Disclaimer: Please note this article is not financial advice. The purpose of our blog is purely educational, so please consult a professional accountant or financial advisor before making any financial decision.

Not every business has the resources to implement advanced technologies like barcode scanners that match products in your accounting and inventory system. Luckily, the first in, first out or FIFO method formula exists! By embracing this inventory valuation method, you can maintain a natural flow in your inventory management processes.

Indulge yourself in this article as it walks you through the ins and outs of the FIFO method.

In the accounting world, the FIFO method is important in managing inventory and keeping an accurate cost determination. Let’s examine its key aspects and how they impact your business.

When applying the first in, first out (FIFO) in your inventory management system, the items bought or produced earliest are sold or consumed first. From there, your remaining inventory will include the more recently acquired goods.

Inventory valuation is a fundamental accounting practice used by companies to determine the value of unsold inventory when preparing financial statements.

In the context of the FIFO method, you need to allocate costs to your inventory in a way that reflects the order acquisition. The first produced items are the first to be used or sold. You’ll record these costs chronologically, ensuring that the expenses of earlier items are primarily accounted for.

COGS refers to the expenses directly associated with producing or acquiring the goods sold during a specific period.

With FIFO, the earliest costs incurred for acquiring or producing the goods sold help you obtain a more accurate representation of the expenses directly related to those items. This calculation allows you to assess profitability and make confident decisions based on the cost-effectiveness of your sales.

You sell a cap for $85 per piece. Then, assume you have sold 50 pieces from 100 caps in your inventory. You want to see how much profit you have made from the 50 pieces you sold. However, the 100 caps in your inventory were purchased from the same supplier at different prices. See the table below for more information.

| Date of Purchase | Quantity | Price | Total |

| 1/1/2023 | 25 | $50 | $1,250 |

| 2/2/2023 | 50 | $55 | $2,750 |

| 3/3/2023 | 25 | $60 | $1,500 |

Notice the data in the table: You purchased three sets of caps from January to March. You initially had 25 caps for $50 each, and you ordered a second batch that contained 50 caps with a $5 increase for each one. In March, you ordered 25 caps to be in stock with another $5 increase, making a total of $60 in the base price of each cap.

“Demand and inflation are the major factors that affect the price increase of goods and services.“

Since you have sold identical caps and you don't have a barcode system that tells you which ones are from January, February, or March, the FIFO method is one of the best options you have to determine your profit.

Again, you had sold 50 caps at $85 each. All in all, you have a total sale of $4,250. Going back to the table, we need to mark out the 25 pieces in January and another 25 pieces from February to satisfy the total of 50 caps. In January, the 25 caps were purchased for $1,250. Then, you need to get another 25 caps from February, multiply them by $55, and get $1,375.

The formula for calculating the gross profit is as follows:

In this case, your revenue is $4,250. Your cost of goods sold is the sum of $1,250 and $1,375. Plugging these values into the formula:

Your gross profit is $1,625 for the 50 caps sold using the FIFO method.

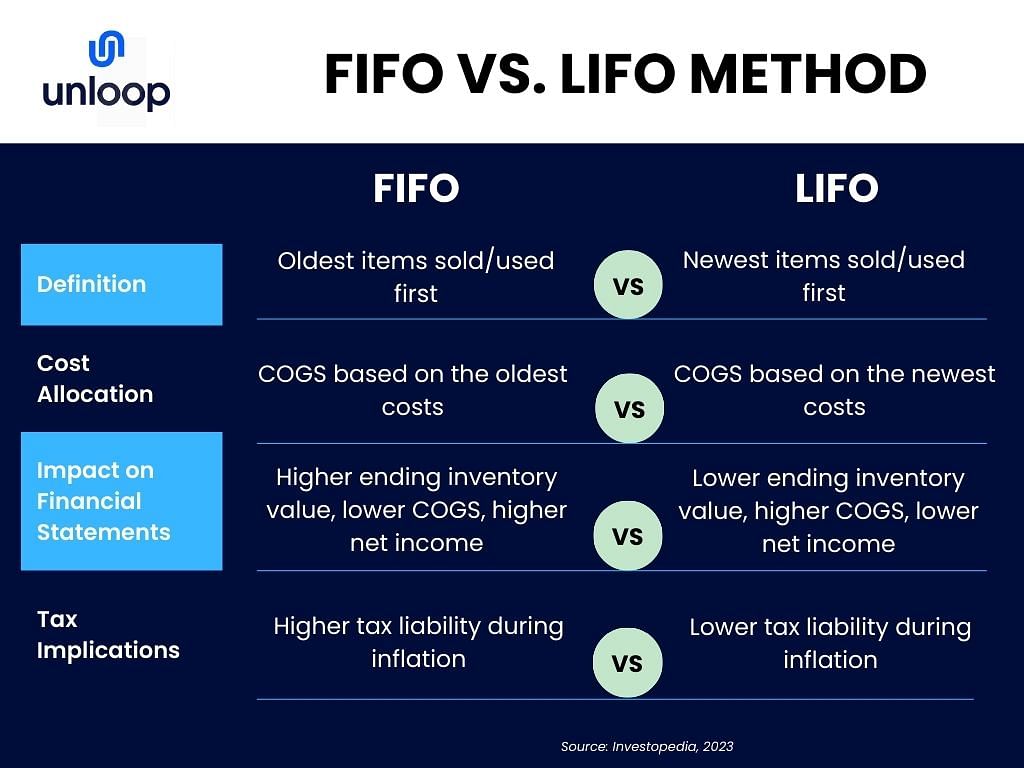

It’s only natural to seek clarification on how FIFO compares with other inventory costing methods, such as the LIFO method.

To provide a comprehensive understanding, we present a concise and insightful comparison between FIFO and LIFO in the following table. This analysis encompasses crucial aspects, from inventory value to its impact on your financial statements.

By assessing the two, you can decide about your inventory management approach.

The FIFO inventory method is one of the most utilized cost flow assumptions. Companies use this calculation to determine which costs go into inventory and which go into expense.

Both costs are essential for accurate financial reporting, better decision-making, and effective inventory management. You can ensure that you allocate sufficient resources while responding swiftly to changing market demands.

The table below provides a useful example of specific cost allocations under inventory and expense categories. They are classified in this manner for accounting purposes.

| Inventory Costs | Expense Costs |

| Direct Materials: Raw materials and other intermediate materials can be physically and directly traced to a specific product. | Administrative Expenses: Include office salaries and wages, advertising costs, and telephone bills. |

| Direct Labor: This cost is usually applied when the company uses variable costs, such as employee wages or salaries. | Selling Costs/Selling Expenses: Commissions for salespeople or efforts to secure new customers, promotional materials, postage, and shipping charges paid by the company to gain more business. |

| Manufacturing Overhead: This consists of overheads for utilities (gas, electricity, etc.), repairs and maintenance of equipment, insurance, rent on factory building and floor space, general office expenses, depreciation on factory machinery, and equipment. |

By knowing this information, you can optimize your inventory strategies, manage your day-to-day work, gain accurate business insights, and assess the profitability of your operations.

There are a few steps in FIFO method accounting:

Once you familiarize yourself with the FIFO method, you can enjoy the following advantages:

The FIFO method is an inventory management formula that helps companies track their products and accurately calculate the COGS to file financial statements or tax returns.

Suppose you have an online business like a shop on the Amazon marketplace. In that case, you can use FIFO if you don't have a barcode system to track your sales and inventory better.

But if you’re hesitant about adopting the inventory method, don’t worry! You can always ask Unloop for professional help. We can help you confidently embrace the benefits of FIFO for your online business. Book a call now!

Unloop is the first and only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don't need to worry. Book a call with an ecommerce accountant today to learn more.