Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Amazon, the largest global platform for product sales, offers unparalleled opportunities for ecommerce businesses. But taxes are also an ever-present reality that can lessen their hard-earned income. Can you really drop the drop shipping sales tax on Amazon? Let’s find out.

As an Amazon seller, you have the painstaking responsibility to collect sales tax for every purchase. But there is a silver lining in the form of dropshipping. This business model is one of the few ventures eligible for the coveted Amazon Tax Exemption Program (ATEP).

But how do you achieve tax-exempt status on Amazon via dropshipping?

In the upcoming sections, we will delve into the specifics, equipping you with the knowledge to implement this tax-saving hack.

We will cover everything from the eligibility criteria to the intricacies of sales tax compliance in dropshipping. Get ready to discover practical tips, actionable steps, and expert guidance that will enable you to position yourself for financial success on Amazon.

Embarking on your drop shipping journey means understanding the key parties involved:

Why is that?

The rules and regulations governing Amazon sales tax vary based on the locations of the buyer, seller, and third-party supplier engaged in each transaction. Discerning the precise methods for collecting and remitting sales tax is paramount to avoid legal consequences.

Here are a few important things to consider if you use the dropshipping model for your business:

A sales tax nexus refers to the connection between a seller and a state, which requires you to collect and remit sales tax from customers in that state. Factors determining a sales tax nexus include having a physical presence, employees, or storing inventory in a state.

Nexus plays a crucial role in the context of dropshipping. If you have a nexus in a state where the sale occurs, collecting sales tax is paramount, even if you’re working with a third-party dropshipper. On the other hand, you’re exempted from collecting sales tax if you don’t have nexus.

In business, a foundational principle holds true: the end customer is responsible for paying the consumption tax, as they directly benefit from the final product. This tax specifically targets consumption, encompassing personal and expenditure purchases.

But when it comes to dropshipping, the sales tax process can get slightly confusing. You might wonder, “Am I obliged to pay tax on the orders I place with my suppliers? Is it the suppliers’ responsibility to collect tax?”

Here’s the good news: You’re not required to pay sales tax on purchases intended for resale. The key lies in a single requirement, which we will delve into in the next section.

If you want to resell products online, you will need a sales tax permit. In this case, it’s not only for collecting and remitting sales tax; this document also helps you apply for the Amazon Business’s Tax Exemption Program.

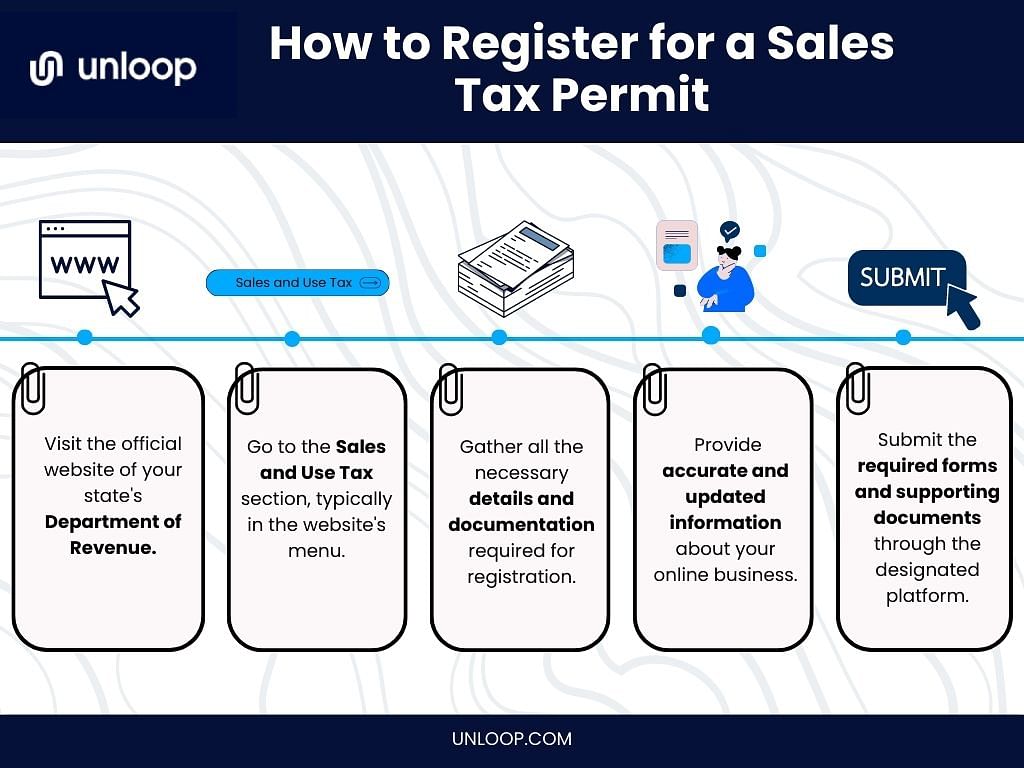

In most states, registering for a sales tax permit is relatively simple and can be completed online. Let’s help you get started.

Having your ducks in a row from the beginning is important as a business owner. This will ensure that you can always correctly identify yourself and your business when dealing with government agencies or financial institutions.

Double-check if you have the following proper documentation for your online business.

The State Department of Revenue is a vital government institution entrusted with tax collection and enforcement of tax laws. Each state operates its own Department of Revenue, overseeing taxation matters within its jurisdiction.

Here are things to remember about registering your online business:

Await confirmation and be patient about the issuance of your sales tax permit. Following these steps establishes your commitment to operating within legal frameworks.

Now that you have your sales tax permit, you're one step closer to getting your tax exemption status approved.

Next is heading over to your Amazon account and applying the following steps.

Online sellers under US law are required to collect sales tax in states with a physical presence or nexus. Amazon has used this loophole to its advantage, systematically avoiding collecting sales tax in most states.

Dropshippers can get Amazon tax exemption from some states, so be sure to check them before applying.

| States Subject to Tax But Can Apply For Tax Exemption | |

| Alabama | Nebraska |

| Arizona | Nevada |

| Arkansas | New Jersey |

| California | New Mexico |

| Colorado | New York |

| Connecticut | North Carolina |

| District of Columbia | North Dakota |

| Florida | Ohio |

| Georgia | Oklahoma |

| Hawaii | Pennsylvania |

| Idaho | Puerto Rico |

| Illinois | Rhode Island |

| Indiana | South Carolina |

| Iowa | South Dakota |

| Kansas | Tennessee |

| Kentucky | Texas |

| Louisiana | Utah |

| Maine | Vermont |

| Maryland | Virginia |

| Massachusetts | Washington |

| Michigan | West Virginia |

| Minnesota | Wisconsin |

| Mississippi | Wyoming |

| Missouri | |

Source: Amazon

You will notice that some places are not included in Amazon business tax-exempt. It's because these states do not levy sales taxes.

| Not Included in Amazon Business Tax-Exempt | |||

|---|---|---|---|

| Alaska (only some municipal governments) | New Hampshire | ||

| Delaware | Oregon | ||

| Montana | |||

Once you have determined the states in which you are seeking Amazon tax exemption, input the requested business information. This may include the business name and the type of products you're selling.

This step entails submitting essential documents such as your sales tax permit and other important tax-exempt records.

Sometimes, having a sales tax permit means having a resale certificate. But if you’re not confident about your eligibility, you must focus on obtaining exemption certificates.

When you purchase from the supplier, you must provide them with your complete exemption certificate. Then, the supplier will not charge you sales tax.

| Note: Some states may insist on their registration number on a separate form or on the MTC form itself for you to get a valid resale certificate. |

Don’t forget to double-check everything after you sign up for a resale certificate. Once you click “Activate Certificates, ” your Amazon tax-exempt status will take effect in 15 minutes. Meanwhile, Amazon Business will upload the Amazon Tax Exemption Certificates within 24 hours.

Collecting, remitting, or paying sales tax is the bare minimum requirement in Amazon, but you also need to stay compliant with rules and regulations. Fortunately, sellers can now apply for sales tax-exempt status.

Unloop can help you through the process and ensure everything is filed correctly so you can continue earning profits without penalty. Are you ready to get tax-free income? Book a call today, and let’s see what Unloop can do for you!

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.