Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Bookkeeping is fundamental to any business, including those operating on Amazon. Effective bookkeeping for Amazon sellers is essential to accurately track sales, expenses, and profits, which is especially crucial for small business owners wanting to grow their businesses.

Tracking finances will help you better understand your business's financial health. The net profit predicts whether your business is earning or failing, so you must update your books regularly. Bookkeeping for Amazon also ensures that you are on top of your tax obligations. You can't compute your taxes when your accounts and business transactions are everywhere.

This handy primer provides a comprehensive overview of bookkeeping practices specifically tailored for Amazon sellers. We'll cover key concepts such as the importance of bookkeeping on the eCommerce platform, some terms to know for beginner Amazon sellers, bookkeeping and accounting software, and the assistance you can get from a bookkeeping and accounting firm.

Whether you are a newbie or a seasoned Amazon seller, understanding bookkeeping fundamentals is crucial in maintaining financial health and achieving long-term success on this eCommerce platform. So, keep reading!

Let's begin by knowing the different bookkeeping terms on financial statements, income statements, balance sheets, credit card statements, or even on an Excel spreadsheet.

Checking Amazon reports and creating customized financial reports will be part of your daily tasks as a business owner. Understanding the basic bookkeeping terms below will allow you to make sense of the numbers and make wise decisions for your eCommerce business.

Cash basis accounting is a method wherein the revenue is only recorded when the monetary payment is received. Accrual accounting, on the other hand, records the revenue in the book as soon as the transaction happens, even before the payment is received.

In business terms, sales are transactions wherein an exchange of goods or services for a specific amount of money or asset has occurred. From the business owner's perspective, it is the number of goods or products the business has successfully sold.

Payment not yet received during the transaction and instead promised later falls under accounts receivable. Recording the transaction ensures that you monitor that the payment is sent on the agreed date and time.

Accounts payable refers to the money you owe to other people. Only short-term liabilities or debts not exceeding a year before settling fall under accounts payable. This may include delayed payroll and unpaid raw materials from suppliers.

When you borrow money through a loan, the transaction will fall under a separate account called Loans Payable. It is not included in the Accounts Payable category, which only caters to short-term debts. These do not cover loans that take more than a year to be paid.

If you're an Amazon seller, which is a type of merchandise business, purchasing inventory is a very important aspect. Inventory is the number of products and raw materials you have in store. Being aware of external factors such as the environment and industry can help you decide how many items you should keep or sell to maintain balance in your inventory.

Purchases are business-related expenses like office supplies, merchandise, raw materials, etc. If you pay it upfront, it will fall under this account.

The details above may come from an Amazon balance sheet through your Amazon seller account. Still, there are also details you'll acquire from different payment channels like your credit card, bank account, and various debit cards. An Amazon accounting software would significantly help you track all transactions from different gateways. Among the many accounting software options, here are the tools we think are the best:

GoDaddy is a web hosting company that offers bookkeeping services. This software has all the essential tools every Amazon business needs, from invoices to tracking profit and loss and establishing financial reports. GoDaddy's services are basic yet useful for small Amazon sellers who still don’t need that many bookkeeping and accounting functions.

GoDaddy's forte is to provide easy-to-use and stress-free accounting software. It is directly connected to your Amazon Seller Central account, so you don't need to integrate it. This software can also generate various reports that enable the user to visualize sales, inventory, and other data.

It is also more affordable than other software, but you must note that the tool lacks double-entry accounting.

Quickbooks Online always makes it to the list whenever we talk about the best cloud-based accounting software in the market. Their target market is large Amazon sellers or enterprises eyeing to increase profits. However, it also provides a complete accounting solution for small businesses.

QuickBooks follows the double-entry accounting method, producing highly accurate reports. Their inventory management feature also changes the game with its excellent product tracking. You can even create a master inventory list to ensure everything's included.

When it comes to taxation, QuickBooks automatically computes your sales taxes according to the tax laws of the city you reside in. You can also manually input the custom rate if needed. This makes paying taxes stress-free.

Quickbooks also produces impressively detailed reports and financial statements like profit and loss, cash flow, and sales reports.

AccountEdge Pro is a mixture of GoDaddy and a bit of QuickBooks with a wide variety of functions to offer to beginner eCommerce sellers. The software is impressive because of its banking, inventory management, and time-tracking features. It is also affordable, which benefits beginner entrepreneurs.

Just like QuickBooks, it uses a double-entry accounting system to ensure the accuracy of accounts. Its banking system is outstanding since it allows almost every bank transaction, like receiving and sending money and making e-payments in the software.

Its inventory management system is also notable since it helps third-party sellers or wholesalers prevent oversupply or undersupply. This matters greatly since Amazon sellers are charged whenever excess stocks stay for over a year.

Kashoo appeals to both beginner and seasoned Amazon sellers because of its simplicity and user-friendly features. It can track expenses, create invoices, and provide updated bank statements.

Its expense tracking feature is very efficient, allowing users to conveniently upload a digital copy of paper receipts and plan their payment schedule monthly or weekly. These features are available on iPhone or iPad. It also allows integrations with third-party banking applications such as PayPal, Stripe, and Square, making bank feed access easier.

Like Kashoo, Fetcher targets small to medium-sized businesses. It offers new sellers a good set of features but comes at a reasonable price.

Fetcher’s way of analyzing profit and loss is unique. It already deducts sales and all other expenses from the total revenue, leaving the net profit. This process makes data more understandable for users, especially those unfamiliar with accounting terms.

Fetcher also closely monitors all expenses and leaves nothing out of the list: sales tax, shipping costs, cost of inventory, subscription costs, and even Amazon FBA fees. Everything's recorded to ensure that no charges remain hidden. It also provides reports for better visualization of figures.

However, if you choose Fetcher, note that it lacks an inventory management feature and double-entry accounting.

Instead of relying on your own Amazon bookkeeping, it would be more efficient to delegate the complex task to experts. An online bookkeeping and accounting service team will apply their knowledge and skills and utilize Amazon bookkeeping software to organize your financial data.

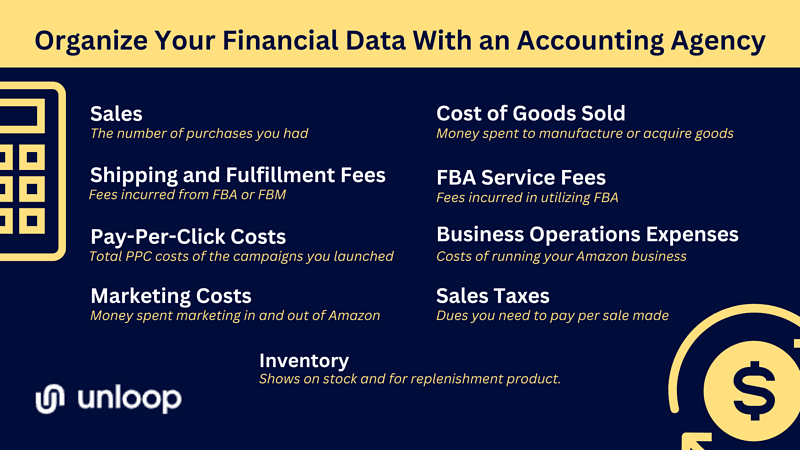

A bookkeeping firm's assistance will streamline your accounting process, allowing you to have accurate data on the following:

The first detail you will see and be interested in is your sales. You’ll see a per-item breakdown in the books, which determines your bestsellers and low-performing products.

Aside from the in-depth view, you can also see a dashboard of sales summaries. An Amazon seller bookkeeping firm can run weekly or monthly financial reports for you. You can also get daily updates with the right accounting software.

When selling on Amazon, you must choose between Fulfilled by a Merchant (FBM) or Fulfillment By Amazon (FBA). FBM means you, the seller, will handle the storage and shipment of all your orders from Amazon. Meanwhile, FBA is when Amazon handles everything for you: from product storage, packing, and shipping, to returns and refunds.

Both methods have their costs. If you are new to the business, updated books can give you a view of which is more efficient. Some sellers find FBM helpful initially, especially with only a few orders. On the other hand, Amazon FBA sellers with rapidly growing numbers find fulfillment assistance extremely helpful as they expand their businesses.

You won’t find it difficult to advertise on Amazon as the platform has various sponsored ad offers:

As the name Pay-Per-Click (PPC) suggests, you only need to pay for the advertisement whenever you get a click. If you launch different sponsored ads simultaneously, you’ll have visibility of the clicks and the cost per type. You'll know which ad type gets the most impressions, clicks, and sales, helping you decide which campaign to focus on to save costs and maintain high sales.

Social media advertising is one of the most effective methods today, as everyone is on Facebook, Instagram, Twitter, or LinkedIn. Vlogs and videos are also booming, so partnering with vloggers is another efficient way to make your products and brand known.

What’s good about tracking all your advertising and marketing expenses is seeing the costs and return on investment in real-time. You’ll know which campaigns are effective and you should invest more in and which ones need to be cut or revised for better performance.

When you begin selling on Amazon, you must always keep an eye on what products are in stock and which ones are for replenishing. Amazon has your back when it comes to inventory management. You have a view of the monetary value of the goods sold and stocks you are about to purchase, giving you insights into which products sell faster.

You can make the most of this feature by having a proper accounting system from your partner accounting and bookkeeping firm. They can integrate Amazon analytics into their accounting software, so you’ll have a single place to see all data on your Amazon business.

Before a product comes to life, it undergoes manufacturing, and the costs you need to pay to bring your products to life are called the Cost of Goods Sold (COGS). COGS vary per seller: some manufacture from scratch, so they must pay for raw materials and labor costs. Meanwhile, some sell ready-made products, so they only need to worry about the shipment fee from factory to warehouse or Amazon fulfillment center.

Whatever you classify your production as, you can monitor your COGS efficiently when your books are organized. You’ll see the breakdown of raw material costs, labor fees, and shipping fees incurred.

FBA has a lot of benefits. You won’t have to worry about renting a warehouse to store your products, as FBA centers have space. You become more credible with an FBA badge on your product listing, strengthening your customers’ trust in your brand because they know that Amazon will handle shipping the products they buy.

You also won’t need to worry about customer inquiries; Amazon handles this for you. Amazon also handles returns and refunds if there are damaged items. They will repackage perfectly working products that have been returned.

Nevertheless, these conveniences come at a price. You’ll see the FBA services fees you must pay when your books are updated.

Finally, although you are selling online, you also incur fees in operating your business, especially when you have an office and employees. You’ll see these all in the books, categorized neatly.

When you see your office’s average monthly expenses, you can see how you can lower your business operating costs. A dedicated team of bookkeepers and accountants will help you take control of the expenses you will incur in the coming months. If you think you’ve spent more than you should, through the help of a bookkeeper, there is always a chance to redeem your business finances.

Taxation is never easy, so many businesses rely on a tax professional from outsourced tax services. You’ll be forced to understand sales taxes when you sell on Amazon. Unlike income tax, where rates are the same and rarely change, sales taxes vary per place, which makes computation more difficult.

The good news is that Amazon is equipped with a system that immediately computes and shows sales taxes. When this data is integrated into your accounting system, it will also reflect on your financial records.

Although Amazon is the one to collect and remit the taxes in most financial transactions, you’ll still see the sales tax data collected through Amazon Marketplace Tax Collection, the platform’s tax filing service.

Bookkeeping and accounting for Amazon play an essential part in the success of your Amazon store. By keeping up-to-date and accurate records of sales and expenses, you can ensure that your business is on track and making the most profit.

With the help of a good bookkeeping agency, you can build the foundations of a successful Amazon business. And this is where Unloop comes in.

We offer helpful resources about Amazon bookkeeping and accounting to get you started. We can also help you manage income, expenses, and other bookkeeping matters you are worried about. Stress no more, and get assistance in your bookkeeping and other accounting struggles with the help of professionals in the field.

Book a call with us today!

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.