Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Are you ready to enter the ecommerce world? It's a huge step considering that most shoppers today rely heavily on technology. Meanwhile, for sellers, it's an opportunity to expand the customer base internationally. But, we must address a common challenge among online sellers: ecommerce sales tax.

With ecommerce, distance won't hinder a business from selling to another state or country. That's an incredible advantage of technology, but it’s also not without challenges. As a first-time ecommerce seller, you might ask yourself: "Do remote businesses need to pay sales tax?" Yes, they do.

Tax collection and remittance are now part of the requirements in ecommerce. Everyone in the industry knows the struggle, and no one expects you to digest everything in a day or two. But we’re here to help.

This article breaks down the fundamentals of sales tax in the USA. Know the basics and read some valuable tips on managing tax compliance.

Here are some of the points we will be covering:

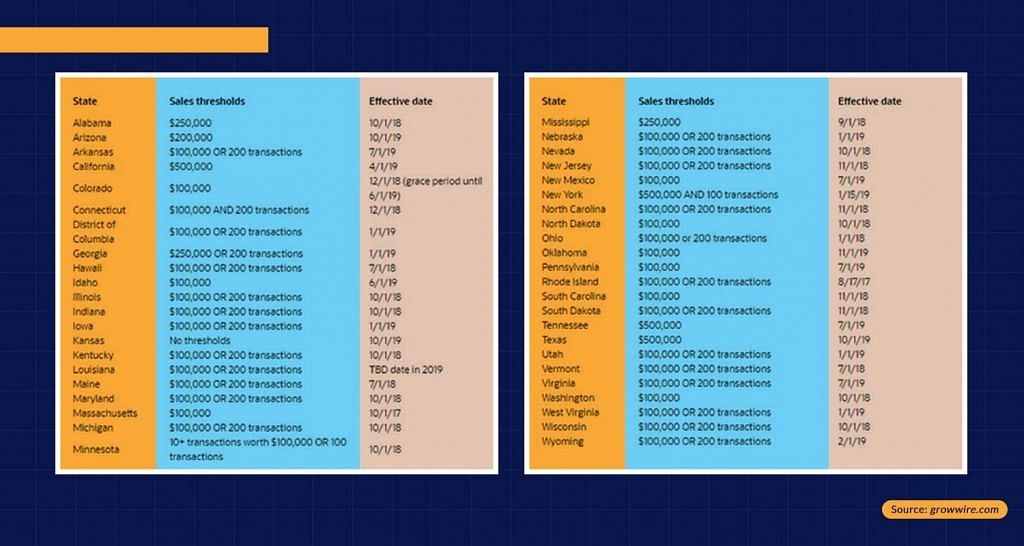

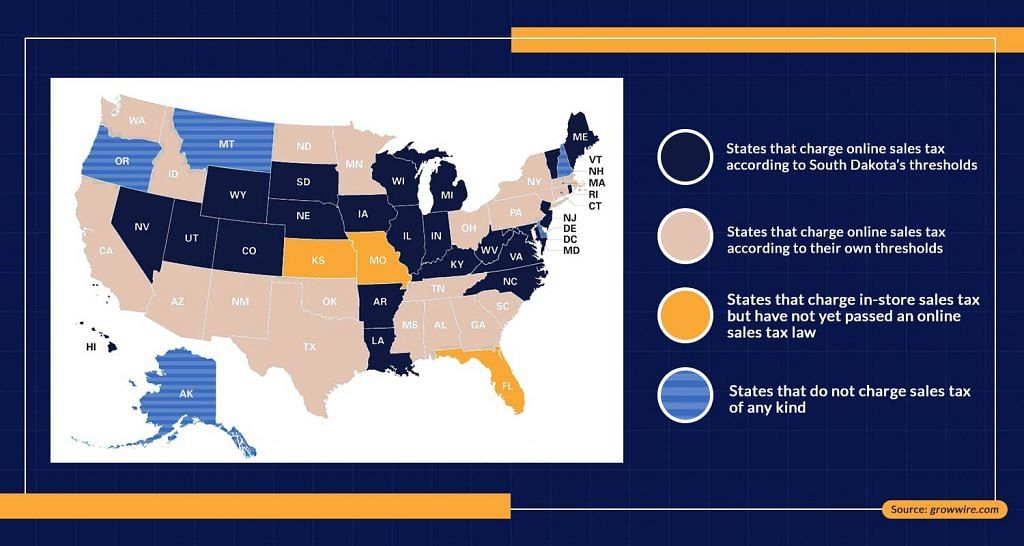

If your business has a physical storefront, office, or warehouse in a certain state, you must pay and remit sales tax. That was the golden rule until the South Dakota v. Wayfair, Inc. happened in 2018, which states that online businesses must collect sales tax regardless of physical presence.

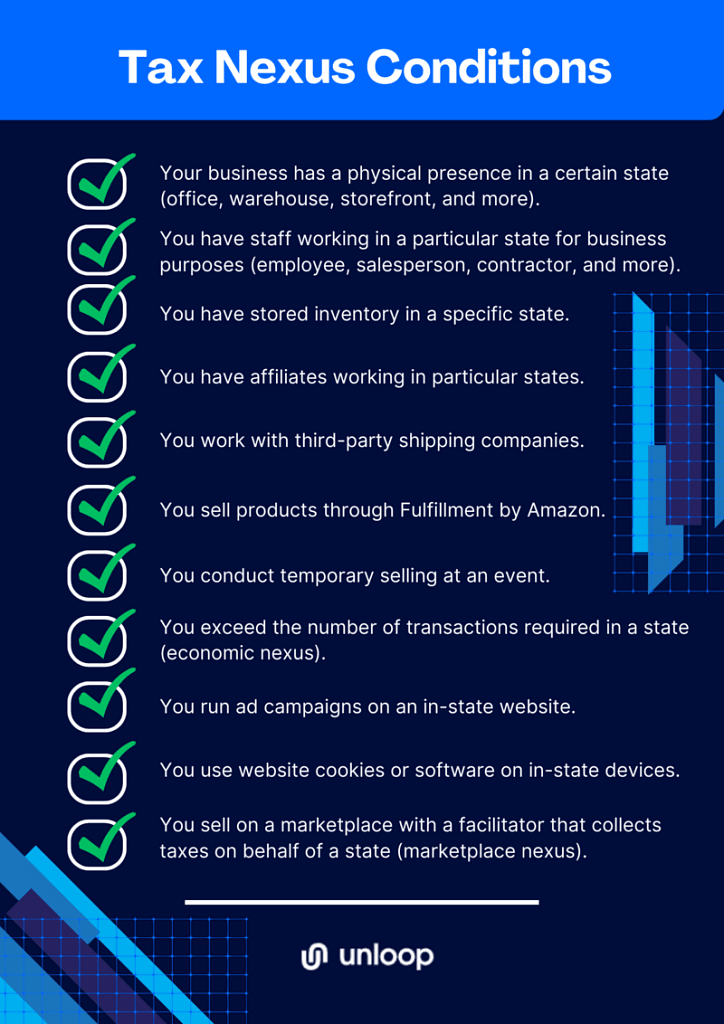

In addition, states can redefine the "sales tax nexus" from a broader perspective so that ecommerce retailers become a part of the scope. Economic nexus or tax nexus happens when a seller has to collect tax in certain states where they exceed the revenue threshold.

The development of ecommerce sales tax laws makes the system immensely complicated—one of the most challenging aspects of ecommerce tax in compliance with constantly changing state policies.

Ecommerce sales tax differs by state, and businesses must learn and comply with all that. It's not easy, and it gets more complicated internationally. Each country has a different tax law, which you must also consider.

Because of the ever-changing tax policies, businesses are pushed to reassess their processing systems and implement operational changes as necessary. If not, sellers can be at risk of financial trouble.

Now that you understand how crucial sales tax is in your ecommerce venture, it's time to learn the basic terms and processes:

Sales tax is a minor percentage of an online retailer's sales. It is a consumer or consumption tax, meaning consumers pay sales tax only on taxable goods. In the US, 45 states have implemented this tax.

Moreover, there are combined sales taxes because counties, cities, and other local areas have "special taxing districts." Special taxing districts, also known as limited-purpose districts, provide special benefits to the residents of a certain local area.

The state where you sell and the destination point are the main factors in charging sales tax. You'll charge customers the sales tax required and remit it to the particular state.

A rule of thumb in product taxability is that any tangible item is automatically taxable. Still, some states have exceptions, such as products with or without a reduced sales tax rate. Your customers will have to pay for these, so ensure they only pay as necessary.

Here's a quick guide on how to calculate sales tax for Ecommerce.

In a formula structure:

Tax nexus is the connection between your business, a state, or any other taxing authority. Naturally, you get a tax nexus in your home state, but some conditions may also prompt other sales tax nexus in some states, such as high revenue. Once you confirm a sales tax nexus, you can begin registering with the state's tax department, collect and remit sales tax, and file a tax return.

We hope the discussions above have helped you understand the online sales tax system better. It may be overwhelming and stressful, but that's much better than getting into a heap of financial trouble later on. Now that you have the basic knowledge let's move on to tax compliance.

Tax compliance can be extremely confusing, and the smallest mistake can snowball into a huge financial mess. To prevent the confusion and stress of your ecommerce taxes, we've provided a step-by-step procedure to serve as your to-do list.

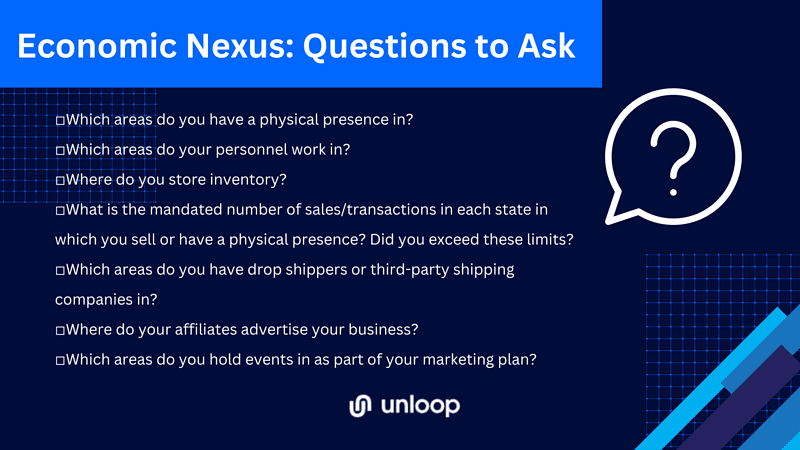

Before proceeding to action, ask yourself some important questions first. Your answers will determine which states you have an economic nexus in. We also recommend you consult with each state you're involved with to confirm these details.

Next, register with the tax authority for a sales permit. This is the document that allows you to collect taxes legally. Contact your state's tax authority to obtain a sales tax permit. Then, you'll be asked to provide the following (not limited to) information:

Depending on the state, these permits may be free or can cost up to $100. The renewal of a sales permit depends on the tax authority you're associated with. For example, some sales tax permits need renewal every one or two years. Meanwhile, others don't require renewal as long as your business still operates.

Some states consider seller's permits as "resale certificates." Generally, resale certificates are signed documents that allow you to buy tax-free goods to resell.

Like sales tax regulations, policies for resale certificates also differ by state. For example, one state considers your sales tax permit the resale certificate. Meanwhile, another requires you to have an independent reseller's permit number.

Ensure your shopping carts, online checkouts, and other marketplace processing systems function properly. There are different bases for tax rates, so your platforms must charge the correct amounts.

Each state makes its own tax rules, hence, the different sales tax sourcing bases. Sales tax sourcing is the basis of charging sales tax, namely, origin-based, destination-based, and mixed sourcing.

Origin-based states follow the tax rate where the business or seller is located. Here are the states that collect origin-based sales tax rates:

| Origin-Based Sales Tax Rates | ||

| STATE | SALES TAX RATES | RANGE OF LOCAL SALES TAX RATES |

| Puerto Rico | 11.50% | 0% |

| California | 7.25% | 0% – 3.25% |

| Indiana | 7.00% | 0% |

| Mississippi | 7.00% | 0% – 1% |

| Minnesota | 6.88% | 0% – 2% |

| Nevada | 6.85% | 0% – 1.525% |

| New Jersey | 6.63% | 0% |

| Arkansas | 6.50% | 0% – 6.125% |

| Kansas | 6.50% | 0% – 5.1% |

| Washington | 6.50% | 0.5% – 4.1% |

| Connecticut | 6.35% | 0% -1% |

| Massachusetts | 6.25% | 0% |

| District of Columbia | 6.00% | 0% |

| Florida | 6.00% | 0% – 2.5% |

| Idaho | 6.00% | 0% – 3% |

| Iowa | 6.00% | 0% – 2% |

| Kentucky | 6.00% | 0% |

| Maryland | 6.00% | 0% |

| Michigan | 6.00% | 0% |

| South Carolina | 6.00% | 0% – 3% |

| Vermont | 6.00% | 0% – 1% |

| West Virginia | 6.00% | 0% – 1% |

| Maine | 5.50% | 0% |

| Nebraska | 5.50% | 0% – 2.5% |

| North Dakota | 5.00% | 0% – 3% |

| Wisconsin | 5.00% | 0% – 1.75% |

| North Carolina | 4.75% | 2% – 3% |

| Oklahoma | 4.50% | 0% – 7% |

| Louisiana | 4.45% | 0% – 8.5% |

| South Dakota | 4.20% | 0% – 8% |

| Alabama | 4.00% | 0% – 9.0% |

| Georgia | 4.00% | 1% – 5% |

| Hawaii | 4.00% | 0% – 0.5% |

| New York | 4.00% | 0% – 5% |

| Wyoming | 4.00% | 0% – 4% |

| Colorado | 2.90% | 0% – 8.3% |

| Alaska | 0.00% | 0% – 9.5% |

| Delaware | 0.00% | 0% |

| Montana | 0.00% | 0% |

| New Hampshire | 0.00% | 0% |

| Oregon | 0.00% | 0% |

Sources:

US Range of Local Sales Tax Rates

Meanwhile, destination-based states follow the tax rate of the shipping address. Here are the states that collect destination-based sales tax rates:

| Destination-Based Sales Tax Rates | ||

| STATE | SALES TAX RATES | RANGE OF LOCAL SALES TAX RATES |

| Rhode Island | 7.00% | 0% |

| Tennessee | 7.00% | 1.5% – 2.75% |

| Illinois | 6.25% | 0% – 5.25% |

| Texas | 6.25% | 0% – 2%, 1.75% local rate for remote sellers |

| Pennsylvania | 6.00% | 0% – 2% |

| Ohio | 5.75% | 0 – 2.25% |

| Arizona | 5.60% | 0 – 7.30% |

| New Mexico | 5.00% | 0.125% – 7.75% |

| Utah | 4.85% | 1% – 7.5% |

| Virginia | 4.30% | 1% – 2.7% |

| Missouri | 4.23% | 0.5% – 7.763% |

Sources:

US Range of Local Sales Tax Rates

California is the lone state with a mixed-sourcing sales tax rate basis. District sales taxes are based on the shipping location, while city, county, and state taxes are based on the business or seller’s location.

| Mixed-Sourcing Sales Tax Rates | ||

| STATE | SALES TAX RATE | RANGE OF LOCAL SALES TAX RATE |

| California | 7.25% | 0% – 3.25% |

Sources:

US Range of Local Sales Tax Rates

Generally, marketplaces significantly differ from each other, and so do their tax collection systems. For example, if you sell on Amazon, you will find a detailed tax collection engine different from another ecommerce site.

Manual accounting puts your business finances at great risk. You might not find any issues at first, but that's because you can still handle the numbers. However, digits and state sales tax laws can change as time passes. Hence, managing data manually will be difficult and error-prone.

Automated cloud-based accounting software is the go-to for ecommerce tax compliance. It helps you meet all deadlines and tax rate differences in real-time. Doing so can prevent discrepancies and financial trouble with the states and customers.

Take note of the filing frequency the state provided when you were obtaining a seller's permit. It tells you how often and on which due dates your ecommerce sales tax filing will take place. Depending on your tax authority, you will usually file and remit taxes monthly, quarterly, or annually.

Unfortunately, states aren't satisfied with just an overall amount of collected taxes. Instead, they would ask for the tax you collected per state, county, city, and other local areas with special taxes.

Before you get floored upon tax remittance day, ensure you're fully equipped with this information. As previously mentioned, automated technology can help you filter out these details.

Let's say you have a tax permit in a certain county but didn't collect anything within a specific period. Still, you must file a sales tax return since it's mandatory. To do so, file "zero reports" or "zero returns" for compliance.

The current sales tax policies for ecommerce won't stay the same forever. It's still developing, so expect changes in requirements and processes in the future. To avoid trouble with outdated sales tax activities, stay on top of changes concerning tax compliance.

Seek updates from the states where you're permitted to collect sales tax. You may regularly visit their website, social media or subscribe to newsletters, if any. If you have an accounting team or tax advisor, consult them about it. Additionally, always monitor your sales and stay alert when they exceed a certain threshold limit.

If you're still unsure whether you're collecting and filing your taxes correctly, you can ask the help of accounting or bookkeeping experts. Don't wait for your tax authority to assess your tax compliance, and avoid charging your customers the wrong amount in their purchases.

Hence, it is best to work with a trusted team of accountants to help you with the how-tos and management of sales taxes.

When tax management starts to take a toll on you, it's time to get help from experts. You might feel reluctant to pay an entire team and have them take charge of your company's financial work. We understand that, so we've enumerated the important things you need to know when hiring bookkeepers or accountants.

You must first understand their roles when hiring a bookkeeping or accounting team. Doing this lets you know exactly what you're paying for and avoid miscommunication during the collaboration. For example, bookkeeping and accounting tasks differ—bookkeepers conduct administrative tasks while accountants interpret and analyze financial data.

Find out the specific tasks they will conduct. For example, in tax compliance, ask if they will help you prepare, manage, or submit sales taxes. Knowing this lets you picture the job distribution: which tasks fall under my care? Which tasks can I turn over to the team?

You get to choose between freelance or firm for tax management services. Each has different pros and cons, and you need to understand them to make a final hiring decision. For example, you have less control over freelancers, but they usually charge lower rates than firms.

Bookkeeping or accounting firms, on the other hand, have a fixed schedule and offer more personnel. While cost can be an issue, you’ll always have someone around to meet your accounting needs.

Consider asking for the area of expertise of the bookkeepers or accountants you're hiring. No matter how good they can be, progress can become slow-paced and risky if they don't understand how your industry works.

If they have working experience concerning your niche, things will be easier to manage and improve. In addition, look for their certifications, such as the American Institute of Professional Bookkeepers (AIPB) and Certified Public Accountant (CPA) licenses.

Whether or not you know much about financial management, how your accountant communicates with you is important. Without proper communication, your business is at risk of financial trouble. Hire someone or a company that complements the way you communicate.

If you need guidance on sales taxes, they must communicate complex matters in a way you can easily understand. Generally, they should not force you to act in any way without even listening to your opinions first. They might have good intentions for your company, but they should still respect your pace and adapt as necessary.

Technology matters significantly in ecommerce tax management. Your ecommerce platforms should display accurate tax rates and process orders seamlessly. Thus, the accountants you'll hire should know the latest and most effective technologies in managing your finances.

Moreover, they should provide you with a demonstration of these tools. Ask them why they'd choose a particular ecommerce sales tax software for a certain transaction. Then, evaluate if their choices are valid, not overpriced, and are the latest, most efficient programs you can use.

Since South Dakota v. Wayfair in 2018, businesses need to turn heads in not just one or two states but almost all of them. As a result, merchants spend up to 300 hours on tax management—isn't it natural to switch to automation now?

Some companies don't include tax management in their list of priorities, which can do more harm than good in the long run. As a seller, you should know that managing sales tax is a huge concern when not properly taken care of. In addition, you must be aware of the potential long-term consequences of incorrect tax compliance.

To avoid that, you must switch to automated management. What are the benefits that await you in sales tax automation?

QuickBooks, A2X, Taxjar, Turbotax, and Hubdocs, are just a few of the most preferred tax management and compliance software today. When hiring bookkeepers or accountants, ensure they are familiar with such tools.

With Unloop's ecommerce sales tax services, you can ensure seamless tax management and compliance for your business. We partner with accounting firms and Taxjar, a tax compliance company, to ensure accurate internet sales taxes on time.

We accommodate you in every step you must take for sales tax compliance. Our action plans are as follows:

Whether you're a US seller on Amazon or Shopify, we have all the bookkeeping solutions ready. If you're serious about growing your business in the online marketplace, take this step with great courage and let us help you from start to finish!

Ecommerce is rapidly developing, and so are the states adapting to the Wayfair rule. In the constantly changing chain of tax systems, you must keep pace with the changes to achieve proper tax compliance.

Once you understand how things work, implement solutions that help you make the work manageable. Hire the right people, use effective tools, and stay on top of your growing ecommerce sales. Book a call with us now!

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.