Running an ecommerce business is not easy. You may know how to make and sell your products, but it takes more than that to sustain the business and achieve business growth. More than a good product, you need to keep an eye on your business’s financial reports.

You can’t just eyeball your finances—your company's sustainability relies on your accounting records. Any business needs a bookkeeping system, and ecommerce businesses are not an exception to this.

In ecommerce bookkeeping, you have to pay attention to inventory tracking. With proper bookkeeping, you can track your inventory, manage the costs, and implement a more strategic business plan to improve your business's efficiency.

However, bookkeeping is not for everyone, and it is not a skill you can learn overnight, either. But thanks to innovation, ecommerce bookkeeping services are now accessible to bookkeeping novices. Help your business grow its profits with the bookkeeping software we’ve listed down for you.

Ecommerce bookkeeping is different from other industries but is similar to how bookkeeping is done for retail businesses. After all, ecommerce is just online retail.

What makes it different from retail, however, is the platform used to sell the products, which impacts the bookkeeping process.

In a traditional commerce business, most of the transactional data is typically found in the business's bank account. In an ecommerce business, the accountant cannot rely on the transactional data from its bank account. The deposit received by the ecommerce business from the merchant (Amazon, Shopify, etc.) is the total amount of its sales for the given period.

However, this will not provide your bookkeeper with accurate data from each transaction or sale you’ve made, including income and time. In addition, this will affect the business's inventory management, thus messing up your recorded profits and pricing. Simply put, a bookkeeper for an ecommerce business cannot rely on net deposits and has to record transactions based on the records from your sales channel.

Moreover, running an ecommerce business means dealing with different online sales tax laws and foreign transaction costs. This might be a hassle, so hiring an ecommerce bookkeeping expert or subscribing to an ecommerce bookkeeping service will save you time.

There are multiple online bookkeeping software in the market. Still, we’ve narrowed it down to ecommerce-optimized software so you get more accurate, online retail-friendly features that fit your business needs.

Below are our top picks of the best bookkeeping software for ecommerce and their selling points.

Perfect for small start-up ecommerce businesses, Xero is an accessible bookkeeping solution. It is a web-based software, allowing you to access it across any device without system requirements or application downloads.

Xero allows you to create invoices, make payments, organize payroll, manage inventory, and pay bills at the tip of your fingers. In addition, Xero allows small businesses to access their financial information with the aid of Xero’s trusted advisors—maximizing the growth of your business.

However, Xero can still be improved upon, especially with its collaboration features. In addition, Xero has to improve its customer service as well for more efficient customer support. For now, you can only contact them through email.

Overall, Xero is a beginner-friendly, accessible, and budget-friendly bookkeeping application you should consider if you’re planning to launch an ecommerce business.

QuickBooks is suitable for beginners, small businesses, and bookkeepers alike.

Skilled bookkeepers and accountants can use QuickBooks Online for convenience and organization.

However, if you are a business seeking online bookkeeping services, make sure to subscribe to QuickBooks Live Bookkeeping. This software offers a full-scale bookkeeping service by connecting you with QuickBooks-certified bookkeepers and having them guide you all throughout the process. In addition, their in-house bookkeepers will ensure that your books are clear of errors.

If you are transitioning into using ecommerce bookkeeping software, QuickBooks is for you. Through QuickBooks’s cleanup service, you can reconcile and organize your previous accounts up to your last tax filing.

To sum it up, QuickBooks is a comprehensive tool that allows you to sync and integrate your records across different platforms. This accounting software is recommended for small business owners with no background in accounting since it is very user-friendly—you’ll have an assigned bookkeeper to help you out.

Another player to enter the list of the best ecommerce bookkeeping software is Zoho Books. It is one of the applications under the Zoho suite, and was specifically made to aid ecommerce business owners in the bookkeeping needs of their businesses.

It is generally used for creating invoices, simplifying taxes, and monitoring financial data. Zoho Books has an inventory management feature that helps create inventories, compute the cost of goods sold, and summarize the ending inventories.

So what makes Zoho Books better than other accounting software? Aside from Zoho Books, the Zoho suite also offers Zoho Inventory. Using Zoho Books and Zoho Inventory side by side can ease the burden of doing all inventory tracking by yourself. However, Zoho Inventory requires a separate subscription.

Another impressive fact about Zoho Books is the accessibility of their software. Users can access the application using a mobile phone by downloading the Zoho Books app. With just your mobile phone, you can send invoices, receive payments, and manage your expenses.

Moreover, Zoho's customer support is above par. There are several ways to contact them; that's why you shouldn't worry when encountering problems in integrating the applications under the Zoho suite!

Ever heard of A2X? A2X is an ecommerce accounting software used by accountants and bookkeepers but is also recommended for ecommerce sellers.

It is a handy tool that automatically categorizes the payout data received from various ecommerce platforms such as Amazon, eBay, Shopify, and Etsy, and transforms them into organized financial reports that perfectly fit Sage, Xero, and other accounting software.

With A2X, bookkeeping is easy as it organizes your data automatically, so your books are up-to-date. No need for manual entries; A2X can help you save time while boosting the accuracy of your books. More than that, its customizable feature allows it to fit the needs of your business.

A2X is great for businesses that serve customers from different countries and encounter different currencies. Its system is built to reconcile financial transactions across borders, taking into consideration tax jurisdictions.

With its support representatives competent in bookkeeping and accounting, A2X boasts excellent customer support. They respond with accurate solutions within hours.

If you are looking for a bookkeeping solution for your ecommerce business, you should definitely consider A2X. This software will make bookkeeping for your business easy, accurate, and up-to-date.

If you want to keep your books simple and concise, Bench is a good fit for you. At an affordable price, Bench can reconcile your bank accounts, categorize your financial transactions, and generate financial statements.

Its features include ecommerce bookkeeping. If you realize that you need a bookkeeper late in the tax year, they can also help you catch up on your bookkeeping backlogs. However, this comes with an extra fee.

What’s amazing about this app is they cross-check your books every month to ensure data accuracy. Then, after your bookkeeper finishes your books, they will be reviewed by Bench’s in-house support team.

Their customer service is also excellent. Sure, you can send them an in-app message—like any other software out there. But with Bench, you can book a call with a partner bookkeeper and ensure that you are on the same page.

Bench’s user interface is also very simple and easy to navigate. You don’t have to be tech-savvy or an accounting expert to understand how this app works. Bookkeeping is definitely made easy with this app.

For now, Bench only serves small businesses within the United States. So if you're a US-based ecommerce business owner seeking bookkeeping services, consider Bench.

Bookkeeping software are extremely helpful for keeping track of your finances, but they have limitations too. The problem is, bookkeeping software just track your financial data and nothing more.

You need an accountant to actually interpret the prepared data in your books into something that you, the business owner, can translate into a business strategy. Unfortunately, bookkeeping software cannot analyze your business performance the way an accountant can.

That doesn’t mean that you need to leave your bookkeeping needs hanging. Here at Unloop, we help you integrate your existing bookkeeping software with our services, so you don’t have to worry about anything at all.

Let Unloop take care of your finances from bookkeeping and preparation of financial statements (income statement, cash flow statement, and balance sheet), right up to tax filings. Pay attention to your business's financial health and earn more profit by booking a call with us today!

Running an ecommerce business is not easy. You may know how to make and sell your products, but it takes more than that to sustain the business and achieve business growth. More than a good product, you need to keep an eye on your business’s financial reports.

You can’t just eyeball your finances—your company's sustainability relies on your accounting records. Any business needs a bookkeeping system, and ecommerce businesses are not an exception to this.

In ecommerce bookkeeping, you have to pay attention to inventory tracking. With proper bookkeeping, you can track your inventory, manage the costs, and implement a more strategic business plan to improve your business's efficiency.

However, bookkeeping is not for everyone, and it is not a skill you can learn overnight, either. But thanks to innovation, ecommerce bookkeeping services are now accessible to bookkeeping novices. Help your business grow its profits with the bookkeeping software we’ve listed down for you.

Ecommerce bookkeeping is different from other industries but is similar to how bookkeeping is done for retail businesses. After all, ecommerce is just online retail.

What makes it different from retail, however, is the platform used to sell the products, which impacts the bookkeeping process.

In a traditional commerce business, most of the transactional data is typically found in the business's bank account. In an ecommerce business, the accountant cannot rely on the transactional data from its bank account. The deposit received by the ecommerce business from the merchant (Amazon, Shopify, etc.) is the total amount of its sales for the given period.

However, this will not provide your bookkeeper with accurate data from each transaction or sale you’ve made, including income and time. In addition, this will affect the business's inventory management, thus messing up your recorded profits and pricing. Simply put, a bookkeeper for an ecommerce business cannot rely on net deposits and has to record transactions based on the records from your sales channel.

Moreover, running an ecommerce business means dealing with different online sales tax laws and foreign transaction costs. This might be a hassle, so hiring an ecommerce bookkeeping expert or subscribing to an ecommerce bookkeeping service will save you time.

There are multiple online bookkeeping software in the market. Still, we’ve narrowed it down to ecommerce-optimized software so you get more accurate, online retail-friendly features that fit your business needs.

Below are our top picks of the best bookkeeping software for ecommerce and their selling points.

Perfect for small start-up ecommerce businesses, Xero is an accessible bookkeeping solution. It is a web-based software, allowing you to access it across any device without system requirements or application downloads.

Xero allows you to create invoices, make payments, organize payroll, manage inventory, and pay bills at the tip of your fingers. In addition, Xero allows small businesses to access their financial information with the aid of Xero’s trusted advisors—maximizing the growth of your business.

However, Xero can still be improved upon, especially with its collaboration features. In addition, Xero has to improve its customer service as well for more efficient customer support. For now, you can only contact them through email.

Overall, Xero is a beginner-friendly, accessible, and budget-friendly bookkeeping application you should consider if you’re planning to launch an ecommerce business.

QuickBooks is suitable for beginners, small businesses, and bookkeepers alike.

Skilled bookkeepers and accountants can use QuickBooks Online for convenience and organization.

However, if you are a business seeking online bookkeeping services, make sure to subscribe to QuickBooks Live Bookkeeping. This software offers a full-scale bookkeeping service by connecting you with QuickBooks-certified bookkeepers and having them guide you all throughout the process. In addition, their in-house bookkeepers will ensure that your books are clear of errors.

If you are transitioning into using ecommerce bookkeeping software, QuickBooks is for you. Through QuickBooks’s cleanup service, you can reconcile and organize your previous accounts up to your last tax filing.

To sum it up, QuickBooks is a comprehensive tool that allows you to sync and integrate your records across different platforms. This accounting software is recommended for small business owners with no background in accounting since it is very user-friendly—you’ll have an assigned bookkeeper to help you out.

Another player to enter the list of the best ecommerce bookkeeping software is Zoho Books. It is one of the applications under the Zoho suite, and was specifically made to aid ecommerce business owners in the bookkeeping needs of their businesses.

It is generally used for creating invoices, simplifying taxes, and monitoring financial data. Zoho Books has an inventory management feature that helps create inventories, compute the cost of goods sold, and summarize the ending inventories.

So what makes Zoho Books better than other accounting software? Aside from Zoho Books, the Zoho suite also offers Zoho Inventory. Using Zoho Books and Zoho Inventory side by side can ease the burden of doing all inventory tracking by yourself. However, Zoho Inventory requires a separate subscription.

Another impressive fact about Zoho Books is the accessibility of their software. Users can access the application using a mobile phone by downloading the Zoho Books app. With just your mobile phone, you can send invoices, receive payments, and manage your expenses.

Moreover, Zoho's customer support is above par. There are several ways to contact them; that's why you shouldn't worry when encountering problems in integrating the applications under the Zoho suite!

Ever heard of A2X? A2X is an ecommerce accounting software used by accountants and bookkeepers but is also recommended for ecommerce sellers.

It is a handy tool that automatically categorizes the payout data received from various ecommerce platforms such as Amazon, eBay, Shopify, and Etsy, and transforms them into organized financial reports that perfectly fit Sage, Xero, and other accounting software.

With A2X, bookkeeping is easy as it organizes your data automatically, so your books are up-to-date. No need for manual entries; A2X can help you save time while boosting the accuracy of your books. More than that, its customizable feature allows it to fit the needs of your business.

A2X is great for businesses that serve customers from different countries and encounter different currencies. Its system is built to reconcile financial transactions across borders, taking into consideration tax jurisdictions.

With its support representatives competent in bookkeeping and accounting, A2X boasts excellent customer support. They respond with accurate solutions within hours.

If you are looking for a bookkeeping solution for your ecommerce business, you should definitely consider A2X. This software will make bookkeeping for your business easy, accurate, and up-to-date.

If you want to keep your books simple and concise, Bench is a good fit for you. At an affordable price, Bench can reconcile your bank accounts, categorize your financial transactions, and generate financial statements.

Its features include ecommerce bookkeeping. If you realize that you need a bookkeeper late in the tax year, they can also help you catch up on your bookkeeping backlogs. However, this comes with an extra fee.

What’s amazing about this app is they cross-check your books every month to ensure data accuracy. Then, after your bookkeeper finishes your books, they will be reviewed by Bench’s in-house support team.

Their customer service is also excellent. Sure, you can send them an in-app message—like any other software out there. But with Bench, you can book a call with a partner bookkeeper and ensure that you are on the same page.

Bench’s user interface is also very simple and easy to navigate. You don’t have to be tech-savvy or an accounting expert to understand how this app works. Bookkeeping is definitely made easy with this app.

For now, Bench only serves small businesses within the United States. So if you're a US-based ecommerce business owner seeking bookkeeping services, consider Bench.

Bookkeeping software are extremely helpful for keeping track of your finances, but they have limitations too. The problem is, bookkeeping software just track your financial data and nothing more.

You need an accountant to actually interpret the prepared data in your books into something that you, the business owner, can translate into a business strategy. Unfortunately, bookkeeping software cannot analyze your business performance the way an accountant can.

That doesn’t mean that you need to leave your bookkeeping needs hanging. Here at Unloop, we help you integrate your existing bookkeeping software with our services, so you don’t have to worry about anything at all.

Let Unloop take care of your finances from bookkeeping and preparation of financial statements (income statement, cash flow statement, and balance sheet), right up to tax filings. Pay attention to your business's financial health and earn more profit by booking a call with us today!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

There’s no room for compromise in managing the financial aspects of a small business. From expense tracking and business transactions to customer service and marketing, small business owners understand the relentless effort required to meet success. Many would turn to QuickBooks, a tool for small business owners.

Online businesses use this popular accounting software because of its user-friendly interface and robust support system. It has plenty of features to benefit you in every part of your business.

But for some, the question still remains: Is QuickBooks a long-term solution? Or is it a potential disaster waiting to happen? This article aims to clarify and address the concerns surrounding QuickBooks for small business owners.

As a non-accountant, using tools like QuickBooks can be frustrating. That’s because you know there’s something you’re doing wrong. You can’t pinpoint what it is or even realize how you committed them. You just know something’s not adding up (literally).

Like other businesses, you may be sucking the software in, booting up the computer, and trying your best to put the numbers in. Unfortunately, that’s where the mistake is often rooted, leaving small business owners reluctant to learn, invest, and familiarize themselves with the tool.

What are these QuickBooks mistakes entrepreneurs often make? Let’s find out below:

QuickBooks Online has a bank sync feature that downloads your bank account transactions. But these are not automatically categorized.

One chaotic mistake most businesses make is adding these synced transactions as entries without sorting them. This problem leads to disorganized journals and ledgers.

When transactions aren’t properly categorized, tracking income and expenses accurately becomes challenging. You may also struggle to identify areas where cost-cutting is needed.

Small business owners place a high value on financial clarity. They want to avoid any unnecessary confusion when it comes to managing their finances.

QuickBooks offers a useful feature that allows you to create sub-accounts under your main accounts. This feature can be a real asset for organizing your expenses efficiently, but surprisingly, many businesses aren't familiar with it. Let's dive into why you should consider using sub-accounts.

Certain sub-accounts can result in redundancy and clutter within your financial statements. Knowing the nature of the income or expenses is important before creating a separate account.

Some businesses worry that they may lose their transaction history with QuickBooks, and it’s easy to see why.

Deleting transactions is like removing a piece of a puzzle in a set. Even if the rest is in order, that missing piece may throw the entire thing off.

If you delete a transaction that’s supposed to be recorded, you must recreate it and fix the transaction amount. This can be a time-consuming and potentially error-prone process.

QuickBooks includes a feature that identifies and flags duplicate transactions for security purposes. But despite the protection, there are still circumstances where double entry can occur:

Another common mistake businesses make is the incorrect recording of loan payments within their accounting records.

Principal payments fulfilling the loan obligation must be debited as loans payable instead of a business expense. That’s because a loan payment is a liability. It should reflect on the balance sheet to accurately depict the company’s financial obligations.

On the other hand, the interests you pay that don’t form part of the original loan amount should be debited under interest expenses. This will land the amount on your income statement, reflecting the cost of borrowing funds.

In addition to deleting and duplicating transactions, some companies also struggle with locking their bookkeeping periods within QuickBooks.

Once you’re confident that every transaction in a certain period is balanced and correct, you must lock it. Failure to do so leaves the door open for possible tampering or unintended modifications.

You might believe that the only solution is to tweak accounts from past periods, but that's not recommended. If all previous periods are already balanced, you can resolve the issue by focusing solely on the current transactions.

While using accounting tools like QuickBooks may present its fair share of challenges for small business owners, their benefits are simply too good to pass up. We believe QuickBooks is worth every penny. Here’s why.

Accurate financial reports are the backbone of informed decision-making in business. You must have comprehensive data about your business finances to achieve such precision.

When you sign up for a QuickBooks plan, you will first be offered up-to-date books. This feature will help you provide and gather all the receipts and documents for the past months to complete a year of income and expense tracking.

You can generate reliable reports that clearly show your financial status.

One thing is certain—there are areas in your small business you can do independently. But relying on experts or software for accounting is still better.

You must establish accounting as a foundation from the beginning, helping you track the inflow and outflow of money. Organized finances will provide relief and clarity even as a one-person team.

As your business expands and evolves, incorporating an accounting tool like QuickBooks becomes essential. You’ll need to readily interpret data for decision-making.

This proactive approach partnered with a powerful accounting tool grants you peace of mind and better financial management.

In today’s dynamic business landscape, it is common for small business owners to sell their products on various ecommerce platforms like Amazon, Shopify, Etsy, Woocommerce, and Squarespace. Given the multiple sales channels, inventory tracking becomes paramount.

QuickBooks offers a unified view of your business performance and enables you to input data from sales across different platforms and update inventory levels when you replenish your supplies. This streamlined process ensures that your inventory records remain precise and updated.

Do not compare software per dime if you are trying to decide which one to have. Check the offers in every plan as compared with another accounting software instead. By comparing the programs and their offers, you’ll see if the investment is worth it.

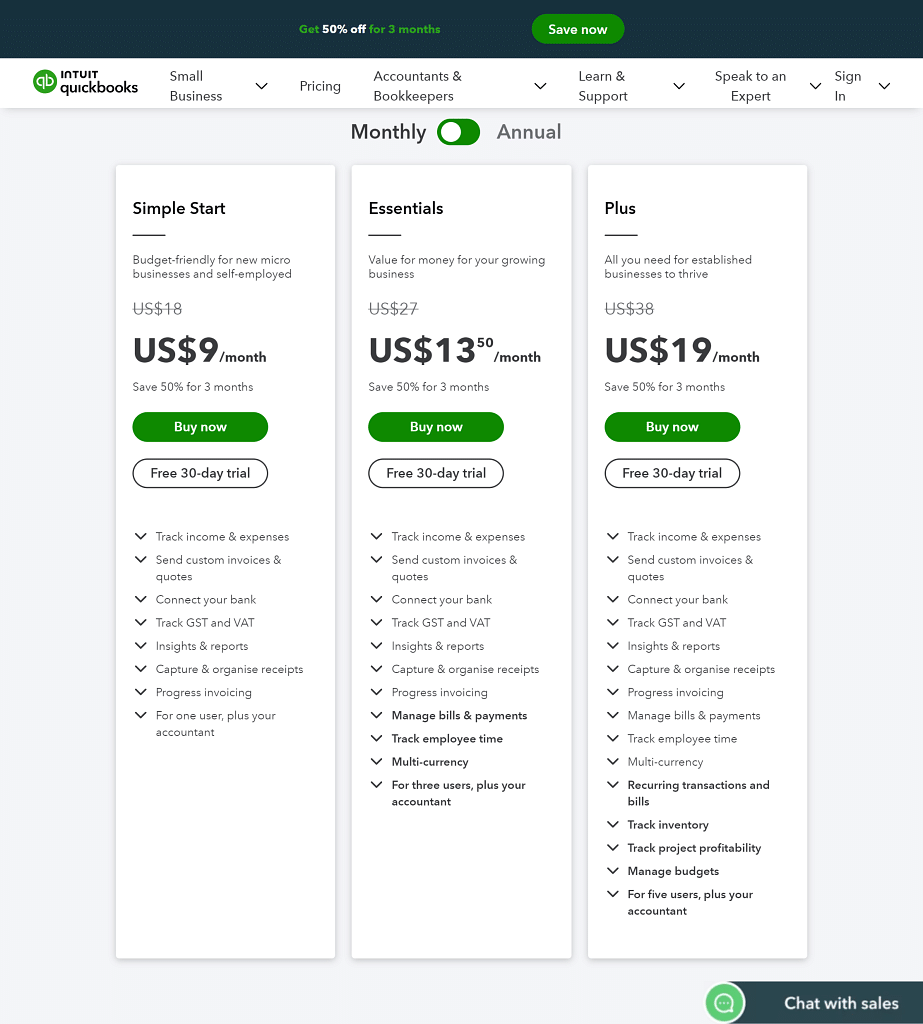

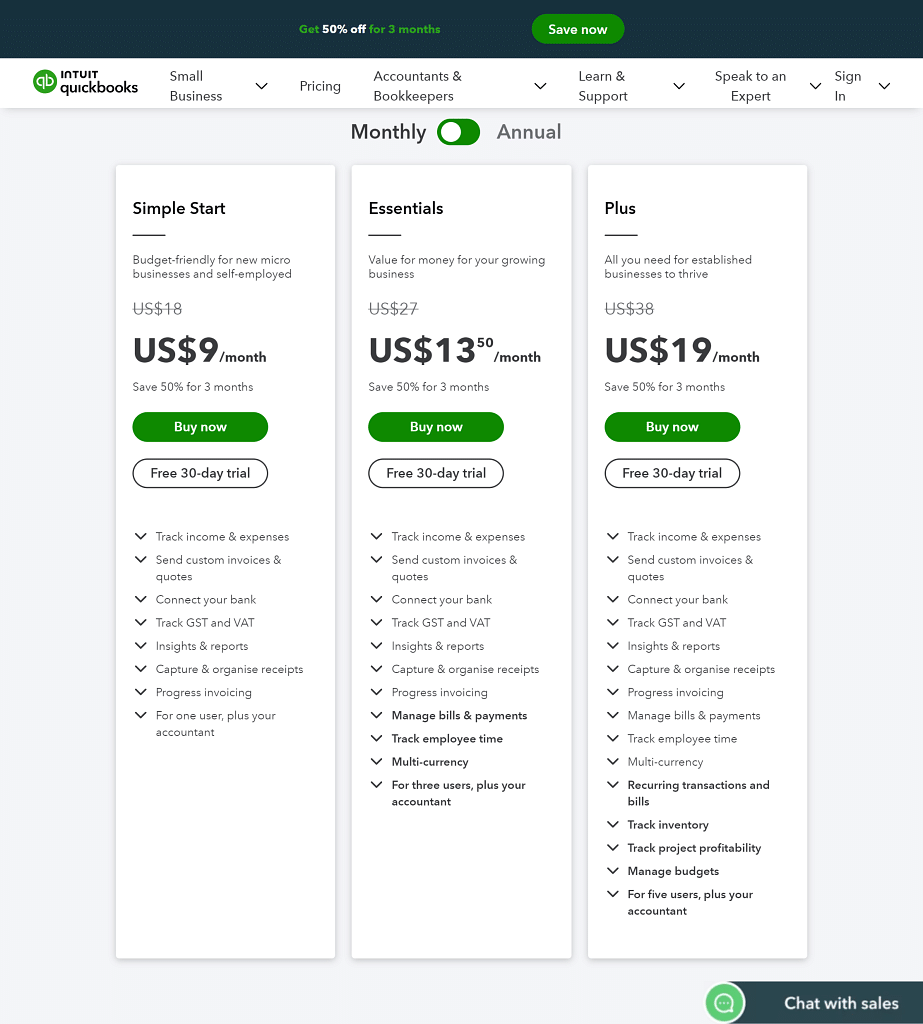

Here’s QuickBooks’ subscription plans as of this writing:

Some accounting software may limit expense tracking for their basic plan. Still, you’ll get this plus unlimited invoices in all QuickBooks plans.

Even with the basic plan, you can manage up to 1099 contractors, keeping your businesses committed to tax obligations. This means your tax deductions are taken care of. Cash flow and financial reporting are also all covered.

| Remember: Affordability is not solely about the price you pay but the value you receive. |

Calculating your tax is a huge challenge for seasoned and new business owners. Luckily, the best accounting software like QuickBooks is here to lend a helping hand.

QuickBooks facilitates the tax calculation process by compiling your tax return based on your net income—the difference between your total income and total expenses. Then, it will automatically provide the data you need for your tax returns.

Furthermore, QuickBooks can provide more accurate sales taxes if you provide the necessary details, such as your country's type of taxes, product or service's tax category, and shipping location. This feature helps you maintain compliance and alleviate the burden of tax-related complexities.

Gone are the days when small businesses solely relied on traditional payment methods. Today, embracing streamlined online payments is becoming the norm.

You can now experience hassle-free payment transactions with tools like QuickBooks. One of its best features is that customers can pay you online. It has integrated third-party payment apps such as Paypal, but it also has a built-in tool called QuickBooks Payments, which you can use to send an electronic invoice to your customers.

QuickBooks has scaled up and dispersed into different versions to fit every type of business out there, especially small ones. Here are the versions worth considering:

QuickBooks Online (QBO) revolutionizes how small businesses oversee their finances with cloud technology. You can access your books using the QuickBooks mobile app, downloadable from the app store. This makes it ideal for nomadic entrepreneurs or people who don't want extra hardware setup or software installation costs.

QuickBooks has kept pace with digital growth by enabling integration and access to ecommerce sites like Shopify and Amazon. Whether at home, in the office, or on the go, you can conveniently check the state of your business and make informed decisions anytime, anywhere.

Moreover, QuickBooks prioritizes the security of your business data. It provides a unique ID system granting secure access to your QuickBooks Online account, protecting your financial information.

If you spend more time on an office desk, you will enjoy QuickBooks Pro's features. This QuickBooks version is one of the three accounting software for desktops or PCs.

Despite its limited accessibility and backup, QuickBooks Pro excels in certain areas, such as in-depth payroll management and more features than QuickBooks Online. This tool helps you save time and minimize errors, from employee salary calculations to generating payroll reports.

If you’re also not confident about QBO's safety features, QuickBooks Pro is potentially more secure for your ecommerce business.

QuickBooks Premier is the second QuickBooks desktop that offers more functions than QuickBooks Pro. These are just some of the functions it offers:

QuickBooks Premier is a great tool for growing online businesses because it has tailored-fit reports for the type of industry you're in. You can predict your profitability by tracking your largest sources of income.

Third-party service providers such as freelancers or real estate agents can now use QuickBooks. This QuickBooks version is also cloud-based and available on your mobile phone.

What sets it apart from QBO or QuickBooks Desktop is it offers to track your business expenses and personal finance and create tax automation. However, you can't upgrade it to any other version. So if you have goals of expanding your remote workforce or small business, this won't work for you in the long run.

QuickBooks Mac is designed for online business owners who use Apple computers. It has similar features to the QBO and Desktop versions but is ideally suited for QuickBooks small business users on Macs.

With its compatibility with the Mac ecosystem and features geared towards small business needs, QuickBooks for Mac is an ideal choice for Apple-based online business owners seeking efficient financial management.

Whether you've been in business for a while or have only just started, you only need to set up a few things before hitting the ground running. The rest you can choose to leave to accounting experts.

Here's what you should pay attention to when you set up QuickBooks for your business.

This is where you set up all the essential information about your business, such as the type of business entity, invoice terms, accounting method, tax forms, and more. These will affect income and sales tax reporting as you move forward.

How to create an account?

The chart of accounts is mandatory information before you start recording transactions in QuickBooks because this is where you input initial business balances.

Want to view your financial transactions?

You’ll gain access to a complete list of predefined account categories, including assets, liabilities, equity, income, and expenses. You can customize these accounts based on your specific business needs.

Connecting a bank account to QuickBooks helps you sync existing transactions from your bank into QuickBooks. This process allows for easier bank reconciliation and ensures that QuickBooks' balances match the ones in the designated business accounts.

To sync bank accounts:

Setting up your balance is mainly about putting all the numbers from your books into QuickBooks. You enter the opening or current amounts of balance sheet accounts and identify unclassified transactions from the bank account synced to the accounting software. This cleans up your journal and ledger entries in QuickBooks and gives you accurate financial reporting.

To enter the opening balance:

QuickBooks users need to add buyers and vendors. This is the only way for them to record and track incoming revenues and supplier payments identified as short-term debt or credit.

For customers:

For vendors:

Adding products and services is the way to record revenue coming from physical or online sales.

To set up your products or services:

You can fill out the product or service name and enter the product's SKU number if you do inventory management. You can also enter your product or service's sales price or rate.

To sum it up, QuickBooks is a recipe for success, but effectively connecting your small business to this accounting software starts with proper knowledge and setup. If you have installed this recently and don't know how to maximize it, you might end up with expensive junk.

The success of your business all comes from using your resources optimally. Fortunately, Unloop is adept with the way this accounting software works. Once you hand over your accounting or bookkeeping, let us work while you focus on your business. Truly, it's like putting your QuickBooks software for business on autopilot.

Talk to us if you're afraid of making QuickBooks mistakes. Book a call today!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

There’s no room for compromise in managing the financial aspects of a small business. From expense tracking and business transactions to customer service and marketing, small business owners understand the relentless effort required to meet success. Many would turn to QuickBooks, a tool for small business owners.

Online businesses use this popular accounting software because of its user-friendly interface and robust support system. It has plenty of features to benefit you in every part of your business.

But for some, the question still remains: Is QuickBooks a long-term solution? Or is it a potential disaster waiting to happen? This article aims to clarify and address the concerns surrounding QuickBooks for small business owners.

As a non-accountant, using tools like QuickBooks can be frustrating. That’s because you know there’s something you’re doing wrong. You can’t pinpoint what it is or even realize how you committed them. You just know something’s not adding up (literally).

Like other businesses, you may be sucking the software in, booting up the computer, and trying your best to put the numbers in. Unfortunately, that’s where the mistake is often rooted, leaving small business owners reluctant to learn, invest, and familiarize themselves with the tool.

What are these QuickBooks mistakes entrepreneurs often make? Let’s find out below:

QuickBooks Online has a bank sync feature that downloads your bank account transactions. But these are not automatically categorized.

One chaotic mistake most businesses make is adding these synced transactions as entries without sorting them. This problem leads to disorganized journals and ledgers.

When transactions aren’t properly categorized, tracking income and expenses accurately becomes challenging. You may also struggle to identify areas where cost-cutting is needed.

Small business owners place a high value on financial clarity. They want to avoid any unnecessary confusion when it comes to managing their finances.

QuickBooks offers a useful feature that allows you to create sub-accounts under your main accounts. This feature can be a real asset for organizing your expenses efficiently, but surprisingly, many businesses aren't familiar with it. Let's dive into why you should consider using sub-accounts.

Certain sub-accounts can result in redundancy and clutter within your financial statements. Knowing the nature of the income or expenses is important before creating a separate account.

Some businesses worry that they may lose their transaction history with QuickBooks, and it’s easy to see why.

Deleting transactions is like removing a piece of a puzzle in a set. Even if the rest is in order, that missing piece may throw the entire thing off.

If you delete a transaction that’s supposed to be recorded, you must recreate it and fix the transaction amount. This can be a time-consuming and potentially error-prone process.

QuickBooks includes a feature that identifies and flags duplicate transactions for security purposes. But despite the protection, there are still circumstances where double entry can occur:

Another common mistake businesses make is the incorrect recording of loan payments within their accounting records.

Principal payments fulfilling the loan obligation must be debited as loans payable instead of a business expense. That’s because a loan payment is a liability. It should reflect on the balance sheet to accurately depict the company’s financial obligations.

On the other hand, the interests you pay that don’t form part of the original loan amount should be debited under interest expenses. This will land the amount on your income statement, reflecting the cost of borrowing funds.

In addition to deleting and duplicating transactions, some companies also struggle with locking their bookkeeping periods within QuickBooks.

Once you’re confident that every transaction in a certain period is balanced and correct, you must lock it. Failure to do so leaves the door open for possible tampering or unintended modifications.

You might believe that the only solution is to tweak accounts from past periods, but that's not recommended. If all previous periods are already balanced, you can resolve the issue by focusing solely on the current transactions.

While using accounting tools like QuickBooks may present its fair share of challenges for small business owners, their benefits are simply too good to pass up. We believe QuickBooks is worth every penny. Here’s why.

Accurate financial reports are the backbone of informed decision-making in business. You must have comprehensive data about your business finances to achieve such precision.

When you sign up for a QuickBooks plan, you will first be offered up-to-date books. This feature will help you provide and gather all the receipts and documents for the past months to complete a year of income and expense tracking.

You can generate reliable reports that clearly show your financial status.

One thing is certain—there are areas in your small business you can do independently. But relying on experts or software for accounting is still better.

You must establish accounting as a foundation from the beginning, helping you track the inflow and outflow of money. Organized finances will provide relief and clarity even as a one-person team.

As your business expands and evolves, incorporating an accounting tool like QuickBooks becomes essential. You’ll need to readily interpret data for decision-making.

This proactive approach partnered with a powerful accounting tool grants you peace of mind and better financial management.

In today’s dynamic business landscape, it is common for small business owners to sell their products on various ecommerce platforms like Amazon, Shopify, Etsy, Woocommerce, and Squarespace. Given the multiple sales channels, inventory tracking becomes paramount.

QuickBooks offers a unified view of your business performance and enables you to input data from sales across different platforms and update inventory levels when you replenish your supplies. This streamlined process ensures that your inventory records remain precise and updated.

Do not compare software per dime if you are trying to decide which one to have. Check the offers in every plan as compared with another accounting software instead. By comparing the programs and their offers, you’ll see if the investment is worth it.

Here’s QuickBooks’ subscription plans as of this writing:

Some accounting software may limit expense tracking for their basic plan. Still, you’ll get this plus unlimited invoices in all QuickBooks plans.

Even with the basic plan, you can manage up to 1099 contractors, keeping your businesses committed to tax obligations. This means your tax deductions are taken care of. Cash flow and financial reporting are also all covered.

| Remember: Affordability is not solely about the price you pay but the value you receive. |

Calculating your tax is a huge challenge for seasoned and new business owners. Luckily, the best accounting software like QuickBooks is here to lend a helping hand.

QuickBooks facilitates the tax calculation process by compiling your tax return based on your net income—the difference between your total income and total expenses. Then, it will automatically provide the data you need for your tax returns.

Furthermore, QuickBooks can provide more accurate sales taxes if you provide the necessary details, such as your country's type of taxes, product or service's tax category, and shipping location. This feature helps you maintain compliance and alleviate the burden of tax-related complexities.

Gone are the days when small businesses solely relied on traditional payment methods. Today, embracing streamlined online payments is becoming the norm.

You can now experience hassle-free payment transactions with tools like QuickBooks. One of its best features is that customers can pay you online. It has integrated third-party payment apps such as Paypal, but it also has a built-in tool called QuickBooks Payments, which you can use to send an electronic invoice to your customers.

QuickBooks has scaled up and dispersed into different versions to fit every type of business out there, especially small ones. Here are the versions worth considering:

QuickBooks Online (QBO) revolutionizes how small businesses oversee their finances with cloud technology. You can access your books using the QuickBooks mobile app, downloadable from the app store. This makes it ideal for nomadic entrepreneurs or people who don't want extra hardware setup or software installation costs.

QuickBooks has kept pace with digital growth by enabling integration and access to ecommerce sites like Shopify and Amazon. Whether at home, in the office, or on the go, you can conveniently check the state of your business and make informed decisions anytime, anywhere.

Moreover, QuickBooks prioritizes the security of your business data. It provides a unique ID system granting secure access to your QuickBooks Online account, protecting your financial information.

If you spend more time on an office desk, you will enjoy QuickBooks Pro's features. This QuickBooks version is one of the three accounting software for desktops or PCs.

Despite its limited accessibility and backup, QuickBooks Pro excels in certain areas, such as in-depth payroll management and more features than QuickBooks Online. This tool helps you save time and minimize errors, from employee salary calculations to generating payroll reports.

If you’re also not confident about QBO's safety features, QuickBooks Pro is potentially more secure for your ecommerce business.

QuickBooks Premier is the second QuickBooks desktop that offers more functions than QuickBooks Pro. These are just some of the functions it offers:

QuickBooks Premier is a great tool for growing online businesses because it has tailored-fit reports for the type of industry you're in. You can predict your profitability by tracking your largest sources of income.

Third-party service providers such as freelancers or real estate agents can now use QuickBooks. This QuickBooks version is also cloud-based and available on your mobile phone.

What sets it apart from QBO or QuickBooks Desktop is it offers to track your business expenses and personal finance and create tax automation. However, you can't upgrade it to any other version. So if you have goals of expanding your remote workforce or small business, this won't work for you in the long run.

QuickBooks Mac is designed for online business owners who use Apple computers. It has similar features to the QBO and Desktop versions but is ideally suited for QuickBooks small business users on Macs.

With its compatibility with the Mac ecosystem and features geared towards small business needs, QuickBooks for Mac is an ideal choice for Apple-based online business owners seeking efficient financial management.

Whether you've been in business for a while or have only just started, you only need to set up a few things before hitting the ground running. The rest you can choose to leave to accounting experts.

Here's what you should pay attention to when you set up QuickBooks for your business.

This is where you set up all the essential information about your business, such as the type of business entity, invoice terms, accounting method, tax forms, and more. These will affect income and sales tax reporting as you move forward.

How to create an account?

The chart of accounts is mandatory information before you start recording transactions in QuickBooks because this is where you input initial business balances.

Want to view your financial transactions?

You’ll gain access to a complete list of predefined account categories, including assets, liabilities, equity, income, and expenses. You can customize these accounts based on your specific business needs.

Connecting a bank account to QuickBooks helps you sync existing transactions from your bank into QuickBooks. This process allows for easier bank reconciliation and ensures that QuickBooks' balances match the ones in the designated business accounts.

To sync bank accounts:

Setting up your balance is mainly about putting all the numbers from your books into QuickBooks. You enter the opening or current amounts of balance sheet accounts and identify unclassified transactions from the bank account synced to the accounting software. This cleans up your journal and ledger entries in QuickBooks and gives you accurate financial reporting.

To enter the opening balance:

QuickBooks users need to add buyers and vendors. This is the only way for them to record and track incoming revenues and supplier payments identified as short-term debt or credit.

For customers:

For vendors:

Adding products and services is the way to record revenue coming from physical or online sales.

To set up your products or services:

You can fill out the product or service name and enter the product's SKU number if you do inventory management. You can also enter your product or service's sales price or rate.

To sum it up, QuickBooks is a recipe for success, but effectively connecting your small business to this accounting software starts with proper knowledge and setup. If you have installed this recently and don't know how to maximize it, you might end up with expensive junk.

The success of your business all comes from using your resources optimally. Fortunately, Unloop is adept with the way this accounting software works. Once you hand over your accounting or bookkeeping, let us work while you focus on your business. Truly, it's like putting your QuickBooks software for business on autopilot.

Talk to us if you're afraid of making QuickBooks mistakes. Book a call today!

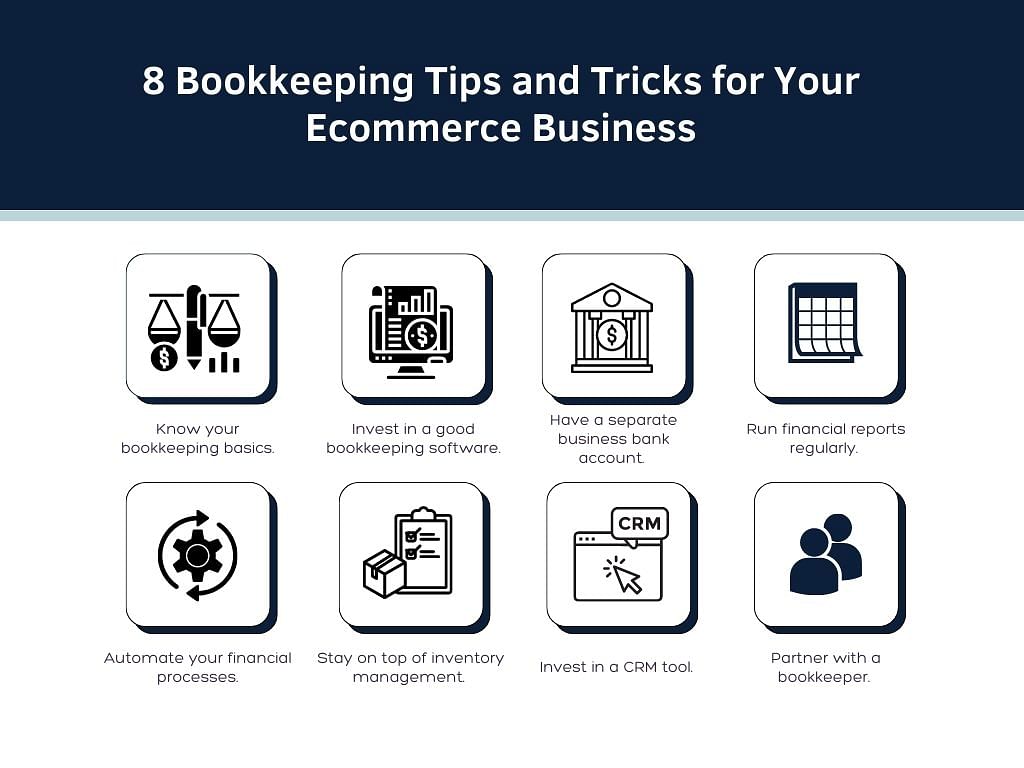

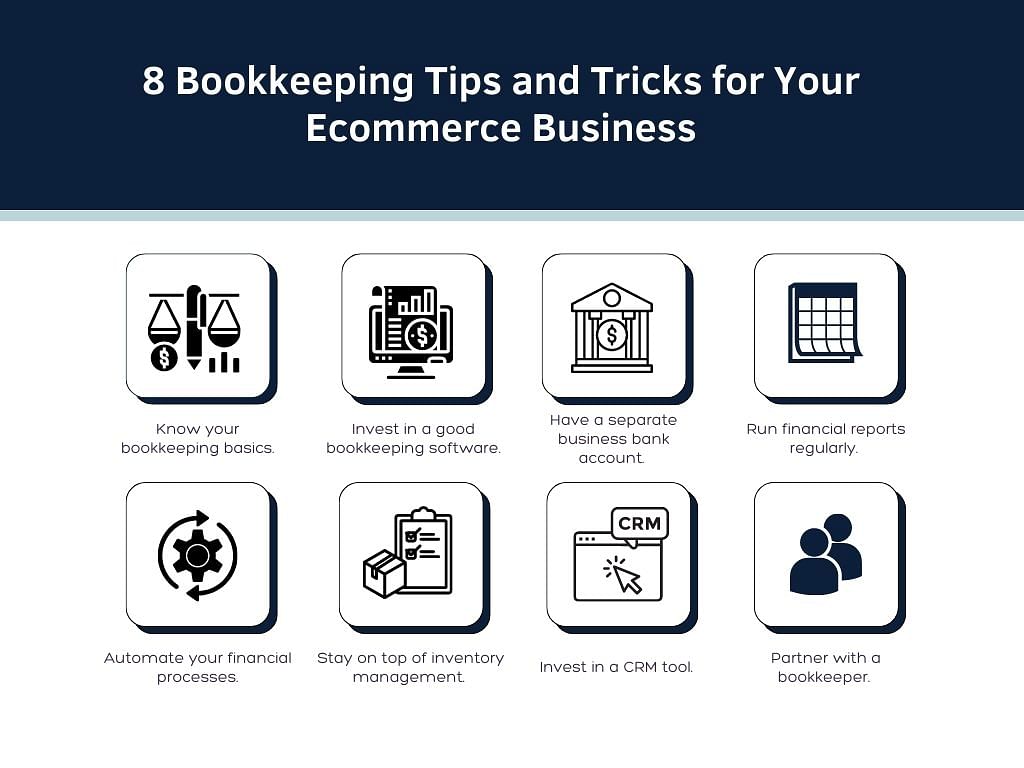

Keeping track of your finances can be tricky and overwhelming, especially if you lead a hectic business in the ecommerce industry. But hang on, there are a few bookkeeping tips and tricks that can help you make this process easier and more efficient. With them, you can avoid dealing with financial problems, such as financial losses, tax filing issues, and even bankruptcy.

So why not take the time today to start thinking about how you can stay on top of your bookkeeping? With the right information and strategies, you’ll be well on your way to steady financial footing for your ecommerce business!

Check out this list of top ecommerce bookkeeping tricks to get your finances in shape:

Before optimizing your bookkeeping processes, arm yourself with basic bookkeeping knowledge first. Begin by knowing that bookkeeping and accounting are separate tasks.

| 💡Bookkeeping tasks are about tracking and organizing data in a business’s books. Accounting, on the other hand, is the task of making sense of numbers through accurate reports. |

Bookkeeping and accounting records go hand in hand. If you’re a small business owner, you’ll have to choose between these two recording methods:

It is also essential to familiarize yourself with bookkeeping and accounting jargon like assets, liabilities, equity, revenue, expenses, costs, and profits. Awareness of these terms will make it quicker and more efficient for you to check your books and understand reports.

Investing in good bookkeeping and accounting software can help you streamline and automate your processes. With the right software, you can integrate your data into the ecommerce platform you are selling on so that your data can be categorized and organized automatically.

You can combine this data with the other key performance indicators you track that aren’t provided by the online marketplace where you’re selling. You can also use the software’s report-generation capabilities to make sense of all your business transactions and other financial data.

When there are changes and updates in the books from different departments of the company, they’ll also get recorded automatically and everybody can view the most updated data immediately.

Other benefits you will enjoy from having bookkeeping and accounting software are the following:

Having separate personal and business accounts is essential to managing your business finances effectively. Designate different bank accounts and credit cards for personal and business purposes.

This way, all transactions can be clearly labeled to minimize the confusion from mixed-account spending. Both small and large companies will benefit from this strategy as it helps maintain control over monetary resources.

| 💡There’s a higher risk of fraud or misuse of confidential data when multiple accounts are not properly secured or managed. |

Run financial reports regularly to utilize the data recorded in the bookkeeping process. Bookkeeping and accounting tools allow you to generate reports in just a few clicks because they have templates. You can quickly check the following financial statements:

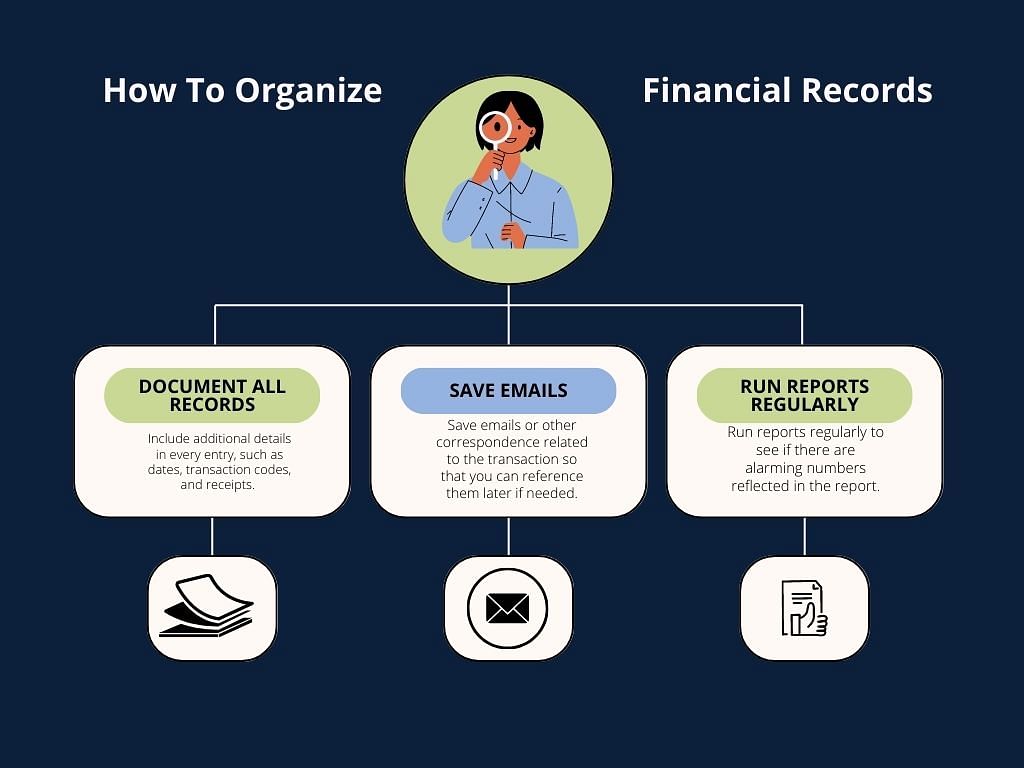

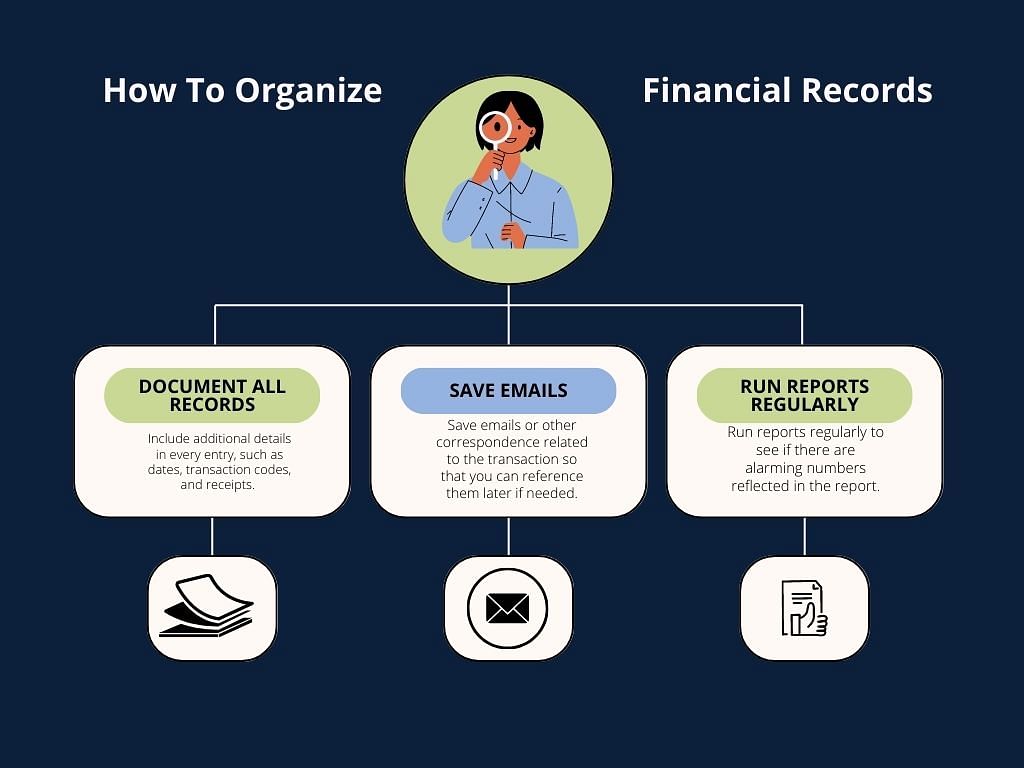

Make sure that your financial statements are organized and comprehensive. To organize your records, start by documenting all your transactions as they occur. This might mean including additional details in every entry, such as dates, transaction codes, and receipts.

Also, save any emails or other correspondence related to the transaction so that you can reference them later if needed.

As a startup ecommerce business, it’s best to run reports as often as possible. Doing so allows you to see your business’s successes and duplicate the best practices that led to those wins. On the other hand, if there are alarming numbers reflected in the reports, you can create mitigation plans quickly and improve your financial performance.

When it comes to ecommerce bookkeeping, one of the best things you can do is to automate your financial processes. Doing this can save you from a lot of hassle in the long run. Set up online access to your accounts to conveniently view your balances and keep track of any changes or updates with ease.

You can also set up automatic withdrawals from your bank account to go straight into your bookkeeping software. This way, you don’t need to enter all of your financial transactions manually.

You can also set up automatic payments for your bills and invoices. By doing this, you won’t have to keep track of when each bill is due, and you won’t have to worry about forgetting to pay a bill on time.

Finally, link your ecommerce bookkeeping software to your credit card and bank statements so that all your transactions will be automatically imported into your software.

Another area of your ecommerce business you need to be on top of is inventory management. Customers get turned off by stores with products they want but can’t buy because of a lack of supply. When your inventory isn’t organized, you miss out on plenty of sales opportunities.

The good news is that most ecommerce sites have an inventory management feature, so you only need to integrate the data into your primary accounting system. You can add the numbers to other data stored in the tool to determine the cost of goods sold and delivery or fulfillment costs.

The collated data and reports will guide you in deciding whether your fulfillment methods are efficient. You can also use your findings to know what kind of promotions to launch and which products to focus on to boost or maintain sales.

One of the most underrated accounting and bookkeeping tips is investing in a tool with a customer relationship management (CRM) feature. This practice will make your business operations even smoother.

The data you’ll get from a CRM tool might not be in monetary value, but you can get just that by combining them with other data stored in your accounting and bookkeeping software. Because customers are your business’s lifeblood, you must include these details in your bookkeeping.

So, give yourself and your bookkeeper the convenience of having customer insights within your main accounting tool.

| 💡A CRM tool saves contacts of leads and customers that can help you conveniently send invoices and do marketing. |

CRM tools also store information like the sales journey of a potential customer and the issues they experience in the sales process.

We’ve already discussed the basics of bookkeeping and knowing how bookkeeping tools and their features help you optimize your ecommerce business operations. Now, we’ll answer a lingering question many business owners like you have: should you hire a professional bookkeeper? Our answer is yes!

Here are the benefits small business owners reap in partnering with bookkeeping professionals:

It’s tempting to do bookkeeping yourself, but with plenty of tasks on your plate, the best move is to delegate it to experts.

By now you know that optimizing your bookkeeping can make your business operations run smoothly. These eight tips may be a lot for some, but implementing them in your business will be worth it.

If you need more bookkeeping tips, assistance using bookkeeping and accounting software, or if you want to delegate bookkeeping tasks to experts, Unloop is here. We have a team of professional bookkeepers who are well-versed in the ecommerce industry, so your books will always be in good hands.

We also specialize in accounts payable services, forecasting, payroll, and taxes. Book a call with us today to get started!

Keeping track of your finances can be tricky and overwhelming, especially if you lead a hectic business in the ecommerce industry. But hang on, there are a few bookkeeping tips and tricks that can help you make this process easier and more efficient. With them, you can avoid dealing with financial problems, such as financial losses, tax filing issues, and even bankruptcy.

So why not take the time today to start thinking about how you can stay on top of your bookkeeping? With the right information and strategies, you’ll be well on your way to steady financial footing for your ecommerce business!

Check out this list of top ecommerce bookkeeping tricks to get your finances in shape:

Before optimizing your bookkeeping processes, arm yourself with basic bookkeeping knowledge first. Begin by knowing that bookkeeping and accounting are separate tasks.

| 💡Bookkeeping tasks are about tracking and organizing data in a business’s books. Accounting, on the other hand, is the task of making sense of numbers through accurate reports. |

Bookkeeping and accounting records go hand in hand. If you’re a small business owner, you’ll have to choose between these two recording methods:

It is also essential to familiarize yourself with bookkeeping and accounting jargon like assets, liabilities, equity, revenue, expenses, costs, and profits. Awareness of these terms will make it quicker and more efficient for you to check your books and understand reports.

Investing in good bookkeeping and accounting software can help you streamline and automate your processes. With the right software, you can integrate your data into the ecommerce platform you are selling on so that your data can be categorized and organized automatically.

You can combine this data with the other key performance indicators you track that aren’t provided by the online marketplace where you’re selling. You can also use the software’s report-generation capabilities to make sense of all your business transactions and other financial data.

When there are changes and updates in the books from different departments of the company, they’ll also get recorded automatically and everybody can view the most updated data immediately.

Other benefits you will enjoy from having bookkeeping and accounting software are the following:

Having separate personal and business accounts is essential to managing your business finances effectively. Designate different bank accounts and credit cards for personal and business purposes.

This way, all transactions can be clearly labeled to minimize the confusion from mixed-account spending. Both small and large companies will benefit from this strategy as it helps maintain control over monetary resources.

| 💡There’s a higher risk of fraud or misuse of confidential data when multiple accounts are not properly secured or managed. |

Run financial reports regularly to utilize the data recorded in the bookkeeping process. Bookkeeping and accounting tools allow you to generate reports in just a few clicks because they have templates. You can quickly check the following financial statements:

Make sure that your financial statements are organized and comprehensive. To organize your records, start by documenting all your transactions as they occur. This might mean including additional details in every entry, such as dates, transaction codes, and receipts.

Also, save any emails or other correspondence related to the transaction so that you can reference them later if needed.

As a startup ecommerce business, it’s best to run reports as often as possible. Doing so allows you to see your business’s successes and duplicate the best practices that led to those wins. On the other hand, if there are alarming numbers reflected in the reports, you can create mitigation plans quickly and improve your financial performance.

When it comes to ecommerce bookkeeping, one of the best things you can do is to automate your financial processes. Doing this can save you from a lot of hassle in the long run. Set up online access to your accounts to conveniently view your balances and keep track of any changes or updates with ease.

You can also set up automatic withdrawals from your bank account to go straight into your bookkeeping software. This way, you don’t need to enter all of your financial transactions manually.

You can also set up automatic payments for your bills and invoices. By doing this, you won’t have to keep track of when each bill is due, and you won’t have to worry about forgetting to pay a bill on time.

Finally, link your ecommerce bookkeeping software to your credit card and bank statements so that all your transactions will be automatically imported into your software.

Another area of your ecommerce business you need to be on top of is inventory management. Customers get turned off by stores with products they want but can’t buy because of a lack of supply. When your inventory isn’t organized, you miss out on plenty of sales opportunities.

The good news is that most ecommerce sites have an inventory management feature, so you only need to integrate the data into your primary accounting system. You can add the numbers to other data stored in the tool to determine the cost of goods sold and delivery or fulfillment costs.

The collated data and reports will guide you in deciding whether your fulfillment methods are efficient. You can also use your findings to know what kind of promotions to launch and which products to focus on to boost or maintain sales.

One of the most underrated accounting and bookkeeping tips is investing in a tool with a customer relationship management (CRM) feature. This practice will make your business operations even smoother.

The data you’ll get from a CRM tool might not be in monetary value, but you can get just that by combining them with other data stored in your accounting and bookkeeping software. Because customers are your business’s lifeblood, you must include these details in your bookkeeping.

So, give yourself and your bookkeeper the convenience of having customer insights within your main accounting tool.

| 💡A CRM tool saves contacts of leads and customers that can help you conveniently send invoices and do marketing. |

CRM tools also store information like the sales journey of a potential customer and the issues they experience in the sales process.

We’ve already discussed the basics of bookkeeping and knowing how bookkeeping tools and their features help you optimize your ecommerce business operations. Now, we’ll answer a lingering question many business owners like you have: should you hire a professional bookkeeper? Our answer is yes!

Here are the benefits small business owners reap in partnering with bookkeeping professionals:

It’s tempting to do bookkeeping yourself, but with plenty of tasks on your plate, the best move is to delegate it to experts.

By now you know that optimizing your bookkeeping can make your business operations run smoothly. These eight tips may be a lot for some, but implementing them in your business will be worth it.

If you need more bookkeeping tips, assistance using bookkeeping and accounting software, or if you want to delegate bookkeeping tasks to experts, Unloop is here. We have a team of professional bookkeepers who are well-versed in the ecommerce industry, so your books will always be in good hands.

We also specialize in accounts payable services, forecasting, payroll, and taxes. Book a call with us today to get started!

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting.. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.