Many aspiring business owners are eager to sell their products in Canada through Amazon.ca. After all, there is an ongoing belief that the ecommerce giant doesn’t collect general or provincial sales taxes there. But many have wondered: why is there no tax on Amazon Canada?

What’s more: do Amazon.ca sellers really not pay taxes for their transactions? As an Amazon seller, it's essential to know when to charge sales tax on items sold through this site and learn if Amazon automatically collects sales tax on behalf of their sellers.

Let’s investigate whether or not Amazon Canada collects sales taxes and answer related Amazon sales tax questions like when does Amazon collect sales tax in Canada, and when does it not?

Let’s begin our investigation by giving a hypothetical situation. Suppose a customer from British Columbia previously ordered from you, and you noticed that Amazon didn’t collect sales taxes during the transaction. How could that happen?

Every Amazon product sold in the United States is subject to sales tax based on the buyer's location. So why didn’t Amazon collect tax from this customer? Is there simply no sales tax collection on Amazon Canada?

There is, but sales tax collection in Canada works differently.

Unlike in the United States, Canadian tax laws apply Goods and Services Tax (GST) and Harmonized Sales Tax (HST) at the federal level. In contrast, Provincial Sales Tax (PST) is applied separately by individual provinces.

Because of this complex tax system, there are times when Amazon Canada doesn’t collect sales taxes for the seller; the seller has to do the collection and remittance themselves.

Certain sellers are also encouraged to create a GST or HST account with the Canada Revenue Agency (CRA) for tax compliance.

As a result, many sellers have been led to believe that sales tax collection and remittance are non-existent on Amazon Canada when this belief is completely false. Debunking this myth will logically lead you to ask: when does Amazon.ca collect tax?

The laws on Amazon sales tax in Canada leave no room for confusion: you need to collect sales tax. Amazon even makes the task easier for sellers by collecting sales taxes independently, especially in these situations.

Back in the day, you could sell online without the hassle of collecting sales tax from your customers until the Marketplace Facilitator (MPF) law took effect.

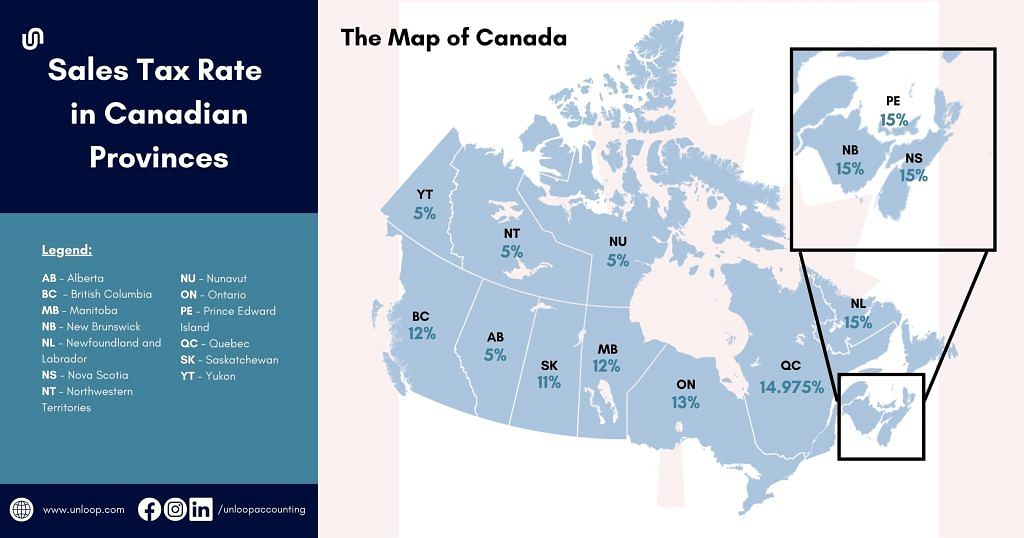

Canadian law bases sales tax charges on the established GST, PST, HST, and Quebec Sales Tax (QST) rates per province.

Suppose you fulfill orders in different provinces across Canada. In that case, Amazon will directly collect sales taxes and remit them to authorities for you as mandated by the MPF.

Amazon is already mandated to collect and remit sales taxes for you through the MPF. Still, Amazon's Tax Collection Service (TCS) can give you control and visibility of your sales tax.

If you have an Amazon professional account, you can log in on Seller Central to optimize the following:

This service particularly helps if you also sell in locations not under MPF jurisdiction. In these cases, TCS can collate sales tax data for you when tax remittance season comes.

Almost all products sold in Canada are taxable, from soft drinks and candies to clothing and footwear. If your products are not tax-exempt and zero-rated goods, you must charge GST, HST, PST, or QST accordingly.

These categories are already defined on Amazon TCS, but you can further customize them. Know your products well to tag them as taxable or tax-exempt.

You must have already figured out whether collecting taxes for your products is under your care or Amazon's. Now, here is some more helpful information on when Amazon does not collect sales taxes

To explain our earlier hypothetical example, British Columbia was previously not under MPF jurisdiction, meaning it was the seller’s responsibility to collect and remit sales taxes from orders from the province, not Amazon’s.

However, online marketplaces like Amazon, eBay, and Facebook are now required to collect provincial sales taxes for their sellers—something that started on July 1, 2022. This change happened because of the law passed by the British Columbian government in June 2022.

If the law changes and removes certain provinces from MPF jurisdiction, you may alternatively delegate the task to sales tax support services to make tax collection and remittance easier.

When you have access to the TCS, you can optimize the settings to exempt the following groups and populations:

The law mandates that if you sell goods that fall under the following classifications, they should be zero-rated:

Include these details in the TCS to exempt your buyers from paying sales tax.

Amazon.ca will collect and remit sales tax if the province is under MPF jurisdiction, the seller is registered with TCS, and their goods are taxable. Meanwhile, Amazon won’t collect and remit taxes if the destination is not under MPF jurisdiction and the seller has zero-rated or tax-exempt products.

After determining sales tax, you need to reconcile all data from TCS with your accounting books to help you with your Amazon seller accounting.

Sounds complicated? Unloop can help you! Our team of experienced bookkeepers will keep your books updated year-round to prepare you for tax season.

We know how important it is for Canadian sellers to stay compliant with tax laws, so skip the hassle of computing your taxes and leave it to us.

If you are interested in getting expert bookkeeping assistance, call us at 877-421-7270. We'd love to discuss our offers with you!

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.