Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Sales tax is an obligation with the heaviest burden. In every sale business owners make, they have to determine and remit the right sales tax amount. It's only reasonable for them to find efficient ways to file a sales tax return. In this department, two names compete: TaxJar vs. QuickBooks.

But should they be rivals in the sales tax game, or is collaboration better? Let Unloop help you answer this question.

Before we can compare, it’s best to introduce our challengers and list their exceptional features. What can TaxJar and QuickBooks do, and what edge do they have against each other?

Photo by rawpixel.com on Freepik

For many ecommerce businesses, especially small business owners, sales tax is one of the most tedious and confusing tasks to account for and remit. That's because sales taxes vary based on region, products sold, and tax codes.

TaxJar sees this burden and resolves it with its sales tax collection technology. It offers additional support to its users by providing online webinars, documentation videos, and informational blogs.

It’s worth noting that while the tool is available for a web-based desktop, platforms like iPhone or Android mobile aren’t supported.

Let’s further discuss TaxJar’s capabilities that make it a sales tax specialist.

Built into the TaxJar system are different sales tax information from 11,000 jurisdictions. It ensures that wherever your sales may come, your business collects sales tax according to that jurisdiction's sales tax code or policy.

TaxJar tracks sales revenue and location to calculate tax exposure. When tax collection reaches a certain nexus threshold, TaxJar will notify you, helping you with accurate sales tax filing.

TaxJar assists in sales tax registration when notified of your nexus exposure. It offers resources on how you can register your business in the nexus. Alternatively, you can also tap TaxJar for registration assistance.

TaxJar has an API that integrates with your ecommerce store. This feature allows your ecommerce business to do accurate sales tax calculations upon the customer's checkout, ensuring your business collects the right sales tax that will reflect on the checkout page.

TaxJar can automate sales tax filing for your ecommerce business. As soon as you enroll in a nexus state, it can use the data collected by their system while it's integrated into your ecommerce account.

With this integration, TaxJar can calculate the correct sales tax based on the products you've sold, making tax returns a breeze. Additionally, it lets you check (and approve) the sales tax amount before it pushes through.

What's so great about TaxJar is its multichannel feature. Their application integrates into many marketplace platforms such as Amazon, Shopify, WooCommerce, Walmart, Square, eBay, Etsy, etc. You won't have to worry about getting another application for another ecommerce business on another marketplace.

Source: Photo by Pixabay from Pexels.com

On the other hand, QuickBooks offers an accounting solution, which means a little bit of everything (including sales tax) and has broader coverage for ecommerce businesses. QuickBooks supports platforms such as Mac desktop, iPhone mobile, Linux desktop or mobile, and more.

Here's what this amazing software can do.

Small business owners instantly get digital accounting and bookkeeping systems, enabling them to transition from hard copy books and spreadsheets into software that can integrate online.

Within the software, the user can generate an invoice and receive them. QuickBooks's invoice management gives sellers an accurate picture of their short-term debt and credits, which will help them manage their cash flow better.

QuickBooks lets users record and track bills and their payments. Additionally, sellers can integrate third-party apps that can automate their bill payments at the click of a button.

Part of bookkeeping is financial statement generation. When done manually, it can take time to complete. With QuickBooks, a bookkeeper can generate them in real time. It can instantly create income statements and balance sheets by taking stock of all system transactions.

One of the struggles of any small business owner is bank reconciliation. Balancing transactions can be challenging, as locating each bank account entry and records isn't easy.

QuickBooks makes bank reconciliation a breeze by syncing your bank data to the software. That means every expense and income aligns with both the accounting software and your bank account balance.

Yes, but not quite, at least in terms of sales tax.

QuickBooks has been around for a long time and has built a strong reputation for meeting the accounting needs of businesses of all sizes. While it offers tax forms for filing income tax and income tax automation features for your employee payroll taxes, its primary focus is accounting, not taxes.

Let's discuss the sales tax filing feature the accounting software offers.

QuickBooks can make calculations on sales tax rates, including the following information:

The rest (including the sales tax return) will fall within your scope.

To set up this feature, follow the steps in the tutorial below.

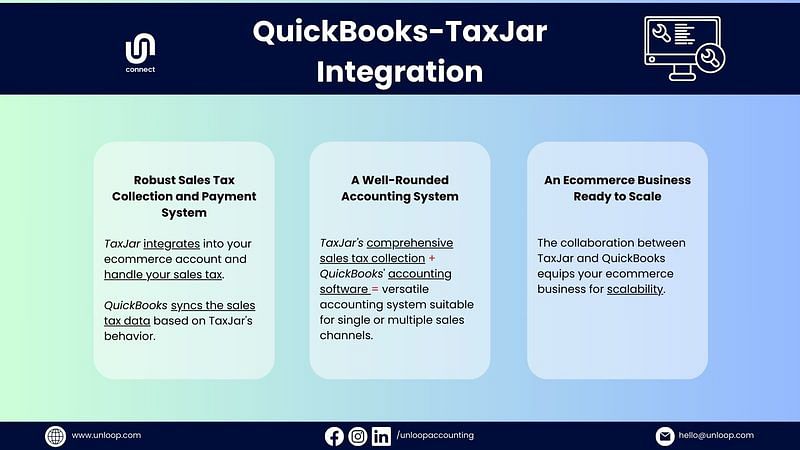

So, what's the final verdict? In the showdown QuickBooks vs. TaxJar, who is the worthy victor? If you ask us what's better for your business, we'll say both. TaxJar and QuickBooks can compete, but their collaboration offers your business the best of both worlds.

Here's what will happen when you do a TaxJar-QuickBooks Online integration.

At Unloop, we use QuickBooks as our main accounting software. We also specialize in seamlessly integrating TaxJar with this tool to help leverage our expertise in ecommerce accounting.

Our professionals ensure efficient management of both software, saving you time for other business matters and maximizing software benefits. Trust Unloop to make your accounting feel like it's on autopilot.

Call us at 877-421-7270 for a consultation, or check out our ecommerce services.

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.