The wine business is one of the most vertically integrated businesses there is. A vineyard can work down the supply chain by building a winery and going further with an ecommerce storefront. But winery bookkeeping and accounting become more complex with this integration.

Sounds daunting? Let Unloop show you how bookkeeping and accounting for wineries work as simply as possible.

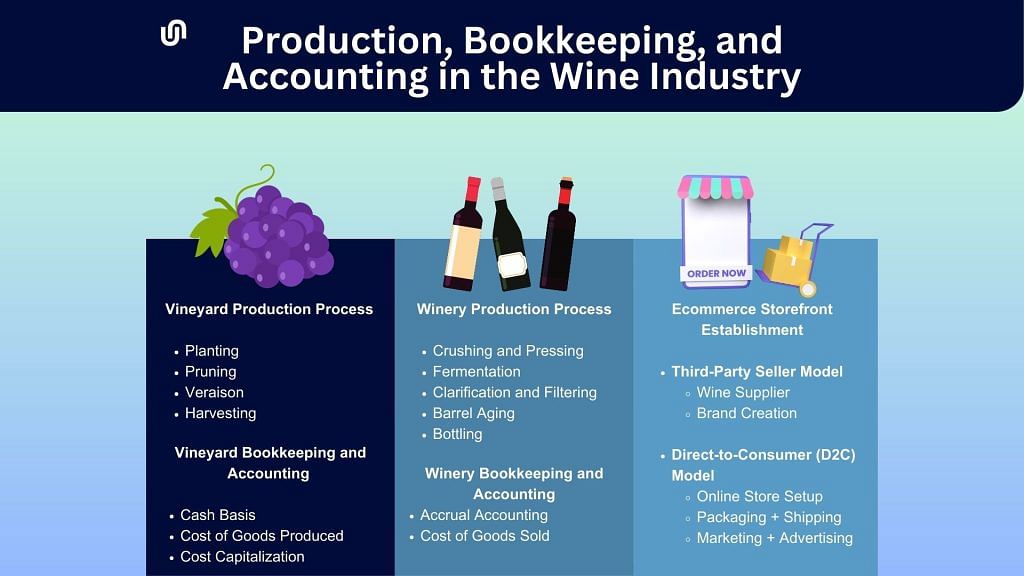

At the top of the wine industry supply chain is the vineyard. This business takes care of grapefruit planting up to harvesting, which wineries will use as a raw material for making wine. The following is the vineyard's production process.

A vineyard is heavy on agricultural activities. The production is long-winding, and it will take years before the vineyard realizes a profit. Given the situation, accountants follow these accounting practices.

Most farm businesses operate using the cash basis accounting method, where income or costs are immediately recognized as soon as the cash is received or spent.

With this accounting type, farms have a clearer view of their cash flow. It also makes tax filing easier because they won’t have to pay taxes in accumulated amounts, unlike in accrual accounting.

Since vineyards are farms, vineyard accountants and bookkeepers use the same accounting method, making it easier to record production costs accurately.

According to accounting principles, accountants use COGP to allocate vineyard costs associated with growing grapes, such as direct labor, overhead, and other supplies and activities involved in the process.

They do so to avoid any miscalculations and confusion between the cost pool of the winery and the vineyard.

Grapes take years to grow. As a result, the vineyard only gets revenue after several years. Farming costs add up during that time without any income to offset them. To resolve this problem, accountants may capitalize on the vineyard's expenses so the business realizes a profit according to the total sales in the given period.

Harvesting the grapes is the departure point of the vineyard and the start of the winery production processes. In the winery, the grapes are turned into wine and are stored as collections for sale in the future.

In most cases, vineyards also have a wine production facility (i.e., winery), so the two terms are often mixed up. But wineries work differently. The video below details the winemaking process.

As briefly shown above, wine production has a different behavior compared to the vineyard. It has similar functions to a general manufacturing process, with some nuances. As a result, accountants adjust their practices according to the winery's needs.

Professionals use the accrual basis accounting method for winery accounting. It's a rational choice because obtaining the raw material for winemaking may not need to be paid immediately due to integration.

On the other hand, getting cash from a sale of a barrel or bottles may also take time. To avoid any miscalculations, accountants record transactions once incurred.

Wineries use the common COGS system primarily because they have a tangible good to sell for a profit.

At present, many wine sellers take their products online. Ecommerce marketplaces, like Amazon, offer a vast network of wine consumers, making it attractive for sellers of all kinds. Online wine sellers can choose between these two models.

A third-party seller can offer a wide variety of wines from different wineries. They are strictly retail. They must also follow the steps a direct-to-consumer takes to have an ecommerce presence (see next section).

However, two additional core steps are necessary to enter the ecommerce market.

Wineries can now sell their wine bottles directly to consumers using the power of ecommerce. Smaller wineries often use a D2C approach, which offers a high-profit margin and a seamless transition, leveraging their existing supply and brand.

All that’s left for wineries like yours to do are the following:

The challenge of running a winery business is that it has two different accounting systems—one for the vineyard and another for the winery itself. Plus, you can take your business online, like creating a separate retail business with another accounting system. Establishing multiple accounting systems is no easy feat, so outsourcing the job to the experts can be significantly beneficial.

Here's what wineries can expect when they outsource their financial management.

Accounting professionals will record all the ecommerce business financial data using double-entry accounting software, such as QuickBooks. This service will include generating financial statements and other financial reporting documents as needed.

The ecommerce retail side of the wine business will have separate COGS recordkeeping. Accountants and bookkeepers report this financial data to you or include them in the income statement for your analysis.

In the ecommerce market, adherence to accounting compliance is essential, which often entails tax management, such as sales tax and income tax. By outsourcing your ecommerce accounting, you'll gain access to seasoned bookkeeping experts who can collaborate with your accountant, ensuring precise tax filing obligations based on comprehensive records and data.

Whether you own a vineyard or are a third-party wine seller, outsourcing your bookkeeping and accounting will lift a huge burden off your back.

Ecommerce has a lot of potential to scale. If the demand for wine spikes, it will be more challenging to do bookkeeping and accounting on your own, so leave it to the experts at Unloop and focus on growing your winery into a successful business. Book a call with us if you want to know more about what we are capable of, or check out our bookkeeping services now for more information.

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.