Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

So you've landed a spot on Amazon to market your small business, which is excellent news! You're ready to embark on a new journey with plenty of opportunities to expand your customer base in the world's largest online retailer. But brace yourself because apart from performing the seller role, you’ll also don the Amazon bookkeeper hat to manage your business well, which is challenging.

In carving your path to success, there are some not-so-fun things you need to work through to accomplish your goals. For example, bookkeeping management; it is one of the most challenging aspects of running an Amazon business.

Amazon accounting can be challenging for any business owner. Smaller-scale ecommerce businesses—though they work on fewer transactions—aren't exempt from the grueling task of bookkeeping and accounting.

Sometimes, not having an accounting system with skilled experts to handle financial transactions adds to an online business's problems. It's difficult for Amazon sellers to take them all at once with the marketplace's complex system.

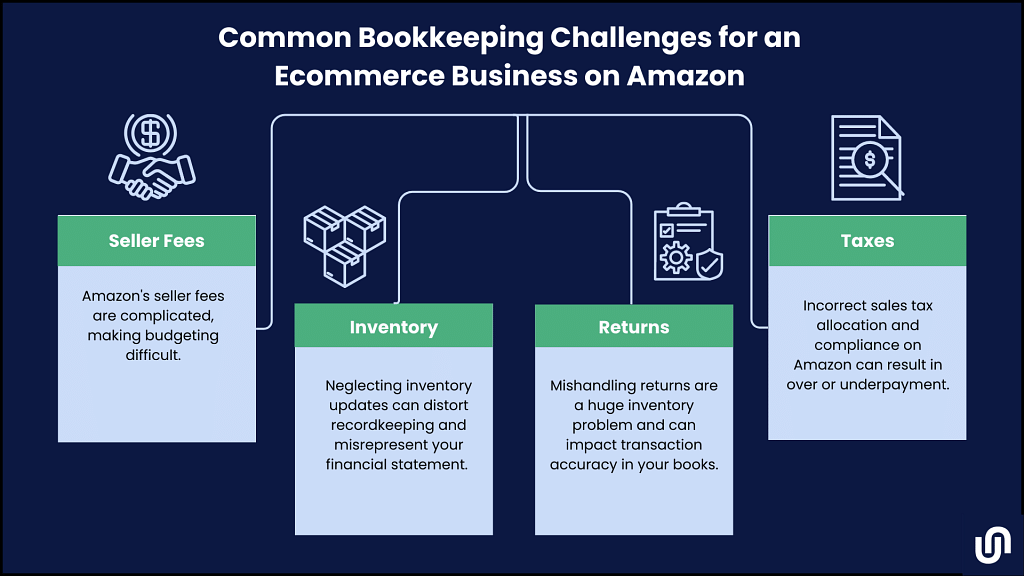

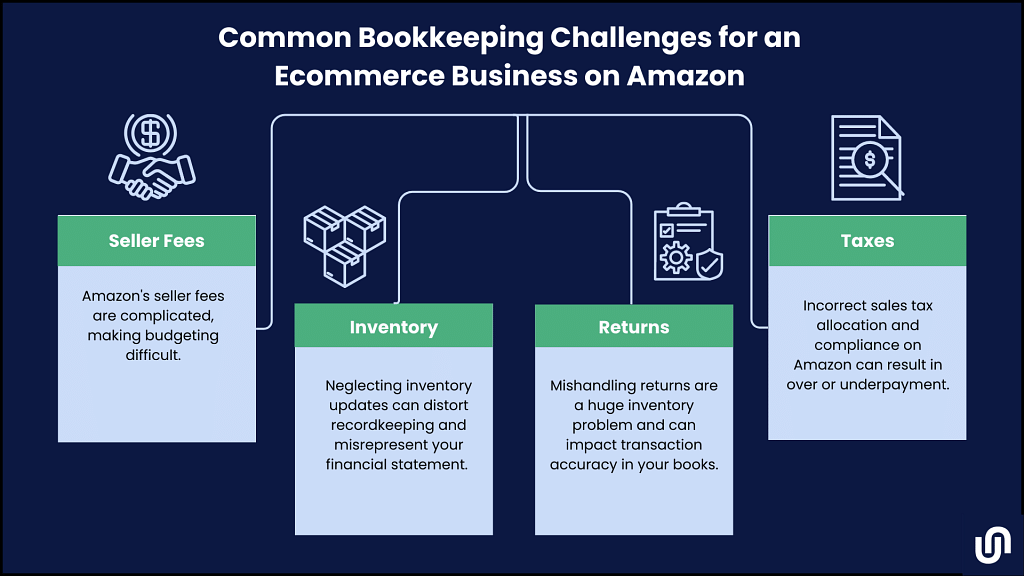

Let Unloop help you by identifying the challenges you might face when doing Amazon seller bookkeeping. It's important to be aware of these challenges so you can find methods to overcome them.

Managing an Amazon business is exciting—the convenience of managing a wide-reaching business from your screen is quite something. Still, small business owners in the marketplace face difficulties understanding bookkeeping and accounting tasks.

The most common roots of these issues are the absence of accounting software and accounting experience or a lack of them. As a result, most brands make the following Amazon accounting and bookkeeping management mistakes:

Amazon has a complex system of seller fees (monthly fees, referral fees, and shipping fees via Fulfillment by Amazon) which makes managing expenses challenging, especially if you lack adequate knowledge and experience on the platform.

These fees have a specific breakdown of charges, complicating the system further. Unfortunately, Amazon doesn't provide single-entry invoices that help you track costs, so you'll have to estimate seller fees yourself.

It impacts three aspects of your financial statements:

All these parts matter when talking about accuracy; that's why updating inventory and ensuring we get it right is crucial.

| Solution Successful inventory management requires an automated tracking system. You need its accuracy and consistency for tracking customs, FBA inventory (if you opted for it), your physical store, and product returns. Otherwise, it will be harder for you to monitor inventory and update your financial statements accurately. This results in a skewed view of your online business's financial health, preventing you from making sound business decisions. |

Product returns are stressful in the first place—they require constant adjustments to your inventory based on return requests to avoid potentially harming customer loyalty. It's the negative kind of "killing two birds with one stone."

With Amazon, things are more complicated because FBA returns are classified into various categories: sellable, damaged, customer-damaged, defective, and carrier-damaged. It may seem organized initially, but Amazon sometimes makes incorrect inventory placements, making a mess of your books and, eventually, your business bank account.

| Solution The best way to handle and reduce the likelihood of returns is to spend time managing and updating your inventory. If it takes too long, you can hire an Amazon accountant specializing in returns. |

Sales tax preparation can be challenging for small ecommerce businesses due to the demand for multi-channel tracking. This results in inaccurate remittance to internal revenue authorities and, consequently, having inaccurate income on the books and in your bank account.

Today's tax regulations are over 10,000, and the variety of these systems is confusing when updating your books. Although Amazon takes the stress of sales tax collection and remittance away from the seller, you still need to track and accurately state multi-channel transactions in the paperwork to meet tax demands.

| Solution To save resources, we recommend hiring an Amazon marketplace professional in a consulting or managing capacity. Another option is to work with an Amazon bookkeeper specializing in the marketplace's sales tax collection system. They have the skills to detail taxes because they are accountants, making it easier for you or your CPA to remit. |

If you're looking for experts offering small business bookkeeping services, Unloop is your perfect business partner!

We understand Amazon's bookkeeping and accounting challenges, so we want to help you manage them the right way. Our team of small business bookkeeping and tax services experts collaborates with reliable accounting firms to ensure the accurate recording and reporting of financial records.

Through our services, you can focus on growing your small business without worrying about documentation and analysis of financial information. If you find yourself having a hard time learning the processes of Amazon bookkeeping, you can always make things easier with us. All it takes to overcome Amazon's bookkeeping challenges is to make an appointment, so go ahead and book a call today.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

So you've landed a spot on Amazon to market your small business, which is excellent news! You're ready to embark on a new journey with plenty of opportunities to expand your customer base in the world's largest online retailer. But brace yourself because apart from performing the seller role, you’ll also don the Amazon bookkeeper hat to manage your business well, which is challenging.

In carving your path to success, there are some not-so-fun things you need to work through to accomplish your goals. For example, bookkeeping management; it is one of the most challenging aspects of running an Amazon business.

Amazon accounting can be challenging for any business owner. Smaller-scale ecommerce businesses—though they work on fewer transactions—aren't exempt from the grueling task of bookkeeping and accounting.

Sometimes, not having an accounting system with skilled experts to handle financial transactions adds to an online business's problems. It's difficult for Amazon sellers to take them all at once with the marketplace's complex system.

Let Unloop help you by identifying the challenges you might face when doing Amazon seller bookkeeping. It's important to be aware of these challenges so you can find methods to overcome them.

Managing an Amazon business is exciting—the convenience of managing a wide-reaching business from your screen is quite something. Still, small business owners in the marketplace face difficulties understanding bookkeeping and accounting tasks.

The most common roots of these issues are the absence of accounting software and accounting experience or a lack of them. As a result, most brands make the following Amazon accounting and bookkeeping management mistakes:

Amazon has a complex system of seller fees (monthly fees, referral fees, and shipping fees via Fulfillment by Amazon) which makes managing expenses challenging, especially if you lack adequate knowledge and experience on the platform.

These fees have a specific breakdown of charges, complicating the system further. Unfortunately, Amazon doesn't provide single-entry invoices that help you track costs, so you'll have to estimate seller fees yourself.

It impacts three aspects of your financial statements:

All these parts matter when talking about accuracy; that's why updating inventory and ensuring we get it right is crucial.

| Solution Successful inventory management requires an automated tracking system. You need its accuracy and consistency for tracking customs, FBA inventory (if you opted for it), your physical store, and product returns. Otherwise, it will be harder for you to monitor inventory and update your financial statements accurately. This results in a skewed view of your online business's financial health, preventing you from making sound business decisions. |

Product returns are stressful in the first place—they require constant adjustments to your inventory based on return requests to avoid potentially harming customer loyalty. It's the negative kind of "killing two birds with one stone."

With Amazon, things are more complicated because FBA returns are classified into various categories: sellable, damaged, customer-damaged, defective, and carrier-damaged. It may seem organized initially, but Amazon sometimes makes incorrect inventory placements, making a mess of your books and, eventually, your business bank account.

| Solution The best way to handle and reduce the likelihood of returns is to spend time managing and updating your inventory. If it takes too long, you can hire an Amazon accountant specializing in returns. |

Sales tax preparation can be challenging for small ecommerce businesses due to the demand for multi-channel tracking. This results in inaccurate remittance to internal revenue authorities and, consequently, having inaccurate income on the books and in your bank account.

Today's tax regulations are over 10,000, and the variety of these systems is confusing when updating your books. Although Amazon takes the stress of sales tax collection and remittance away from the seller, you still need to track and accurately state multi-channel transactions in the paperwork to meet tax demands.

| Solution To save resources, we recommend hiring an Amazon marketplace professional in a consulting or managing capacity. Another option is to work with an Amazon bookkeeper specializing in the marketplace's sales tax collection system. They have the skills to detail taxes because they are accountants, making it easier for you or your CPA to remit. |

If you're looking for experts offering small business bookkeeping services, Unloop is your perfect business partner!

We understand Amazon's bookkeeping and accounting challenges, so we want to help you manage them the right way. Our team of small business bookkeeping and tax services experts collaborates with reliable accounting firms to ensure the accurate recording and reporting of financial records.

Through our services, you can focus on growing your small business without worrying about documentation and analysis of financial information. If you find yourself having a hard time learning the processes of Amazon bookkeeping, you can always make things easier with us. All it takes to overcome Amazon's bookkeeping challenges is to make an appointment, so go ahead and book a call today.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

So you have finally achieved your long-time dream of creating and managing a small business. But, unfortunately, dreams like that don't just stop after you’ve earned enough. Your success needs to be protected by making sure your finances are in check. This is why if you want your business to grow, you need to know a few bookkeeping tasks. However, bookkeeping might be an additional task that will weigh you down in the long run. Don't worry; there are professional bookkeeping Vancouver services that can help you manage your finances so you can focus on other responsibilities or enjoy more free time.

This article gives you an idea of the bookkeeping services you or your bookkeeper need to know and manage to keep track of your business.

Monthly financial statements are the key to ensuring that your business is on track. But, as a business owner, you're probably too busy with day-to-day operations to keep an eye out for potential risks or problems. That's why it makes sense for you to get monthly bookkeeping services Vancouver can offer to monitor all aspects of your business.

Detailed business reports are essential to financial planning and cash flow projections. Your monthly statements of profit and loss, balance sheet, and cash flow will provide you with a snapshot of your company's fiscal health so that you can make informed decisions about its future growth potential. For example, you'll be able to compare how much money was brought in versus how much was spent on expenses. In addition, by looking at your monthly statements, you'll be able to see if any changes need to be made concerning your product prices or marketing strategies.

Hubdoc and Dex Bookkeeping and an expense management application that you or your bookkeeper can automatically use for financial data such as receipts, bills, and other information. You need to sync your accounts from different vendors once, and this software will record all the past and incoming invoices. For example, with Hubdoc, if you want to sync your Paypal receipts along with other overall receipts, you need to click the Paypal icon and log in your username and password once. After that, it will automatically sync with your account.

What's great with software like these is that it eliminates the time and effort of data entry and sifting through a mountain of papers. For example, you only have to take a picture of your receipt and upload it using a computer or mobile device or send it to an app-generated email. Additionally, it has a mobile app version so you can check your finances anytime.

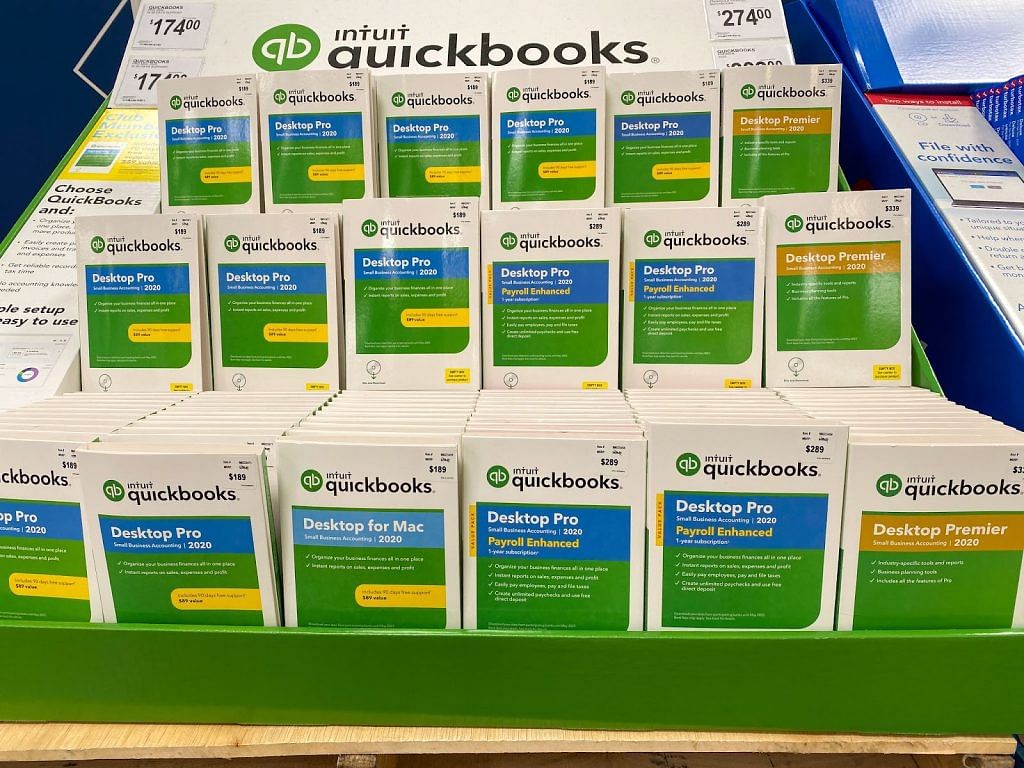

You might be confused why you need accounting software when you already have a bookkeeping one. Xero and Quickbooks are software that you or your accountant can use to extract or reconcile data from your bookkeeping app. So when your bank, your transactions, or your expenses are synced with the software, you can use it for creating reports. Most importantly, this automated accounting software includes invoicing and payroll, an added feature that bookkeeping apps don't have.

This includes account reconciliation, where you make sure all transactions in your accounts like credit cards or bank balances match financial records. It also includes creating invoices and making payments. Other features include invoice reminders, email support with experts in the industry, customized reports with graphs and charts to give you a visual representation of your company's financial status, custom price list for customers that will automatically pop up when they view or purchase an item on your website based on their location.

Vancouver bookkeeping services experts recommend that you get monthly bookkeeping services from a professional who will handle all of your company's financial accounts. This means unlimited account handling for your business, which can help you save time and money because it eliminates the need to hire additional staff or train existing employees on how to do this task.

By outsourcing these responsibilities, you can focus more on growing your business. For example, you'll be able to allocate resources into expanding company operations or starting up a new one without worrying about potential risks and problems because there's someone else keeping an eye out for them.

Bookkeeping services Vancouver BC that offer the mentioned features will help you keep track of your business finances, so you will always know how your business is doing. Unloop offers these services monthly and more and even has an option for a more customized service catered to only what you need. In addition, we will happily migrate the data for free if you are already using a different accounting or bookkeeping software.

If you are interested in Unloop services, then book a call or get in touch with us through the number 877-421-7270. We look forward to helping you grow your business!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

So you have finally achieved your long-time dream of creating and managing a small business. But, unfortunately, dreams like that don't just stop after you’ve earned enough. Your success needs to be protected by making sure your finances are in check. This is why if you want your business to grow, you need to know a few bookkeeping tasks. However, bookkeeping might be an additional task that will weigh you down in the long run. Don't worry; there are professional bookkeeping Vancouver services that can help you manage your finances so you can focus on other responsibilities or enjoy more free time.

This article gives you an idea of the bookkeeping services you or your bookkeeper need to know and manage to keep track of your business.

Monthly financial statements are the key to ensuring that your business is on track. But, as a business owner, you're probably too busy with day-to-day operations to keep an eye out for potential risks or problems. That's why it makes sense for you to get monthly bookkeeping services Vancouver can offer to monitor all aspects of your business.

Detailed business reports are essential to financial planning and cash flow projections. Your monthly statements of profit and loss, balance sheet, and cash flow will provide you with a snapshot of your company's fiscal health so that you can make informed decisions about its future growth potential. For example, you'll be able to compare how much money was brought in versus how much was spent on expenses. In addition, by looking at your monthly statements, you'll be able to see if any changes need to be made concerning your product prices or marketing strategies.

Hubdoc and Dex Bookkeeping and an expense management application that you or your bookkeeper can automatically use for financial data such as receipts, bills, and other information. You need to sync your accounts from different vendors once, and this software will record all the past and incoming invoices. For example, with Hubdoc, if you want to sync your Paypal receipts along with other overall receipts, you need to click the Paypal icon and log in your username and password once. After that, it will automatically sync with your account.

What's great with software like these is that it eliminates the time and effort of data entry and sifting through a mountain of papers. For example, you only have to take a picture of your receipt and upload it using a computer or mobile device or send it to an app-generated email. Additionally, it has a mobile app version so you can check your finances anytime.

You might be confused why you need accounting software when you already have a bookkeeping one. Xero and Quickbooks are software that you or your accountant can use to extract or reconcile data from your bookkeeping app. So when your bank, your transactions, or your expenses are synced with the software, you can use it for creating reports. Most importantly, this automated accounting software includes invoicing and payroll, an added feature that bookkeeping apps don't have.

This includes account reconciliation, where you make sure all transactions in your accounts like credit cards or bank balances match financial records. It also includes creating invoices and making payments. Other features include invoice reminders, email support with experts in the industry, customized reports with graphs and charts to give you a visual representation of your company's financial status, custom price list for customers that will automatically pop up when they view or purchase an item on your website based on their location.

Vancouver bookkeeping services experts recommend that you get monthly bookkeeping services from a professional who will handle all of your company's financial accounts. This means unlimited account handling for your business, which can help you save time and money because it eliminates the need to hire additional staff or train existing employees on how to do this task.

By outsourcing these responsibilities, you can focus more on growing your business. For example, you'll be able to allocate resources into expanding company operations or starting up a new one without worrying about potential risks and problems because there's someone else keeping an eye out for them.

Bookkeeping services Vancouver BC that offer the mentioned features will help you keep track of your business finances, so you will always know how your business is doing. Unloop offers these services monthly and more and even has an option for a more customized service catered to only what you need. In addition, we will happily migrate the data for free if you are already using a different accounting or bookkeeping software.

If you are interested in Unloop services, then book a call or get in touch with us through the number 877-421-7270. We look forward to helping you grow your business!

Many aspiring business owners are eager to sell their products in Canada through Amazon.ca. After all, there is an ongoing belief that the ecommerce giant doesn’t collect general or provincial sales taxes there. But many have wondered: why is there no tax on Amazon Canada?

What’s more: do Amazon.ca sellers really not pay taxes for their transactions? As an Amazon seller, it's essential to know when to charge sales tax on items sold through this site and learn if Amazon automatically collects sales tax on behalf of their sellers.

Let’s investigate whether or not Amazon Canada collects sales taxes and answer related Amazon sales tax questions like when does Amazon collect sales tax in Canada, and when does it not?

Let’s begin our investigation by giving a hypothetical situation. Suppose a customer from British Columbia previously ordered from you, and you noticed that Amazon didn’t collect sales taxes during the transaction. How could that happen?

Every Amazon product sold in the United States is subject to sales tax based on the buyer's location. So why didn’t Amazon collect tax from this customer? Is there simply no sales tax collection on Amazon Canada?

There is, but sales tax collection in Canada works differently.

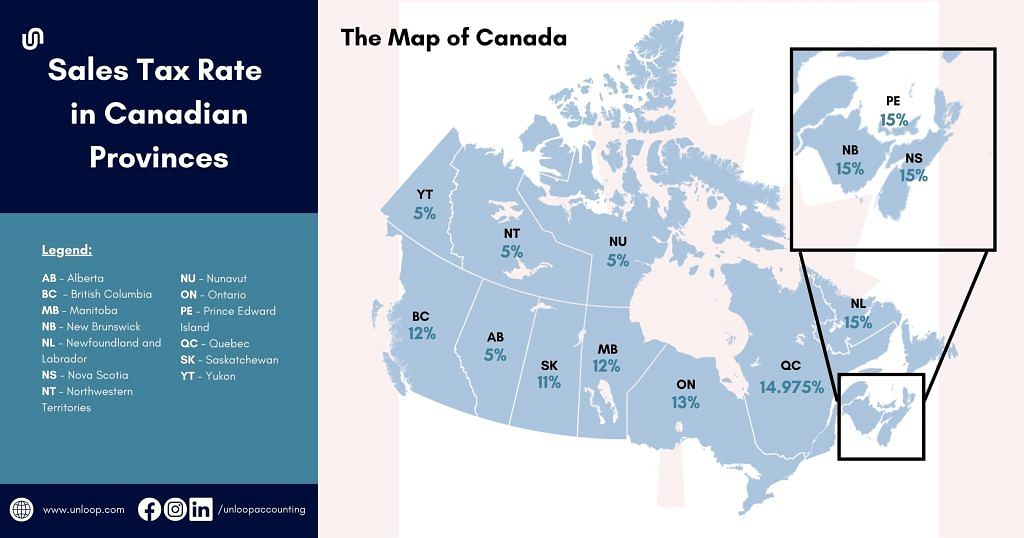

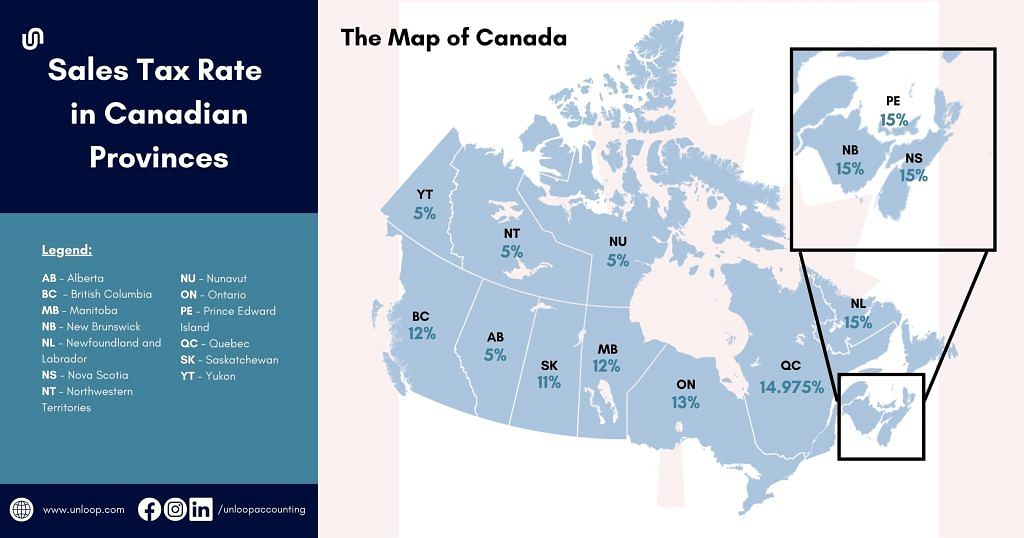

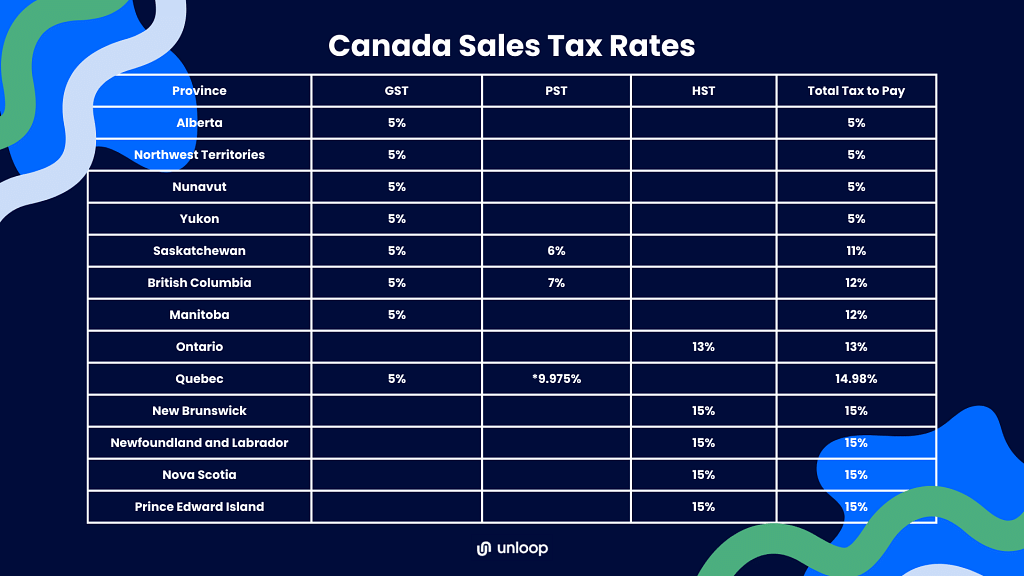

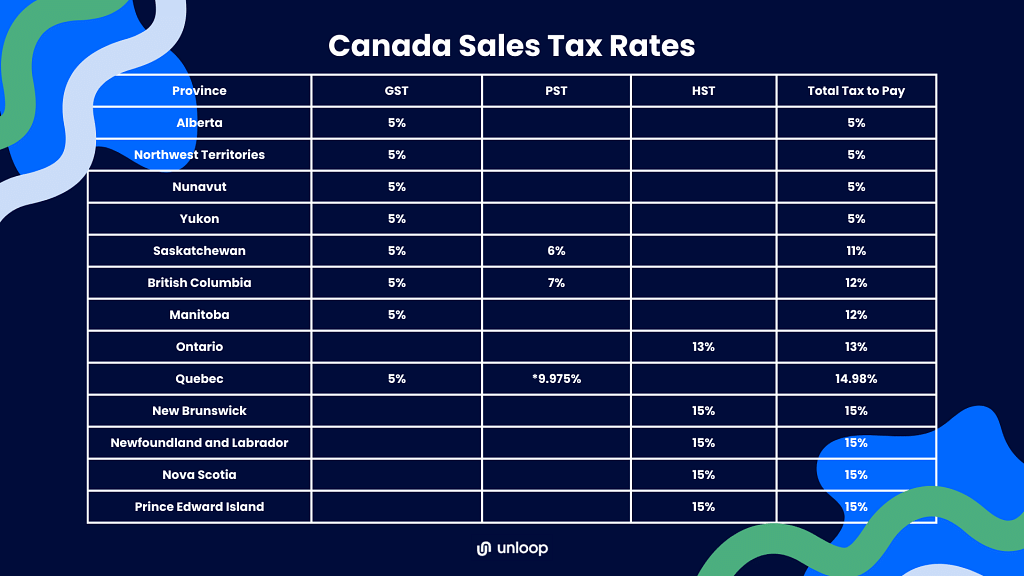

Unlike in the United States, Canadian tax laws apply Goods and Services Tax (GST) and Harmonized Sales Tax (HST) at the federal level. In contrast, Provincial Sales Tax (PST) is applied separately by individual provinces.

Because of this complex tax system, there are times when Amazon Canada doesn’t collect sales taxes for the seller; the seller has to do the collection and remittance themselves.

Certain sellers are also encouraged to create a GST or HST account with the Canada Revenue Agency (CRA) for tax compliance.

As a result, many sellers have been led to believe that sales tax collection and remittance are non-existent on Amazon Canada when this belief is completely false. Debunking this myth will logically lead you to ask: when does Amazon.ca collect tax?

The laws on Amazon sales tax in Canada leave no room for confusion: you need to collect sales tax. Amazon even makes the task easier for sellers by collecting sales taxes independently, especially in these situations.

Back in the day, you could sell online without the hassle of collecting sales tax from your customers until the Marketplace Facilitator (MPF) law took effect.

Canadian law bases sales tax charges on the established GST, PST, HST, and Quebec Sales Tax (QST) rates per province.

Suppose you fulfill orders in different provinces across Canada. In that case, Amazon will directly collect sales taxes and remit them to authorities for you as mandated by the MPF.

Amazon is already mandated to collect and remit sales taxes for you through the MPF. Still, Amazon's Tax Collection Service (TCS) can give you control and visibility of your sales tax.

If you have an Amazon professional account, you can log in on Seller Central to optimize the following:

This service particularly helps if you also sell in locations not under MPF jurisdiction. In these cases, TCS can collate sales tax data for you when tax remittance season comes.

Almost all products sold in Canada are taxable, from soft drinks and candies to clothing and footwear. If your products are not tax-exempt and zero-rated goods, you must charge GST, HST, PST, or QST accordingly.

These categories are already defined on Amazon TCS, but you can further customize them. Know your products well to tag them as taxable or tax-exempt.

You must have already figured out whether collecting taxes for your products is under your care or Amazon's. Now, here is some more helpful information on when Amazon does not collect sales taxes

To explain our earlier hypothetical example, British Columbia was previously not under MPF jurisdiction, meaning it was the seller’s responsibility to collect and remit sales taxes from orders from the province, not Amazon’s.

However, online marketplaces like Amazon, eBay, and Facebook are now required to collect provincial sales taxes for their sellers—something that started on July 1, 2022. This change happened because of the law passed by the British Columbian government in June 2022.

If the law changes and removes certain provinces from MPF jurisdiction, you may alternatively delegate the task to sales tax support services to make tax collection and remittance easier.

When you have access to the TCS, you can optimize the settings to exempt the following groups and populations:

The law mandates that if you sell goods that fall under the following classifications, they should be zero-rated:

Include these details in the TCS to exempt your buyers from paying sales tax.

Amazon.ca will collect and remit sales tax if the province is under MPF jurisdiction, the seller is registered with TCS, and their goods are taxable. Meanwhile, Amazon won’t collect and remit taxes if the destination is not under MPF jurisdiction and the seller has zero-rated or tax-exempt products.

After determining sales tax, you need to reconcile all data from TCS with your accounting books to help you with your Amazon seller accounting.

Sounds complicated? Unloop can help you! Our team of experienced bookkeepers will keep your books updated year-round to prepare you for tax season.

We know how important it is for Canadian sellers to stay compliant with tax laws, so skip the hassle of computing your taxes and leave it to us.

If you are interested in getting expert bookkeeping assistance, call us at 877-421-7270. We'd love to discuss our offers with you!

Many aspiring business owners are eager to sell their products in Canada through Amazon.ca. After all, there is an ongoing belief that the ecommerce giant doesn’t collect general or provincial sales taxes there. But many have wondered: why is there no tax on Amazon Canada?

What’s more: do Amazon.ca sellers really not pay taxes for their transactions? As an Amazon seller, it's essential to know when to charge sales tax on items sold through this site and learn if Amazon automatically collects sales tax on behalf of their sellers.

Let’s investigate whether or not Amazon Canada collects sales taxes and answer related Amazon sales tax questions like when does Amazon collect sales tax in Canada, and when does it not?

Let’s begin our investigation by giving a hypothetical situation. Suppose a customer from British Columbia previously ordered from you, and you noticed that Amazon didn’t collect sales taxes during the transaction. How could that happen?

Every Amazon product sold in the United States is subject to sales tax based on the buyer's location. So why didn’t Amazon collect tax from this customer? Is there simply no sales tax collection on Amazon Canada?

There is, but sales tax collection in Canada works differently.

Unlike in the United States, Canadian tax laws apply Goods and Services Tax (GST) and Harmonized Sales Tax (HST) at the federal level. In contrast, Provincial Sales Tax (PST) is applied separately by individual provinces.

Because of this complex tax system, there are times when Amazon Canada doesn’t collect sales taxes for the seller; the seller has to do the collection and remittance themselves.

Certain sellers are also encouraged to create a GST or HST account with the Canada Revenue Agency (CRA) for tax compliance.

As a result, many sellers have been led to believe that sales tax collection and remittance are non-existent on Amazon Canada when this belief is completely false. Debunking this myth will logically lead you to ask: when does Amazon.ca collect tax?

The laws on Amazon sales tax in Canada leave no room for confusion: you need to collect sales tax. Amazon even makes the task easier for sellers by collecting sales taxes independently, especially in these situations.

Back in the day, you could sell online without the hassle of collecting sales tax from your customers until the Marketplace Facilitator (MPF) law took effect.

Canadian law bases sales tax charges on the established GST, PST, HST, and Quebec Sales Tax (QST) rates per province.

Suppose you fulfill orders in different provinces across Canada. In that case, Amazon will directly collect sales taxes and remit them to authorities for you as mandated by the MPF.

Amazon is already mandated to collect and remit sales taxes for you through the MPF. Still, Amazon's Tax Collection Service (TCS) can give you control and visibility of your sales tax.

If you have an Amazon professional account, you can log in on Seller Central to optimize the following:

This service particularly helps if you also sell in locations not under MPF jurisdiction. In these cases, TCS can collate sales tax data for you when tax remittance season comes.

Almost all products sold in Canada are taxable, from soft drinks and candies to clothing and footwear. If your products are not tax-exempt and zero-rated goods, you must charge GST, HST, PST, or QST accordingly.

These categories are already defined on Amazon TCS, but you can further customize them. Know your products well to tag them as taxable or tax-exempt.

You must have already figured out whether collecting taxes for your products is under your care or Amazon's. Now, here is some more helpful information on when Amazon does not collect sales taxes

To explain our earlier hypothetical example, British Columbia was previously not under MPF jurisdiction, meaning it was the seller’s responsibility to collect and remit sales taxes from orders from the province, not Amazon’s.

However, online marketplaces like Amazon, eBay, and Facebook are now required to collect provincial sales taxes for their sellers—something that started on July 1, 2022. This change happened because of the law passed by the British Columbian government in June 2022.

If the law changes and removes certain provinces from MPF jurisdiction, you may alternatively delegate the task to sales tax support services to make tax collection and remittance easier.

When you have access to the TCS, you can optimize the settings to exempt the following groups and populations:

The law mandates that if you sell goods that fall under the following classifications, they should be zero-rated:

Include these details in the TCS to exempt your buyers from paying sales tax.

Amazon.ca will collect and remit sales tax if the province is under MPF jurisdiction, the seller is registered with TCS, and their goods are taxable. Meanwhile, Amazon won’t collect and remit taxes if the destination is not under MPF jurisdiction and the seller has zero-rated or tax-exempt products.

After determining sales tax, you need to reconcile all data from TCS with your accounting books to help you with your Amazon seller accounting.

Sounds complicated? Unloop can help you! Our team of experienced bookkeepers will keep your books updated year-round to prepare you for tax season.

We know how important it is for Canadian sellers to stay compliant with tax laws, so skip the hassle of computing your taxes and leave it to us.

If you are interested in getting expert bookkeeping assistance, call us at 877-421-7270. We'd love to discuss our offers with you!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Filing corporate income taxes in Canada is a vital requirement, whether you're a new small business or an established entity. This comprehensive guide will help you effectively navigate this process, with a specific focus on Schedule 100 and 125.

Equip yourself with knowledge on how to enhance your financial standing and efficiently handle your tax obligations, securing your business's success within the Canadian fiscal structure.

We'll go over the following topics:

As a Canadian corporation, it is important to understand your financial statements and reporting requirements for tax purposes. The Canada Revenue Agency (CRA) requires corporations to file a corporate income tax return annually, which includes a balance sheet and an income statement.

| How to Compute Gross and Net Income |

Gross Income = Total Revenue - Cost of Goods Sold Net Income = Total Revenue - Total Expenses* *Total Expenses = Operating Expenses + Non-Operating Expenses |

The first step in computing the income is to gather all the required income statement information, including total sales, all sources of income, operating expenses, and non-operating expenses for the year. Once the detailed information has been obtained, plug them into one of the three formulas above to calculate the gross income, total business expenses, and net income.

The balance sheet computation comes next. Compared to the income statement, the main difference with the formula is that it calculates all assets and total liabilities starting from zero.

| How to Compute Assets |

Assets = Liabilities + Equity |

Using these simple formulas will allow you to obtain your company's net worth or stockholder's equity at a specific time.

Once the income statement and balance sheet information have been completed, it's time to start preparing your T2 Corporation Income Tax Return.

All the documents you need to prepare your corporate tax return are available on the Canada Revenue Agency's website. Once there, find "T2 Returns and Relevant Schedules" using the search field for a faster and more accurate result.

When you click the top result, you are redirected to the T2 Returns and Schedules page that lists all the forms you need to prepare your company's tax return and fulfill your corporation's tax obligations. These are the relevant schedules or forms you have to accomplish for the preparation of your business tax return:

Canada Schedule 100 Balance Sheet Information tax form is a vital document the Canada Revenue Agency (CRA) requires for corporations and partnerships to provide a comprehensive snapshot of their financial standing. This form highlights the corporation's assets, liabilities, equity as well as retained earnings offering crucial insights into its financial health.

The form mandates the reporting of balance sheet line items, including:

Canada Schedule 125 or the Income Statement Information tax form, is a crucial document used by individuals and businesses in Canada to report their income, operating, and non-operating expenses. This form plays a significant role in calculating the taxable income and determining the amount of tax owed.

It requires detailed information about various sources of income, such as:

Moreover, the form provides a clear breakdown of revenue and expenses, allowing taxpayers to understand their financial position and make informed decisions for future financial planning.

Canada Schedule 50 Shareholder Information tax form is a crucial document that provides detailed information about a company's shareholders to the Canadian Revenue Agency (CRA). This form contains essential data such as:

It is compulsory for corporations operating in Canada to accurately fill out this shareholder information form and submit it annually. The information gathered through Schedule 50 assists CRA in effectively monitoring and enforcing tax regulations.

This form ensures transparency in the tax system by enabling the government to verify the accuracy of reported income and holdings, preventing tax evasion, and promoting fairness among taxpayers.

Canada Schedule 8 Capital Cost Allowance (CCA) tax form is an important document used to calculate depreciation expenses for income tax purposes in Canada. This form is primarily used by businesses to determine the amount they can deduct each year as capital cost allowance on their eligible assets.

Companies make costs for acquiring and upgrading assets, but the CCA makes it easier for businesses to recover. Just note that CCA rates are different depending on the asset. By completing Schedule 8, businesses can accurately calculate their CCA deductions and reduce their taxable income, benefiting from tax savings.

To report your corporation's net income or loss for a tax assessment, you need the Canada Schedule 1 Net Income (Loss) for Income Tax Purposes tax form. This form is integral to the Canadian income tax return, officially known as the T1 General form.

It requires taxpayers to meticulously calculate their revenues, deductions, and expenses to determine their net income or loss. By filling out Schedule 1 accurately, taxpayers can ensure compliance with Canadian tax laws, facilitating a fair and efficient income tax assessment.

A Canada T2 Corporation Income Tax Return is a tax form filed by Canadian corporations to report their annual income, deductions, and tax payable to the Canada Revenue Agency. Corporations use this return to calculate the taxes owed to the government based on their net income generated during the tax year.

The T2 return includes various schedules and forms that capture detailed financial information, such as:

It is essential for corporations to accurately complete and file their T2 returns on time to ensure compliance with Canadian tax laws and avoid penalties or interest charges.

Canada Schedule 4 Corporation Loss Continuity Application is a tax form used by corporations in Canada to claim their losses and carry them forward to future tax years. This form helps businesses to offset their current or future income with the losses incurred in previous years, reducing their overall tax liability.

The form requires corporations to provide detailed information about their losses, including

By completing this form accurately, businesses can optimize the valuable tax planning strategy and ensure that their losses are effectively utilized to minimize their tax burden while maximizing their available deductions.

Once all the forms above have been filled out accurately, it is time to submit your corporate income tax return. Knowing how to file business taxes in Canada properly is very important. The CRA accepts both paper and electronic submissions of corporate income tax returns.

When filing a hard copy income tax return, attach all required schedules, supporting documents, and financial statements. If anything is missing or incomplete, it may delay processing your corporation income tax return.

It is important to note that the T2 Corporation Income Tax Return is due within six months after your company's tax year ends. If you are filing late, there will be a penalty fee of 5% per month for up to 12 months when your return is filed beyond the deadline.

If both Schedule 100 and 125 forms have been completed correctly, CRA automatically calculates Schedule 50 and Schedule 200. Once these schedules are complete, do not forget to submit them with all other required documents before the due date to fulfill your corporation's tax obligations.

Now that you know how to file corporate taxes in Canada, don't forget to consult a tax professional if you have any questions. With the right help and guidance, filing your company's tax return should be easy.

If either Form 100 or 125 has been completed incorrectly, the CRA will charge penalties up to 12 months after the due date of the T2 Corporation Income Tax Return (Schedule 200) as per tax law.

Make your corporation income tax return tax filing smooth and problem-free. Partner with tax specialists or a qualified accounting firm that can guide you through corporate tax filing.

Unloop offers income tax preparation services and tax management. Sales taxes or income taxes in Canada or the US? We got you! You do not have to worry about completing your financial statement information as we utilize the latest and most efficient software for your bookkeeping. We can generate an income statement summary and balance sheet in a few clicks.

Book a consultation call with us today!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Filing corporate income taxes in Canada is a vital requirement, whether you're a new small business or an established entity. This comprehensive guide will help you effectively navigate this process, with a specific focus on Schedule 100 and 125.

Equip yourself with knowledge on how to enhance your financial standing and efficiently handle your tax obligations, securing your business's success within the Canadian fiscal structure.

We'll go over the following topics:

As a Canadian corporation, it is important to understand your financial statements and reporting requirements for tax purposes. The Canada Revenue Agency (CRA) requires corporations to file a corporate income tax return annually, which includes a balance sheet and an income statement.

| How to Compute Gross and Net Income |

Gross Income = Total Revenue - Cost of Goods Sold Net Income = Total Revenue - Total Expenses* *Total Expenses = Operating Expenses + Non-Operating Expenses |

The first step in computing the income is to gather all the required income statement information, including total sales, all sources of income, operating expenses, and non-operating expenses for the year. Once the detailed information has been obtained, plug them into one of the three formulas above to calculate the gross income, total business expenses, and net income.

The balance sheet computation comes next. Compared to the income statement, the main difference with the formula is that it calculates all assets and total liabilities starting from zero.

| How to Compute Assets |

Assets = Liabilities + Equity |

Using these simple formulas will allow you to obtain your company's net worth or stockholder's equity at a specific time.

Once the income statement and balance sheet information have been completed, it's time to start preparing your T2 Corporation Income Tax Return.

All the documents you need to prepare your corporate tax return are available on the Canada Revenue Agency's website. Once there, find "T2 Returns and Relevant Schedules" using the search field for a faster and more accurate result.

When you click the top result, you are redirected to the T2 Returns and Schedules page that lists all the forms you need to prepare your company's tax return and fulfill your corporation's tax obligations. These are the relevant schedules or forms you have to accomplish for the preparation of your business tax return:

Canada Schedule 100 Balance Sheet Information tax form is a vital document the Canada Revenue Agency (CRA) requires for corporations and partnerships to provide a comprehensive snapshot of their financial standing. This form highlights the corporation's assets, liabilities, equity as well as retained earnings offering crucial insights into its financial health.

The form mandates the reporting of balance sheet line items, including:

Canada Schedule 125 or the Income Statement Information tax form, is a crucial document used by individuals and businesses in Canada to report their income, operating, and non-operating expenses. This form plays a significant role in calculating the taxable income and determining the amount of tax owed.

It requires detailed information about various sources of income, such as:

Moreover, the form provides a clear breakdown of revenue and expenses, allowing taxpayers to understand their financial position and make informed decisions for future financial planning.

Canada Schedule 50 Shareholder Information tax form is a crucial document that provides detailed information about a company's shareholders to the Canadian Revenue Agency (CRA). This form contains essential data such as:

It is compulsory for corporations operating in Canada to accurately fill out this shareholder information form and submit it annually. The information gathered through Schedule 50 assists CRA in effectively monitoring and enforcing tax regulations.

This form ensures transparency in the tax system by enabling the government to verify the accuracy of reported income and holdings, preventing tax evasion, and promoting fairness among taxpayers.

Canada Schedule 8 Capital Cost Allowance (CCA) tax form is an important document used to calculate depreciation expenses for income tax purposes in Canada. This form is primarily used by businesses to determine the amount they can deduct each year as capital cost allowance on their eligible assets.

Companies make costs for acquiring and upgrading assets, but the CCA makes it easier for businesses to recover. Just note that CCA rates are different depending on the asset. By completing Schedule 8, businesses can accurately calculate their CCA deductions and reduce their taxable income, benefiting from tax savings.

To report your corporation's net income or loss for a tax assessment, you need the Canada Schedule 1 Net Income (Loss) for Income Tax Purposes tax form. This form is integral to the Canadian income tax return, officially known as the T1 General form.

It requires taxpayers to meticulously calculate their revenues, deductions, and expenses to determine their net income or loss. By filling out Schedule 1 accurately, taxpayers can ensure compliance with Canadian tax laws, facilitating a fair and efficient income tax assessment.

A Canada T2 Corporation Income Tax Return is a tax form filed by Canadian corporations to report their annual income, deductions, and tax payable to the Canada Revenue Agency. Corporations use this return to calculate the taxes owed to the government based on their net income generated during the tax year.

The T2 return includes various schedules and forms that capture detailed financial information, such as:

It is essential for corporations to accurately complete and file their T2 returns on time to ensure compliance with Canadian tax laws and avoid penalties or interest charges.

Canada Schedule 4 Corporation Loss Continuity Application is a tax form used by corporations in Canada to claim their losses and carry them forward to future tax years. This form helps businesses to offset their current or future income with the losses incurred in previous years, reducing their overall tax liability.

The form requires corporations to provide detailed information about their losses, including

By completing this form accurately, businesses can optimize the valuable tax planning strategy and ensure that their losses are effectively utilized to minimize their tax burden while maximizing their available deductions.

Once all the forms above have been filled out accurately, it is time to submit your corporate income tax return. Knowing how to file business taxes in Canada properly is very important. The CRA accepts both paper and electronic submissions of corporate income tax returns.

When filing a hard copy income tax return, attach all required schedules, supporting documents, and financial statements. If anything is missing or incomplete, it may delay processing your corporation income tax return.

It is important to note that the T2 Corporation Income Tax Return is due within six months after your company's tax year ends. If you are filing late, there will be a penalty fee of 5% per month for up to 12 months when your return is filed beyond the deadline.

If both Schedule 100 and 125 forms have been completed correctly, CRA automatically calculates Schedule 50 and Schedule 200. Once these schedules are complete, do not forget to submit them with all other required documents before the due date to fulfill your corporation's tax obligations.

Now that you know how to file corporate taxes in Canada, don't forget to consult a tax professional if you have any questions. With the right help and guidance, filing your company's tax return should be easy.

If either Form 100 or 125 has been completed incorrectly, the CRA will charge penalties up to 12 months after the due date of the T2 Corporation Income Tax Return (Schedule 200) as per tax law.

Make your corporation income tax return tax filing smooth and problem-free. Partner with tax specialists or a qualified accounting firm that can guide you through corporate tax filing.

Unloop offers income tax preparation services and tax management. Sales taxes or income taxes in Canada or the US? We got you! You do not have to worry about completing your financial statement information as we utilize the latest and most efficient software for your bookkeeping. We can generate an income statement summary and balance sheet in a few clicks.

Book a consultation call with us today!

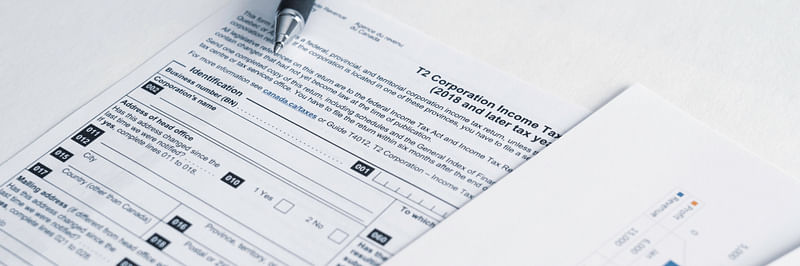

After years of earning the trust of business owners and retailers, Peachtree Accounting has rebranded and is now known as Sage Accounting. Sage Accounting software also offers Sage 50, Sage 100, and more products for accounting needs.

Interested to know what’s new with Peachtree, or should we say Sage Accounting? Can we still use Peachtree Accounting software? What can businesses get from this rebranding, especially small business owners? Let’s dive deeper into this article and learn the new strengths of Sage Accounting.

Before we explore the improvements in Sage Accounting, let’s first learn the history behind this accounting software.

| 💡Before it became the Sage Accounting that we know, it was first known as Peachtree Accounting. It was released way back in the 1980s by the Sage Group. |

Everything was simple back then. Do you still remember what Windows looked like? The setup of Peachtree required Windows 95, Windows 98, or Windows NT 4. Then, you insert the Peachtree Accounting compact disc and install it. Peachtree was, in fact, a classic software.

After more than twenty years of providing powerful accounting and financial reporting capabilities, Sage released their 2011 version. Two years later, the cloud-based online accounting software Sage 50cloud was officially launched in the US market.

Now, Sage Accounting offers an excellent roster of accounting products and services for all sizes of businesses, including Sage Intacct and Sage X3.

Peachtree was well-received by many—a trusted solution, the perfect accounting software for small businesses. So, we’re pretty sure many of the product’s long-time users doubt the upgrade is any good. Why fix something that’s already perfect, right?

But, as advertised, Sage Accounting still features the same functionality and interface as Peachtree. So, believe us when we say it still looks like the ever-so-technical dashboard of Peachtree with a few tweaks in the system.

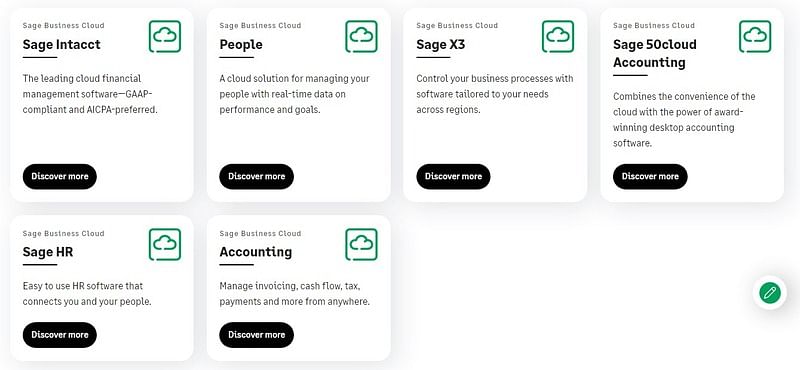

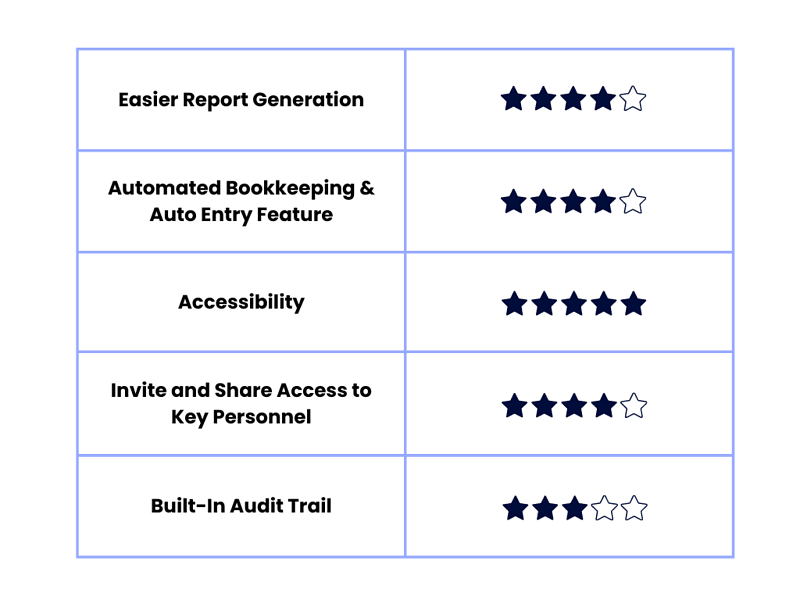

There are upsides to getting the latest software. Let’s see if the Sage business cloud accounting improvements are worth your money.

We live in the era of technology and e-commerce. As a result, no device, no mere program, does one simple function. Let’s take a look at some of the basic accounting functions and new features of Sage accounting:

| Basic accounting services: |

| New features: |

Seamless. Convenient. Collaborative.

These are the words we would use to describe today’s new and improved Sage online accounting software. Let’s take a deeper look into the strengths of this cloud-based accounting software:

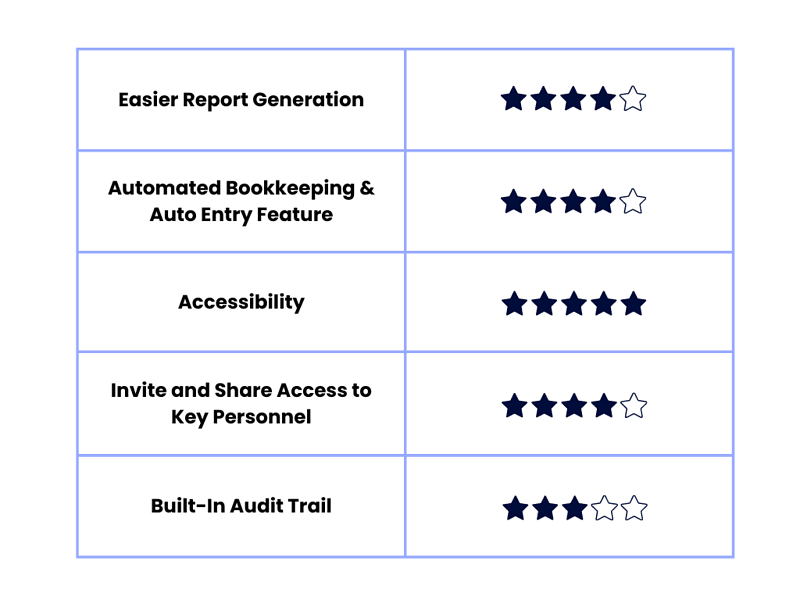

Sage may not always have a user-friendly interface. However, filing payroll and income tax reports could never have been easier and simpler with Sage Accounting. Everything you need is right before you, just a click away.

Sage Accounting’s simplicity is a huge advantage, especially when not all business owners are tech-savvy. Since they’re comfortable with using this tool, it is only a matter of time before they can enjoy the other benefits of Sage Accounting completely.

The accounting software has an automated bookkeeping system that allows you to focus on other parts of your business. You don’t have to worry about losing the receipts you have on hand through the Sage Accounting plan. With your smartphone, you can take a picture of the receipt and upload it directly to the accounting software.

The Auto Entry feature automatically extracts information from the receipt and categorizes them. These categorized entries are posted accurately on Sage, eliminating the need for manual data input.

With Microsoft Office 365 Integration, Sage Accounting provides you with secure online access and financial tools on any device at any time of day. Of course, you need to have internet access, but who doesn’t have internet access in this day and age?

Financial reports from the previous year are easily traceable, and every transaction is backed up and saved. You have fewer worries about redoing your work.

Employees, customers, and suppliers are all part of your company. Therefore, it makes sense that your financial statements include paychecks, purchase orders, and deposits.

Sage Accounting allows you to invite your accountant and colleagues and manage their access settings. Such a feature gives way to a more collaborative work environment as it happens in real-time, which is more secure overall.

The built-in audit trail lets you track every user’s activity, providing peace of mind that your employees are doing their job and your books are updated on time.

Now that you know the improvements and advantages of Sage Accounting, it would also be beneficial for your business to consider the potential drawbacks of this software before using it.

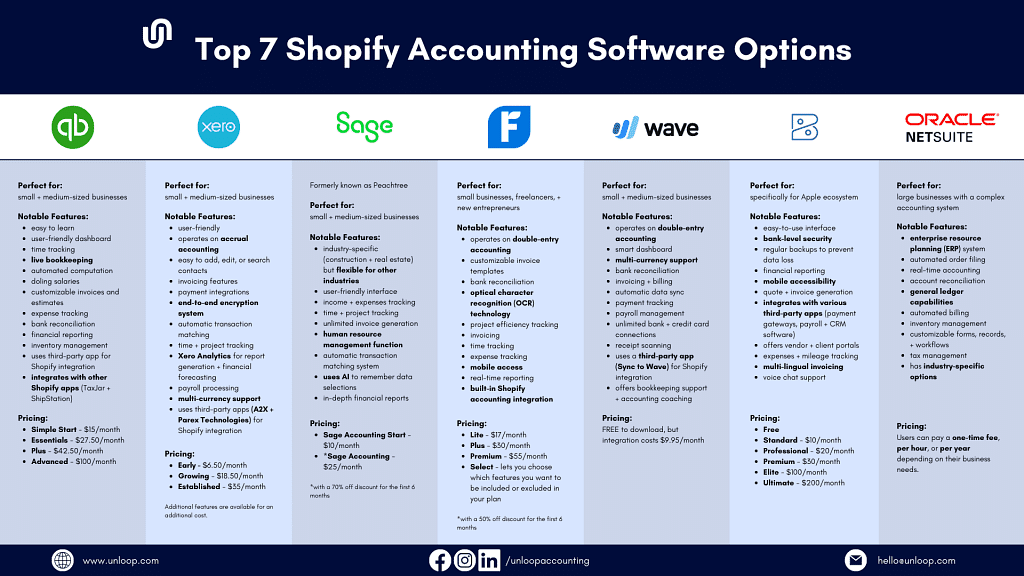

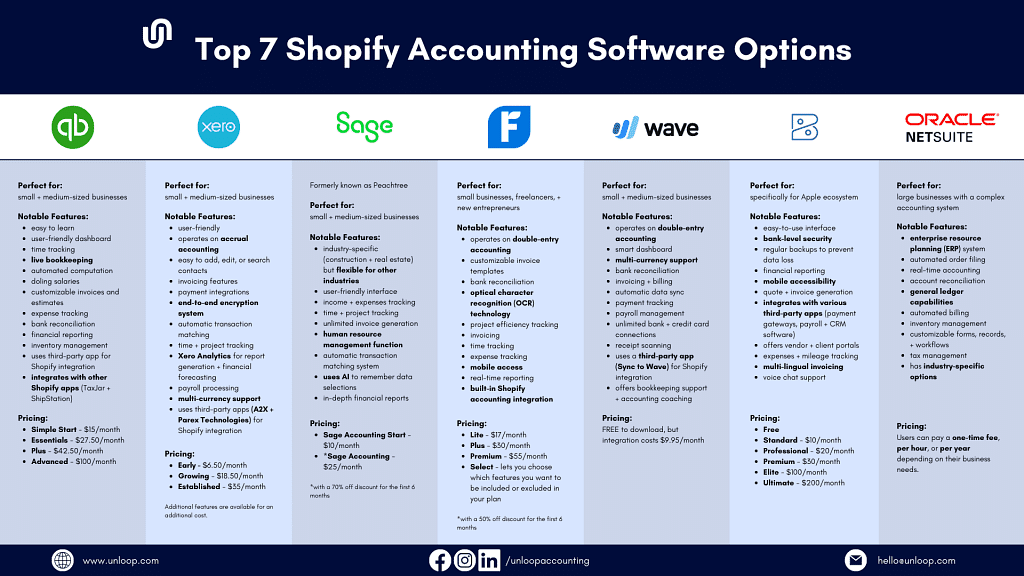

Not satisfied with Sage Accounting’s makeover? No problem. We want to give you financial decisions optimal for your organization’s unique needs. So, if Sage Accounting is not the one for you, here are the top 3 accounting programs you might want to try:

Compared to Sage Accounting’s Sage 50cloud program, Wave has limited features centered around invoicing and printing receipts. Wave is suitable for business owners who use traditional accounting tools and want to try out accounting software. The tool’s accounting, invoicing, and receipt scanning features are free.

This could be the perfect alternative if your business is doing great in your industry and expansion is around the corner. FreshBooks offers great invoice-to-payment functionality integrated with e-commerce platforms such as Shopify and Stripe.

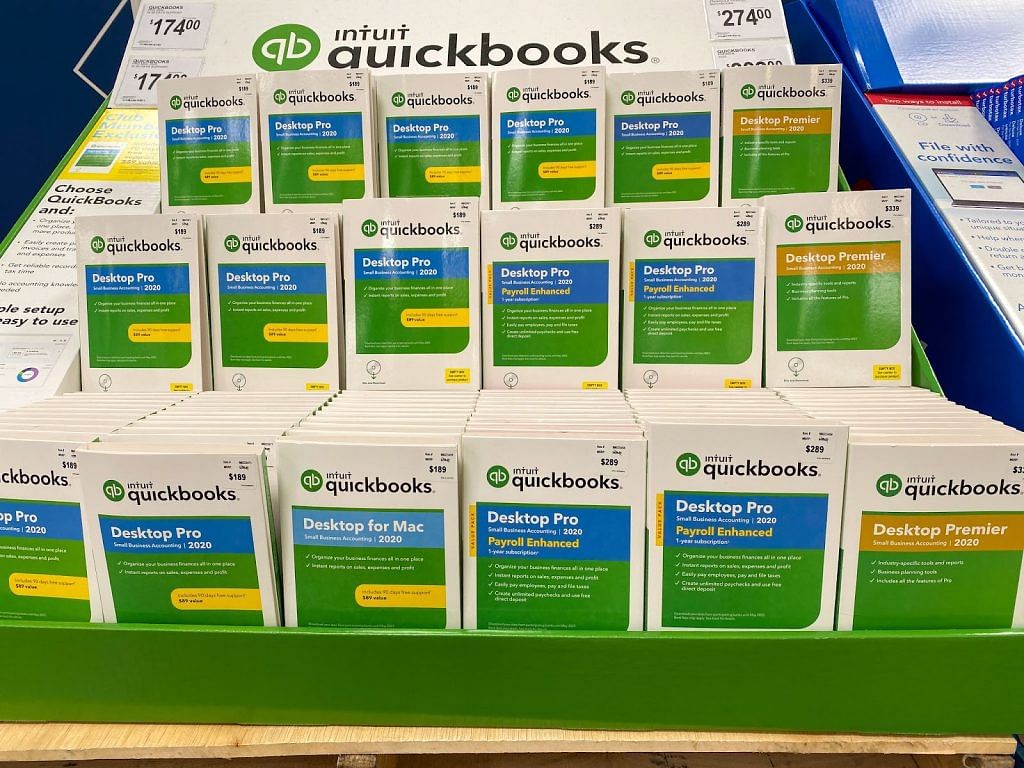

Do you want flexible and customizable reporting with a minimalist look at an affordable price? QuickBooks Online offers many features, but it is best for small businesses or freelancers.

If you’re starting your business venture, you’re lucky to have read about Peachtree Accounting’s upgrade to Sage Accounting. Being in the know is always key to staying on top of things. If you’re looking for a robust and reliable accounting solution, you now know Sage should be on your list.

If you are still looking for a team to work with, Unloop is here. We provide accounting services at affordable prices. If you want to know more about us, book a call, and we’ll help you make bookkeeping and financial management easier for your business.

After years of earning the trust of business owners and retailers, Peachtree Accounting has rebranded and is now known as Sage Accounting. Sage Accounting software also offers Sage 50, Sage 100, and more products for accounting needs.

Interested to know what’s new with Peachtree, or should we say Sage Accounting? Can we still use Peachtree Accounting software? What can businesses get from this rebranding, especially small business owners? Let’s dive deeper into this article and learn the new strengths of Sage Accounting.

Before we explore the improvements in Sage Accounting, let’s first learn the history behind this accounting software.

| 💡Before it became the Sage Accounting that we know, it was first known as Peachtree Accounting. It was released way back in the 1980s by the Sage Group. |

Everything was simple back then. Do you still remember what Windows looked like? The setup of Peachtree required Windows 95, Windows 98, or Windows NT 4. Then, you insert the Peachtree Accounting compact disc and install it. Peachtree was, in fact, a classic software.

After more than twenty years of providing powerful accounting and financial reporting capabilities, Sage released their 2011 version. Two years later, the cloud-based online accounting software Sage 50cloud was officially launched in the US market.

Now, Sage Accounting offers an excellent roster of accounting products and services for all sizes of businesses, including Sage Intacct and Sage X3.

Peachtree was well-received by many—a trusted solution, the perfect accounting software for small businesses. So, we’re pretty sure many of the product’s long-time users doubt the upgrade is any good. Why fix something that’s already perfect, right?

But, as advertised, Sage Accounting still features the same functionality and interface as Peachtree. So, believe us when we say it still looks like the ever-so-technical dashboard of Peachtree with a few tweaks in the system.

There are upsides to getting the latest software. Let’s see if the Sage business cloud accounting improvements are worth your money.

We live in the era of technology and e-commerce. As a result, no device, no mere program, does one simple function. Let’s take a look at some of the basic accounting functions and new features of Sage accounting:

| Basic accounting services: |

| New features: |

Seamless. Convenient. Collaborative.

These are the words we would use to describe today’s new and improved Sage online accounting software. Let’s take a deeper look into the strengths of this cloud-based accounting software:

Sage may not always have a user-friendly interface. However, filing payroll and income tax reports could never have been easier and simpler with Sage Accounting. Everything you need is right before you, just a click away.

Sage Accounting’s simplicity is a huge advantage, especially when not all business owners are tech-savvy. Since they’re comfortable with using this tool, it is only a matter of time before they can enjoy the other benefits of Sage Accounting completely.

The accounting software has an automated bookkeeping system that allows you to focus on other parts of your business. You don’t have to worry about losing the receipts you have on hand through the Sage Accounting plan. With your smartphone, you can take a picture of the receipt and upload it directly to the accounting software.

The Auto Entry feature automatically extracts information from the receipt and categorizes them. These categorized entries are posted accurately on Sage, eliminating the need for manual data input.

With Microsoft Office 365 Integration, Sage Accounting provides you with secure online access and financial tools on any device at any time of day. Of course, you need to have internet access, but who doesn’t have internet access in this day and age?

Financial reports from the previous year are easily traceable, and every transaction is backed up and saved. You have fewer worries about redoing your work.

Employees, customers, and suppliers are all part of your company. Therefore, it makes sense that your financial statements include paychecks, purchase orders, and deposits.

Sage Accounting allows you to invite your accountant and colleagues and manage their access settings. Such a feature gives way to a more collaborative work environment as it happens in real-time, which is more secure overall.

The built-in audit trail lets you track every user’s activity, providing peace of mind that your employees are doing their job and your books are updated on time.

Now that you know the improvements and advantages of Sage Accounting, it would also be beneficial for your business to consider the potential drawbacks of this software before using it.

Not satisfied with Sage Accounting’s makeover? No problem. We want to give you financial decisions optimal for your organization’s unique needs. So, if Sage Accounting is not the one for you, here are the top 3 accounting programs you might want to try:

Compared to Sage Accounting’s Sage 50cloud program, Wave has limited features centered around invoicing and printing receipts. Wave is suitable for business owners who use traditional accounting tools and want to try out accounting software. The tool’s accounting, invoicing, and receipt scanning features are free.

This could be the perfect alternative if your business is doing great in your industry and expansion is around the corner. FreshBooks offers great invoice-to-payment functionality integrated with e-commerce platforms such as Shopify and Stripe.

Do you want flexible and customizable reporting with a minimalist look at an affordable price? QuickBooks Online offers many features, but it is best for small businesses or freelancers.

If you’re starting your business venture, you’re lucky to have read about Peachtree Accounting’s upgrade to Sage Accounting. Being in the know is always key to staying on top of things. If you’re looking for a robust and reliable accounting solution, you now know Sage should be on your list.

If you are still looking for a team to work with, Unloop is here. We provide accounting services at affordable prices. If you want to know more about us, book a call, and we’ll help you make bookkeeping and financial management easier for your business.

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Amazon is not just a regular online marketplace; it's a massive platform that facilitates countless transactions on a daily basis. And where there are transactions, there are taxes. Sellers must understand the tax obligations of selling on such a platform. The solution? Amazon seller tax software designed for e-commerce platforms.

Taxes can pose business challenges due to the varying rates across jurisdictions. One wrong move can result in penalties, fines, and potential legal issues. By harnessing the power of tax software tools, you can automate sales tax filings while staying compliant with the ever-changing tax regulations of Amazon.

Before we delve into the best tax software for Amazon sellers, let's ensure we're all on the same page about the fundamentals of sales tax in this online marketplace.

Sales tax is a transaction-based tax that varies by state and sometimes by local jurisdictions. As an Amazon seller, you must know whether you are responsible for collecting and remitting sales tax returns based on specific rules and regulations.

In many cases, Amazon takes care of the hassle of calculating, collecting, and remitting sales tax for orders shipped to certain states. Isn't that a relief? No more stressing about manually figuring out tax processes for every transaction in those states.

But what about the other states? Sadly, the landscape changes when it comes to other states where Amazon doesn't assume the role of a facilitator. In these jurisdictions, sellers are responsible for the entire sales tax process. They must fulfill their duty accordingly to avoid any legal issues.

You can refer to this table for more information to find out which countries are covered by Amazon's marketplace legislation.

Sales tax is a topic that affects every ecommerce retailer, regardless of their size. But when it comes to Amazon FBA, the realm of sales tax can become more intricate and demanding compared to other retailers.

Amazon FBA offers numerous advantages, such as storage, packaging, and shipping services, allowing you to focus on their products and customer experience. But the convenience of FBA also brings with it a complex web of sales tax obligations that businesses must unravel.

Let’s start with the concept of Nexus. It refers to an Amazon seller's connection or presence in a particular state. With FBA, sellers often store their inventory in Amazon’s fulfillment centers across various states. This physical presence in multiple states can trigger sales tax obligations in those jurisdictions, even if the seller is based in a different state.

Another one is the dynamic nature of inventory movement within Amazon’s FBA network. Inventory may be transferred between fulfillment centers to optimize storage and shipping efficiency. While this benefits sellers in terms of logistics, it adds intricacy to sales tax compliance since the movement can impact the specific jurisdictions where sales occur.

Regulatory changes can also indicate an ongoing challenge for FBA sellers. Sales tax laws and regulations are not static; they often undergo state, country, and local modifications. These changes encompass new tax rates, adjusted thresholds, or revised exemptions. Staying updated and ensuring compliance can be demanding.

Let's not forget about physical products or tangible personal property. Sales tax obligations typically apply to the sale of physical goods, which is true for many products sold through Amazon FBA. Determining the correct sales tax rates and taxability of each item can be a lot, mainly when exemptions or special rules apply to certain things.

Navigating these hurdles requires a proactive approach to streamline sales tax management. The question now is, how will you rise to the challenge and stay on top of your tax responsibilities?

Managing Amazon sales tax compliance can quickly become overwhelming and prone to errors. Fortunately, there are solutions available to simplify the process.

You can now leverage sales tax automation software that integrates with your Amazon account. These nifty solutions take the burden off your shoulders by automatically calculating the appropriate sales tax for each transaction based on the customer's location and applicable tax rules.

As promised, here are four tax software options for Amazon sellers like you:

| TaxJar | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at $19/month |

| Sales Channels | Integrates with major ecommerce platforms, including Amazon, Shopify, Etsy, and Paypal |

| Tax Filing and Reporting | Uses TaxJar Autofile, a built-in technology that can electronically submit sales tax returns directly to the respective tax authorities. |

| Customer Support | Offers customer support via email and phone |

One of the most challenging tasks in sales tax rate computation is the first step—knowing which jurisdiction's sales tax nexus you fall under. National and local tax regulations make sales tax more complicated. But you can skip these worries with Taxjar, as the software stores information from 11,000 states, provinces, and municipalities.

Amazon also has the Marketplace Tax Collection, so even the tax acquisition and remittance are made for you. Meanwhile, Taxjar lets you export sales data in a CSV file to complete your sales taxes and have it ready for your financial reports.

| Taxomate | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at $12/month |

| Sales Channels | Integrates with Amazon and other e-commerce platforms like eBay, Shopify, and Walmart |

| Tax Filing and Reporting | Accountants can import settlements as sales receipts into QuickBooks or Xero and match them against bank deposits from Amazon. Bookkeepers can generate quarterly and yearly tax reports and verify them against the form 1099-K sent by Amazon to the IRS. |

| Customer Support | Offers customer support via email, chat, 1:1 onboarding |

Taxomate has you covered on your sales and income taxes. As your taxes are monitored, so is your inventory. You'll have data on best-selling products and when it is time for stock replenishment.

Once you purchase from Amazon and other ecommerce sites like Shopify and eBay, the details are automatically sent to Taxomate. Given that you have expanded your customers abroad and use a different currency, the multicurrency function of Taxomate will make tax computation and remittance easier.

| A2X | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at $19/month |

| Sales Channels | Integrates with Amazon and other ecommerce platforms like eBay, Shopify, Walmart, BigCommerce, and Etsy |

| Tax Filing and Reporting | A2X tells you exactly how much sales tax was collected per bank deposit. |

| Customer Support | FAQs/Forum, Phone Support, Knowledge Base, Email/Help Desk, Chat, 24/7 (Live rep) |

Another reliable software that can track your ecommerce business operations is A2X. Unlike other software that focuses on taxes, A2X's coverage is broader. It serves as automated bookkeeping for your business, which removes the need for manual input and the risk of data inaccuracy.

Amazon FBA and sales tax assistance are made possible because the software monitors FBA inventory locations and the destination of orders. These two details are the basis of sales tax rates. Because of the historical data available on the software, you can also check trends on sales tax and your business as a whole.

| HelloTax | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at 39€/month |

| Sales Channels | Integrates with Amazon and other ecommerce platforms like eBay, Shopify, WooCommerce, CDiscount, and Magento |

| Tax Filing and Reporting | Once your accounts are connected, and sales data are uploaded, HelloTax will organize your transactions and prepare reports. They will handle the filing of your VAT returns in the countries of your choice and take over communication with the tax authorities. All the necessary information and deadlines will be accessible to you on your dashboard. |

| Customer Support | FAQs/Forum, Phone Support, Knowledge Base, Email/Help Desk, Chat, 24/7 (Live rep) |

Your customers might be from countries that pay VAT, so it pays to know about it and how it is implemented. HelloTax helps you comply with requirements by offering features tailored to VAT calculations, reporting, and compliance.

Various EU countries and some provinces in Canada can benefit from this tax information reporting software. Most have distinct VAT systems and regulations requiring careful attention.

Navigating taxes, whether for local or international sales, can be a complex undertaking. You must understand how much tax is owed in each country or the recent changes in guidelines. But fear not; we're here to help!

At Unloop, we understand your challenges as an Amazon seller, so we've curated a list of exceptional software solutions to make your tax troubles a breeze. These innovative applications enable you to accurately calculate tax rates based on specific regions where your products are sold, simplifying the compliance process like never before.

But our support doesn’t stop here. We’re here to handle all your financial management needs through our reliable and efficient sales tax preparer services. You can focus on the bigger picture of your business while we handle the nitty-gritty of Amazon tax management.

Let us be your reliable partner in conquering the complexities of Amazon sales tax. Book a call now!

Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Amazon is not just a regular online marketplace; it's a massive platform that facilitates countless transactions on a daily basis. And where there are transactions, there are taxes. Sellers must understand the tax obligations of selling on such a platform. The solution? Amazon seller tax software designed for e-commerce platforms.

Taxes can pose business challenges due to the varying rates across jurisdictions. One wrong move can result in penalties, fines, and potential legal issues. By harnessing the power of tax software tools, you can automate sales tax filings while staying compliant with the ever-changing tax regulations of Amazon.

Before we delve into the best tax software for Amazon sellers, let's ensure we're all on the same page about the fundamentals of sales tax in this online marketplace.

Sales tax is a transaction-based tax that varies by state and sometimes by local jurisdictions. As an Amazon seller, you must know whether you are responsible for collecting and remitting sales tax returns based on specific rules and regulations.

In many cases, Amazon takes care of the hassle of calculating, collecting, and remitting sales tax for orders shipped to certain states. Isn't that a relief? No more stressing about manually figuring out tax processes for every transaction in those states.

But what about the other states? Sadly, the landscape changes when it comes to other states where Amazon doesn't assume the role of a facilitator. In these jurisdictions, sellers are responsible for the entire sales tax process. They must fulfill their duty accordingly to avoid any legal issues.

You can refer to this table for more information to find out which countries are covered by Amazon's marketplace legislation.

Sales tax is a topic that affects every ecommerce retailer, regardless of their size. But when it comes to Amazon FBA, the realm of sales tax can become more intricate and demanding compared to other retailers.

Amazon FBA offers numerous advantages, such as storage, packaging, and shipping services, allowing you to focus on their products and customer experience. But the convenience of FBA also brings with it a complex web of sales tax obligations that businesses must unravel.

Let’s start with the concept of Nexus. It refers to an Amazon seller's connection or presence in a particular state. With FBA, sellers often store their inventory in Amazon’s fulfillment centers across various states. This physical presence in multiple states can trigger sales tax obligations in those jurisdictions, even if the seller is based in a different state.

Another one is the dynamic nature of inventory movement within Amazon’s FBA network. Inventory may be transferred between fulfillment centers to optimize storage and shipping efficiency. While this benefits sellers in terms of logistics, it adds intricacy to sales tax compliance since the movement can impact the specific jurisdictions where sales occur.

Regulatory changes can also indicate an ongoing challenge for FBA sellers. Sales tax laws and regulations are not static; they often undergo state, country, and local modifications. These changes encompass new tax rates, adjusted thresholds, or revised exemptions. Staying updated and ensuring compliance can be demanding.

Let's not forget about physical products or tangible personal property. Sales tax obligations typically apply to the sale of physical goods, which is true for many products sold through Amazon FBA. Determining the correct sales tax rates and taxability of each item can be a lot, mainly when exemptions or special rules apply to certain things.

Navigating these hurdles requires a proactive approach to streamline sales tax management. The question now is, how will you rise to the challenge and stay on top of your tax responsibilities?

Managing Amazon sales tax compliance can quickly become overwhelming and prone to errors. Fortunately, there are solutions available to simplify the process.

You can now leverage sales tax automation software that integrates with your Amazon account. These nifty solutions take the burden off your shoulders by automatically calculating the appropriate sales tax for each transaction based on the customer's location and applicable tax rules.

As promised, here are four tax software options for Amazon sellers like you:

| TaxJar | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at $19/month |

| Sales Channels | Integrates with major ecommerce platforms, including Amazon, Shopify, Etsy, and Paypal |

| Tax Filing and Reporting | Uses TaxJar Autofile, a built-in technology that can electronically submit sales tax returns directly to the respective tax authorities. |

| Customer Support | Offers customer support via email and phone |

One of the most challenging tasks in sales tax rate computation is the first step—knowing which jurisdiction's sales tax nexus you fall under. National and local tax regulations make sales tax more complicated. But you can skip these worries with Taxjar, as the software stores information from 11,000 states, provinces, and municipalities.

Amazon also has the Marketplace Tax Collection, so even the tax acquisition and remittance are made for you. Meanwhile, Taxjar lets you export sales data in a CSV file to complete your sales taxes and have it ready for your financial reports.

| Taxomate | |

| Key Features | |

| Pricing | Subscription-based pricing, with plans starting at $12/month |

| Sales Channels | Integrates with Amazon and other e-commerce platforms like eBay, Shopify, and Walmart |