Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

No matter how small your ecommerce business is, you still have a tax liability. If you live in Canada and sell a few items online, you must still pay taxes on your earnings. There are several different types of taxes that you may be responsible for, but let’s explore the essentials of filing income tax in Canada.

This blog post will break everything down about filing your income taxes. Keep reading to learn more!

Running an ecommerce business in Canada involves understanding and navigating the Canadian income tax system. It’s also important to note that the same tax laws apply whether you’re operating a brick-and-mortar or web-based business.

So, as a business owner, you are responsible for calculating and reporting your income and paying the required taxes to the Canada Revenue Agency (CRA).

Here are some of the basics of filing income taxes in Canada:

How you’re taxed and the forms you must fill out during tax time depends on your business structure. Since you’re managing an ecommerce business, it falls into one of these business structures:

Sole proprietorships and partnerships report their income on a personal tax return, while corporations file a separate corporate tax return. In some cases, a Canadian-controlled private corporation (CCPC) may be eligible for a reduced tax rate of 9%.

When calculating income tax, consider both federal and provincial or territorial rates. The federal income tax brackets for individuals range from 15% to 33%, whereas corporations pay a net tax rate of 15% with a basic rate of 38%, reduced to 28% after federal tax abatement.

Rates of territorial or provincial income taxes vary depending on your location. So, aside from your business structure, these rates also apply when paying your taxes.

For ecommerce businesses, it’s essential to charge sales tax on sales made to Canadian customers. If your annual revenue exceeds $30,000, you must charge the appropriate sales tax based on the destination province.

This involves registering for the Goods and Services Tax (GST) or Harmonized Sales Tax (HST) and remitting the collected taxes to the CRA.

In Canada, you can reduce your taxable income through tax deductions and credits. For small business owners like you, tax deductions can bump you into a lower tax bracket, reducing the amount of taxes you pay for the year.

All expenses incurred while operating your business are categorized as business expenses, and you can claim them as deductions on your tax return. For example, if you’re renting a warehouse to store your inventory, the utility costs you incur are a business deduction.

When filing your income tax, you may calculate the taxes owed or any refunds you may be entitled to. If you cannot make the full payment immediately, you can arrange a payment plan with the CRA.

On the other hand, if you overpaid your taxes, you may be eligible for a tax refund. Tax refunds could result from the CRA collecting more income tax than what was rightfully due, and they will refund the overpayment.

Businesses have to pay taxes like individual taxpayers based on their profit. Here are the types of taxes that may apply to your business:

Income tax is imposed on the earnings of individuals or companies involved in business activities. It is calculated based on your taxable income.

Some common types of income are employment income, pension income, investment income, and rental income. Even if you’re self-employed on your full-time business, you still have to pay for personal income tax.

If you’re selling on Amazon and other ecommerce platforms or creating paid content on YouTube, you’ll receive an income statement from these channels. You can use it for reporting within your tax return.

The sales tax in Canada varies depending on the province or territory in which you reside. There are three types of sales taxes: the GST, HST, and Provincial Sales Tax (PST).

The GST is a federal tax, while the PST and HST are levied by the provinces. If you’re registered for GST, you must charge GST on all taxable goods and services made in Canada. The tax rates also differ across provinces.

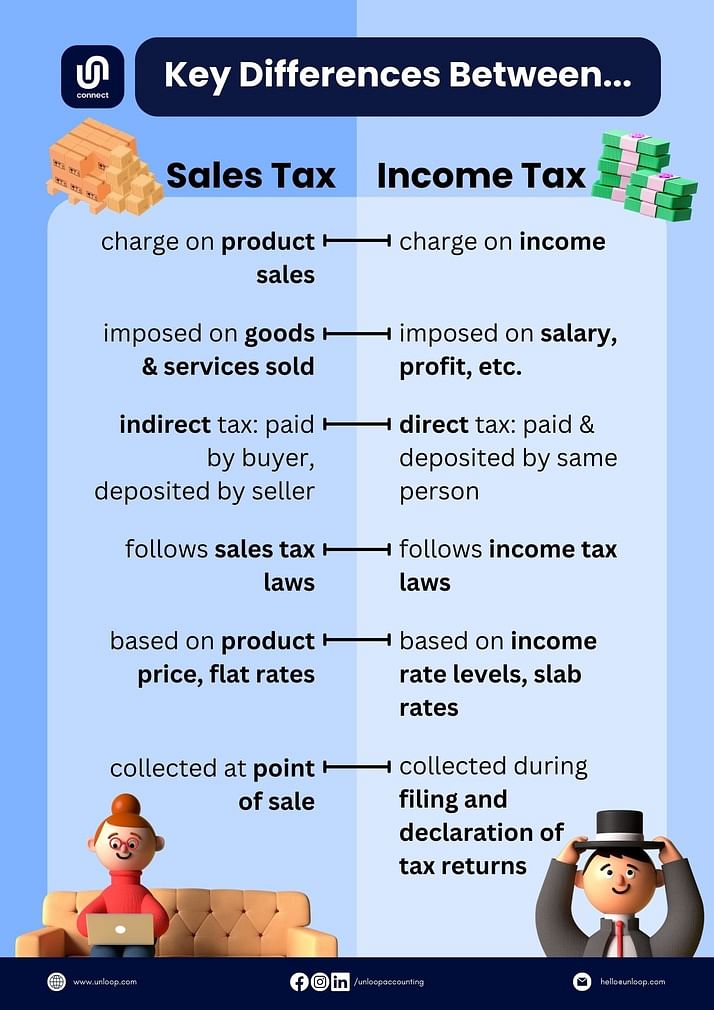

As a small business owner, income and sales taxes are most likely to be the taxes you’ll pay and charge. Here are the differences between the two:

Once your ecommerce business is registered as a corporation, you must pay corporate income tax on the taxable income it generates. The federal corporate income tax rate stands at 15%. Corporate income tax rates vary depending on the area of jurisdiction and the size of your business.

If you’re an ecommerce business owner with employees, you must withhold payroll taxes from your employees’ paychecks and remit them to the CRA. Payroll taxes include income tax, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI) premiums.

The income tax deductions depend on the employee’s income and personal exemptions declared on their TD1 form.

Filing your taxes can be painless if you take the time to stay organized throughout the year and know what to expect come tax season. Learn how to take the edge off when these tax deadlines are fast approaching.

Proper bookkeeping is essential to ensure a complete and accurate tax return. Keep track of all your income slips and receipts for deductible expenses throughout the year. This will help you stay organized and avoid costly tax filing mistakes.

The easiest way to file is to do it electronically. The income tax e-filing deadline will be less of a headache if you can pay using accounting or tax software. This typically results in a refund being issued in less than a month. Direct deposit is simple and effective. Plus, it’s more secure than sending a paper check.

What if you realized you added too many zeroes to your income tax return after filing it? Don’t panic - this is surprisingly common among many new and veteran business owners.

First, gather relevant information or documents to help you correct the mistake. Then, submit a completed Form T1 Adjustment Request and other supporting documents.

If the error resulted in paying more taxes, you must be prepared to pay the interest or penalties needed. On the other hand, if the mistake decreases your tax bill, the CRA can refund the amount.

If you are unsure about certain aspects of your tax return or require expert advice, it’s best to consult a tax professional. An accountant can help you with complex tax situations, navigate Canada’s unique tax regulations, and assist in finding deductions to maximize your return. Working with a professional will help save you time, stress, and even money in the long run.

That’s it for our tax tips for small online businesses! Tax filing might be overwhelming, especially if you’re still growing your ecommerce business. We also hope we have helped you better understand the Canadian income tax system more.

If you prefer someone else to handle your taxes, Unloop is here to help. With Unloop, you can easily and quickly file your taxes anytime, anywhere. There’s also no need to worry about making mistakes—our expert team will review your return and ensure everything is correct before filing.

We’ll also help you maximize your refund to get the most out of your hard-earning profits. So why wait?

Book a call with us, and we’ll help you in filing your tax returns!

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.