Many entrepreneurs know that accounting for startups is unnecessary. A common rationale is that an early-phase startup involves only expenses in its financial transactions. During the early phase, the startup founder tries to build a new product without the certainty of commercial value.

Yet, accounting can also be the key to measuring how far the business has come and if it should continue. Let Unloop unpack the nature of startups, its typical operating procedures, and why founders should establish an accounting system early on.

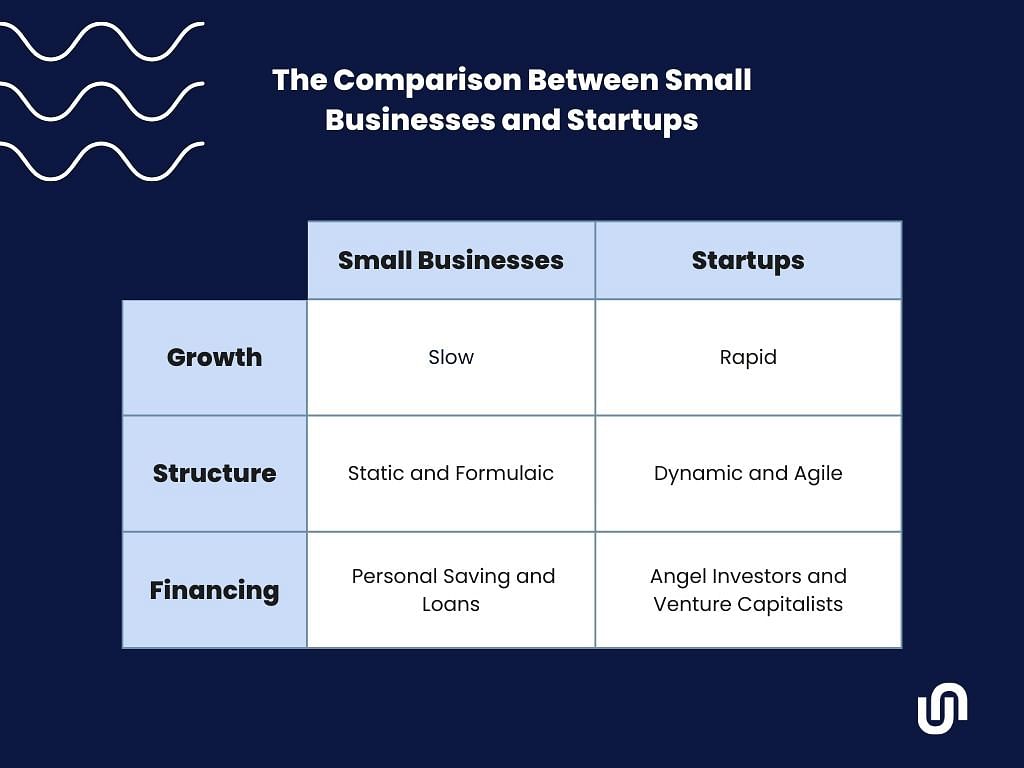

To a layman, a startup and a small business are interchangeable. However, differences in certain aspects of their structure and objectives, such as the following, separate the two.

When you think about a small business, what usually comes to mind are restaurants, cafes, or brick-and-mortar retail shops. Small businesses typically compete in a stable market with other businesses, projecting their growth to be slow and steady.

On the other hand, startups are built for rapid business growth, so startup businesses usually differ from conventional ones. For example, a startup restaurant would have a system different from regular restaurants. Otherwise, it remains a small business.

Typically, startups grow faster by creating innovative ventures that can disrupt an existing market. McDonald's is a great example of a startup—it changed the way food was made and inadvertently created a new industry: fast food.

A startup and a small business can have identical structures. But there is a high possibility a startup will switch to a business structure that best suits its goals, like growth. Fast growth requires a startup founder to be ready to scrap any ineffective parts of their organization. It is one of the key characteristics of a startup: instability. It is a process that involves high risks and high rewards.

Meanwhile, small businesses limit themselves to conventional, tried-and-true organizational structures. For example, if you run a restaurant, there is a natural hierarchy in the kitchen. There is a chef de cuisine, a sous chef, then the garde manger, and so on—and success in the industry means sticking to the formula.

Financing determines the major difference between a startup and a small business because their objectives stem from whoever is financing their operations. Since startups are risky, expensive ventures, they are usually funded by angel investors or venture capitalists for equity, from which they will expect quick returns in exchange for taking on most, if not all, of the exposure, hence the need for scalable growth.

A small business is usually self-funded, either from the owner's savings or a personal loan. Because funding comes from the owner's pocket, the risk exposure is high, so the owner tends to grow the business slowly to make sure decisions would lead to a steady flow of income.

Until the late 2000s, most people thought a startup was just another business. But since then, the idea of creating startups has become standardized and more focused on innovation, and it isn’t exclusive to big players.

It’s important to recognize this process in your own business for you to better navigate accounting under the context of a startup. Note the brief review of the method below.

Based on the methods laid out above, we can build a case for setting up startup accounting systems as early as possible. Here are some things that happen when you run a startup.

Whether you're innovating a disruptive solution or offering a simple product, the development will take time. Depending on the complexity of the product, it can be days or even years before you build your first MVP.

We've all heard of the adage time is money. So all the time spent renting a co-working space to brainstorm and develop a product will drain down the startup's business bank accounts. In certain cases, founders will lose track of their financial position and may need another round of funding to get off the ground.

Funding doesn't always have to come from the founder. In some cases, the founder may only have an idea, a skillset, and a few people willing to contribute labor. If they want the startup to take off, they'll need outside funding.

The best bet will be venture capitalists and private investors, and they will need to see how their investment is performing. So it's always a good idea to account for the money you're meant to grow. Financial records and bank statements give founders a rundown of transactions, but to keep track of where the fund is going, you need to generate financial reports, which makes accounting systems necessary.

In a typical scenario, people working in a startup are doing it part-time as a passion project. But once it gets off the ground, things can get more hands-on to the point that most or all the people involved in the project will need to work full-time.

When the founder and their team dedicate themselves to the project like regular employees, they'll need a salary to survive. This also means they have to pay taxes. That's where establishing an accounting system and hiring an accountant can help.

If there's a single expectation you should have before performing accounting for startups, it is that profits may not roll in soon. Like product development, it can take months or years to realize a positive bottom line.

By establishing an accounting system early on in the startup, you'll know through financial statements whether you're already making a profit from the day-to-day operations or are still on the road to paying your startup costs before the product launch.

When it comes to startups, the decision to establish an accounting system early on is often a low-priority task. That's reasonable, considering there is no business coming in yet. It's only when investors throw big money at it that founders begin to appreciate the benefits of accounting. But let us show you what getting your accounting fixed early will do for your startup.

For startups, establishing an accounting system can be as easy as subscribing to accounting software and having a team of experts run it part-time. An accountant or bookkeeper recording transactions and overseeing the startup's financial data helps place the foundation of the accounting process that will grow along with the startup.

This means no more headaches about planning the right processes later, as it can get more complex when the startup becomes a medium or large-scale business.

All the financial data should be recorded properly at the beginning. Even if it's all going to the expense account, it can become part of financial reports during the product development phase.

This information is useful to the founders and other stakeholders as it gives them an idea of the startup's financial health and how its budgeting resources.

Once the startup becomes a fully-operational business that earns profit, all the business transactions recorded also form part of the financial statement (i.e., the income statement, balance sheet, and cash flow statement). This information will be essential for evaluating how the business is doing.

Financial statements help owners see the business's financial health and make important business decisions, such as taking the company public, requesting another round of investments, or closing shop.

Another thing that happens with startups is disorganized finances. Some founders think that the money they toss into the de facto startup is unofficial as it isn't formally registered to any trade and commerce authority. So their personal finances, and perhaps along with their investors, are mixed into the startup as one and the same.

Knowing accounting basics and employing proper accounting methods from the get-go helps founders separate personal, investors, and startup business transactions. This makes reconciling bank statements and financial reporting for the startup smooth sailing in the long run.

Recall that when founders and the team start getting salaries for their work in the startup, they're obligated to remit payroll taxes, especially if the startup is already legalized.

Once the startup earns significant profits, it may be subject to different taxes. For example, income tax is one of the many financial obligations of any business entity. During tax season, they must file income tax returns to stay compliant. Establishing an accounting system early on and having it run by experts will make filing easier and more accurate.

Once you have an accounting system in place, you also have to run it on top of managing your startup. To most founders, this can be overwhelming, especially if their skillset leans toward building and running their own business.

Given this scenario, investing in bookkeeping software run by startup accountants from an outsourced accounting firm is a step in the right direction. Here are some ways it can make your life as a business owner easier.

Can you imagine handling your own accounting on top of everything? Accounting and bookkeeping services take away the extra stress from your job and allow you to spend more energy on running your business.

Outsourced accounting firms save you money since hiring accounting services is much cheaper than adding an entire team of accountants to your payroll.

Once you have your data ready, it's important you evaluate them accurately. But even if you have the most accurate books, the data in them won't matter unless you have an experienced team analyzing them for you.

Accounting services for startups follow generally accepted accounting principles (GAAP) and use either cash accounting or accrual accounting method depending on the startup business's needs. They also know how to analyze your financial reports specifically for your business's long-term goals. To do so, they will produce and analyze the following financial statements:

Any financial decision can make or break your startup—that's how volatile startups are. If you want it to grow continuously and produce adequate results, you'll have to make decisions that are nothing short of the best.

Accounting services for startups have an in-house team of seasoned accountants who specialize in launching your startup further. They can help make decisions concerning investments, stock options, and valuation. This is especially helpful for taxes since companies always struggle with the technical side of filing taxes and how to save money on tax returns.

Consider that even the smallest projects incur costs. To measure the project's success, the cost incurred to pull it off is always part of the equation. That goes the same for startups.

So whether you're in the ideation phase or already on your 100th iteration, an accounting system will help you count your costs. This gives you, the founder, the chance to recoup them. Unloop can help you establish an accounting system that fits your needs, whatever startup stage you're in. So book a call with us if you need your startup’s finances sorted, or check out our bookkeeping services now.

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.