Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Picture this: You’re an entrepreneur who owns a small business in Toronto. You figure your business will be even better by having a bookkeeper on board. With that in mind, you hop on a computer, open up a search engine, and type “bookkeeping services Toronto”, expecting to find quick and easy bookkeeping solutions.

You check the companies that offer small business bookkeeping in Toronto, and you learn three things:

If you’re reading this, don’t lose hope—this might be the guide you need.

In this blog post, you’ll learn how to find the best accounting and bookkeeping services that will match your business. You’ll also find out how Unloop can help you manage your books without you spending a lot, going through so many steps, and risking your safety.

First things first, what are the things you must consider before hiring bookkeeping and accounting services in Toronto? The best bookkeeping service provider for your small business is out there; you just need to evaluate your business needs and size to start.

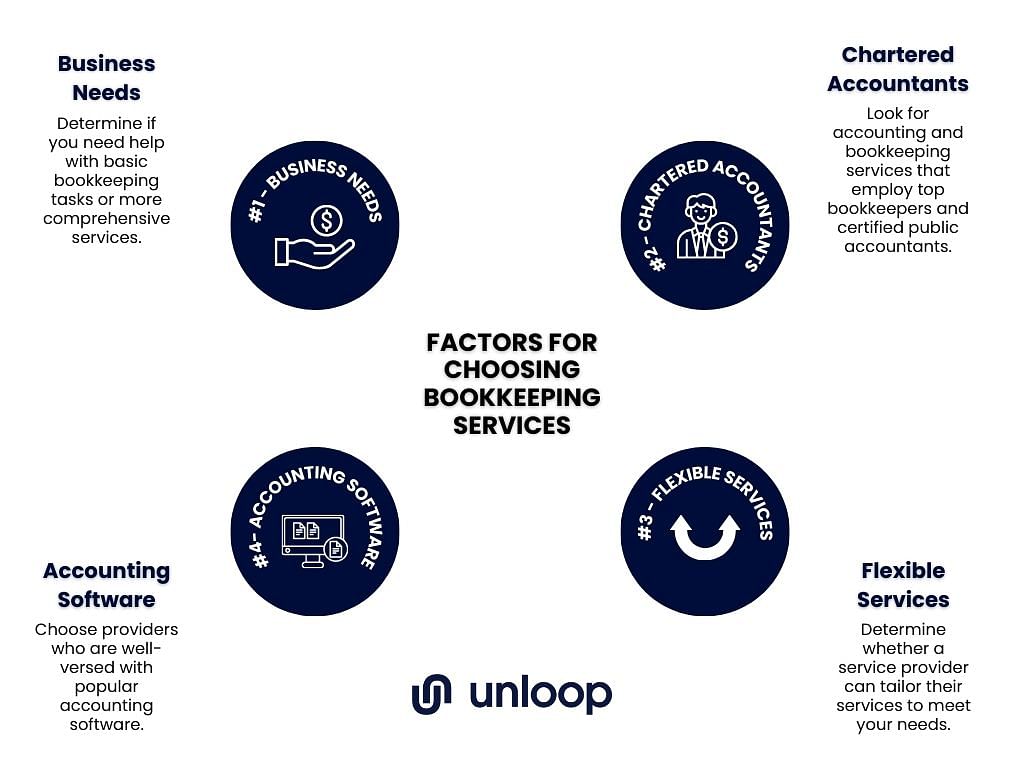

Here’s a list of factors you should think about:

When choosing small business bookkeeping services, it’s essential to consider your specific needs. Do you operate a brick-and-mortar store or run an online business on Amazon or other e-commerce sites?

| 💡Assess the size and complexity of your business operations and the volume of financial transactions you handle. |

Determine if you need help with basic bookkeeping tasks, such as:

Understanding your business needs will help you find a bookkeeping service in Toronto that aligns with your goals and can provide the necessary support right away.

Another important factor to consider is the expertise and qualifications of the accounting professionals involved. Look for accounting and bookkeeping services that employ top bookkeepers and certified public accountants (CPAs).

According to CPA Ontario, a non-profit organization, they have 99,000 members, including CPAs from Toronto. These experts can provide financial advice, help manage your taxes, and make your accounting and bookkeeping process stress-free.

Consider the tools and accounting software a bookkeeping and accounting service provider uses. Choose providers who are well-versed with popular accounting software such as QuickBooks and Xero.

| 💡Efficient use of accounting software can streamline your financial processes and enhance accuracy in your business’s financial health. |

Every business has unique requirements, and it is essential to choose accounting and bookkeeping services that offer flexibility. Determine whether a service provider can tailor their services to meet your needs.

For instance, small business owners may have seasonal fluctuations, so they may need additional support during peak periods.

They may also look into digitizing their books or adopt cloud-based software—it's important to seek service providers who are well-versed in cloud-based systems such as QuickBooks and Xero.

Now that you know the factors to consider when hiring Toronto bookkeeping services, let’s explore why Unloop could be the best service provider for your business:

For small business owners like you, running a business has to be cost-efficient. You understand that whatever expenses your business has and will have in the future will ultimately affect your bottom line. You want to spend your resources wisely by investing as much in activities that will yield the most revenue possible.

Bookkeeping and accounting, unfortunately, do not come cheap. You know why your small business needs an accountant, but the service’s cost doesn’t justify the investment. You want better pricing—a competitive one. Using technology and resources that allow more competitive pricing, Unloop has an edge above traditional accounting services.

We understand that a small business owner like you knows the value of their time. However, the problem with traditional bookkeeping services is that it takes many back-and-forths before the service can officially start. That’s wasted time that costs not only money but also opportunities.

Traditional accounting firms offering bookkeeping services tend to be bureaucratic. We get it. That’s part of why accounting firms are good at what they do: they follow accounting processes and systems by the book, which can be rigid.

Unloop has identified this inefficiency and adopted a more streamlined process to save a lot of time. Our approach is more agile:

People can do almost anything online. It makes perfect business sense to transfer the cost and burden of bookkeeping to a trustworthy team who can work with you remotely. You get the best pool of talents by outsourcing your bookkeeping to those who can do it well at a cheaper cost from anywhere in the world.

When you outsource your bookkeeping service to a remote team of professionals, there is no need to schedule in-person meetings or travel to a physical location. Remote services allow for scalability, enabling you to pay for the services you need without hiring a dedicated in-house bookkeeper.

This cost-effective approach also benefits small businesses or startups with limited financial resources. These are the things Unloop can do for you. We offer bookkeeping in Toronto, Vaughan, Markham, or anywhere in Canada because we are completely remote.

It’s time for you to take your business in the right direction, wherein you adapt to a world of virtual efficiency. Partner with Unloop and have a global team of talented bookkeepers with much more competitive rates than traditional bookkeeping services and a streamlined, agile bookkeeping process from the get-go.

All the while, you can focus your valuable time on managing your business. Plus, you can ensure that your financial information is in the right hands and up-to-date to help you develop strategic decisions for your business.

Book a call today and let Unloop handle your books accurately, efficiently, and 100% remote!

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.