also included in the cash flow while also keeping track of expenses that have not yet been fulfilled.

With accrual accounting, business owners are given the whole picture of their company's financial situation. And with fulfilled and unfulfilled payments in their company's financial data, they can make long-term plans for their financial transactions and better understand their company's overall financial health.

Here are a few examples of accruals.

| Accrued Revenues | Accrued revenue is the money companies are expected to receive even before payment. Once revenue has been earned, a company’s accounting considers it the company’s money. |

| Deferred Revenues | Deferred revenue is the money a company receives for goods or services even before they have fulfilled their client’s demands. When a business makes deferred revenues, the amount is postponed from being included in a company’s revenue until the client’s demands have been met. |

| Accrued Income | Accrued income is the profit earned before payment. Unlike accrued revenue, accrued income is a company’s net profit. Accounting for accrued income does not include expenses attached to the sale of the goods or services that provided the income. |

| Accrued Expenses | Accrued expenses is the amount of money a company owes. When companies make loans or make purchases with long-term payment schedules, they log these expenses regardless of whether or not they fit the same accounting period. |

| Accounts Receivable | Accounts receivable is the amount of money a company expects to be paid. Invoices have already been sent for the money in accounts receivable, giving the company a concrete timeframe of when they expect to get the money. |

| Accounts Payable | Accounts payable is the amount of money a company owes to other people or businesses when they make purchases from them (in the form of goods or services). |

Hiring a trained professional to help you manage your business means allocating resources to pay them. But, of course, you want your hard-earned money to be worthy of the service you are getting.

So let's look at the different responsibilities of accountants and bookkeepers to help you further differentiate bookkeeping and accounting tasks.

Although they don’t necessarily need an accounting degree to perform the job, most people prefer hiring bookkeepers who have finished an associate’s or bachelor’s degree related to accounting or business.

Bookkeepers are trained and do not need state-mandated exams and certifications to do their job. On average, a bookkeeper's rate starts at $30 per hour.

Whether cash flow comes in plenty or slows down, tracking everything that comes in and out of your business is a way of telling if your business is doing well. Part of a bookkeeper's job is recording weekly business sales and expense transactions.

Because of modern technology, automated bookkeeping software is now available, making it easier for bookkeepers to record your data. Moreover, bookkeeping software instantly summarizes your transactions whether you want monthly, quarterly, or annual data.

It's common for small businesses to have suppliers instead of producing their own goods. Of course, you need to pay the suppliers for the goods they manufacture for you. You can work with several suppliers if your company sells various goods.

The bookkeeper must make payments to your suppliers. They can also make payments on behalf of your business for other necessary expenses.

In addition, as they make payments for your business, they are in charge of the collection. They send invoices to your clients to ensure all payments are made on time. They also record if payments and receivables come in late to ensure that your sheets remain balanced.

A bookkeeper's service may vary, and it can include processing payroll. For small businesses, bookkeepers can perform some duties of the HR department. For example, they can assist in processing paychecks and ensure employees get their pay accurately and on time.