It takes someone with a keen eye and an open mind willing to consume a good amount of knowledge to expand a new business. So, if you’re reading an article like this, you’ve already got that part checked out, which means you’re up for something more challenging: learning how to do accounting for a small business.

A basic understanding of accounting can help small business owners:

Reading up on online business accounting is a great way to catch up on how new businesses do things in the modern world. Luckily, we’ve prepared a quick guide you can breeze through.

Are you a small business owner who struggles with accounting? Do you feel like you’re constantly playing catch-up with your finances? You’re not alone. Many small business owners have a great vision for their ventures, only to meet challenges in bookkeeping and accounting.

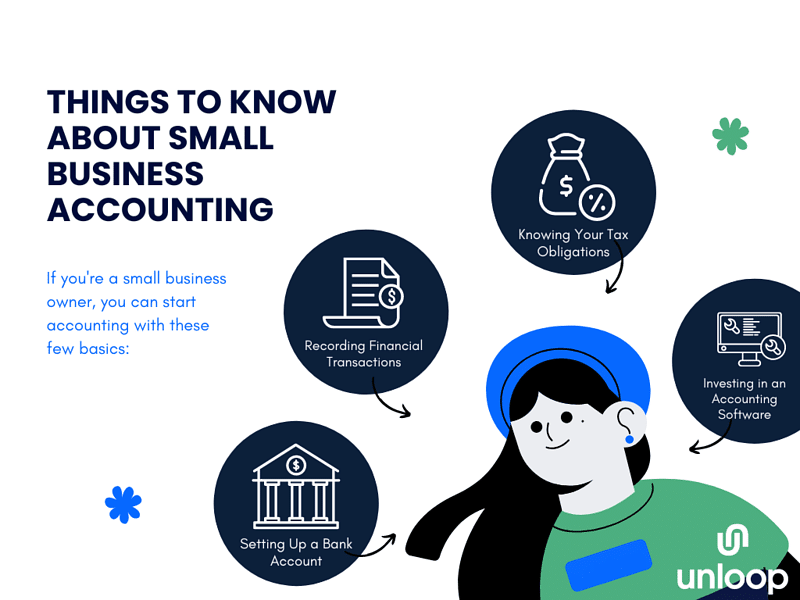

Check out these must-know small business accounting basics:

Every business needs its own business bank account. It helps establish your small business and separate your personal and business finances, making tracking business expenses and income much easier.

Before you get a separate bank account for your small business, research and compare different banks and their offerings, such as:

| 💡You will be transacting with the bank in the long run, so make sure you choose wisely. |

Besides having separate personal and business bank accounts, you should also get a business credit card.

Having a good credit score helps small businesses gain access to business assets and capital they wouldn’t have had otherwise. It allows them to make large purchases and take advantage of supplier discounts without paying upfront in cash.

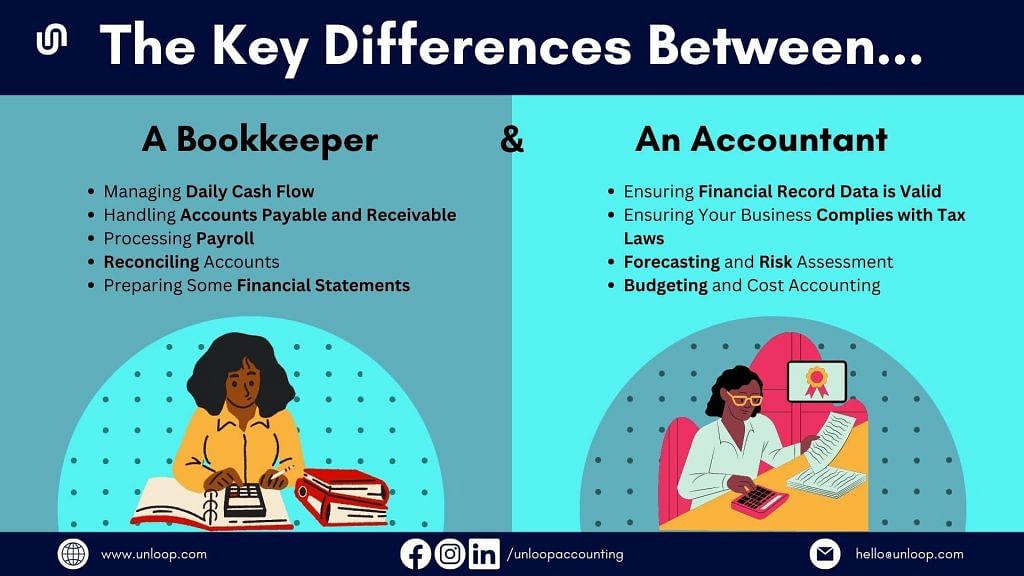

When you run a business, there must be accurate expense tracking. This is what “bookkeeping” is for. You’ve probably heard of that word and perhaps seen it being used interchangeably with “accounting,” but understand that these two services are entirely different.

Bookkeeping involves recording and tracking business transactions. This includes systematically recording financial transactions such as:

Basic bookkeeping aims to provide accurate and up-to-date financial reports of a business’s financial activities.

Accounting is analyzing and interpreting financial information generated from those financial reports to produce business financial statements. These would include income statements and balance sheets, which provide a snapshot of a business’s financial health at a given time.

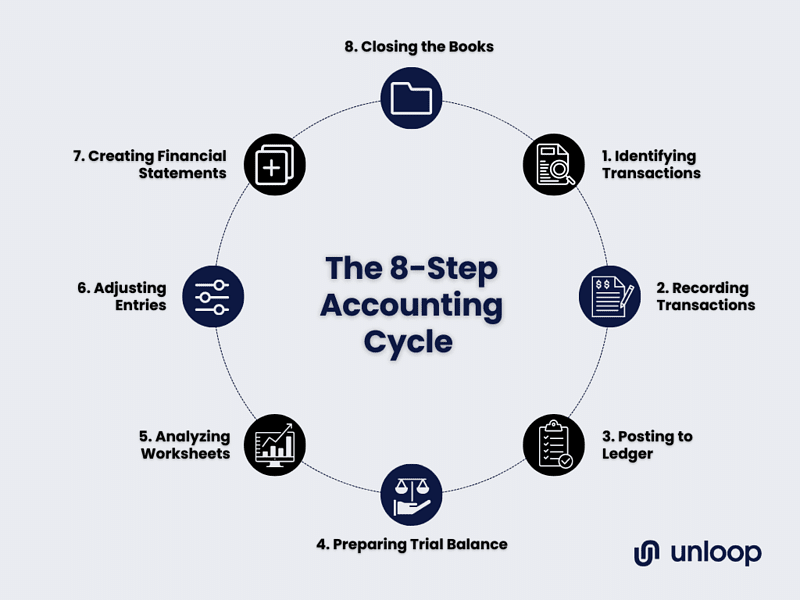

This question might have popped up as you read that previous paragraph. Yes, there is a process, and it’s referred to as “the accounting cycle.”

| 💡The accounting cycle is the series of steps a business follows to ensure its transactions are recorded, processed, and reported accurately. |

It follows eight significant accounting tasks:

There are also two methods to record financial transactions that business owners have to decide on:

Now that you’ve got a good grasp of what basic accounting for small businesses is, it’s essential to build on that knowledge. Tax and accounting are good examples, as they both deal with a business’s financial information.

An accounting system involves processing, verifying, and reporting a business’s financial transactions. In contrast, tax involves the payment of things like income taxes to the government based on the information reported by the business.

The data generated by the accounting process is used to calculate a business’s taxable income and tax liability. After which, the data is used to prepare tax returns.

| 💡Note that the legal structure of a business will determine its tax obligations. |

For example, small business owners registered as limited liability companies (LLCs) or partnerships may claim business income on their personal tax return.

Accounting and tax professionals may also provide business services in preparing tax returns. This may include advising on tax-efficient strategies to minimize a business’s tax liability, such as tax deductions and credits.

Nowadays, entrepreneurs have embraced using small business accounting software because of its convenience, efficiency, and affordability. Accounting software automates manual accounting tasks, such as:

Accounting software can cut long hours of complicated work for small businesses. Most accounting software programs also integrate with other business tools, such as payroll and invoicing software, which helps streamline financial management.

Want to know how to make your business finances easier to manage? Check out these tips:

Link your business bank account to your accounting software. Doing this makes bank payments convenient for your customers who opt for them. When your customers pay or you make any payments and withdrawals, the transaction is automatically recorded in bank statements and the books.

Fraud is also less likely to occur because your bookkeepers can easily raise the alarm when data don’t match.

When you have set up bank linking, invoicing, and receipt management for your business, making and collecting payments on time will be easier. You can give your customers discounts and incentives to encourage them to pay in advance or on the due date.

| 💡Through timely payment, the data you can generate from reports will be accurate, and cash flow management will be easier. |

Forecasting and planning your transactions is necessary instead of just recording them as they happen. As a small business owner, you need to keep your records even from previous years, as they will be useful in planning finances for the coming year.

Through historical financial data, you can project possible revenue and expenses. As a result, you can budget your money for the year and break it into quarterly, monthly, and even weekly allocations.

Here’s our last but not least tip. You can hire small business accounting services to simplify bookkeeping and accounting. Partner with trained bookkeepers and accountants to handle your business finances.

Hiring an in-house team works, too, but partnering with reliable agencies is the way to go if you want to save costs while receiving the same quality of work.

So there you have it—the small business accounting basics and how to make your finances easier to manage. We hope these tips have made you feel more confident handling your business finances.

If you ever need a hand with accounting, don’t hesitate to reach out! We at Unloop are passionate about helping growing businesses and making them succeed through our bookkeeping, income tax, and sales tax services.

Book a call with us now to get started on accounting for your business.

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.