It's no secret that Amazon is the biggest online shopping platform in the world for sellers and buyers alike. Each year, there's an increase in users on Amazon. So if you have a business and want to extend your store into the online world, Amazon is the best way to do so. It allows small business owners to reach more people and increase their revenue.

Amazon also has an FBA program that helps merchants sell their products more easily. If you plan to start a business on Amazon, here's everything you need to know about the Amazon FBA program.

If you have a product-based business, you need a warehouse to store your products and a reliable company to ship your goods. Amazon addresses those worries, and its program offers to take responsibility for storing your goods, packing them, and shipping them to your customers.

When you use their program, your items will be eligible for Amazon prime shipping. Furthermore, Amazon also covers damages and will give you a full refund when they happen. The Amazon FBA makes online selling more convenient and economical for merchants.

If you want to become an FBA seller, you can start applying to the program by checking it out in your Amazon Seller Central account. Amazon will ask you to specify what items you will be selling to help identify which warehouse to send your products to. Then, once your products are in the warehouse, every time a customer orders from you, Amazon will do the rest.

Additionally, every time an order is complete, Amazon notifies you about the status of your products in storage. Since Amazon is doing the bulk of the work for you, there are FBA fees you need to fulfill to keep the program running. Here are some of them.

FBA fees are the ones you pay Amazon for doing the work for you. The cost of FBA fees may vary depending on how big or small your item is. The price may also differ depending on your product category. One important reminder is that the FBA fee is levied per unit.

Amazon charges a merchant a fee every time you sell a product using Amazon. There are two payment options for this charge. The basic plan is to pay Amazon $0.99 for every unit you sell. The professional plan charges you $39.99 per month regardless of how many items you sell in that period.

You should have your approximate Amazon monthly sales to help you determine which plan to use. For example, if you sell hundreds of items monthly, the professional plan will save you from excess sales charges.

Whether you have a physical store or are an Amazon seller, one thing is for sure—you need to collect sales tax. Amazon collects sales tax for their sellers, but it's your responsibility to fill up important details for proper sales tax compliance. Furthermore, there are other taxes involved when you have an Amazon business.

Here is an easy guide for online sellers to help you navigate the confusing part of tax filing.

The most important form to accomplish when dealing with Amazon FBA taxes is form 1099-K. This form contains all the business income you must file and declare to your government. The information you should include in this form are:

Additionally, to make it easier for you to track your tax obligations, Amazon generates the form for you. Although, as an Amazon seller, it's your responsibility to check if there are any discrepancies in the tax data before you file it to your tax collection agency.

Sales tax is a consumption tax levied by the government on the sales of goods and services. If you are a product-based business, most of your goods will be imposed with sales tax, and you have to collect them as a seller. However, sales tax rates may vary depending on where the sales originates.

You can collect the correct sales tax rate by identifying your business's sales tax nexus. In most cases, the nexus you belong to is the state where your base of operations is. But other business functions can also dictate what sales nexus you belong in.

As a general rule, your tax nexus should be your home state, but for Amazon FBA sellers taxes, it's not always the case. Since your products are sent to an Amazon warehouse, there are situations in which your items are in another state. In this case, your sales tax nexus will follow where your inventory storage is.

If you're worried that you must manually collect sales tax every time someone purchases from your business, you can relax. Amazon handles the sales tax collection. Once a customer checks out an item, Amazon automatically adds the proper sales tax to the final cost. You see reports of your sales tax collections on your Amazon seller central account.

However, before Amazon can start collecting sales tax, you must first apply for a permit to collect them. After which, you have to set up the collection rate in your Amazon account. If you have products that are eligible for exemptions, you have to put it in your tax settings so the platform can collect sales tax properly.

Since Amazon generates almost all the forms and reports you need for your sales tax, all you have to do is to file them. You have time to prepare for filing your taxes and ensure that all data is valid and complies with the taxation laws. Here are several ways to file your taxes.

Whether you have a physical store or you own an online store, accounting is part of running a business. Unfortunately, accounting is also one of the messiest, most time-consuming, and most confusing tasks to handle. As a business owner, you need to oversee many aspects of your business, and you can't spend all your time on accounting.

Unloop offers accounting services for Amazon sellers so business owners can focus on other parts of their business. Our services include:

The Amazon FBA program is a big help for sellers to run their businesses conveniently. From storing and packing to shipping your goods, Amazon handles it all for you. But, of course, even as you enjoy their services, it is your responsibility to comply with tax laws.

We hope this short guide on handling your Amazon FBA sales taxes helps you understand and prepare your tax for the incoming tax season. If you need professional help, Unloop has a team of ecommerce experts to help you with your business accounting. Book a call with us today!

It's no secret that Amazon is the biggest online shopping platform in the world for sellers and buyers alike. Each year, there's an increase in users on Amazon. So if you have a business and want to extend your store into the online world, Amazon is the best way to do so. It allows small business owners to reach more people and increase their revenue.

Amazon also has an FBA program that helps merchants sell their products more easily. If you plan to start a business on Amazon, here's everything you need to know about the Amazon FBA program.

If you have a product-based business, you need a warehouse to store your products and a reliable company to ship your goods. Amazon addresses those worries, and its program offers to take responsibility for storing your goods, packing them, and shipping them to your customers.

When you use their program, your items will be eligible for Amazon prime shipping. Furthermore, Amazon also covers damages and will give you a full refund when they happen. The Amazon FBA makes online selling more convenient and economical for merchants.

If you want to become an FBA seller, you can start applying to the program by checking it out in your Amazon Seller Central account. Amazon will ask you to specify what items you will be selling to help identify which warehouse to send your products to. Then, once your products are in the warehouse, every time a customer orders from you, Amazon will do the rest.

Additionally, every time an order is complete, Amazon notifies you about the status of your products in storage. Since Amazon is doing the bulk of the work for you, there are FBA fees you need to fulfill to keep the program running. Here are some of them.

FBA fees are the ones you pay Amazon for doing the work for you. The cost of FBA fees may vary depending on how big or small your item is. The price may also differ depending on your product category. One important reminder is that the FBA fee is levied per unit.

Amazon charges a merchant a fee every time you sell a product using Amazon. There are two payment options for this charge. The basic plan is to pay Amazon $0.99 for every unit you sell. The professional plan charges you $39.99 per month regardless of how many items you sell in that period.

You should have your approximate Amazon monthly sales to help you determine which plan to use. For example, if you sell hundreds of items monthly, the professional plan will save you from excess sales charges.

Whether you have a physical store or are an Amazon seller, one thing is for sure—you need to collect sales tax. Amazon collects sales tax for their sellers, but it's your responsibility to fill up important details for proper sales tax compliance. Furthermore, there are other taxes involved when you have an Amazon business.

Here is an easy guide for online sellers to help you navigate the confusing part of tax filing.

The most important form to accomplish when dealing with Amazon FBA taxes is form 1099-K. This form contains all the business income you must file and declare to your government. The information you should include in this form are:

Additionally, to make it easier for you to track your tax obligations, Amazon generates the form for you. Although, as an Amazon seller, it's your responsibility to check if there are any discrepancies in the tax data before you file it to your tax collection agency.

Sales tax is a consumption tax levied by the government on the sales of goods and services. If you are a product-based business, most of your goods will be imposed with sales tax, and you have to collect them as a seller. However, sales tax rates may vary depending on where the sales originates.

You can collect the correct sales tax rate by identifying your business's sales tax nexus. In most cases, the nexus you belong to is the state where your base of operations is. But other business functions can also dictate what sales nexus you belong in.

As a general rule, your tax nexus should be your home state, but for Amazon FBA sellers taxes, it's not always the case. Since your products are sent to an Amazon warehouse, there are situations in which your items are in another state. In this case, your sales tax nexus will follow where your inventory storage is.

If you're worried that you must manually collect sales tax every time someone purchases from your business, you can relax. Amazon handles the sales tax collection. Once a customer checks out an item, Amazon automatically adds the proper sales tax to the final cost. You see reports of your sales tax collections on your Amazon seller central account.

However, before Amazon can start collecting sales tax, you must first apply for a permit to collect them. After which, you have to set up the collection rate in your Amazon account. If you have products that are eligible for exemptions, you have to put it in your tax settings so the platform can collect sales tax properly.

Since Amazon generates almost all the forms and reports you need for your sales tax, all you have to do is to file them. You have time to prepare for filing your taxes and ensure that all data is valid and complies with the taxation laws. Here are several ways to file your taxes.

Whether you have a physical store or you own an online store, accounting is part of running a business. Unfortunately, accounting is also one of the messiest, most time-consuming, and most confusing tasks to handle. As a business owner, you need to oversee many aspects of your business, and you can't spend all your time on accounting.

Unloop offers accounting services for Amazon sellers so business owners can focus on other parts of their business. Our services include:

The Amazon FBA program is a big help for sellers to run their businesses conveniently. From storing and packing to shipping your goods, Amazon handles it all for you. But, of course, even as you enjoy their services, it is your responsibility to comply with tax laws.

We hope this short guide on handling your Amazon FBA sales taxes helps you understand and prepare your tax for the incoming tax season. If you need professional help, Unloop has a team of ecommerce experts to help you with your business accounting. Book a call with us today!

Starting a business comes with many headaches, and most have nothing to do with selling products and services. A huge responsibility of a business owner is managing a business's situation—building a culture, training employees, and, most of all, keeping the company's financial situation in good standing.

Since startup companies have little to no assets, they tend to go the simpler route with their financial records. Many startup owners prefer dealing with cash-basis accounting, better known as single-entry bookkeeping (which we'll discuss more later).

While this is a good way to manage accounting for your startup, you can't depend on it forever.

If your business grows, you might have to expand your accounting to cover the new areas of your financial business structure, like assets, liabilities, and equity. The IRS even mandates that companies with annual gross sales of over $5 million cannot use single-entry accounting.

Eventually (with enough hard work and luck), your business will grow, and along with it must grow your financial statements, financial transactions, and financial records—basically your whole accounting system. You'll need to make a choice: go big or go home.

In general terms, bookkeeping is the process of accounting for a company's business transactions. Bookkeeping organizes business transactions and turns them into records that reflect the company's financial situation, which completes the accounting process.

Financial records are vital in keeping businesses afloat. Without bookkeeping, businesses would be in financial darkness. With no written or recorded financial information, any financial decision or transaction would have to be closer to a guess than a concrete decision. Simply put, a business without proper bookkeeping in place will not thrive, let alone survive.

That said, not all forms of financial management are made equal. For example, startup accounting and bookkeeping differ from that of large businesses—it all falls on what is necessary and what your business prohibits you from excluding in a financial statement.

Essentially, there are two types of bookkeeping, both with their own advantages and disadvantages.

Single-entry bookkeeping is the simplest form of accounting and bookkeeping. With single-entry bookkeeping, you simply state income and business expenses—usually accompanied by a brief description of the financial transaction and its date—against each other on a table and calculate the difference as your business's cash balance. This is also called cash accounting.

Accounting for startups and small businesses usually starts with single-entry bookkeeping for several reasons. One is because single-entry bookkeeping is much cheaper. You can do it on cheap accounting software or, if you're frugal, you can even do it on a piece of paper with a pen or a pencil.

While single-entry bookkeeping falls under generally accepted accounting principles, it isn't ideal, especially for growing businesses. This is due to single-entry bookkeeping having entries lacking detail. In addition, since single-entry bookkeeping does not specify the nature of income and business expenses, it cannot produce a balance sheet—an essential part of your company's financial health. It is also more prone to error and is unacceptable for taxes.

If you're counting on your business growing, you will have to consider double-entry bookkeeping for your company's financial data.

Single-entry to double-entry bookkeeping is like Little League to the NBL. While single entry bookkeeping can get you an idea of your company's financial data, double-entry bookkeeping gives you the whole picture.

With double-entry bookkeeping, you include debit and credit or the increase and decrease of accounts in different situations. For example, debit can increase assets and decrease liabilities, while credit can increase liabilities and then decrease assets.

Single-entry bookkeeping does not have debit and credit and thus cannot specify the nature of accounts. A classic example of this is loans. In single-entry bookkeeping, the money produced from loans is inserted directly into income; in double-entry bookkeeping, the loan is tagged as a liability—a debit—adding context to your financial report and leaving you with much more accurate accounting.

Double-entry bookkeeping takes notes of assets, liabilities, and equities, in addition to everything a single-entry system records. This can be used to produce a balance sheet. Large businesses prefer double-entry bookkeeping because it is more contextual, and it becomes easier to account for vast assets and put them into financial records.

Eventually, large businesses will move to accrual accounting, something double-entry bookkeeping makes easier. By then, their finances will operate more on a schedule instead of relying solely on the income entering the company.

Now that you know the two types, it's time we dive into the tasks which make up bookkeeping, some of which you might probably be doing already. Here are some bookkeeping tasks to do on a weekly and monthly basis.

Weekly bookkeeping tasks are mostly about records. Every week, you must input the week's transactions and prepare them for evaluation at the end of the month. Here are some of them.

One of the first bookkeeping tasks you must do weekly is to record any type of financial transaction made in the company's name: mainly income and expenses.

Most startup businesses do this in a journal, but it's ideal to do it on a spreadsheet or bookkeeping software since it's safer to store it digitally than have it out in the open.

Of course, it's not enough that you'll simply jot how much money is going in and out; you'll also have to mark transactions differently to ensure an accurate accounting of your finances.

For example, while sales and loans both bring in money for the company, only sales can be labeled as assets in double-entry bookkeeping because loans have to be paid back in the future and are thus liabilities.

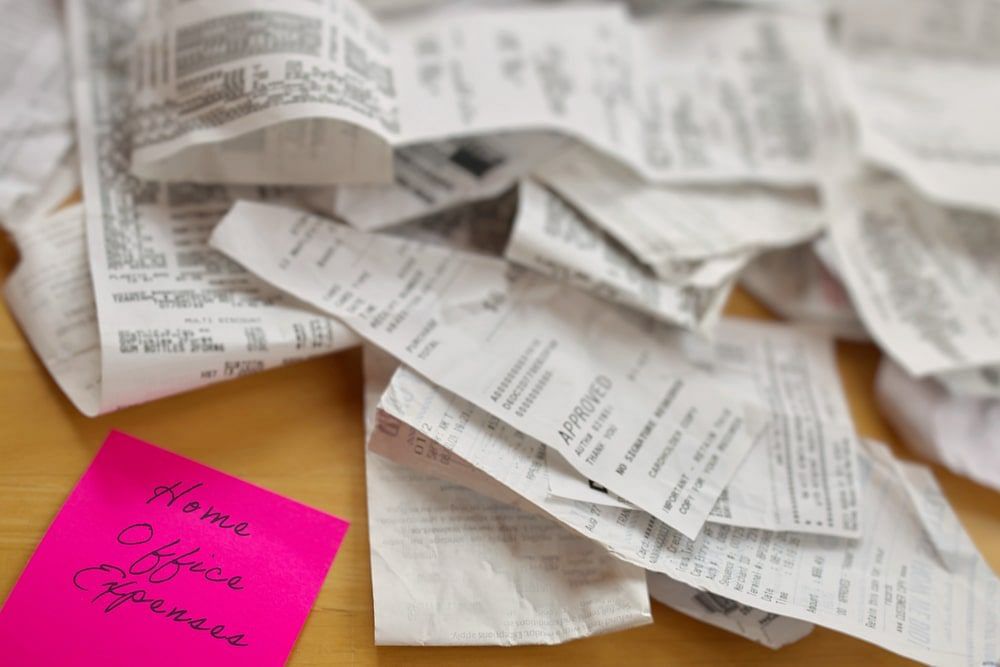

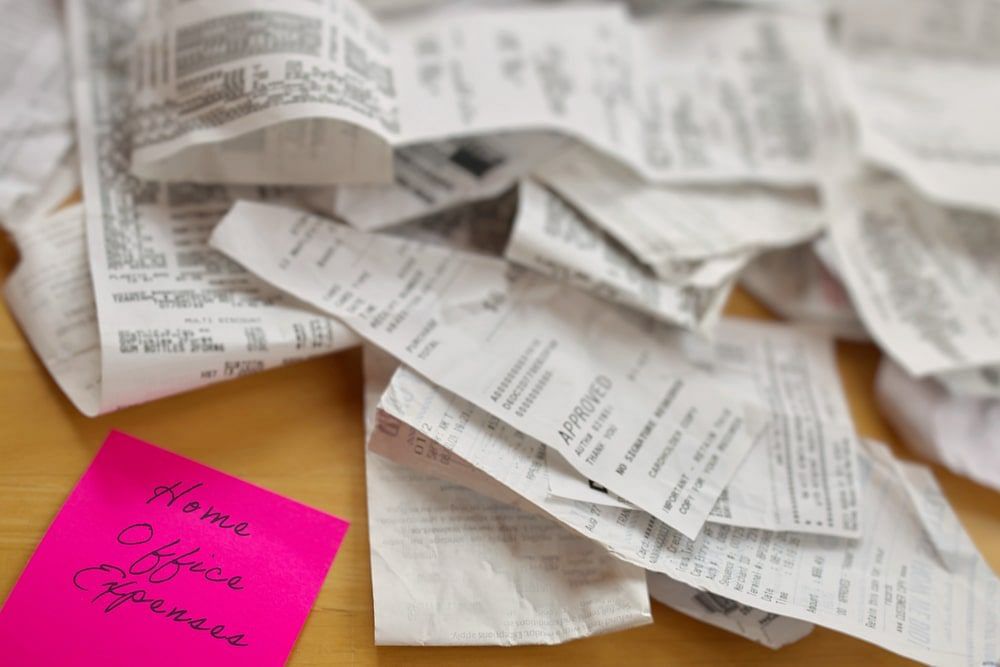

After jotting your transactions in a journal or typing them into bookkeeping software, you'll want to file them for later reference. Physical copies of receipts should be shelved and digitized to avoid losing them.

Digitization is important, especially in today's ecommerce world, where most transactions are done electronically.

Monthly bookkeeping tasks are important for your company's financial health and stability. The tasks you'll have to be doing on a monthly basis are about maintaining your company's financial standing and, more importantly, looking into its future.

Reconciling your accounts is, basically, double-checking. This helps maintain the integrity of your records and spot any inconsistencies that could be signs of fraud or theft within a company.

Accounting is not only recording finances but also predicting how much your company has in the future. By readying your invoices, you can come up with a realistic income you can expect for the following month.

Sometimes, we let unpaid invoices slide. While it is normal to have to follow up on outstanding invoices, this should be an urgent priority. Letting unpaid invoices go robs your company of the money you were expecting from a sale and disrupts the harmony of your finances.

Following up on outstanding invoices can lead to them being paid which procures additional income for your company.

While income adds assets to your business, expenses add liabilities, and paying them or leaving them unpaid could determine your net profit margin ratio for the next month as well as the overall health of your business.

Clearing your monthly bills leaves you with less debt going into the next month, and less debt means more profit for your business. It can also help monitor how much you owe in business taxes before you submit your next tax returns.

Once all monthly tasks have been settled, you are left with your company's financial status, which you will then evaluate (ideally, with the help of an accountant). You will see how much your business has profited, how the cash flow is doing, how much there is to spend, or worse, how much you have lost and how much you still owe.

Regardless, it is important to evaluate your finances because this is how you can decide on your company's future, and the steps to take to help it grow.

Bookkeeping can be difficult, especially for startups, so if you want to go big with your business, it's time for you to upgrade your company's bookkeeping and accounting processes.

Unloop is one of the best accounting services on the market, and, luckily for you, we offer bookkeeping services, too. At Unloop, we can ensure you save money by having accurate records. We also handle accounts payable, forecasting, payroll, and tax services.

Book a call with us, and see what Unloop can do for your business!

Starting a business comes with many headaches, and most have nothing to do with selling products and services. A huge responsibility of a business owner is managing a business's situation—building a culture, training employees, and, most of all, keeping the company's financial situation in good standing.

Since startup companies have little to no assets, they tend to go the simpler route with their financial records. Many startup owners prefer dealing with cash-basis accounting, better known as single-entry bookkeeping (which we'll discuss more later).

While this is a good way to manage accounting for your startup, you can't depend on it forever.

If your business grows, you might have to expand your accounting to cover the new areas of your financial business structure, like assets, liabilities, and equity. The IRS even mandates that companies with annual gross sales of over $5 million cannot use single-entry accounting.

Eventually (with enough hard work and luck), your business will grow, and along with it must grow your financial statements, financial transactions, and financial records—basically your whole accounting system. You'll need to make a choice: go big or go home.

In general terms, bookkeeping is the process of accounting for a company's business transactions. Bookkeeping organizes business transactions and turns them into records that reflect the company's financial situation, which completes the accounting process.

Financial records are vital in keeping businesses afloat. Without bookkeeping, businesses would be in financial darkness. With no written or recorded financial information, any financial decision or transaction would have to be closer to a guess than a concrete decision. Simply put, a business without proper bookkeeping in place will not thrive, let alone survive.

That said, not all forms of financial management are made equal. For example, startup accounting and bookkeeping differ from that of large businesses—it all falls on what is necessary and what your business prohibits you from excluding in a financial statement.

Essentially, there are two types of bookkeeping, both with their own advantages and disadvantages.

Single-entry bookkeeping is the simplest form of accounting and bookkeeping. With single-entry bookkeeping, you simply state income and business expenses—usually accompanied by a brief description of the financial transaction and its date—against each other on a table and calculate the difference as your business's cash balance. This is also called cash accounting.

Accounting for startups and small businesses usually starts with single-entry bookkeeping for several reasons. One is because single-entry bookkeeping is much cheaper. You can do it on cheap accounting software or, if you're frugal, you can even do it on a piece of paper with a pen or a pencil.

While single-entry bookkeeping falls under generally accepted accounting principles, it isn't ideal, especially for growing businesses. This is due to single-entry bookkeeping having entries lacking detail. In addition, since single-entry bookkeeping does not specify the nature of income and business expenses, it cannot produce a balance sheet—an essential part of your company's financial health. It is also more prone to error and is unacceptable for taxes.

If you're counting on your business growing, you will have to consider double-entry bookkeeping for your company's financial data.

Single-entry to double-entry bookkeeping is like Little League to the NBL. While single entry bookkeeping can get you an idea of your company's financial data, double-entry bookkeeping gives you the whole picture.

With double-entry bookkeeping, you include debit and credit or the increase and decrease of accounts in different situations. For example, debit can increase assets and decrease liabilities, while credit can increase liabilities and then decrease assets.

Single-entry bookkeeping does not have debit and credit and thus cannot specify the nature of accounts. A classic example of this is loans. In single-entry bookkeeping, the money produced from loans is inserted directly into income; in double-entry bookkeeping, the loan is tagged as a liability—a debit—adding context to your financial report and leaving you with much more accurate accounting.

Double-entry bookkeeping takes notes of assets, liabilities, and equities, in addition to everything a single-entry system records. This can be used to produce a balance sheet. Large businesses prefer double-entry bookkeeping because it is more contextual, and it becomes easier to account for vast assets and put them into financial records.

Eventually, large businesses will move to accrual accounting, something double-entry bookkeeping makes easier. By then, their finances will operate more on a schedule instead of relying solely on the income entering the company.

Now that you know the two types, it's time we dive into the tasks which make up bookkeeping, some of which you might probably be doing already. Here are some bookkeeping tasks to do on a weekly and monthly basis.

Weekly bookkeeping tasks are mostly about records. Every week, you must input the week's transactions and prepare them for evaluation at the end of the month. Here are some of them.

One of the first bookkeeping tasks you must do weekly is to record any type of financial transaction made in the company's name: mainly income and expenses.

Most startup businesses do this in a journal, but it's ideal to do it on a spreadsheet or bookkeeping software since it's safer to store it digitally than have it out in the open.

Of course, it's not enough that you'll simply jot how much money is going in and out; you'll also have to mark transactions differently to ensure an accurate accounting of your finances.

For example, while sales and loans both bring in money for the company, only sales can be labeled as assets in double-entry bookkeeping because loans have to be paid back in the future and are thus liabilities.

After jotting your transactions in a journal or typing them into bookkeeping software, you'll want to file them for later reference. Physical copies of receipts should be shelved and digitized to avoid losing them.

Digitization is important, especially in today's ecommerce world, where most transactions are done electronically.

Monthly bookkeeping tasks are important for your company's financial health and stability. The tasks you'll have to be doing on a monthly basis are about maintaining your company's financial standing and, more importantly, looking into its future.

Reconciling your accounts is, basically, double-checking. This helps maintain the integrity of your records and spot any inconsistencies that could be signs of fraud or theft within a company.

Accounting is not only recording finances but also predicting how much your company has in the future. By readying your invoices, you can come up with a realistic income you can expect for the following month.

Sometimes, we let unpaid invoices slide. While it is normal to have to follow up on outstanding invoices, this should be an urgent priority. Letting unpaid invoices go robs your company of the money you were expecting from a sale and disrupts the harmony of your finances.

Following up on outstanding invoices can lead to them being paid which procures additional income for your company.

While income adds assets to your business, expenses add liabilities, and paying them or leaving them unpaid could determine your net profit margin ratio for the next month as well as the overall health of your business.

Clearing your monthly bills leaves you with less debt going into the next month, and less debt means more profit for your business. It can also help monitor how much you owe in business taxes before you submit your next tax returns.

Once all monthly tasks have been settled, you are left with your company's financial status, which you will then evaluate (ideally, with the help of an accountant). You will see how much your business has profited, how the cash flow is doing, how much there is to spend, or worse, how much you have lost and how much you still owe.

Regardless, it is important to evaluate your finances because this is how you can decide on your company's future, and the steps to take to help it grow.

Bookkeeping can be difficult, especially for startups, so if you want to go big with your business, it's time for you to upgrade your company's bookkeeping and accounting processes.

Unloop is one of the best accounting services on the market, and, luckily for you, we offer bookkeeping services, too. At Unloop, we can ensure you save money by having accurate records. We also handle accounts payable, forecasting, payroll, and tax services.

Book a call with us, and see what Unloop can do for your business!

The choice of bookkeeping service package you make today will directly impact your profit margin and your time for the short or long term. You also have to account for the costs your business incurs more than your revenue for it to be profitable.

Accounting services are essential for a growing business, but they have a cost. As a business owner, you pay to keep your business numbers intact. So it's only logical to make a cost-effective choice before deciding to commit.

If you're looking for bookkeeping price packages in Canada or the US, let Unloop help you with the following guide.

Bookkeeping and accounting firms adapt different pricing models for their services. This is to allow an option that will match the client's needs with the solutions they provide. There are at least three pricing packages.

This type of bookkeeping pricing package offers you a fixed amount to pay for an agreed service. They may do the work earlier or later than expected, but as long as the service is completed, you must pay the rate.

Compared to a flat rate, an hourly rate charges you a fixed amount on an hourly basis. This type of accounting pricing package makes efficiency important because the longer the service takes to complete, the higher the amount you pay. The good news is that an hourly rate is a good option if you only need minor services.

Some accounting businesses bundle services together and offer them on a fixed monthly bookkeeping and accounting rate called a subscription. They also offer different levels or what they call "tiers" that cater to different levels of accounting business needs.

Many accounting service companies offer a host of services for their clients. Their arrangement may vary depending on your case, or it may be a fixed package containing several services. But no matter what accounting service firm you deal with, you will encounter the following services.

This service is a staple in any bookkeeping service company. If there's only one service they have to provide, it is bookkeeping, which is the core process of any financial accounting.

From bookkeeping, they can extend the service to financial statement preparation and reporting. In most cases, financial statements come bundled as part of bookkeeping service packages as it is connected to the process. But some accounting service firms offer monthly financial reports as a business advantage.

In some enterprises with a business-to-business (B2B) model, there can be frequent volume purchases, and these transactions often involve credits. Accountants understand that with the volume comes the complexity of managing accounts payable, which can wreak havoc on a business's cash flow. So they offer assistance and management as part of their service offering.

As the number of employees increases, paying them becomes more challenging. That's because apart from the volume, you may also have different types of employees, such as regular full-time, part-time, or contract employees. All these employee types have different treatments. So accountants offer payroll services to ensure salary is paid accurately for everyone and the disbursement is recorded properly in the business's accounting system.

Accountants understand the value of knowing future revenue potential for management. So to relieve business owners of the guesswork, accountants offer forecasting services to project short-term and long-term income and how a purchase decision can affect future revenues.

Tax is the most complex subject for any business owner. Yet taxes are obligations that every business must fulfill. To ensure that business owners are paying the correct tax amount and avoid legal repercussions, accountants can offer tax preparation assistance to help businesses know the right tax amount to pay.

Before selecting from bookkeeping pricing packages offered by an accounting service company, consider the following criteria. These will help you determine the right arrangement that will maximize your profit.

How big the business is plays an important factor when choosing a bookkeeping service. There are several ways to measure your business size: the number of employees, the size of equity invested, and the volume of transactions.

Each of these will affect how complex the accounting service is needed. For example, if you're a startup business with less than five employees, you may only need a part-time bookkeeping service, but if you have hundreds of regular workers, you'll need a skilled accounting team handling the payroll, books, and bank accounts.

Most small businesses use a program or software to handle their accounting and bookkeeping work. So it's important to tell your prospective bookkeeper what you are using (or not using) so they can do their best to adjust to your needs.

As an example, Unloop is a bookkeeping agency that specializes in QuickBooks. If you're using the same software, the transition will be smooth, but if you're using a different accounting software such as Xero or Sage50, they will have to work with what you have or transition you to QuickBooks.

An accountant familiar with your industry will know how your numbers work. This means they are far more capable of working efficiently and giving you accounting information that they know will help.

Unloop is a service agency that specializes in ecommerce. We know how to work with numbers and can provide you with the reports you need for decision-making. Not only that, but we can also offer advice on what steps you can take to maximize profitability.

Inquire about what services the bookkeeping company has to offer. The more services they can offer, the better. That's because you can always expand the service you need for them, which makes for a more efficient operation of your accounting systems.

You'll want to get a full-service accounting agency that offers services like the ones mentioned above. This way, you won't have to search for another company to do a different aspect of your accounting.

A bookkeeping service company must have a track record of both past and ongoing clients. So check if they have some under their belt. This verifies their legitimacy and competence.

It's much better if you can get feedback about their service. Check their website for client testimonials or ask for case studies you can read. If their clients are satisfied, then it's likely that you will be, too.

Now that you know the different pricing packages and services available, you are in a better position to decide what the best package applies to your business. But to hone in on the most cost-effective decision, you must find out what your business needs and talk to an accounting service provider.Talk to Unloop. We have three different price packages to offer you to make sure it's customized according to your business needs. Book a call with us or check out our ecommerce services now.

The choice of bookkeeping service package you make today will directly impact your profit margin and your time for the short or long term. You also have to account for the costs your business incurs more than your revenue for it to be profitable.

Accounting services are essential for a growing business, but they have a cost. As a business owner, you pay to keep your business numbers intact. So it's only logical to make a cost-effective choice before deciding to commit.

If you're looking for bookkeeping price packages in Canada or the US, let Unloop help you with the following guide.

Bookkeeping and accounting firms adapt different pricing models for their services. This is to allow an option that will match the client's needs with the solutions they provide. There are at least three pricing packages.

This type of bookkeeping pricing package offers you a fixed amount to pay for an agreed service. They may do the work earlier or later than expected, but as long as the service is completed, you must pay the rate.

Compared to a flat rate, an hourly rate charges you a fixed amount on an hourly basis. This type of accounting pricing package makes efficiency important because the longer the service takes to complete, the higher the amount you pay. The good news is that an hourly rate is a good option if you only need minor services.

Some accounting businesses bundle services together and offer them on a fixed monthly bookkeeping and accounting rate called a subscription. They also offer different levels or what they call "tiers" that cater to different levels of accounting business needs.

Many accounting service companies offer a host of services for their clients. Their arrangement may vary depending on your case, or it may be a fixed package containing several services. But no matter what accounting service firm you deal with, you will encounter the following services.

This service is a staple in any bookkeeping service company. If there's only one service they have to provide, it is bookkeeping, which is the core process of any financial accounting.

From bookkeeping, they can extend the service to financial statement preparation and reporting. In most cases, financial statements come bundled as part of bookkeeping service packages as it is connected to the process. But some accounting service firms offer monthly financial reports as a business advantage.

In some enterprises with a business-to-business (B2B) model, there can be frequent volume purchases, and these transactions often involve credits. Accountants understand that with the volume comes the complexity of managing accounts payable, which can wreak havoc on a business's cash flow. So they offer assistance and management as part of their service offering.

As the number of employees increases, paying them becomes more challenging. That's because apart from the volume, you may also have different types of employees, such as regular full-time, part-time, or contract employees. All these employee types have different treatments. So accountants offer payroll services to ensure salary is paid accurately for everyone and the disbursement is recorded properly in the business's accounting system.

Accountants understand the value of knowing future revenue potential for management. So to relieve business owners of the guesswork, accountants offer forecasting services to project short-term and long-term income and how a purchase decision can affect future revenues.

Tax is the most complex subject for any business owner. Yet taxes are obligations that every business must fulfill. To ensure that business owners are paying the correct tax amount and avoid legal repercussions, accountants can offer tax preparation assistance to help businesses know the right tax amount to pay.

Before selecting from bookkeeping pricing packages offered by an accounting service company, consider the following criteria. These will help you determine the right arrangement that will maximize your profit.

How big the business is plays an important factor when choosing a bookkeeping service. There are several ways to measure your business size: the number of employees, the size of equity invested, and the volume of transactions.

Each of these will affect how complex the accounting service is needed. For example, if you're a startup business with less than five employees, you may only need a part-time bookkeeping service, but if you have hundreds of regular workers, you'll need a skilled accounting team handling the payroll, books, and bank accounts.

Most small businesses use a program or software to handle their accounting and bookkeeping work. So it's important to tell your prospective bookkeeper what you are using (or not using) so they can do their best to adjust to your needs.

As an example, Unloop is a bookkeeping agency that specializes in QuickBooks. If you're using the same software, the transition will be smooth, but if you're using a different accounting software such as Xero or Sage50, they will have to work with what you have or transition you to QuickBooks.

An accountant familiar with your industry will know how your numbers work. This means they are far more capable of working efficiently and giving you accounting information that they know will help.

Unloop is a service agency that specializes in ecommerce. We know how to work with numbers and can provide you with the reports you need for decision-making. Not only that, but we can also offer advice on what steps you can take to maximize profitability.

Inquire about what services the bookkeeping company has to offer. The more services they can offer, the better. That's because you can always expand the service you need for them, which makes for a more efficient operation of your accounting systems.

You'll want to get a full-service accounting agency that offers services like the ones mentioned above. This way, you won't have to search for another company to do a different aspect of your accounting.

A bookkeeping service company must have a track record of both past and ongoing clients. So check if they have some under their belt. This verifies their legitimacy and competence.

It's much better if you can get feedback about their service. Check their website for client testimonials or ask for case studies you can read. If their clients are satisfied, then it's likely that you will be, too.

Now that you know the different pricing packages and services available, you are in a better position to decide what the best package applies to your business. But to hone in on the most cost-effective decision, you must find out what your business needs and talk to an accounting service provider.Talk to Unloop. We have three different price packages to offer you to make sure it's customized according to your business needs. Book a call with us or check out our ecommerce services now.

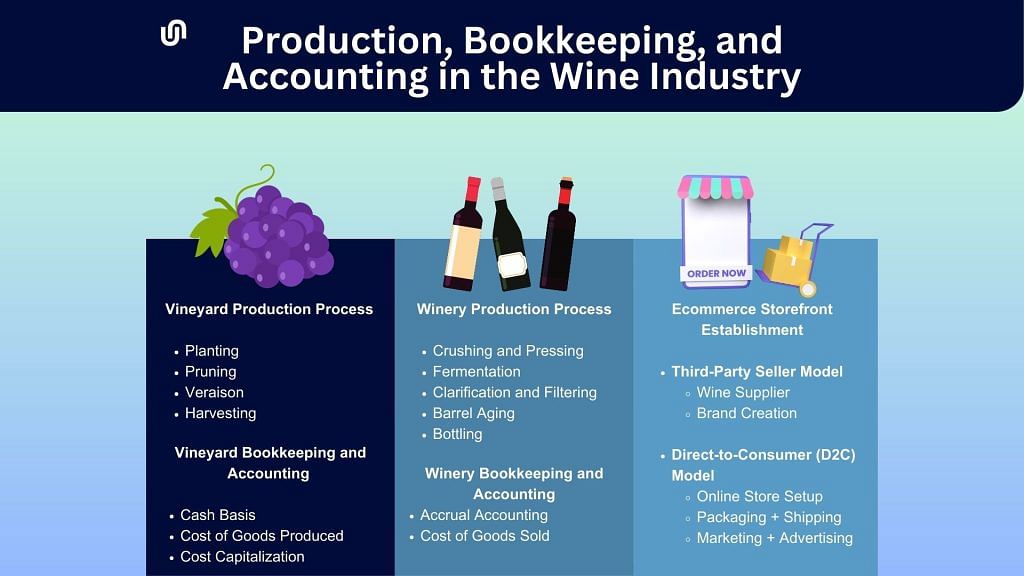

The wine business is one of the most vertically integrated businesses there is. A vineyard can work down the supply chain by building a winery and going further with an ecommerce storefront. But winery bookkeeping and accounting become more complex with this integration.

Sounds daunting? Let Unloop show you how bookkeeping and accounting for wineries work as simply as possible.

At the top of the wine industry supply chain is the vineyard. This business takes care of grapefruit planting up to harvesting, which wineries will use as a raw material for making wine. The following is the vineyard's production process.

A vineyard is heavy on agricultural activities. The production is long-winding, and it will take years before the vineyard realizes a profit. Given the situation, accountants follow these accounting practices.

Most farm businesses operate using the cash basis accounting method, where income or costs are immediately recognized as soon as the cash is received or spent.

With this accounting type, farms have a clearer view of their cash flow. It also makes tax filing easier because they won’t have to pay taxes in accumulated amounts, unlike in accrual accounting.

Since vineyards are farms, vineyard accountants and bookkeepers use the same accounting method, making it easier to record production costs accurately.

According to accounting principles, accountants use COGP to allocate vineyard costs associated with growing grapes, such as direct labor, overhead, and other supplies and activities involved in the process.

They do so to avoid any miscalculations and confusion between the cost pool of the winery and the vineyard.

Grapes take years to grow. As a result, the vineyard only gets revenue after several years. Farming costs add up during that time without any income to offset them. To resolve this problem, accountants may capitalize on the vineyard's expenses so the business realizes a profit according to the total sales in the given period.

Harvesting the grapes is the departure point of the vineyard and the start of the winery production processes. In the winery, the grapes are turned into wine and are stored as collections for sale in the future.

In most cases, vineyards also have a wine production facility (i.e., winery), so the two terms are often mixed up. But wineries work differently. The video below details the winemaking process.

As briefly shown above, wine production has a different behavior compared to the vineyard. It has similar functions to a general manufacturing process, with some nuances. As a result, accountants adjust their practices according to the winery's needs.

Professionals use the accrual basis accounting method for winery accounting. It's a rational choice because obtaining the raw material for winemaking may not need to be paid immediately due to integration.

On the other hand, getting cash from a sale of a barrel or bottles may also take time. To avoid any miscalculations, accountants record transactions once incurred.

Wineries use the common COGS system primarily because they have a tangible good to sell for a profit.

At present, many wine sellers take their products online. Ecommerce marketplaces, like Amazon, offer a vast network of wine consumers, making it attractive for sellers of all kinds. Online wine sellers can choose between these two models.

A third-party seller can offer a wide variety of wines from different wineries. They are strictly retail. They must also follow the steps a direct-to-consumer takes to have an ecommerce presence (see next section).

However, two additional core steps are necessary to enter the ecommerce market.

Wineries can now sell their wine bottles directly to consumers using the power of ecommerce. Smaller wineries often use a D2C approach, which offers a high-profit margin and a seamless transition, leveraging their existing supply and brand.

All that’s left for wineries like yours to do are the following:

The challenge of running a winery business is that it has two different accounting systems—one for the vineyard and another for the winery itself. Plus, you can take your business online, like creating a separate retail business with another accounting system. Establishing multiple accounting systems is no easy feat, so outsourcing the job to the experts can be significantly beneficial.

Here's what wineries can expect when they outsource their financial management.

Accounting professionals will record all the ecommerce business financial data using double-entry accounting software, such as QuickBooks. This service will include generating financial statements and other financial reporting documents as needed.

The ecommerce retail side of the wine business will have separate COGS recordkeeping. Accountants and bookkeepers report this financial data to you or include them in the income statement for your analysis.

In the ecommerce market, adherence to accounting compliance is essential, which often entails tax management, such as sales tax and income tax. By outsourcing your ecommerce accounting, you'll gain access to seasoned bookkeeping experts who can collaborate with your accountant, ensuring precise tax filing obligations based on comprehensive records and data.

Whether you own a vineyard or are a third-party wine seller, outsourcing your bookkeeping and accounting will lift a huge burden off your back.

Ecommerce has a lot of potential to scale. If the demand for wine spikes, it will be more challenging to do bookkeeping and accounting on your own, so leave it to the experts at Unloop and focus on growing your winery into a successful business. Book a call with us if you want to know more about what we are capable of, or check out our bookkeeping services now for more information.

The wine business is one of the most vertically integrated businesses there is. A vineyard can work down the supply chain by building a winery and going further with an ecommerce storefront. But winery bookkeeping and accounting become more complex with this integration.

Sounds daunting? Let Unloop show you how bookkeeping and accounting for wineries work as simply as possible.

At the top of the wine industry supply chain is the vineyard. This business takes care of grapefruit planting up to harvesting, which wineries will use as a raw material for making wine. The following is the vineyard's production process.

A vineyard is heavy on agricultural activities. The production is long-winding, and it will take years before the vineyard realizes a profit. Given the situation, accountants follow these accounting practices.

Most farm businesses operate using the cash basis accounting method, where income or costs are immediately recognized as soon as the cash is received or spent.

With this accounting type, farms have a clearer view of their cash flow. It also makes tax filing easier because they won’t have to pay taxes in accumulated amounts, unlike in accrual accounting.

Since vineyards are farms, vineyard accountants and bookkeepers use the same accounting method, making it easier to record production costs accurately.

According to accounting principles, accountants use COGP to allocate vineyard costs associated with growing grapes, such as direct labor, overhead, and other supplies and activities involved in the process.

They do so to avoid any miscalculations and confusion between the cost pool of the winery and the vineyard.

Grapes take years to grow. As a result, the vineyard only gets revenue after several years. Farming costs add up during that time without any income to offset them. To resolve this problem, accountants may capitalize on the vineyard's expenses so the business realizes a profit according to the total sales in the given period.

Harvesting the grapes is the departure point of the vineyard and the start of the winery production processes. In the winery, the grapes are turned into wine and are stored as collections for sale in the future.

In most cases, vineyards also have a wine production facility (i.e., winery), so the two terms are often mixed up. But wineries work differently. The video below details the winemaking process.

As briefly shown above, wine production has a different behavior compared to the vineyard. It has similar functions to a general manufacturing process, with some nuances. As a result, accountants adjust their practices according to the winery's needs.

Professionals use the accrual basis accounting method for winery accounting. It's a rational choice because obtaining the raw material for winemaking may not need to be paid immediately due to integration.

On the other hand, getting cash from a sale of a barrel or bottles may also take time. To avoid any miscalculations, accountants record transactions once incurred.

Wineries use the common COGS system primarily because they have a tangible good to sell for a profit.

At present, many wine sellers take their products online. Ecommerce marketplaces, like Amazon, offer a vast network of wine consumers, making it attractive for sellers of all kinds. Online wine sellers can choose between these two models.

A third-party seller can offer a wide variety of wines from different wineries. They are strictly retail. They must also follow the steps a direct-to-consumer takes to have an ecommerce presence (see next section).

However, two additional core steps are necessary to enter the ecommerce market.

Wineries can now sell their wine bottles directly to consumers using the power of ecommerce. Smaller wineries often use a D2C approach, which offers a high-profit margin and a seamless transition, leveraging their existing supply and brand.

All that’s left for wineries like yours to do are the following:

The challenge of running a winery business is that it has two different accounting systems—one for the vineyard and another for the winery itself. Plus, you can take your business online, like creating a separate retail business with another accounting system. Establishing multiple accounting systems is no easy feat, so outsourcing the job to the experts can be significantly beneficial.

Here's what wineries can expect when they outsource their financial management.

Accounting professionals will record all the ecommerce business financial data using double-entry accounting software, such as QuickBooks. This service will include generating financial statements and other financial reporting documents as needed.

The ecommerce retail side of the wine business will have separate COGS recordkeeping. Accountants and bookkeepers report this financial data to you or include them in the income statement for your analysis.

In the ecommerce market, adherence to accounting compliance is essential, which often entails tax management, such as sales tax and income tax. By outsourcing your ecommerce accounting, you'll gain access to seasoned bookkeeping experts who can collaborate with your accountant, ensuring precise tax filing obligations based on comprehensive records and data.

Whether you own a vineyard or are a third-party wine seller, outsourcing your bookkeeping and accounting will lift a huge burden off your back.

Ecommerce has a lot of potential to scale. If the demand for wine spikes, it will be more challenging to do bookkeeping and accounting on your own, so leave it to the experts at Unloop and focus on growing your winery into a successful business. Book a call with us if you want to know more about what we are capable of, or check out our bookkeeping services now for more information.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

In recent years, ecommerce platforms like Amazon have undeniably taken a greater role in the economy and our lifestyles. So if you wish to survive the competitive ecommerce world this 2023, hiring an Amazon bookkeeper isn’t just a nice-to-have—it’s essential.

Let us convince you why hiring bookkeeping services for Amazon sellers is not only a mere luxury for those who can afford them but an indispensable key to online success.

There will always be skeptics, and it isn't a bad thing. It’s only natural to know that the ecommerce industry isn't just a passing trend before jumping on the bandwagon.

Ensuring long-term growth becomes especially important when investing your money to buy initial inventory and hire employees.

Is setting up a store and selling on the world's largest online retailer worth it? Yes! Here are a few reasons establishing a business on Amazon is ideal.

Big-box stores like Walmart and Target always come to mind when shopping. Be it grocery items, furniture, or appliances, the go-to for almost everything you need is a big-box store. For this reason, physical retailers enjoy a steady supply of customers, keeping their aisles busy and parking lots full.

However, in 2020, Amazon's Gross Merchandise Value (GMV) exceeded that of Walmart. Amazon achieved a 41% GMV growth, while Walmart grew by 10%. These numbers translate to the volume of sales made within a year.

Given this trajectory, it's clear that Amazon is on an upward swing, and today might be a good time to get involved.

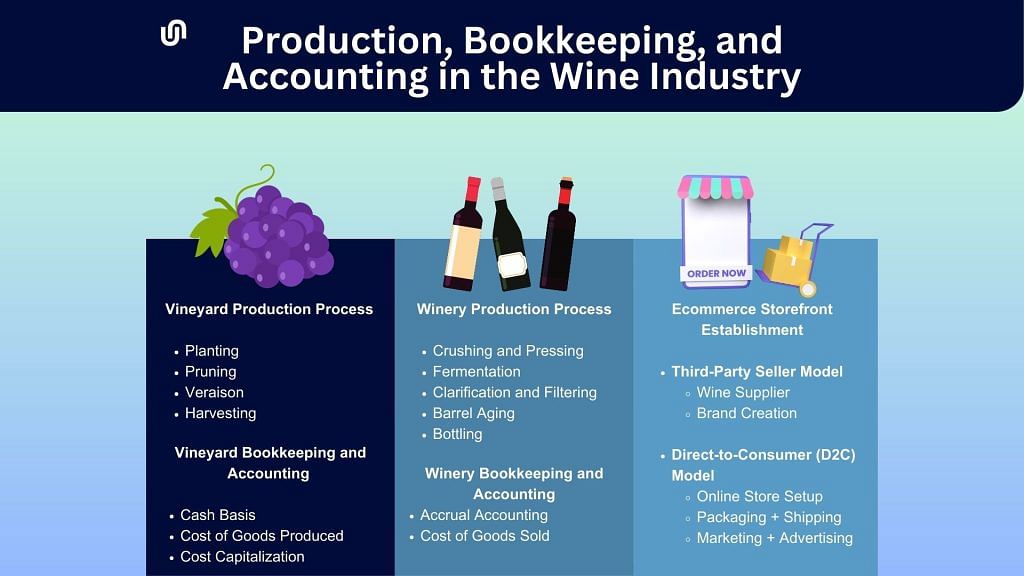

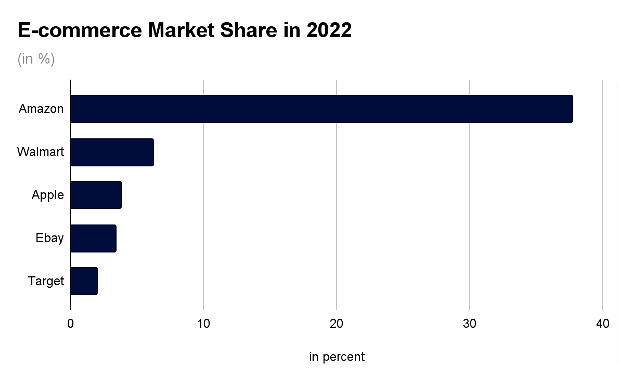

When asked about ecommerce, which company comes to mind? If Amazon isn't the first thing you thought about, you might be living in a cave! Amazon has truly taken over the ecommerce market.

Projections for Amazon promise a favorable outlook for the company and ecommerce in general, as analysts predicted that Amazon would take 50% of the ecommerce market share. The marketplace is nearing this benchmark after taking almost 40% of the market share in 2022.

Source: Data from Statista.com

How does this translate for Amazon sellers like you? If you want to increase your products' visibility, be smart and put them up on display on Amazon. The more people visit Amazon, the higher the chances of translating traffic into actual sales.

Smartphones have become inseparable from us. We have been doing most of our daily activities with the help of these gadgets. For instance, a meal can be delivered right to your home's doorstep through a mobile app.

Taking advantage of this shift to mobile use, ecommerce platforms like Amazon optimize their websites and apps to work seamlessly with mobile devices. This leads to mobile commerce being projected to exceed $510 billion in sales in 2023.

You can gain from this projected growth by having your products accessible on mobile devices through the Amazon app. In fact, the Amazon app is listed as one of the top mobile commerce platforms, gaining close to 21 million monthly active users and almost 35 million downloads in 2022.

Consuming all sorts of content on social media platforms is addicting. Entrepreneurs have seized this valuable opportunity by buying ad spaces and building a marketing strategy for social commerce.

With a well-managed and engaging social media page, you can convert traffic on your page to sales on your Amazon store. You can even tap influencers and micro-influencers to generate interest in your products.

As long as social media remains popular, you can use the platform to promote your products and increase your brand's visibility on the Amazon marketplace.

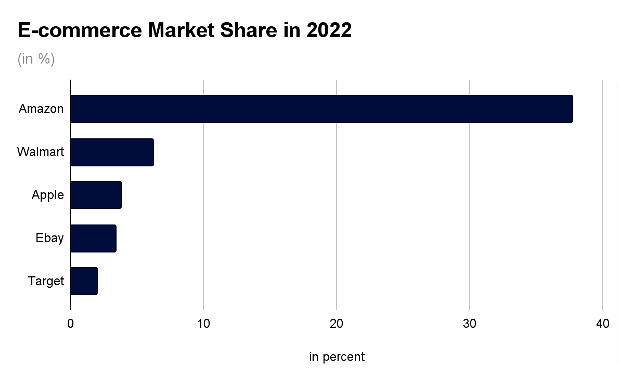

Thanks to your hard work and a touch of luck, you've managed to grow your ecommerce business, receiving thousands of orders daily. Congratulations! But can you keep up?

Scaling up your business means adding new members to what used to be a one-person team. Unless you have eight tentacles, you cannot juggle crucial tasks like inventory management, shipment, and accounting via your Amazon Seller Central account.

That's why you must hire bookkeeping services to keep your financial transactions in order and avoid financial trouble. And the best part? Hiring professional bookkeepers is as easy as booking a call!

Read more to familiarize yourself with what bookkeepers can do for you and your growing business.

You must have a system that keeps track of the number of goods sold and the money going in and leaving your business. New small business owners can get away with collecting receipts and encoding them manually on their self-made spreadsheets.

But as you scale up your operations, manual entry will be time-consuming and prone to costly errors. Hiring an Amazon accountant or bookkeeper with an accrual accounting system will help you monitor your cash inflow and outflow. They can do all the work on your behalf.

No matter how busy your daily business operations are, you can always rely on your bookkeeper to consider every penny that goes in and out of your business.

Losing receipts and skipping accounting for your daily income and expenses is all too easy. But even though you’re unlikely to face immediate legal consequences for such lapses, you must still do your due diligence concerning money matters.

Your negligence might result in penalties from government auditors when tax season comes. A tight schedule is no excuse for overlooking your tax accounting. So, it’s time for you to hire a team of professional bookkeepers to settle and minimize your taxes for you.

While you still have to file taxes yourself, bookkeepers prepare everything to account for every cent you owe the government.

Are you a hands-on business owner? Nothing beats being in the trenches of your growing business and attending to every transaction yourself. But too much involvement on the ground may prevent you from seeing the bigger picture. You need to zoom out to check how your small business is doing.

Professional bookkeepers employ the best bookkeeping software for Amazon sellers to generate summary reports about your business' performance.

For example, is your business making money? Which quarter saw growth in Amazon sales? You can answer all these questions by glancing at your summary report.

In addition to tracking your daily earnings, you should also set targets for the future growth of your business.

Of course, you'll have milestones and deadlines to meet along the way. However, crafting a timetable should be based on past performance and cash flow for it to be realistic and achievable.

Fortunately, you can instantly skip the complicated math and request a projections report with an experienced ecommerce bookkeeper. You can rely on their projections based on the data gathered from your business's past performance. They even use cloud accounting software that takes additional data from current trends observed in the market.

2023 might just be the best time to become an Amazon FBA seller. Aspiring ecommerce businesses will definitely benefit from the current industry trends, including social commerce and mobile commerce.

However, you will need help in such a risky yet rewarding endeavor. Amazon bookkeeping and ecommerce accounting can be difficult without the help of professional accounting services.

So don't let your Amazon business get caught in the tangle of accounting and sales tax liability web! Ditch your clunky Google Sheet spreadsheets and hire a reliable Amazon seller bookkeeping service today!

Book a call now and check out our bookkeeping services for budding entrepreneurs like you!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

In recent years, ecommerce platforms like Amazon have undeniably taken a greater role in the economy and our lifestyles. So if you wish to survive the competitive ecommerce world this 2023, hiring an Amazon bookkeeper isn’t just a nice-to-have—it’s essential.

Let us convince you why hiring bookkeeping services for Amazon sellers is not only a mere luxury for those who can afford them but an indispensable key to online success.

There will always be skeptics, and it isn't a bad thing. It’s only natural to know that the ecommerce industry isn't just a passing trend before jumping on the bandwagon.

Ensuring long-term growth becomes especially important when investing your money to buy initial inventory and hire employees.

Is setting up a store and selling on the world's largest online retailer worth it? Yes! Here are a few reasons establishing a business on Amazon is ideal.

Big-box stores like Walmart and Target always come to mind when shopping. Be it grocery items, furniture, or appliances, the go-to for almost everything you need is a big-box store. For this reason, physical retailers enjoy a steady supply of customers, keeping their aisles busy and parking lots full.

However, in 2020, Amazon's Gross Merchandise Value (GMV) exceeded that of Walmart. Amazon achieved a 41% GMV growth, while Walmart grew by 10%. These numbers translate to the volume of sales made within a year.

Given this trajectory, it's clear that Amazon is on an upward swing, and today might be a good time to get involved.

When asked about ecommerce, which company comes to mind? If Amazon isn't the first thing you thought about, you might be living in a cave! Amazon has truly taken over the ecommerce market.

Projections for Amazon promise a favorable outlook for the company and ecommerce in general, as analysts predicted that Amazon would take 50% of the ecommerce market share. The marketplace is nearing this benchmark after taking almost 40% of the market share in 2022.

Source: Data from Statista.com

How does this translate for Amazon sellers like you? If you want to increase your products' visibility, be smart and put them up on display on Amazon. The more people visit Amazon, the higher the chances of translating traffic into actual sales.

Smartphones have become inseparable from us. We have been doing most of our daily activities with the help of these gadgets. For instance, a meal can be delivered right to your home's doorstep through a mobile app.

Taking advantage of this shift to mobile use, ecommerce platforms like Amazon optimize their websites and apps to work seamlessly with mobile devices. This leads to mobile commerce being projected to exceed $510 billion in sales in 2023.

You can gain from this projected growth by having your products accessible on mobile devices through the Amazon app. In fact, the Amazon app is listed as one of the top mobile commerce platforms, gaining close to 21 million monthly active users and almost 35 million downloads in 2022.

Consuming all sorts of content on social media platforms is addicting. Entrepreneurs have seized this valuable opportunity by buying ad spaces and building a marketing strategy for social commerce.

With a well-managed and engaging social media page, you can convert traffic on your page to sales on your Amazon store. You can even tap influencers and micro-influencers to generate interest in your products.

As long as social media remains popular, you can use the platform to promote your products and increase your brand's visibility on the Amazon marketplace.

Thanks to your hard work and a touch of luck, you've managed to grow your ecommerce business, receiving thousands of orders daily. Congratulations! But can you keep up?

Scaling up your business means adding new members to what used to be a one-person team. Unless you have eight tentacles, you cannot juggle crucial tasks like inventory management, shipment, and accounting via your Amazon Seller Central account.

That's why you must hire bookkeeping services to keep your financial transactions in order and avoid financial trouble. And the best part? Hiring professional bookkeepers is as easy as booking a call!

Read more to familiarize yourself with what bookkeepers can do for you and your growing business.

You must have a system that keeps track of the number of goods sold and the money going in and leaving your business. New small business owners can get away with collecting receipts and encoding them manually on their self-made spreadsheets.

But as you scale up your operations, manual entry will be time-consuming and prone to costly errors. Hiring an Amazon accountant or bookkeeper with an accrual accounting system will help you monitor your cash inflow and outflow. They can do all the work on your behalf.

No matter how busy your daily business operations are, you can always rely on your bookkeeper to consider every penny that goes in and out of your business.

Losing receipts and skipping accounting for your daily income and expenses is all too easy. But even though you’re unlikely to face immediate legal consequences for such lapses, you must still do your due diligence concerning money matters.

Your negligence might result in penalties from government auditors when tax season comes. A tight schedule is no excuse for overlooking your tax accounting. So, it’s time for you to hire a team of professional bookkeepers to settle and minimize your taxes for you.

While you still have to file taxes yourself, bookkeepers prepare everything to account for every cent you owe the government.

Are you a hands-on business owner? Nothing beats being in the trenches of your growing business and attending to every transaction yourself. But too much involvement on the ground may prevent you from seeing the bigger picture. You need to zoom out to check how your small business is doing.

Professional bookkeepers employ the best bookkeeping software for Amazon sellers to generate summary reports about your business' performance.

For example, is your business making money? Which quarter saw growth in Amazon sales? You can answer all these questions by glancing at your summary report.

In addition to tracking your daily earnings, you should also set targets for the future growth of your business.

Of course, you'll have milestones and deadlines to meet along the way. However, crafting a timetable should be based on past performance and cash flow for it to be realistic and achievable.

Fortunately, you can instantly skip the complicated math and request a projections report with an experienced ecommerce bookkeeper. You can rely on their projections based on the data gathered from your business's past performance. They even use cloud accounting software that takes additional data from current trends observed in the market.

2023 might just be the best time to become an Amazon FBA seller. Aspiring ecommerce businesses will definitely benefit from the current industry trends, including social commerce and mobile commerce.

However, you will need help in such a risky yet rewarding endeavor. Amazon bookkeeping and ecommerce accounting can be difficult without the help of professional accounting services.

So don't let your Amazon business get caught in the tangle of accounting and sales tax liability web! Ditch your clunky Google Sheet spreadsheets and hire a reliable Amazon seller bookkeeping service today!

Book a call now and check out our bookkeeping services for budding entrepreneurs like you!

One of the numerous responsibilities of managing a business is bookkeeping. A business needs to record all its assets and expenses to determine how good—or bad—the business is doing. Good bookkeeping is the foundation of seamless accounting, and we're here to help you with your bookkeeping process.

In this article, we'll discuss how double-entry accounting works and why this bookkeeping method is the one you should use for your business.

The practice of documenting transactions in at least two accounts is known as double-entry accounting. Transactions in double-entry bookkeeping often appear in the debit and credit entries.

Having two columns allows you to monitor if both sides are balanced, which will help you pinpoint problems early on. Double-entry bookkeeping is one of the most efficient ways to monitor your company's financial health and growth.

If you plan to use this accounting method, you should know the different account types a transaction may fall into. Here are the primary account types for the double-entry accounting system.

A chart of accounts, which includes each account on the balance sheet and income statement where an accountant makes an entry, is necessary for the double-entry system. Companies can add and modify accounts to better reflect their unique operations, accounting, and reporting requirements.

It's possible for you to do double-entry bookkeeping manually. But, if you're using this bookkeeping method, getting an accounting software will make it easier to set up and prevent errors.

Accounting software options are not just for accountants. They are designed with business owners in mind. Even with little knowledge of accounting, you can surely use them with ease. To help you with the process, here are four crucial steps to start your double-entry bookkeeping system.

As previously stated, you need to record business transactions in at least two accounts for double-entry bookkeeping. The first step is to set up the chart of accounts where you'll be recording transactions.

Bookkeeping software can set up charts for your business automatically. Take advantage of the technology to make the process easier for you.

In this bookkeeping method, the debit entry is on the left side of the ledger accounts, while the credit entry is on the right. It makes it easier to see if your accounts are balanced this way.

A debit entry in the charts will increase the amount of assets and expense accounts. The amount of the obligation, revenue, and equity accounts will rise as a result of a credit entry. If you handle your finances properly at the end of the accounting period, all your accounts should be balanced.

Once your accounts are set up, and you understand how credit and debit work, you can start recording your financial transactions. For example, at the end of February, say you are due to pay $250 for rent. Here is how it would appear in your bookkeeping.

| Date | Account | Debit | Credit |

| 02/28/2023 | Cash | $250 | |

| 02/28/2023 | Expenses (Rent) | $250 |

If you only list the $250 in expenses at the end of the accounting period. You will find a missing $250 in your cash account. If you're lucky to remember where the money went, you have your book balanced, but if not, you'll have discrepancies in your data.

Consider another scenario where you spend $800 in business expenses.

| Date | Account | Debit | Credit |

| 03/12/2023 | Rental car | $350 | |

| 03/12/2023 | Meals | $160 | |

| 03/12/2023 | Hotel | $290 | |

| 03/12/2023 | Cash | $800 |

In double-entry accounting, you can clearly see the different expenses you use on your travel. This will give you a clear picture of spending patterns, which allows you to strategize how to spend and handle your finances.

After encoding all the data in your accounts, you will be ready to generate financial statements. Use these statements to assess the status of your financial health. Read and understand them to strategize further on how to lower your expenses or boost your revenue.

You can also use financial statements to get a bank loan. Furthermore, investors look at your financial statements to see if your business is eligible for sponsors or huge investments.

At first glance, the double-entry method may sound complicated because of the left and right entries you must do. But even professional accountants will recommend double-entry accounting for businesses. Here are some reasons why you should do it.

When you run a business, keeping an accurate record of your transactions is vital for business success. With double-entry bookkeeping, every detail of your finances is recorded. You can ensure the important numbers are noted, and it is easy to spot any discrepancies.

Furthermore, it makes it easier to track which businesses and individuals you owe as well as track those payments your business is yet to receive.

How you choose to handle your finances will dictate the success of your business. Double-entry accounting can help make more informed business decisions that cater to its growth.

For example, in double-entry bookkeeping, you break down all the expenses. It can be for travel, marketing, or even replenishing your inventory. You can analyze the data and brainstorm strategies to control your costs. It helps you make decisions if you need to control your money or spend more towards the development of your business.

The big difference from single-entry accounting is that double-entry accounting is more comprehensive, allowing business owners to widen their financial analysis. Imagine if you have a single-entry accounting process that only shows your expenses. You cannot compare it with anything, other than the historical data you have on hand.

But with double-entry accounting, you can see the money coming into your business. This will give you confidence that you are also gaining profit as you spend to run business operations.

One thing about double-entry accounting is it's complicated for business owners, especially those new to the industry. But don't worry! Unloop is here to help small business owners with their double-entry bookkeeping.

We are a team of experts that helps businesses with their bookkeeping and accounting needs to grow in their industry. We offer bookkeeping services which include:

On the surface, bookkeeping is simply keeping an organized and complete record of business transactions. But in reality, keeping up with recording is a challenge, especially when you handle all the other tasks in your business. Professional services ensure that every dollar that goes in and out of your business is accounted for.

We hope this quick overview of double-entry accounting helps you understand bookkeeping for your small business. Remember, Unloop offers several accounting services if you need more professional help. Talk to our experts by booking a call with us today!

One of the numerous responsibilities of managing a business is bookkeeping. A business needs to record all its assets and expenses to determine how good—or bad—the business is doing. Good bookkeeping is the foundation of seamless accounting, and we're here to help you with your bookkeeping process.