So you've taken the next big step. Congratulations! Starting a new business is no small feat. It must have taken months or years to get to where you are now, with loads of time to conceptualize and implement a business plan in between. However, before you truly hit the road, you must lay some solid groundwork first.

Running a company is a never-ending stream of rewarding successes accompanied by ever-expanding to-do lists. To consistently stay on top of your business, you'll have to keep track of the inevitable accounting duties. Bookkeeping that is accurate and up to date is the foundation of every profitable small business. Understanding bookkeeping best practices and when to hire business bookkeeping services is critical for keeping the company going smoothly now and in the future, regardless of the type of business you manage.

If learning the ins and outs of simple bookkeeping for small businesses sounds overwhelming, try to reel the information in slowly but surely. Learn about the various options open to you and why it is essential to maintain accurate financial records. But first of all, let's make sure we're on the same page.

Bookkeeping is the method of keeping records of any financial transaction made by a business from its inception to its closure. Each financial transaction is registered based on supporting documents, depending on the type of accounting method used for the company. That paperwork may be a receipt, an invoice, a sales order, or some form of the financial report demonstrating that the transaction occurred.

Bookkeeping transactions can be registered manually in a journal or inputted automatically using software such as QuickBooks bookkeeping services. Most companies now maintain accounts that display their financial expenses using advanced bookkeeping computer programs. To report financial transactions, bookkeepers may use either single-entry or double-entry bookkeeping. Bookkeepers must grasp the firm's accounting chart and how to manage the books using debits and credits.

Automation has been dominating in many industries, and for a good cause. After all, when an AI is taking care of most of the mundane tasks in your company, you gather yourself time and money to grow other aspects of your business. With that said, automation feels right at home with small business bookkeeping. The accounting process is filled with repetitive tasks that can pile on and add unnecessary workload to your employees. Modern accounting software is more than capable of automatically calculating important financial figures while simultaneously organizing your spreadsheets.

When shopping around for accounting software, it's a good idea to consider your company's storage, accessibility, and security needs. Don't go buying the first software that comes up on your google search. Instead, identify your needs first, so you can optimize your subscription costs and make the most out of the software.

Many situations will arise where you'll have to shoulder miscellaneous costs out of your pocket. While this might seem insignificant, it's good accounting practice to record those expenses in your company's records. Keep the business receipts and submit them to your accounting staff to reimburse you with a check. Reimbursing business-related costs should follow the same process as reimbursing your employees. This might include: Recording the details of your purchase on a spreadsheet (date, vendor, purpose, receipt), subsequently followed by an issuance of the reimbursement cheque. On that note, the cheque should be different from a salary cheque, so your bookkeeper can easily categorize the expense in your books.

Newsflash: It's a business. You're probably going to be getting an onslaught of paperwork. Accounting source papers are a recorded document of all your business' transactions. Source papers are essential in answering any queries or demonstrate proof for when the taxman comes knocking. Most tax authorities mandate companies to keep 5-7 years' worth of documents. This could include invoices, receipts, wage records, and other documents demonstrating a crumb trail of your business's financial transactions.

When your documents are in disarray, you'll be in a bind when you need a certain document. It'll be like finding a needle in a haystack. To avoid this issue, it's best to have an archiving system where you can organize files according to date, type of transaction, etc. Having an organized system also saves you money and time trying to procure documents that can no longer be found in any practicable time horizon.

It's easy to lose track of a business, especially with all the aspects that need attending to. This can lead to missing important tax filing deadlines. However, it's as easy as setting up a huge calendar or a google alert for important upcoming dates to ensure you never have to worry about missing it.

Harking back on number 3, when you have an organized archiving system, you can easily set up all the required documents so that you can be prepared ahead of time, which helps avoid all the fussing about during the busy tax season.

Late or unpaid invoices can leave plenty of frustratingly blank spaces in your spreadsheet. When running a business, it's your prime responsibility to develop a strategy for effectively following up and managing unfulfilled invoices. This could include writing down penalty clauses for late payments or having a contact team follow up consistently on the invoice.

As a rule of thumb, most firms assign a 30-day, 60-day, or 90-day category on late invoices, with a different strategy for each milestone. Of course, we'd all hate for it to reach the 90-day mark, but it doesn't hurt to be prepared. Late payments are incredibly impactful, especially for cash-intensive businesses.

The expense of hiring a bookkeeping service depends on a lot of variables. The rates can be influenced by the following:

If simple bookkeeping is what your business requires at this time, you'll need to consider whether to do it in-house or outsource it. If you wish to appoint and oversee a bookkeeper, you must also decide if the job is part-time or full-time. If you plan to outsource, you can choose between local bookkeeping agencies, local CPA firms that provide bookkeeping services, or specialized, global outsourced bookkeeping firms. Let's take a look at three different solutions that your organization could explore to meet this need.

Hiring a part-time bookkeeping service is more appropriate for small to medium-sized businesses. The costs of hiring such a service can vary greatly. Part-time bookkeepers are paid an average hourly rate of $20, which increases depending on the position or job description. Part-time bookkeepers are expected to perform basic bookkeeping tasks with your collaboration and consistent supervision.

A part-time bookkeeping service is an excellent choice if you're able to do a portion of your bookkeeping tasks and errands per month but need some assistance. You can expect your part-time bookkeeper to enter receipts and keep tabs on the employee timesheets, as well as organizing the accounts receivable and payable. When hiring a bookkeeper on a part-time basis, the management should check on the bookkeeper's job to ensure its speed and accuracy.

Some businesses take a shortcut by teaching a manager or an office employee the ropes on fulfilling part-time bookkeeping tasks. While this has a chance at success and is often the most budget-wise path for most businesses, the consequences of a steep learning curve and time spent can be detrimental to the business' productivity.

While the rates can vary depending on your location, the average rate of a full-time bookkeeper can be anywhere between $35,000 to $55,000 per year, on top of bonuses and overhead. As per GlassDoor's reports, a full-time bookkeeper working in high-cost cities like New York and Los Angeles could reach upwards to an amount of $70,000. Overheads can mean an additional 20% on top of the wage for office parking or lunch allowance.

A full-time bookkeeper is tasked with organizing the company's accounts daily. Having your accounts and documents organized and up to date is the core of a company's financial capabilities. Therefore, hiring a full-time bookkeeper for your growing company could spell out success for your long-term goals.

A full-time bookkeeper may be tasked with but not limited to activities such as fee payments, customer billings, timesheet organization and accounting, and laying down financial statements every end of the month. As the company owner, you would also need to double-check the final reports to ensure consistency.

To effectively outsource your bookkeeping responsibilities, you'll need to figure out what aspects of your financial management needs outsourcing. Outsourcing rates can vary depending on the volume of transactions and other factors you studied when hiring a part-time bookkeeper and defining their role. The estimated monthly cost of outsourcing a bookkeeping service can be anywhere between $500 to $2500. Outsourcing gives you the flexibility to customize what specific service your business needs.

You have the option of outsourcing more specialized accounting functions and controller roles in attaining a complete 'virtual accounting department", which would no doubt increase the pay scale but could be just what your business needs to accelerate its growth. Suppose the company is still in the developmental phase. In that case, you should consider making a move to full accrual accounting, with management and financial reporting that will make it easy to scale your business. This degree of complexity in financial management goes beyond your knowledge and will be instrumental for other business stakeholders such as investors, advisors, and banks.

If part-time or full-time bookkeeping seems to be limited to your business needs, choosing to go with a highly specialized bookkeeping firm may be the wisest choice.

There's plenty to learn, but the fact that you're reading this signifies that you have your business's best interest at heart. Acing your books right off the bat saves you headaches down the road. If you're unsure about organizing your finances, choosing any of the bookkeeping services above may be the right choice for you.

So you've taken the next big step. Congratulations! Starting a new business is no small feat. It must have taken months or years to get to where you are now, with loads of time to conceptualize and implement a business plan in between. However, before you truly hit the road, you must lay some solid groundwork first.

Running a company is a never-ending stream of rewarding successes accompanied by ever-expanding to-do lists. To consistently stay on top of your business, you'll have to keep track of the inevitable accounting duties. Bookkeeping that is accurate and up to date is the foundation of every profitable small business. Understanding bookkeeping best practices and when to hire business bookkeeping services is critical for keeping the company going smoothly now and in the future, regardless of the type of business you manage.

If learning the ins and outs of simple bookkeeping for small businesses sounds overwhelming, try to reel the information in slowly but surely. Learn about the various options open to you and why it is essential to maintain accurate financial records. But first of all, let's make sure we're on the same page.

Bookkeeping is the method of keeping records of any financial transaction made by a business from its inception to its closure. Each financial transaction is registered based on supporting documents, depending on the type of accounting method used for the company. That paperwork may be a receipt, an invoice, a sales order, or some form of the financial report demonstrating that the transaction occurred.

Bookkeeping transactions can be registered manually in a journal or inputted automatically using software such as QuickBooks bookkeeping services. Most companies now maintain accounts that display their financial expenses using advanced bookkeeping computer programs. To report financial transactions, bookkeepers may use either single-entry or double-entry bookkeeping. Bookkeepers must grasp the firm's accounting chart and how to manage the books using debits and credits.

Automation has been dominating in many industries, and for a good cause. After all, when an AI is taking care of most of the mundane tasks in your company, you gather yourself time and money to grow other aspects of your business. With that said, automation feels right at home with small business bookkeeping. The accounting process is filled with repetitive tasks that can pile on and add unnecessary workload to your employees. Modern accounting software is more than capable of automatically calculating important financial figures while simultaneously organizing your spreadsheets.

When shopping around for accounting software, it's a good idea to consider your company's storage, accessibility, and security needs. Don't go buying the first software that comes up on your google search. Instead, identify your needs first, so you can optimize your subscription costs and make the most out of the software.

Many situations will arise where you'll have to shoulder miscellaneous costs out of your pocket. While this might seem insignificant, it's good accounting practice to record those expenses in your company's records. Keep the business receipts and submit them to your accounting staff to reimburse you with a check. Reimbursing business-related costs should follow the same process as reimbursing your employees. This might include: Recording the details of your purchase on a spreadsheet (date, vendor, purpose, receipt), subsequently followed by an issuance of the reimbursement cheque. On that note, the cheque should be different from a salary cheque, so your bookkeeper can easily categorize the expense in your books.

Newsflash: It's a business. You're probably going to be getting an onslaught of paperwork. Accounting source papers are a recorded document of all your business' transactions. Source papers are essential in answering any queries or demonstrate proof for when the taxman comes knocking. Most tax authorities mandate companies to keep 5-7 years' worth of documents. This could include invoices, receipts, wage records, and other documents demonstrating a crumb trail of your business's financial transactions.

When your documents are in disarray, you'll be in a bind when you need a certain document. It'll be like finding a needle in a haystack. To avoid this issue, it's best to have an archiving system where you can organize files according to date, type of transaction, etc. Having an organized system also saves you money and time trying to procure documents that can no longer be found in any practicable time horizon.

It's easy to lose track of a business, especially with all the aspects that need attending to. This can lead to missing important tax filing deadlines. However, it's as easy as setting up a huge calendar or a google alert for important upcoming dates to ensure you never have to worry about missing it.

Harking back on number 3, when you have an organized archiving system, you can easily set up all the required documents so that you can be prepared ahead of time, which helps avoid all the fussing about during the busy tax season.

Late or unpaid invoices can leave plenty of frustratingly blank spaces in your spreadsheet. When running a business, it's your prime responsibility to develop a strategy for effectively following up and managing unfulfilled invoices. This could include writing down penalty clauses for late payments or having a contact team follow up consistently on the invoice.

As a rule of thumb, most firms assign a 30-day, 60-day, or 90-day category on late invoices, with a different strategy for each milestone. Of course, we'd all hate for it to reach the 90-day mark, but it doesn't hurt to be prepared. Late payments are incredibly impactful, especially for cash-intensive businesses.

The expense of hiring a bookkeeping service depends on a lot of variables. The rates can be influenced by the following:

If simple bookkeeping is what your business requires at this time, you'll need to consider whether to do it in-house or outsource it. If you wish to appoint and oversee a bookkeeper, you must also decide if the job is part-time or full-time. If you plan to outsource, you can choose between local bookkeeping agencies, local CPA firms that provide bookkeeping services, or specialized, global outsourced bookkeeping firms. Let's take a look at three different solutions that your organization could explore to meet this need.

Hiring a part-time bookkeeping service is more appropriate for small to medium-sized businesses. The costs of hiring such a service can vary greatly. Part-time bookkeepers are paid an average hourly rate of $20, which increases depending on the position or job description. Part-time bookkeepers are expected to perform basic bookkeeping tasks with your collaboration and consistent supervision.

A part-time bookkeeping service is an excellent choice if you're able to do a portion of your bookkeeping tasks and errands per month but need some assistance. You can expect your part-time bookkeeper to enter receipts and keep tabs on the employee timesheets, as well as organizing the accounts receivable and payable. When hiring a bookkeeper on a part-time basis, the management should check on the bookkeeper's job to ensure its speed and accuracy.

Some businesses take a shortcut by teaching a manager or an office employee the ropes on fulfilling part-time bookkeeping tasks. While this has a chance at success and is often the most budget-wise path for most businesses, the consequences of a steep learning curve and time spent can be detrimental to the business' productivity.

While the rates can vary depending on your location, the average rate of a full-time bookkeeper can be anywhere between $35,000 to $55,000 per year, on top of bonuses and overhead. As per GlassDoor's reports, a full-time bookkeeper working in high-cost cities like New York and Los Angeles could reach upwards to an amount of $70,000. Overheads can mean an additional 20% on top of the wage for office parking or lunch allowance.

A full-time bookkeeper is tasked with organizing the company's accounts daily. Having your accounts and documents organized and up to date is the core of a company's financial capabilities. Therefore, hiring a full-time bookkeeper for your growing company could spell out success for your long-term goals.

A full-time bookkeeper may be tasked with but not limited to activities such as fee payments, customer billings, timesheet organization and accounting, and laying down financial statements every end of the month. As the company owner, you would also need to double-check the final reports to ensure consistency.

To effectively outsource your bookkeeping responsibilities, you'll need to figure out what aspects of your financial management needs outsourcing. Outsourcing rates can vary depending on the volume of transactions and other factors you studied when hiring a part-time bookkeeper and defining their role. The estimated monthly cost of outsourcing a bookkeeping service can be anywhere between $500 to $2500. Outsourcing gives you the flexibility to customize what specific service your business needs.

You have the option of outsourcing more specialized accounting functions and controller roles in attaining a complete 'virtual accounting department", which would no doubt increase the pay scale but could be just what your business needs to accelerate its growth. Suppose the company is still in the developmental phase. In that case, you should consider making a move to full accrual accounting, with management and financial reporting that will make it easy to scale your business. This degree of complexity in financial management goes beyond your knowledge and will be instrumental for other business stakeholders such as investors, advisors, and banks.

If part-time or full-time bookkeeping seems to be limited to your business needs, choosing to go with a highly specialized bookkeeping firm may be the wisest choice.

There's plenty to learn, but the fact that you're reading this signifies that you have your business's best interest at heart. Acing your books right off the bat saves you headaches down the road. If you're unsure about organizing your finances, choosing any of the bookkeeping services above may be the right choice for you.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

These days, we're seeing a lot of popular accounting software programs offering different business solutions that make entrepreneurs' lives easier. Despite this abundance, it's still best to narrow down your options. We've done that for you by pitting two of the best software against each other: Peachtree vs. QuickBooks.

In this article, Unloop will tackle two of the most talked-about accounting software in business, Peachtree—also known as Sage 50—and QuickBooks. Naturally, these two must be on top of your choices, so let us help you decide by showing you a fair comparison that will help you weigh what's best for your own business.

As small business owners and accounting professionals, we must first consider accuracy when choosing accounting software. Managing and auditing your books with highly accurate solutions is paramount, and we know that both software is worth trying, especially if you're an owner looking for a risk-free option.

For ecommerce businesses, a mid-tier software is the practical choice when setting up an accounting system for the first time. Sage 50 and QuickBooks Online each offer one with the features that every business owner or accountant will benefit from. Let’s put them side by side for comparison.

| Sage 50 vs. QuickBooks: Mid-Tier Plan Key Feature Comparison | ||

| Features | Sage 50 Premium Accounting | QuickBooks Online Essentials |

| Number of users | 1 - 5 users | 1 - 3 users |

| Inventory tracking | Yes | No |

| Job costing | Yes | Yes |

| Cloud capabilities | Yes | Yes |

| Bank account sync | Yes | Yes |

| Invoice management | Yes | Yes |

| Insights and Reports | Yes | Yes |

| Track expenses | Yes | Yes |

| Payroll subscription | Separate module | Separate module |

| Fraud Protection | Yes | No |

| Support plan | Yes | Yes |

| Audit trail | Yes | Yes |

One of the biggest advantages of QuickBooks Online is its vast app integrations across many platforms, not just for accounting but for payroll and ecommerce with over 750 apps. Compared to Sage 50 with over 120 apps available in the marketplace, QuickBooks easily takes the lead for this criteria.

| Sage 50 vs. QuickBooks: App Integrations Feature Comparison | |

| Sage 50 | QuickBooks Online |

| Process and pay your employees with Sage 50 Payroll | Pay your people with Intuit Payroll |

| Tax-filing feature available in Sage50 Pro Accounting and higher | Avalara AvaTax lets you pay taxes conveniently |

| Connect Sage 50 to Xero using a third-party integration platform | Direct Xero-QuickBooks integration |

QuickBooks Online’s interface is user-friendly. When you pull up the software, you’ll first see a sidebar menu on the left side that has all the essential options you need such as the dashboard, banking, sales, taxes, and reports, to name a few.

The main section of QuickBooks Online’s interface gives you a straightforward design with few details, yet presents you with the necessary ones in a way that’s easy to digest.

Sage 50, on the other hand, gives more detail and looks tighter compared to most accounting software. They are generous with details, so you’ll often encounter windows and dialogue boxes that contain lists, dropdown boxes, radio buttons, and other key design features. This is perfect for business owners and managers who want more information and control on how they manage their finances.

| Sage 50 vs. QuickBooks: Layout and Design Comparison | |

| Sage 50 | QuickBooks Online |

| Detailed design with multiple tabs and screens | Simple and minimal design |

| Has a shortcut section on the software’s side menu | Includes every essential option on the side menu instead |

| Detailed top bar menu with similarities to MS Office’s top bar design | Top bar menu includes only several icons on the right side of the dashboard |

| Minimal graph representations of data | Highly visual graphs matched with data |

The good news is that both Sage 50 and QuickBooks Online graciously offer special discounts. Moreover, QuickBooks has a 30-day trial period, and Sage 50 lets you take a test drive or view an on-demand demo.

If you do decide to subscribe, here are the available plans.

QuickBooks Online has four plans with varying subscription prices and user capacity.

| QuickBooks Online Plan Comparison | ||||

| Simple Start | Essentials | Plus | Advanced | |

| Pricing | $15 / Month | $30 / Month | $45 / Month | $100 / Month |

| Users up to | 1 user | 3 users | 5 users | 25 users |

| Suitable for | Freelancers, micro-businesses, beginner accountants or non-professionals | Small businesses | Businesses needed inventory and project management | SMBs (small- to medium-sized businesses) |

PeachTree offers three tiers for their online accounting software. Each of the plans are also paid on subscription basis.

| Peachtree Online Plan Comparison | |||

| Pro Accounting | Premium Accounting | Quantum Accounting | |

| Pricing | $57.17 / Month | $82.09 / Month | $136 / Month |

| Users up to | 1 user | 5 users | 40 users |

| Suitable for | Solopreneurs and micro-businesses | Small businesses | MLBs (medium-sized to large businesses) |

Sage 50 isa tool you can install on a desktop computer. When you look for tools to help you track your business finances, this name will be among the first recommendations you will see. Here are its highlights.

Sage 50 has categorized its offers for different businesses: small, medium, and businesses of any size. So, owners can easily pick the services that fit the expanse of their venture. For instance, a small business offer includes cloud-based accounting, time and billing tracking, and workforce management. More and more bookkeeping and accounting features are added to the plans for other business sizes.

Sage’s service categorization for various industries differentiates it from other small business accounting tools. The software particularly flexes its reliability by being an accounting tool for several for-profit and non-profit industries. The tool’s features are tailor-fitted to satisfy the needs of the different trades.

Nevertheless, if you do not fall into any of the industries mentioned, you can still enjoy these features of Sage 50:

These offers will be included depending on the plan you subscribe to. The greater your investment, the more features you will get.

Not far behind, the accounting tool many businesses go to is QuickBooks. Similar to most software companies, its maker, Intuit, offers several product lines such as their top-of-the line QuickBooks Enterprise and their powerful starter, QuickBooks Essentials. But the most popular among ecommerce businesses is QuickBooks Online.

You can access this software on desktop computers and mobile phones. QuickBooks is equally reliable as Sage 50 because of the following features.

When you sign up for a QuickBooks plan, you'll enjoy its live bookkeeping immediately. This feature keeps your books up-to-date by ensuring that financial data from the start of the year to the current month are collected, categorized, and stored. If you sign-up midyear, bookkeepers will track whatever data is missing. Trained bookkeepers will update your books live from then on.

You'll also get to enjoy these traditional bookkeeping and accounting features by using QuickBooks:

Keeping your finances tracked has plenty of benefits, but one is being prepared when tax season comes. With QuickBooks, you'll be equipped with all the data you need. To ensure that all the data you submit for a tax audit is accurate, QuickBooks has a tax penalty protection that guarantees up to a $25,000 payment per year if you get any tax-related inaccuracies and errors from the tool.

Another perk that sets QuickBooks apart from its competitors is the Priority Circle. This service offers QuickBooks Advanced users in-depth training about software usage and 24/7 customer support. You won’t need to go the extra mile by looking for a QuickBooks training program, which will surely cost extra.

As two highly-sought accounting software, Sage 50 and QuickBooks understand what most businesses need when it comes to management. To be competitive, they have to expand what their software is capable of, extending them beyond bookkeeping and accounting. The result is a set of four features similar to each other yet delivered in their own unique ways.

You’ll enjoy the following offerings with both QuickBooks and Sage 50.

Make sense of all the details your bookkeeper has logged in and generate reports of your business income and expenses through accounting features of both QuickBooks and Sage 50. You can rely on both software to store and create accurate reports quicker than manual accounting. Software and third-party apps make the task very simple and less complex.

There are other accounting apps available such as Photeeq, FreshBooks, and Zoho Books. If you have important documents in another software, you can integrate them easily to QuickBooks or Peachtree as both software have the capabilities.

As a result, there will be no need to open several books and Excel sheets to check data because everything you need will be in one place. With these features, you can access real-time business data remotely and generate reports from the latest numbers.

Cloud-based technology is a way to secure data. Before, you’d store important information about the company on an office desktop, which anyone can access. Now, data can be stored in the cloud with impregnable security that requires special approval for each step.

The company's manager can control who can access business information through cloud-based accounting. In most cases, the company bookkeeper, accountant, and finance teams are the only people granted access. Then, everyone with access can see the same information no matter where you access the app.

You can reap plenty of benefits with accurate time tracking and project management. Among them are the following:

A small business owner must look for these convenient features in accounting software—both Sage 50 and QuickBooks offer them.

Everything these days is automated, so if you run into software that does not offer the automation expectations you have, strike it off your list. Regarding receiving and sending payments, generating invoices, storing receipts, and sorting all these transactions into categories for accounting, both QuickBooks and Sage 50 have got you covered.

So, get ready to link your payment gateways, receiving accounts, bank accounts, and credit cards to Sage 50 and QuickBooks so the software can track all direct deposits and expenses immediately. Wherever you are, when you receive a notification of payment or request to pay, you can process them instantly as long as there is an internet connection.

Both Sage 50 and QuickBooks have a service focused on human resource (HR) management, which is essential once you've grown your business and already managed several employees.

The HR feature is especially helpful if you have a diverse team of professionals working for you. This ensures employees' wellbeing is handled well according to the laws and regulations where your business operates.

Despite their similarities, the two accounting software also have to differentiate themselves to stand out. Here are the four key differences that may determine whether you'll choose Sage 50 or QuickBooks.

A prime difference between Sage 50 and QuickBooks is bookkeeping services. QuickBooks has a team of expert bookkeepers clients can consult with via appointment to check how their business is sailing. Once you sign up for QuickBooks’s full-service live bookkeeping, these professionals can help you cleanup your accounting data and do ongoing accounting and consultation.

The live bookkeeping function, however, is different with Sage. The Sage Live feature only offers real-time collaboration with people that handle your bookkeeping. As for providing a full service accountant, you’ll need to get your own.

In terms of accounting software interface, QuickBooks focuses more on a user-friendly interface with a clean-looking dashboard and a simplified side menu which helps users easily see and navigate through the sections to find out essential information.

Sage 50 gives more detail. It packs a lot of options on its dashboard which includes a sidebar menu and a top bar menu. Users can see different sections and icons on their screen for pointing to a specific segment you need to update or manage.

Accounting and bookkeeping are needed in all business types and sizes. Aside from offering general assistance, both Sage 50 and QuickBooks provide industry-specific accounting in niches different from each other. Here are the differences in industries they serve.

| Sage 50 vs. QuickBooks: Industry Niche | |

| Sage 50 | QuickBooks Online |

| Checmicals | Churches |

| Franchise | |

| SaaS and Subscription | |

We recommend QuickBooks Online over Sage 50 because of a few critical factors. It’s cheaper than Peachtree because it doesn’t require a desktop app and the software can work online. The accounting software also has a user-friendly interface, making it easier for ecommerce business owners to learn. Many accountants also prefer the simplicity of QuickBooks Online.

Unloop’s team of bookkeepers are also experts in QuickBooks Online. It's the software we use to help out ecommerce business owners clean up and maintain their financial records so they can make better decisions. If you choose QuickBooks as your accounting software, maximize its potential by having a team who knows how to use it as if your bookkeeping is on autopilot. Give us a call now!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

These days, we're seeing a lot of popular accounting software programs offering different business solutions that make entrepreneurs' lives easier. Despite this abundance, it's still best to narrow down your options. We've done that for you by pitting two of the best software against each other: Peachtree vs. QuickBooks.

In this article, Unloop will tackle two of the most talked-about accounting software in business, Peachtree—also known as Sage 50—and QuickBooks. Naturally, these two must be on top of your choices, so let us help you decide by showing you a fair comparison that will help you weigh what's best for your own business.

As small business owners and accounting professionals, we must first consider accuracy when choosing accounting software. Managing and auditing your books with highly accurate solutions is paramount, and we know that both software is worth trying, especially if you're an owner looking for a risk-free option.

For ecommerce businesses, a mid-tier software is the practical choice when setting up an accounting system for the first time. Sage 50 and QuickBooks Online each offer one with the features that every business owner or accountant will benefit from. Let’s put them side by side for comparison.

| Sage 50 vs. QuickBooks: Mid-Tier Plan Key Feature Comparison | ||

| Features | Sage 50 Premium Accounting | QuickBooks Online Essentials |

| Number of users | 1 - 5 users | 1 - 3 users |

| Inventory tracking | Yes | No |

| Job costing | Yes | Yes |

| Cloud capabilities | Yes | Yes |

| Bank account sync | Yes | Yes |

| Invoice management | Yes | Yes |

| Insights and Reports | Yes | Yes |

| Track expenses | Yes | Yes |

| Payroll subscription | Separate module | Separate module |

| Fraud Protection | Yes | No |

| Support plan | Yes | Yes |

| Audit trail | Yes | Yes |

One of the biggest advantages of QuickBooks Online is its vast app integrations across many platforms, not just for accounting but for payroll and ecommerce with over 750 apps. Compared to Sage 50 with over 120 apps available in the marketplace, QuickBooks easily takes the lead for this criteria.

| Sage 50 vs. QuickBooks: App Integrations Feature Comparison | |

| Sage 50 | QuickBooks Online |

| Process and pay your employees with Sage 50 Payroll | Pay your people with Intuit Payroll |

| Tax-filing feature available in Sage50 Pro Accounting and higher | Avalara AvaTax lets you pay taxes conveniently |

| Connect Sage 50 to Xero using a third-party integration platform | Direct Xero-QuickBooks integration |

QuickBooks Online’s interface is user-friendly. When you pull up the software, you’ll first see a sidebar menu on the left side that has all the essential options you need such as the dashboard, banking, sales, taxes, and reports, to name a few.

The main section of QuickBooks Online’s interface gives you a straightforward design with few details, yet presents you with the necessary ones in a way that’s easy to digest.

Sage 50, on the other hand, gives more detail and looks tighter compared to most accounting software. They are generous with details, so you’ll often encounter windows and dialogue boxes that contain lists, dropdown boxes, radio buttons, and other key design features. This is perfect for business owners and managers who want more information and control on how they manage their finances.

| Sage 50 vs. QuickBooks: Layout and Design Comparison | |

| Sage 50 | QuickBooks Online |

| Detailed design with multiple tabs and screens | Simple and minimal design |

| Has a shortcut section on the software’s side menu | Includes every essential option on the side menu instead |

| Detailed top bar menu with similarities to MS Office’s top bar design | Top bar menu includes only several icons on the right side of the dashboard |

| Minimal graph representations of data | Highly visual graphs matched with data |

The good news is that both Sage 50 and QuickBooks Online graciously offer special discounts. Moreover, QuickBooks has a 30-day trial period, and Sage 50 lets you take a test drive or view an on-demand demo.

If you do decide to subscribe, here are the available plans.

QuickBooks Online has four plans with varying subscription prices and user capacity.

| QuickBooks Online Plan Comparison | ||||

| Simple Start | Essentials | Plus | Advanced | |

| Pricing | $15 / Month | $30 / Month | $45 / Month | $100 / Month |

| Users up to | 1 user | 3 users | 5 users | 25 users |

| Suitable for | Freelancers, micro-businesses, beginner accountants or non-professionals | Small businesses | Businesses needed inventory and project management | SMBs (small- to medium-sized businesses) |

PeachTree offers three tiers for their online accounting software. Each of the plans are also paid on subscription basis.

| Peachtree Online Plan Comparison | |||

| Pro Accounting | Premium Accounting | Quantum Accounting | |

| Pricing | $57.17 / Month | $82.09 / Month | $136 / Month |

| Users up to | 1 user | 5 users | 40 users |

| Suitable for | Solopreneurs and micro-businesses | Small businesses | MLBs (medium-sized to large businesses) |

Sage 50 isa tool you can install on a desktop computer. When you look for tools to help you track your business finances, this name will be among the first recommendations you will see. Here are its highlights.

Sage 50 has categorized its offers for different businesses: small, medium, and businesses of any size. So, owners can easily pick the services that fit the expanse of their venture. For instance, a small business offer includes cloud-based accounting, time and billing tracking, and workforce management. More and more bookkeeping and accounting features are added to the plans for other business sizes.

Sage’s service categorization for various industries differentiates it from other small business accounting tools. The software particularly flexes its reliability by being an accounting tool for several for-profit and non-profit industries. The tool’s features are tailor-fitted to satisfy the needs of the different trades.

Nevertheless, if you do not fall into any of the industries mentioned, you can still enjoy these features of Sage 50:

These offers will be included depending on the plan you subscribe to. The greater your investment, the more features you will get.

Not far behind, the accounting tool many businesses go to is QuickBooks. Similar to most software companies, its maker, Intuit, offers several product lines such as their top-of-the line QuickBooks Enterprise and their powerful starter, QuickBooks Essentials. But the most popular among ecommerce businesses is QuickBooks Online.

You can access this software on desktop computers and mobile phones. QuickBooks is equally reliable as Sage 50 because of the following features.

When you sign up for a QuickBooks plan, you'll enjoy its live bookkeeping immediately. This feature keeps your books up-to-date by ensuring that financial data from the start of the year to the current month are collected, categorized, and stored. If you sign-up midyear, bookkeepers will track whatever data is missing. Trained bookkeepers will update your books live from then on.

You'll also get to enjoy these traditional bookkeeping and accounting features by using QuickBooks:

Keeping your finances tracked has plenty of benefits, but one is being prepared when tax season comes. With QuickBooks, you'll be equipped with all the data you need. To ensure that all the data you submit for a tax audit is accurate, QuickBooks has a tax penalty protection that guarantees up to a $25,000 payment per year if you get any tax-related inaccuracies and errors from the tool.

Another perk that sets QuickBooks apart from its competitors is the Priority Circle. This service offers QuickBooks Advanced users in-depth training about software usage and 24/7 customer support. You won’t need to go the extra mile by looking for a QuickBooks training program, which will surely cost extra.

As two highly-sought accounting software, Sage 50 and QuickBooks understand what most businesses need when it comes to management. To be competitive, they have to expand what their software is capable of, extending them beyond bookkeeping and accounting. The result is a set of four features similar to each other yet delivered in their own unique ways.

You’ll enjoy the following offerings with both QuickBooks and Sage 50.

Make sense of all the details your bookkeeper has logged in and generate reports of your business income and expenses through accounting features of both QuickBooks and Sage 50. You can rely on both software to store and create accurate reports quicker than manual accounting. Software and third-party apps make the task very simple and less complex.

There are other accounting apps available such as Photeeq, FreshBooks, and Zoho Books. If you have important documents in another software, you can integrate them easily to QuickBooks or Peachtree as both software have the capabilities.

As a result, there will be no need to open several books and Excel sheets to check data because everything you need will be in one place. With these features, you can access real-time business data remotely and generate reports from the latest numbers.

Cloud-based technology is a way to secure data. Before, you’d store important information about the company on an office desktop, which anyone can access. Now, data can be stored in the cloud with impregnable security that requires special approval for each step.

The company's manager can control who can access business information through cloud-based accounting. In most cases, the company bookkeeper, accountant, and finance teams are the only people granted access. Then, everyone with access can see the same information no matter where you access the app.

You can reap plenty of benefits with accurate time tracking and project management. Among them are the following:

A small business owner must look for these convenient features in accounting software—both Sage 50 and QuickBooks offer them.

Everything these days is automated, so if you run into software that does not offer the automation expectations you have, strike it off your list. Regarding receiving and sending payments, generating invoices, storing receipts, and sorting all these transactions into categories for accounting, both QuickBooks and Sage 50 have got you covered.

So, get ready to link your payment gateways, receiving accounts, bank accounts, and credit cards to Sage 50 and QuickBooks so the software can track all direct deposits and expenses immediately. Wherever you are, when you receive a notification of payment or request to pay, you can process them instantly as long as there is an internet connection.

Both Sage 50 and QuickBooks have a service focused on human resource (HR) management, which is essential once you've grown your business and already managed several employees.

The HR feature is especially helpful if you have a diverse team of professionals working for you. This ensures employees' wellbeing is handled well according to the laws and regulations where your business operates.

Despite their similarities, the two accounting software also have to differentiate themselves to stand out. Here are the four key differences that may determine whether you'll choose Sage 50 or QuickBooks.

A prime difference between Sage 50 and QuickBooks is bookkeeping services. QuickBooks has a team of expert bookkeepers clients can consult with via appointment to check how their business is sailing. Once you sign up for QuickBooks’s full-service live bookkeeping, these professionals can help you cleanup your accounting data and do ongoing accounting and consultation.

The live bookkeeping function, however, is different with Sage. The Sage Live feature only offers real-time collaboration with people that handle your bookkeeping. As for providing a full service accountant, you’ll need to get your own.

In terms of accounting software interface, QuickBooks focuses more on a user-friendly interface with a clean-looking dashboard and a simplified side menu which helps users easily see and navigate through the sections to find out essential information.

Sage 50 gives more detail. It packs a lot of options on its dashboard which includes a sidebar menu and a top bar menu. Users can see different sections and icons on their screen for pointing to a specific segment you need to update or manage.

Accounting and bookkeeping are needed in all business types and sizes. Aside from offering general assistance, both Sage 50 and QuickBooks provide industry-specific accounting in niches different from each other. Here are the differences in industries they serve.

| Sage 50 vs. QuickBooks: Industry Niche | |

| Sage 50 | QuickBooks Online |

| Checmicals | Churches |

| Franchise | |

| SaaS and Subscription | |

We recommend QuickBooks Online over Sage 50 because of a few critical factors. It’s cheaper than Peachtree because it doesn’t require a desktop app and the software can work online. The accounting software also has a user-friendly interface, making it easier for ecommerce business owners to learn. Many accountants also prefer the simplicity of QuickBooks Online.

Unloop’s team of bookkeepers are also experts in QuickBooks Online. It's the software we use to help out ecommerce business owners clean up and maintain their financial records so they can make better decisions. If you choose QuickBooks as your accounting software, maximize its potential by having a team who knows how to use it as if your bookkeeping is on autopilot. Give us a call now!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

The day is almost over, but the list of department meetings, client calls, and supplier meetups is far from done, but you still push through as visibility on everything that is going on with your business is your top concern. The tasks can be both challenging and assuring. As a business owner, you need to ensure that all parts of your business work well and towards the goals you set.

When it comes to financial goals, you can make your day a bit less overloaded with tasks if you have bookkeepers monitoring the money coming in and out of your business.

We’ll discuss here the seven basic services you’ll get from bookkeepers and what work arrangement is best for your business.

Running a business is slightly the same as running a household only that your business has—more bills to monitor! Some of the bills you need to record are the following:

These are just some of the general bills you need to pay. Of course, the bigger the company, the more bills to account for.

Together with bills monitoring are the creation, recording, and distribution of invoices. Without a bookkeeper, you can pay all your dues, and forget the tracking afterward.

The bookkeeper will ensure that everything is recorded, so when the accountant needs expenses data, a complete record with proper documentation can be provided. With the help of technology, this task is made easier. There are bookkeeping software that allows the storage of receipts, photos, and invoices.

The bookkeeper also documents all the income from actual sales, accounts receivable, and from company assets for both cash flow and profitability checking. Since the bookkeeper also monitors the expenses like taxes and debts, it will be easier to generate reports on gross income and income pre and post-taxation.

Income information is important in growing your business as this is the report investors and future partners would like to see—your business profitability.

The bookkeeper may or may not be the actual person who talks to the bank, but part of bookkeeping administration services is checking all bank transactions and credit card accounts.

Bank and credit card details must match all the expenses and income documents recorded by the bookkeeper. If there are items not accounted for even after rechecking, you can enact an investigation as there may be fraudulent money coming in or out of your business.

Bookkeepers are not only concerned with their ledgers and software that show all financial transactions of the company. They are also great team players who coordinate with different company departments for all money-related transactions.

To make everybody’s time well-spent in the office, the bookkeeper creates a streamlined process of submitting all the income from sales and assets and expenses from purchases, debts, and subscriptions. Think of the bookkeeper as your money tracking executive assistant.

The payroll is one of the many areas of your business where you always want to be accurate as other people are depending on it. Making mistakes can mean demotivation of employees or even loss of trust. Having bookkeeping services for business means there will be a person solely dedicated to doing the following for your employees’ salaries:

How often do you have your business financial reports? With remote bookkeeping/Calgary-based bookkeepers working with you, you can make the reports as often as you can as all the expenses and income are accurately monitored.

Your company accountant can generate reports easily when the data needed is readily available from the bookkeeper. Looking at raw transactions would help, but reports are easier to understand with graphs and tables made by an accountant.

Now, after knowing all the bookkeeping services Calgary-based and remote firms can offer, you might be thinking of signing up for a service. Let us help you know whether you need a part-time, full-time, in-house, or outsourced bookkeeper.

Whether you are thinking of hiring a bookkeeper part-time, full-time, or outsourcing to bookkeeping firms (Calgary or remote services), you are on the right track as you know you need to hire one!

Consider the following:

A part-time, outsourced service may work for smaller businesses, while a full-time, in-house bookkeeper would be helpful for bigger companies. Yet, with the advent of technology, full-time, outsourced bookkeeping consulting services also work.

We are Unloop, and we help business owners selling on, but not limited to, Amazon, Shopify, Walmart, and Woocommerce. Let us help you track your finances, so you can make well-thought decisions and scale your business!

You can put off your plate bookkeeping and accounting tasks and spend your extra time monitoring other equally essential business operations with our remote team. Get all your financial assistance anywhere you are in the world!

You can call us at 877-421-7270 to get started. Talk to you soon!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

The day is almost over, but the list of department meetings, client calls, and supplier meetups is far from done, but you still push through as visibility on everything that is going on with your business is your top concern. The tasks can be both challenging and assuring. As a business owner, you need to ensure that all parts of your business work well and towards the goals you set.

When it comes to financial goals, you can make your day a bit less overloaded with tasks if you have bookkeepers monitoring the money coming in and out of your business.

We’ll discuss here the seven basic services you’ll get from bookkeepers and what work arrangement is best for your business.

Running a business is slightly the same as running a household only that your business has—more bills to monitor! Some of the bills you need to record are the following:

These are just some of the general bills you need to pay. Of course, the bigger the company, the more bills to account for.

Together with bills monitoring are the creation, recording, and distribution of invoices. Without a bookkeeper, you can pay all your dues, and forget the tracking afterward.

The bookkeeper will ensure that everything is recorded, so when the accountant needs expenses data, a complete record with proper documentation can be provided. With the help of technology, this task is made easier. There are bookkeeping software that allows the storage of receipts, photos, and invoices.

The bookkeeper also documents all the income from actual sales, accounts receivable, and from company assets for both cash flow and profitability checking. Since the bookkeeper also monitors the expenses like taxes and debts, it will be easier to generate reports on gross income and income pre and post-taxation.

Income information is important in growing your business as this is the report investors and future partners would like to see—your business profitability.

The bookkeeper may or may not be the actual person who talks to the bank, but part of bookkeeping administration services is checking all bank transactions and credit card accounts.

Bank and credit card details must match all the expenses and income documents recorded by the bookkeeper. If there are items not accounted for even after rechecking, you can enact an investigation as there may be fraudulent money coming in or out of your business.

Bookkeepers are not only concerned with their ledgers and software that show all financial transactions of the company. They are also great team players who coordinate with different company departments for all money-related transactions.

To make everybody’s time well-spent in the office, the bookkeeper creates a streamlined process of submitting all the income from sales and assets and expenses from purchases, debts, and subscriptions. Think of the bookkeeper as your money tracking executive assistant.

The payroll is one of the many areas of your business where you always want to be accurate as other people are depending on it. Making mistakes can mean demotivation of employees or even loss of trust. Having bookkeeping services for business means there will be a person solely dedicated to doing the following for your employees’ salaries:

How often do you have your business financial reports? With remote bookkeeping/Calgary-based bookkeepers working with you, you can make the reports as often as you can as all the expenses and income are accurately monitored.

Your company accountant can generate reports easily when the data needed is readily available from the bookkeeper. Looking at raw transactions would help, but reports are easier to understand with graphs and tables made by an accountant.

Now, after knowing all the bookkeeping services Calgary-based and remote firms can offer, you might be thinking of signing up for a service. Let us help you know whether you need a part-time, full-time, in-house, or outsourced bookkeeper.

Whether you are thinking of hiring a bookkeeper part-time, full-time, or outsourcing to bookkeeping firms (Calgary or remote services), you are on the right track as you know you need to hire one!

Consider the following:

A part-time, outsourced service may work for smaller businesses, while a full-time, in-house bookkeeper would be helpful for bigger companies. Yet, with the advent of technology, full-time, outsourced bookkeeping consulting services also work.

We are Unloop, and we help business owners selling on, but not limited to, Amazon, Shopify, Walmart, and Woocommerce. Let us help you track your finances, so you can make well-thought decisions and scale your business!

You can put off your plate bookkeeping and accounting tasks and spend your extra time monitoring other equally essential business operations with our remote team. Get all your financial assistance anywhere you are in the world!

You can call us at 877-421-7270 to get started. Talk to you soon!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

So you've landed a spot on Amazon to market your small business, which is excellent news! You're ready to embark on a new journey with plenty of opportunities to expand your customer base in the world's largest online retailer. But brace yourself because apart from performing the seller role, you’ll also don the Amazon bookkeeper hat to manage your business well, which is challenging.

In carving your path to success, there are some not-so-fun things you need to work through to accomplish your goals. For example, bookkeeping management; it is one of the most challenging aspects of running an Amazon business.

Amazon accounting can be challenging for any business owner. Smaller-scale ecommerce businesses—though they work on fewer transactions—aren't exempt from the grueling task of bookkeeping and accounting.

Sometimes, not having an accounting system with skilled experts to handle financial transactions adds to an online business's problems. It's difficult for Amazon sellers to take them all at once with the marketplace's complex system.

Let Unloop help you by identifying the challenges you might face when doing Amazon seller bookkeeping. It's important to be aware of these challenges so you can find methods to overcome them.

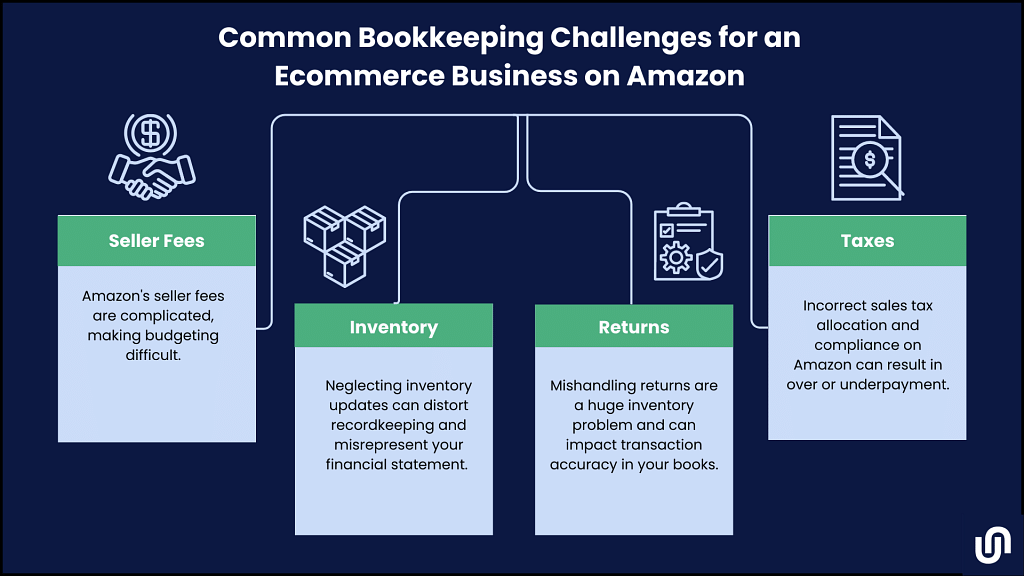

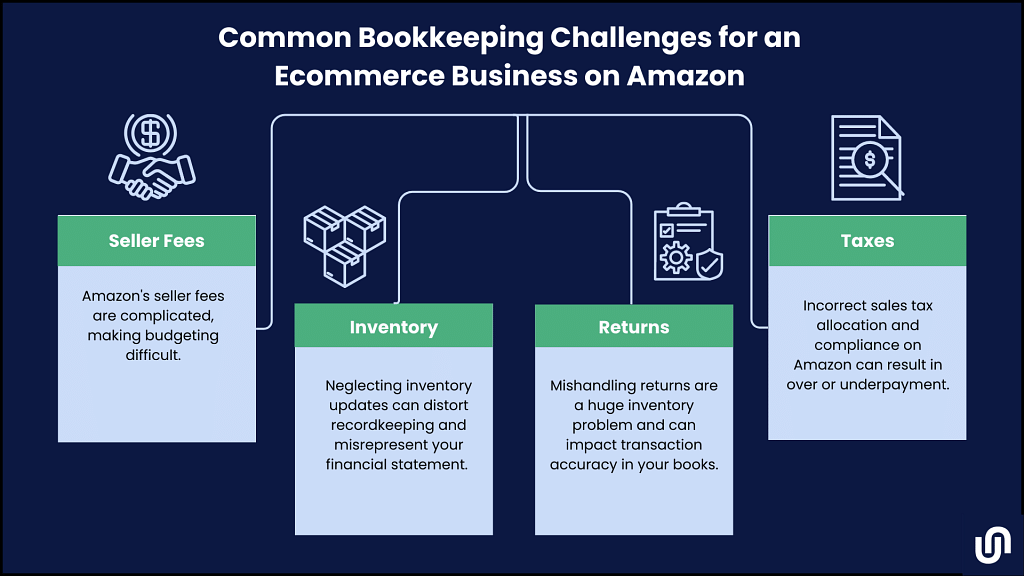

Managing an Amazon business is exciting—the convenience of managing a wide-reaching business from your screen is quite something. Still, small business owners in the marketplace face difficulties understanding bookkeeping and accounting tasks.

The most common roots of these issues are the absence of accounting software and accounting experience or a lack of them. As a result, most brands make the following Amazon accounting and bookkeeping management mistakes:

Amazon has a complex system of seller fees (monthly fees, referral fees, and shipping fees via Fulfillment by Amazon) which makes managing expenses challenging, especially if you lack adequate knowledge and experience on the platform.

These fees have a specific breakdown of charges, complicating the system further. Unfortunately, Amazon doesn't provide single-entry invoices that help you track costs, so you'll have to estimate seller fees yourself.

It impacts three aspects of your financial statements:

All these parts matter when talking about accuracy; that's why updating inventory and ensuring we get it right is crucial.

| Solution Successful inventory management requires an automated tracking system. You need its accuracy and consistency for tracking customs, FBA inventory (if you opted for it), your physical store, and product returns. Otherwise, it will be harder for you to monitor inventory and update your financial statements accurately. This results in a skewed view of your online business's financial health, preventing you from making sound business decisions. |

Product returns are stressful in the first place—they require constant adjustments to your inventory based on return requests to avoid potentially harming customer loyalty. It's the negative kind of "killing two birds with one stone."

With Amazon, things are more complicated because FBA returns are classified into various categories: sellable, damaged, customer-damaged, defective, and carrier-damaged. It may seem organized initially, but Amazon sometimes makes incorrect inventory placements, making a mess of your books and, eventually, your business bank account.

| Solution The best way to handle and reduce the likelihood of returns is to spend time managing and updating your inventory. If it takes too long, you can hire an Amazon accountant specializing in returns. |

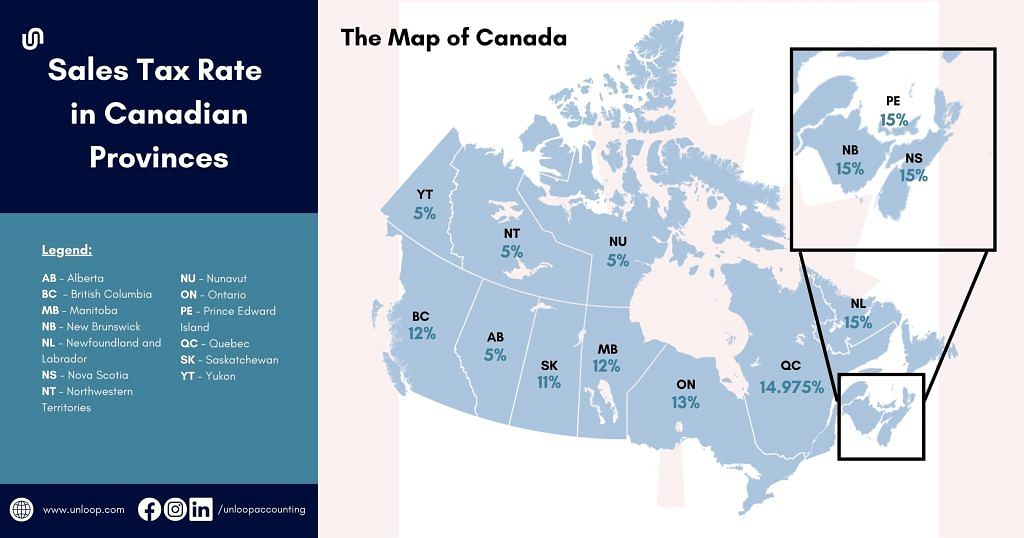

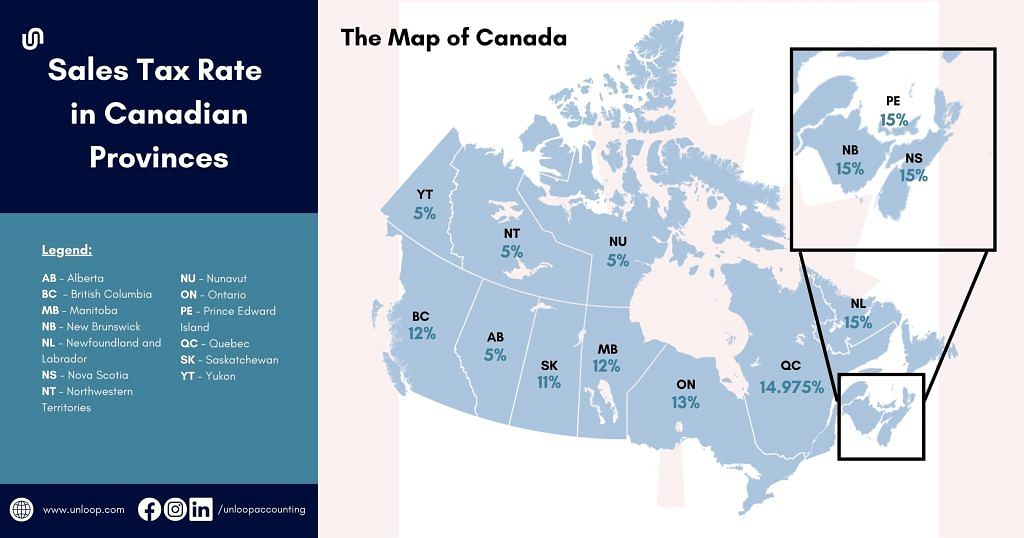

Sales tax preparation can be challenging for small ecommerce businesses due to the demand for multi-channel tracking. This results in inaccurate remittance to internal revenue authorities and, consequently, having inaccurate income on the books and in your bank account.

Today's tax regulations are over 10,000, and the variety of these systems is confusing when updating your books. Although Amazon takes the stress of sales tax collection and remittance away from the seller, you still need to track and accurately state multi-channel transactions in the paperwork to meet tax demands.

| Solution To save resources, we recommend hiring an Amazon marketplace professional in a consulting or managing capacity. Another option is to work with an Amazon bookkeeper specializing in the marketplace's sales tax collection system. They have the skills to detail taxes because they are accountants, making it easier for you or your CPA to remit. |

If you're looking for experts offering small business bookkeeping services, Unloop is your perfect business partner!

We understand Amazon's bookkeeping and accounting challenges, so we want to help you manage them the right way. Our team of small business bookkeeping and tax services experts collaborates with reliable accounting firms to ensure the accurate recording and reporting of financial records.

Through our services, you can focus on growing your small business without worrying about documentation and analysis of financial information. If you find yourself having a hard time learning the processes of Amazon bookkeeping, you can always make things easier with us. All it takes to overcome Amazon's bookkeeping challenges is to make an appointment, so go ahead and book a call today.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

So you've landed a spot on Amazon to market your small business, which is excellent news! You're ready to embark on a new journey with plenty of opportunities to expand your customer base in the world's largest online retailer. But brace yourself because apart from performing the seller role, you’ll also don the Amazon bookkeeper hat to manage your business well, which is challenging.

In carving your path to success, there are some not-so-fun things you need to work through to accomplish your goals. For example, bookkeeping management; it is one of the most challenging aspects of running an Amazon business.

Amazon accounting can be challenging for any business owner. Smaller-scale ecommerce businesses—though they work on fewer transactions—aren't exempt from the grueling task of bookkeeping and accounting.

Sometimes, not having an accounting system with skilled experts to handle financial transactions adds to an online business's problems. It's difficult for Amazon sellers to take them all at once with the marketplace's complex system.

Let Unloop help you by identifying the challenges you might face when doing Amazon seller bookkeeping. It's important to be aware of these challenges so you can find methods to overcome them.

Managing an Amazon business is exciting—the convenience of managing a wide-reaching business from your screen is quite something. Still, small business owners in the marketplace face difficulties understanding bookkeeping and accounting tasks.

The most common roots of these issues are the absence of accounting software and accounting experience or a lack of them. As a result, most brands make the following Amazon accounting and bookkeeping management mistakes:

Amazon has a complex system of seller fees (monthly fees, referral fees, and shipping fees via Fulfillment by Amazon) which makes managing expenses challenging, especially if you lack adequate knowledge and experience on the platform.

These fees have a specific breakdown of charges, complicating the system further. Unfortunately, Amazon doesn't provide single-entry invoices that help you track costs, so you'll have to estimate seller fees yourself.

It impacts three aspects of your financial statements:

All these parts matter when talking about accuracy; that's why updating inventory and ensuring we get it right is crucial.

| Solution Successful inventory management requires an automated tracking system. You need its accuracy and consistency for tracking customs, FBA inventory (if you opted for it), your physical store, and product returns. Otherwise, it will be harder for you to monitor inventory and update your financial statements accurately. This results in a skewed view of your online business's financial health, preventing you from making sound business decisions. |

Product returns are stressful in the first place—they require constant adjustments to your inventory based on return requests to avoid potentially harming customer loyalty. It's the negative kind of "killing two birds with one stone."

With Amazon, things are more complicated because FBA returns are classified into various categories: sellable, damaged, customer-damaged, defective, and carrier-damaged. It may seem organized initially, but Amazon sometimes makes incorrect inventory placements, making a mess of your books and, eventually, your business bank account.

| Solution The best way to handle and reduce the likelihood of returns is to spend time managing and updating your inventory. If it takes too long, you can hire an Amazon accountant specializing in returns. |

Sales tax preparation can be challenging for small ecommerce businesses due to the demand for multi-channel tracking. This results in inaccurate remittance to internal revenue authorities and, consequently, having inaccurate income on the books and in your bank account.

Today's tax regulations are over 10,000, and the variety of these systems is confusing when updating your books. Although Amazon takes the stress of sales tax collection and remittance away from the seller, you still need to track and accurately state multi-channel transactions in the paperwork to meet tax demands.

| Solution To save resources, we recommend hiring an Amazon marketplace professional in a consulting or managing capacity. Another option is to work with an Amazon bookkeeper specializing in the marketplace's sales tax collection system. They have the skills to detail taxes because they are accountants, making it easier for you or your CPA to remit. |

If you're looking for experts offering small business bookkeeping services, Unloop is your perfect business partner!

We understand Amazon's bookkeeping and accounting challenges, so we want to help you manage them the right way. Our team of small business bookkeeping and tax services experts collaborates with reliable accounting firms to ensure the accurate recording and reporting of financial records.

Through our services, you can focus on growing your small business without worrying about documentation and analysis of financial information. If you find yourself having a hard time learning the processes of Amazon bookkeeping, you can always make things easier with us. All it takes to overcome Amazon's bookkeeping challenges is to make an appointment, so go ahead and book a call today.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

So you have finally achieved your long-time dream of creating and managing a small business. But, unfortunately, dreams like that don't just stop after you’ve earned enough. Your success needs to be protected by making sure your finances are in check. This is why if you want your business to grow, you need to know a few bookkeeping tasks. However, bookkeeping might be an additional task that will weigh you down in the long run. Don't worry; there are professional bookkeeping Vancouver services that can help you manage your finances so you can focus on other responsibilities or enjoy more free time.

This article gives you an idea of the bookkeeping services you or your bookkeeper need to know and manage to keep track of your business.

Monthly financial statements are the key to ensuring that your business is on track. But, as a business owner, you're probably too busy with day-to-day operations to keep an eye out for potential risks or problems. That's why it makes sense for you to get monthly bookkeeping services Vancouver can offer to monitor all aspects of your business.

Detailed business reports are essential to financial planning and cash flow projections. Your monthly statements of profit and loss, balance sheet, and cash flow will provide you with a snapshot of your company's fiscal health so that you can make informed decisions about its future growth potential. For example, you'll be able to compare how much money was brought in versus how much was spent on expenses. In addition, by looking at your monthly statements, you'll be able to see if any changes need to be made concerning your product prices or marketing strategies.

Hubdoc and Dex Bookkeeping and an expense management application that you or your bookkeeper can automatically use for financial data such as receipts, bills, and other information. You need to sync your accounts from different vendors once, and this software will record all the past and incoming invoices. For example, with Hubdoc, if you want to sync your Paypal receipts along with other overall receipts, you need to click the Paypal icon and log in your username and password once. After that, it will automatically sync with your account.

What's great with software like these is that it eliminates the time and effort of data entry and sifting through a mountain of papers. For example, you only have to take a picture of your receipt and upload it using a computer or mobile device or send it to an app-generated email. Additionally, it has a mobile app version so you can check your finances anytime.

You might be confused why you need accounting software when you already have a bookkeeping one. Xero and Quickbooks are software that you or your accountant can use to extract or reconcile data from your bookkeeping app. So when your bank, your transactions, or your expenses are synced with the software, you can use it for creating reports. Most importantly, this automated accounting software includes invoicing and payroll, an added feature that bookkeeping apps don't have.

This includes account reconciliation, where you make sure all transactions in your accounts like credit cards or bank balances match financial records. It also includes creating invoices and making payments. Other features include invoice reminders, email support with experts in the industry, customized reports with graphs and charts to give you a visual representation of your company's financial status, custom price list for customers that will automatically pop up when they view or purchase an item on your website based on their location.

Vancouver bookkeeping services experts recommend that you get monthly bookkeeping services from a professional who will handle all of your company's financial accounts. This means unlimited account handling for your business, which can help you save time and money because it eliminates the need to hire additional staff or train existing employees on how to do this task.

By outsourcing these responsibilities, you can focus more on growing your business. For example, you'll be able to allocate resources into expanding company operations or starting up a new one without worrying about potential risks and problems because there's someone else keeping an eye out for them.

Bookkeeping services Vancouver BC that offer the mentioned features will help you keep track of your business finances, so you will always know how your business is doing. Unloop offers these services monthly and more and even has an option for a more customized service catered to only what you need. In addition, we will happily migrate the data for free if you are already using a different accounting or bookkeeping software.

If you are interested in Unloop services, then book a call or get in touch with us through the number 877-421-7270. We look forward to helping you grow your business!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

So you have finally achieved your long-time dream of creating and managing a small business. But, unfortunately, dreams like that don't just stop after you’ve earned enough. Your success needs to be protected by making sure your finances are in check. This is why if you want your business to grow, you need to know a few bookkeeping tasks. However, bookkeeping might be an additional task that will weigh you down in the long run. Don't worry; there are professional bookkeeping Vancouver services that can help you manage your finances so you can focus on other responsibilities or enjoy more free time.

This article gives you an idea of the bookkeeping services you or your bookkeeper need to know and manage to keep track of your business.

Monthly financial statements are the key to ensuring that your business is on track. But, as a business owner, you're probably too busy with day-to-day operations to keep an eye out for potential risks or problems. That's why it makes sense for you to get monthly bookkeeping services Vancouver can offer to monitor all aspects of your business.

Detailed business reports are essential to financial planning and cash flow projections. Your monthly statements of profit and loss, balance sheet, and cash flow will provide you with a snapshot of your company's fiscal health so that you can make informed decisions about its future growth potential. For example, you'll be able to compare how much money was brought in versus how much was spent on expenses. In addition, by looking at your monthly statements, you'll be able to see if any changes need to be made concerning your product prices or marketing strategies.

Hubdoc and Dex Bookkeeping and an expense management application that you or your bookkeeper can automatically use for financial data such as receipts, bills, and other information. You need to sync your accounts from different vendors once, and this software will record all the past and incoming invoices. For example, with Hubdoc, if you want to sync your Paypal receipts along with other overall receipts, you need to click the Paypal icon and log in your username and password once. After that, it will automatically sync with your account.

What's great with software like these is that it eliminates the time and effort of data entry and sifting through a mountain of papers. For example, you only have to take a picture of your receipt and upload it using a computer or mobile device or send it to an app-generated email. Additionally, it has a mobile app version so you can check your finances anytime.

You might be confused why you need accounting software when you already have a bookkeeping one. Xero and Quickbooks are software that you or your accountant can use to extract or reconcile data from your bookkeeping app. So when your bank, your transactions, or your expenses are synced with the software, you can use it for creating reports. Most importantly, this automated accounting software includes invoicing and payroll, an added feature that bookkeeping apps don't have.