Outsourcing tasks for different business areas can be beneficial, especially when you're not well-versed in doing such things. When it comes to finances, you can get a bookkeeper or an accountant to help you. But what’s the difference between bookkeeping and accounting in the first place?

You've come to the right place if you're considering hiring either of the two (or both). We'll list the different responsibilities of bookkeepers and accountants so you can hire the proper help for your growing business.

Since they both involve managing a company's financial position, many use the terms bookkeeping and accounting interchangeably. However, they are vastly different.

Bookkeeping focuses on collecting, filing, and recording financial transactions. Bookkeepers focus on keeping things organized while accurately recording these business transactions.

The discipline of bookkeeping follows this cycle when recording business transactions.

There are two ways to do bookkeeping: single-entry and double-entry bookkeeping.

In the simplest sense, bookkeeping for startups means jotting down expenses and evening them out at the end of the week with the sales. This type of bookkeeping is called single-entry bookkeeping, which tracks only how much money goes in and out of the company without diving into the specifics.

While acceptable for small business owners, single-entry bookkeeping can leave much room for error, especially in financial reports. Since it lacks data, single-entry bookkeeping cannot produce a balance sheet. It will also be difficult to do taxes since the IRS does not allow single-entry bookkeeping to be used as a record for tax returns.

Compared to the previous type, double-entry bookkeeping is much more complicated. However, it can give you much more accurate financial reports. In double-entry bookkeeping, transactions are entered twice: once each for different accounting tools, debit and credit.

For example, if you make a loan, single-entry bookkeeping will label it as income. However, the interest attached to that loan will also become an expense.

On the other hand, if you enter a loan in double-entry bookkeeping, the system will label it as a debit, which is a liability more than an asset.

Double-entry bookkeeping can provide business owners with much more accurate reports and, since it logs debit and credit, can also provide a company with a balance sheet.

Accounting aims to evaluate financial information for a company or organization. It is about having an overall look at the business's financial data and interpreting that data to create sound decisions, such as acquiring business loans and expanding the business.

Accountants are more focused on understanding and analyzing the provided financial data. They provide consultations based on said data and are tasked to give out advice regarding financial decisions in business operations.

There are several subdisciplines under accounting, some of them are:

Accounting can be performed in two ways, depending on the company's financial situation.

Cash-basis accounting is a type of accounting that bases the business's current financial position on its immediate transactions. In cash-basis accounting, accountants record how much money goes directly into a business and how much they spend on expenses and figure out their net profit.

When accounting on a cash basis, accountants don't include delayed payments as part of the company's cash flow, making this method more limited than accrual accounting.

On the other hand, accrual accounting is a type of accounting that accounts for all assets and liabilities of a company. In this type of accounting, sales that have not been fulfilled yet are also included in the cash flow while also keeping track of expenses that have not yet been fulfilled.

With accrual accounting, business owners are given the whole picture of their company's financial situation. And with fulfilled and unfulfilled payments in their company's financial data, they can make long-term plans for their financial transactions and better understand their company's overall financial health.

Here are a few examples of accruals.

| Accrued Revenues | Accrued revenue is the money companies are expected to receive even before payment. Once revenue has been earned, a company’s accounting considers it the company’s money. |

| Deferred Revenues | Deferred revenue is the money a company receives for goods or services even before they have fulfilled their client’s demands. When a business makes deferred revenues, the amount is postponed from being included in a company’s revenue until the client’s demands have been met. |

| Accrued Income | Accrued income is the profit earned before payment. Unlike accrued revenue, accrued income is a company’s net profit. Accounting for accrued income does not include expenses attached to the sale of the goods or services that provided the income. |

| Accrued Expenses | Accrued expenses is the amount of money a company owes. When companies make loans or make purchases with long-term payment schedules, they log these expenses regardless of whether or not they fit the same accounting period. |

| Accounts Receivable | Accounts receivable is the amount of money a company expects to be paid. Invoices have already been sent for the money in accounts receivable, giving the company a concrete timeframe of when they expect to get the money. |

| Accounts Payable | Accounts payable is the amount of money a company owes to other people or businesses when they make purchases from them (in the form of goods or services). |

Hiring a trained professional to help you manage your business means allocating resources to pay them. But, of course, you want your hard-earned money to be worthy of the service you are getting.

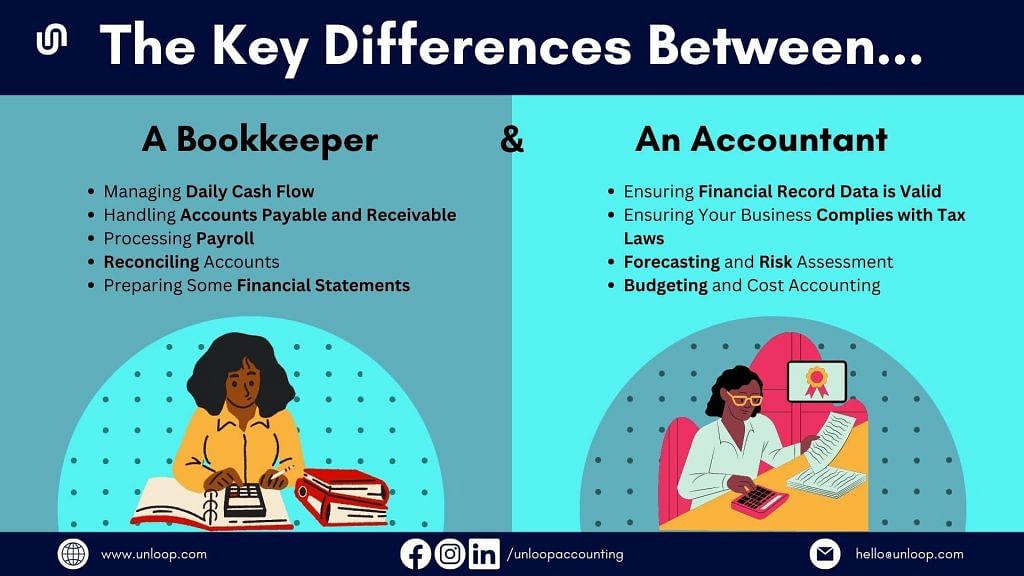

So let's look at the different responsibilities of accountants and bookkeepers to help you further differentiate bookkeeping and accounting tasks.

Although they don’t necessarily need an accounting degree to perform the job, most people prefer hiring bookkeepers who have finished an associate’s or bachelor’s degree related to accounting or business.

Bookkeepers are trained and do not need state-mandated exams and certifications to do their job. On average, a bookkeeper's rate starts at $30 per hour.

Whether cash flow comes in plenty or slows down, tracking everything that comes in and out of your business is a way of telling if your business is doing well. Part of a bookkeeper's job is recording weekly business sales and expense transactions.

Because of modern technology, automated bookkeeping software is now available, making it easier for bookkeepers to record your data. Moreover, bookkeeping software instantly summarizes your transactions whether you want monthly, quarterly, or annual data.

It's common for small businesses to have suppliers instead of producing their own goods. Of course, you need to pay the suppliers for the goods they manufacture for you. You can work with several suppliers if your company sells various goods.

The bookkeeper must make payments to your suppliers. They can also make payments on behalf of your business for other necessary expenses.

In addition, as they make payments for your business, they are in charge of the collection. They send invoices to your clients to ensure all payments are made on time. They also record if payments and receivables come in late to ensure that your sheets remain balanced.

A bookkeeper's service may vary, and it can include processing payroll. For small businesses, bookkeepers can perform some duties of the HR department. For example, they can assist in processing paychecks and ensure employees get their pay accurately and on time.

Bookkeepers also reconcile accounts to maintain a company's financial integrity. They are well-equipped in identifying and finding errors in the books they maintain. Reconciling your accounts can fish out any inconsistencies in your company's accounting, which could single out any fraud or theft attempts within your business.

Businesses produce several financial statements. The data on these statements can tell if your business is stable or on the verge of failing. These statements are then given to licensed accountants to review and analyze.

Balance sheets, cash flow statements, income statements, and statements of equity are a few crucial financial documents that bookkeepers can produce.

A certified public accountant goes through a rigorous accounting degree and must pass state-mandated licensure examinations before offering services. A certified accountant's average rate is between $50–$100. It can go higher depending on their work experience.

The accountant's role is to ensure all data in the business's financial records are valid and accurate. Accountants are responsible for tracking any statement inconsistencies and pinpointing any problems. They will also be in charge of consulting with a bookkeeper when they see these inconsistencies.

Once everything is verified, accountants will be the ones to answer if auditors check on your business. They also present these statements to stakeholders and potential investors to help grow your business.

If bookkeepers record the cash flow in a business, the accountant makes sure you pay up correctly—especially taxes. Taxation is an important part of business, and you must comply with tax laws to run your business legally and smoothly.

Accountants file all tax returns for your business. Tax filing is done quarterly or annually, depending on the rule of your country's tax collection agency. Accountants ensure you file and declare taxes on time so you won't have to pay fines and other unnecessary expenses.

An accountant can examine your business's financial records to forecast your business's future. Besides records, there are other ways accountants can predict the direction of your business.

For example, the market research method uses how many people are potential buyers when a product is launched. This information can help you significantly enhance your sales.

Other forecasting methods may include factors like GDP, economic factors, trending, and data models, which can be used for long-term forecasts. Accountants can also help you plan your business's next step. Risk assessment lets you see if your actions will benefit your business growth.

Many small business owners tend to go big and be reckless with their decisions, causing failure. Accountants will be able to strategize with you along the way so your business resources won't go to waste. Their financial advice will help you allocate your resources to the right department.

Small businesses strive to make their processes more efficient to lessen their expenses. Budgeting within the business process is also in the job description of an accountant. They can pinpoint your business areas with unnecessary expenses that they think you can lessen.

Accountants can help you save money and allocate them to the other areas of your business you can improve.

As mentioned, modern technology has made accounting and bookkeeping easier. If you aren’t fond of letting other people handle the work, looking for affordable accounting and bookkeeping software with easy-to-use features is ideal.

These tools may vary according to their uses and features. Choosing the one most suited to your business is crucial.

This software is best for small businesses because it is affordable and, at the same time, effective. One of the best things about QuickBooks is its tools for different accounting tasks, such as creating professional invoices, taking payments, keeping tabs on expenses, and monitoring your cash flow.

Besides these, what makes QuickBooks attractive is its scalability. You can adjust your plan according to your business's size and needs. It is recommended for small businesses that wish to expand later on.

Another great choice of accounting software for small business owners is NetSuite because of its variety of features, including enterprise resource planning tools. Its automation makes it simple for businesses to collect and send invoices and get a clear picture of how they are doing financially.

FreshBooks is one of the best choices for those who still can't afford expensive plans. Despite its affordable price, this software is an all-in-one accounting solution that can provide essential bookkeeping services for your business.

FreshBooks also boasts easy-to-use features, which benefit those who don't have a background in accounting. FreshBooks is recommended for freelancers and new business owners.

This simple accounting software is best for microbusinesses with its basic features and affordability, allowing businesses to grow without spending big on accounting software programs. Its basic features include tax services and generating financial reports.

The difference between accounting and bookkeeping may be hard to spot as they both focus on the financial aspect of the business. To simplify, bookkeepers keep all financial transactions in an organized record. In comparison, accountants are the ones to analyze and interpret the data.

So which one is better for a small business? As you start, bookkeeping will be easier for you to handle. The accounting process can be a little trickier but still manageable. However, hiring both may be a good decision as your business grows and more cash flows into your company. For trusted bookkeepers and professional partnered accountants, book a call with Unloop at +1 877-421-7270 and talk to our professionals. We offer many different financial services to fit a small business's budget.

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.