Tax is a word people don't like to hear—especially Shopify sellers. It's enough to make anyone feel nervous. But you can't avoid it if you don't want to pay penalties or possibly face jail time.

Fortunately, Shopify has robust sales tax collection software that collects sales tax on your behalf, but these software don't file or remit your sales taxes. So it's up to you to organize and take care of the nitty-gritty bit of filing your taxes, not to mention issuing tax refunds.

Sales tax compliance can be a daunting aspect of your Shopify business, but there are software apps that can help you with automation. Here are five software apps you can use to automate Shopify sales tax compliance in 2023.

TaxJar is a leading provider of sales tax automation services for eCommerce businesses. They help online sellers collect, file, and pay their sales taxes. TaxJar makes sales tax filing and payment easy, so shop owners can concentrate on what they should be doing: selling online.

Price: Starts at $19/month

Free Trial: 30 days

Zonos Duty & Tax is an eCommerce software developed by a team of professionals with extensive experience in the field. It can help you rest at ease with tax and duty compliance in the United Kingdom, Europe, and other international borders.

Customers won't be blindsided when they receive their items. There will be no unexpected taxes, duties, or other hidden costs. This should minimize issues with returned goods and costly returns.

Price: Starts at $20/month + 1.9% transaction fee for international orders.

Free Trial: None

Quaderno is a Shopify app that helps store owners with tax obligations and international compliance. It can help store owners who want to comply with international laws while also providing them with peace of mind that their enterprises' major tax, invoicing, and accounting concerns are taken care of.

It also helps owners keep track of their sales tax liability. The tool automatically calculates the sales tax rate for each state and jurisdiction and provides a streamlined way to file and pay taxes. Quaderno offers several other features, such as invoicing and reporting, that can help businesses save time and money. Quaderno is essential for any business that needs to manage its sales tax liability.

Price: Starts at $49/month

Free Trial: 7 days

LatoriApps' Tax Exempt Manager is a tax management software designed for store owners who want to stay compliant with the complex EU tax laws. Compliance with VAT rules for business-to-business transactions in Europe is tough. However, it's made a lot easier thanks to this software, which captures and verifies each customer's VAT ID automatically.

Price: $9.99/month

Free Trial: 14 days

Intuit's QuickBooks Online is a small business accounting software that gives users the ability to handle their accounting data in a single app. In addition, the software is accessible from any internet-connected device, making it a convenient option for business owners who are always on the go.

Price: Starts at $8.50/month

Free Trial: 30 days

If you're looking for a comprehensive sales tax solution or need help staying on top of your tax compliance, TaxJar or QuickBooks should do the trick. But as an eCommerce shop owner, you have a lot of things to worry about. From keeping up with inventory to managing shipping and customer service—there's a lot to stay on top of.

Of course, there's also the financial side of things. Keeping track of your sales, expenses, and profits can be daunting, especially if you're not accounting-savvy. That's where we come in. Unloop has a team of eCommerce accountants who are well-equipped and trained to handle accounting services in the US and Canada. Book a call with an expert today to learn more!

Tax is a word people don't like to hear—especially Shopify sellers. It's enough to make anyone feel nervous. But you can't avoid it if you don't want to pay penalties or possibly face jail time.

Fortunately, Shopify has robust sales tax collection software that collects sales tax on your behalf, but these software don't file or remit your sales taxes. So it's up to you to organize and take care of the nitty-gritty bit of filing your taxes, not to mention issuing tax refunds.

Sales tax compliance can be a daunting aspect of your Shopify business, but there are software apps that can help you with automation. Here are five software apps you can use to automate Shopify sales tax compliance in 2023.

TaxJar is a leading provider of sales tax automation services for eCommerce businesses. They help online sellers collect, file, and pay their sales taxes. TaxJar makes sales tax filing and payment easy, so shop owners can concentrate on what they should be doing: selling online.

Price: Starts at $19/month

Free Trial: 30 days

Zonos Duty & Tax is an eCommerce software developed by a team of professionals with extensive experience in the field. It can help you rest at ease with tax and duty compliance in the United Kingdom, Europe, and other international borders.

Customers won't be blindsided when they receive their items. There will be no unexpected taxes, duties, or other hidden costs. This should minimize issues with returned goods and costly returns.

Price: Starts at $20/month + 1.9% transaction fee for international orders.

Free Trial: None

Quaderno is a Shopify app that helps store owners with tax obligations and international compliance. It can help store owners who want to comply with international laws while also providing them with peace of mind that their enterprises' major tax, invoicing, and accounting concerns are taken care of.

It also helps owners keep track of their sales tax liability. The tool automatically calculates the sales tax rate for each state and jurisdiction and provides a streamlined way to file and pay taxes. Quaderno offers several other features, such as invoicing and reporting, that can help businesses save time and money. Quaderno is essential for any business that needs to manage its sales tax liability.

Price: Starts at $49/month

Free Trial: 7 days

LatoriApps' Tax Exempt Manager is a tax management software designed for store owners who want to stay compliant with the complex EU tax laws. Compliance with VAT rules for business-to-business transactions in Europe is tough. However, it's made a lot easier thanks to this software, which captures and verifies each customer's VAT ID automatically.

Price: $9.99/month

Free Trial: 14 days

Intuit's QuickBooks Online is a small business accounting software that gives users the ability to handle their accounting data in a single app. In addition, the software is accessible from any internet-connected device, making it a convenient option for business owners who are always on the go.

Price: Starts at $8.50/month

Free Trial: 30 days

If you're looking for a comprehensive sales tax solution or need help staying on top of your tax compliance, TaxJar or QuickBooks should do the trick. But as an eCommerce shop owner, you have a lot of things to worry about. From keeping up with inventory to managing shipping and customer service—there's a lot to stay on top of.

Of course, there's also the financial side of things. Keeping track of your sales, expenses, and profits can be daunting, especially if you're not accounting-savvy. That's where we come in. Unloop has a team of eCommerce accountants who are well-equipped and trained to handle accounting services in the US and Canada. Book a call with an expert today to learn more!

Bookkeeping for Amazon sellers can be a daunting and highly complex task, but it is essential. With all your financial transactions managed and recorded, financial reporting will be a breeze, making sales tax compliance easier and ensuring accurate financial insights for your business.

Learn how bookkeeping can contribute to your Amazon business's growth and overall success and discover which tools can make this challenging task easier below.

Managing your business’s financial health is one of the most crucial parts of establishing any successful company and brand. Not only can you determine your store’s current state, but you can also use the data you’ve gathered to spot trends and profitable opportunities.

When it comes to selling on the ecommerce giant, here are a few ways an Amazon seller can benefit from bookkeeping.

Knowledge is power, even in Amazon bookkeeping. After all, you can control your expenses only when you have visibility on them. You can pinpoint hefty expenses, keep costs low, aim for a higher income and profit, and save money with bookkeeping.

You have the convenience of seeing the following business costs and expenses on Amazon:

Besides tracking expenses, you can also use bookkeeping to monitor your sales, compute your income, check your total assets, and know the worth of your company.

Some of the details you can check with bookkeeping include the following:

Amazon has Marketplace Tax Collection to comply with the Marketplace Facilitator Law that allows third-party sellers to collect and remit sales taxes on behalf of sellers.

However, while Amazon already has accurate records for you—making tax time easier—it still pays to monitor the data. When all your Amazon small business transactions are monitored throughout the year, tax time and paying your taxes will be uncomplicated.

Make the most of the data from Amazon's default reports and different channels to see the financial state of your business through reports. The best accounting software generates the following in just a few clicks:

Bookkeeping and accounting tools have templates you can readily use, but they are also flexible if you want to generate customized reports. Plenty of bookkeeping services also allow you to choose the type of accounting method you prefer: cash-basis accounting, double-entry accounting, and more.

Most importantly, you can use the reports you generate above for investor presentations. Let the numbers talk through your reports.

Meanwhile, to scale your Amazon store, there will be times when you need to apply for loans. Many creditors require seeing some of the above reports to ensure you can pay for your debts and interest.

Because you have a proper bookkeeping system in place, you won’t have to worry about the two situations and other business presentations you must make.

We’ve established how helpful bookkeeping is for any Amazon store and business. However, laying out these benefits won’t remove the fact that bookkeeping is complicated, dizzying, and headache-inducing.

Fortunately, through innovation and technological advancements, plenty of accounting tools are available to help business owners and sellers like you through this arduous process. One of them is QuickBooks.

QuickBooks is an exceptional accounting system for viewing your bookkeeping numbers. So whether you don't have it yet or are already using it and want to integrate it, let Unloop shed some light on what you can do to produce those numbers easily.

Small business owners on Amazon have access to a global marketplace. As a result, they can have sales from all over the world. Tracking the current exchange rate for a particular overseas sale can be challenging. The same is true for business purchases and accounting for cost and expenses.

That's why QuickBooks's ability to account for the current exchange rate is very helpful. It will determine the correct currency amount at the sale or purchase, giving you and your accounting staff accurate numbers and peace of mind.

Once you discover how to integrate your QuickBooks Online to your Amazon seller account, doing your bookkeeping for sales transactions will be much easier.

QuickBooks Online can sync sales from your Amazon store to your online accounting software. Besides that, it can sync returns and refunds. Again, this feature takes the burden off you and your bookkeeper when searching for and recording sales.

Every business owner must remit the correct sales tax amount. While Amazon facilitates the collection process for each sale you make, it's your responsibility to determine the sales tax amount.

With QuickBooks, this process is made easier. The accounting software automatically calculates the correct sales tax amount for you, depending on the state which you must remit it to.

Another challenge for small businesses on Amazon is inventory management. While Amazon has a robust inventory system monitored by SKUs, this still has to translate to accounting. That means you must track every cost of goods sold (COGS) and product price apart from the outflow.

Tracking inventory is crucial when it comes to accounting for inventory. Thankfully, QuickBooks supports inventory tracking for Amazon sellers. The software allows real-time inventory valuation. Plus, it lets you sort inventory quantities at a given date and time for better inventory purchase planning.

For those new to QuickBooks and Amazon FBA, there can be a lot of questions running through your minds. Here are some important ones that can help you understand the whys and the hows of QuickBooks and Amazon.

QuickBooks Commerce (formerly TradeGecko) has a feature that integrates directly with your Amazon seller account. This QuickBooks plan is best for inventory tracking based on user reviews. In addition, it allows you to manage your orders at an accounting level.

You can have Amazon integration for product pricing and stock information for all products you upload on your Amazon store.

Unfortunately, QuickBooks’ parent company, Intuit, announced earlier this year that it would officially discontinue the plan after August 31, 2023 to focus on other products they offer, like QuickBooks Online.

QuickBooks offers a lot of accounting software plans both online and on desktop. If you want a more convenient way to sync your Amazon business account, getting QuickBooks Online (QBO) is better. If you still need to purchase QuickBooks, here's an overview of the QuickBooks plans available.

No, it's not. Newbie Amazon sellers interchange the terms Amazon Business and Amazon Seller Central—they think both are the same. But Amazon Business is a purchasing account for businesses that want to streamline bulk orders using the Amazon marketplace.

Businesses outside of Amazon integrate their Amazon Business account to fetch purchase transactions and make it easier for their accounting staff to keep records. On the other hand, Amazon Seller Central helps you become a seller in the huge Amazon Marketplace.

Not directly. But you can use several third-party applications to connect QuickBooks Online to your Amazon FBA or Amazon seller account. This can be tricky, especially for those new to Amazon and QuickBooks.

On the other hand, integrating QuickBooks Online with an Amazon Business account is much easier.

Luckily, your accounting will be a breeze once you get past the QuickBooks-Amazon integration. After that, you'll just have to figure out how to make the links needed for a fully-functioning Amazon seller account with a QBO.

Definitely! You can outsource it to professionals who specialize in Amazon seller bookkeeping and accounting. They'll handle the data migration and Amazon integration for you, so all you need to do is hand over information, sit back, and watch them work.

Certain accounting and bookkeeping companies like Unloop have their own QuickBooks Online plan. This makes it easy for us to set up an efficient accounting system for your Amazon store.

Besides pairing your Amazon business, we can also do the following, given our skills and expertise.

Companies like ours have years of experience handling ecommerce companies that sell on Amazon, Shopify, or other multichannel marketplaces. We know where to look and record each of your business transactions accurately.

If you already have accounts payable (and receivable) transactions, Unloop can help you manage payment and cash flow using QuickBooks Online. We'll know what payments are due and align them with your business's resources to ensure you pay at the right time without losing liquidity.

An Amazon seller's inventory is one of the hardest to manage and track. In addition, the inventory level is affected when a sale or refund is made. So if your business has frequent and high-volume sales, it can cause headaches to get the proper numbers on the number of goods and the cost of goods sold.

Bookkeeping and accounting agencies understand this predicament. That's why we handle the accounting aspects of your inventory to ensure you get the right COGS. This is crucial, especially when determining the correct net profit in your business's income statement.

If your Amazon business is big enough to have employees, you must account for their payroll. Bookkeeping and accounting agencies with sophisticated skills matched with a superior QuickBooks plan can make paying and accounting for payroll easy.

Business planning is important for business owners who aim for growth. They'll need a robust forecast of their potential income and expenses to plan well.

Accounting professionals using QuickBooks can use the accounting software's features to give you a projection of what your business may be like in the short and long term. You can decide whether to push through or sell your business.

Tax filing is another challenging task for an ecommerce business owner. Amazon sellers deal with two primary taxes: sales and income.

Professionals can use QuickBooks's tax sync feature for your Amazon business and offer assistance to pay your taxes well. Additionally, we know our way around tax forms for the kind of business structure you have to make accurate records.

While undeniably difficult, bookkeeping is essential for any business to function properly and efficiently. Amazon sellers with bookkeeping tools like QuickBooks already have a leg up in their daily operations.

They often integrate their QuickBooks with their Amazon Seller Central account to make bookkeeping processes easier. But this integration is easier said than done.

Luckily, bookkeeping agencies like Unloop know how to do it, so we can take it off your plate. Spend more time on growing your Amazon business by letting us do the integration and running your books for you. Call us at 877-421-7270 for a consultation, or check out our ecommerce services now.

Bookkeeping for Amazon sellers can be a daunting and highly complex task, but it is essential. With all your financial transactions managed and recorded, financial reporting will be a breeze, making sales tax compliance easier and ensuring accurate financial insights for your business.

Learn how bookkeeping can contribute to your Amazon business's growth and overall success and discover which tools can make this challenging task easier below.

Managing your business’s financial health is one of the most crucial parts of establishing any successful company and brand. Not only can you determine your store’s current state, but you can also use the data you’ve gathered to spot trends and profitable opportunities.

When it comes to selling on the ecommerce giant, here are a few ways an Amazon seller can benefit from bookkeeping.

Knowledge is power, even in Amazon bookkeeping. After all, you can control your expenses only when you have visibility on them. You can pinpoint hefty expenses, keep costs low, aim for a higher income and profit, and save money with bookkeeping.

You have the convenience of seeing the following business costs and expenses on Amazon:

Besides tracking expenses, you can also use bookkeeping to monitor your sales, compute your income, check your total assets, and know the worth of your company.

Some of the details you can check with bookkeeping include the following:

Amazon has Marketplace Tax Collection to comply with the Marketplace Facilitator Law that allows third-party sellers to collect and remit sales taxes on behalf of sellers.

However, while Amazon already has accurate records for you—making tax time easier—it still pays to monitor the data. When all your Amazon small business transactions are monitored throughout the year, tax time and paying your taxes will be uncomplicated.

Make the most of the data from Amazon's default reports and different channels to see the financial state of your business through reports. The best accounting software generates the following in just a few clicks:

Bookkeeping and accounting tools have templates you can readily use, but they are also flexible if you want to generate customized reports. Plenty of bookkeeping services also allow you to choose the type of accounting method you prefer: cash-basis accounting, double-entry accounting, and more.

Most importantly, you can use the reports you generate above for investor presentations. Let the numbers talk through your reports.

Meanwhile, to scale your Amazon store, there will be times when you need to apply for loans. Many creditors require seeing some of the above reports to ensure you can pay for your debts and interest.

Because you have a proper bookkeeping system in place, you won’t have to worry about the two situations and other business presentations you must make.

We’ve established how helpful bookkeeping is for any Amazon store and business. However, laying out these benefits won’t remove the fact that bookkeeping is complicated, dizzying, and headache-inducing.

Fortunately, through innovation and technological advancements, plenty of accounting tools are available to help business owners and sellers like you through this arduous process. One of them is QuickBooks.

QuickBooks is an exceptional accounting system for viewing your bookkeeping numbers. So whether you don't have it yet or are already using it and want to integrate it, let Unloop shed some light on what you can do to produce those numbers easily.

Small business owners on Amazon have access to a global marketplace. As a result, they can have sales from all over the world. Tracking the current exchange rate for a particular overseas sale can be challenging. The same is true for business purchases and accounting for cost and expenses.

That's why QuickBooks's ability to account for the current exchange rate is very helpful. It will determine the correct currency amount at the sale or purchase, giving you and your accounting staff accurate numbers and peace of mind.

Once you discover how to integrate your QuickBooks Online to your Amazon seller account, doing your bookkeeping for sales transactions will be much easier.

QuickBooks Online can sync sales from your Amazon store to your online accounting software. Besides that, it can sync returns and refunds. Again, this feature takes the burden off you and your bookkeeper when searching for and recording sales.

Every business owner must remit the correct sales tax amount. While Amazon facilitates the collection process for each sale you make, it's your responsibility to determine the sales tax amount.

With QuickBooks, this process is made easier. The accounting software automatically calculates the correct sales tax amount for you, depending on the state which you must remit it to.

Another challenge for small businesses on Amazon is inventory management. While Amazon has a robust inventory system monitored by SKUs, this still has to translate to accounting. That means you must track every cost of goods sold (COGS) and product price apart from the outflow.

Tracking inventory is crucial when it comes to accounting for inventory. Thankfully, QuickBooks supports inventory tracking for Amazon sellers. The software allows real-time inventory valuation. Plus, it lets you sort inventory quantities at a given date and time for better inventory purchase planning.

For those new to QuickBooks and Amazon FBA, there can be a lot of questions running through your minds. Here are some important ones that can help you understand the whys and the hows of QuickBooks and Amazon.

QuickBooks Commerce (formerly TradeGecko) has a feature that integrates directly with your Amazon seller account. This QuickBooks plan is best for inventory tracking based on user reviews. In addition, it allows you to manage your orders at an accounting level.

You can have Amazon integration for product pricing and stock information for all products you upload on your Amazon store.

Unfortunately, QuickBooks’ parent company, Intuit, announced earlier this year that it would officially discontinue the plan after August 31, 2023 to focus on other products they offer, like QuickBooks Online.

QuickBooks offers a lot of accounting software plans both online and on desktop. If you want a more convenient way to sync your Amazon business account, getting QuickBooks Online (QBO) is better. If you still need to purchase QuickBooks, here's an overview of the QuickBooks plans available.

No, it's not. Newbie Amazon sellers interchange the terms Amazon Business and Amazon Seller Central—they think both are the same. But Amazon Business is a purchasing account for businesses that want to streamline bulk orders using the Amazon marketplace.

Businesses outside of Amazon integrate their Amazon Business account to fetch purchase transactions and make it easier for their accounting staff to keep records. On the other hand, Amazon Seller Central helps you become a seller in the huge Amazon Marketplace.

Not directly. But you can use several third-party applications to connect QuickBooks Online to your Amazon FBA or Amazon seller account. This can be tricky, especially for those new to Amazon and QuickBooks.

On the other hand, integrating QuickBooks Online with an Amazon Business account is much easier.

Luckily, your accounting will be a breeze once you get past the QuickBooks-Amazon integration. After that, you'll just have to figure out how to make the links needed for a fully-functioning Amazon seller account with a QBO.

Definitely! You can outsource it to professionals who specialize in Amazon seller bookkeeping and accounting. They'll handle the data migration and Amazon integration for you, so all you need to do is hand over information, sit back, and watch them work.

Certain accounting and bookkeeping companies like Unloop have their own QuickBooks Online plan. This makes it easy for us to set up an efficient accounting system for your Amazon store.

Besides pairing your Amazon business, we can also do the following, given our skills and expertise.

Companies like ours have years of experience handling ecommerce companies that sell on Amazon, Shopify, or other multichannel marketplaces. We know where to look and record each of your business transactions accurately.

If you already have accounts payable (and receivable) transactions, Unloop can help you manage payment and cash flow using QuickBooks Online. We'll know what payments are due and align them with your business's resources to ensure you pay at the right time without losing liquidity.

An Amazon seller's inventory is one of the hardest to manage and track. In addition, the inventory level is affected when a sale or refund is made. So if your business has frequent and high-volume sales, it can cause headaches to get the proper numbers on the number of goods and the cost of goods sold.

Bookkeeping and accounting agencies understand this predicament. That's why we handle the accounting aspects of your inventory to ensure you get the right COGS. This is crucial, especially when determining the correct net profit in your business's income statement.

If your Amazon business is big enough to have employees, you must account for their payroll. Bookkeeping and accounting agencies with sophisticated skills matched with a superior QuickBooks plan can make paying and accounting for payroll easy.

Business planning is important for business owners who aim for growth. They'll need a robust forecast of their potential income and expenses to plan well.

Accounting professionals using QuickBooks can use the accounting software's features to give you a projection of what your business may be like in the short and long term. You can decide whether to push through or sell your business.

Tax filing is another challenging task for an ecommerce business owner. Amazon sellers deal with two primary taxes: sales and income.

Professionals can use QuickBooks's tax sync feature for your Amazon business and offer assistance to pay your taxes well. Additionally, we know our way around tax forms for the kind of business structure you have to make accurate records.

While undeniably difficult, bookkeeping is essential for any business to function properly and efficiently. Amazon sellers with bookkeeping tools like QuickBooks already have a leg up in their daily operations.

They often integrate their QuickBooks with their Amazon Seller Central account to make bookkeeping processes easier. But this integration is easier said than done.

Luckily, bookkeeping agencies like Unloop know how to do it, so we can take it off your plate. Spend more time on growing your Amazon business by letting us do the integration and running your books for you. Call us at 877-421-7270 for a consultation, or check out our ecommerce services now.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Sales tax is an obligation with the heaviest burden. In every sale business owners make, they have to determine and remit the right sales tax amount. It's only reasonable for them to find efficient ways to file a sales tax return. In this department, two names compete: TaxJar vs. QuickBooks.

But should they be rivals in the sales tax game, or is collaboration better? Let Unloop help you answer this question.

Before we can compare, it’s best to introduce our challengers and list their exceptional features. What can TaxJar and QuickBooks do, and what edge do they have against each other?

Photo by rawpixel.com on Freepik

For many ecommerce businesses, especially small business owners, sales tax is one of the most tedious and confusing tasks to account for and remit. That's because sales taxes vary based on region, products sold, and tax codes.

TaxJar sees this burden and resolves it with its sales tax collection technology. It offers additional support to its users by providing online webinars, documentation videos, and informational blogs.

It’s worth noting that while the tool is available for a web-based desktop, platforms like iPhone or Android mobile aren’t supported.

Let’s further discuss TaxJar’s capabilities that make it a sales tax specialist.

Built into the TaxJar system are different sales tax information from 11,000 jurisdictions. It ensures that wherever your sales may come, your business collects sales tax according to that jurisdiction's sales tax code or policy.

TaxJar tracks sales revenue and location to calculate tax exposure. When tax collection reaches a certain nexus threshold, TaxJar will notify you, helping you with accurate sales tax filing.

TaxJar assists in sales tax registration when notified of your nexus exposure. It offers resources on how you can register your business in the nexus. Alternatively, you can also tap TaxJar for registration assistance.

TaxJar has an API that integrates with your ecommerce store. This feature allows your ecommerce business to do accurate sales tax calculations upon the customer's checkout, ensuring your business collects the right sales tax that will reflect on the checkout page.

TaxJar can automate sales tax filing for your ecommerce business. As soon as you enroll in a nexus state, it can use the data collected by their system while it's integrated into your ecommerce account.

With this integration, TaxJar can calculate the correct sales tax based on the products you've sold, making tax returns a breeze. Additionally, it lets you check (and approve) the sales tax amount before it pushes through.

What's so great about TaxJar is its multichannel feature. Their application integrates into many marketplace platforms such as Amazon, Shopify, WooCommerce, Walmart, Square, eBay, Etsy, etc. You won't have to worry about getting another application for another ecommerce business on another marketplace.

Source: Photo by Pixabay from Pexels.com

On the other hand, QuickBooks offers an accounting solution, which means a little bit of everything (including sales tax) and has broader coverage for ecommerce businesses. QuickBooks supports platforms such as Mac desktop, iPhone mobile, Linux desktop or mobile, and more.

Here's what this amazing software can do.

Small business owners instantly get digital accounting and bookkeeping systems, enabling them to transition from hard copy books and spreadsheets into software that can integrate online.

Within the software, the user can generate an invoice and receive them. QuickBooks's invoice management gives sellers an accurate picture of their short-term debt and credits, which will help them manage their cash flow better.

QuickBooks lets users record and track bills and their payments. Additionally, sellers can integrate third-party apps that can automate their bill payments at the click of a button.

Part of bookkeeping is financial statement generation. When done manually, it can take time to complete. With QuickBooks, a bookkeeper can generate them in real time. It can instantly create income statements and balance sheets by taking stock of all system transactions.

One of the struggles of any small business owner is bank reconciliation. Balancing transactions can be challenging, as locating each bank account entry and records isn't easy.

QuickBooks makes bank reconciliation a breeze by syncing your bank data to the software. That means every expense and income aligns with both the accounting software and your bank account balance.

Yes, but not quite, at least in terms of sales tax.

QuickBooks has been around for a long time and has built a strong reputation for meeting the accounting needs of businesses of all sizes. While it offers tax forms for filing income tax and income tax automation features for your employee payroll taxes, its primary focus is accounting, not taxes.

Let's discuss the sales tax filing feature the accounting software offers.

QuickBooks can make calculations on sales tax rates, including the following information:

The rest (including the sales tax return) will fall within your scope.

To set up this feature, follow the steps in the tutorial below.

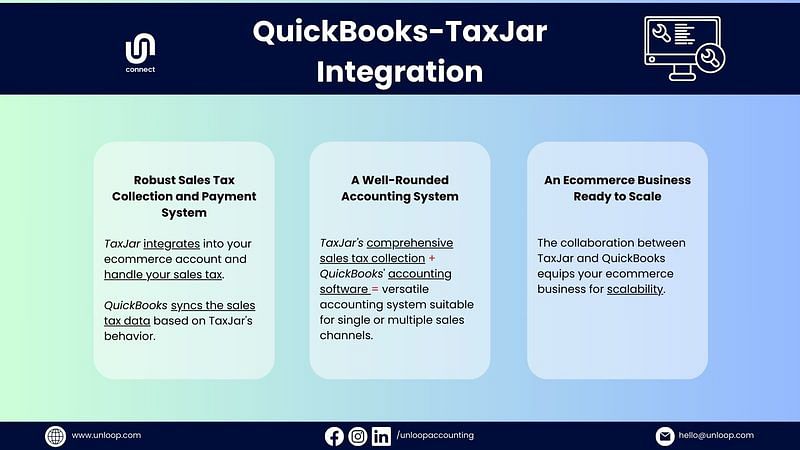

So, what's the final verdict? In the showdown QuickBooks vs. TaxJar, who is the worthy victor? If you ask us what's better for your business, we'll say both. TaxJar and QuickBooks can compete, but their collaboration offers your business the best of both worlds.

Here's what will happen when you do a TaxJar-QuickBooks Online integration.

At Unloop, we use QuickBooks as our main accounting software. We also specialize in seamlessly integrating TaxJar with this tool to help leverage our expertise in ecommerce accounting.

Our professionals ensure efficient management of both software, saving you time for other business matters and maximizing software benefits. Trust Unloop to make your accounting feel like it's on autopilot.

Call us at 877-421-7270 for a consultation, or check out our ecommerce services.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Sales tax is an obligation with the heaviest burden. In every sale business owners make, they have to determine and remit the right sales tax amount. It's only reasonable for them to find efficient ways to file a sales tax return. In this department, two names compete: TaxJar vs. QuickBooks.

But should they be rivals in the sales tax game, or is collaboration better? Let Unloop help you answer this question.

Before we can compare, it’s best to introduce our challengers and list their exceptional features. What can TaxJar and QuickBooks do, and what edge do they have against each other?

Photo by rawpixel.com on Freepik

For many ecommerce businesses, especially small business owners, sales tax is one of the most tedious and confusing tasks to account for and remit. That's because sales taxes vary based on region, products sold, and tax codes.

TaxJar sees this burden and resolves it with its sales tax collection technology. It offers additional support to its users by providing online webinars, documentation videos, and informational blogs.

It’s worth noting that while the tool is available for a web-based desktop, platforms like iPhone or Android mobile aren’t supported.

Let’s further discuss TaxJar’s capabilities that make it a sales tax specialist.

Built into the TaxJar system are different sales tax information from 11,000 jurisdictions. It ensures that wherever your sales may come, your business collects sales tax according to that jurisdiction's sales tax code or policy.

TaxJar tracks sales revenue and location to calculate tax exposure. When tax collection reaches a certain nexus threshold, TaxJar will notify you, helping you with accurate sales tax filing.

TaxJar assists in sales tax registration when notified of your nexus exposure. It offers resources on how you can register your business in the nexus. Alternatively, you can also tap TaxJar for registration assistance.

TaxJar has an API that integrates with your ecommerce store. This feature allows your ecommerce business to do accurate sales tax calculations upon the customer's checkout, ensuring your business collects the right sales tax that will reflect on the checkout page.

TaxJar can automate sales tax filing for your ecommerce business. As soon as you enroll in a nexus state, it can use the data collected by their system while it's integrated into your ecommerce account.

With this integration, TaxJar can calculate the correct sales tax based on the products you've sold, making tax returns a breeze. Additionally, it lets you check (and approve) the sales tax amount before it pushes through.

What's so great about TaxJar is its multichannel feature. Their application integrates into many marketplace platforms such as Amazon, Shopify, WooCommerce, Walmart, Square, eBay, Etsy, etc. You won't have to worry about getting another application for another ecommerce business on another marketplace.

Source: Photo by Pixabay from Pexels.com

On the other hand, QuickBooks offers an accounting solution, which means a little bit of everything (including sales tax) and has broader coverage for ecommerce businesses. QuickBooks supports platforms such as Mac desktop, iPhone mobile, Linux desktop or mobile, and more.

Here's what this amazing software can do.

Small business owners instantly get digital accounting and bookkeeping systems, enabling them to transition from hard copy books and spreadsheets into software that can integrate online.

Within the software, the user can generate an invoice and receive them. QuickBooks's invoice management gives sellers an accurate picture of their short-term debt and credits, which will help them manage their cash flow better.

QuickBooks lets users record and track bills and their payments. Additionally, sellers can integrate third-party apps that can automate their bill payments at the click of a button.

Part of bookkeeping is financial statement generation. When done manually, it can take time to complete. With QuickBooks, a bookkeeper can generate them in real time. It can instantly create income statements and balance sheets by taking stock of all system transactions.

One of the struggles of any small business owner is bank reconciliation. Balancing transactions can be challenging, as locating each bank account entry and records isn't easy.

QuickBooks makes bank reconciliation a breeze by syncing your bank data to the software. That means every expense and income aligns with both the accounting software and your bank account balance.

Yes, but not quite, at least in terms of sales tax.

QuickBooks has been around for a long time and has built a strong reputation for meeting the accounting needs of businesses of all sizes. While it offers tax forms for filing income tax and income tax automation features for your employee payroll taxes, its primary focus is accounting, not taxes.

Let's discuss the sales tax filing feature the accounting software offers.

QuickBooks can make calculations on sales tax rates, including the following information:

The rest (including the sales tax return) will fall within your scope.

To set up this feature, follow the steps in the tutorial below.

So, what's the final verdict? In the showdown QuickBooks vs. TaxJar, who is the worthy victor? If you ask us what's better for your business, we'll say both. TaxJar and QuickBooks can compete, but their collaboration offers your business the best of both worlds.

Here's what will happen when you do a TaxJar-QuickBooks Online integration.

At Unloop, we use QuickBooks as our main accounting software. We also specialize in seamlessly integrating TaxJar with this tool to help leverage our expertise in ecommerce accounting.

Our professionals ensure efficient management of both software, saving you time for other business matters and maximizing software benefits. Trust Unloop to make your accounting feel like it's on autopilot.

Call us at 877-421-7270 for a consultation, or check out our ecommerce services.

Bookkeeping and payroll services are two of the most important financial aspects in a business. Bookkeeping tracks all transactions, data, and important documents regarding your business. Meanwhile, payroll ensures you fulfill your responsibility to your employees by paying them on time and giving them their benefits.

Yet, many small business owners don't know what to expect from a bookkeeping and payroll service. Many are confused about who to partner with for these vital services. This blog post will discuss what you can expect from a good bookkeeping and payroll service and how to choose the right partner worth what good bookkeeping and payroll services cost. Let’s begin!

Bookkeeping is the task of tracking the money that is coming in and out of your business. The data is categorized and organized in books to be used by the accountant for financial reporting. As you grow your business, the income and expenses to track pile up. A great bookkeeping service will give your business these benefits.

As a starter, a bookkeeping and accounting agency uses reliable bookkeeping and accounting software like QuickBooks, Xero, or Sage50 Cloud. An agency acknowledges the conveniences that technology brings: accuracy, automation, integration, and data security. Hence, the first thing they’ll do is set up an accounting software account for your business.

After that, the work begins. You do not have to worry about the transactions you weren’t able to track before signing up for the service, as the agency should be able to backtrack all those transactions. As a result, when tax season comes, you’ll have complete data to declare and the correct dues to pay.

Your partner agency also keeps your books up-to-date. The software will help automate data collection from various income and expense channels. Transactions from your bank accounts and various payment channels will be jotted down on the books. As the business owner, all you have to do is double-check the details in case there are any errors.

Bookkeeping and accounting are there to ensure that whenever you need to check the financial status of your business, you’ll get the latest numbers. Some of the statements you can receive with the help of an agency are the following:

A business bank account left unchecked is more prone to fraud and other financial malpractices. But the bank reconciliation service offered by bookkeeping and accounting agencies will record all the money deposited in or withdrawn from your bank account in the books. Simply investigate if you see any anomalies.

Agencies go the extra mile to add a human touch to their service. This comes from 24/7 customer service in multiple channels. If you have questions regarding the software or any book details, you can set up a meeting or get reports. They are always just a message away.

Payroll is as essential as bookkeeping. When you process your payroll smoothly, you’ll keep your workforce happy and driven to help your business succeed. Hence, investing in a payroll service is worth it. Either get it separately, or sign up for a payroll service together with bookkeeping. This is what you can get with a dedicated service.

Even in payroll, data and documentation are everything. So, the first task of the payroll expert you are partnered with is to collect all essential employee information like names, addresses, civil statuses, and tax statuses. They may ask your employees to accomplish tax forms for withholding tax and any bank information where you will send their salary.

Through the help of bookkeeping and accounting software, the payroll expert will calculate your employees’ gross and net pay. Gross salary is the amount workers receive before deductions, while the net pay deducts taxes and benefits. You should include all these details in employees’ payslips for transparency. They should also be included in the books for your reference.

You’ll rely on software to process payroll if partnered with an agency. This method is better than manual payment as it is less prone to mistakes and can be integrated into your bookkeeping and accounting software for faster computation and tracking. After the computation, you can send the salary straight to your employees’ accounts.

Every worker is responsible for paying taxes, and one thing you can do for them is handling income tax, deductions, collection, and remittance. An agency is equipped with tax software with the latest tax information, so you are sure that your computations are accurate. It can again be integrated into your accounting system for tracking.

When it comes to bookkeeping and payroll services, you want to ensure that you’re partnering with a company that understands the ins and outs of both. Doing so can keep your books in order, and process your employees’ pay accurately and on time.

We've outlined what you can expect from each service, but the question remains: who should you partner with?

If you are looking for an agency that offers bookkeeping and payroll services, look no further than Unloop. Our bookkeeping services include book updates, financial statement preparation, and tax management. We’ll do your payroll and taxes for you! We are just a call away if you are interested in accounting, tax preparation, bookkeeping, and payroll services. Talk to you soon!

Bookkeeping and payroll services are two of the most important financial aspects in a business. Bookkeeping tracks all transactions, data, and important documents regarding your business. Meanwhile, payroll ensures you fulfill your responsibility to your employees by paying them on time and giving them their benefits.

Yet, many small business owners don't know what to expect from a bookkeeping and payroll service. Many are confused about who to partner with for these vital services. This blog post will discuss what you can expect from a good bookkeeping and payroll service and how to choose the right partner worth what good bookkeeping and payroll services cost. Let’s begin!

Bookkeeping is the task of tracking the money that is coming in and out of your business. The data is categorized and organized in books to be used by the accountant for financial reporting. As you grow your business, the income and expenses to track pile up. A great bookkeeping service will give your business these benefits.

As a starter, a bookkeeping and accounting agency uses reliable bookkeeping and accounting software like QuickBooks, Xero, or Sage50 Cloud. An agency acknowledges the conveniences that technology brings: accuracy, automation, integration, and data security. Hence, the first thing they’ll do is set up an accounting software account for your business.

After that, the work begins. You do not have to worry about the transactions you weren’t able to track before signing up for the service, as the agency should be able to backtrack all those transactions. As a result, when tax season comes, you’ll have complete data to declare and the correct dues to pay.

Your partner agency also keeps your books up-to-date. The software will help automate data collection from various income and expense channels. Transactions from your bank accounts and various payment channels will be jotted down on the books. As the business owner, all you have to do is double-check the details in case there are any errors.

Bookkeeping and accounting are there to ensure that whenever you need to check the financial status of your business, you’ll get the latest numbers. Some of the statements you can receive with the help of an agency are the following:

A business bank account left unchecked is more prone to fraud and other financial malpractices. But the bank reconciliation service offered by bookkeeping and accounting agencies will record all the money deposited in or withdrawn from your bank account in the books. Simply investigate if you see any anomalies.

Agencies go the extra mile to add a human touch to their service. This comes from 24/7 customer service in multiple channels. If you have questions regarding the software or any book details, you can set up a meeting or get reports. They are always just a message away.

Payroll is as essential as bookkeeping. When you process your payroll smoothly, you’ll keep your workforce happy and driven to help your business succeed. Hence, investing in a payroll service is worth it. Either get it separately, or sign up for a payroll service together with bookkeeping. This is what you can get with a dedicated service.

Even in payroll, data and documentation are everything. So, the first task of the payroll expert you are partnered with is to collect all essential employee information like names, addresses, civil statuses, and tax statuses. They may ask your employees to accomplish tax forms for withholding tax and any bank information where you will send their salary.

Through the help of bookkeeping and accounting software, the payroll expert will calculate your employees’ gross and net pay. Gross salary is the amount workers receive before deductions, while the net pay deducts taxes and benefits. You should include all these details in employees’ payslips for transparency. They should also be included in the books for your reference.

You’ll rely on software to process payroll if partnered with an agency. This method is better than manual payment as it is less prone to mistakes and can be integrated into your bookkeeping and accounting software for faster computation and tracking. After the computation, you can send the salary straight to your employees’ accounts.

Every worker is responsible for paying taxes, and one thing you can do for them is handling income tax, deductions, collection, and remittance. An agency is equipped with tax software with the latest tax information, so you are sure that your computations are accurate. It can again be integrated into your accounting system for tracking.

When it comes to bookkeeping and payroll services, you want to ensure that you’re partnering with a company that understands the ins and outs of both. Doing so can keep your books in order, and process your employees’ pay accurately and on time.

We've outlined what you can expect from each service, but the question remains: who should you partner with?

If you are looking for an agency that offers bookkeeping and payroll services, look no further than Unloop. Our bookkeeping services include book updates, financial statement preparation, and tax management. We’ll do your payroll and taxes for you! We are just a call away if you are interested in accounting, tax preparation, bookkeeping, and payroll services. Talk to you soon!

Understanding your business finances is the key to managing your business properly. Business cash flow dictates business operations. You should have sufficient balance to pay your obligations such as wages, taxes and suppliers, while ensuring that a good amount comes into your business for a positive income.

The amount of money coming in and out can make or break a business. In this article, we'll talk about the difference between cash inflow and outflow and tips to help manage them to maintain positive overall financial health.

The net amount of money entering and leaving your business is known as cash flow. It disregards the funds in your bank account and credit from suppliers. Cash flow also does not count the money that other businesses owe you. Cash flow is plainly the cash coming and leaving your business in a certain period: weekly, monthly, quarterly or annually.

Understanding business cash flow is crucial. It lets you see if you have enough resources to pay for your business operations—like rent, supplies, employee wages, and other operational costs. Business cash flow also helps your business grow. Investors and banks use cash flow statements to assess your overall financial health and see if you can be eligible for loans and investments.

There are three ways that money enters and leaves your company. To help you better comprehend each of them, let's look at each one in more detail.

Operating Activities

Operating cash flow is money that comes in and out of your business through basic business operations such as creating sales or providing services. Inflow from operating activities is the net income you make from selling your products or service, inventory and accounts receivable.

Cash outflow is related to operating activities where you spend resources on the cost of production, rent, marketing and advertising efforts, taxes, and employee salary.

Investing Activities

The money that passes throughout your business as a result of the company's investment is known as cash flow from investing activities. A company can have short-term or long-term investments. For example, getting government-issued bonds like bills and floating-rate notes are short-term investments.

Buying new equipment or purchasing a building to house your business is a long-term investment for businesses. The money you used to buy these investments is considered outflow. Cash outflow is more common in investing activities.

Financing Activities

Cash flow from financing activities include stock sales, loans, dividend payments, and long-term debt payments. Cash inflow in this category is the money you receive when you apply for loans and the ones you generate from selling stock and equity.

Cash outflow in financing activities is money you use to repay the principal amount of existing debts and dividend payments.

Cash inflow is the money coming into your business. Simply put, cash inflow is all the money that goes into your business, whether from investments or selling your products and services. When the cash inflow for your company exceeds the cash outflow, you have a positive cash flow.

A positive cash flow guarantees that business operations can run smoothly and without problems. It is a good indication that you have enough resources to keep your business operations running, and that you can allocate some of them toward business growth.

Cash outflow is the money moving out of your business. The money you use to pay for your business to continue operating is outflow. Rent, wages, operating costs, buying inventory, and interest payments for the loans you borrow are all outflows.

Startups and new businesses may experience more cash outflow in the beginning. Since all their resources are used to launch the business, more outflow is expected. However, once you start selling, you can break even and generate more cash inflow.

When you have been running your business for quite some time, and your cash outflow is still greater than the inflow, it is an indication of negative cash flow. This can be the start of the downfall of your business.

But it's not too late! We have some tips to help your business generate positive cash flow.

It's always good for a business to take on long-term projects with big payouts. But when a project is spread over a long period of time, the more difficult it is to pay bills to enable the project to continue.

Ask for a deposit and establish milestones to avoid burning out your resources. The initial deposits will help you buy the materials you need, and the milestones will allow your clients to see your progress and keep cash flow consistent.

One way to keep a positive cash flow is to increase your prices. If you're worried you'll lose clients with a price increase, you can experiment with it. For example, you can sell products for higher prices to new customers and retain the price for your returning and loyal customers.

You can also increase the price for some of your products and retain the original price for others so your customers won't be perplexed by the price changes while you keep a positive cash flow.

Sales and revenue are just one part of a business's cash flow. You can keep a positive cash flow by controlling your expenses. Negotiating with suppliers can be advantageous to business owners. For example, bulk ordering supplies can give you discounts.

You can enjoy free or discounted shipping rates if you order from suppliers in your locality. Negotiating with suppliers can lessen your expenses, equating to an improved and positive cash flow.

Many business owners think that investing in technology is an unnecessary expense. Technology is advancing rapidly, and some are designed to reduce production costs. There are pieces of machinery that can do what humans do. Technology can do tasks faster and more efficiently which means you can hire fewer people—saving your payment on wages and other expenses.

Look for technology that will make your production more efficient. However, always consider its price. If you're buying a piece of equipment, ensure you have enough resources to purchase it, and that it will not affect any of your business operations.

Now that you are aware of how vital business cash flow is, managing it properly should be on top of your list. If you're new to the business and are still confused about how cash flow works, Unloop is here to help you.

Unloop offers professional ecommerce accounting services, and organized bookkeeping is the key to getting an overview of your business cash flow status. Our bookkeeping services include:

Cash flow is just one part of running a business, and we hope this blog post gives you a better understanding of your finances. For more professional accounting help, book a call and work with Unloop today!

Understanding your business finances is the key to managing your business properly. Business cash flow dictates business operations. You should have sufficient balance to pay your obligations such as wages, taxes and suppliers, while ensuring that a good amount comes into your business for a positive income.

The amount of money coming in and out can make or break a business. In this article, we'll talk about the difference between cash inflow and outflow and tips to help manage them to maintain positive overall financial health.

The net amount of money entering and leaving your business is known as cash flow. It disregards the funds in your bank account and credit from suppliers. Cash flow also does not count the money that other businesses owe you. Cash flow is plainly the cash coming and leaving your business in a certain period: weekly, monthly, quarterly or annually.

Understanding business cash flow is crucial. It lets you see if you have enough resources to pay for your business operations—like rent, supplies, employee wages, and other operational costs. Business cash flow also helps your business grow. Investors and banks use cash flow statements to assess your overall financial health and see if you can be eligible for loans and investments.

There are three ways that money enters and leaves your company. To help you better comprehend each of them, let's look at each one in more detail.

Operating Activities

Operating cash flow is money that comes in and out of your business through basic business operations such as creating sales or providing services. Inflow from operating activities is the net income you make from selling your products or service, inventory and accounts receivable.

Cash outflow is related to operating activities where you spend resources on the cost of production, rent, marketing and advertising efforts, taxes, and employee salary.

Investing Activities

The money that passes throughout your business as a result of the company's investment is known as cash flow from investing activities. A company can have short-term or long-term investments. For example, getting government-issued bonds like bills and floating-rate notes are short-term investments.

Buying new equipment or purchasing a building to house your business is a long-term investment for businesses. The money you used to buy these investments is considered outflow. Cash outflow is more common in investing activities.

Financing Activities

Cash flow from financing activities include stock sales, loans, dividend payments, and long-term debt payments. Cash inflow in this category is the money you receive when you apply for loans and the ones you generate from selling stock and equity.

Cash outflow in financing activities is money you use to repay the principal amount of existing debts and dividend payments.

Cash inflow is the money coming into your business. Simply put, cash inflow is all the money that goes into your business, whether from investments or selling your products and services. When the cash inflow for your company exceeds the cash outflow, you have a positive cash flow.

A positive cash flow guarantees that business operations can run smoothly and without problems. It is a good indication that you have enough resources to keep your business operations running, and that you can allocate some of them toward business growth.

Cash outflow is the money moving out of your business. The money you use to pay for your business to continue operating is outflow. Rent, wages, operating costs, buying inventory, and interest payments for the loans you borrow are all outflows.

Startups and new businesses may experience more cash outflow in the beginning. Since all their resources are used to launch the business, more outflow is expected. However, once you start selling, you can break even and generate more cash inflow.

When you have been running your business for quite some time, and your cash outflow is still greater than the inflow, it is an indication of negative cash flow. This can be the start of the downfall of your business.

But it's not too late! We have some tips to help your business generate positive cash flow.

It's always good for a business to take on long-term projects with big payouts. But when a project is spread over a long period of time, the more difficult it is to pay bills to enable the project to continue.

Ask for a deposit and establish milestones to avoid burning out your resources. The initial deposits will help you buy the materials you need, and the milestones will allow your clients to see your progress and keep cash flow consistent.

One way to keep a positive cash flow is to increase your prices. If you're worried you'll lose clients with a price increase, you can experiment with it. For example, you can sell products for higher prices to new customers and retain the price for your returning and loyal customers.

You can also increase the price for some of your products and retain the original price for others so your customers won't be perplexed by the price changes while you keep a positive cash flow.

Sales and revenue are just one part of a business's cash flow. You can keep a positive cash flow by controlling your expenses. Negotiating with suppliers can be advantageous to business owners. For example, bulk ordering supplies can give you discounts.

You can enjoy free or discounted shipping rates if you order from suppliers in your locality. Negotiating with suppliers can lessen your expenses, equating to an improved and positive cash flow.

Many business owners think that investing in technology is an unnecessary expense. Technology is advancing rapidly, and some are designed to reduce production costs. There are pieces of machinery that can do what humans do. Technology can do tasks faster and more efficiently which means you can hire fewer people—saving your payment on wages and other expenses.

Look for technology that will make your production more efficient. However, always consider its price. If you're buying a piece of equipment, ensure you have enough resources to purchase it, and that it will not affect any of your business operations.

Now that you are aware of how vital business cash flow is, managing it properly should be on top of your list. If you're new to the business and are still confused about how cash flow works, Unloop is here to help you.

Unloop offers professional ecommerce accounting services, and organized bookkeeping is the key to getting an overview of your business cash flow status. Our bookkeeping services include:

Cash flow is just one part of running a business, and we hope this blog post gives you a better understanding of your finances. For more professional accounting help, book a call and work with Unloop today!

These days, conveniently running a business is just within every business owner’s fingertips. A business owner can connect with bookkeeping and accounting firms online for financial management. And these agencies can offer complete solutions from keeping books up-to-date, business planning and forecasting, payroll, income taxes, sales taxes and more! But despite having this assistance, it still pays when business owners like you know bookkeeping and financial accounting—even just the basics.

In this blog post, we’ll help you understand what income statements, balance sheets, and cash flow statements are. It is important that you still know what these reports are for and the jargon that comes with them, even if you’re getting assistance from a bookkeeping and accounting firm.

An income statement, also called profit and loss statement, is just one of the many reports you’ll get to know your business performance. An income statement shows whether your business is profitable or not. Profitability is when your business has a higher income than all business costs. If you check your income statement, you’ll see a long list of details, which all contribute to knowing your business’s profit. The details are as follows:

Operating Revenues: A company’s earnings from selling goods and services.

Cost of Goods Sold/Cost of Sales: For manufacturers, this is the money used in creating products. For retailers and wholesalers, this is the cost incurred to acquire the products they sell from suppliers.

Gross Profit: You can calculate your gross profit by deducting COGS/COS from the price of your products or services.

Operating Expenses: These expenses include the money you use to pay office rent, payroll, employee benefits, and insurance. Marketing and advertising expenses are also included here. The total operating expenses are costs that must be paid to ensure smooth business operations.

Operating Earnings: You can get your operating income by subtracting operating expenses and depreciation from a company’s revenues.

Non-Operating Income: These items bring income to the company from sources other than sales. Non-operating items include dividend income, interest income, and money earned from selling assets.

Earnings Before Taxes: As the term suggests, this is your business's income before deducting taxes.

Net Income/Profit Margin: When all costs, total expenses incurred, and taxes are deducted from the company’s earnings, you’ll get your net income. This item defines whether your business is profitable or not.

Understanding an income statement is essential for all business owners. To make the most of the report, check your net income. Apply the 5%, 10%, and 20% rules to see whether your business is going well or needs a little push. A 5% profit margin is low, so you must set game plans to increase sales and lower expenses. A 10% profit margin is a good start if you have just begun your venture. Still, aim for the 20% and up margin—a percentage considered high or good.

To validate or negate your assumptions, you can check out the income statement’s notes added by your accountant. Accountants are trained to do financial analysis, so you’ll find their insights helpful. You can also get into the details and see which expenses are hurting your business, and check if there is a chance of lowering them.

Don’t forget to do a comparative income statement analysis from one particular period to the next. It is a usual practice to compare the latest and the previous year’s income statement. But for startup businesses, you can analyze income statements more often, so you can see how your profit is doing and if there are changes you need to make with your business plans to reach your profit mark.

To know your company's assets, liabilities, and shareholder’s/owner’s equity, the report you need to check is the balance sheet. These three details in the balance sheet reflect your company’s net worth and can also be used to know whether you can pay your financial obligations.

To understand this report better, let’s check what net worth, assets, liabilities, and shareholder’s/owner’s equity mean.

Net Worth: You can calculate your business net worth by deducting liabilities from assets. Net worth, also called net wealth, shows your company’s value.

Assets: Assets may be a single category in the balance sheet, but they can be further broken down into different details to pinpoint where your company's money is coming from. Some company assets are the following:

Not all these assets are in cash form, but they all add value to your company assets.

Liabilities: This is the money that you owe to people, organizations, or suppliers. Some examples of liabilities are the following:

These liabilities can be paid in the short-term or long-term, but they will cost you one way or another.

Shareholder’s Equity/Owner’s Equity: Shareholder’s equity is the difference you get when liabilities are deducted from the assets. It is the money you, shareholders, or stockholders will get from all liquidated assets minus liabilities. If you are the sole proprietor of your business, you’ll get the owner’s equity.

There are a lot of insights you can get by analyzing a balance sheet. To begin with, you’ll know your business’s financial performance in terms of the amount of money you’ve earned or your profit through the shareholder’s/owner’s equity. The shareholder’s/owner’s equity can be positive or negative.

Positive equity is when your assets are higher than your liabilities. This means that you can finance your business operations and pay off costs or debts. When your liabilities exceed your assets, this is negative equity. You can adjust your business plans accordingly when you see your business is failing and maintain the best practices when you get good results.

You can also use this report during an investor’s presentation. Through this report, the investors can see where your money for business operations comes from and on which liabilities they are being spent on. They’ll also get an idea of what they’ll get based on the past balance sheets you provide. A positive shareholder’s equity will entice them to invest.

As the name of this report suggests, a cash flow statement shows how money comes in and out of your company. This statement has three main parts that will allow you and investors to see the details of how you spend and earn money. Here they are.

Operating Activities: As the name of this section implies, this is the money that comes in from sales, services, and regular business operations. It also tracks the money that goes out through accounts payables, tax and interest payments, and employee salaries.

Financing Activities: If you want to see how your business money moves around you, your investors, and creditors, check the cash from financing activities. This part shows the money that comes in from investors and banks and the money that goes out to be paid to debts and loans, to shareholders’ dividends, or to stock buybacks.

Investing Activities: The money you earn and give out in investing is included in this section. Some investing activities are loan creation and collection, asset acquisition and selling, and purchase and selling of fixed assets.

A cash flow statement shows how your company earns and where the company’s earnings are spent. It also reflects that the company has enough cash to pay business expenses.

An excellent looking cash flow is when all expenses are paid, and there’s still money left. This is called positive cash flow, a situation where there is more incoming cash than outgoing. On the other hand, a negative cash flow is when more money goes out of your business than what’s coming in.

It is important to note that a negative or positive cash flow doesn’t always reflect your company’s profitability. There may be times when cash flow is negative because you’ve invested in scaling your business, so it doesn’t mean that your business isn’t profitable. In the same way, cash flow may be positive because of borrowed credit and not because the company is profitable.

Income statements, balance sheets, and cash flow statements are three of the most important financial statements you’ll need to get regularly. These reports will be your basis for business planning and decision-making. When looking for investors, these are the reports you can present to show your capability to run and make your business thrive.

And if you ever need additional cash, these documents must be shown to creditors. And as a part of your business owner's daily routine, you can check these financial statements daily to stay updated.

When you understand these reports and the details within, it is easy to connect with the bookkeeping and accounting firm you are partnered with. During the reporting period, you’ll understand your company's financial health.If you are still looking for a reliable firm to partner with, Unloop is here for you! We have qualified professionals who can handle bookkeeping for your business and generate these reports. Contact us now for a detailed discussion of our services.

These days, conveniently running a business is just within every business owner’s fingertips. A business owner can connect with bookkeeping and accounting firms online for financial management. And these agencies can offer complete solutions from keeping books up-to-date, business planning and forecasting, payroll, income taxes, sales taxes and more! But despite having this assistance, it still pays when business owners like you know bookkeeping and financial accounting—even just the basics.

In this blog post, we’ll help you understand what income statements, balance sheets, and cash flow statements are. It is important that you still know what these reports are for and the jargon that comes with them, even if you’re getting assistance from a bookkeeping and accounting firm.

An income statement, also called profit and loss statement, is just one of the many reports you’ll get to know your business performance. An income statement shows whether your business is profitable or not. Profitability is when your business has a higher income than all business costs. If you check your income statement, you’ll see a long list of details, which all contribute to knowing your business’s profit. The details are as follows:

Operating Revenues: A company’s earnings from selling goods and services.

Cost of Goods Sold/Cost of Sales: For manufacturers, this is the money used in creating products. For retailers and wholesalers, this is the cost incurred to acquire the products they sell from suppliers.

Gross Profit: You can calculate your gross profit by deducting COGS/COS from the price of your products or services.

Operating Expenses: These expenses include the money you use to pay office rent, payroll, employee benefits, and insurance. Marketing and advertising expenses are also included here. The total operating expenses are costs that must be paid to ensure smooth business operations.

Operating Earnings: You can get your operating income by subtracting operating expenses and depreciation from a company’s revenues.

Non-Operating Income: These items bring income to the company from sources other than sales. Non-operating items include dividend income, interest income, and money earned from selling assets.

Earnings Before Taxes: As the term suggests, this is your business's income before deducting taxes.

Net Income/Profit Margin: When all costs, total expenses incurred, and taxes are deducted from the company’s earnings, you’ll get your net income. This item defines whether your business is profitable or not.

Understanding an income statement is essential for all business owners. To make the most of the report, check your net income. Apply the 5%, 10%, and 20% rules to see whether your business is going well or needs a little push. A 5% profit margin is low, so you must set game plans to increase sales and lower expenses. A 10% profit margin is a good start if you have just begun your venture. Still, aim for the 20% and up margin—a percentage considered high or good.